by Calculated Risk on 5/26/2011 04:14:00 PM

Thursday, May 26, 2011

Lawler: Census 2010 Demographic Profile: Highlights, Excess Housing Supply Estimate, and Comparison to HVS

CR Note: This is a long piece from economist Tom Lawler. First Lawler looks at the Census 2010 data and compares to the Housing Vacancies and Homeownership (HVS). This is very important because the HVS is used by many analysts to estimate the excess housing supply.

Later in the piece, Lawler looks at several quick and dirty methods of estimating the national excess housing supply. I suspect housing analysts and journalists will want to read the entire post (the excess supply is critical and just about everyone uses the HVS). For those only interested in the excess supply section, scan down to "excess supply" NOTE: I've added a page break because this is very long!

I will work up my own estimate of the excess supply very soon. The following is from Tom Lawler ...

From economist Tom Lawler: Census 2010 Demographic Profile: Highlights, and Comparisons to the Now Officially Discredited HVS/CPS

Census released the decennial Census 2010 demographic profile of the United States today, and the data confirmed that other Census housing data derived from the Current Population Survey are based on a sample not representative of the US housing market as a whole.

On the homeownership front, the Census 2010 data showed that the US homeownership rate on April 1, 2010 was 65.1%, or 1.9 percentage points below estimates from both the Current Population Survey (CPS) Annual Social and Economic Supplement (ASEC) for March and the CPS Housing Vacancy Survey (HVS) for the first half of 2010.

According to Census, the 90% confidence interval for the annual CPS/HVS US homeownership rate was +/- 0.5 percentage points. Given the actual “gap” between the CPS/HVS estimate and the Census 2010 homeownership rate, it is pretty clear from a statistical standpoint that one can firmly reject the hypothesis that the sample used to generate housing tenure estimates from the CPS/HVS is NOT representative of the US as a whole.

Here is a chart showing homeownership rate estimates for (1) the last 3 decennial Censuses; (2) the CPS/ASEC; and (3) the CPS/HVS.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The differences among the various homeownership rate estimates were de minimus in 1990, but were significant in 2000 – with the CPS based homeownership rates significantly higher than the Census 2000 estimates. That gap widened dramatically in 2010. E.g., the CPS/ASEC and the CPS/HVS both suggested that the US homeownership rate from the middle of the first half of 2000 to the middle of the first half of 2010 declined just marginally – to 67.0% from 67.2%. The decennial Census, in marked contrast, suggests that from 2000 to 2010 the US homeownership rate fell to 65.1% from 66.2%. From a demographers’ standpoint, these are HUGE differences.

LPS: Mortgage Delinquency Rates increased slightly in April, Foreclosure pipeline "Bloated"

by Calculated Risk on 5/26/2011 12:40:00 PM

LPS Applied Analytics released their April Mortgage Performance data. From LPS:

•Delinquencies increased slightly in April. Delinquencies are down almost 10% on the year and over 25% from the peak in January 2010.According to LPS, 7.97% of mortgages were delinquent in April, up from 7.78% in March, but down from 8.80% in February and down from 9.52% in April 2010. Some of this increase is the normal seasonal pattern.

•The inventory of late stage delinquencies continues to age, with 40% of borrowers who are in 90+ delinquency status having not made a payment in over a year.

•Improvement continues in the early stages of the pipeline as new seriously delinquent loan rates have dropped to three year lows.

•Both foreclosure starts and sales declined in April -foreclosure sales are still well below the pre-moratoria levels of late 2010.

•The foreclosure pipeline remains bloated with overhang at every level and limited foreclosure sale activity

LPS reports that 4.14% of mortgages were in the foreclosure process, down from the record 4.21% in March. This gives a total of 12.11% delinquent or in foreclosure. It breaks down as:

• 2.24 million loans less than 90 days delinquent.

• 1.96 million loans 90+ days delinquent.

• 2.18 million loans in foreclosure process.

For a total of 6.39 million loans delinquent or in foreclosure in April.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph provided by LPS Applied Analytics shows the aging for the 90+ days delinquent bucket.

What is surprising is the large percentage in the 90+ days delinquent bucket that are more than 12 months delinquent and haven't moved to the "in foreclosure process" bucket. About 40% of loans in the 90+ days bucket - or about 800,000 loans - have been delinquent over a year.

The second graph - from the March report - shows the aging of loans in the foreclosure process.

