by Calculated Risk on 9/27/2012 11:00:00 AM

Thursday, September 27, 2012

Kansas City Fed: Regional Manufacturing Activity "slowed somewhat" in September

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Slowed Somewhat

The Federal Reserve Bank of Kansas City released the September Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity slowed somewhat, although producers’ expectations for future activity remained relatively positive.This was below expectations of a 5 reading for the composite index. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

“Factories reported only minimal overall growth in our region in September, and both production and new orders fell slightly” said Wilkerson. “But firms anticipate growth to pick up later this year and on into next year.”

...

The month-over-month composite index was 2 in September, down from 8 in August and 5 in July, and the lowest in nine months. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. ... The production index dropped from 7 to -4, and the shipments, new orders, and order backlog indexes also moved into negative territory. The employment index eased from 2 to 1, while the new orders for export index inched higher but remained below zero. Both inventory indexes eased but were still in positive territory.

Despite the overall slowdown, most future factory indexes were little changed and remained at generally favorable levels. The future composite index was unchanged at 16, while the future shipments, new orders, and order backlog indexes increased slightly. The future employment index was stable at 16, while the future production index eased somewhat from 31 to 29. The future capital expenditures index fell for the second straight month, while the new orders for export index posted no change.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through September), and five Fed surveys are averaged (blue, through September) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

The ISM index for September will be released Monday, Oct 1st, and these surveys suggest another weak reading close to 50.

NAR: Pending home sales index declined 2.6% in August

by Calculated Risk on 9/27/2012 10:03:00 AM

From the NAR: Pending Home Sales Decline in August

The Pending Home Sales Index, a forward-looking indicator based on contract signings, declined 2.6 percent to 99.2 in August from an upwardly revised 101.9 in July but is 10.7 percent above August 2011 when it was 89.6. The data reflect contracts but not closings.This was below the consensus forecast of a slight increase.

The PHSI in the Northeast rose 0.9 percent to 78.2 in August and is 19.9 percent above August 2011. In the Midwest the index declined 2.6 percent to 95.0 in August but is also 19.9 percent higher than a year ago. Pending home sales in the South slipped 1.1 percent to an index of 110.4 in August but are 13.2 percent above August 2011. With broad inventory shortages in the West, the index fell 7.2 percent in August to 102.5 and is 4.2 percent below a year ago.

Contract signings usually lead sales by about 45 to 60 days, so this is for sales in September and October.

Weekly Initial Unemployment Claims decline to 359,000

by Calculated Risk on 9/27/2012 08:30:00 AM

Other releases: From the BEA, Q2 GDP was revised down to 1.3% from 1.7%.

From the Census Bureau:

New orders for manufactured durable goods in August decreased $30.1 billion or 13.2 percent to $198.5 billion, the U.S. Census Bureau announced today. This decrease, down following three consecutive monthly increases, was the largest decrease since January 2009 and followed a 3.3 percent July increase.The decline was due to the volatile transportation sector.

The DOL reports:

In the week ending September 22, the advance figure for seasonally adjusted initial claims was 359,000, a decrease of 26,000 from the previous week's revised figure of 385,000. The 4-week moving average was 374,000, a decrease of 4,500 from the previous week's revised average of 378,500.The previous week was revised up from 382,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 374,000.

This was below the consensus forecast of 376,000.

And here is a long term graph of weekly claims:

Mostly moving sideways this year, but moving up recently.

Wednesday, September 26, 2012

Thursday: Unemployment Claims, Durable Goods, GDP

by Calculated Risk on 9/26/2012 08:04:00 PM

On Europe ...

From the Financial Times: Rajoy fights Spanish turmoil

Mariano Rajoy will on Thursday attempt to stave off a backlash from financial markets by announcing budget plans for next year ... His government is also preparing to unveil a new reform programme and the results of a banking stress test.From the NY Times: European Markets Jolted Amid Protests in Greece and Spain

Excerpt with permission.

On Tuesday in Spain, tens of thousands of demonstrators besieged Parliament to protest austerity measures planned by Mr. Rajoy. ...On Thursday:

In Athens, trade unions called a nationwide strike Wednesday to contest billions of dollars in new salary and pension cuts being discussed by the government and its international creditors. ...

[Prime Minister Antonis] Samaras is negotiating a $15 billion austerity package that is needed to persuade Greece’s so-called troika of lenders — the International Monetary Fund, the European Central Bank and the European Commission — to release nearly $40.7 billion in financial aid that the country needs to stay solvent.

