by Calculated Risk on 4/07/2011 10:37:00 PM

Thursday, April 07, 2011

Mortgage Lenders lay off workers as refinance activity declines rapidly

From Scott Reckard at the LA Times: Home lenders shed workers as mortgage rates climb

A rebound in mortgage rates from last year's near-record low has reduced consumer demand for home loans and refinancings, leading Wells Fargo & Co. to join other industry stalwarts in laying off loan processors and related workers.Maybe they can have these workers help with modifications and foreclosures ...

The San Francisco bank, the nation's No. 1 mortgage lender, has handed pink slips to about 1,900 workers who had processed loans generated both by Wells' mortgage unit and by independent brokers, a spokesman said Thursday. ... Notifications went out March 23 telling affected workers their jobs would end in 60 days ...

It doesn't take much of an increase in rates for refinance activity to slow sharply.

The MBA refinance index has fallen sharply since last October, suggesting refinance volumes have fallen about 60% - as 30 year mortgage rates increased from 4.21% in October to the current 4.93%.

House Prices: Nominal, Real, Price-to-Rent

by Calculated Risk on 4/07/2011 05:09:00 PM

By request, here is an update to a few graphs including the CoreLogic HPI released this morning (the February report is an average of December, January and February prices).

Nominal House Prices

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

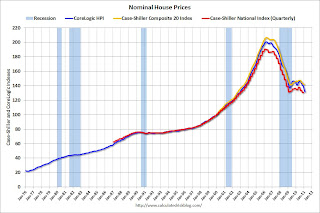

The first graph shows the quarterly Case-Shiller National Index (through Q4 2010), and the monthly Case-Shiller Composite 20 (through January release) and CoreLogic House Price Indexes (through February release) in nominal terms (as reported).

In nominal terms, the National index is back to Q1 2003 levels, the Composite 20 index is slightly above the May 2009 lows, and the CoreLogic index back to January 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter).

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter).

Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q1 2000 levels, the Composite 20 index is back to January 2001, and the CoreLogic index back to January 2000.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through January 2011 using the Case-Shiller Composite 20 and CoreLogic House Price Index.

Here is a similar graph through January 2011 using the Case-Shiller Composite 20 and CoreLogic House Price Index.

This graph shows the price to rent ratio (January 1998 = 1.0).

An interesting point: the measure of Owners' Equivalent Rent (OER) is at about the same level as two years - so the price-to-rent ratio has mostly followed changes in nominal house prices since then. Rents are starting to increase again, and OER will probably increase in 2011 - lowering the price-to-rent ratio.

On a price-to-rent basis, the Composite 20 index is just above the May 2009 levels, and the CoreLogic index is back to January 2000.

I'll have more analysis when the Case-Shiller index is released on April 26th.

Earlier:

• CoreLogic: House Prices declined 2.7% in February, Prices now 4.1% below 2009 Lows

Hotels: Occupancy Rate improves in Latest Survey

by Calculated Risk on 4/07/2011 02:29:00 PM

This was an easy comparison because of the timing of Easter.

Here is the weekly update on hotels from HotelNewsNow.com: STR: Softer comps make for strong weekly results

The weekly results were boosted by softer year-over-year comparisons. Easter, a historically low travel weekend for hotels, was on 4 April 2010.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

Overall, the U.S. hotel industry’s occupancy was up 12.2% to 60.8%, its average daily rate increased 5.3% to US$100.18, and its revenue per available room finished the week up 18.1% to US$60.91.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the seasonal pattern for the hotel occupancy rate.

