by Calculated Risk on 3/12/2012 12:04:00 PM

Monday, March 12, 2012

Report: New Bank Stress Test results expected by Thursday

From Nelson Schwartz at the NY Times: Latest Stress Tests Are Expected to Show Progress at Most Banks

[T]he Federal Reserve this week will release the results of its latest stress tests, which are expected to show broadly improved balance sheets at most institutions.The stress test scenario was announced last November and is outlined here.

...

Unlike the findings of the last round of stress tests, which ended last March, the results of this round will be made public by the Federal Reserve, with an announcement expected by Thursday.

The stress tests assumed the unemployment rate will rise to 13% in 2013, that the Dow Jones Total Stock Market Index will decline by more than 50% from the November level. The scenario assumed that house prices would fall another 20%+, and bottom at almost 47% down from the peak.

Note: The Fed uses the CoreLogic index for house prices, and the index has declined over 4% since the stress test scenario was released in November, and the index was off 34% from the peak as of January.

Report: Public transportation ridership increases 2.3% in 2011

by Calculated Risk on 3/12/2012 09:11:00 AM

From the APTA: 10.4 Billion Trips Taken On U.S. Public Transportation In 2011

According to a report released today by the American Public Transportation Association (APTA), Americans took 10.4 billion trips on public transportation in 2011, the second highest annual ridership since 1957. Only ridership in 2008, when gas rose to more than $4 a gallon, surpassed last year’s ridership. With an increase of 2.3 percent over the 2010 ridership, this was the sixth year in a row that more than 10 billion trips were taken on public transportation systems nationwide. During 2011, vehicle miles of travel (VMTs) declined by 1.2 percent.And below is a graph of gasoline prices. Gasoline prices bottomed in December and have been moving up again. Note: The graph below shows oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

...

“Two top reasons for the increased ridership are higher gas prices and in certain areas, a recovering economy with more people returning to work,” said [APTA President and CEO Michael Melaniphy]. “Since nearly sixty percent of trips taken on public transportation are for work commutes, it’s not surprising to see ridership increase in areas where the economy has improved.”

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Sunday, March 11, 2012

Report: Mortgage Settlement might be filed in court Monday

by Calculated Risk on 3/11/2012 09:39:00 PM

Nick Timiraos at the WSJ has some details about the settlement. He also writes that the settlement documents might be filed in court tomorrow.

Here is the online site for the mortgage settlement. Note the "National Mortgage Settlement (coming soon)" in the upper right.

From Timiraos: Mortgage Deal Is Built on Tradeoffs

Settlement documents, which could be filed in court as soon as Monday, will detail the formulas governing how banks gain credit for that aid, as well as new standards banks will have to follow when they deal with borrowers who face or go through foreclosure.

...

Of the total $25 billion settlement, around $5 billion will be paid as fines. An added $3 billion will be used to help homeowners who owe more than their homes are worth refinance. To pay the remaining $17 billion, banks will receive credits for helping troubled borrowers, of which $10 billion goes toward cutting loan balances for borrowers who are underwater, owing more than their homes are worth.

...

Banks can satisfy up to 10% of the $17 billion in credits, for example, by waiving the right to pursue deficiency judgments on mortgages that have recourse, such as home-equity loans. ... Banks can satisfy up to 5% of the credits by providing more generous relocation assistance to foreclosed homeowners.

Lawler: REO inventory of "the F's", PLS, and FDIC-insured institutions combined down about 21% last year

by Calculated Risk on 3/11/2012 06:05:00 PM

CR Note: On Friday I posted a graph of REO inventory (lender Real Estate Owned) for the Fs (Fannie, Freddie and the FHA). Economist Tom Lawler has added estimates for FDIC insured institutions and PLS (private label securities).

From Tom Lawler:

Below is a chart showing estimates of the SF REO inventory of the F’s, private-label ABS (from Barclays Capital), and FDIC-insured institutions. On the latter I have changed my estimation procedure. Rather than assume a constant carrying cost, I am assuming that the average carrying cost at FDIC insured institutions is 50% higher than the average for Fannie and Freddie. Both Fannie and Freddie’s average REO carrying costs have declined steadily over the past two years, and that’s probably true for banks as well.