Mr. Rajoy has been trying for months to convince investors that Spain can handle its own problems and that it will not need a bailout that would force Madrid to cede some authority over its fiscal affairs to its lenders, and is set to introduce new cutbacks to meet budgetary goals. Those will include restrictions on early retirement and various measures to streamline regulations and fight unemployment ...

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 376 thousand from 382 thousand.

• Also at 8:30 AM, the Durable Goods Orders report for August will be released by the Census Bureau. The consensus is for a 5.0% decrease in durable goods orders.

• Also at 8:30 AM, the BEA will released the third estimate of Q2 Gross Domestic Product. The consensus is that real GDP increased 1.7% annualized in Q2, unchanged form the second estimate.

• At 10:00 AM, the NAR will release the Pending Home Sales Index for September. The consensus is for a 0.3% increase in the index.

• At 10:30 AM, the Kansas City Fed regional Manufacturing Survey for September will be released. This is the last of the regional surveys for September. The consensus is for a reading of 5, down from 8 in August (above zero is expansion).

A question for the September economic prediction contest:

Earlier on new home sales:

• New Home Sales at 373,000 SAAR in August

• New Home Sales and Distressing Gap

• New Home Sales graphs

New Home Prices: Average Highest since 2008

by Calculated Risk on 9/26/2012 03:20:00 PM

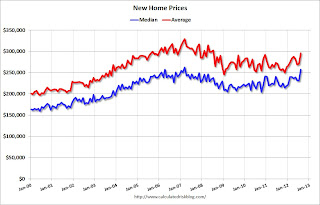

As part of the new home sales report, the Census Bureau reported that the average price for new homes increased to the highest level since August 2008.

From the Census Bureau: "The median sales price of new houses sold in August 2012 was $256,900; the average sales price was $295,300."

The following graph shows the median and average new home prices.

Click on graph for larger image.

Click on graph for larger image.

During the bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. With fewer foreclosures now, it appears the builders are moving to slightly higher price points.

The second graph shows the percent of new home sales by price. At the peak of the housing bubble, almost 40% of new homes were sold for more than $300K - and over 20% were sold for over $400K.

The percent of home over $300K declined to 20% in January 2009. Now it has rebounded to around 35%. And less than 10% were under $150K.

The percent of home over $300K declined to 20% in January 2009. Now it has rebounded to around 35%. And less than 10% were under $150K.

Earlier:

• New Home Sales at 373,000 SAAR in August

• New Home Sales and Distressing Gap

• New Home Sales graphs

New Home Sales and Distressing Gap

by Calculated Risk on 9/26/2012 12:51:00 PM

New home sales have averaged 362,000 on an annual rate basis through August. That means sales are on pace to increase 18% from last year (and based on the last few months, sales will probably increase more than 20% this year).

Here is a table showing sales and the change from the previous year since the peak in 2005:

| Year | New Home Sales (000s) | Change |

|---|---|---|

| 2005 | 1,283 | |

| 2006 | 1,051 | -18% |

| 2007 | 776 | -26% |

| 2008 | 485 | -38% |

| 2009 | 375 | -23% |

| 2010 | 323 | -14% |

| 2011 | 306 | -5% |

| 20121 | 362 | 18% |

| 12012 pace through July. | ||

But even with a 20%+ increase this year, 2012 will be the 3rd lowest year since the Census Bureau started tracking new home sales in 1963. This year will be above 2010 and 2011, and it is possible - with a fairly strong last four months - that sales will be close to the level in 2009.

Given the current low level of sales, and current market conditions (supply and demand), sales will probably continue to increase over the next few years. I don't expect sales to increase to 2005 levels, but something close to 800,000 is possible once the number of distressed sales declines to more normal levels.

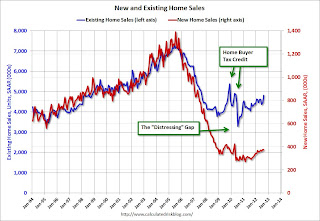

Here is an update to the distressing gap graph.

Click on graph for larger image.

