by Calculated Risk on 2/05/2015 02:20:00 PM

Thursday, February 05, 2015

NAHB: Builder Confidence improves Year-over-year for the 55+ Housing Market in Q4

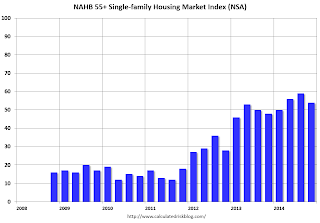

This is a quarterly index from the the National Association of Home Builders (NAHB) and is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008 (during the housing bust), so the readings were initially very low. Note that this index is Not Seasonally Adjusted (NSA) and usually dips in Q4 compared to Q3 (just seasonal).

From the NAHB: Builder Confidence in the 55+ Housing Market Ends Fourth Quarter on a Record High

The fourth quarter results of the National Association of Home Builders’ (NAHB) latest 55+ Housing Market Index (HMI) released today show that builders are feeling quite positive about the market. All segments of the market—single-family homes, condominiums and multifamily rental—registered increases compared to the same quarter a year ago. The single-family index increased six points to a level of 54, which is the highest fourth-quarter reading since the inception of the index in 2008 and the 13th consecutive quarter of year over year improvements.

...

All components of the 55+ single-family HMI posted increases from a year ago: present sales increased five points to 58, expected sales for the next six months rose two points to 64 and traffic of prospective buyers increased six points to 39.

“The strength of the 55+ segment of the housing industry has been fueled in part by rising home values,” said NAHB Chief Economist David Crowe. “Older home owners are finding it easier to sell their existing homes at a favorable price, allowing them to rent or buy a new home in a 55+ community.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ HMI through Q4 2014. The index increased in Q4 to 54 from 48 in Q4 2013. This indicates that more builders view conditions as good than as poor.

There are two key drivers in addition to the improved economy: 1) there is a large cohort moving into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics should be favorable for the 55+ market.

Goldman Sachs Employment Forecast: 210,000 jobs added, Unemployment Rate decline to 5.5%

by Calculated Risk on 2/05/2015 12:40:00 PM

Note: Yesterday I wrote: Preview for January Employment Report: Taking the Under

From Goldman Sachs economist David Mericle: January Payrolls Preview

We forecast nonfarm payroll job growth of 210k in January, below the consensus forecast of 230k. Payroll employment growth exceeded 250k in each of the last four months and averaged 246k over the 12 months of 2014, a substantial pick-up from the 194k average gain in 2013. On balance, labor market indicators were softer in January, with the decline in the ISM non-manufacturing employment index the most notable sign of slower hiring. We also expect a moderately positive two-month back-revision. The January report will also include annual benchmark revisions to payroll employment, but the preliminary revisions released in September indicated very little change.

...

We expect employment gains to push the unemployment rate down to 5.5% in January from an unrounded 5.565% in December, though new population controls that will be included with the January report create some uncertainty.

...

The two-tenths decline in average hourly earnings was the major surprise of the December payrolls report. But as we argued last month, calendar distortions and an unusual pattern of holiday retail hiring likely accounted for most of the downside surprise. We therefore expect average hourly earnings to rebound this month, growing an above-trend +0.4% in January, although we see some risk of a softer January gain coupled with an upward revision to December. Average hourly earnings rose just 1.7% over the year ending in December, contributing to the soft 2.1% year-on-year increase in our wage tracker. We expect an acceleration to around 2.75% by year-end, still well below the 3-4% rate of wage growth that Fed Chair Janet Yellen has identified as normal.

emphasis added

Trade Deficit increases in December to $46.6 Billion

by Calculated Risk on 2/05/2015 08:55:00 AM

The Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $46.6 billion in December, up $6.8 billion from $39.8 billion in November, revised. December exports were $194.9 billion, down $1.5 billion from November. December imports were $241.4 billion, up $5.3 billion from November.The trade deficit was much larger than the consensus forecast of $38.0 billion.

The first graph shows the monthly U.S. exports and imports in dollars through December 2014.

Click on graph for larger image.

Click on graph for larger image.Imports increased and exports decreased in December.

Exports are 17% above the pre-recession peak and up 1% compared to December 2013; imports are 4% above the pre-recession peak, and up about 5% compared to December 2013.

The second graph shows the U.S. trade deficit, with and without petroleum, through December.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $73.64 in December, down from $82.95 in November, and down from $91.33 in December 2013. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

Note: There is a lag due to shipping and long term contracts, but oil prices will really decline over the next several months - and the oil deficit will get much smaller.

The trade deficit with China increased to $28.3 billion in December, from $24.5 billion in December 2013. The deficit with China is a large portion of the overall deficit.

The increase in the trade deficit was due to a higher volume of oil imports (volatile month-to-month), a larger deficit with China, and a larger deficit with the Euro Area ($11.7 billion in Dec 2014 compared to $8.8 billion in Dec 2013).

