by Calculated Risk on 1/29/2013 01:34:00 PM

Tuesday, January 29, 2013

HVS: Q4 Homeownership and Vacancy Rates

The Census Bureau released the Housing Vacancies and Homeownership report for Q4 2012 this morning.

This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey. Note: I expect housing economist Tom Lawler to send me some comments on this today.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply, or rely on the homeownership rate, except as a guide to the trend.

Click on graph for larger image.

Click on graph for larger image.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased slightly to 65.4%, and down from 65.5% in Q3.

I'd put more weight on the decennial Census numbers and that suggests the actual homeownership rate is probably in the 64% to 65% range.

The HVS homeowner vacancy rate was unchanged at 1.9% in Q4. This is the lowest level since 2005 for this report.

The HVS homeowner vacancy rate was unchanged at 1.9% in Q4. This is the lowest level since 2005 for this report.

The homeowner vacancy rate has peaked and is now declining, although it isn't really clear what this means. Are these homes becoming rentals? Anyway - once again - this probably shows that the trend is down, but I wouldn't rely on the absolute numbers.

The rental vacancy rate was increased in Q4 to 8.7%, from 8.6% in Q3.

The rental vacancy rate was increased in Q4 to 8.7%, from 8.6% in Q3.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the overall trend in the rental vacancy rate - and Reis reported that the rental vacancy rate has fallen to the lowest level since 2001.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey. Unfortunately many analysts still use this survey to estimate the excess vacant supply. However this does suggest that the housing vacancy rates have declined sharply.

Earlier on House Prices:

• Case-Shiller: House Prices increased 5.5% year-over-year in November

• Comment on House Prices, Real House Prices, and Price-to-Rent Ratio

• All Current House Price Graphs

Comment on House Prices, Real House Prices, and Price-to-Rent Ratio

by Calculated Risk on 1/29/2013 11:27:00 AM

There is a clear seasonal pattern for house prices, and earlier this year I predicted that the Case-Shiller indexes would turn negative month-to-month in October on a Not Seasonally Adjusted (NSA) basis. That is the normal seasonal pattern.

Also I expected smaller month-to-month declines this winter than for the same months last year. Sure enough, Case-Shiller reported that the Composite 20 index NSA declined slightly in October, and also declined slightly again in November (a 0.1% decline). In November 2011, the index declined 1.3% on a month-to-month basis, so this is a significant change.

Over the winter the key will be to watch the year-over-year change in house prices and to compare to the NSA lows in early 2012. I think the house price indexes have already bottomed, and will be up over 6% or so year-over-year when prices reach the usual seasonal bottom in early 2013.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index over the last several years (both through November). The CoreLogic index turned negative month-to-month in the September report, and then turned slightly positive in November (CoreLogic is a 3 month weighted average, with the most recent month weighted the most). Case-Shiller NSA turned negative month-to-month in the October report (also a three month average, but not weighted), but was only slightly negative in November.

For November, Case-Shiller reported the sixth consecutive year-over-year (YoY) gain in their house price indexes since 2010 - and the increase back in 2010 was related to the housing tax credit. Excluding the tax credit, the previous YoY increase was back in 2006. The YoY increase in November suggests that house prices probably bottomed earlier in 2012 (the YoY change lags the turning point for prices).

The following table shows the year-over-year increase for each month this year.

| Case-Shiller Composite 20 Index | |

|---|---|

| Month | YoY Change |

| Jan-12 | -3.9% |

| Feb-12 | -3.5% |

| Mar-12 | -2.6% |

| Apr-12 | -1.7% |

| May-12 | -0.5% |

| Jun-12 | 0.6% |

| Jul-12 | 1.1% |

| Aug-12 | 1.9% |

| Sep-12 | 2.9% |

| Oct-12 | 4.2% |

| Nov-12 | 5.5% |

| Dec-12 | |

| Jan-13 | |

Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation.

