by Calculated Risk on 1/29/2013 11:27:00 AM

Tuesday, January 29, 2013

Comment on House Prices, Real House Prices, and Price-to-Rent Ratio

There is a clear seasonal pattern for house prices, and earlier this year I predicted that the Case-Shiller indexes would turn negative month-to-month in October on a Not Seasonally Adjusted (NSA) basis. That is the normal seasonal pattern.

Also I expected smaller month-to-month declines this winter than for the same months last year. Sure enough, Case-Shiller reported that the Composite 20 index NSA declined slightly in October, and also declined slightly again in November (a 0.1% decline). In November 2011, the index declined 1.3% on a month-to-month basis, so this is a significant change.

Over the winter the key will be to watch the year-over-year change in house prices and to compare to the NSA lows in early 2012. I think the house price indexes have already bottomed, and will be up over 6% or so year-over-year when prices reach the usual seasonal bottom in early 2013.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index over the last several years (both through November). The CoreLogic index turned negative month-to-month in the September report, and then turned slightly positive in November (CoreLogic is a 3 month weighted average, with the most recent month weighted the most). Case-Shiller NSA turned negative month-to-month in the October report (also a three month average, but not weighted), but was only slightly negative in November.

For November, Case-Shiller reported the sixth consecutive year-over-year (YoY) gain in their house price indexes since 2010 - and the increase back in 2010 was related to the housing tax credit. Excluding the tax credit, the previous YoY increase was back in 2006. The YoY increase in November suggests that house prices probably bottomed earlier in 2012 (the YoY change lags the turning point for prices).

The following table shows the year-over-year increase for each month this year.

| Case-Shiller Composite 20 Index | |

|---|---|

| Month | YoY Change |

| Jan-12 | -3.9% |

| Feb-12 | -3.5% |

| Mar-12 | -2.6% |

| Apr-12 | -1.7% |

| May-12 | -0.5% |

| Jun-12 | 0.6% |

| Jul-12 | 1.1% |

| Aug-12 | 1.9% |

| Sep-12 | 2.9% |

| Oct-12 | 4.2% |

| Nov-12 | 5.5% |

| Dec-12 | |

| Jan-13 | |

Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation.

Real prices, and the price-to-rent ratio, are back to late 1999 to 2000 levels depending on the index.

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q3 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through November) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q3 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through November) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to Q1 2003 levels (and also back up to Q3 2010), and the Case-Shiller Composite 20 Index (SA) is back to September 2003 levels, and the CoreLogic index (NSA) is back to January 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to mid-1999 levels, the Composite 20 index is back to September 2000, and the CoreLogic index back to February 2001.

In real terms, most of the appreciation in the last decade is gone.

Price-to-Rent

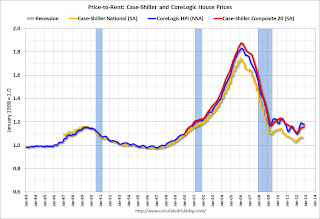

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q3 1999 levels, the Composite 20 index is back to September 2000 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.