by Calculated Risk on 11/19/2011 08:05:00 AM

Saturday, November 19, 2011

Summary for Week Ending Nov 18th

Another week, same lead sentence: The drama in Europe continues to overshadow the U.S. economic situation and the European financial crisis continues to pose the greatest downside risk to the U.S. economy. That said ...

In the U.S., the economic data continues to show improvement. The four week average of initial weekly unemployment claims fell below 400,000 for the first time since April. Retail sales were solid in October. Housing starts declined slightly – due to the volatile multi-family starts segment – but were well above expectations.

For manufacturing, industrial production and capacity utilization continued to increase, and both the NY Fed and Philly Fed surveys showed some expansion (the first time both showed expansion since May).

Mortgage delinquencies declined in Q3 (slowly), and inflation moderated in October. All positive news for the economy and the news flow led to several Q4 upgrades, from Bloomberg: “Economists at JPMorgan Chase & Co. (JPM) in New York now see gross domestic product rising 3 percent in the final quarter, up from a previous prediction of 2.5 percent. Macroeconomic Advisers in St. Louis increased its forecast to 3.2 percent from 2.9 percent at the start of November, while New York-based Morgan Stanley & Co. boosted its outlook to 3.5 percent from 3 percent.” Also Merrill Lynch has increased their Q4 forecast to 3.0%.

Here is a summary in graphs:

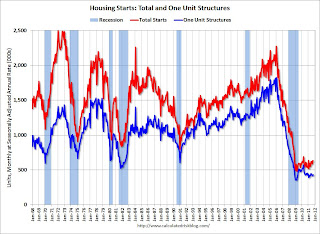

• Housing Starts declined slightly in October

Click on graph for larger image.

Click on graph for larger image.

Total housing starts were at 628 thousand (SAAR) in October, down 0.3% from the revised September rate of 630 thousand (SAAR). Most of the increase this year has been for multi-family starts.

Single-family starts increased 3.9% to 430 thousand in October.

Multi-family starts are increasing in 2011 - although from a very low level. This was well above expectations of 605 thousand starts in October.

Single family starts are still "moving sideways".

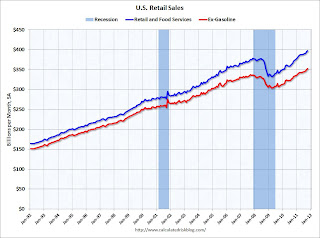

• Retail Sales increased 0.5% in October

On a monthly basis, retail sales were up 0.5% from September to October (seasonally adjusted, after revisions), and sales were up 7.9% from October 2010. Retail sales excluding autos increased 0.6% in October. Sales for September were unrevised with a 1.1% increase.

On a monthly basis, retail sales were up 0.5% from September to October (seasonally adjusted, after revisions), and sales were up 7.9% from October 2010. Retail sales excluding autos increased 0.6% in October. Sales for September were unrevised with a 1.1% increase.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 19.5% from the bottom, and now 5.1% above the pre-recession peak (not inflation adjusted)

This was well above the consensus forecast for retail sales of a 0.2% increase in October, and no change ex-auto. This was a solid report, especially following the very strong September report.

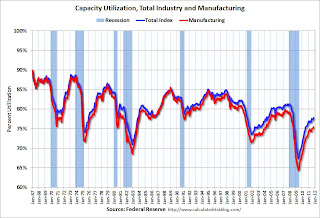

• Industrial Production increased 0.7% in October, Capacity Utilization increased

"Industrial production expanded 0.7 percent in October after having declined 0.1 percent in September. Previously, industrial production was reported to have gained 0.2 percent in September ... Capacity utilization for total industry stepped up to 77.8 percentThis graph shows Capacity Utilization."

"Industrial production expanded 0.7 percent in October after having declined 0.1 percent in September. Previously, industrial production was reported to have gained 0.2 percent in September ... Capacity utilization for total industry stepped up to 77.8 percentThis graph shows Capacity Utilization."Capacity utilization at 77.8% is still 2.6 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in October to 94.7, however September was revised down.