"31% of loans in foreclosure have not made a payment in over 2 years." So about one third of the 2.2 million loans in the foreclosure process haven't made a payment in over 2 years.

"31% of loans in foreclosure have not made a payment in over 2 years." So about one third of the 2.2 million loans in the foreclosure process haven't made a payment in over 2 years.These two graphs show the "bloated" backlog of seriously delinquent loans (90+ days and in foreclosure).

The good news is the improvement in the early stages, however there is still an enormous number of seriously delinquent loans.

Note: Earlier today, RealtyTrac put out their monthly foreclosure report. The report included the statement: "[T]he current inventory of 1.9 million properties already on the banks’ books, or in foreclosure." I think that number is incorrect. RealtyTrac estimates about 872,000 REOs (Real Estate Owned) and another 1 million in foreclosure.

However, as LPS reported (the MBA has reported similar numbers), there about 2.2 million loans in the foreclosure process, and economist Tom Lawler has estimated the number of REO on lenders' books at about 600,000. Plus there are an additional 2 million loans 90+ days delinquent (about 800,000 are over 1 year delinquent). Some of these loans will cure because of modifications or other reasons. And some of these homes will be sold as short sales. But it appears the number of homes in the pipeline is well over 1.9 million. Just trying to get the numbers correct!

Final note: Recently I've seen seen some very high estimates of the percentage of distressed U.S. homes. So here are some numbers to use:

• There are just under 75 million owner occupied homes in the U.S.

• Just over 50 million homes have a mortgage (LPS estimated 54 million in 2010). The remaining are owned free and clear.

• There are 6.4 million loans delinquent, with about 4.1 million seriously delinquent (90+ days or in foreclosure).

Kansas City Manufacturing Survey: Activity was largely unchanged in May

by Calculated Risk on 5/26/2011 11:19:00 AM

From the Kansas City Fed: May Survey Results are Flat Following Rapid Growth the Past Two Months

The Federal Reserve Bank of Kansas City released the May Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity was largely unchanged in May, although new orders for exports continued to grow.There was almost no growth in May, but the good news was price pressures eased a little and employment continued to expand.

“Factory activity in our region was essentially flat in May following rapid growth in recent months,” said Wilkerson. “But, survey contacts remain generally optimistic about the future and reported plans to continue expanding their workforces.”

Wilkerson said price indexes eased in May with fewer firms planning to raise selling prices and some slowdown in price increases for materials.

...

The month-over-month composite index was 1 in May, down from 14 in April and 27 in March. ... By contrast, the employment index eased but remained well above zero.

The last regional survey (Dallas) will be released on Tuesday May 31st. All of the regional surveys have indicated a sharp slowdown in activity in May, and combined, suggest the ISM manufacturing survey for May will be in the mid-50s (to be released June 1st).

Q1 real GDP growth unrevised at 1.8% annualized rate

by Calculated Risk on 5/26/2011 09:00:00 AM

From the BEA: Gross Domestic Product, First Quarter 2011 (second estimate)

This was below the consensus forecast of an upward revision to 2.1%, and the details were weaker. Overall GDP growth was unrevised in the second estimate, although Personal Consumption Expenditures (PCE) growth was revised down, mostly offset by an increase in the "Change in private inventories". (see table at bottom for changes in contribution to GDP).

The following graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The current quarter is in blue.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The dashed line is the current growth rate. Growth in Q1 at 1.8% annualized was below trend growth (around 3.1%) - and very weak for a recovery, especially with all the slack in the system.

The following table shows the changes from the advance release (this is the Contributions to Percent Change in Real Gross Domestic Product).

