by Calculated Risk on 7/25/2018 12:34:00 PM

Wednesday, July 25, 2018

A few Comments on June New Home Sales

New home sales for June were reported at 631,000 on a seasonally adjusted annual rate basis (SAAR). This was below the consensus forecast, and the three previous months, combined, were revised down.

Sales in June were up 2.4% year-over-year compared to June 2017. This was weak YoY growth, especially since was a fairly easy comparison since new home sales were soft in mid-year 2017.

There have been several articles recently about a weaker housing market (see: Has the Housing Market Peaked? (Part 2)). However I expect new home sales and single family starts will increase further over the next couple of years.

If new home sales weaken further this year, I'd be a more concerned. But so far, the growth in new home sales in 2018 is about what I expected.

Earlier: New Home Sales decrease to 631,000 Annual Rate in June.

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

Sales are up 6.9% through June compared to the same period in 2017. Decent growth so far, and the next two months will be an easy comparison to 2017.

This is on track to be close to my forecast for 2018 of 650 thousand new home sales for the year; an increase of about 6% over 2017. There are downside risks to that forecast, such as higher mortgage rates, higher costs (labor and material), and possible policy errors.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales decrease to 631,000 Annual Rate in June

by Calculated Risk on 7/25/2018 10:11:00 AM

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 631 thousand.

The previous three months were revised down, combined.

"Sales of new single-family houses in June 2018 were at a seasonally adjusted annual rate of 631,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 5.3 percent below the revised May rate of 666,000, but is 2.4 percent above the June 2017 estimate of 616,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in June to 5.7 months from 5.3 months in May.

The months of supply increased in June to 5.7 months from 5.3 months in May. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of June was 301,000. This represents a supply of 5.7 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

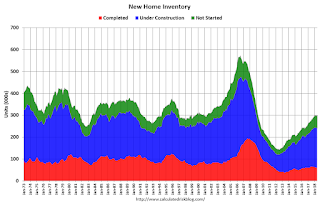

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is also somewhat low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In June 2018 (red column), 57 thousand new homes were sold (NSA). Last year, 56 thousand homes were sold in June.

The all time high for June was 115 thousand in 2005, and the all time low for June was 28 thousand in 2010 and in 2011.

This was below expectations of 669,000 sales SAAR, and the previous months were revised down, combined. I'll have more later today.

MBA: Mortgage Applications Decreased Slightly in Latest Weekly Survey

by Calculated Risk on 7/25/2018 07:00:00 AM

From the MBA: Mortgage Application Activity and Rates Nearly Flat in Latest MBA Weekly Survey

Mortgage applications decreased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 20, 2018.

... The Refinance Index increased 1 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 2 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) remained unchanged at 4.77 percent, with points decreasing to 0.45 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 2% year-over-year.

Tuesday, July 24, 2018

Wednesday: New Home Sales

by Calculated Risk on 7/24/2018 08:00:00 PM

Wednesday:

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM: New Home Sales for June from the Census Bureau. The consensus is for 669 thousand SAAR, down from 689 thousand in May.

Has the Housing Market Peaked? (Part 2)

by Calculated Risk on 7/24/2018 04:09:00 PM

On Friday I wrote: Has Housing Market Activity Peaked? I concluded

"I do not think housing has peaked, and I think new home sales and single family starts will increase further over the next couple of years."Since then we've seen several reports of softening existing home sales in a number of cities (Seattle, Portland, California, and more). And the NAR reported sales were down year-over-year in June, and probably more important that inventory was up year-over=year for the first time since June 2015.

And the CAR reported California: "Home sales stumble", Inventory up 8.1% YoY

As I noted last Friday, I think it is likely that existing home sales will move more sideways going forward. However it is important to remember that new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc. - but overall the economic impact is small compared to a new home sale.

Also I think the growth in multi-family starts is behind us, and that multi-family starts peaked in June 2015. See: Comments on June Housing Starts

For the economy, what we should be focused on are single family starts and new home sales. As I noted in Investment and Recessions "New Home Sales appears to be an excellent leading indicator, and currently new home sales (and housing starts) are up solidly year-over-year, and this suggests there is no recession in sight."

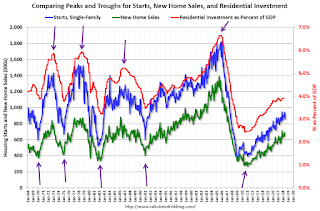

For the bottoms and troughs for key housing activity, here is a graph of Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

Click on graph for larger image.

Click on graph for larger image.The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

RI as a percent of GDP has been sluggish recently, mostly due to softness in multi-family residential. However, both single family starts and new home sales are still moving up (ignoring month-to-month fluctuations).

Also, look at the relatively low level of RI as a percent of GDP, new home sales and single family starts compared to previous peaks. To have a significant downturn from these levels would be surprising.

So my view remains: I do not think housing has peaked, and I think new home sales and single family starts will increase further over the next couple of years.

Top Twenty GDP Quarters since 2000

by Calculated Risk on 7/24/2018 01:16:00 PM

I expect some really poor analysis after the advance GDP report is released on Friday (the Consensus is the BEA will report real annualized GDP of 4.2% for Q2).

Below is a table of the top 20 quarters since Q1 2000. A 4.2% quarter would be the 9th best since Q1 2000.

