by Calculated Risk on 12/19/2011 03:47:00 PM

Monday, December 19, 2011

ECB Warns on Risks

From the NY Times: E.C.B. Warns of Dangers Ahead for Euro Zone Economy

The European Central Bank warned Monday of a perilous year ahead as the sovereign debt crisis collides with slower economic growth and a dearth of market financing for banks.From the Financial Times: ECB warns of global contagion risks

...

By some measures, the stresses on the European financial system are approaching or even exceeding levels last seen after the bankruptcy of Lehman Brothers in September 2008.

...

A teleconference among E.U. finance ministers ended Monday with an agreement by euro zone nations to contribute around €150 billion, or $195 billion, through the I.M.F. European leaders had committed to contribute “up to €200 billion” at a summit in Brussels on Dec. 9.

The comments hinted at ECB concern over politicians’ failure to bring the crisis under control, and at the danger of countries’ fiscal austerity plans being derailed by domestic politics.This is very depressing. Europe is probably already in a recession, and the ECB and other European policymakers still think that fiscal deficits are the cause of the problem. What Europe needs is growth and re-balancing - and some fiscal adjustments. The ECB is also concerned that austerity will be "derailed by domestic politics". That should not be a surprise. The results of austerity alone - a deeper recession - will not survive the ballot booth.

excerpt with permission

Q3 2011: Mortgage Equity Withdrawal strongly negative

by Calculated Risk on 12/19/2011 12:59:00 PM

Special Note: Dr. James Kennedy has a new method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". I still haven't evaluated his method yet (here is a companion spread sheet), so the following is using my old "simple" method.

Note 2: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity (hence the name "MEW", but there is little MEW right now!), normal principal payments and debt cancellation.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q3 2011, the Net Equity Extraction was minus $75 billion, or a negative 2.6% of Disposable Personal Income (DPI). This is not seasonally adjusted.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined sharply in Q3. Mortgage debt has declined by $730 billion over the last fourteen quarters. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance. Note: most homeowners pay down their principal a little each month unless they have an IO or Neg AM loan, so with no new borrowing, equity extraction would always be slightly negative.

NAHB Builder Confidence index increases in December

by Calculated Risk on 12/19/2011 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) increased in December to 21 from 19 in November. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Rises for the Third Consecutive Month

Builder confidence in the market for newly built, single-family homes edged up two points from a downwardly revised number to 21 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for December, released today. This marks a third consecutive month in which builder confidence has improved, and brings the index to its highest point since May of 2010.

...

“This is the first time that builder confidence has improved for three consecutive months since mid-2009, which signifies a legitimate though slowly emerging upward trend,” said NAHB Chief Economist David Crowe. “While large inventories of foreclosed properties continue to plague the most distressed markets and consumer worries about job security and the challenges of selling an existing home remain significant factors, builders are reporting more inquiries and more interest among potential buyers than they have seen in previous months.”

...

Each of the HMI’s three component indexes registered a third consecutive month of improvement in December. The component gauging current sales conditions rose two points in the latest month to 22, while the component gauging sales expectations in the next six months edged up one point to 26. The component gauging traffic of prospective buyers gained three points to 18, which is its highest level since May of 2008.

Builder confidence primarily gained strength in the South in December, where a four-point gain to 25 brought that region’s HMI score to its highest level since March of 2008. A one-point gain to 16 was registered in the West, while the Midwest held unchanged at 24 and the Northeast slipped one point to 15.

Click on graph for larger image.

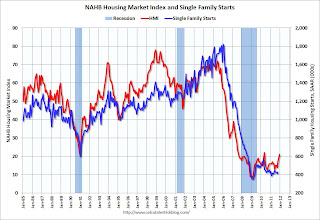

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the December release for the HMI and the October data for starts (November housing starts will be released tomorrow).

Both confidence and housing starts have been moving sideways at a very depressed level for several years - but confidence seems to be moving up a little now. This is still very low, but this is the highest level since May 2010 - and that boost was due to the housing tax credit. Not counting the tax credit, the last time the index was above this level was in 2007.

Weekend:

• Summary for Week ending Dec 16th

• Schedule for Week of Dec 18th

• Ten Economic Questions for 2012

Residential Remodeling Index at new high in October

by Calculated Risk on 12/19/2011 08:30:00 AM

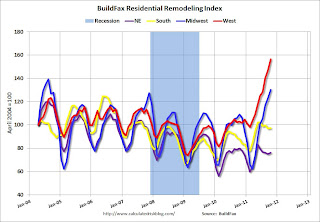

The BuildFax Residential Remodeling Index increased for the twenty-fourth straight month in October to 147.6, a new high for the index. This was up from 141.4 in September, and up 39% year-over-year from 105.8 in October 2010. This is based on the number of properties pulling residential construction permits in a given month.

In October 2011, all four regions - West, Midwest, Northeast and South - had gains. The West is at a new all time high, and is up 52% year-over-year. The Midwest is near an all time high, and is up 20% year-over-year. The South is up 11% year-over-year and the Northeast was up from September but is still down 4% year-over-year.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the NSA index by region. Most of the recent increase is in the West and Midwest. The South is also starting to increase.

