by Calculated Risk on 3/10/2012 08:24:00 AM

Saturday, March 10, 2012

Summary for Week Ending March 9th

A key story all week was the Greek debt swap that was fairly well received. See from the WSJ: Greece Defaults, and Tries to Move On. There are still many difficulties ahead for Greece, but it appears they will receive the next bailout and avoid collapse for now.

In the U.S., the February employment report was better than expected, especially considering the upward revisions to payrolls for December and January. There were 227,000 payroll jobs added in February, with 233,000 private sector jobs added, and 6,000 government jobs lost. The unemployment rate was unchanged at 8.3%. U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, declined to 14.9% from 15.1% in January. The change in December payroll employment was revised up from +203,000 to +223,000, and January was revised up from +243,000 to +284,000.

There are reasons to expect better job growth overall this year compared to 2011. Last year was negatively impacted by the tsunami, bad weather, high oil prices and the debt ceiling debate. We can't predict the weather, and oil prices are high again - but hopefully there will be no natural disasters this year, and also no threats of defaulting on the debt.

Plus residential investment (new home sales and housing starts) has made the bottom turn, and even with a sluggish housing recovery, residential investment will add to economic growth in 2012. Also, the employment losses from state and local governments will probably end mid-year. As the BLS noted:

Government employment was essentially unchanged in January and February. In 2011, government lost an average of 22,000 jobs per month.Employment growth in manufacturing will probably slow in 2012, but the overall picture is improving. Unfortunately the labor market is still very weak with 12.8 million Americans unemployed and 5.4 million unemployed for more than 6 months.

Another positive report was the ISM services survey that indicated faster expansion in February. Negatives included a larger trade deficit, an increase in initial weekly unemployment claims, and - of course - falling house prices in January.

Still it was a pretty positive week. Here is a summary in graphs:

• February Employment Report: 227,000 Jobs, 8.3% Unemployment Rate

This graph shows the jobs added or lost per month (excluding temporary Census jobs) since the beginning of 2008.

Click on graph for larger image.

Click on graph for larger image.Job growth started picking up early last year, but then the economy was hit by a series of shocks (oil price increase, tsunami in Japan, debt ceiling debate) - and now it appears job growth is picking up again.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate was unchanged at 8.3% (red line).

The Labor Force Participation Rate increased to 63.9% in February (blue line). This is the percentage of the working age population in the labor force. The slight increase in the participation rate is a little good news. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the decline is due to demographics.

The Labor Force Participation Rate increased to 63.9% in February (blue line). This is the percentage of the working age population in the labor force. The slight increase in the participation rate is a little good news. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the decline is due to demographics.The Employment-Population ratio increased to 58.6% in February (black line).

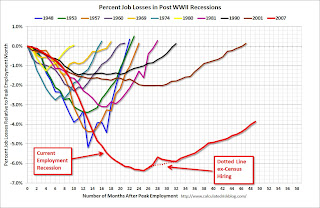

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - much worst than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

• ISM Non-Manufacturing Index indicates faster expansion in February

The February ISM Non-manufacturing index was at 57.3%, up from 56.8% in January. The employment index decreased in February to 55.7%, down from 57.4% in January. Note: Above 50 indicates expansion, below 50 contraction.

The February ISM Non-manufacturing index was at 57.3%, up from 56.8% in January. The employment index decreased in February to 55.7%, down from 57.4% in January. Note: Above 50 indicates expansion, below 50 contraction. This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 56.1% and indicates slightly faster expansion in February than in January.

• Trade Deficit increased in January to $52.6 Billion

The Department of Commerce reports: "[T]otal January exports of $180.8 billion and imports of $233.4 billion resulted in a goods and services deficit of $52.6 billion, up from $50.4 billion in December, revised." The trade deficit was above the consensus forecast of $49 billion.

The Department of Commerce reports: "[T]otal January exports of $180.8 billion and imports of $233.4 billion resulted in a goods and services deficit of $52.6 billion, up from $50.4 billion in December, revised." The trade deficit was above the consensus forecast of $49 billion.This graph shows the monthly U.S. exports and imports in dollars through January 2012.

Exports are well above the pre-recession peak and up 8% compared to January 2011; imports just passed the pre-recession high and imports are up about 8% compared to January 2011.

• Weekly Initial Unemployment Claims increase to 362,000

This graph shows the 4-week moving average of weekly claims since January 2000.

This graph shows the 4-week moving average of weekly claims since January 2000.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased slightly this week to 355,000.

The 4-week moving average is near the lowest level since early 2008.

• CoreLogic: House Price Index declined 1.0% in January to new post-bubble low

From CoreLogic: CoreLogic® January Home Price Index Shows Sixth Consecutive Monthly Decline

From CoreLogic: CoreLogic® January Home Price Index Shows Sixth Consecutive Monthly DeclineThis graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 1.0% in January, and is down 3.1% over the last year. The index is off 34% from the peak - and is now at a new post-bubble low.

Some of this decline was seasonal (the CoreLogic index is NSA) and month-to-month price changes will probably remain negative through March 2012. Last year prices fell about 2.5% from January 2011 to March 2011, and there will probably be a similar decline this year.

• Fed's Flow of Funds: Household Real Estate Value declined $213 billion in Q4

The Federal Reserve released the Q4 2011 Flow of Funds report today: Flow of Funds.

The Federal Reserve released the Q4 2011 Flow of Funds report today: Flow of Funds. The Fed estimated that the value of household real estate fell $213 billion to $15.96 trillion in Q4 2011. The value of household real estate has fallen $6.75 trillion from the peak - and was still falling at the end of 2011.

This graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $42 billion in Q4. Mortgage debt has now declined by $777 billion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

• Other Economic Stories ...

• LPS: House Price Index declined 1.0% in December

• CFO Survey: U.S. Employment Growth to Accelerate

• ADP: Private Employment increased 216,000 in February

• From Jim Hamilton: Oil prices and the U.S. economy

• LPS: Foreclosure Starts and Sales increase Sharply in January