by Calculated Risk on 9/01/2010 12:15:00 PM

Wednesday, September 01, 2010

Some comments on August ISM Manufacturing Index

The Institute for Supply Management reported this morning that the PMI increased to 56.3 from 55.5 in July. Expectations were for a decrease to 53.0. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is an update to the graph showing the regional Fed manufacturing surveys and the ISM index through August.

The Fed surveys suggested that the ISM index would probably decline, but the relationship is noisy. Based on this graph I'd expect either the Fed surveys to bounce back in September - or the ISM to decline. Here is a long term graph that hopefully puts the uptick in August in perspective.

Here is a long term graph that hopefully puts the uptick in August in perspective.

In addition to the increase in the PMI, the production index increased to 59.9 from 57.0, and the employment index increased from 58.6 in July to 60.4. That suggests increased manufacturing employment in August.

However the new orders index declined in August to 53.1 from 53.5 in July (still expanding, but at a slower pace). And the inventory index was up for the 2nd month in a row to 51.4.

This report was somewhat better than expected, but I still expect the index to decline over the next couple of months.

General Motors: Sales off sharply from August 2009

by Calculated Risk on 9/01/2010 11:18:00 AM

Note: Sales in August 2009 were boosted by "Cash-for-clunkers".

From MarketWatch: GM August U.S. sales down 24.9% to 185,176 units

General Motors Co. said Wednesday that U.S. sales in August slumped 24.9% to 185,176 vehicles from 246,479 in August 2009.Note: in August 2009 U.S. light vehicle sales were 14.1 million (SAAR). This was related to "Cash-for-clunkers" - also General Motors emerged from bankruptcy on July 10, 2009.

I'll add reports from the other major auto companies as updates to this post.

Update1: From MarketWatch: Ford U.S. August sales slide 10.7% to 157,503

From MarketWatch: Chrysler U.S. August sales rise 7% to 99,611 units

NOTE: Once all the reports are released, I'll post a graph of the estimated total August light vehicle sales (SAAR: seasonally adjusted annual rate) - usually around 4 PM ET. Most estimates are for an increase to 11.6 million SAAR in August from the 11.5 million SAAR in July.

Construction Spending declines in July

by Calculated Risk on 9/01/2010 10:15:00 AM

Note: the ISM PMI increased to 56.3 from 55.5 in July (I'll have more later).

Overall construction spending decreased in July. Click on graph for larger image in new window.

Click on graph for larger image in new window.

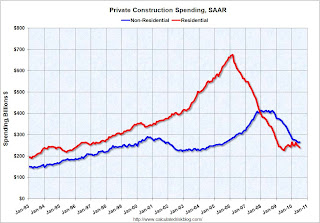

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

From the Census Bureau: July 2010 Construction at $805.2 Billion Annual Rate

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during July 2010 was estimated at a seasonally adjusted annual rate of $805.2 billion, 1.0 percent (±1.4%)* below the revised June estimate of $813.1 billion. The July figure is 10.7 percent (±1.8%) below the July 2009 estimate of $901.2 billion.Private residential construction spending has turned down again - after the tax credit expired - and residential investment (RI) will be a drag on Q3 GDP. The "good" news is the overall drag from RI will be much smaller than during 2006, 2007 and 2008.

...

Spending on private construction was at a seasonally adjusted annual rate of $506.4 billion, 0.8 percent (±1.3%)* below the revised June estimate of $510.7 billion. Residential construction was at a seasonally adjusted annual rate of $240.3 billion in July, 2.6 percent (±1.3%) below the revised June estimate of $246.7 billion. Nonresidential construction was at a seasonally adjusted annual rate of $266.1 billion in July, 0.8 percent (±1.3%)* above the revised June estimate of $264.0billion.

ADP: Private Employment decreases 10,000 in August

by Calculated Risk on 9/01/2010 08:15:00 AM

ADP reports:

Private sector employment decreased by 10,000 from July to August on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated change of employment from June to July was revised down slightly, from the previously reported increase of 42,000 to an increase of 37,000.Note: ADP is private nonfarm employment only (no government jobs).

The decline in private employment in August confirms a pause in the recovery already evident in other economic data.

...

Unlike the estimate of total establishment employment to be released on Friday by the Bureau of Labor Statistics (BLS), today’s figure does not include the effects of federal hiring — and now firing — for the 2010 Census.

The consensus was for ADP to show an increase of about 20,000 private sector jobs in August, so this was below consensus.

The BLS reports on Friday, and the consensus is for a decrease of 90,000 payroll jobs in August, on a seasonally adjusted (SA) basis, with the loss of around 116,000 temporary Census 2010 jobs (+26,000 ex-Census).

MBA: Purchase Application activity suggests low level of existing home sales in August and September

by Calculated Risk on 9/01/2010 07:33:00 AM

The MBA reports: Mortgage Applications Increase as Rates Hit New Low in MBA Weekly Survey

The Refinance Index increased 2.8 percent from the previous week and is at its highest level since May 1, 2009. The seasonally adjusted Purchase Index increased 1.8 percent from one week earlier.

...

"Refinancing activity picked up again last week, reaching new 15-month highs, as borrowers took advantage of even lower mortgage rates. The drop in mortgage rates was in line with Treasury rates as the latest data continue to show weak economic growth and an exceptionally weak housing market," said Michael Fratantoni, MBA's Vice President of Research and Economics. "The sharp decline in MBA's Purchase Application index in May had provided a clear leading indicator of the drops in new and existing home sales that were reported for June and July. Despite the slight increase in purchase activity in the past week, the continued low level of purchase applications indicates we are unlikely to see an increase in new home sales reported for August or existing home sales reported for September."

