by Calculated Risk on 11/20/2017 10:22:00 AM

Monday, November 20, 2017

Lawler: Selected Operating Statistics, Large Publicly-Traded Home Builders

Below is a table showing selected operating statistics for eight large, publicly-traded builders for the quarter ended September 30, 2017.

From housing economist Tom Lawler:

| Net Orders | Settlements | Average Closing Price $ (000s) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/17 | 9/16 | % Chg | 9/17 | 9/16 | % Chg | 9/17 | 9/16 | % Chg |

| D.R. Horton | 10,333 | 8,744 | 18.2% | 13,165 | 12,247 | 7.5% | 307 | 297 | 3.2% |

| Pulte Group | 5,300 | 4,775 | 11.0% | 5,151 | 5,037 | 2.3% | 399 | 374 | 6.7% |

| NVR | 4,200 | 3,477 | 20.8% | 4,158 | 3,922 | 6.0% | 393 | 384 | 2.3% |

| Cal Atlantic | 3,416 | 3,531 | -3.3% | 3,380 | 3,680 | -8.2% | 448 | 452 | -0.9% |

| Beazer Homes | 1,315 | 1,346 | -2.3% | 1,904 | 1,856 | 2.6% | 350 | 334 | 4.6% |

| Meritage Homes | 1,874 | 1,737 | 7.9% | 1,969 | 1,800 | 9.4% | 409 | 409 | 0.0% |

| MDC Holdings | 1,270 | 1,296 | -2.0% | 1,317 | 1,293 | 1.9% | 444 | 445 | -0.2% |

| M/I Homes | 1,225 | 1,008 | 21.5% | 1,256 | 1,148 | 9.4% | 366 | 365 | 0.3% |

| SubTotal | 28,933 | 25,914 | 11.7% | 32,300 | 30,983 | 4.3% | 364 | 356 | 2.1% |

Comments on October Housing Starts

by Calculated Risk on 11/20/2017 08:11:00 AM

Last Friday: Housing Starts increased to 1.290 Million Annual Rate in October

The housing starts report released Friday showed starts were up 13.7% in October compared to September, however starts were down 2.9% year-over-year compared to October 2016.

This first graph shows the month to month comparison between 2016 (blue) and 2017 (red).

Starts were down 2.9% in October 2017 compared to October 2016 (a difficult comparison), and starts are up only 5.8% year-to-date.

Note that single family starts are up 10.2% year-to-date, and the weakness (as expected) has been in multi-family starts.

My guess was starts would increase around 3% to 7% in 2017. Looks about right.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has turned down recently. Completions (red line) have lagged behind - and completions have just passed starts (more deliveries).

Completions lag starts by about 12 months, so completions will probably turn down in about a year.

As I've been noting for a couple of years, the growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a few more years of increasing single family starts and completions.

Sunday, November 19, 2017

Sunday Night Futures

by Calculated Risk on 11/19/2017 06:39:00 PM

Weekend:

• Schedule for Week of Nov 19, 2017

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 3, and DOW futures are down 23 (fair value).

Oil prices were down over the last week with WTI futures at $56.55 per barrel and Brent at $62.54 per barrel. A year ago, WTI was at $46, and Brent was at $46 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.54 per gallon. A year ago prices were at $2.15 per gallon - so gasoline prices are up 39 cents per gallon year-over-year.

Sacramento Housing in October: Sales down 5% YoY, Active Inventory up 2% YoY

by Calculated Risk on 11/19/2017 08:15:00 AM

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For several years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In October, total sales were down 4.7% from October 2016, and conventional equity sales were up 0.9% compared to the same month last year.

In October, 1.4% of all resales were distressed sales. This was down from 2.2% last month, and down from 4.4% in October 2016.

The percentage of REOs was at 0.7%, and the percentage of short sales was 0.7%.

Sacramento Realtor Press Release: October marks highest median sales price in 10.5 years

October ended with a 3.2% decrease in sales, down from 1,560inSeptemberto 1,510. Compared with the 1,584 sales of October 2016, the current number is a 4.7% decrease. Equity sales for the month continued to grow, accounting for 98.5% (1,510) of the sales this month. REO/bank-owned and Short Sales made up the difference with 11 sales (.7%) and 11 sales (.7%) for the month, respectively.Here are the statistics.

