by Calculated Risk on 1/08/2018 10:06:00 AM

Monday, January 08, 2018

Update: Framing Lumber Prices Up Sharply Year-over-year

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs - and prices are once again near the bubble highs.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through November 2017 (via NAHB), and 2) CME framing futures.

Prices in early 2018 are up solidly year-over-year and might exceed the housing bubble highs in the Spring of 2018. Note: CME prices hit an all time high briefly in November.

Right now Random Lengths prices are up 22% from a year ago, and CME futures are up about 46% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

It looks like we will see record prices this year.

Sunday, January 07, 2018

Sunday Night Futures

by Calculated Risk on 1/07/2018 08:00:00 PM

Weekend:

• Schedule for Week of Jan 7, 2018

Monday:

• 3:00 PM ET, Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $18.0 billion in November.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 2, and DOW futures are up 67 (fair value).

Oil prices were up over the last week with WTI futures at $61.57 per barrel and Brent at $67.72 per barrel. A year ago, WTI was at $54, and Brent was at $56 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.49 per gallon. A year ago prices were at $2.38 per gallon - so gasoline prices are up 11 cents per gallon year-over-year.

Oil Rigs "Total US oil rigs were down 5 to 742 this week"

by Calculated Risk on 1/07/2018 11:32:00 AM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Jan 5, 2017:

• Total US oil rigs were down 5 to 742 this week

• Horizontal oil rigs declined again, -2 to 650

• The reticence of operators to add rigs in the face of surging oil prices is remarkable. It suggests we are seeing a second inflection point with even greater restraint from operators. (The first inflection point for this cycle occurred in July.)br />

• Oil price bears will find no comfort in this report. Expect oil prices to continue to rise until we see life in the horizontal rig count.

...

• Incredible price action again this week, with WTI breaching the $62 threshold, and the Brent spread holding around $6.50.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Saturday, January 06, 2018

Schedule for Week of January 7, 2018

by Calculated Risk on 1/06/2018 08:01:00 AM

The key economic reports this week are December retail sales and the Consumer Price Index (CPI).

3:00 PM: Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $18.0 billion in November.

6:00 AM ET: NFIB Small Business Optimism Index for December.

10:00 AM ET: Job Openings and Labor Turnover Survey for November from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for November from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in October to 5.996 million from 6.177 in September.

The number of job openings (yellow) were up 7.3% year-over-year, and Quits were up 3.3% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 245 thousand initial claims, down from 250 thousand the previous week.

8:30 AM: The Producer Price Index for December from the BLS. The consensus is a 0.2% increase in PPI, and a 0.2% increase in core PPI.

8:30 AM ET: Retail sales for December will be released. The consensus is for a 0.5% increase in retail sales.

8:30 AM ET: Retail sales for December will be released. The consensus is for a 0.5% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 5.0% on a YoY basis in November.

8:30 AM: The Consumer Price Index for December from the BLS. The consensus is for a 0.1% increase in CPI, and a 0.2% increase in core CPI.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for November. The consensus is for a 0.3% increase in inventories.

Friday, January 05, 2018

Q4 GDP Forecasts

by Calculated Risk on 1/05/2018 07:25:00 PM

From Merrill Lynch:

Core capital goods shipments and orders were revised down in November. The trade deficit widened more than expected. These data sliced 0.2pp from 4Q GDP tracking, bringing us down to 2.3%.From the Altanta Fed: GDPNow

emphasis added

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2017 is 2.7 percent on January 5, down from 3.2 percent on January 3.From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 4.0% for 2017:Q4 and 3.4% for 2018:Q1.CR Note: This is a wide range of forecasts (from 2.3% to 4.0%).

Looking back at the October forecasts for Q3, Merrill was 3.0%, the Atlanta Fed at 2.7% and the NY Fed at 1.5% (the BEA reported 3.0% before revisions).

For Q2, the July forecasts were Merrill at 2.1%, the Atlanta Fed at 2.5%, and the NY Fed at 2.0% (the BEA initially reported 2.6%).

AAR: Rail Carloads increased, "Best Year Ever" for Intermodal

by Calculated Risk on 1/05/2018 05:10:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Rail traffic ended 2017 on a positive note. Total U.S. rail carloads in December 2017 were up 2.5% (24,606 carloads) over December 2016, their first year-over-year monthly increase in six months, thanks largely to gains in carloads of crushed stone, sand, and gravel; metallic ores; and chemicals. ... For all of 2017, total carloads were up 2.9%, or 381,266 carloads ... Meanwhile, U.S. intermodal traffic was up 5.3% (53,990 units) in December 2017 over December 2016 and up 3.9% (521,121 units) in 2017 over 2016. 2017 was the best year ever for U.S. intermodal volume.

