by Calculated Risk on 9/08/2018 08:11:00 AM

Saturday, September 08, 2018

Schedule for Week of September 9, 2018

The key economic reports this week are August Retail sales, and the August Consumer Price Index (CPI).

For manufacturing, August industrial production will be released this week.

3:00 PM: Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $14.0 billion in July.

6:00 AM: NFIB Small Business Optimism Index for August.

10:00 AM ET: Job Openings and Labor Turnover Survey for July from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for July from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased slightly in June to 6.662 million from 6.659 million in May.

The number of job openings (yellow) were up 9% year-over-year, and Quits were up 7% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Producer Price Index for August from the BLS. The consensus is a 0.2% increase in PPI, and a 0.2% increase in core PPI.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims, up from 203 thousand the previous week.

8:30 AM: The Consumer Price Index for August from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.2% increase in core CPI.

8:30 AM ET: Retail sales for August will be released. The consensus is for a 0.4% increase in retail sales.

8:30 AM ET: Retail sales for August will be released. The consensus is for a 0.4% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 5.1% on a YoY basis in July.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 78.3%.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for September).

Friday, September 07, 2018

AAR: August Rail Carloads Up 3.8% YoY, Intermodal Up 5.1% YoY

by Calculated Risk on 9/07/2018 04:59:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

August 2018 was yet another good month for rail traffic. U.S. railroads originated 1.39 million carloads in August 2018, up 3.8% (50,335 carloads) over August 2017.

…

U.S. railroads also originated 1.44 million intermodal containers and trailers in August 2018, up 5.1%, or 70,198 units, over August 2017.

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Light blue is 2018.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

U.S. railroads originated 1,386,026 carloads in August 2018, up 50,335 carloads, or 3.8%, over August 2017. August 2018 was the sixth straight year-over-year monthly increase for total carloads, Carloads averaged 277,205 per week in August 2018, the most for any month since October 2015. The 3.8% percentage gain in August 2018 was the biggest for any month since June 2017.

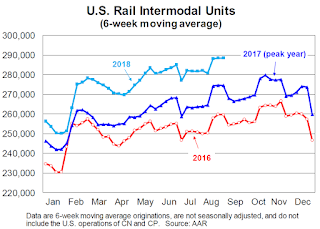

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):U.S. intermodal originations totaled 1,442,920 containers and trailers in August 2018, up 5.1%, or 70,198 units, over August 2017. Average weekly intermodal volume in August 2018 was 288,584 units, the second highest weekly average for any month in history (behind June 2018’s 289,993).2018 will be another record year for intermodal traffic.

Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 9/07/2018 03:35:00 PM

By request, here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (19 months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 804,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 391,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,964,000 under President Clinton (light blue), by 14,717,000 under President Reagan (dark red), 9,041,000 under President Carter (dashed green), 1,509,000 under President G.H.W. Bush (light purple), and 11,907,000 under President Obama (dark blue).

During the first 19 months of Mr. Trump's term, the economy has added 3,556,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 266,000 jobs).

During the first 19 months of Mr. Trump's term, the economy has added 27,000 public sector jobs.

After 19 months of Mr. Trump's presidency, the economy has added 3,583,000 jobs, about 375,000 behind the projection.

Q3 GDP Forecasts

by Calculated Risk on 9/07/2018 01:33:00 PM

From Goldman Sachs:

We boosted our Q3 GDP tracking estimate by two tenths to +3.2% (qoq ar). [Sept 6 estimate].From Merrill Lynch:

emphasis added

July construction data disappointed, edging down our 3Q GDP tracker by 0.1pp to 3.2%. Meanwhile, positive data revisions lifted 2Q GDP tracking to 4.4% from 4.2%. [Sept 7 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2018 is 4.4 percent on September 5, down from 4.7 percent on September 4. [Sept 5 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.2% for 2018:Q3 and 2.8% for 2018:Q4. [Sept 7 estimate]CR Note: It looks like GDP will be in the 3s in Q3.

