by Calculated Risk on 12/03/2018 10:03:00 AM

Monday, December 03, 2018

ISM Manufacturing index increased to 59.3 in November

The ISM manufacturing index indicated expansion in November. The PMI was at 59.3% in November, up from 57.7% in October. The employment index was at 58.4%, up from 56.8% last month, and the new orders index was at 62.1%, up from 57.4%.

From the Institute for Supply Management: November 2018 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in November, and the overall economy grew for the 115th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The November PMI® registered 59.3 percent, an increase of 1.6 percentage points from the October reading of 57.7 percent. The New Orders Index registered 62.1 percent, an increase of 4.7 percentage points from the October reading of 57.4 percent. The Production Index registered 60.6 percent, a 0.7 percentage-point increase compared to the October reading of 59.9 percent. The Employment Index registered 58.4 percent, an increase of 1.6 percentage points from the October reading of 56.8 percent. The Supplier Deliveries Index registered 62.5 percent, a 1.3-percentage point decrease from the October reading of 63.8 percent. The Inventories Index registered 52.9 percent, an increase of 2.2 percentage points from the October reading of 50.7 percent. The Prices Index registered 60.7 percent, a 10.9-percentage point decrease from the October reading of 71.6 percent, indicating higher raw materials prices for the 33rd consecutive month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 57.2%, and suggests manufacturing expanded at a faster pace in November than in October.

Ten Years Gone: Remembering Tanta

by Calculated Risk on 12/03/2018 08:40:00 AM

Ten years ago my friend and co-blogger Doris "Tanta" Dungey passed away. Please click on the links below for more about Tanta.

I'd just like to say it was an honor sharing this blog with her. I miss her. And I miss her unique and insightful views on daily events.

With her quick wit and extensive knowledge she would have been a major force on social media, especially Twitter. Tanta Vive!

NY Times: Doris Dungey, Prescient Finance Blogger, Dies at 47

WaPo: Doris J. Dungey; Blogger Chronicled Mortgage Crisis

CR writes: Sad News: Tanta Passes Away

Some of her incredible work: The Compleat UberNerd

And for much more: Tanta: In Memoriam

Sunday, December 02, 2018

Monday: ISM Mfg, Construction Spending

by Calculated Risk on 12/02/2018 08:24:00 PM

Weekend:

• Schedule for Week of December 2, 2018

Monday:

• At 10:00 AM, ISM Manufacturing Index for November. The consensus is for 57.2%, down from 57.7%. The PMI was at 57.7% in October, the employment index was at 56.8%, and the new orders index was at 57.4%.

• At 10:00 AM, Construction Spending for October. The consensus is for 0.4% increase in spending.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 41 and DOW futures are up 435 (fair value).

Oil prices were up over the last week with WTI futures at $52.94 per barrel and Brent at $61.60 per barrel. A year ago, WTI was at $58, and Brent was at $63 - so WTI oil prices are down 10%, and Brent prices down about 5% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.44 per gallon. A year ago prices were at $2.46 per gallon, so gasoline prices are down slightly year-over-year.

November 2018: Unofficial Problem Bank list increased to 78 Institutions

by Calculated Risk on 12/02/2018 08:21:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for November 2018.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for November 2018. During the month, the list increased by three institutions to 78 banks. Aggregate assets declined from $56.3 billion to $53.9 billion, with most of the change coming from a $2.8 reduction because of a move to updated third quarter financials. A year ago, the list held 108 institutions with assets of $25.5 billion.

Additions this month include Eastern National Bank, Miami, FL ($414 million); The Morris County National Bank of Naples, Naples, TX ($100 million); and Columbia Savings and Loan Association, Milwaukee, WI ($24 million). Columbia Savings originally debuted on the list in July 2011 and was removed in August 2017. Perhaps the removal in 2017 was premature.

On November 20th, the FDIC released industry results for the third quarter of 2018 and disclosed that the Official Problem Bank List held 71 banks with assets of $53.3 billion.

Saturday, December 01, 2018

Schedule for Week of December 2, 2018

by Calculated Risk on 12/01/2018 08:11:00 AM

The key report this week is the November employment report on Friday.

Other key indicators include the November ISM manufacturing and non-manufacturing indexes, November auto sales, and the October trade deficit.

Fed Chair Jerome Powell testifies on the Economic Outlook on Wednesday.

10:00 AM: ISM Manufacturing Index for November. The consensus is for 57.2%, down from 57.7%.

10:00 AM: ISM Manufacturing Index for November. The consensus is for 57.2%, down from 57.7%.Here is a long term graph of the ISM manufacturing index.

The PMI was at 57.7% in October, the employment index was at 56.8%, and the new orders index was at 57.4%.

10:00 AM: Construction Spending for October. The consensus is for 0.4% increase in spending.

All day: Light vehicle sales for November.