Weekly Initial Unemployment Claims increased to 278,000

by Calculated Risk on 2/05/2015 08:33:00 AM

The DOL reported:

In the week ending January 31, the advance figure for seasonally adjusted initial claims was 278,000, an increase of 11,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 265,000 to 267,000. The 4-week moving average was 292,750, a decrease of 6,500 from the previous week's revised average. The previous week's average was revised up by 750 from 298,500 to 299,250.The previous week was revised up to 267,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 292,750.

This was lower than the consensus forecast of 290,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, February 04, 2015

Thursday: Trade Deficit, Unemployment Claims

by Calculated Risk on 2/04/2015 08:46:00 PM

The West Coast port slowdown is ongoing and will have an impact on the December trade report. From Reuters: Contract negotiators for U.S. West Coast ports hit snag

Shipping companies and terminal operators for 29 U.S. West Coast ports appeared to have hit a snag on Wednesday in protracted labor negotiations with the dockworkers' union, calling a news conference to publicly address the status of the talks.Also falling oil prices will have an impact on the trade deficit. Oil imports averaged $82.95 per barrel in November, and will probably be close to $70 in December (and fall further in January).

The negotiations, joined in recent weeks by a federal mediator, have coincided with chronic cargo backups hampering freight traffic through waterfronts handling nearly half of U.S. maritime trade and more than 70 percent of imports from Asia.

...

The congestion has been most pronounced at Los Angeles and Long Beach, the nation's two busiest shipping hubs. During the past two days, port authorities there reported more than 20 freighters left idled at anchor, waiting for berths to open.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 290 thousand from 265 thousand.

• Also at 8:30 AM, the Trade Balance report for December from the Census Bureau. The consensus is for the U.S. trade deficit to be at $38.0 billion in December from $39.0 billion in November.

Greece and the ECB

by Calculated Risk on 2/04/2015 04:48:00 PM

From the ECB: Eligibility of Greek bonds used as collateral in Eurosystem monetary policy operations

The Governing Council of the European Central Bank (ECB) today decided to lift the waiver affecting marketable debt instruments issued or fully guaranteed by the Hellenic Republic. The waiver allowed these instruments to be used in Eurosystem monetary policy operations despite the fact that they did not fulfil minimum credit rating requirements. The Governing Council decision is based on the fact that it is currently not possible to assume a successful conclusion of the programme review and is in line with existing Eurosystem rules.Joseph Cotterill at FT AlphaVille explains: Greece and the ECB: the first cut

Greek sovereign bonds, T-bills and government-guaranteed debt will no longer be welcome at the ECB Tower as of 11 February.

The waiver — which let in Greek debt despite its junk-rated status for as long as Greece was in a programme — has been something of a merry-go-round before, in previous points of crisis between Greece and its official creditors. Bank bonds guaranteed by the government were also due to be kicked out at the end of this month because of a two year-old decision.

This is the first cut. As Karl Whelan has explained, Greece’s use of ELA will be closely watched by the ECB’s Governing Council from this point and the screws could be turned here too in time. ELA is costlier for Greek banks to use — and is genuine lending of last resort — so it’s a lot more important for Greece’s position for this bit of plumbing to stay on.

Preview for January Employment Report: Taking the Under

by Calculated Risk on 2/04/2015 01:35:00 PM

Month after month I've taken the "over" for the employment report ("over" the consensus), and that has been correct most months. However, for January, I'll take the "under" ... however I think there is a good chance that employment will be up 3 million year-over-year (it would take 192 thousand jobs added including revisions).

Friday at 8:30 AM ET, the BLS will release the employment report for January. The consensus, according to Bloomberg, is for an increase of 230,000 non-farm payroll jobs in January (with a range of estimates between 215,000 and 268,000), and for the unemployment rate to be unchanged at 5.6%.

The BLS reported 252,000 jobs added in December.

Here is a summary of recent data:

• The ADP employment report showed an increase of 213,000 private sector payroll jobs in January. This was below expectations of 220,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth slightly below expectations.

• The ISM manufacturing employment index decreased in January to 54.1%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs were unchanged in January. The ADP report indicated a 14,000 increase for manufacturing jobs in January.

The ISM non-manufacturing employment index decreased in January to 51.6%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 115,000 in January.

Combined, the ISM indexes suggests employment gains of 115,000. This suggests growth below expectations.

• Initial weekly unemployment claims averaged close to 298,000 in January, up from 291,000 in December. For the BLS reference week (includes the 12th of the month), initial claims were at 308,000; this was up from 289,000 during the reference week in December.

Generally this suggests a few more layoffs, seasonally adjusted, in January compared to the previous four months (employment gains averaged 284,000 per month for the previous four months).

• The final January University of Michigan consumer sentiment index increased to 98.1 from the December reading of 93.6. This was the highest level in over ten years. Sentiment is frequently coincident with changes in the labor market, but this increase is probably mostly due to sharply lower gasoline prices.