Real prices, and the price-to-rent ratio, are back to late 1999 to 2000 levels depending on the index.

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q3 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through November) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q3 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through November) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to Q1 2003 levels (and also back up to Q3 2010), and the Case-Shiller Composite 20 Index (SA) is back to September 2003 levels, and the CoreLogic index (NSA) is back to January 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to mid-1999 levels, the Composite 20 index is back to September 2000, and the CoreLogic index back to February 2001.

In real terms, most of the appreciation in the last decade is gone.

Price-to-Rent

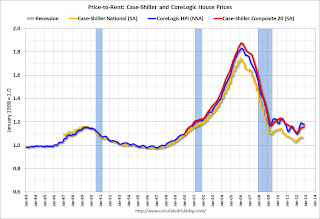

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q3 1999 levels, the Composite 20 index is back to September 2000 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

Case-Shiller: House Prices increased 5.5% year-over-year in November

by Calculated Risk on 1/29/2013 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for November (a 3 month average of September, October and November).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Extend Gains According to the S&P/Case-Shiller Home Price Indices

Data through November 2012, released today by S&P Dow Jones Indices for its S&P/Case-Shiller1 Home Price Indices ... showed home prices rose 4.5% for the 10-City Composite and 5.5% for the 20-City Composite in the 12 months ending in November 2012.

“The November monthly figures were stronger than October, with 10 cities seeing rising prices versus seven the month before.” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. Phoenix and San Francisco were both up 1.4% in November followed by Minneapolis up 1.0%. On the down side, Chicago was again amongst the weakest with a drop of 1.3% for November.

“Winter is usually a weak period for housing which explains why we now see about half the cities with falling month-to-month prices compared to 20 out of 20 seeing rising prices last summer. The better annual price changes also point to seasonal weakness rather than a reversal in the housing market. Further evidence that the weakness is seasonal is seen in the seasonally adjusted figures: only New York saw prices fall on a seasonally adjusted basis while Cleveland was flat.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.7% from the peak, and up 0.5% in November (SA). The Composite 10 is up 5.3% from the post bubble low set in March (SA).

The Composite 20 index is off 29.8% from the peak, and up 0.6% (SA) in November. The Composite 20 is up 6.0% from the post-bubble low set in March (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 4.5% compared to November 2011.

The Composite 20 SA is up 5.5% compared to November 2011. This was the sixth consecutive month with a year-over-year gain since 2010 (when the tax credit boosted prices temporarily). This was the largest year-over-year gain for the Composite 20 index since 2006.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in November seasonally adjusted (also 10 of 20 cities increased NSA). Prices in Las Vegas are off 57.6% from the peak, and prices in Dallas only off 3.8% from the peak. Note that the red column (cumulative decline through November 2012) is above previous declines for all cities.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in November seasonally adjusted (also 10 of 20 cities increased NSA). Prices in Las Vegas are off 57.6% from the peak, and prices in Dallas only off 3.8% from the peak. Note that the red column (cumulative decline through November 2012) is above previous declines for all cities.This was slightly below the consensus forecast for a 5.8% YoY increase. I'll have more on prices later.

Monday, January 28, 2013

Tuesday: Case-Shiller House Prices

by Calculated Risk on 1/28/2013 08:58:00 PM

From the WSJ: Bank 'Stress Tests' to Be Released Over 2 Days

The Federal Reserve said Monday that it will release the results of the latest "stress tests" for the nation's 19 largest banks over two separate days in March.Here is the Federal Reserve press release.

...

The Fed said it will release on March 7 scores assessing how banks would hold up under deteriorating economic and financial-market conditions. On March 14, the Fed will reveal whether the 19 banks will be permitted to repurchase stock or pay dividends.

...

Unlike previous years, banks whose dividend or share-buyback plans would cause them to fail the central bank's test will essentially be allowed a mulligan, giving them the chance to pare back or alter their plan to meet Fed thresholds before the official results are released.