| Contributions to Percent Change in Q1 Real Gross Domestic Product | |||

|---|---|---|---|

| 2nd Estimate | Advance | Change | |

| Percent change at annual rate: | |||

| Gross domestic product | 1.8 | 1.8 | 0.0 |

| Percentage points at annual rates: | |||

| Personal consumption expenditures.. | 1.53 | 1.91 | -0.4 |

| Goods | 0.83 | 1.12 | -0.3 |

| Durable goods | 0.66 | 0.78 | -0.1 |

| Nondurable goods | 0.17 | 0.34 | -0.2 |

| Services | 0.69 | 0.80 | -0.1 |

| Gross private domestic investment | 1.45 | 1.01 | 0.4 |

| Fixed investment | 0.26 | 0.09 | 0.2 |

| Nonresidential | 0.33 | 0.18 | 0.2 |

| Structures | -0.48 | -0.63 | 0.2 |

| Equipment and software | 0.81 | 0.80 | 0.0 |

| Residential | -0.07 | -0.09 | 0.0 |

| Change in private inventories | 1.19 | 0.93 | 0.3 |

| Net exports of goods and services | -0.06 | -0.08 | 0.0 |

| Exports | 1.16 | 0.64 | 0.5 |

| Imports | -1.22 | -0.72 | -0.5 |

| Government consumption expenditures | -1.07 | -1.09 | 0.0 |

| Federal | -0.68 | -0.68 | 0.0 |

| National defense | -0.68 | -0.69 | 0.0 |

| Nondefense | 0.00 | 0.00 | 0.0 |

| State and local | -0.39 | -0.41 | 0.0 |

Weekly Initial Unemployment Claims increase to 424,000

by Calculated Risk on 5/26/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

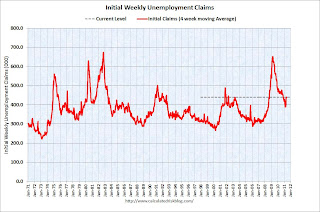

In the week ending May 21, the advance figure for seasonally adjusted initial claims was 424,000, an increase of 10,000 from the previous week's revised figure of 414,000. The 4-week moving average was 438,500, a decrease of 1,750 from the previous week's revised average of 440,250.The following graph shows the 4-week moving average of weekly claims for the last 40 years.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 438,500.

The 4-week average is back to the level of last November when there were fewer payroll jobs being added each month - and that is very concerning.

Wednesday, May 25, 2011

Misc: State Revenues increases, Gas Prices fall, GDP and Weekly Claims tomorrow

by Calculated Risk on 5/25/2011 10:19:00 PM

• From the Rockefeller Institute of Government: States Report Strong Growth in Tax Revenues in the First Quarter of 2011

The Rockefeller Institute's compilation of data from 47 early reporting states shows collections from major tax sources increased by 9.1 percent in nominal terms in the first quarter of 2011 compared to the same quarter of 2010. That represented the third consecutive quarter of increasing strength in revenues. Tax collections now have been rising for five straight quarters, following five quarters of declines, but were still 3.1 percent lower in early 2011 than in the same period three years agoThe press release has a state by state breakdown. Revenue is still 3.1% lower than at the beginning of the recession.

...

In terms of dollars, California reported the largest increase in overall tax collections in the first quarter of 2011, where revenue collections rose by $1.4 billion or 5.6 percent. Illinois and New York also reported large increases in overall tax collections in terms of dollars.

• According to gasbuddy.com, gasoline prices are down about 15 cents per gallon nationally from the peak. Oil prices moved up today to almost $102 per barrel (WTI futures), but we should still further gasoline price declines after the Memorial Day weekend.

• At 8:30 AM tomorrow, the Department of Labor will release the initial weekly unemployment claims report. This is being watched closely now because of the sharp increase in initial claims at the end of April. The consensus is for a decrease to 404,000 from 409,000 last week.

Also at 8:30 AM, the BEA will release the second estimate of Q1 GDP. The consensus is for an upward revision to 2.1% annualized real GDP growth (from 1.8%). Goldman Sachs put out a note this afternoon:

[W]e now expect an upward revision to 2.1% (one tenth higher than before). [However the] soft April results ... imply about two tenths of additional downside risk to our Q2 GDP growth forecast, on top of our downward revision to 3.0% yesterday.Best to all

DOT: Vehicle Miles Driven decreased 1.4% in March compared to March 2010

by Calculated Risk on 5/25/2011 05:52:00 PM

The Department of Transportation (DOT) reported that vehicle miles driven in March were down 1.4% compared to March 2010:

Travel on all roads and streets changed by -1.4% (-3.5 billion vehicle miles) for March 2011 as compared with March 2010. Travel for the month is estimated to be 250.4 billion vehicle miles.

Cumulative Travel for 2011 changed by -0.1% (-0.8 billion vehicle miles).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the rolling 12 month total vehicle miles driven.

Note: in the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months. Currently miles driven has been below the previous peak for 40 months - so this is a new record for longest period below the previous peak - and still counting!

The second graph shows the year-over-year change from the same month in the previous year. So far the current decline is not as a severe as in 2008.