Note: Permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.

Even though new home construction is still moving sideways, two other components of residential investment are doing better: multi-family construction and home improvement. Data Source: BuildFax, Courtesy of Index.BuildFax.com

Sunday Night Futures

by Calculated Risk on 12/19/2011 12:09:00 AM

From CNN: North Korea's longtime leader Kim Jong Il dead at 69. A little more uncertainty ...

The Asian markets are red tonight. The Nikkei is down about 1%, and the Hang Seng is down 2.5%. The Seoul Composite is down over 3%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are down 7.5 and Dow futures are down 70.

Oil: WTI futures are down to $92.67 and Brent is down to $102.50 per barrel.

Earlier:

• Summary for Week ending Dec 16th

• Schedule for Week of Dec 18th

• Ten Economic Questions for 2012

Sunday, December 18, 2011

Financial Times interview with ECB president Mario Draghi

by Calculated Risk on 12/18/2011 07:45:00 PM

From the Financial Times: Draghi warns on eurozone break-up

Here is the transcript of the interview with ECB president Mario Draghi. A few excerpts:

Financial Times: ... these austerity programmes are very harsh. Don’t think that some countries are really in effect in a debtor’s prison?There are alternatives, as an example see Tim Duy's Europe Still Heading For Collapse

Mario Draghi: Do you see any alternative?

FT: They could leave the eurozone?

MD: ... Leaving the euro area, devaluing your currency, you create a big inflation, and at the end of that road, the country would have to undertake the same reforms that were due to begin with, but in a much weaker position.

This sounds like "an endless vista of austerity", and that will not survive the polling booths for long.

Earlier:

• Summary for Week ending Dec 16th

• Schedule for Week of Dec 18th

• Ten Economic Questions for 2012

Ten Economic Questions for 2012

by Calculated Risk on 12/18/2011 02:01:00 PM

Last year I listed Ten Economic Questions for 2011. These are still important questions for 2012, so once again I'll try to add some thoughts on these questions - and a few predictions - before the end of year.

1) House Prices: How much further will house prices fall on the national repeat sales indexes (Case-Shiller, CoreLogic)?

2) Residential Investment: Residential investment (RI) made a modest positive contribution to GDP growth in 2011, the first positive contribution since 2005. RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. Historically RI has been the best leading indicator for the economy, but the growth in RI will probably be modest again in 2012. How much will RI increase in 2012?

3) Distressed house sales: Foreclosure activity is still very high, although activity slowed in 2011 because of "foreclosure gate" issues. The number of REOs (Real Estate Owned by lenders) also declined in 2011. Will foreclosure activity pick up in 2012?

4) Economic growth: It appeared GDP growth would increase a little in 2011, but then the economy was hit by a series of shocks including extreme weather (significant snow storms, flooding, hurricane Irene), the oil price increase related to the "Arab Spring", the tsunami in Japan, and the debt ceiling debate in D.C. during late July and early August. Even with all these shocks, 2011 real GDP growth was still positive, but below trend.

Heading into 2012 there are significant downside risks from the European financial crisis and from U.S. fiscal tightening. Will the U.S. economy grow in 2012? Or will there be another recession?

5) Employment: The U.S. economy added about 132 thousands payroll jobs per month in 2011 through November (156 thousand private sector). Although this was an improvement from 2010, this was still weak payroll growth for a recovery. How many payroll jobs will be added in 2012?

6) Unemployment Rate: The unemployment rate is still elevated at 8.6% in November. Last year, my prediction was for the unemployment rate to still be above 9% in December 2011. I thought the participation rate would increase a little in 2011 - however the participation rate continued to decline - and that pushed down the unemployment rate.

I still think we will see some bounce back in the participation rate - and that will put upward pressure on the unemployment rate. What will the unemployment rate be in December 2012?

7) State and Local Governments: It is starting to look like there will be less drag in 2012 than in 2011. How much of a drag will state and local budget problems have on economic growth and employment?

8) Europe and the Euro: What will happen in Europe in 2012? How much of a drag will the problems in Europe have on U.S. growth?

9) Inflation: Will the inflation rate rise or fall in 2012?

10) Monetary Policy: Will the Fed introduce QE3? Will the Fed change their communication strategy and include the likely future path of the Fed Funds rate?

Earlier:

• Summary for Week ending Dec 16th

• Schedule for Week of Dec 18th

State Budget Cuts: Nearing the End?

by Calculated Risk on 12/18/2011 09:42:00 AM

There are more budget cuts coming in California, but the cuts may be nearing the end. The ongoing state and local budget cuts have been a significant drag on economic and employment growth for the last several years.

From the San Francisco Chronicle: California leaders say time for cuts may be ending

General fund spending has dropped by $17 billion since 2007 - from a high of nearly $103 billion - and the cuts continued as recently as last week ... [and Gov. Jerry Brown] warned the bad news wasn't over: Next month he'll unveil a budget proposal with yet more spending cuts.State and local governments have cut 227,000 payroll jobs this year through November, after cutting 249,000 jobs last year - and more cuts are coming. And state and local governments have been a drag on GDP for four consecutive years, subtracting about 0.3% from GDP growth this year (through Q3). There is more cutting ahead, but the pace of cutting should slow in 2012 - and there will be less drag on GDP and employment.

