by Calculated Risk on 12/12/2018 07:00:00 AM

Wednesday, December 12, 2018

MBA: Mortgage Applications Increased in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications rose 1.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 7, 2018.

... The Refinance Index increased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 4 percent higher than the same week one year ago.

...

“Mortgage rates fell across the board last week, driven by a similar slide in Treasuries. Trade fears dominated investors’ concerns for another week, and this was amplified by data released by the U.S. Commerce Department showing a widening trade deficit,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The 30-year fixed mortgage rate decreased 12 basis points over the week back below 5 percent, representing the largest single week drop since 2017.”

Added Kan, “As a result of these recent rate declines, we saw another weekly increase in refinance applications, along with a rise in the average refinance loan size. Larger loans tend to react more readily for a given change in mortgage rates. Meanwhile, purchase application activity also increased over the week and was up more than three percent compared to a year ago.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 4.96 percent, the lowest level since September 2018, from 5.08 percent, with points increasing to 0.48 from 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 4.0% year-over-year.

Tuesday, December 11, 2018

Wednesday: CPI

by Calculated Risk on 12/11/2018 08:32:00 PM

Wednesday:

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM: The Consumer Price Index for November from the BLS. The consensus is for no change in CPI, and a 0.2% increase in core CPI.

A comment on Professor Shiller's "The Housing Boom Is Already Gigantic. How Long Can It Last?"

by Calculated Risk on 12/11/2018 03:52:00 PM

Last Friday, Professor Robert Shiller wrote in the NY Times: The Housing Boom Is Already Gigantic. How Long Can It Last?

We are, once again, experiencing one of the greatest housing booms in United States history.First, it is important to note that Professor Shiller is discussing house prices, as opposed to housing activity (usually a "housing boom" would refer to new home sales and housing starts). This is not one of the "greatest housing booms" in terms of new home sales and housing starts - in fact, housing activity is still somewhat low historically.

How long this will last and where it is heading next are impossible to know now.

But it is time to take notice: My data shows that this is the United States’ third biggest housing boom in the modern era.

More Shiller:

Even after factoring in Consumer Price Index inflation, real existing home prices were up almost 40 percent during that period. That is a substantial increase in less than seven years. In fact, based on my data, it amounts to the third strongest national boom in real terms since the Consumer Price Index began in 1913, behind only the explosive run-up in prices that led to the great financial crisis of a decade ago, and one connected with World War II and the great postwar Baby Boom.Here Shiller is measuring from the house price bottom - when prices were driven down by significant distressed activity - to the current top. So perhaps some of the recent increase was a bounce back from all the distressed selling. Shiller dismisses this explanation:

The simplest narrative being given for the current boom is just that the 2008-2009 financial crisis and the so-called Great Recession are over and home prices are returning to normal.Nominal prices are 11 percent higher than the previous peak, however real prices are about 9 percent below the previous peak (I wouldn't call that "almost as high").

But that explanation does not cut it either. In September they were 11 percent higher than at the 2006 peak in nominal terms, and almost as high in real terms. This is not a return to normal, but a market that appears to be rising to a record.

Also Shiller leaves out a key point - there is an upward slope to real house prices over time. Shiller has calculated an upward slope of about 0.2% per year for real prices. I think it is higher.

Shiller did an awesome job of piecing together various price indexes to obtain long term prices. However, as I've noted before, if Shiller had used some different indexes for earlier periods, his graph would have indicated a larger upward slope for real house prices. Here was an earlier post on this: The upward slope of Real House Prices. A few excerpts from my earlier post:

It is important to realize that Professor Shiller used the quarterly Case-Shiller National index starting in 1987. From 1975 through 1986 he used what is now called the FHFA index. He used other price indexes in earlier periods.The indexes I used captured a larger percentage of the market than the indexes Shiller used.

...

The FHFA index used by Shiller was based on a small percentage of transactions back in the '70s. If we look at the CoreLogic index instead, there is a clear upward slope to real house prices.

