by Calculated Risk on 9/01/2011 01:54:00 PM

Thursday, September 01, 2011

Employment Situation Preview: Another Weak Report

Tomorrow the BLS will release the August Employment Situation Summary at 8:30 AM ET. Bloomberg is showing the consensus is for an increase of 67,000 payroll jobs in August, and for the unemployment rate to hold steady at 9.1%.

Once again estimates all over the place, including more whispers of a negative headline number. This isn't surprising since the economic data for August was very weak - especially during the first couple weeks of the month as the shock of a possible U.S. government default rattled consumer and business confidence.

The BLS survey reference week includes the 12th of the month, and the 12th fell on a Friday in August - at the end of the 2nd full week and just after the economic freeze due to the D.C. debate. So even with slightly less worrisome economic reports towards the end of the month, it is possible that the headline number could be below consensus or even negative.

An added wrinkle was the labor dispute at Verizon. I've seen several estimates, but the Verizon dispute (since settled) probably reduced employment by 45,000 in August (these will be added back in September).

So these two factors, 1) a reference period right after a significant shock, and 2) the Verizon labor dispute, suggest a weak employment report.

Here is a summary of recent data:

• The ADP employment report showed an increase of 91,000 private sector payroll jobs in August. Of course ADP hasn't been very useful in predicting the BLS report. Also note that government payrolls have been shrinking by about 30,000 each month. The ADP does use the same reference week as the BLS, and this would suggest around 60,000 nonfarm payroll jobs added.

• Initial weekly unemployment claims averaged about 410,000 per week in August, down slightly from the 412,000 average in July.

• The ISM manufacturing employment index decreased to 51.8%, down from 53.5% in July. Based on a historical correlation between the ISM index and the BLS employment report for manufacturing, this reading suggests a decline of about 10,000 private payroll jobs for manufacturing in August. Note: The ISM non-manufacturing index for August will be released next Tuesday.

• The final July Reuters / University of Michigan consumer sentiment index decreased to 55.7 from 63.7 in July. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. This was probably impacted by the debt ceiling debate, but in general this would suggest a weak labor market.

• And on the unemployment rate from Gallup: Gallup Finds U.S. Unemployment Up in August

Unemployment, as measured by Gallup without seasonal adjustment, is at 9.1% at the end of August -- up from 8.8% at the end of July.NOTE: The Gallup poll results are Not Seasonally Adjusted (NSA), so use with caution. Usually the NSA unemployment rate declines in August, so this would suggest an increase in the unemployment rate.

These data further confirm Gallup's mid-month prediction that the August unemployment rate that the government will report Friday will be higher than the 9.1% it reported in July -- barring another sizable decline in the U.S. workforce or an unusual seasonal adjustment.

Because of the reference period following so soon after an economic shock, and also because of the Verizon labor dispute, I'll take the "under" on the number of jobs added (less than 67,000). I'll also take the over on the unemployment rate (I expect higher than 9.1%).

Construction Spending declined in July

by Calculated Risk on 9/01/2011 12:20:00 PM

Note on Auto Sales: Once all the reports are released, I'll post a graph of the estimated total August light vehicle sales (SAAR) - usually around 4 PM ET. The consensus is for a decrease to 12.1 million SAAR in August from 12.2 million SAAR in July. Sales in August 2010 were at a 11.44 million SAAR.

Catching up ... this morning from the Census Bureau reported that overall construction spending declined in July:

during July 2011 was estimated at a seasonally adjusted annual rate of $789.5 billion, 1.3 percent (±1.9%)* below the revised June estimate of $799.8 billion.Private construction spending decline in July:

Spending on private construction was at a seasonally adjusted annual rate of $514.5 billion, 0.9 percent (±1.1%)* below the revised June estimate of $519.0 billion. Residential construction was at a seasonally adjusted annual rate of $248.1 billion in July, 1.4 percent (±1.3%) below the revised June estimate of $251.7 billion. Nonresidential construction was at a seasonally adjusted annual rate of $266.4 billion in July, 0.4 percent (±1.1%)* below the revised June estimate of $267.3 billion.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 63% below the peak in early 2006, and non-residential spending is 36% below the peak in January 2008.

Private construction spending is mostly moving sideways, and it is public construction spending that is now declining. Note: Residential construction spending for May and June were revised up significantly.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending has turned positive, but public spending is now falling sharply as the stimulus spending ends. The improvements in private non-residential are mostly due to energy spending.

ISM Manufacturing index declines slightly to 50.6

by Calculated Risk on 9/01/2011 10:00:00 AM

PMI was at 50.6% in August, down from 50.9% in July. The employment index was at 51.8%, down from 53.5%, and new orders increased to 49.6%, up from 49.2%.