As I've noted before, based on demographics, 2% is the new 4% (that is just simple arithmetic). I've also noted that a large government program (such as a war, or a tax cut) can give a short term boost to GDP. So Q2 should be fine, but not a game change.

| Top 20 GDP Quarters since 2000 Real GDP, Annualized Rate | ||||

|---|---|---|---|---|

| GDP | Year | Quarter | President | |

| 1 | 7.8% | 2000 | Q2 | Clinton |

| 2 | 6.9% | 2003 | Q3 | G.W.Bush |

| 3 | 5.2% | 2014 | Q3 | Obama |

| 4 | 4.9% | 2006 | Q1 | G.W.Bush |

| 5 | 4.8% | 2003 | Q4 | G.W.Bush |

| 6 | 4.6% | 2011 | Q4 | Obama |

| 7 | 4.6% | 2014 | Q2 | Obama |

| 8 | 4.3% | 2005 | Q1 | G.W.Bush |

| 9 | 4.0% | 2013 | Q4 | Obama |

| 10 | 3.9% | 2009 | Q4 | Obama |

| 11 | 3.9% | 2010 | Q2 | Obama |

| 12 | 3.8% | 2003 | Q2 | G.W.Bush |

| 13 | 3.7% | 2002 | Q1 | G.W.Bush |

| 14 | 3.7% | 2004 | Q3 | G.W.Bush |

| 15 | 3.5% | 2004 | Q4 | G.W.Bush |

| 16 | 3.4% | 2005 | Q3 | G.W.Bush |

| 17 | 3.2% | 2006 | Q4 | G.W.Bush |

| 18 | 3.2% | 2015 | Q1 | Obama |

| 19 | 3.2% | 2017 | Q3 | Trump |

| 20 | 3.1% | 2007 | Q2 | G.W.Bush |

Richmond Fed: "Fifth District Manufacturing Firms Saw Slowing Growth in July"

by Calculated Risk on 7/24/2018 10:02:00 AM

From the Richmond Fed: Fifth District Manufacturing Firms Saw Slowing Growth in July

Fifth District manufacturing expanded at a slower pace in July, according to results of the most recent survey from the Federal Reserve Bank of Richmond. The composite manufacturing index fell from 21 in June to 20 in July, but it remained in solid expansionary territory. This decrease resulted from a decrease in the employment and shipments indexes, as the other component (new orders) held steady. Firms were optimistic in July, expecting to see robust growth across most indicators in the coming months.All of the regional manufacturing reports for July have been solid so far.

Manufacturing employment growth slowed in July, as the employment index fell from 23 in June to 22 in July. Firms continued to struggle to find workers with the skills they needed and expect this struggle to continue in the next six months.

emphasis added

Black Knight: National Mortgage Delinquency Rate Increased Slightly in June

by Calculated Risk on 7/24/2018 08:39:00 AM

From Black Knight: Black Knight’s First Look: June Sees Fewest Foreclosure Starts in Over 17 Years; Active Foreclosure Inventory Falls Below 300,000 for First Time Since Q3 2006

• Foreclosure starts fell another 3.1 percent in June for the lowest single-month total in more than 17 yearsAccording to Black Knight's First Look report for June, the percent of loans delinquent increased 2.7% in June compared to May, and decreased 1.6% year-over-year.

• Active foreclosures continued to decline as well, falling below 300,000 for the first time in nearly 12 years

• The inventory of loans in active foreclosure has fallen 30 percent (-119k) over the past 12 months

• Delinquencies edged seasonally upward in June, but remain 1.59 percent below last year’s levels

• After rising following the 2017 hurricane season, 90-day delinquencies hit a new post-recession low

The percent of loans in the foreclosure process decreased 4.5% in June and were down 30.0% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.74% in June, up from 3.64% in May.

The percent of loans in the foreclosure process decreased in June to 0.56%.

The number of delinquent properties, but not in foreclosure, is down 7,000 properties year-over-year, and the number of properties in the foreclosure process is down 119,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| June 2018 | May 2018 | June 2017 | June 2016 | |

| Delinquent | 3.74% | 3.64% | 3.80% | 4.31% |

| In Foreclosure | 0.56% | 0.59% | 0.81% | 1.10% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,925,000 | 1,867,000 | 1,932,000 | 2,178,000 |

| Number of properties in foreclosure pre-sale inventory: | 291,000 | 303,000 | 410,000 | 558,000 |

| Total Properties | 2,216,000 | 2,171,000 | 2,342,000 | 2,736,000 |

Monday, July 23, 2018

Mortgage Rates at Top of Recent Range

by Calculated Risk on 7/23/2018 07:31:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Surge to 1-Month Highs

Mortgage rates rose today at the quickest pace in months, ultimately hitting the highest levels since June 25th for the average lender. While neither of those are "fun" facts for fans of low rates, they are made slightly more palatable by the nature of the recent range.Tuesday:

Specifically, rates hadn't moved very much since late June. The average mortgage seeker will not have seen a change in their quoted interest rate during that time (the only adjustments have been to upfront closing costs/credits). The point is that it didn't require a huge move to be able to say "highest in a month" or "fastest pace in months." [30YR FIXED - 4.625% - 4.75%]

emphasis added

• At 9:00 AM ET, FHFA House Price Index for May 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for July.

Housing Inventory Tracking

by Calculated Risk on 7/23/2018 03:17:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was up 0.5% year-over-year (YoY) in June, the first YoY increase since June 2015!

The graph below shows the YoY change for non-contingent inventory in Houston, Las Vegas, Sacramento and also Phoenix (through June) and total existing home inventory as reported by the NAR (through June 2018).

This shows the YoY change in inventory for Houston, Las Vegas, Phoenix, and Sacramento. The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory in Sacramento was up 26% year-over-year in June (inventory was still very low), and has increased YoY for nine consecutive months.

Also note that inventory is still down 11% YoY in Las Vegas (red), but the YoY decline has been getting smaller - and inventory in Vegas will probably be up YoY very soon.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing. Currently I expect national inventory will be up YoY at the end of 2018 (but still be low).

This is not comparable to late 2005 when inventory increased sharply signaling the end of the housing bubble, but it does appear that inventory is bottoming nationally.