The occupancy rate is well above the rate in 2009 and 2010, and fairly close to the rate in 2008.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Reis: Mall Vacancy rates increase in Q1

by Calculated Risk on 4/07/2011 11:30:00 AM

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

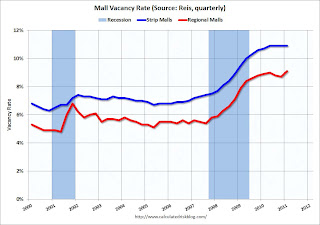

From Bloomberg: Mall Vacancies Climb to Highest in Decade as U.S. Retailers Close Stores

The vacancy rate [at U.S. regional malls] climbed to 9.1 percent from 8.9 percent a year earlier and 8.7 percent in the fourth quarter, [Reis reported]. It was the highest since Reis began publishing data on regional malls in the beginning of 2000.The previous record for regional malls was 9.0% in Q2 2010 (Reis started tracking regional malls in 2000). The record vacancy rate for strip malls was in 1990 at 11.1%.

At neighborhood and community shopping centers, which usually are anchored by discount and grocery stores, the vacancy rate rose to 10.9 percent from 10.7 percent a year earlier. The rate was unchanged from the three previous quarters and the highest since it reached 11 percent in 1991, according to Reis.

As noted in the article, stores are still being closed as long term leases expire.

Earlier on Office vacancy rates:

• Reis: Office Vacancy Rate declines slightly in Q1

• When will Office Investment increase?

And apartment vacancy rates:

• Forecast: Rising Rents to slow House Price Declines

CoreLogic: House Prices declined 2.7% in February, Prices now 4.1% below 2009 Lows

by Calculated Risk on 4/07/2011 09:15:00 AM

Notes: CoreLogic reports the year-over-year change. The headline for this post is for the change from January to February 2011. The CoreLogic HPI is a three month weighted average of December, January and February, and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Home Price Index Shows Year-Over-Year Decline for Seventh Straight Month

According to the CoreLogic HPI, national home prices, including distressed sales, declined by 6.7 percent in February 2011 compared to February 2010 after declining by 5.5 percent in January 2011 compared to January 2010. Excluding distressed sales, year-over-year prices declined by 0.1 percent in February 2011 compared to February 2010 and by 1.4 percent in January 2011 compared to January 2010. Distressed sales include short sales and real estate owned (REO) transactions.

Despite the continued overall decline, home prices excluding distressed properties are showing signs of stability according to Mark Fleming, chief economist with CoreLogic. “When you remove distressed properties from the equation, we’re seeing a significantly reduced pace of depreciation and greater stability in many markets. Price declines are increasingly isolated to the distressed segment of the market, mostly in the form of REO sales, as the stock of foreclosures is slowly cleared." he said.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 6.7% over the last year, and off 34.5% from the peak.

This is the seventh straight month of year-over-year declines, and the eighth straight month of month-to-month declines. The index is now 4.1% below the previous post-bubble low set in March 2009, and I expect to see further new post-bubble lows for this index over the next few months.

Weekly Initial Unemployment Claims decline to 382,000

by Calculated Risk on 4/07/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending April 2, the advance figure for seasonally adjusted initial claims was 382,000, a decrease of 10,000 from the previous week's revised figure of 392,000. The 4-week moving average was 389,500, a decrease of 5,750 from the previous week's revised average of 395,250.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the 4-week moving average of weekly claims for the last 40 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 389,500.

This is the 6th consecutive week with the 4-week average below the 400,000 level. This is still elevated, and we'd like to see the number of initial claims continue to decline (and hiring pickup too). But this is a small positive step in the right direction.

Wednesday, April 06, 2011

Forecast: Rising Rents to slow House Price Declines

by Calculated Risk on 4/06/2011 08:23:00 PM

As I mentioned this morning, the sharp decline in the rental vacancy rate, to 6.2% in Q1 2011, suggests that the excess supply of housing is being absorbed. Here is a graph of the Reis apartment vacancy rate:

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The vacancy rate is back to early 2008 levels, and is not far above the rate of 2006 (around 5.7%). As the vacancy rate falls, rents will rise and this will help support house prices. See this post on the price-to-rent ratio.

Housing economist Tom Lawler predicted this afternoon: 'Rising rents combined with a substantial reduction in the “excess supply” of housing (single family as well) will also help stem the recent “renewed” downturn in US home prices well before the end of this year.'

I think prices might fall for another year or two in real terms (inflation adjusted), but I agree that it is likely that nominal house prices will bottom this year.