...

Active Listing Inventory decreased slightly, decreasing 3.4% from 2,625 to 2,536.The Months of Inventory remained at 1.7 Months. A year ago the Months of inventory was 1.6 and Active Listing Inventory stood at 2,492 listings(-1.8% from current figure).

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes increased 1.8% year-over-year (YoY) in October. This YoY inventory increase followed 29 consecutive months with a YoY decrease in inventory in Sacramento.

Cash buyers accounted for 13.6% of all sales - this has been generally declining (frequently investors).

Summary: This data suggests a normal market with few distressed sales, and less investor buying - but with limited inventory. Keep an eye on inventory - this might be a change in trend.

Saturday, November 18, 2017

Schedule for Week of Nov 19, 2017

by Calculated Risk on 11/18/2017 08:09:00 AM

The key economic report this week is October existing home sales.

Happy Thanksgiving!

No economic releases scheduled.

8:30 AM ET: Chicago Fed National Activity Index for October. This is a composite index of other data.

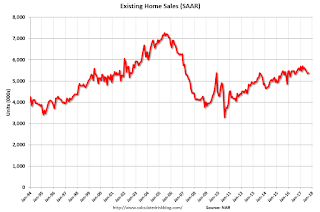

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 5.40 million SAAR, up from 5.39 million in August.

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 5.40 million SAAR, up from 5.39 million in August.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 5.60 million SAAR for October.

6:00 PM ET: Panel Discussion with Fed Chair Janet Yellen, Moderated discussion with Mervyn King, At the New York University Stern School of Business, New York, New York

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, down from 249 thousand the previous week.

8:30 AM: Durable Goods Orders for October from the Census Bureau. The consensus is for a 0.5% increase in durable goods orders.

10:00 AM: University of Michigan's Consumer sentiment index (final for November). The consensus is for a reading of 97.9, up from the preliminary reading 97.8.

2:00 PM: FOMC Minutes, Meeting of October 31- November 1, 2017

All US markets will be closed in observance of the Thanksgiving Day Holiday.

The NYSE and the NASDAQ will close early at 1:00 PM ET.

Friday, November 17, 2017

Oil Rigs "Rigs counts took a breather this week"

by Calculated Risk on 11/17/2017 08:21:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Nov 17, 2017:

• Rigs counts took a breather this week

• Total US oil rigs were flat, +0 to 738

• Horizontal oil rigs eased back, -1 to 636

...

• On Wednesday, I suggested that excess inventory draws in the US and the Brent-WTI spread likely meant a resumption of upward oil price pressures, and we saw that today, with WTI up $1.35 and the Brent spread holding steady at $6.25

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Lawler: Early Read on Existing Home Sales in October

by Calculated Risk on 11/17/2017 03:55:00 PM

From housing economist Tom Lawler:

Based on publicly-available state and local realtor/MLS reports from across the country released through today, I predict that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.60 million in October, up 3.9% from September’s preliminary estimate and up 1.3% from last October’s seasonally-adjusted pace. Unadjusted sales should register a higher YOY gain, reflecting this October’s higher business day count compared to last October’s.

On the inventory front, local realtor/MLS data suggest that the NAR’s estimate of the number of existing homes for sale at the end of October will be about 1.88 million, down 1.1% from September’s preliminary estimate and down 6.5% from last October’s estimate.

Finally, realtor/MLS data suggest that the NAR’s estimate of the median existing SF home sales price last month was up 5.8% from last October.

CR Note: Existing home sales for October are scheduled to be released next Tuesday. The consensus is for sales of 5.40 million SAAR. Take the over on Tuesday!

Lawler: Has US Household Growth Slowed, and If So, Why?

by Calculated Risk on 11/17/2017 01:31:00 PM

From housing economist Tom Lawler: Has US Household Growth Slowed, and If So, Why?

Yesterday the Census Bureau released estimates of America’s Families and Living Arrangements (which includes household estimates) based on the Annual Social and Economic Supplement of the CPS for March 2017, and the estimates suggested that US household growth slowed considerably in the 12-month period ending this March – though by less than that shown in the Census Bureau’s tables.