The consensus was for a 0.4% increase in Industrial Production in October, and an increase to 77.6% for Capacity Utilization. Adjusting for the downward revision for September, this was about at consensus.

• MBA: Mortgage Delinquencies decline slightly in Q3

The MBA reported that 12.42 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2011 (delinquencies seasonally adjusted). This is down slightly from 12.87 percent in Q2 2011.

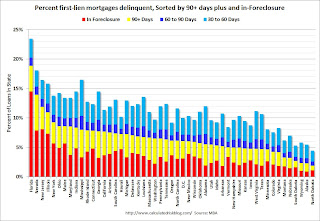

The MBA reported that 12.42 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2011 (delinquencies seasonally adjusted). This is down slightly from 12.87 percent in Q2 2011. This graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent decreased to 3.19% from 3.46% in Q2. This is the lowest level since early 2007. Delinquent loans in the 60 day bucket decreased slightly to 1.30% from 1.37% last quarter. This is the lowest level since Q1 2008. There was a decrease in the 90+ day delinquent bucket too. This decreased to 3.50% from 3.61% in Q2 2011. This is the lowest level since 2008. This decrease was probably due to the pickup in foreclosure actions.

The percent of loans in the foreclosure process was unchanged at 4.43%.

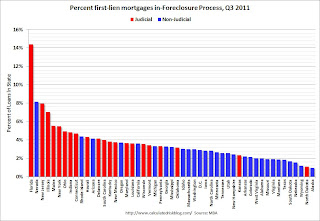

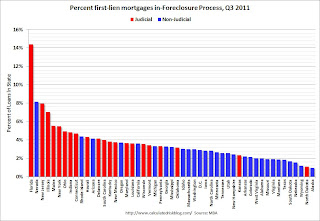

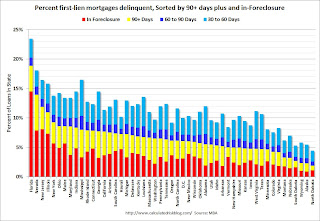

This graph shows the percent of loans in the foreclosure process by state and by foreclosure process. Red is for states with a judicial foreclosure process. Because the judicial process is longer, those states typically have a higher percentage of loans in the process. Nevada is an exception.

This graph shows the percent of loans in the foreclosure process by state and by foreclosure process. Red is for states with a judicial foreclosure process. Because the judicial process is longer, those states typically have a higher percentage of loans in the process. Nevada is an exception.Florida, Nevada, New Jersey, Illinois and New York are the top five states with percent of loans in the foreclosure process. In Arizona and California, the percent of loans in the foreclosure process is declining fairly rapidly.

This graph shows all delinquent loans by state (sorted by percent seriously delinquent).

This graph shows all delinquent loans by state (sorted by percent seriously delinquent).Florida and Nevada have the highest percentage of serious delinquent loans, followed by New Jersey, Illinois, and New York.

So the delinquency rate improved in each bucket (30+, 60+, 90+ days), but the percent of loans in the foreclosure process was unchanged. The key problem remains the very high level of seriously delinquent loans and loans in the foreclosure process.

• AIA: Architecture Billings Index increased in October

This graph shows the Architecture Billings Index since 1996. The index increased to 49.4 in October from 46.9 in September. Anything below 50 indicates contraction in demand for architects' services.

This graph shows the Architecture Billings Index since 1996. The index increased to 49.4 in October from 46.9 in September. Anything below 50 indicates contraction in demand for architects' services.Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So the recent surveys suggests further declines in CRE investment in 2012.

• Regional Fed Manufacturing Surveys: Empire and Philly

From the Philly Fed: Regional manufacturing is expanding, but at a slow pace

From the NY Fed: Conditions for New York manufacturers held steady in November.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through November. The ISM and total Fed surveys are through October.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through November. The ISM and total Fed surveys are through October.The average of the Empire State and Philly Fed surveys increased again in November, and is has been slightly positive for two months.

• Rate of increase slows for Key Measures of Inflation in October

"According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in October. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.4% annualized rate) during the month.

