by Calculated Risk on 10/22/2018 03:35:00 PM

Monday, October 22, 2018

NMHC: Apartment Market Tightness Index remained negative for 12th Consecutive Quarter

The National Multifamily Housing Council (NMHC) released their October report: October Apartment Market Conditions Experience Headwinds

The Market Tightness Index was below 50 (looser conditions) for the 12th consecutive month. The Index came in at 41 in October.

This index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. And it also helped me call the bottom in vacancy rate more recently.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser over the last quarter.

This is the twelfth consecutive quarterly survey indicating looser conditions - it appears supply has caught up with demand - and I expect rent growth to continue to slow.

Housing Inventory Tracking

by Calculated Risk on 10/22/2018 10:02:00 AM

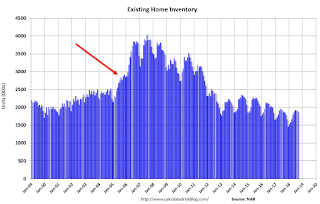

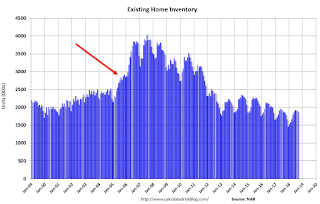

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was up 1.1% year-over-year (YoY) in September, this the second consecutive YoY increase, following over three years of YoY declines.

The graph below shows the YoY change for non-contingent inventory in Houston, Las Vegas, Sacramento, and Phoenix (through September) and total existing home inventory as reported by the NAR (also through September). (I'll be adding more areas).

The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory was up 33% YoY in Las Vegas in September (red), the third consecutive month with a YoY increase.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased. Inventory was up 6% year-over-year in Houston in September.

Inventory is a key for the housing market, and I am watching inventory for the impact of the new tax law and higher mortgage rates on housing. I expect national inventory will be up YoY at the end of 2018 (but still to be somewhat low).

Also note that inventory in Seattle was up 78% year-over-year in September (not graphed)!

Although I expect inventory to increase YoY in 2018, I expect inventory to follow the normal seasonal pattern (not keep increasing all year like in 2005).

So the current increase in inventory is not comparable to late 2005 when inventory increased sharply signaling the end of the housing bubble.

Also inventory is still very low. In cities like Las Vegas and Sacramento, inventory has finally moved above 2 months supply - but still historically low.

Chicago Fed "Index Points to a Moderation in Economic Growth in September"

by Calculated Risk on 10/22/2018 08:39:00 AM

From the Chicago Fed: Index Points to a Moderation in Economic Growth in September

The Chicago Fed National Activity Index (CFNAI) decreased to +0.17 in September from +0.27 in August. Two of the four broad categories of indicators that make up the index decreased from August, but three of the four categories made positive contributions to the index in September. The index’s three-month moving average, CFNAI-MA3, moved down to +0.21 in September from +0.27 in August.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was slightly above the historical trend in September (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, October 21, 2018

Sunday Night Futures

by Calculated Risk on 10/21/2018 08:09:00 PM

Weekend:

• Schedule for Week of October 21, 2018

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for September. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 11 and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $69.25 per barrel and Brent at $79.87 per barrel. A year ago, WTI was at $52, and Brent was at $58 - so oil prices are up about 35% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.84 per gallon. A year ago prices were at $2.44 per gallon, so gasoline prices are up 40 cents per gallon year-over-year.

Hotels: Occupancy Rate Declined Slightly Year-over-year

by Calculated Risk on 10/21/2018 09:17:00 AM

From HotelNewsNow.com: US hotel results for week ending 13 October

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 7-13 October 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 8-14 October 2017, the industry recorded the following:

• Occupancy: -0.7% to 71.9%

• Average daily rate (ADR): +1.6% to US$132.76

• Revenue per available room (RevPAR): +0.8% to US$95.42

…

Due to difficult-to-match year-over-year comparisons, Houston, Texas, experienced the steepest declines in occupancy (-25.0% to 63.9%) and RevPAR (-31.3% to US$67.70). Houston’s hotel performance was lifted in the weeks and months that followed Hurricane Harvey in 2017 as properties filled with displaced residents, relief workers, insurance adjustors, media members, etc.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is just ahead of the record year in 2017.

Note: 2017 finished strong due to the impact of the hurricanes. There will be some boost to hotel occupancy in the Carolina and Florida regions following hurricanes Florence and Michael, but I expect the overall occupancy to be lower in 2018 than in 2017.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, October 20, 2018

Schedule for Week of October 21, 2018

by Calculated Risk on 10/20/2018 08:11:00 AM

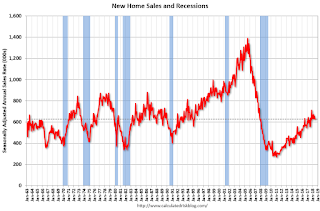

The key reports this week are September New Home sales, and the advance estimate of Q3 GDP.