Compared to the end of 2010, estimated REO inventories for the F’s, PLS, and FDIC-insured institutions combined at the end of 2011 were down about 21% to the lowest level since the end of 2007.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

More CR: As Tom Lawler has noted before: "This is NOT an estimate of total residential REO, as it excludes non-FHA government REO (VA, USDA, etc.), credit unions, finance companies, non-FDIC-insured banks and thrifts, and a few other lender categories." However this is the bulk of the 1-4 family REO - probably 90% or more. Rounding up the estimate (using 90%) suggests total REO is just around 520,000 in Q4.

REO inventories have declined over the last year. This was a combination of more sales and fewer acquisitions due to the slowdown in the foreclosure process. However there are many more foreclosures coming and I expect the REO inventory to start increasing again.

Yesterday:

• Summary for Week ending March 9th

• Schedule for Week of March 11th

Distressed House Sales using Sacramento Data for February

by Calculated Risk on 3/11/2012 01:31:00 PM

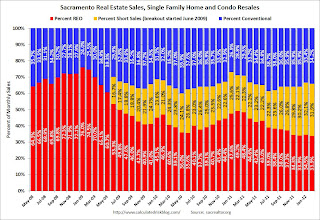

I've been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

This will be interesting once something changes significantly. So far there has been a shift from REO to short sales, and the percentage of distressed sales has been declining gradually year-over-year. The percent of distressed sales in Sacramento decreased in February compared January; the normal seasonal pattern. Usually January has the largest percentage of short sales for the year.

In February 2012, 65.8% of all resales (single family homes and condos) were distressed sales. This was down from 71.2% in February 2011, and the lowest percentage of February distressed sales since Sacramento started breaking out the data.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales. There is a seasonal pattern for conventional sales (stronger in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales decreases every summer and the increases in the fall and winter.

There will be probably be more foreclosures following the mortgage servicer settlement, but it is possible the percent of conventional sales will be over 40% this summer for the first time since the crisis started.

Total sales were up 14.2% compared to February 2011. Active Listing Inventory declined 54.3% from last February, and total inventory, including "short sale contingent", was off 30% year-over-year.

Cash buyers accounted for 33.7% of all sales (frequently investors), and median prices are off 5.3% from last February.

This data might be helpful in determining when the market is improving. So far it looks like REO sales have declined, partially offset by an increase in short sales, and a small decline in the total percent of distressed sales. Also inventory has plummeted - even inventory including "short sale contingent" listings.

AAR: Rail Traffic "mixed" in February

by Calculated Risk on 3/11/2012 09:36:00 AM

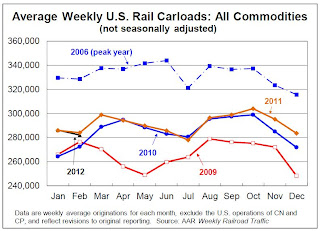

From the Association of American Railroads (AAR): AAR Reports Mixed Results for February Rail Traffic

The Association of American Railroads (AAR) today reported U.S. rail carloads originated in February 2012 totaled 1,410,992, down 27,555 carloads or 1.9 percent, compared with February 2011. Intermodal volume in February 2012 was 1,122,458 containers and trailers, up 26,284 units or 2.4 percent compared with February 2011. February’s average of 224,492 intermodal units per week was the third highest ever for a February for U.S. railroads.

...

“If you exclude carloads of coal and grain, which are down for reasons that have little to do with the state of the economy, rail traffic in February was encouraging,” said AAR Senior Vice President John T. Gray. “Intermodal traffic was up for the 27th straight month, while carloads of a wide range of commodities—lumber, chemicals, petroleum, paper, steel and more—saw increases in February. Time will tell, but we’re hopeful it’s a sign of broad-based improvement in economic conditions.”

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA).

U.S. rail carloads totaled 1,410,992 in February 2012 (the five weeks ending March 3), down 1.9% (27,555 carloads) from the same period in 2011.According to the AAR, the decline in coal is because coal is being used less for electricity generation.

...

Coal was the main problem in February. U.S. railroads originated 592,316 carloads of coal in February 2012, down 70,583 carloads (10.6%) from February 2011. That’s the biggest year-over-year monthly percentage decline for coal since January 2010. U.S. rail carloads excludingcoal were up 5.5% (43,028 carloads) in February 2012 over February 2011.

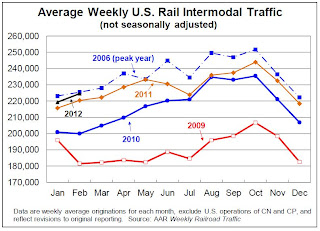

The second graph is for intermodal traffic (using intermodal or shipping containers):

Graphs reprinted with permission.

