by Calculated Risk on 12/11/2018 09:10:00 AM

Tuesday, December 11, 2018

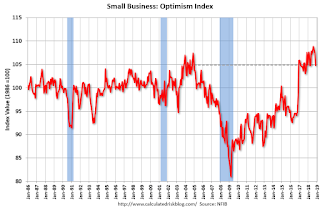

Small Business Optimism Index decreased in November

CR Note: Most of this survey is noise, but there is some information, especially on the labor market and the "Single Most Important Problem".

From the National Federation of Independent Business (NFIB): November 2018 Report: Small Business Optimism Index

Small business optimism slightly dipped in November. The Index declined 2.6 points to 104.8 with more than half the decline attributable to Expected Business Conditions and Expected Real Sales.

..

Job creation was solid in November at a net addition of 0.19 workers per firm (including those making no change in employment), up slightly from September and October readings at 0.15. ... Twenty-five percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem (up 2 points), matching the record high reached in August. Thirty-four percent of all owners reported job openings they could not fill in the current period, down 4 points from last month’s record high.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 104.8 in November.

Note: Usually small business owners complain about taxes and regulations (currently 2nd and 3rd on the "Single Most Important Problem" list). However, during the recession, "poor sales" was the top problem. Now the difficulty of finding qualified workers is the top problem.

Monday, December 10, 2018

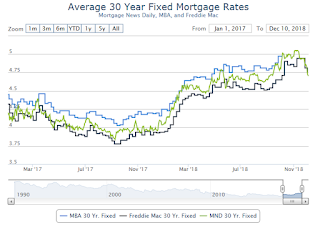

"Mortgage rates at their lowest levels in several months"

by Calculated Risk on 12/10/2018 05:22:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rate Rally May Be Pausing

First things first: the average mortgage lender improved modestly today, compared to last Friday's levels. This leaves mortgage rates at their lowest levels in several months. That's great news and indeed, the last few weeks have been the best few weeks we've seen in more than a year. That having been said, we're now reaching the stage where the strong move in underlying financial markets may be running out of steam. [30YR FIXED - 4.75%]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This is a graph from Mortgage News Daily (MND) showing 30 year fixed rates from three sources (MND, MBA, Freddie Mac).

The MND 30 year fixed rate is at the same level as back in May 2018 (4.75%).

Mortgage Equity Withdrawal slightly positive in Q3

by Calculated Risk on 12/10/2018 01:10:00 PM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released yesterday) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q3 2018, the Net Equity Extraction was a positive $33 billion, or a 0.9% of Disposable Personal Income (DPI) .

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

MEW has been positive for 8 of the last 10 quarters. With a slower rate of debt cancellation, MEW will likely be mostly positive going forward - but nothing like during the housing bubble.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $91 billion in Q3.

The Flow of Funds report also showed that Mortgage debt has declined by $0.43 trillion since the peak.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

AAR: November Rail Carloads Down 0.2% YoY, Intermodal Up 2.5% YoY

by Calculated Risk on 12/10/2018 12:15:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

It’s not like the sky is falling or anything, but while U.S. rail traffic numbers were very solid a few months ago, they were less solid in November. Total carloads fell 0.2% (2,418 carloads) in November 2018 from November 2017, their first decline in nine months. Major blame goes to crushed stone, sand, and gravel, carloads of which fell 12.8% (12,090 carloads) thanks to a decline in carloads of frac sand. … Intermodal rose 2.5% in November. That sounds pretty good, but it’s the smallest increase in 19 months. ... In terms of rail traffic, November might just be the “back” in a case of two steps forward, one step back. But it could be the start of something more. Stay tuned.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Light blue is 2018.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

Rail carload volumes in some recent months were impressive. In November? Not so much. U.S. railroads originated 1.032 million carloads in November 2018, down 0.2%, or 2,418 carloads, from November 2017. It was the first year-over-year decline for total carloads in nine months (see the bottom left chart below). Weekly average total carloads in November 2018 were 258,017, the lowest for November since sometime before 1988, which is when our data begin.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):U.S. rail carloads weren’t as impressive in November as they were in other recent months. The same goes for intermodal. U.S. railroads originated 1.10 million containers and trailers in November 2018, up from 1.07 million in November 2017. The 2.5% gain this year over last is the smallest monthly percentage gain in 19 months. Year-to-date intermodal volume through November was up 5.5%, or 699,102 units, over last year. If that percentage holds for one more month, 2018 will have the largest annual percentage gain for intermodal since 2010.2018 will be another record year for intermodal traffic.