Click on graph for larger image.This "distressing gap" graph that shows existing home sales (left axis) and new home sales (right axis) through August. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders haven't been able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to close - mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Earlier:

• New Home Sales at 373,000 SAAR in August

• New Home Sales graphs

New Home Sales at 373,000 SAAR in August

by Calculated Risk on 9/26/2012 10:00:00 AM

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 373 thousand. This was down slightly from a revised 374 thousand SAAR in July (revised up from 372 thousand). Sales in June were revised up.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in August 2012 were at a seasonally adjusted annual rate of 373,000... This is 0.3 percent below the revised July rate of 374,000, but is 27.7 percent above the August 2011 estimate of 292,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply was unchanged in August at 4.5 months. July was revised down from 4.6 months.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of August was 141,000. This represents a supply of 4.5 months at the current sales rate.On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at a record low 38,000 units in August. The combined total of completed and under construction is at the lowest level since this series started.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In August 2012 (red column), 31 thousand new homes were sold (NSA). Last year only 25 thousand homes were sold in August. This was the third weakest August since this data has been tracked. The high for August was 110 thousand in 2005.

Even though sales are still very low, new home sales have clearly bottomed. New home sales have averaged 362 thousand SAAR over the first 8 months of 2012, after averaging under 300 thousand for the previous 18 months. Most of the recent revisions have been up too.

Even though sales are still very low, new home sales have clearly bottomed. New home sales have averaged 362 thousand SAAR over the first 8 months of 2012, after averaging under 300 thousand for the previous 18 months. Most of the recent revisions have been up too.This was below expectations of 380,000, but this was another fairly solid report and indicates an ongoing sluggish recovery in residential investment.

MBA: Mortgage Refinance Activity increases as mortgage rates fall to new survey lows

by Calculated Risk on 9/26/2012 07:03:00 AM

From the MBA: Mortgage Rates Drop to New Survey Lows

The Refinance Index increased 3 percent from the previous week to the highest level in six weeks. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.63 percent, the lowest rate in the history of the survey, from 3.72 percent, with points decreasing to 0.41 from 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index. The purchase index has been mostly moving sideways over the last two years.

So far the purchase index has not indicated an increase in purchase activity, although the recent Fed survey of loan officers suggested there has been some increase.

The second graph shows the refinance index.

The second graph shows the refinance index.The refinance activity is at the highest level in six weeks and has been generally moving up over the last year.

Tuesday, September 25, 2012

Wednesday: New Home Sales

by Calculated Risk on 9/25/2012 08:53:00 PM

A couple of "zingers" from the WSJ: Seven Zingers in Sheila Bair’s New Book

On Mr. Paulson not having time to meet with her early on: “Clearly, the former CEO of Goldman Sachs didn’t think the head of an agency that insured $100,000 bank deposits was worth his time. That would change...”On Wednesday:

Ms. Bair got zinged herself by a protester outside the Treasury building during TARP negotiations, mistaking her for a “fat cat” banker as she exited. “How much did that suit cost?” the protester asked. $139 at Macy’s, Bair replied.

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Look for record low mortgage rates and some pickup in refinance activity.

• At 10:00 AM, the Census Bureau will release the New Home Sales report for August. The consensus is for an increase in sales to 380 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 372 thousand in July. Watch for possible upgrades to the sales rates for previous months.

A question for the September economic prediction contest:

DOT: Vehicle Miles Driven decreased 0.3% in July

by Calculated Risk on 9/25/2012 05:54:00 PM

The Department of Transportation (DOT) reported today:

Travel on all roads and streets changed by -0.3% (-0.8 billion vehicle miles) for July 2012 as compared with July 2011. Travel for the month is estimated to be 258.3 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

Cumulative Travel for 2012 changed by +0.9% (14.8 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 56 months - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices peaked in April at close to $4.00 per gallon, and then started falling.

Gasoline prices peaked in April at close to $4.00 per gallon, and then started falling.Gasoline prices were down in July to an average of $3.50 per gallon according to the EIA. Last year, prices in July averaged $3.70 per gallon - and even with the decline in gasoline prices, miles driven declined year-over-year in July.

Just looking at gasoline prices suggest miles driven will be down in August too.

However, as I've mentioned before, gasoline prices are just part of the story. The lack of growth in miles driven over the last 4+ years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers. With all these factors, it may be years before we see a new peak in miles driven.

Earlier on house prices:

• Case-Shiller: House Prices increased 1.2% year-over-year in July

• House Price Comments, Real House Prices, Price-to-Rent Ratio