Comments on August Employment Report

by Calculated Risk on 9/07/2018 09:43:00 AM

The headline jobs number at 201,000 for August was slightly above consensus expectations of 195 thousand, however the previously two months were revised down by a combined 50 thousand. Overall this was a solid report.

Earlier: August Employment Report: 201,000 Jobs Added, 3.9% Unemployment Rate

In August, the year-over-year employment change was 2.330 million jobs. This is solid year-over-year growth.

Average Hourly Earnings

Wage growth was above expectations in August. From the BLS:

"In August, average hourly earnings for all employees on private nonfarm payrolls rose by 10 cents to $27.16. Over the year, average hourly earnings have increased by 77 cents, or 2.9 percent."

Click on graph for larger image.

Click on graph for larger image.This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.9% YoY in August.

Wage growth has generally been trending up.

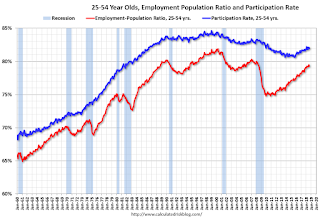

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate decreased in August to 82.0%, and the 25 to 54 employment population ratio decreased to 79.3%.

The participation rate had been trending down for this group since the late '90s, however, with more younger workers (and fewer 50+ age workers), the prime participation rate might move up some more. The employment population ratio is almost back to the pre-great recession highs.

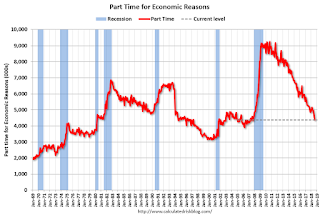

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers), at 4.4 million, changed little over the month but was down by 830,000 over the year. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons has been generally trending down, and the number decreased in August to the lowest level since October 2007. The number working part time for economic reasons suggests there is still a little slack in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 7.4% in August. This is the lowest level for U-6 since April 2001.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.435 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 1.478 million in June.

Summary:

The headline jobs number was slightly above expectations, however the previous two months were revised down.

The headline unemployment rate was unchanged at 3.9%, and U-6 decreased to 7.4% - the lowest rate since 2001. And wage growth was above expectations.

Overall, this was a solid report. For the first eight months of 2018, job growth has been solid, averaging 207 thousand per month.

August Employment Report: 201,000 Jobs Added, 3.9% Unemployment Rate

by Calculated Risk on 9/07/2018 08:40:00 AM

From the BLS:

Total nonfarm payroll employment increased by 201,000 in August, and the unemployment rate was unchanged at 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in professional and business services, health care, wholesale trade, transportation and warehousing, and mining.

...

The change in total nonfarm payroll employment for June was revised down from +248,000 to +208,000, and the change for July was revised down from +157,000 to +147,000. With these revisions, employment gains in June and July combined were 50,000 less than previously reported.

...

In August, average hourly earnings for all employees on private nonfarm payrolls rose by 10 cents to $27.16. Over the year, average hourly earnings have increased by 77 cents, or 2.9 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 201 thousand in August (private payrolls increased 204 thousand).

Payrolls for June and July were revised down by a combined 50 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In August the year-over-year change was 2.330 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate declined in August to 62.7%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Labor Force Participation Rate declined in August to 62.7%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics. The Employment-Population ratio decreased to 60.3% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged in August at 3.9%.

This was close to the consensus expectations of 195,000 jobs, however the previous two months combined were revised down by 50,000. A decent report.

I'll have much more later ...

Thursday, September 06, 2018

Friday: Employment Report

by Calculated Risk on 9/06/2018 06:41:00 PM

My August Employment Preview

Goldman: August Payrolls Preview

Friday:

• At 8:30 AM, Employment Report for August. The consensus is for an increase of 198,000 non-farm payroll jobs in August, up from the 157,000 non-farm payroll jobs added in July. The consensus is for the unemployment rate to decline to 3.8%.

Goldman: August Payrolls Preview

by Calculated Risk on 9/06/2018 02:52:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate that nonfarm payrolls increased 175k in August ... While continued strength in employment surveys and jobless claims data suggest underlying labor demand remains solid, we expect a drag of around 40k from negative residual seasonality. ...