If Professor Shiller had used the Freddie Mac quarterly index back to 1970 (instead of the PHCPI), there would be more of an upward slope to his graph too. So it is important to understand that for earlier periods the data is probably less accurate.

Tom Lawler has also written in depth about this: Lawler: On the upward trend in Real House Prices

During the housing bubble, the difference between a slight upward slope in real prices (0.2% per year according to Shiller's index) and a slightly larger increase in real prices using other indexes (probably between 1% and 1.5% per year) didn't make any difference; there was obviously a huge bubble in house prices. But when comparing price "booms" over time, there is a huge difference.

If we use 1.5% per year for real price increases, the current "boom" in prices would be the fourth largest since the 1970s (and only about half the size of the late '70s and late '80s price boom), and if we use a 1.0% real increase, the current "boom" is on the same order as the late '70s and '80s price booms.

No big deal, and definitely not a "gigantic" boom in house prices.

Note: Following both the '70s and '80s prices booms, price increases slowed significant and mostly moved sideways for some years in nominal terms. Maybe that will happen again.

Goldman Forecast on 2019 Rate Hikes

by Calculated Risk on 12/11/2018 01:49:00 PM

A few brief excerpts from a Goldman Sachs research note:

Currently, we see the probability of a funds rate hike at 45% for 2019Q1, 75% for Q2, 70% for Q3, and 60% for Q4 … this represents a 3-hike baseline for 2019. (We recently shifted to this view from our previous 4-hike baseline, mainly because of tighter financial conditions.) The corresponding probability-weighted path … implies 2.0 hikes in 2019, a smaller but still clearly hawkish number when compared to market pricing of 0.7 hikes.CR Note: Most analysts expect another rate hike will be announced at the conclusion of the FOMC meeting next week (December 19th). However there is a wide range of views on how much the Fed will hike in 2019.

Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 12/11/2018 11:59:00 AM

By request, here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (22 months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 804,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 391,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,964,000 under President Clinton (light blue), by 14,717,000 under President Reagan (dark red), 9,041,000 under President Carter (dashed green), 1,509,000 under President G.H.W. Bush (light purple), and 11,907,000 under President Obama (dark blue).

During the first 22 months of Mr. Trump's term, the economy has added 4,132,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 266,000 jobs).

During the first 22 months of Mr. Trump's term, the economy has added 65,000 public sector jobs.

After 22 months of Mr. Trump's presidency, the economy has added 4,197,000 jobs, about 386,000 behind the projection.

Small Business Optimism Index decreased in November

by Calculated Risk on 12/11/2018 09:10:00 AM

CR Note: Most of this survey is noise, but there is some information, especially on the labor market and the "Single Most Important Problem".

From the National Federation of Independent Business (NFIB): November 2018 Report: Small Business Optimism Index

Small business optimism slightly dipped in November. The Index declined 2.6 points to 104.8 with more than half the decline attributable to Expected Business Conditions and Expected Real Sales.

..

Job creation was solid in November at a net addition of 0.19 workers per firm (including those making no change in employment), up slightly from September and October readings at 0.15. ... Twenty-five percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem (up 2 points), matching the record high reached in August. Thirty-four percent of all owners reported job openings they could not fill in the current period, down 4 points from last month’s record high.

emphasis added

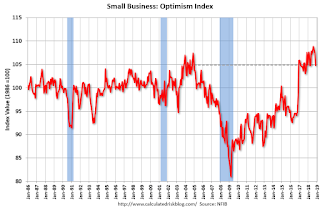

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 104.8 in November.

Note: Usually small business owners complain about taxes and regulations (currently 2nd and 3rd on the "Single Most Important Problem" list). However, during the recession, "poor sales" was the top problem. Now the difficulty of finding qualified workers is the top problem.