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Dark blue is 2017.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

U.S. railroads originated 998,168 carloads in December 2017, up 2.5% (24,606 carloads) over December 2016. It’s the first year-over-year monthly increase for total carloads in six months. Total carloads averaged 249,542 per week in December 2017. Since 1988, when our data begin, only 2009, 2014, and 2015 had fewer weekly average carloads in December than December 2017 did. Still, you take what you can get; the carload increase in December was certainly welcome.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):2017 was the best year ever for U.S. intermodal. Originations for the year were 14.01 million containers and trailers, up 3.9%, or 521,121 units, over 2016 and up 2.2%, or 301,172 units, over 2015’s previous record of 13.71 million units. In December, intermodal volume was 1.07 million units, up 5.3%, or 53,980 units, over December 2016. In 2017, containers accounted for 91.0% of U.S. intermodal units, down slightly from 2016’s 91.3%. Eleven of the top 12 U.S. intermodal weeks in history were in 2017.

Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 1/05/2018 02:50:00 PM

Here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (just eleven months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 811,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 396,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,966,000 under President Clinton (light blue), by 14,717,000 under President Reagan (dark red), 9,041,000 under President Carter (dashed green), 1,510,000 under President G.H.W. Bush (light purple), and 11,756,000 under President Obama (dark blue).

During the first eleven months of Mr. Trump's term, the economy has added 1,809,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 268,000 jobs).

During the first eleven months of Mr. Trump's term, the economy has added 30,000 public sector jobs.

After eleven months of Mr. Trump's presidency, the economy has added 1,839,000 jobs, about 453,000 behind the projection.

Earlier: Trade Deficit at $50.5 Billion in November

by Calculated Risk on 1/05/2018 12:27:00 PM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $50.5 billion in November, up $1.6 billion from $48.9 billion in October, revised. November exports were $200.2 billion, $4.4 billion more than October exports. November imports were $250.7 billion, $6.0 billion more than October imports.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in November.

Exports are 12% above the pre-recession peak and up 8% compared to November 2016; imports are 8% above the pre-recession peak, and up 8% compared to November 2016.

Trade has been picking up.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $50.10 in October, up from $47.26 in November, and up from $40.81 in November 2016. The petroleum deficit had been declining for years (although the petroleum deficit has been steady for the last few years) this is the major reason the overall deficit has mostly moved sideways since early 2012.

The trade deficit with China increased to $35.4 billion in November, from $30.5 billion in November 2016.

ISM Non-Manufacturing Index decreased to 55.9% in December

by Calculated Risk on 1/05/2018 10:05:00 AM

The November ISM Non-manufacturing index was at 55.9%, down from 57.4% in November. The employment index increased in December to 56.3%, from 55.3%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: December 2017 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in December for the 96th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 55.9 percent, which is 1.5 percentage points lower than the November reading of 57.4 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased to 57.3 percent, 4.1 percentage points lower than the November reading of 61.4 percent, reflecting growth for the 101st consecutive month, at a slower rate in December. The New Orders Index registered 54.3 percent, 4.4 percentage points lower than the reading of 58.7 percent in November. The Employment Index increased 1 percentage point in December to 56.3 percent from the November reading of 55.3 percent. The Prices Index increased by 0.1 percentage point from the November reading of 60.7 percent to 60.8 percent, indicating that prices increased in December for the seventh consecutive month. According to the NMI®, 14 non-manufacturing industries reported growth. There has been a second consecutive month of pullback in the rate of growth. Overall, the majority of respondents’ comments indicate that they finished the year on a positive note. They also indicate optimism for business conditions and the economic outlook going forward."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slower expansion in December than in November.

Comments on December Employment Report

by Calculated Risk on 1/05/2018 08:49:00 AM

The headline jobs number was below consensus expectations at 148 thousand, probably somewhat due to weather (snow) during the reference week in December (Weather was the reason I took the "under"). The previous two months were revised down slightly by a combined 9 thousand jobs.

Earlier: December Employment Report: 148,000 Jobs Added, 4.1% Unemployment Rate

In December, the year-over-year change was 2.055 million jobs. This is still generally trending down.

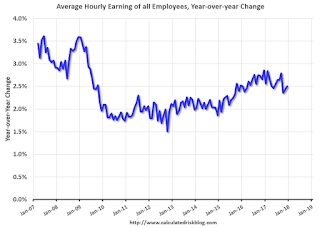

Average Hourly Earnings

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.5% YoY in December.

Wage growth had been trending up, although the acceleration in wage growth slowed in 2017.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was essentially unchanged at 4.9 million in December but was down by 639,000 over the year. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons increased slightly in December. The number working part time for economic reasons suggests a little slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 8.1% in December.

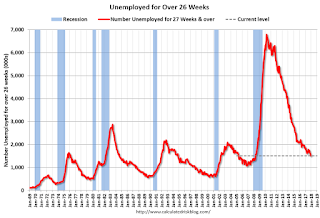

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.52 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 1.59 million in November

This is the lowest level since April 2008.

This is trending down, but still a little elevated.

The headline jobs number was a little disappointing and the unemployment rate unchanged at a low level - but overall a continuation of multi-year trends. Wage growth was disappointing again.