Graphs reprinted with permission.Intermodal traffic is close to the peak year in 2006.

U.S. rail intermodal volume in February 2012 was 1,122,458 containers and trailers, up 2.4% (26,284 units) over February 2011 on a non-seasonally adjusted basis and the 27th straight year-over-year monthly increase. February’s average of 224,492 intermodal units per week was the third highest ever for a February for U.S. railroads (behind 2006 and 2007). Intermodal growth continues to be a function of increased globalization; the conversion of domestic all-truck to intermodal rail movements; better service due to more terminals and improved infrastructure; and other factors.

Yesterday:

• Summary for Week ending March 9th

• Schedule for Week of March 11th

Saturday, March 10, 2012

Construction Employment, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 3/10/2012 08:01:00 PM

A few more graphs based on the February employment report. The first graph below shows the number of total construction payroll jobs in the U.S. including both residential and non-residential since 1969.

Construction employment decreased by 13 thousand jobs in February, but construction employment has increased 98 thousand since bottoming in January 2011. Last year was the first year with an increase in construction employment since 2006, and the first with an increase in residential construction employment since 2005.

Unfortunately this graph is a combination of both residential and non-residential construction employment. The BLS only started breaking out residential construction employment fairly recently (residential specialty trade contractors in 2001).

Usually residential investment (and residential construction) leads the economy out of recession, and non-residential construction usually lags the economy. Because this graph is a blend, it masks the usual pickup in residential construction following previous recessions. Of course residential construction didn't lead the economy this time because of the large excess supply of vacant homes.

Click on graph for larger image.

Click on graph for larger image.

Construction employment is generally increasing and construction will add to both GDP and employment growth in 2012.

As I've noted for years, there are usually two bottoms for housing following a bubble: 1) when housing starts, new home sales, and residential construction bottoms, and 2) when house prices bottom. It is pretty clear that the bottom is in for housing starts, new home sales and construction employment, and I think we are very close on prices.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.All categories are moving down (the less than 5 week category is back to normal levels). The other categories are still high.

The the long term unemployed declined to 3.5% of the labor force - this is still very high, but the lowest since August 2009.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

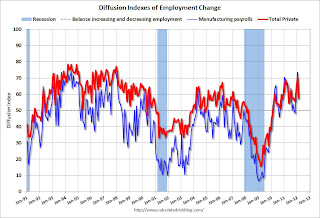

This is a little more technical. The BLS diffusion index for total private employment was at 57.9 in February and for manufacturing, the diffusion index was at 56.8. The index was revised up sharply for January - to the highest level since the '90s.

This is a little more technical. The BLS diffusion index for total private employment was at 57.9 in February and for manufacturing, the diffusion index was at 56.8. The index was revised up sharply for January - to the highest level since the '90s.Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.It appears job growth is now fairly widespread across industries.

Earlier:

• Summary for Week ending March 9th

• Schedule for Week of March 11th

Employment posts yesterday:

• February Employment Report: 227,000 Jobs, 8.3% Unemployment Rate

• Employment Summary and Discussion

• All Employment Graphs

• An older post: Percent Job Losses: Great Recession and Great Depression

Unofficial Problem Bank list declines to 956 Institutions

by Calculated Risk on 3/10/2012 06:17:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Mar 9, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Several changes resulted in the Unofficial Problem Bank List having 956 institutions with assets of $383.3 billion. This week there were four removals and one addition. Last year, the list had 964 institutions with assets of $420.7 billion. The removals include the failed New City Bank, Chicago, IL ($71 million); an unassisted merger of Americantrust Federal Savings Bank, Peru, IN ($99 million); and action terminations for Macatawa Bank, Holland, MI ($1.5 billion Ticker: MCBC) and Magyar Bank, New Brunswick, NJ ($526 million Ticker: MGYR). The addition this week is Bryan Bank & Trust, Richmond, GA ($240 million Ticker: SAVB), whose affiliate The Savannah Bank, National Association, Savannah, GA is also on the list. Next week, we anticipate the OCC will release its actions through mid-February 2012.Earlier:

• Summary for Week ending March 9th

• Schedule for Week of March 11th

Schedule for Week of March 11th

by Calculated Risk on 3/10/2012 01:01:00 PM

Earlier:

• Summary for Week ending March 9th

Retail sales for February is the key report this week. For manufacturing, the March NY Fed (Empire state) and Philly Fed surveys will be released on Thursday, and the February Industrial Production and Capacity Utilization report will be released on Friday.

