by Calculated Risk on 12/02/2018 08:21:00 AM

Sunday, December 02, 2018

November 2018: Unofficial Problem Bank list increased to 78 Institutions

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for November 2018.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for November 2018. During the month, the list increased by three institutions to 78 banks. Aggregate assets declined from $56.3 billion to $53.9 billion, with most of the change coming from a $2.8 reduction because of a move to updated third quarter financials. A year ago, the list held 108 institutions with assets of $25.5 billion.

Additions this month include Eastern National Bank, Miami, FL ($414 million); The Morris County National Bank of Naples, Naples, TX ($100 million); and Columbia Savings and Loan Association, Milwaukee, WI ($24 million). Columbia Savings originally debuted on the list in July 2011 and was removed in August 2017. Perhaps the removal in 2017 was premature.

On November 20th, the FDIC released industry results for the third quarter of 2018 and disclosed that the Official Problem Bank List held 71 banks with assets of $53.3 billion.

Saturday, December 01, 2018

Schedule for Week of December 2, 2018

by Calculated Risk on 12/01/2018 08:11:00 AM

The key report this week is the November employment report on Friday.

Other key indicators include the November ISM manufacturing and non-manufacturing indexes, November auto sales, and the October trade deficit.

Fed Chair Jerome Powell testifies on the Economic Outlook on Wednesday.

10:00 AM: ISM Manufacturing Index for November. The consensus is for 57.2%, down from 57.7%.

10:00 AM: ISM Manufacturing Index for November. The consensus is for 57.2%, down from 57.7%.Here is a long term graph of the ISM manufacturing index.

The PMI was at 57.7% in October, the employment index was at 56.8%, and the new orders index was at 57.4%.

10:00 AM: Construction Spending for October. The consensus is for 0.4% increase in spending.

All day: Light vehicle sales for November.

All day: Light vehicle sales for November.The consensus is for 17.2 million SAAR in October, down from the BEA estimate of 17.5 million SAAR in October 2018 (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

10:00 AM: Corelogic House Price index for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 175,000 jobs added, down from 227,000 in October.

10:00 AM: the ISM non-Manufacturing Index for November. The consensus is for a decrease to 59.0 from 60.3.

10:15 AM: Testimony, Fed Chair Jerome Powell, The Economic Outlook, Before the Joint Economic Committee, U.S. Senate

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, down from 234 thousand the previous week.

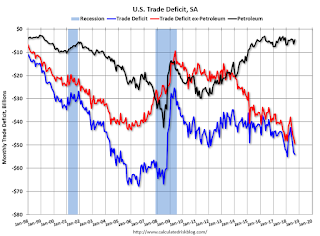

8:30 AM: Trade Balance report for October from the Census Bureau.

8:30 AM: Trade Balance report for October from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $54.9 billion. The U.S. trade deficit was at $54.0 billion in September.

12:00 PM: Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

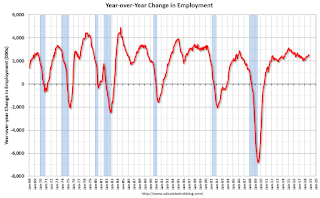

8:30 AM: Employment Report for November. The consensus is for 190,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

8:30 AM: Employment Report for November. The consensus is for 190,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.There were 250,000 jobs added in October, and the unemployment rate was at 3.7%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In October the year-over-year change was 2.516 million jobs.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for December).

3:00 PM: Consumer Credit from the Federal Reserve.

Friday, November 30, 2018

Oil Rigs Increased

by Calculated Risk on 11/30/2018 07:01:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on November 30, 2018:

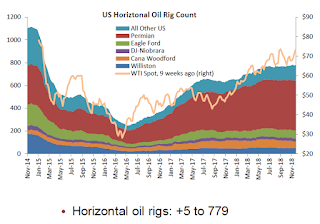

• Oil rigs gained +2 to 887

• Horizontal oil rigs gained more solidly, +5 at 779

• The model forecasts one more week of rig gains, after which numbers crash.

• Breakeven to add rigs rose to around $72 WTI, compared to $50.50 WTI on the screen as of the writing of this report

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Fannie Mae: Mortgage Serious Delinquency Rate Declined in October

by Calculated Risk on 11/30/2018 04:12:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined to 0.79% in October, from 0.82% in September. The serious delinquency rate is down from 1.01% in October 2017.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

This is the lowest serious delinquency rate for Fannie Mae since September 2007.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 2.73% are seriously delinquent. For loans made in 2005 through 2008 (5% of portfolio), 4.82% are seriously delinquent, For recent loans, originated in 2009 through 2018 (92% of portfolio), only 0.33% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

The increase late last year in the delinquency rate was due to the hurricanes - there were no worries about the overall market.

I expect the serious delinquency rate will probably decline to 0.5 to 0.7 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Q4 GDP Forecasts

by Calculated Risk on 11/30/2018 02:38:00 PM

From Merrill Lynch:

We continue to track 3Q GDP at 3.5% qoq saar while 4Q GDP is tracking higher at 2.7% [Nov 30 estimate].And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 2.6 percent on November 29, up from 2.5 percent on November 21. [Nov 29 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast for 2018:Q4 stands at 2.5%. [Nov 30 estimate]CR Note: These early estimates suggest GDP in the mid-to-high 2s for Q4.