Monday, December 10, 2018

"Mortgage rates at their lowest levels in several months"

by Calculated Risk on 12/10/2018 05:22:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rate Rally May Be Pausing

First things first: the average mortgage lender improved modestly today, compared to last Friday's levels. This leaves mortgage rates at their lowest levels in several months. That's great news and indeed, the last few weeks have been the best few weeks we've seen in more than a year. That having been said, we're now reaching the stage where the strong move in underlying financial markets may be running out of steam. [30YR FIXED - 4.75%]

emphasis added

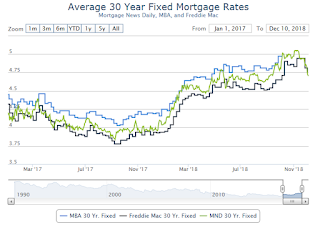

Click on graph for larger image.

Click on graph for larger image.This is a graph from Mortgage News Daily (MND) showing 30 year fixed rates from three sources (MND, MBA, Freddie Mac).

The MND 30 year fixed rate is at the same level as back in May 2018 (4.75%).

Mortgage Equity Withdrawal slightly positive in Q3

by Calculated Risk on 12/10/2018 01:10:00 PM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released yesterday) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q3 2018, the Net Equity Extraction was a positive $33 billion, or a 0.9% of Disposable Personal Income (DPI) .

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

MEW has been positive for 8 of the last 10 quarters. With a slower rate of debt cancellation, MEW will likely be mostly positive going forward - but nothing like during the housing bubble.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $91 billion in Q3.

The Flow of Funds report also showed that Mortgage debt has declined by $0.43 trillion since the peak.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

AAR: November Rail Carloads Down 0.2% YoY, Intermodal Up 2.5% YoY

by Calculated Risk on 12/10/2018 12:15:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

It’s not like the sky is falling or anything, but while U.S. rail traffic numbers were very solid a few months ago, they were less solid in November. Total carloads fell 0.2% (2,418 carloads) in November 2018 from November 2017, their first decline in nine months. Major blame goes to crushed stone, sand, and gravel, carloads of which fell 12.8% (12,090 carloads) thanks to a decline in carloads of frac sand. … Intermodal rose 2.5% in November. That sounds pretty good, but it’s the smallest increase in 19 months. ... In terms of rail traffic, November might just be the “back” in a case of two steps forward, one step back. But it could be the start of something more. Stay tuned.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Light blue is 2018.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

Rail carload volumes in some recent months were impressive. In November? Not so much. U.S. railroads originated 1.032 million carloads in November 2018, down 0.2%, or 2,418 carloads, from November 2017. It was the first year-over-year decline for total carloads in nine months (see the bottom left chart below). Weekly average total carloads in November 2018 were 258,017, the lowest for November since sometime before 1988, which is when our data begin.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):U.S. rail carloads weren’t as impressive in November as they were in other recent months. The same goes for intermodal. U.S. railroads originated 1.10 million containers and trailers in November 2018, up from 1.07 million in November 2017. The 2.5% gain this year over last is the smallest monthly percentage gain in 19 months. Year-to-date intermodal volume through November was up 5.5%, or 699,102 units, over last year. If that percentage holds for one more month, 2018 will have the largest annual percentage gain for intermodal since 2010.2018 will be another record year for intermodal traffic.

BLS: Job Openings increase to 7.1 Million in October

by Calculated Risk on 12/10/2018 10:08:00 AM

Notes: In October there were 7.0709 million job openings, and, according to the October Employment report, there were 6.075 million unemployed. So, for the seventh consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015 (almost 4 years).

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 7.1 million on the last business day of October, the U.S. Bureau of Labor Statistics reported today. Over the month, hires edged up to 5.9 million, and separations were little changed at 5.6 million. Within separations, the quits rate was little changed at 2.3 percent and the layoffs and discharges rate was unchanged at 1.1 percent. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed in October at 3.5 million. The quits rate was 2.3 percent. The number of quits was little changed for total private and unchanged for government.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for October, the most recent employment report was for November.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in October to 7.079 million from 6.960 million in September.

The number of job openings (yellow) are up 17% year-over-year.

Quits are up 9% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are at a high level, and quits are increasing year-over-year. This was a strong report.