"According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in October. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.4% annualized rate) during the month. ...

The CPI less food and energy increased 0.1% (1.6% annualized rate) on a seasonally adjusted basis. ... Over the last 12 months, the median CPI rose 2.2%, the trimmed-mean CPI rose 2.5%, the CPI rose 3.5%, and the CPI less food and energy rose 2.1%."

On a year-over-year basis, these measures of inflation are increasing, and are slightly above the Fed's target. However, on a monthly basis, the rate of increase is mostly below the Fed's target. On a monthly basis, the median Consumer Price Index increased 2.3% at an annualized rate, the 16% trimmed-mean Consumer Price Index increased 1.4% annualized, and core CPI increased 1.6% annualized.

These key price measures increased at a lower rate than in September.

• Weekly Initial Unemployment Claims: Four Week average falls under 400,000

"In the week ending November 12, the advance figure for seasonally adjusted initial claims was 388,000, a decrease of 5,000 from the previous week's revised figure of 393,000. The 4-week moving average was 396,750, a decrease of 4,000 from the previous week's revised average of 400,750."

"In the week ending November 12, the advance figure for seasonally adjusted initial claims was 388,000, a decrease of 5,000 from the previous week's revised figure of 393,000. The 4-week moving average was 396,750, a decrease of 4,000 from the previous week's revised average of 400,750."The following graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 396,750. This is the lowest level for the 4 week average since early April - although this is still elevated.

• Residential Remodeling Index at new high in September

The BuildFax Residential Remodeling Index was at 141.4 in September, up from 138.6 in August. This is based on the number of properties pulling residential construction permits in a given month.

The BuildFax Residential Remodeling Index was at 141.4 in September, up from 138.6 in August. This is based on the number of properties pulling residential construction permits in a given month. This is the highest level for the index (started in 2004) - even above the levels from 2004 through 2006 during the home equity ("home ATM") withdrawal boom.

Note: Permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

Even though new home construction is still moving sideways, two other components of residential investment will increase in 2011: multi-family construction and home improvement.

• Other Economic Stories ...

• LPS: House Price Index Shows 3.8 Percent Year-Over-Year Decline in August

• NAHB Builder Confidence index increases in November

Friday, November 18, 2011

Europe Update

by Calculated Risk on 11/18/2011 09:45:00 PM

On the mess in Greece, from the Athens News: Troika back in town

Prime Minister Lucas Papademos ... must win pledges from the rival parties that they will do what it takes to meet bailout terms or Greece's lenders will withhold an 8bl euro aid tranche Athens needs to dodge default next month, plus longer-term financing later.Samaras may be correct about the austerity measures, but if he doesn't sign the agreement, I doubt the Troika will provide the 8 billion euro aid tranche - and Greece would then default in December.

As part of that process, representatives from the "troika" of the International Monetary Fund, the European Union and European Central Bank met with [Finance minister] Venizelos and Papademos on Friday and it is expected that Pasok party leader George Papandreou will be meeting the troika at his office in Parliament at 10:30 on Saturday morning. ND leader, Antonis Samaras is also due to meet officials from troika on Saturday.

Tensions have risen between coalition partners, Pasok and ND, as the latter's leader, Antonis Samaras, has refused to sign the commitment sought by EU and IMF authorities.

Underscoring the pressure on Athens, the Dutch finance minister said the Greek parties had "to make a clear and unequivocal choice in writing" by signing a pledge. ... "Are they with us, or not? We don't have the luxury of patience any longer," Jan Kees de Jager said.

Samaras said on Thursday said he wanted to win an outright majority in the snap election to reverse the austerity measures he disagrees with.

From the NY Times: Europe Fears a Credit Squeeze as Investors Sell Bond Holdings

Financial institutions are dumping their vast holdings of European government debt and spurning new bond issues by countries like Spain and Italy. And many have decided not to renew short-term loans to European banks, which are needed to finance day-to-day operations.

...