BLS: Job Openings increase to 7.1 Million in October

by Calculated Risk on 12/10/2018 10:08:00 AM

Notes: In October there were 7.0709 million job openings, and, according to the October Employment report, there were 6.075 million unemployed. So, for the seventh consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015 (almost 4 years).

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 7.1 million on the last business day of October, the U.S. Bureau of Labor Statistics reported today. Over the month, hires edged up to 5.9 million, and separations were little changed at 5.6 million. Within separations, the quits rate was little changed at 2.3 percent and the layoffs and discharges rate was unchanged at 1.1 percent. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed in October at 3.5 million. The quits rate was 2.3 percent. The number of quits was little changed for total private and unchanged for government.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for October, the most recent employment report was for November.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in October to 7.079 million from 6.960 million in September.

The number of job openings (yellow) are up 17% year-over-year.

Quits are up 9% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are at a high level, and quits are increasing year-over-year. This was a strong report.

Black Knight Mortgage Monitor for October

by Calculated Risk on 12/10/2018 08:00:00 AM

Black Knight released their Mortgage Monitor report for October today. According to Black Knight, 3.64% of mortgages were delinquent in October, down from 4.44% in October 2017. Black Knight also reported that 0.52% of mortgages were in the foreclosure process, down from 0.68% a year ago.

This gives a total of 4.16% delinquent or in foreclosure.

Press Release: Black Knight: Total Tappable Equity Falls for First Time Since Housing Recovery Began; Softening Home Prices in the Most Equity-Rich Markets Driving Decline

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based on data as of the end of October 2018. This month, Black Knight looked at full Q3 2018 data to revisit the U.S. home equity landscape, finding that quarterly declines were seen in both total equity and tappable equity, the amount available for homeowners with mortgages to borrow against before hitting a maximum 80 percent combined loan-to-value (LTV) ratio. Ben Graboske, executive vice president of Black Knight’s Data & Analytics division, explained that the decline is being driven by home prices pulling back on a quarterly basis in some of the nation’s most expensive housing markets.

“After seeing a significant slowdown in its growth from the first to second quarters of 2018, the amount of tappable equity fell by $140 billion in Q3 2018,” said Graboske. “That is the first decline we’ve seen since the housing recovery began, and its cause can be traced directly to softening home prices in some of the nation’s most expensive – and equity- rich – markets. Indeed, tappable equity fell in 60 of the 100 largest markets, including 12 of the top 15. Three markets in California alone – San Jose, San Francisco and Los Angeles – accounted for 55 percent of the total net decline. Add Seattle into the mix, and you see that just four markets were behind two-thirds of the net reduction in tappable equity. All were areas where home price growth has far outpaced the national average in recent years, but in which prices fell in Q3 2018 – from as little as one percent in Los Angeles, to a 4.6 percent drop in San Jose.

“Of course, there is still $9.8 trillion in total home equity in the market, some $5.9 trillion of which is tappable. That’s $571 billion more than in Q3 2017, and tappable equity remains near an all-time high. It’s also important to remember that in general third quarters are relatively flat as far as home prices are concerned, and that tappable equity is up on an annual basis in 98 percent of major metro areas. But the fact remains that affordability concerns are beginning to have an impact on home prices, particularly in more expensive markets, and as a result, on homeowner equity as well.

Interestingly enough – although for-sale inventory is up on an annual basis for the first time in four years – an analysis of listings on mortgaged properties suggests that homeowners reluctant to put their current homes on the market due to ‘rate lock’ or ‘affordability lock’ may still be holding down available inventory by about six percent. By constraining the supply of available homes, this in turn may be countering what might otherwise be greater downward pressure on home prices.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor showing Black Knight's estimate of active listings (using Realtor.com).