... in the past year, the governor and lawmakers have put a significant dent in the problem. In November 2010, the Legislative Analyst's Office projected that California would have budget deficits of around $20 billion per year over the next five years if the governor and Legislature did not take decisive action. ... Last month, the legislative analyst projected future deficits at under $6 billion per year ... More action is sure to come. Brown last week said he would propose billions more in spending cuts when he proposes a budget next month for the year beginning July 1.

In addition to that, voters will be asked in November whether to approve tax increases worth $7 billion per year over the next five years, including in the next fiscal year.

Earlier:

• Summary for Week ending Dec 16th

• Schedule for Week of Dec 18th

Saturday, December 17, 2011

Inland Empire: Unemployment Rate now declining

by Calculated Risk on 12/17/2011 09:21:00 PM

I've been tracking the employment situation in California's Inland Empire since 2005. I expected housing and construction dependent areas like the Inland Empire to be hit hard during the housing bust. Sure enough, the Inland Empire was considered "ground zero" for the housing bust (along with Las Vegas, Phoenix, Sacramento, most of Florida and several other areas). Now the employment situation is finally starting to improve a little.

From the North County Times: [Local] Job picture improves in November as economy begins to heal

California's jobless rate dipped to 11.3 percent in November from 11.7 percent the previous month, with 6,600 jobs added ... The state's jobless rate was the lowest since May 2009.In 2005, I wrote:

...

Riverside County's unemployment rate fell to 12.8 percent in November, down from a revised 13.7 percent in October and sharply lower than the year-ago estimate of 14.8 percent.

Of all the areas experiencing a housing boom, the areas most at risk have had the greatest increase in real estate related jobs. These jobs include home construction, real estate agents, mortgage brokers, inspectors and more. ... I believe that areas like the Inland Empire will suffer the most when housing activity slows.And in 2006, in response to a sanguine forecast from a local economist, I wrote: Housing: Inverted Reasoning?

[W]hat happens during a housing bust? Just look at the unemployment rate in the previous bust.

The unemployment rate in California rose from 5.2% to 10.4% in just over two years. For the Inland Empire, the unemployment rate rose from 4.8% to double digits in the same period, peaking at 12.4%. ... As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of construction employment and the unemployment rate for the Inland Empire.

With the housing bust, the percent construction employment declined sharply and the unemployment rate peaked at 15.1%. Hey, Hoocoodanode?

But now it appears the California economy is starting to slowly improve - even in the Inland Empire. The unemployment rate is falling, and it appears construction employment has bottomed.

But look at the Inland Empire unemployment rate following the previous housing bust (early 90s). The unemployment rate only declined gradually over several years. That is probably what will happen this time too - I expect the areas that were most dependent on housing and construction during the bubble to see the slowest employment recovery over the next few years.

Earlier:

• Summary for Week ending Dec 16th

• Schedule for Week of Dec 18th

Unofficial Problem Bank list declines to 974 institutions

by Calculated Risk on 12/17/2011 04:49:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 16, 2011. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

After a four week hiatus, the FDIC got back to closings. Also, the OCC got back to releasing its enforcement activities on the first Friday after the 15th of the month. As a result, there were several changes to the Unofficial Problem Bank List this week. In all, there were five removals and two additions, which leave the list standing at 974 institutions with assets of $398.3 billion. A year ago, the list held 920 institutions with assets of $411.4 billion.

The removals include one cure, two unassisted mergers, and two failures. The OCC terminated an action against BNC National Bank, Glendale, AZ ($667 million Ticker: BNCC). Viking Bank, Seattle, WA ($387 million) and AmericaUnited Bank and Trust Company USA, Schaumburg, IL found merger partners. The two failures were Western National Bank, Phoenix, AZ ($163 million) and Premier Community Bank of the Emerald Coast, Crestview, FL ($126 million).

Given the calendar, the FDIC is likely [finished] with closings in 2011. If so, the year will end with 92 failures at an initial estimated cost of $7.2 billion for liquidating assets of $35.9 billion, which translates into a resolution cost of about 20% of failed bank assets. Buyers were willing to pay a deposit premium in only 22 of the resolutions and loss share agreements were done in 57 resolutions covering $17.9 billion of failed assets acquired.

The additions include First Federal Savings and Loan Association of McMinnville, McMinnville, OR ($346 million) and SouthernTrust Bank, Goreville, IL ($52 million).

The OCC converted a few Formal Agreements or previously OTS issued Supervisory Agreements to Consent Orders. Next Friday, we anticipate the FDIC will release its enforcement action activity for the month of November.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of bank failures by week (cumulative) for the last several years.

In 2008, 25 banks failed, 140 banks failed in 2009, 157 in 2010, and 92 in 2011. As "surferdude" noted, this is probably the last of the closings for 2011.

Earlier:

• Summary for Week ending Dec 16th

• Schedule for Week of Dec 18th