Tuesday economic releases:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for November. Although this is the November report, it is really a 3 month average of September, October and November. The consensus is for a 5.8% year-over-year increase in the Composite 20 index (NSA) for November. The Zillow forecast is for the Composite 20 to increase 5.3% year-over-year, and for prices to increase 0.4% month-to-month seasonally adjusted.

• At 10:00 AM, Conference Board's consumer confidence index for January. The consensus is for the index to be unchanged at 65.1.

• Also at 10:00 AM, the Q4 Housing Vacancies and Homeownership report from the Census Bureau will be released. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't match other measures (like the decennial Census and the ACS) and this survey probably shouldn't be used to estimate the excess vacant housing supply.

Existing Home Inventory up 3.7% in late January

by Calculated Risk on 1/28/2013 03:30:00 PM

One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'll be tracking inventory weekly for the next few months.

If inventory does bottom, we probably will not know for sure until late in the year. In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The NAR data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) kindly sent me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year.

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - through January - it appears inventory is increasing at a more normal rate.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

The key will be to see how much inventory increases over the next few months. In 2010, inventory was up 8% by early March, and up 15% by the end of March.

For 2011 and 2012, inventory only increased about 5% at the peak.

So far in 2013, inventory is up 3.7%, and the next few months will be very interesting for inventory!

Dallas Fed: Regional Manufacturing Activity "Strengthens" in January

by Calculated Risk on 1/28/2013 11:38:00 AM

From the Dallas Fed: Texas Manufacturing Activity Strengthens in January

Texas factory activity rose sharply in January, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 3.5 to 12.9, which is consistent with faster growth.This was the strongest regional manufacturing report for January and above expectations of a reading of 4.0 for the general business activity index.

Other measures of current manufacturing activity also indicated stronger growth in January. The new orders index jumped 13 points to 12.2, its highest reading since March 2011. The capacity utilization index shot up from 2.1 to 14.0, implying utilization rates increased faster than last month. The shipments index rose 9 points to 21.9, indicating shipments quickened in January.

Perceptions of broader business conditions were more positive in January. The general business activity index increased from 2.5 to 5.5, its best reading since March. The company outlook index also rose sharply to 12.6, largely due to a drop in the share of firms reporting a worsened outlook from 10 percent in December to 6 percent in January.

Labor market indicators reflected a sharp increase in hiring but flat workweeks.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through January), and five Fed surveys are averaged (blue, through January) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through December (right axis).

The average of the five regional surveys turned negative again.

The ISM index for January will be released Friday, Feb 1st, and these surveys suggest another weak reading - and probably indicating contraction (below 50). Note: The Markit Flash index was surprisingly strong in January.

Pending Home Sales index declines in December

by Calculated Risk on 1/28/2013 10:00:00 AM

From the NAR: Pending Home Sales Down in December but Remain on Uptrend

The Pending Home Sales Index,* a forward-looking indicator based on contract signings, fell 4.3 percent to 101.7 in December from 106.3 in November but is 6.9 percent higher than December 2011 when it was 95.1. The data reflect contracts but not closings.Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in January and February.

...

Lawrence Yun , NAR chief economist, said there is an uneven uptrend. "The supply limitation appears to be the main factor holding back contract signings in the past month. Still, contract activity has risen for 20 straight months on a year-over-year basis," he said. "Buyer interest remains solid, as evidenced by a separate Realtor® survey which shows that buyer foot traffic is easily outpacing seller traffic."

Yun said shortages of available inventory are limiting sales in some areas. "Supplies of homes costing less than $100,000 are tight in much of the country, especially in the West, so first-time buyers have fewer options," he said ...

The PHSI in the Northeast fell 5.4 percent to 78.8 in December but is 8.4 percent higher than December 2011. In the Midwest the index rose 0.9 percent to 104.8 in December and is 14.4 percent above a year ago. Pending home sales in the South declined 4.5 percent to an index of 111.5 in December but are 10.1 percent higher December 2011. In the West the index fell 8.2 percent in December to 101.0 and is 5.3 percent below a year ago.

