by Calculated Risk on 11/17/2011 02:39:00 PM

Thursday, November 17, 2011

Q3 MBA National Delinquency Survey: Comments and State Data

A few comments from Michael Fratantoni, MBA's Vice President of Research and Economics on the conference call.

• Delinquencies are down, foreclosure starts are up due to a couple of servicers and products (ARMs).

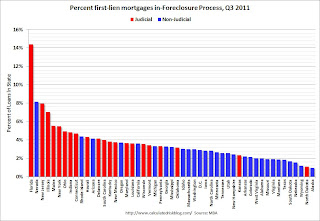

• The inventory of foreclosures-in-process was unchanged, but that masks two different trends. For judicial states, the number of in-foreclosure properties continues to increase and is up to 6.8% of all properties with a mortgage. For non-judicial states, the number of in-foreclosure properties is falling - and is down to 2.9%.

• Fratantoni expects it will take 3 to 4 years for delinquencies to return to "normal" (the levels prior to the crisis) assuming steady economic growth.

• On the possible impact of the possible mortgage settlement, Fratantoni said it was too early to know since the details are not available.

CR Note: I expect the in-foreclosure inventory to decline - especially in judicial states - after a settlement is reached. Some of the decline will probably be due to more mortgage modifications, but most because the servicers will start completing more foreclosures.

• Judicial foreclosure states usually have the highest percentage of loans in the foreclosure process.

Click on graph for larger image.

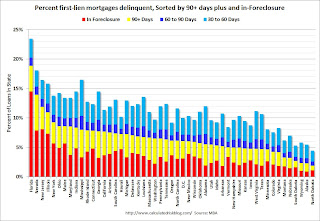

Click on graph for larger image.

This graph shows the percent of loans in the foreclosure process by state and by foreclosure process. Red is for states with a judicial foreclosure process. Because the judicial process is longer, those states typically have a higher percentage of loans in the process. Nevada is an exception.

Florida, Nevada, New Jersey, Illinois and New York are the top five states with percent of loans in the foreclosure process. In Arizona and California, the percent of loans in the foreclosure process is declining fairly rapidly.

This graph shows all delinquent loans by state (sorted by percent seriously delinquent).

This graph shows all delinquent loans by state (sorted by percent seriously delinquent).

Florida and Nevada have the highest percentage of serious delinquent loans, followed by New Jersey, Illinois, and New York.

Note: the MBA's National Delinquency Survey (NDS) covers about "43.5 million first-lien mortgages on one- to four-unit residential properties" and is "estimated to cover around 88 percent of the outstanding first-lien mortgages in the market." This gives about 6.1 million loans delinquent or in the foreclosure process.

Earlier:

• MBA: Mortgage Delinquencies decline slightly in Q3