• On small business hiring: The small business index from Intuit showed a 20,000 increase in small business employment in January, down from 30,000 added in November and December.

• Trim Tabs reported that the U.S. economy added between 190,000 and 220,000 jobs in January. This was down from their 210,000 to 240,000 range last month (that was low but close). "TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 141 million U.S. workers subject to withholding" December and January are challenging for TrimTabs due to year end bonuses - so they provided a range again this month.

• Conclusion: There is always some randomness to the employment report, but most indicators suggest fewer jobs added in January compared to the previous several months. The consensus forecast reflects some slowdown in employment growth, but I'll take the under this month (below 230,000).

Special Note: In addition to the normal revisions, the annual benchmark revision will be released with the January report. The preliminary estimate was an additional 7,000 jobs as of March 2014 (not a large revision).

Also, the new population controls will be used in the Current Population Survey (CPS) estimation process. The BLS notes that the "household survey data for January 2015 will not be directly comparable with data for December 2014 or earlier periods".

ISM Non-Manufacturing Index increased to 56.7% in January

by Calculated Risk on 2/04/2015 10:09:00 AM

The January ISM Non-manufacturing index was at 56.7%, up from 56.5% in December. The employment index decreased in January to 51.6%, down from 55.7% in December. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: January 2015 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in January for the 60th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 56.7 percent in January, 0.2 percentage point higher than the December reading of 56.5 percent. This represents continued growth in the non-manufacturing sector. The Non-Manufacturing Business Activity Index increased to 61.5 percent, which is 2.9 percentage points higher than the December reading of 58.6 percent, reflecting growth for the 66th consecutive month at a faster rate. The New Orders Index registered 59.5 percent, 0.3 percentage point higher than the reading of 59.2 percent registered in December. The Employment Index decreased 4.1 percentage points to 51.6 percent from the December reading of 55.7 percent and indicates growth for the eleventh consecutive month. The Prices Index decreased 4.3 percentage points from the December reading of 49.8 percent to 45.5 percent, indicating prices contracted in January when compared to December. According to the NMI®, eight non-manufacturing industries reported growth in January. Comments from respondents vary by industry and company; however, they are mostly positive and/or reflect stability about business conditions."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was close to the consensus forecast of 56.5% and suggests slightly faster expansion in January than in December. The sharp decline in the employment index is a little concerning.

ADP: Private Employment increased 213,000 in January

by Calculated Risk on 2/04/2015 08:20:00 AM

Private sector employment increased by 213,000 jobs from December to January according to the January ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 220,000 private sector jobs added in the ADP report.

...

Goods-producing employment rose by 31,000 jobs in January, down from 47,000 jobs gained in December. The construction industry added 18,000 jobs, down from last month’s gain of 26,000. Meanwhile, manufacturing added 14,000 jobs in January, below December’s 23,000.

Service-providing employment rose by 183,000 jobs in January, down from 207,000 in December. ...

Mark Zandi, chief economist of Moody’s Analytics, said, “Employment posted another solid gain in January, although the pace of growth is slower than in recent months. Businesses in the energy and supplying industries are already scaling back payrolls in reaction to the collapse in oil prices, while industries benefiting from the lower prices have been slower to increase their hiring. All indications are that the job market will continue to improve in 2015.”

The BLS report for January will be released on Friday and the consensus is for 230,000 non-farm payroll jobs added in December.

MBA: Mortgage Applications increase, FHA Refinance Applications up 76%

by Calculated Risk on 2/04/2015 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

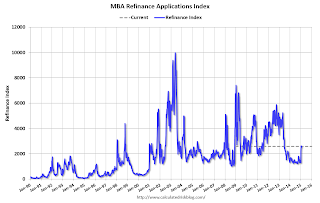

Mortgage applications increased 1.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 30, 2015. ...

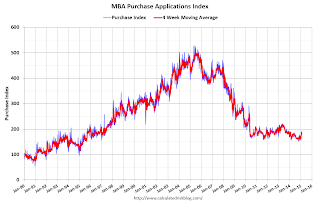

The Refinance Index increased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier.

...

“Following several weeks of already elevated refinance activity due to falling interest rates, FHA refinance applications increased 76.5 percent in response to a reduction in annual mortgage insurance premiums which took effect January 26,” said Lynn Fisher, MBA’s Vice President of Research and Economics. “Conventional refinance volume was up only 0.5 percent for the week while VA refinance volume was down 24.3 percent. FHA purchase applications were also up 12.4 percent over the week prior, despite a decrease in purchase applications in the rest of the market.” ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.79 percent, the lowest level since May 2013, from 3.83 percent, with points increasing to 0.29 from 0.26 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

It looks like 2015 will see more refinance activity than in 2014, especially from FHA loans!

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the purchase index is up 3% from a year ago.