NAR 2019 Home Price Forecast Correction

by Calculated Risk on 11/30/2018 12:54:00 PM

In the Pending Home Sales release yesterday, the NAR wrote:

Looking ahead to next year, existing sales are forecast to decline 0.4 percent and home prices to drop roughly 2.5 percent.Forecasting a price decline would be huge news!

However that was a typo in the release. As Andrea Riquier at MarketWatch noted on the NAR forecast (after contacting the NAR):

Home prices WILL NOT DECLINE 2.5%, price appreciation will decline to a 2.5% annual rate.This is still lower than the 3.1% median home price increase in 2019 that NAR economist Lawrence Yun was forecasting a few weeks.

Zillow Case-Shiller Forecast: Slower House Price Gains in October

by Calculated Risk on 11/30/2018 11:53:00 AM

The Case-Shiller house price indexes for September were released this week. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Aaron Terrazas at Zillow: September Case-Shiller Results and October Forecast: A Slow Return to the Push-Pull of a Normal Market

The U.S. National S&P CoreLogic Case-Shiller Home Price Index — which tracks home prices — rose 5.5 percent in September from a year earlier, in line with Zillow’s forecast last month.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be smaller in September than in August as house price growth slows.

...

Zillow forecasts an even slower 5.4 percent annual gain for October.

Chicago PMI Increased in November

by Calculated Risk on 11/30/2018 10:02:00 AM

From the Chicago PMI: Chicago Business Barometer Surges to 66.4 in November

The MNI Chicago Business Barometer surged to an 11-month high of 66.4 in November, up 8.0 points from October’s 58.4.This was well above the consensus forecast of 58.0.

Business activity recorded its most impressive performance so far this year in November, ending a three-month run of declines. Although broad-based, with increases across all five of the Barometer’s subcomponents, resurgent orders, solid output and higher unfinished orders were the month’s key drivers.

...

Building on October’s rise, the Employment indicator strengthened further in November, hitting a three-month high and moving further clear of the neutral-50 mark.

…

“The MNI Chicago Business Barometer clipped a run of three consecutive declines in emphatic style in November, boosted primarily by resurgent orders – stronger than typically seen at this time of year and enough to push the Barometer to its best level since December,” said Jamie Satchi, Economist at MNI Indicators.

“However, many firms reported seeing the effects of higher China tariffs on their invoices for the first time, and voiced concern that business could be stifled going forward,” he added.

emphasis added

Thursday, November 29, 2018

Freddie Mac: Mortgage Serious Delinquency Rate Decreased in October

by Calculated Risk on 11/29/2018 05:39:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in October was 0.71%, down from 0.73% in September. Freddie's rate is down from 0.86% in October 2017.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This is the lowest serious delinquency rate for Freddie Mac since January 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The increase in the delinquency rate late last year was due to the hurricanes (These are serious delinquencies, so it took three months late to be counted).

I expect the delinquency rate to decline to a cycle bottom in the 0.5% to 0.7% range - but this is close to a bottom.

Note: Fannie Mae will report for October soon.

FOMC Minutes: "Further gradual increases"

by Calculated Risk on 11/29/2018 05:33:00 PM

Catching up … From the Fed: Minutes of the Federal Open Market Committee, November 7-8, 2018. A few excerpts:

In their discussion of monetary policy, participants agreed that it would be appropriate to maintain the current target range for the federal funds rate at this meeting. Participants generally judged that the economy had been evolving about as they had anticipated, with economic activity rising at a strong rate, labor market conditions continuing to strengthen, and inflation running at or near the Committee's longer-run objective. Almost all participants reaffirmed the view that further gradual increases in the target range for the federal funds rate would likely be consistent with sustaining the Committee's objectives of maximum employment and price stability.

Consistent with their judgment that a gradual approach to policy normalization remained appropriate, almost all participants expressed the view that another increase in the target range for the federal funds rate was likely to be warranted fairly soon if incoming information on the labor market and inflation was in line with or stronger than their current expectations. However, a few participants, while viewing further gradual increases in the target range of the federal funds rate as likely to be appropriate, expressed uncertainty about the timing of such increases. A couple of participants noted that the federal funds rate might currently be near its neutral level and that further increases in the federal funds rate could unduly slow the expansion of economic activity and put downward pressure on inflation and inflation expectations.

Participants emphasized that the Committee's approach to setting the stance of policy should be importantly guided by incoming data and their implications for the economic outlook. They noted that their expectations for the path of the federal funds rate were based on their current assessment of the economic outlook. Monetary policy was not on a preset course; if incoming information prompted meaningful reassessments of the economic outlook and attendant risks, either to the upside or the downside, their policy outlook would change. Various factors such as the recent tightening in financial conditions, risks in the global outlook, and some signs of slowing in interest-sensitive sectors of the economy on the one hand, and further indicators of tightness in labor markets and possible inflationary pressures, on the other hand, were noted in this context. Participants also commented on how the Committee's communications in its postmeeting statement might need to be revised at coming meetings, particularly the language referring to the Committee's expectations for "further gradual increases" in the target range for the federal funds rate. Many participants indicated that it might be appropriate at some upcoming meetings to begin to transition to statement language that placed greater emphasis on the evaluation of incoming data in assessing the economic and policy outlook; such a change would help to convey the Committee's flexible approach in responding to changing economic circumstances.

emphasis added