The pullback — which is increasing almost daily — is driven by worries that some European countries may not be able to fully repay their bond borrowings, which in turn would damage banks that own large amounts of those bonds. It also increases the already rising pressure on the European Central Bank to take more aggressive action.

On Friday, the bank’s new president, Mario Draghi, put the onus on European leaders to deploy the long-awaited euro zone bailout fund to resolve the crisis, implicitly rejecting calls for the European Central Bank to step up and become the region’s “lender of last resort.”

Bank Failures #89 & 90: Iowa and Louisiana

by Calculated Risk on 11/18/2011 07:09:00 PM

These recent Occupied banks

Are not on Wall Street

by Soylent Green is People

From the FDIC: Grinnell State Bank, Grinnell, Iowa, Assumes All of the Deposits of Polk County Bank, Johnston, Iowa

As of September 30, 2011, Polk County Bank had approximately $91.6 million in total assets and $82.0 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $12.0 million. ... Polk County Bank is the 89th FDIC-insured institution to fail in the nation this year, and the first in Iowa.From the FDIC: First NBC Bank, New Orleans, Louisiana, Assumes All of the Deposits of Central Progressive Bank, Lacombe, Louisiana

As of September 30, 2011, Central Progressive Bank had approximately $383.1 million in total assets and $347.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $58.1 million. ... Central Progressive Bank is the 90th FDIC-insured institution to fail in the nation this year, and the first in Louisiana.A first this year for both states.

Lawler: Early Read on October Existing Home Sales

by Calculated Risk on 11/18/2011 04:02:00 PM

From economist Tom Lawler:

Based on my regional tracking, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of about 4.86 million in October, down 1.0% from September’s pace, and up 11% from last October’s pace. Compared to a year ago sales showed little growth (or actual declines) in a number of northeast and mid-Atlantic areas.

Active listings were clearly down again in October from September, with my “best guess” nationwide being a drop of 3.5%. NAR’s inventory numbers don’t often track publicly-available listings, but I’d guess NAR’s numbers will show a similar monthly drop. If that were the case, the NAR’s existing home inventory number would show a YOY decline of about 13.1% (less than publicly-available listings data would suggest, but that has been the case for a while.)

On the median sales price side, a larger % of realtor groups/MLS/etc. reported YOY declines in median sales prices in October than was the case in September, and in many others reported larger YOY % declines in October than in September. Based on the data I have, I estimate that the NAR will show an October median existing home sales price that is about 5.2% lower than last October. In September the NAR’s MSP showed a YOY drop of 3.5%.

CR Note: The NAR is scheduled to release their October existing home sales report on Monday November 21st at 10 AM ET. The consensus is for sales of 4.80 million (close to Tom's estimate). With a 3.5% decline in inventory, this would give 8.3 months of supply, down from the reported 8.5 months in September. Also - the NAR might announce the release of the "benchmark revisions" that are expected to show downward revisions for sales and inventory since 2006 or so.

Mortgage Delinquencies by Loan Type

by Calculated Risk on 11/18/2011 01:30:00 PM

By request, the following graphs show the percent of loans delinquent by loan type: Prime, Subprime, FHA and VA. First a table comparing the number of loans in 2007 and Q3 2011 so readers can understand the shift in loan types.

Both the number of prime and subprime loans have declined over the last four years; the number of subprime loans is down by about one-third. Meanwhile the number of FHA loans has increased sharply.

Note: There are about 50 million total first-lien loans - the MBA survey is about 88% of the total.

| MBA National Delinquency Survey Loan Count | ||||

|---|---|---|---|---|

| Q2 2007 | Q3 2011 | Change | Q3 2011 Seriously Delinquent | |

| Prime | 33,916,830 | 31,302,080 | -2,614,750 | 1,734,135 |

| Subprime | 6,204,535 | 4,193,659 | -2,010,876 | 1,077,351 |

| FHA | 3,030,214 | 6,594,478 | 3,564,264 | 553,277 |

| VA | 1,096,450 | 1,436,140 | 339,690 | 66,493 |

| Survey Total | 44,248,029 | 43,526,357 | -721,672 | 3,431,256 |

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.First a repeat: This graph shows the percent of loans delinquent by days past due. Loans 30 days delinquent decreased to 3.19% from 3.46% in Q2. This is the lowest level since early 2007.