From the Institute for Supply Management: August 2011 Manufacturing ISM Report On Business®

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI registered 50.6 percent, a decrease of 0.3 percentage point from July, indicating expansion in the manufacturing sector for the 25th consecutive month, at a slightly slower rate. The Production Index registered 48.6 percent, indicating contraction for the first time since May of 2009, when it registered 45 percent. The New Orders and Backlog of Orders Indexes edged up slightly from July, but both indexes are indicating contraction in August at slower rates than in July. The rate of increase in prices slowed for the fourth consecutive month, dropping another 3.5 percentage points in August to 55.5 percent. The overall sentiment is one of concern and caution over the domestic and international economic environment, which is affecting customers' confidence and willingness to place orders, at least in the short term."

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 48.5% and suggests manufacturing expanded - slowly - in August.

The regional surveys early in August were especially weak, but the surveys towards the end of the month were a little better - suggesting the debt ceiling debate impacted consumer and business confidence early in August.

Weekly Initial Unemployment Claims decline to 409,000

by Calculated Risk on 9/01/2011 08:30:00 AM

The DOL reports:

In the week ending August 27, the advance figure for seasonally adjusted initial claims was 409,000, a decrease of 12,000 from the previous week's revised figure of 421,000. The 4-week moving average was 410,250, an increase of 1,750 from the previous week's revised average of 408,500.The following graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 410,250.

Weekly claims declined slightly, but the 4-week average is still elevated. Next week claims will probably increase due to Hurricane Irene.

Note: The Verizon strike added to claims the previous two weeks.

Misc: Germany economy "resilient", GDP per capita

by Calculated Risk on 9/01/2011 12:12:00 AM

• From the WSJ: Germany's Resiliency Buoys Europe

A pair of bullish reports, on German employment and manufacturing, were reassuring on Wednesday: Unemployment remained at its lowest level in nearly two decades last month, while July machine orders jumped 9% from a year earlier. The latest data suggest that Europe's largest economy, which is expected to grow 3% this year, remains resilient ...• This is similar to the recession measure graphs I posted from Doug Short: Real GDP per Capita

[Doug's] preferred GDP metric is the per-capita variant. I take real GDP and divide it by the mid-month population estimates from the Census Bureau, which has reported this data from 1959 (hence my 1960 starting date). By this measure, Q2 2011 GDP is 3.4% off its peak.Check out the 2nd graph at Doug's site.

Earlier:

• ADP: Private Employment increased 91,000 in August

• CoreLogic: Home Price Index increased 0.8% in July

• Restaurant Performance Index declined in July

• Fannie Mae and Freddie Mac Serious Delinquency Rates mostly unchanged in July

Wednesday, August 31, 2011

Lawler: Census 2010: Homeownership Rates by Selected Age Groups

by Calculated Risk on 8/31/2011 07:22:00 PM

Update from Lawler: Yesterday I gave some stats on the "states" with the highest and lowest shares of owner-occupied homes owned free and clear. Those %'s were incorrect; they were %'s for the % of ALL occupied homes owner free and clear. (My bad).

From economist Tom Lawler:

While Census has not released “Summary File 1” for the US as a whole, it has released such data for all 50 states plus DC. As such, aggregate US data from these files, including homeownership rates by selected age groups, can be constructed using the mathematical tools called “addition” and “division.”

Note the sizable declines in homeownership rates over the last decade in the 25-54 year old age groups!

| US Homeownership by Age Group (Decennial Census) | ||||

|---|---|---|---|---|

| 1980 | 1990 | 2000 | 2010 | |

| 15 to 24 years | 22.1% | 17.1% | 17.9% | 16.1% |

| 25 to 34 years | 51.6% | 45.3% | 45.6% | 42.0% |

| 35 to 44 years | 71.2% | 66.2% | 66.2% | 62.3% |

| 45 to 54 years | 77.0% | 75.3% | 74.9% | 71.5% |

| 55 to 64 years | 77.6% | 79.7% | 79.8% | 77.3% |

| 65 years and over | 70.1% | 75.2% | 78.1% | 77.5% |

| Total | 64.4% | 64.2% | 66.2% | 65.1% |

Here is a comparison of the decennial Census homeownership rates (which reflect April 1st) and the Housing Vacancy Survey (which are yearly average estimates). HVS data by age group only go back to 1982.