According to the data released yesterday, the CPS/ASEC-based estimate of the number of US households in March 2017 was 126.224 million, up just 405,000 from the March 2016 household estimate of 125.819 million from the 2016 CPS/ASEC. As I noted in an earlier report, however, this meager yearly gain is understated, because the 2016 CPS/ASEC estimates were based on “2015 Vintage” population estimates for 2016, and last year Census (in its “2016 Vintage” release) revised down considerably its population estimates for 2016 (and for earlier years.) Annoyingly, Census does not go back and revise earlier year CPS/ASEC household estimates to reflect revisions in population estimates.

For example, CPS/ASEC tables show an increase in the US adult (18+) civilian non-institutionalized population of just 0.59%, from March 2016 to March 2017, while Census’ updated population estimates shown an increase of 0.89% over this period (again, reflecting a downward revision to 2016 estimates).

If one were to adjust the 2016 CPS/ASEC household estimate to reflect the downward revisions in 2016 population estimates, the “adjusted” CPS/ASEC household estimate would be about 125.445 million, and the “adjusted” increase in the CPS/ASEC household estimate for 2017 would be about 779,000. This “adjusted” gain still represents a marked slowed in estimated household growth.

The CPS/ASEC-based slowdown in household growth for 2017 (an “adjusted” increase of 0.62%, compared to an “adjusted” increase in the adult population of 0.89%) reflects, by arithmetic, an increase in the average household size and a decrease in the aggregate adult “headship” rate. The lower headship rates for 2017 compared to 2016 were not driven by a gain in the number of young adults living with parents (which decreased slightly from last year’s elevated levels), but instead by a decline in the number of people living alone (mainly in the 35+ group).

The other major CPS household estimate, based on the Housing Vacancy Survey (HVS) supplement to the CPS, has also showed a marked deceleration in growth. The CPS/HVS estimate of the number of US households in the third quarter of 2017 was 119.085 million, up only 407,000 from the estimate for the third quarter of 2016. (Reminder: the CPS/ASEC household estimate is “controlled” to independent population estimates, while the CPS/HVS household estimate is “controlled” to independent housing stock estimates.)

One other household estimate produced by Census comes from the American Community Survey, though only annual estimates are available. For 2016 the ACS-based US household estimate was 118.860 million, up just 652,000 from the 2016 ACS estimate. The ACS household estimate is also effectively “controlled” to independent housing stock estimates.

Here is a table showing the latest yearly increase in household estimates from various surveys compared to the average annual increases in the previous 5-year period

| Recent Increases in Estimated Number of Households, Various Surveys (000's) | ||||

|---|---|---|---|---|

| Latest Yearly Increase | Time Period | Average Increase, Previous 5 Years | Time Period | |

| CPS/ASEC Reported | 405 | 3/16-3/17 | 1,178 | 3/11-3/16 |

| Adjusted* | 779 | 3/16-3/17 | 1,103 | 3/11-3/16 |

| CPS/HVS | 407 | Q3/16-Q3/17 | 1,049 | Q3/11-Q3/16 |

| ACS | 654 | 2015-2016 | 728 | 2010-2015 |

| *Adjusted by LEHC to reflect downward revisions in 2016 population estimates | ||||

One of the striking things to note is that all of these surveys suggest that US household growth in either 2016 or part of 2017 was slower that was the case in the previous 5-year period, and (not shown) well below the average annual gains of last decade. If true, then the recent declines in headship rates may either be more “structural” than “cyclical,” or may be reflective of societal shifts and other economic factors. (more on this later).

Of course, one needs to be cautious of using any of these surveys to gauge “actual” trends, as none matches up that well with Decennial Census results. However, the latest data suggest that some of the most “bullish” cases for housing demand based on “demographics” and “pent-up demand” may be “bull.”

On the latter score, Census still plans to release updated US population projections sometime before the end of this year. These projections will almost certainly show slower projected population growth than the latest available projections released in 2014, and that had unrealistically high assumptions about net international immigration.

MBA: Mortgage Delinquency Rate increases in Q3 mostly due to Hurricanes

by Calculated Risk on 11/17/2017 10:41:00 AM

From the MBA: Delinquencies Up in MBA’s National Delinquency Survey for Q3 2017

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 4.88 percent of all loans outstanding at the end of the third quarter of 2017. The delinquency rate was up 64 basis points from the previous quarter, and was 36 basis points higher than one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The percentage of loans on which foreclosure actions were started during the third quarter was 0.25 percent, a decrease of one basis point from the previous quarter, and five basis points lower than one year ago. The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 1.23 percent, down 6 basis points from the previous quarter and 32 basis points lower than one year ago.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 2.52 percent in the third quarter, up 3 basis points from the previous quarter, but 44 basis points lower than one year ago.

