by Calculated Risk on 11/15/2017 11:29:00 AM

Wednesday, November 15, 2017

Key Measures Show Inflation picks up in October

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.3% annualized rate) in October. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.3% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for October here. Motor fuel decreased 20% in October, annualized, following a sharp increase in September due to Hurricane Harvey.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.3% annualized rate) in October. The CPI less food and energy rose 0.2% (2.7% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy rose 1.8%. Core PCE is for September and increased 1.3% year-over-year.

On a monthly basis, median CPI was at 3.3% annualized, trimmed-mean CPI was at 2.3% annualized, and core CPI was at 2.7% annualized.

Using these measures, inflation picked up year-over-year in October. However, overall, these measures are mostly below the Fed's 2% target (Median CPI is slightly above).

AIA: Architecture Billings Index "Bounce Back" in October

by Calculated Risk on 11/15/2017 10:27:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Bounce Back

After a stand-alone month of contracting demand for design services, there was a modest uptick in the Architecture Billings Index (ABI) for October. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the October ABI score was 51.7, up from a score of 49.1 in the previous month. This score reflects an increase in design services provided by U.S. architecture firms (any score above 50 indicates an increase in billings). The new projects inquiry index was 60.2, up from a reading of 59.0 the previous month, while the new design contracts index eased slightly from 52.9 to 52.8.

“As we enter the fourth quarter, there is enough design activity occurring that construction conditions should remain healthy moving through 2018,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Extended strength in inquiries and new design contracts, along with balanced growth across the major building sectors signals further gains throughout the construction industry.”

...

• Regional averages: Northeast (54.0), South (50.8), West (49.8), Midwest (49.0)

• Sector index breakdown: commercial / industrial (51.2), mixed practice (50.7), multi-family residential (50.7), institutional (50.7)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.7 in October, up from 49.1 in September. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 10 of the last 12 months, suggesting a further increase in CRE investment into 2018.

Retail Sales increased 0.2% in October

by Calculated Risk on 11/15/2017 08:41:00 AM

On a monthly basis, retail sales increased 0.2 percent from September to October (seasonally adjusted), and sales were up 4.6 percent from October 2016.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for October 2017, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $486.6 billion, an increase of 0.2 percent from the previous month, and 4.6 percent above October 2016. ... The August 2017 to September 2017 percent change was revised from up 1.6 percent to up 1.9 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.4% in October.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.1% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.1% on a YoY basis.The increase in October was slightly above expectations, and sales in August and September were revised up.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 11/15/2017 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Surve

Mortgage applications increased 3.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 10, 2017. This week’s results do not include an adjustment for the Veterans’ Day holiday.

... The Refinance Index increased 6 percent from the previous week to its highest level since October 2017. The seasonally adjusted Purchase Index increased 0.4 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 17 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) remained unchanged at 4.18 percent, with points increasing to 0.40 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 17% year-over-year.

Tuesday, November 14, 2017

NY Fed Q3 Report: "Total Household Debt Increases, Delinquency Rates of Several Debt Types Continue Rising"

by Calculated Risk on 11/14/2017 07:18:00 PM

From the NY Fed: Total Household Debt Increases, Delinquency Rates of Several Debt Types Continue Rising

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit, which reported that total household debt increased by $116 billion (0.9%) to $12.96 trillion in the third quarter of 2017. There were increases in mortgage, student, auto and credit card debt (increasing by 0.6%, 1.0%, 1.9% and 3.1% respectively) and a modest decline in home equity lines of credit (HELOC) balances (decreasing by 0.9%).

...

Credit card and auto loan flows into delinquency increased. Specifically, credit card flows into delinquency have increased over the past year, while auto loan flows into delinquency have been steadily increasing for several years.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q3. Household debt previously peaked in 2008, and bottomed in Q2 2013.

From the NY Fed:

Mortgage balances, the largest component of household debt, increased again during the third quarter. Mortgage balances shown on consumer credit reports on September 30 stood at $8.74 trillion, an increase of $52 billion from the second quarter of 2017. Balances on home equity lines of credit (HELOC) have been slowly declining; they dropped by $4 billion and now stand at $448 billion. Non-housing balances, which have been increasing steadily for nearly 6 years overall, saw a $68 billion increase in the third quarter. Auto loans grew by $23 billion and credit card balances increased by $24 billion, while student loans saw a $13 billion increase.

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).The overall delinquency rate increased in Q3. From the NY Fed:

Aggregate delinquency rates ticked up slightly in the third quarter of 2017. As of September 30, 4.9% of outstanding debt was in some stage of delinquency. Of the $630 billion of debt that is delinquent, $408 billion is seriously delinquent (at least 90 days late or “severely derogatory”). Flows into delinquency deteriorated for some types of debt. The flow into 90+ delinquent for credit card balances has been increasing notably for one year, and that measure for auto loans has increased, and the flow into 90+ delinquency for auto loan balances has been slowly increasing since 2012.There is much more in the report.