| US Homeownership by Age Group (Housing Vacancy Survey) | ||||

|---|---|---|---|---|

| 1980 | 1990 | 2000 | 2010 | |

| 15 to 24 years | --- | 15.7% | 21.7% | 22.8% |

| 25 to 34 years | --- | 44.2% | 47.1% | 44.4% |

| 35 to 44 years | --- | 66.3% | 67.9% | 65.0% |

| 45 to 54 years | --- | 75.2% | 76.5% | 73.5% |

| 55 to 64 years | --- | 79.3% | 80.3% | 79.0% |

| 65 years and over | --- | 76.3% | 80.4% | 80.5% |

| Total | --- | 63.9% | 67.4% | 66.9% |

While the decennial Census data show that the homeownership rates for all age groups save for “geezers” in 2010 were down significantly from 1990, the HVS data do not show the same declines. Census officials are unsure of why there are such large discrepancies, but most – though not all -- feel that the decennial Census data are more accurate, and that there is “sumpin’ wrong” with the HVS data (the same is true for the HVS vacancy data), and not just for 2010, but for 2000 as well.

Some readers might be surprised at the sizable declines in the homeownership rates for younger householders from 1980 to 1990 – after all, they’ve been deluged with charts showing “aggregate” US homeownership rates over the last several years, but with little or no discussion of homeownership rates by age group. There was actually a fair amount written about the drop in younger householder homeownership rates from 1980 to 1990, with researchers attributing the decline to a number of factors – younger folks marrying later in life, job choices and labor mobility, and several other factors (I don’t plan to summarize the literature.)

Also from Tom Lawler: Number of Homes Owned Free and Clear

Here is a table derived from the decennial Census 2010 on the number of owner-occupied homes with a mortgage vs. those owned free and clear.

| Owner-Occupied Homes (Census 2010) | |

|---|---|

| Total | 75,986,074 |

| Owned with a mortgage or loan | 52,979,430 |

| Owned free and clear | 23,006,644 |

Update: By state with correction:

| % of OO Homes owned free and clear, 2010 | |

|---|---|

| US Total | 30.3% |

| Alabama | 36.6% |

| Alaska | 31.2% |

| Arizona | 27.9% |

| Arkansas | 38.9% |

| California | 22.3% |

| Colorado | 22.3% |

| Connecticut | 26.4% |

| Delaware | 28.2% |

| District of Columbia | 19.6% |

| Florida | 33.0% |

| Georgia | 25.6% |

| Hawaii | 29.3% |

| Idaho | 29.1% |

| Illinois | 28.3% |

| Indiana | 27.9% |

| Iowa | 34.8% |

| Kansas | 33.3% |

| Kentucky | 35.9% |

| Louisiana | 40.9% |

| Maine | 33.5% |

| Maryland | 21.2% |

| Massachusetts | 25.8% |

| Michigan | 31.3% |

| Minnesota | 27.2% |

| Mississippi | 41.5% |

| Missouri | 31.5% |

| Montana | 38.5% |

| Nebraska | 33.7% |

| Nevada | 21.4% |

| New Hampshire | 27.5% |

| New Jersey | 27.1% |

| New Mexico | 37.7% |

| New York | 33.0% |

| North Carolina | 30.3% |

| North Dakota | 42.9% |

| Ohio | 30.0% |

| Oklahoma | 37.7% |

| Oregon | 28.2% |

| Pennsylvania | 35.0% |

| Rhode Island | 26.2% |

| South Carolina | 33.9% |

| South Dakota | 39.1% |

| Tennessee | 34.1% |

| Texas | 34.4% |

| Utah | 23.7% |

| Vermont | 31.9% |

| Virginia | 25.3% |

| Washington | 25.6% |

| West Virginia | 47.7% |

| Wisconsin | 30.3% |

| Wyoming | 36.5% |

CR Note: So, in 2010, about 30.3% of owner-occupied homes were owned free and clear. There will be much more on the 2010 Census data once the Summary File is released.

Fannie Mae and Freddie Mac Serious Delinquency Rates mostly unchanged in July

by Calculated Risk on 8/31/2011 04:15:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate was unchanged at 4.08% in July. This is down from 4.82% in July of 2010. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate increased to 3.51% in July from 3.50% in June. This is down from 3.89% in July 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Note that the Fannie and Freddie serious delinquency rates are much lower than the overall serious delinquency rate (LPS reported that the overall serious delinquency rate and in-foreclosure was 7.72% in July).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Some of the rapid increase in 2009 was probably because of foreclosure moratoriums, and also because loans in trial mods were considered delinquent until the modifications were made permanent.

Although the delinquency rate was unchanged in July, the serious delinquency rate has been falling as Fannie and Freddie work through the backlog of delinquent loans.

The normal serious delinquency rate is under 1%, and it doesn't look like the delinquency rate will be back to "normal" for a number of years.