Marina Walsh, MBA’s Vice President of Industry Analysis, offered the following commentary on the survey:

“In the third quarter of 2017, the overall delinquency rate rose by 64 basis points over the previous quarter, with the 30-day delinquency rate accounting for 50 basis points of this variance. Hurricanes Harvey, Irma and Maria caused disruptions and destruction in numerous states. Florida, Texas, neighboring states, as well as devastated Puerto Rico, saw substantial increases in their past due rates. While forbearance is in place for many borrowers affected by these storms, our survey asks servicers to report these loans as delinquent if the payment was not made based on the original terms of the mortgage regardless of any forbearance plans in place.

“Mortgage delinquencies increased across all loan types – FHA, VA and conventional – on a seasonally-adjusted basis. The FHA delinquency rate increased to 9.40 percent from 7.94 percent in the second quarter, a 146 basis-point increase and the highest quarter-over-quarter increase reported in the history of our survey. The VA delinquency rate increased 52 basis points to 4.24 percent from 3.72 percent in the second quarter. The conventional delinquency rate increased 50 basis points to 3.97 percent from 3.47 percent in the second quarter.

“While the storms played a critical factor in explaining the rise in the overall delinquency rate, there are other factors to consider, especially given delinquency rate increases in other states not directly impacted by the storms. First, there were timing issues associated with the last day of the month being a Saturday. Processing for mortgage payments made over the weekend did not occur until Monday, October 2 and thus these mortgage payments were identified as 30-days delinquent per NDS definitions.

“Second, delinquency rates were already at historic lows in the second quarter of 2017. The FHA and VA delinquency rates were at their lowest levels since 1996 and 1979 respectively, while the conventional delinquency rate reached its lowest level since 2005. It would not be unexpected for delinquencies to eventually increase from these levels.

...

“It will likely take about three or four more quarters for the effects of the most recent hurricanes on the survey results to dissipate. That said, we see loan performance as still healthy and strong, supported by a positive employment and wage outlook. Thus far in 2017, job growth is averaging 169,000 jobs per month, unemployment rate has decreased from 4.8 to 4.1 percent, and wage growth is 3.8 percent on a year over year basis.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

The percent of loans 30 and 60 days delinquent increased in Q3, primarily due to the hurricanes.

The 90 day bucket increased in Q3, and remains a little elevated.

The percent of loans in the foreclosure process continues to decline, and is close to normal levels.

BLS: Unemployment Rates Lower in 12 states in October; Alabama, Hawaii and Texas at New Series Lows

by Calculated Risk on 11/17/2017 10:29:00 AM

Note from the BLS on Puerto Rico:

The Puerto Rico household survey was conducted for the October 2017 reference period. However, the response rate was below average, in part as a result of difficulties accessing some remote areas that were significantly affected by Hurricanes Irma and Maria.From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in October in 12 states, higher in 1 state, and stable in 37 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Twenty-three states had jobless rate decreases from a year earlier, 2 states and the District had increases, and 25 states had little or no change. The national unemployment rate edged down to 4.1 percent in October and was 0.7 percentage point lower than a year earlier.

...

Hawaii had the lowest unemployment rate in October, 2.2 percent, followed by North Dakota, 2.5 percent. The rates in Alabama (3.6 percent), Hawaii (2.2 percent), and Texas (3.9 percent) set new series lows. ... Alaska had the highest jobless rate, 7.2 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

Fourteen states have reached new all time lows since the end of the 2007 recession. These fourteen states are: Alabama, Arkansas, California, Colorado, Hawaii, Idaho, Maine, Mississippi, North Dakota, Oregon, Tennessee, Texas, Washington, and Wisconsin.

The states are ranked by the highest current unemployment rate. Alaska, at 7.2%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently one state has an unemployment rate at or above 7% (light blue); Only two states and D.C. are at or above 6% (dark blue). The states are Alaska (7.2%) and New Mexico (6.1%). D.C. is at 6.6%.