Delinquent loans in the 60 day bucket decreased slightly to 1.30% from 1.37% last quarter. This is the lowest level since Q1 2008. There was a decrease in the 90+ day delinquent bucket too. This decreased to 3.50% from 3.61% in Q2 2011. This is the lowest level since 2008. This decrease was probably due to the pickup in foreclosure actions.

The percent of loans in the foreclosure process was unchanged at 4.43%.

Note: Scale changes for each of the following graphs.

The second graph is for all prime loans.

The second graph is for all prime loans. This is the key category now ("We are all subprime!", Tanta).

Since there are far more prime loans than any other category (see table above), about half the loans seriously delinquent now are prime loans - even though the overall delinquency rate is lower than other loan types.

This graph is for subprime. This category gets most of the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.

This graph is for subprime. This category gets most of the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.Although the delinquency rate is still very high, the number of subprime loans had declined sharply.

This graph is for FHA loans. The delinquency rate decreased in Q3 and has mostly been declining the last couple years. Some of the decline is because most of the FHA loans were made in the last few years, not in the 2004 to 2006 period like subprime.

This graph is for FHA loans. The delinquency rate decreased in Q3 and has mostly been declining the last couple years. Some of the decline is because most of the FHA loans were made in the last few years, not in the 2004 to 2006 period like subprime.Another reason for the improvement was eliminating Downpayment Assistance Programs (DAPs). These were programs that allowed the seller to give the buyer the downpayment through a 3rd party "charity" (for a fee of course). The buyer had no money in the house and the default rates were absolutely horrible. HUD mentioned this in the annual review of the FHA financial status.

The last graph is for VA loans.

The last graph is for VA loans.All four categories saw a decrease in overall delinquencies Q3.

There are still quite a few subprime loans that are in distress, but the real keys going forward are prime loans and FHA loans.

The recovery in U.S. Heavy Truck Sales, and a forecast for November Auto Sales

by Calculated Risk on 11/18/2011 10:52:00 AM

Another bright spot for the economy has been the recovery in heavy truck sales (see graph below).

First, here is an early forecast for November light vehicle sales from J.D. Power and Associates:

November new-vehicle retail sales are projected to come in at 791,900 units, which represents a seasonally adjusted annualized rate (SAAR) of 11.3 million units—the highest monthly selling rate in three and a half years.Their total sales forecast would be 13.4 million (SAAR), and that would be the highest sales rate since August 2008 (excluding cash-for-clunkers in August 2009).

Total light-vehicle sales in November are expected to come in at 975,600 units, which is 8 percent higher than in November 2010. Fleet sales are expected to decrease by 6 percent compared with November 2010, but will account for 19 percent of total sales.

Growth in auto sales should make a nice positive contribution to Q4 GDP. Sales in Q3 averaged 12.45 million SAAR, and just looking at October and this forecast for November, sales will be up close to 7% in Q4 over Q3 (over 30% annualized).

Click on graph for larger image.

Click on graph for larger image.This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is current estimated sales rate.

Heavy truck sales really collapsed during the recession, falling to a low of 175 thousand in April 2009 on a seasonally adjusted annual rate (SAAR). Since then sales have almost doubled and hit 346 thousand (SAAR) in October 2011.

This is the highest level since June 2007 (over 4 years ago). And this is still below the average of the last 20 years - and well below the peaks - so there is probably more growth in sales to come.

Credit Stress Indicators

by Calculated Risk on 11/18/2011 09:01:00 AM

It has been a long time since I posted a few indicators of credit stress.

First - I want to reiterate that the U.S. economic data has looked better recently and Q4 U.S. GDP should be OK (more sluggish growth). I think the most likely path is no U.S. recession in 2012. However there are downside risks - especially from the European financial crisis (and apparently European recession) and also from more fiscal tightening the U.S..