From Black Knight:

• After hitting a post-recession low in January 2018, for sale inventory is up 2% from last year

• That's the first annual increase in more than 4 years, as softening demand causes a net increase in the number of homes listed for sale

• As a point of comparison, and similar to today, the increase in inventory in 2013/2014 was due in part to rising rates putting pressure on the buy side of the housing equation

• Mapping the rise in inventory against 30-year rates, the current increase may be slightly lower and more delayed than expected based on what was observed in 2013/2014 and again in 2015/2016There is much more in the mortgage monitor.

• One potential factor could be homeowners with a mortgage hesitant to list their homes and give up a low fixed interest rate, i.e., "rate lock"

• Despite inventories rising, the average days on market continues to decline, with the median property listed for 68 days, down 5 days on average from a year ago

• Days on market tend to increase as inventories rise, so we may see a shift in coming months

Sunday, December 09, 2018

Monday: Job Openings

by Calculated Risk on 12/09/2018 08:32:00 PM

Weekend:

• Schedule for Week of December 9, 2018

Monday:

• At 10:00 AM ET, Job Openings and Labor Turnover Survey for October from the BLS.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 16 and DOW futures are down 165 (fair value).

Oil prices were mixed over the last week with WTI futures at $52.58 per barrel and Brent at $62.15 per barrel. A year ago, WTI was at $57, and Brent was at $64 - so WTI oil prices are down about 10%, and Brent prices down about 3% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.42 per gallon. A year ago prices were at $2.46 per gallon, so gasoline prices are down slightly year-over-year.

Hotels: Occupancy Rate Increased Year-over-year, On Pace for Record Year

by Calculated Risk on 12/09/2018 08:17:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 1 December

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 25 November through 1 December 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 26 November through 2 December 2017, the industry recorded the following:

• Occupancy: +1.0% to 57.3%

• Average daily rate (ADR): +2.2% to US$120.23

• Revenue per available room (RevPAR): +3.3% to US$68.93

…

Houston, Texas, reported the steepest declines in each of the three key performance metrics: occupancy (-17.4% to 56.9%), ADR (-6.8% to US$99.64) and RevPAR (-23.1% to US$56.70).

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

This is the fourth strong year in a row for hotel occupancy. The occupancy rate, year-to-date, is just ahead of the record year in 2017.

Seasonally, the occupancy rate will now decline through the end of the year.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, December 08, 2018

Schedule for Week of December 9, 2018

by Calculated Risk on 12/08/2018 08:11:00 AM

The key economic reports this week are November CPI and Retail Sales.

For manufacturing, November industrial production will be released this week.

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in September to 7.009 million from 7.293 million in August.

The number of job openings (yellow) were up 12% year-over-year, and Quits were up 11% year-over-year.

6:00 AM: NFIB Small Business Optimism Index for November.

8:30 AM: The Producer Price Index for November from the BLS. The consensus is for no change in PPI, and a 0.1% increase in core PPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for November from the BLS. The consensus is for no change in CPI, and a 0.2% increase in core CPI.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 228 thousand initial claims, down from 231 thousand the previous week.

8:30 AM ET: Retail sales for November will be released. The consensus is for a 0.1% increase in retail sales.

8:30 AM ET: Retail sales for November will be released. The consensus is for a 0.1% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 3.6% on a YoY basis.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 78.5%.

Friday, December 07, 2018

Q4 GDP Forecasts

by Calculated Risk on 12/07/2018 06:01:00 PM

From Merrill Lynch:

Disappointing construction data sliced 0.2pp from our 4Q GDP tracking down to 2.5%, and a tenth off 3Q GDP down to 3.5%. [Dec 7 estimate].And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 2.4 percent on December 7, down from 2.7 percent on December 6. The nowcast of fourth-quarter real final sales of domestic product growth decreased from 2.9 percent to 2.7 percent after this morning’s employment report from the U.S. Bureau of Labor Statistics. The nowcast of the contribution of inventory investment to fourth-quarter real GDP growth decreased from -0.23 percentage points to -0.33 percentage points after the employment report and this morning’s wholesale trade release from the U.S. Census Bureau. [Dec 7 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.4% for both 2018:Q4 and 2019:Q1 [Dec 7 estimate]CR Note: These early estimates suggest GDP in the mid 2s for Q4.