by Calculated Risk on 2/04/2015 07:01:00 AM

Wednesday, February 04, 2015

MBA: Mortgage Applications increase, FHA Refinance Applications up 76%

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 30, 2015. ...

The Refinance Index increased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier.

...

“Following several weeks of already elevated refinance activity due to falling interest rates, FHA refinance applications increased 76.5 percent in response to a reduction in annual mortgage insurance premiums which took effect January 26,” said Lynn Fisher, MBA’s Vice President of Research and Economics. “Conventional refinance volume was up only 0.5 percent for the week while VA refinance volume was down 24.3 percent. FHA purchase applications were also up 12.4 percent over the week prior, despite a decrease in purchase applications in the rest of the market.” ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.79 percent, the lowest level since May 2013, from 3.83 percent, with points increasing to 0.29 from 0.26 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

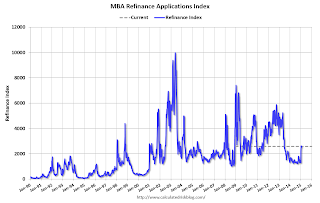

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

It looks like 2015 will see more refinance activity than in 2014, especially from FHA loans!

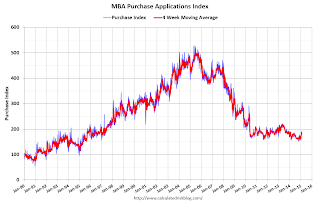

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the purchase index is up 3% from a year ago.