The somewhat improved economy in the U.S. has led Macroeconomic Advisers to up their Q4 GDP forecast to 3.2%, and for Merrill Lynch to up their Q4 forecast to 3.0%. From Neil Irwin at the WaPo:

Putting all the recent evidence together, forecasting firm Macroeconomic Advisers projects that the economy will have grown at a 3.2 percent annual rate in the final three months of 2011 ...And from Bloomberg (ht sum luk):

Economists at JPMorgan Chase & Co. (JPM) in New York now see gross domestic product rising 3 percent in the final quarter, up from a previous prediction of 2.5 percent. Macroeconomic Advisers in St. Louis increased its forecast to 3.2 percent from 2.9 percent at the start of November, while New York-based Morgan Stanley & Co. boosted its outlook to 3.5 percent from 3 percent.That is still sluggish growth with all the slack in the system, but an improvement over Q3 and the event driven weakness earlier this year.

Here are a few indicators of credit stress:

•

Here is a screen shot of the TED spread from Bloomberg.

Here is a screen shot of the TED spread from Bloomberg. The TED spread is at 0.49, and has been rising recently (top graph). The 5 year graph shows that recent increase in comparison to the U.S. financial crisis in 2008.

Click on graph for larger image.

The peak was 4.63 on Oct 10th. A normal spread is around 0.5.

• The three month LIBOR has increased:

Data from the British Bankers' Association showed the three-month dollar London Interbank Offered Rate, or Libor, rose to 0.47944% from 0.47111% Wednesday.The three-month LIBOR rate peaked during the crisis at 4.81875% on Oct 10, 2008. This is rising again, but still low.

• The A2P2 spread as at 0.49. This spread has increased slightly over the last few days, but far lower than the peak of the financial crisis of 5.86.

This is the spread between high and low quality 30 day nonfinancial commercial paper. Right now quality 30 day nonfinancial paper is yielding close to zero.

•

The two year swap spread screen shot from Bloomberg. This spread is just over 51.

The two year swap spread screen shot from Bloomberg. This spread is just over 51. This spread peaked at near 165 in early October 2008.

By these indicators, credit stress is rising, but it is still very low compared to the levels reached in September 2008.

Thursday, November 17, 2011

LA Port Traffic in October: Exports increase year-over-year, Imports down

by Calculated Risk on 11/17/2011 08:43:00 PM

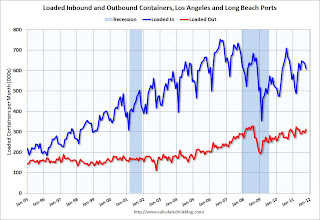

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported - and possible hints about the trade report for October. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic is down 0.6% from September, and outbound traffic is up 0.3%.

Inbound traffic is "rolling over" and this might suggest that retailers are cautious about the coming holiday season.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of October, loaded inbound traffic was down 7% compared to October 2010, and loaded outbound traffic was up 3% compared to October 2010.

For the month of October, loaded inbound traffic was down 7% compared to October 2010, and loaded outbound traffic was up 3% compared to October 2010.

Exports have been increasing, although bouncing around month-to-month. Exports are up from last year, but are still below the peak in 2008.

Imports have been soft - this is the 5th month in a row with a year-over-year decline in imports.

Earlier:

• Weekly Initial Unemployment Claims: Four Week average falls under 400,000

• MBA: Mortgage Delinquencies decline slightly in Q3

• Q3 MBA National Delinquency Survey: Comments and State Data

• Philly Fed: "Regional manufacturing is expanding, but at a slow pace"

• Housing Starts decline slightly in October

• Multi-family Starts and Completions, and Quarterly Starts by Intent

Multi-family Starts and Completions, and Quarterly Starts by Intent

by Calculated Risk on 11/17/2011 06:22:00 PM

Since it usually takes over a year on average to complete multi-family projects - and multi-family starts were at a record low last year - it makes sense that there will be a record low, or near record low, number of multi-family completions this year.

The following graph shows the lag between multi-family starts and completions using a 12 month rolling total.