On prices, the February Producer Price index (PPI) will be released Thursday, and CPI will be released on Friday. Also - there is a one day FOMC meeting on Tuesday.

No Releases Scheduled.

7:30 AM: NFIB Small Business Optimism Index for February.

7:30 AM: NFIB Small Business Optimism Index for February. Click on graph for larger image in graph gallery.

This graph shows the small business optimism index since 1986. The index increased slightly to 93.9 in January from 93.8 in December. This was the fifth increase in a row after declining for six consecutive months. The consensus is for an increase to 95.0 in February.

8:30 AM: Retail Sales for February.

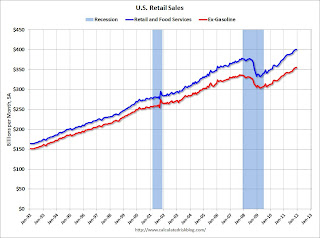

8:30 AM: Retail Sales for February. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail Retail sales are up 20.7% from the bottom, and now 6.1% above the pre-recession peak (not inflation adjusted).

The consensus is for retail sales to increase 1.2% in February, and for retail sales ex-autos to increase 0.8%.

9:00 AM: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for February (a measure of transportation).

10:00 AM: Manufacturing and Trade: Inventories and Sales for January (Business inventories). The consensus is for 0.6% increase in inventories.

10:00 AM ET: Job Openings and Labor Turnover Survey for January from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for January from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in December, and the number of job openings (yellow) has generally been trending up, and are up about 15% year-over-year compared to December 2010.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for January 2012

2:15 PM: FOMC Meeting Announcement. No changes are expected to interest rates.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

8:30 AM: Import and Export Prices for February. The consensus is a for a 0.6% increase in import prices.

9:00 AM: Fed Chairman Ben Bernanke speaks, "Community Banking", At the Independent Community Bankers of America National Convention and Techworld, Nashville, Tennessee. No news is expected.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 355,000 from 362,000 last week.

8:30 AM: Producer Price Index for February. The consensus is for a 0.5% increase in producer prices (0.2% increase in core).

8:30 AM ET: NY Fed Empire Manufacturing Survey for March. The consensus is for a reading of 17.5, down from 19.5 in February (above zero is expansion).

10:00 AM: Philly Fed Survey for March. The consensus is for a reading of 11, up from 10.2 last month (above zero indicates expansion).

8:30 AM: Consumer Price Index for February. The consensus is a 0.5% increase in prices. The consensus for core CPI to increase 0.2%.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for February.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for February. This shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production in February, and for Capacity Utilization to increase to 78.8% (from 78.5%).

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (perliminary for March). The consensus is for a slight increase to 75.6 up from the February reading of 75.3.

Summary for Week Ending March 9th

by Calculated Risk on 3/10/2012 08:24:00 AM

A key story all week was the Greek debt swap that was fairly well received. See from the WSJ: Greece Defaults, and Tries to Move On. There are still many difficulties ahead for Greece, but it appears they will receive the next bailout and avoid collapse for now.

In the U.S., the February employment report was better than expected, especially considering the upward revisions to payrolls for December and January. There were 227,000 payroll jobs added in February, with 233,000 private sector jobs added, and 6,000 government jobs lost. The unemployment rate was unchanged at 8.3%. U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, declined to 14.9% from 15.1% in January. The change in December payroll employment was revised up from +203,000 to +223,000, and January was revised up from +243,000 to +284,000.

There are reasons to expect better job growth overall this year compared to 2011. Last year was negatively impacted by the tsunami, bad weather, high oil prices and the debt ceiling debate. We can't predict the weather, and oil prices are high again - but hopefully there will be no natural disasters this year, and also no threats of defaulting on the debt.

Plus residential investment (new home sales and housing starts) has made the bottom turn, and even with a sluggish housing recovery, residential investment will add to economic growth in 2012. Also, the employment losses from state and local governments will probably end mid-year. As the BLS noted:

Government employment was essentially unchanged in January and February. In 2011, government lost an average of 22,000 jobs per month.Employment growth in manufacturing will probably slow in 2012, but the overall picture is improving. Unfortunately the labor market is still very weak with 12.8 million Americans unemployed and 5.4 million unemployed for more than 6 months.