Wednesday: Retail Sales, CPI, NY Fed Mfg Survey

by Calculated Risk on 11/14/2017 06:18:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for October be released. The consensus is for a 0.1% increase in retail sales.

• Also at 8:30 AM, The Consumer Price Index for October from the BLS. The consensus is for a 0.1% increase in CPI, and a 0.2% increase in core CPI.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for November. The consensus is for a reading of 26.0, down from 30.2.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for September. The consensus is for a 0.1% increase in inventories.

• During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate)

LA area Port Traffic: Imports increased YoY, Exports decreased YoY in October

by Calculated Risk on 11/14/2017 02:18:00 PM

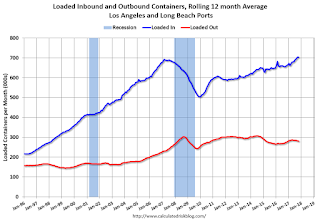

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 0.1% compared to the rolling 12 months ending in September. Outbound traffic was down 0.7% compared to the rolling 12 months ending in September.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

This was the 2nd highest level of imports ever for the month of October - following record imports in July, August and September - suggesting the retailers are optimistic about the Christmas Holiday shopping season.

In general imports have been increasing, and exports are mostly moving sideways to down recently.

A few random thoughts on Taxes

by Calculated Risk on 11/14/2017 12:54:00 PM

A few random thoughts ...

Income and corporate taxes are just part of the tax system. Americans pay a wide variety of taxes. These include sales, property, payroll, state and Federal income and corporate taxes, and more. Many of these taxes are regressive, meaning that lower income families pay a higher percentage of their income for these taxes. Sales taxes and payroll taxes are example of regressive taxes.

There are some "hidden" taxes, such as resource extraction taxes (severance tax "imposed on the removal of non-renewable natural resources") and state lotteries. The severance tax is borne primarily by consumers, and is therefore regressive - and lotteries are also regressive.

The main non-regressive taxes are income and corporate taxes. Higher income families generally pay a higher percentage of their income for these taxes. So when there is a discussion of reducing corporate and income taxes - and "broadening the base" for income taxes - this makes the entire tax system more regressive.

To make the system more progressive (where higher income families pay a higher percentage of their income in taxes), the discussion would be about decreasing regressive taxes (like the payroll tax), or increasing income and corporate taxes.

Why change the tax code? There could be many reasons to change the code: to make it simpler, to encourage certain activities (homeownership, investment, education, etc.), or to remove existing tax preferences, to spur growth, to reduce the deficit, to change the balance of who pays taxes.

As an example, to spur growth we could look for ways to lower income and wealth inequality (this is slowing growth in the US), and also ways to put more money in the hands of low to middle income families (people who tend to spend additional money). Examples of policies to spur growth in the short term would be reducing the payroll tax, and for growth in the longer term, increase the estate tax (and make it unavoidable).

What about the business cycle? If we look at the business cycle and the deficit, economic theory suggests that the government should increase the deficit during economic downturns, and work down the deficit during expansions. The economy is currently in the mid-to-late stage of a recovery, so decreasing the deficit makes sense now.

Conclusion: Right now it might make sense to reduce the payroll tax, increase income taxes - especially the estate tax (and make it unavoidable) - and reduce the deficit. Basically the opposite of the current proposal that reduces the burden on high income earners, offset by more debt and increasing the burden on low-to-middle income families.

NFIB: Small Business Optimism Index "inches up" in October

by Calculated Risk on 11/14/2017 09:22:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Index inches up in October in October

The October Index rose to 103.8, up from 103 the previous month. The historically strong performance extends the streak of positive months dating back to last November, when it shot up immediately following the election.

Four of the Index components rose last month. Five declined slightly, while one remained unchanged. Outlook for expansion and sales expectations each jumped six points, while job openings increased by five points.

The tight labor market got tighter for small business owners last month, continuing a year-long trend. Fifty-nine percent of owners said they tried to hire in October, with 88 percent of them reporting no or few qualified applicants. Hiring activity was particularly high in Florida and Georgia, as construction firms are still trying to meet higher demand caused by the recent hurricane.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased slightly to 103.8 in October.

Monday, November 13, 2017

"Mortgage Rates Sideways to Slightly Higher"

by Calculated Risk on 11/13/2017 05:21:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Sideways to Slightly Higher

Mortgage rates were unchanged to slightly higher today, keeping them in line with their highest levels in more than 2 weeks, depending on the lender [30YR FIXED - 4.0%]. Bond markets (which underlie mortgage rates) were in slightly better shape this morning, but that failed to translate to rate sheet improvements due to bond market weakness on Friday afternoon.Tuesday:

There were no significant economic reports or market moving headlines for bonds/rates today, but that will quickly change as the week progresses. Wednesday brings a key inflation report--the Consumer Price Index (CPI). Markets are also interested in any meaningful tax bill headlines, including the vote scheduled for the House version of the bill on Thursday.

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for October.

• At 8:30 AM, The Producer Price Index for October from the BLS. The consensus is a 0.1% increase in PPI, and a 0.2% increase in core PPI.