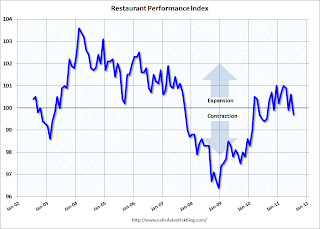

Restaurant Performance Index declined in July

by Calculated Risk on 8/31/2011 01:41:00 PM

From the National Restaurant Association: Restaurant Industry Outlook Softened in July as Restaurant Performance Index Slipped to Its Lowest Level in 11 Months

As a result of softer same-store sales and traffic levels and a dampened outlook among restaurant operators, the National Restaurant Association’s (www.restaurant.org) Restaurant Performance Index (RPI) fell below 100 in July. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 99.7 in July, down from 100.6 in June and the lowest level in 11 months.

“Although same-store sales and customer traffic levels remained positive in July, restaurant operators’ outlook for the economy took a pessimistic turn,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “This survey month was burdened with the debt ceiling crisis and the downgrade in the nation’s credit rating, which added an additional layer of uncertainty in an already fragile economic recovery.”

...

Restaurant operators reported somewhat softer same-store sales results in July. ... Restaurant operators also reported softer customer traffic levels in July.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The index declined to 99.7 in July (above 100 indicates expansion).

Unfortunately the data for this index only goes back to 2002.

This is a minor report, but still interesting (barely "D-List" data).

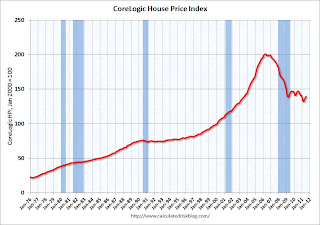

CoreLogic: Home Price Index increased 0.8% in July

by Calculated Risk on 8/31/2011 10:10:00 AM

• First on the Chicago PMI Chicago Business Barometer™ Slipped: The overall index decreased to 56.5 from 58.8 in July. This was above consensus expectations of 53.5. Note: any number above 50 shows expansion. The employment index increased to 52.1 from 51.5. The new orders index decreased to 56.9 from 59.4.

• Notes: This CoreLogic Home Price Index is for July. The Case-Shiller index released yesterday was for June. Case-Shiller is the most followed house price index, but CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average of May, June and July (July weighted the most) and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® July Home Price Index Shows Fourth Consecutive Month-Over-Month Increase

CoreLogic ... today released its July Home Price Index (HPI) which shows that home prices in the U.S. increased for the fourth consecutive month, inching up 0.8 percent on a month-over-month basis. On a year-over-year basis, however, national home prices, including distressed sales, declined by 5.2 percent in July 2011 compared to July 2010. In June 2011, prices declined by 6.0 percent* compared to June 2010. Excluding distressed sales, year-over-year prices declined by 0.6 percent in July 2011 compared to July 2010 and by 1.9* percent in June 2011 compared to June 2010. Distressed sales include short sales and real estate owned (REO) transactions. [*CR note: June index was revised up]

“While July’s numbers remained relatively positive, particularly for non-distressed sales which have been stable, seasonal influences are expected to fade in late summer. At that point the month-over-month growth will most likely turn negative. The slowdown in economic growth and increased uncertainty caused by the recent stock market volatility will continue to exert downward pressure on prices,” said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.8% in July, and is down 5.2% over the last year, and off 30.6% from the peak - and up 5.5% from the March low.

As Mark Fleming noted, some of this increase is seasonal (the CoreLogic index is NSA) and the index is still off 5.2% from last July. Month-to-month prices will probably turn negative later this year (the normal seasonal pattern).

Yesterday:

• Case Shiller: Home Prices increased in June

• Real House Prices and Price-to-Rent

• LPS: Average Loan in Foreclosure Is Delinquent for Record 599 Days

ADP: Private Employment increased 91,000 in August

by Calculated Risk on 8/31/2011 08:15:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector rose 91,000 from July to August on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated advance in employment from June to July was revised down modestly to 109,000, from the initially reported 114,000.Note: ADP is private nonfarm employment only (no government jobs).

...

Employment in the service-providing sector rose by 80,000 in August, marking 20 consecutive months of employment gains. Employment in the goods-producing sector rose by 11,000 in August, up from a loss of 2,000 jobs last month. Manufacturing employment slipped 4,000 in August.

This was slightly below the consensus forecast of an increase of 100,000 private sector jobs in August. The BLS reports on Friday, and the consensus is for an increase of 67,000 payroll jobs in August, on a seasonally adjusted (SA) basis.

Of course the ADP report has not been very useful in predicting the BLS report.