As I've noted several times, with limited inventory at the low end and fewer foreclosures, we might see flat or even declining existing home sales. The key for sales is that the number of conventional sales is increasing while foreclosure and short sales decline.

Housing Spillover Effects

by Calculated Risk on 1/28/2013 09:04:00 AM

People frequently ask how a sector that currently accounts for 2.5% of the US economy can be so important. First, residential investment has large swings during the business cycle, and will probably increase sharply over the next few years. Second, there are spillover effects from housing - meaning housing has a much larger impact on overall economic activity than just "residential investment".

We are starting to see some signs of spillover from Kate Linebaugh and James Hagerty at the WSJ: From Power Tools to Carpets, Housing Recovery Signs Mount

Companies that sell power tools, air conditioners, carpet fibers, furniture and cement mixers are reporting stronger sales for the fourth quarter, providing further evidence that a turnaround in the housing market is taking hold.Weekend:

... executives at companies exposed to housing are growing more optimistic. Improvement in the sector could help broad tracts of the economy by creating jobs, improving consumer confidence and boosting property-tax receipts for municipalities. Construction typically is a big job creator during expansions, though the industry has been slow to staff up during the current recovery.

"The housing recovery will help lift businesses that have long been dormant," said Mark Vitner, senior economist at Wells Fargo. "People will be fixing up homes to put them up for sale—buying new air conditioners, painting, fixing roofs. As the new-home market picks up, that really feeds into [gross domestic product]."

• Summary for Week Ending Jan 25th

• Schedule for Week of Jan 27th

• Thresholds for QE

• Me, Me, Me

Sunday, January 27, 2013

Monday: Durable Goods, Pending Home Sales

by Calculated Risk on 1/27/2013 09:16:00 PM

This is related to my earlier post on Thresholds for QE, from Binyamin Appelbaum at the NY Times: At Fed, Nascent Debate on When to Slow Asset Buying

The looming question is how much longer the asset purchases will continue.This discussion is just starting, and I don't expect any significant announcements after the FOMC meeting this week.

... the discussion already has begun to swing toward informal thresholds.

Mr. Rosengren said last year that the Fed should certainly continue the purchases until the unemployment rate declines at least below 7.25 percent.

James Bullard, president of the Federal Reserve Bank of St. Louis ... [told] CNBC that he expected the unemployment rate to drop to near 7 percent by the end of the year and that it would then be appropriate for the Fed to consider suspending its program of asset purchases.

The Asian markets are mostly green tonight; the Shanghai Composite index is up 1%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures and DOW are flat (fair value).

Oil prices have moved up a little recently with WTI futures at $95.97 per barrel and Brent at $113.27 per barrel. Gasoline prices are up about 5 cents over the last 10 days.

Monday:

• At 8:30 AM ET, Durable Goods Orders for December from the Census Bureau. The consensus is for a 1.6% increase in durable goods orders.

• At 10:00 AM, the NAR will release their Pending Home Sales Index for December. The consensus is for a 0.3% decrease in the index.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for January will be released. This is the last of the regional surveys for January. The consensus is a decrease to 4.0 from 6.8 in December (above zero is expansion).

Weekend:

• Summary for Week Ending Jan 25th

• Schedule for Week of Jan 27th

• Thresholds for QE

• Me, Me, Me

Does this mark the top for bond prices?

by Calculated Risk on 1/27/2013 05:35:00 PM

Fun on a Sunday with a hat tip to reader Jeff for suggesting this post.

Last year I posted a photo of the early construction phase of the PIMCO Taj Mahal. Now they are working on the interior of the building (building on the left).

The question is: Does completion of the PIMCO building mark the top for bond prices?

Earlier:

• Summary for Week Ending Jan 25th

• Schedule for Week of Jan 27th

• Thresholds for QE

• Me, Me, Me