We estimate the unemployment rate fell one tenth to 3.8% … we expect average hourly earnings to increase 0.2% month over month and 2.7% year over year ...

emphasis added

August Employment Preview

by Calculated Risk on 9/06/2018 01:07:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for August. The consensus is for an increase of 195,000 non-farm payroll jobs in August (with a range of estimates between 150,000 to 237,000), and for the unemployment rate to decline to 3.8%.

The BLS reported 157,000 jobs added in July.

Here is a summary of recent data:

• The ADP employment report showed an increase of 163,000 private sector payroll jobs in August. This was below consensus expectations of 182,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth below expectations.

• The ISM manufacturing employment index increased in August to 58.5%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll increased about 25,000 in August. The ADP report indicated manufacturing jobs increased 19,000 in August.

The ISM non-manufacturing employment index increased in August to 56.7%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 250,000 in August.

Combined, the ISM indexes suggests employment gains of about 275,000. This suggests employment growth well above expectations.

• Initial weekly unemployment claims averaged 209,500 in August down from 214,500 in July. For the BLS reference week (includes the 12th of the month), initial claims were at 210,000, up slightly from 208,000 during the reference week in July.

The slight increase during the reference week suggests a solid employment report in August.

• The final August University of Michigan consumer sentiment index decreased to 96.2 from the July reading of 97.9. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Merrill Lynch has introduced a new payrolls tracker based on private internal BAC data. The tracker suggests private payrolls increased by 245,000 in August, and this suggests employment growth above expectations.

• Looking back at the three previous years:

In August 2017, the consensus was for 180,000 jobs, and the BLS reported 156,000 jobs added.

In August 2016, the consensus was for 175,000 jobs, and the BLS reported 151,000 jobs added.

In August 2015, the consensus was for 223,000 jobs, and the BLS reported 173,000 jobs added.

In general it looks like the consensus is frequently too high for the month of August.

• Conclusion: These reports suggest a solid employment report in August. The ADP report suggests employment growth below expectations, however, the ISM reports, and the Merrill payrolls tracker suggest a report above expectations. Since the consensus has been too high for August over the last few years, my guess is that the employment report will be below expectations (usually these indicators give a decent indication, however last month I took the "over", and the actual was "under").

Las Vegas Real Estate in August: Sales Down 3% YoY, Inventory up 20% YoY

by Calculated Risk on 9/06/2018 11:33:00 AM

This is a key former distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Southern Nevada home prices hovering this summer, GLVAR housing statistics for August 2018

After climbing steadily since 2012, local home prices have been hovering this summer, with a report released today by the Greater Las Vegas Association of REALTORS® (GLVAR) showing prices back to where they were in May.1) Overall sales were down 3.3% year-over-year from 4,012 in August 2017 to 3,881 in August 2018.

...

The total number of existing local homes, condos and townhomes sold during August was 3,881. Compared to one year ago, August sales were down 6.4 percent for homes, but up 11.0 percent for condos and townhomes. Overall, he said sales so far this year remain behind last year’s pace.

...

Meanwhile, Bishop said the housing supply increased in August, which he called good news for potential buyers. However, he said Southern Nevada still has less than a two-month supply of existing homes available for sale when a six-month supply would be a balanced market. By the end of August, GLVAR reported 5,818 single-family homes listed for sale without any sort of offer. That’s up from July and up 12.8 percent from one year ago. For condos and townhomes, the 1,184 properties listed without offers in August represented a 73.4 percent increase from one year ago.

...

The number of so-called distressed sales continues to drop. GLVAR reported that short sales and foreclosures combined accounted for just 2.5 percent of all existing local home sales in August, down from 6.1 percent of all sales one year ago.

emphasis added

2) Active inventory (single-family and condos) is up from a year ago, from a total of 5,840 in August 2017 to 7,002 in August 2018. Note: Total inventory was up 19.9% year-over-year. This is a significant change in inventory.

3) Fewer distressed sales.