Another positive report was the ISM services survey that indicated faster expansion in February. Negatives included a larger trade deficit, an increase in initial weekly unemployment claims, and - of course - falling house prices in January.

Still it was a pretty positive week. Here is a summary in graphs:

• February Employment Report: 227,000 Jobs, 8.3% Unemployment Rate

This graph shows the jobs added or lost per month (excluding temporary Census jobs) since the beginning of 2008.

Click on graph for larger image.

Click on graph for larger image.Job growth started picking up early last year, but then the economy was hit by a series of shocks (oil price increase, tsunami in Japan, debt ceiling debate) - and now it appears job growth is picking up again.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate was unchanged at 8.3% (red line).

The Labor Force Participation Rate increased to 63.9% in February (blue line). This is the percentage of the working age population in the labor force. The slight increase in the participation rate is a little good news. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the decline is due to demographics.

The Labor Force Participation Rate increased to 63.9% in February (blue line). This is the percentage of the working age population in the labor force. The slight increase in the participation rate is a little good news. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the decline is due to demographics.The Employment-Population ratio increased to 58.6% in February (black line).

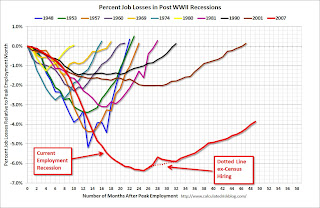

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - much worst than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

• ISM Non-Manufacturing Index indicates faster expansion in February

The February ISM Non-manufacturing index was at 57.3%, up from 56.8% in January. The employment index decreased in February to 55.7%, down from 57.4% in January. Note: Above 50 indicates expansion, below 50 contraction.

The February ISM Non-manufacturing index was at 57.3%, up from 56.8% in January. The employment index decreased in February to 55.7%, down from 57.4% in January. Note: Above 50 indicates expansion, below 50 contraction. This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 56.1% and indicates slightly faster expansion in February than in January.

• Trade Deficit increased in January to $52.6 Billion

The Department of Commerce reports: "[T]otal January exports of $180.8 billion and imports of $233.4 billion resulted in a goods and services deficit of $52.6 billion, up from $50.4 billion in December, revised." The trade deficit was above the consensus forecast of $49 billion.

The Department of Commerce reports: "[T]otal January exports of $180.8 billion and imports of $233.4 billion resulted in a goods and services deficit of $52.6 billion, up from $50.4 billion in December, revised." The trade deficit was above the consensus forecast of $49 billion.This graph shows the monthly U.S. exports and imports in dollars through January 2012.

Exports are well above the pre-recession peak and up 8% compared to January 2011; imports just passed the pre-recession high and imports are up about 8% compared to January 2011.

• Weekly Initial Unemployment Claims increase to 362,000

This graph shows the 4-week moving average of weekly claims since January 2000.

This graph shows the 4-week moving average of weekly claims since January 2000.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased slightly this week to 355,000.

The 4-week moving average is near the lowest level since early 2008.

• CoreLogic: House Price Index declined 1.0% in January to new post-bubble low

From CoreLogic: CoreLogic® January Home Price Index Shows Sixth Consecutive Monthly Decline

From CoreLogic: CoreLogic® January Home Price Index Shows Sixth Consecutive Monthly DeclineThis graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 1.0% in January, and is down 3.1% over the last year. The index is off 34% from the peak - and is now at a new post-bubble low.

Some of this decline was seasonal (the CoreLogic index is NSA) and month-to-month price changes will probably remain negative through March 2012. Last year prices fell about 2.5% from January 2011 to March 2011, and there will probably be a similar decline this year.

• Fed's Flow of Funds: Household Real Estate Value declined $213 billion in Q4

The Federal Reserve released the Q4 2011 Flow of Funds report today: Flow of Funds.

The Federal Reserve released the Q4 2011 Flow of Funds report today: Flow of Funds. The Fed estimated that the value of household real estate fell $213 billion to $15.96 trillion in Q4 2011. The value of household real estate has fallen $6.75 trillion from the peak - and was still falling at the end of 2011.

This graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $42 billion in Q4. Mortgage debt has now declined by $777 billion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

• Other Economic Stories ...

• LPS: House Price Index declined 1.0% in December

• CFO Survey: U.S. Employment Growth to Accelerate

• ADP: Private Employment increased 216,000 in February

• From Jim Hamilton: Oil prices and the U.S. economy

• LPS: Foreclosure Starts and Sales increase Sharply in January