For manufacturing, the Richmond, and Kansas City Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for September. This is a composite index of other data.

10:00 AM ET: Richmond Fed Survey of Manufacturing Activity for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for August 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for September from the Census Bureau.

10:00 AM: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 625 thousand SAAR, down from 629 thousand in August.

During the day: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 212 thousand initial claims, up from 210 thousand the previous week.

8:30 AM: Durable Goods Orders for September from the Census Bureau. The consensus is for a 1.4% decrease in durable goods orders.

10:00 AM: Pending Home Sales Index for September. The consensus is for no change in the index.

11:00 AM: the Kansas City Fed manufacturing survey for October.

8:30 AM: Gross Domestic Product, 3nd quarter 2018 (Advance estimate). The consensus is that real GDP increased 3.3% annualized in Q3, down from 4.2% in Q2.

10:00 AM: University of Michigan's Consumer sentiment index (Final for October). The consensus is for a reading of 99.0.

Friday, October 19, 2018

Oil Rigs Increase Slightly

by Calculated Risk on 10/19/2018 08:04:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on October 19, 2018:

• Oil rigs were up this week, +4 to 873

• Horizontal oil rigs were flat at 772

...

• Although WTI is down, the Midland price is still near annual highs and well above the Permian breakeven

• We continue to expect a modest recovery in spreads and largely flat rig counts, although the model shows a healthy horizontal oil rig gain next week

• Shale production continues to increase by around 1.5 mbpd / year

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Q3 GDP Forecasts

by Calculated Risk on 10/19/2018 02:42:00 PM

The BEA is scheduled to release the advance estimate of Q3 GDP on Friday, Oct 26th. The early consensus is real GDP increased 3.3% on an annualized basis in Q3. Here are a few forecasts:

From Merrill Lynch:

We expect 3Q GDP growth of 3.4% in the advance release next week. [Oct 19 estimate].From Goldman Sachs:

emphasis added

We left our Q3 GDP tracking estimate unchanged on a rounded basis at +3.5% (qoq ar). [Oct 19 estimate]From Nomura:

We expect real GDP growth to increase solidly by 3.4% q-o-q saar in Q3 [Oct 19 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2018 is 3.9 percent on October 17, down from 4.0 percent on October 15. [Oct 17 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.1% for 2018:Q3 and 2.4% for 2018:Q4. [Oct 19 estimate]CR Note: It looks like GDP will be in the 3s in Q3.

BLS: Unemployment Rates Lower in 9 states in September, Six States at New Series Lows

by Calculated Risk on 10/19/2018 01:25:00 PM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in September in 9 states, higher in 4 states, and stable in 37 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Sixteen states had jobless rate decreases from a year earlier and 34 states and the District had little or no change.

...

Hawaii had the lowest unemployment rate in September, 2.2 percent. The rates in Arkansas (3.5 percent), California (4.1 percent), Idaho (2.7 percent), South Carolina (3.3 percent), Texas (3.8 percent), and Washington (4.4 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 6.5 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

At the worst of the great recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 6% (dark blue).

A Few Comments on September Existing Home Sales

by Calculated Risk on 10/19/2018 11:19:00 AM

Earlier: NAR: Existing-Home Sales Declined to 5.15 million in September

A few key points:

1) The key for the housing - and the overall economy - is new home sales, single family housing starts and overall residential investment. Overall this is a reasonable level for existing home sales, and the recent weakness is no surprise given the increase in mortgage rates.

2) Inventory is still low, but was up 1.1% year-over-year (YoY) in September. This was the second consecutive year-over-year increase in inventory, and the first YoY increases since May 2015.

3) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. See: Lawler: Early Read on Existing Home Sales in September. The consensus was for sales of 5.30 million SAAR, Lawler estimated the NAR would report 5.20 million SAAR in September, and the NAR actually reported 5.15 million.

The current slight YoY increase in inventory is nothing like what happened in 2005 and 2006. In 2005 (see red arrow), inventory kept increasing all year, and that was a sign the bubble was ending.

Although I expect inventory to increase YoY in 2018, I expect inventory to follow the normal seasonal pattern (not keep increasing all year).

Also inventory levels remains low, and could increase significantly and still be at normal levels. No worries.

Sales NSA in September (420,000, red column) were well below sales in September 2017 (462,000, NSA), and the lowest for September since 2012.

Sales NSA through September (first nine months) are down about 2.1% from the same period in 2017.

This is a small YoY decline in sales to-date - it is likely that higher mortgage rates are impacting sales, and it is possible there has been an impact from the changes to the tax law (eliminating property taxes write-off, etc).