The blue line is for multifamily starts and the red line is for multifamily completions. Since multifamily starts collapsed in 2009, completions collapsed in 2010.

Click on graph for larger image.

Click on graph for larger image.

The rolling 12 month total for starts (blue line) has been increasing all year. It now appears multi-family starts will be in the 150 thousand to 160 thousand unit range in 2011, up from 104 thousand units in 2010. That is a 50%+ increase in starts - but from a very low level.

Completions (red line) appear to have bottomed. This is probably because builders are rushing projects to completion because of the strong demand for rental units.

It is important to emphasize that even with a strong increase in multi-family construction, it is 1) from a very low level, and 2) multi-family is a small part of residential investment (RI). But this is bright spot for construction.

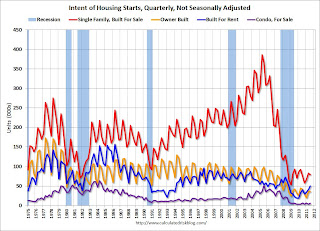

Also today, the Census Bureau released the "Quarterly Starts and Completions by Purpose and Design" report for Q3 2011. Although this data is Not Seasonally Adjusted (NSA), it shows the trends for several key housing categories.

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale were up slightly year-over-year in Q3. This was the 2nd weakest Q3 on record. Owner built starts were at a record low for a Q3, and condos built for sale are scrapping along the bottom.

Only the 'units built for rent' is showing any significant pickup. This is a 25% increase from Q3 2010 and more than double Q3 2009.

The largest category - starts of single family units, built for sale - has mostly been moving sideways at very depressed level for about 3 years.

Earlier:

• Weekly Initial Unemployment Claims: Four Week average falls under 400,000

• MBA: Mortgage Delinquencies decline slightly in Q3

• Q3 MBA National Delinquency Survey: Comments and State Data

• Philly Fed: "Regional manufacturing is expanding, but at a slow pace"

• Housing Starts decline slightly in October

Q3 MBA National Delinquency Survey: Comments and State Data

by Calculated Risk on 11/17/2011 02:39:00 PM

A few comments from Michael Fratantoni, MBA's Vice President of Research and Economics on the conference call.

• Delinquencies are down, foreclosure starts are up due to a couple of servicers and products (ARMs).

• The inventory of foreclosures-in-process was unchanged, but that masks two different trends. For judicial states, the number of in-foreclosure properties continues to increase and is up to 6.8% of all properties with a mortgage. For non-judicial states, the number of in-foreclosure properties is falling - and is down to 2.9%.

• Fratantoni expects it will take 3 to 4 years for delinquencies to return to "normal" (the levels prior to the crisis) assuming steady economic growth.

• On the possible impact of the possible mortgage settlement, Fratantoni said it was too early to know since the details are not available.

CR Note: I expect the in-foreclosure inventory to decline - especially in judicial states - after a settlement is reached. Some of the decline will probably be due to more mortgage modifications, but most because the servicers will start completing more foreclosures.

• Judicial foreclosure states usually have the highest percentage of loans in the foreclosure process.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of loans in the foreclosure process by state and by foreclosure process. Red is for states with a judicial foreclosure process. Because the judicial process is longer, those states typically have a higher percentage of loans in the process. Nevada is an exception.

Florida, Nevada, New Jersey, Illinois and New York are the top five states with percent of loans in the foreclosure process. In Arizona and California, the percent of loans in the foreclosure process is declining fairly rapidly.

This graph shows all delinquent loans by state (sorted by percent seriously delinquent).

This graph shows all delinquent loans by state (sorted by percent seriously delinquent).

Florida and Nevada have the highest percentage of serious delinquent loans, followed by New Jersey, Illinois, and New York.

Note: the MBA's National Delinquency Survey (NDS) covers about "43.5 million first-lien mortgages on one- to four-unit residential properties" and is "estimated to cover around 88 percent of the outstanding first-lien mortgages in the market." This gives about 6.1 million loans delinquent or in the foreclosure process.

Earlier:

• MBA: Mortgage Delinquencies decline slightly in Q3