The second graph shows the year-over-year change from the same month in the previous year. So far the current decline is not as a severe as in 2008.U.S. oil prices in March averaged $103 per barrel, and although prices have declined in May from the April highs, prices have only fallen to just below the prices in March. Also other sources have reported demand for gasoline is down in April and May, so I expect the data for April to show a sharp year-over-year decline in miles driven.

ATA Trucking index decreased 0.7% in April

by Calculated Risk on 5/25/2011 02:54:00 PM

From ATA Trucking: ATA Truck Tonnage Index Fell 0.7 Percent in April

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.7 percent in April after gaining a revised 1.9 percent in March 2011. March’s increase was slightly better than the 1.7 percent ATA reported on April 26, 2011. The latest drop put the SA index at 114.9 (2000=100) in April, down from the March level of 115.6.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Here is a long term graph that shows ATA's Fore-Hire Truck Tonnage index.

The dashed line is the current level of the index.

Compared with April 2010, SA tonnage climbed 4.8 percent. In March, the tonnage index was 6.5 percent above a year earlier.

“The drop in April is not a concern. Since freight volumes are so volatile truck tonnage is unlikely to grow every month, even on a seasonally adjusted basis,” ATA Chief Economist Bob Costello said. “I expect economic activity, and with it truck freight levels to grow at a moderate pace in the coming months and quarters.”

“The industry, and the economy at large, should benefit from the recent declines in oil and diesel prices,” Costello added.

...

Trucking serves as a barometer of the U.S. economy, representing 67.2 percent of tonnage carried by all modes of domestic freight transportation ... Motor carriers collected $563.4 billion, or 81.2 percent of total revenue earned by all transport modes.

Debt Ceiling Charade: Vote to Fail Next Week

by Calculated Risk on 5/25/2011 11:49:00 AM

Stan Collender writes: Not A Surprise: GOP Plans Vote On Debt Ceiling Bill Next Week

House Republicans announced yesterday that they would bring a "clean" debt ceiling to the House floor next week. ... by allowing members to vote against it now, the leadership will also be making it easier for some of them to vote for a debt ceiling increase later this summer.The theater of the absurd. Otherwise known as politics.

And from the WSJ: Geithner Dismisses Debt-Ceiling Debate as Political Theater

U.S. Treasury Secretary Timothy Geithner Wednesday dismissed as political theater a House vote on the debt ceiling that is expected to fail, and said Congress would ultimately raise the limit this summer.The key point is the vote next week is meaningless and the debt ceiling will be increased this summer.

“Right now this is all theater. Beneath the theater you are starting to see people work together,” Geithner said

More Negative Sentiment for Homeownership

by Calculated Risk on 5/25/2011 09:51:00 AM

During the housing busts that followed the California housing bubbles of the late '70s and late '80s, there came a period when sentiment for homeownership changed. The evidence was anecdotal, but it was not uncommon to hear people say owning a home was "dumb".

So one thing I've been looking for is a change in sentiment. Earlier posts on this with anecdotal evidence: Housing: Feeling the Hate, More "Hate" for Housing, and More "Hate" for Homeownership.

A shift in sentiment doesn't mean housing prices have bottomed - it just means the market is getting closer. In previous busts it seemed like negative sentiment lasted for a few years.

Last week Trulia and RealtyTrac released a survey of when Americans thought the housing market would recover. (ht Keith Jurow, Keith is far more bearish than I am bearish).

Here is the survey: Trulia and RealtyTrac Survey Reveals 54 Percent of American Adults Now Believe Housing Recovery Remains Unlikely Until 2014 or Later

As more cities across the nation experience double dips in home prices , more than half (54 percent) of U.S. adults believe recovery in the housing market will not happen until 2014 or later, according to the survey released today. In a previous survey conducted six months ago , 42 percent of American adults said they thought the market would turn around by 2012 or had already turned around. Now, only 23 percent continue to think this will happen.

| When American Adults Believe Housing Market Will Recover | |||

|---|---|---|---|

| Apr-11 | Nov-10 | % Change | |

| Already Recovered[1] | 5% | 5% | 0% |

| By the end of 2011 | 3% | 10% | -70% |

| 2012 | 15% | 27% | -44% |

| 2013 | 24% | 24% | 0% |

| 2014 or Later | 54% | 34% | 59% |

Clearly there has been a sharp shift in when people think the housing market will "recover". Expecting a recovery is somewhat different from asking when people will want to buy, but I think they are somewhat related - if non-owners think the market won't bottom for several years, they would probably also say they won't buy soon too. Just a little more evidence of a shift in sentiment ...