Portugal to ask for Bailout

by Calculated Risk on 4/06/2011 03:52:00 PM

It was just a matter of when ...

From Reuters: Portugal's Finance Minister: We Now Need EU Aid After All

"In this difficult situation, which could have been avoided, I understand that it is necessary to resort to the financing mechanisms available within the European framework," said Finance Minister Fernando Teixeira dos Santos.Here is the 10 year bond yield from Bloomberg for Portugal. Everyone expected Portugal to ask for a bailout, but is this the last EU country to ask for help? That is a key quesiton.

Budgets and Political Grandstanding

by Calculated Risk on 4/06/2011 02:30:00 PM

• As I noted back in January, the deficit and the debt are real issues, but the "debt ceiling" debate is political posturing. (If you follow the links back a few years, this was originally making fun of Democrats).

I still believe a shutdown will be averted, but if not, here is an article from Michael Shear at the NY Times on the possible consequences: White House Says Shutdown Would Harm the Economy (pay wall)

Administration officials said that nearly 800,000 federal workers would probably be told to stop working if a deal was not reached in the next two days. Small business loans would stop. Tax returns filed on paper would not be processed. Government Web sites would go dark. And federal loan guarantees for new mortgages would become unavailable.This is a real concern, but I don't believe anyone in Congress is THAT stupid.

Speaking to reporters on a morning conference call, a senior administration official said the cumulative impact of the shutdown “would have a significant impact on our economic momentum.”

• Unfortunately the Paul Ryan budget plan is riddled with errors. Here are the original projections (they have been changed without changing the plan - not a good sign). The plan has many unrealistic projections (unemployment, residential investment, and more). Bad math ruins the whole plan, and it isn't even a starting point for discussion.

Also, as I noted earlier in the comments, I'm in the "over 55" group that will not see a change to Medicare under Ryan's plan. I object to this vote buying scheme (older people vote). Whatever plan is good enough for those 25 years old, 35 years old and 45 years old - is good enough for me. I believe in shared sacrifice, and I refuse to ask younger workers to take less while I get more. I understand this plan is DOA if it applies to older workers, then so be it.

Aren't there any leaders in America who can talk shared sacrifice to solve a problem?

Construction Employment Outlook Update

by Calculated Risk on 4/06/2011 11:48:00 AM

By request, here is an update to a graph I posted just over a year ago on construction employment. Last year the outlook for construction employment was grim. This year will be a little better - but not much.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the number of construction payroll jobs (blue line), and the number of construction jobs as a percent of total non-farm payroll jobs (red line).

Construction employment is down 2.2 million jobs from the peak in April 2006, but up 16 thousand jobs so far this year.

Note: Unfortunately this graph is a combination of both residential and non-residential construction employment. The BLS only started breaking out residential construction employment fairly recently (residential building employees in 1985, and residential specialty trade contractors in 2001). Usually residential investment (and residential construction) lead the economy out of recession, and non-residential construction usually lags the economy. Because this graph is a blend, it masks the usually pickup in residential construction for previous recessions. Of course residential investment didn't lead the economy this time because of the huge overhang of existing housing units.

This table below shows the annual change in construction jobs (total, residential and non-residential).

| Annual Change in Payroll jobs (000s) | |||

|---|---|---|---|

| Year | Total Construction Jobs | Residential Construction Jobs | Non-Residential |

| 2002 | -85 | 88 | -173 |

| 2003 | 127 | 161 | -34 |

| 2004 | 290 | 230 | 60 |

| 2005 | 416 | 268 | 148 |

| 2006 | 152 | -62 | 214 |

| 2007 | -198 | -273 | 75 |

| 2008 | -787 | -510 | -277 |

| 2009 | -1053 | -431 | -622 |

| 2010 | -149 | -113 | -36 |

| March 2011 | 16 | 8 | 8 |

In 2011, for the first time since 2005, I expect residential construction employment to increase - mostly because of multi-family construction. I also expect residential investment to make a small positive contribution to GDP growth this year - also for the first time since 2005.