All day: Light vehicle sales for November.The consensus is for 17.2 million SAAR in October, down from the BEA estimate of 17.5 million SAAR in October 2018 (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

10:00 AM: Corelogic House Price index for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 175,000 jobs added, down from 227,000 in October.

10:00 AM: the ISM non-Manufacturing Index for November. The consensus is for a decrease to 59.0 from 60.3.

10:15 AM: Testimony, Fed Chair Jerome Powell, The Economic Outlook, Before the Joint Economic Committee, U.S. Senate

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, down from 234 thousand the previous week.

8:30 AM: Trade Balance report for October from the Census Bureau.

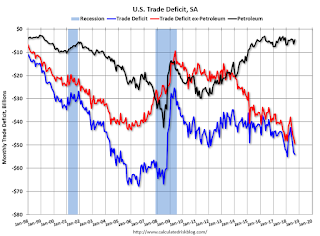

8:30 AM: Trade Balance report for October from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $54.9 billion. The U.S. trade deficit was at $54.0 billion in September.

12:00 PM: Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

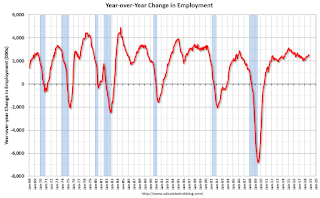

8:30 AM: Employment Report for November. The consensus is for 190,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

8:30 AM: Employment Report for November. The consensus is for 190,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.There were 250,000 jobs added in October, and the unemployment rate was at 3.7%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In October the year-over-year change was 2.516 million jobs.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for December).

3:00 PM: Consumer Credit from the Federal Reserve.

Friday, November 30, 2018

Oil Rigs Increased

by Calculated Risk on 11/30/2018 07:01:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on November 30, 2018:

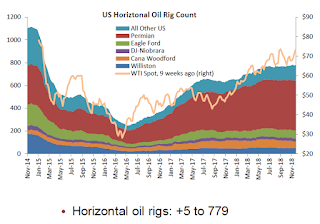

• Oil rigs gained +2 to 887

• Horizontal oil rigs gained more solidly, +5 at 779

• The model forecasts one more week of rig gains, after which numbers crash.

• Breakeven to add rigs rose to around $72 WTI, compared to $50.50 WTI on the screen as of the writing of this report

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Fannie Mae: Mortgage Serious Delinquency Rate Declined in October

by Calculated Risk on 11/30/2018 04:12:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined to 0.79% in October, from 0.82% in September. The serious delinquency rate is down from 1.01% in October 2017.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

This is the lowest serious delinquency rate for Fannie Mae since September 2007.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 2.73% are seriously delinquent. For loans made in 2005 through 2008 (5% of portfolio), 4.82% are seriously delinquent, For recent loans, originated in 2009 through 2018 (92% of portfolio), only 0.33% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

The increase late last year in the delinquency rate was due to the hurricanes - there were no worries about the overall market.

I expect the serious delinquency rate will probably decline to 0.5 to 0.7 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Q4 GDP Forecasts

by Calculated Risk on 11/30/2018 02:38:00 PM

From Merrill Lynch:

We continue to track 3Q GDP at 3.5% qoq saar while 4Q GDP is tracking higher at 2.7% [Nov 30 estimate].And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 2.6 percent on November 29, up from 2.5 percent on November 21. [Nov 29 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast for 2018:Q4 stands at 2.5%. [Nov 30 estimate]CR Note: These early estimates suggest GDP in the mid-to-high 2s for Q4.

NAR 2019 Home Price Forecast Correction

by Calculated Risk on 11/30/2018 12:54:00 PM

In the Pending Home Sales release yesterday, the NAR wrote:

Looking ahead to next year, existing sales are forecast to decline 0.4 percent and home prices to drop roughly 2.5 percent.Forecasting a price decline would be huge news!

However that was a typo in the release. As Andrea Riquier at MarketWatch noted on the NAR forecast (after contacting the NAR):

Home prices WILL NOT DECLINE 2.5%, price appreciation will decline to a 2.5% annual rate.This is still lower than the 3.1% median home price increase in 2019 that NAR economist Lawrence Yun was forecasting a few weeks.

Zillow Case-Shiller Forecast: Slower House Price Gains in October

by Calculated Risk on 11/30/2018 11:53:00 AM

The Case-Shiller house price indexes for September were released this week. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Aaron Terrazas at Zillow: September Case-Shiller Results and October Forecast: A Slow Return to the Push-Pull of a Normal Market

The U.S. National S&P CoreLogic Case-Shiller Home Price Index — which tracks home prices — rose 5.5 percent in September from a year earlier, in line with Zillow’s forecast last month.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be smaller in September than in August as house price growth slows.

...

Zillow forecasts an even slower 5.4 percent annual gain for October.