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.43 percent from 4.55 percent, with points increasing to 1.34 from 0.89 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The contract rate is a new low for this survey.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Usually I start the graph in January 1990, but this shorter term graph shows that the purchase index has been moving sideways since May of this year.

As the MBA's Fratantoni noted, this suggests existing home sales in August and September will be around the same level as in July.

Tuesday, August 31, 2010

Existing Home Inventory declines slightly in August

by Calculated Risk on 8/31/2010 07:10:00 PM

Tom Lawler reports that at the end of August, listings on Realtor.com totaled 4,007,860, down 0.7% from 4,038,133 at the end of July. This is 2.5% above August 2009.

The NAR reported inventory at 3.98 million at the end of July, and at 3.924 million in August 2009. So they will probably report inventory at close to 4 million for August.

Since sales probably only increased slightly in August, the months-of-supply metric will be in double digits again in August and probably still over 12 months.

Note: there is a seasonal pattern for existing home inventory. Usually inventory peaks in July and declines slightly through October - and then declines sharply at the end of the year as sellers take their homes off the market for the holidays.

Restaurant Index shows contraction in July

by Calculated Risk on 8/31/2010 04:14:00 PM

This is one of several industry specific indexes I track each month.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Same store sales and customer traffic both declined in July (on a year-over-year basis). This is the fourth consecutive month of declines.

Unfortunately the data for this index only goes back to 2002.

Note: Any reading above 100 shows expansion for this index.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Remained Uncertain in July as Restaurant Performance Index Remains Essentially Flat

As a result of soft sales and traffic levels and a deteriorating outlook among restaurant operators, the National Restaurant Association’s comprehensive index of restaurant activity remained essentially flat in July. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 99.4 in July, down 0.1 percent from June and its fourth consecutive decline. In addition, the RPI stood below 100 for the third consecutive month, which signifies contraction in the index of key industry indicators.Restaurants are a discretionary expense, and this contraction could be because of the sluggish recovery or might suggest further weakness in consumer spending in the months ahead.

...

Restaurant operators reported negative same-store sales for the fourth consecutive month in July, with the overall results similar to the June performance.

...

Restaurant operators also reported a net decline in customer traffic levels in July.

...

Restaurant operators have become less optimistic about their prospects for sales growth in recent months.

emphasis added

FOMC August Minutes: Both employment and inflation to fall short of dual mandate

by Calculated Risk on 8/31/2010 02:00:00 PM

From the Fed: Minutes of the Federal Open Market Committee

Economic outlook:

Members still saw the economic expansion continuing, and most believed that inflation was likely to stabilize near recent low readings in coming quarters and then gradually rise toward levels they consider more consistent with the Committee's dual mandate for maximum employment and price stability. Nonetheless, members generally judged that the economic outlook had softened somewhat more than they had anticipated, particularly for the near term, and some saw increased downside risks to the outlook for both growth and inflation. Some members expressed a concern that in this context any further adverse shocks could have disproportionate effects, resulting in a significant slowing in growth going forward. While no member saw an appreciable risk of deflation, some judged that the risk of further near-term disinflation had increased somewhat. More broadly, members generally saw both employment and inflation as likely to fall short of levels consistent with the dual mandate for longer than had been anticipated.And on policy:

All but one member concluded that it would be appropriate to begin reinvesting principal received from agency debt and MBS held in the SOMA by purchasing longer-term Treasury securities in order to keep constant the face value of securities held in the SOMA and thus avoid the upward pressure on longer-term interest rates that might result if those holdings were allowed to decline. Several members emphasized that in addition to continuing to develop and test instruments to facilitate an eventual exit from the period of unusually accommodative monetary policy, the Committee would need to consider steps it could take to provide additional policy stimulus if the outlook were to weaken appreciably further. Given the softer tone of recent data and the more modest near-term outlook, members agreed that some changes to the statement's characterization of the economic and financial situation were necessary.Not much new ...

On Case-Shiller House Prices: October is the "Witching Hour"

by Calculated Risk on 8/31/2010 12:54:00 PM

As we've discussed for some time, the Case-Shiller index is seriously lagged to real time data. The release today was for "June", but it is really an average of April, May and June.

Home sales were strong in April, May and June, and then collapsed in July. And prices have probably been falling for two months now - but that won't show up in Case-Shiller until the end of next month or even October (the Case-Shiller release at the end of October will be for June, July and August).

Note: The title for this post is from Rolfe Winkler at the WSJ's Heard on the Street (last week): Housing's Witching Hour

[T]he S&P/Case-Shiller home-price index ... could be set for another leg down. The index is computed using a three-month rolling average, meaning last month's weakness really should assert itself in late October.RadarLogic released a statement today: As Predicted, June S&P/Case-Shiller Home Price Indices Overstate Housing Market Strength

[T]he latest S&P/Case-Shiller home price indices show healthy improvement in home prices while other housing market indicators, including the RPX Composite price, show that housing markets are starting to weaken.The CoreLogic repeat sales index showed prices were flat from May to June (CoreLogic uses a weighted 3 month average and picks up the trend change a little quicker than Case-Shiller).

... We believe that these figures overstate the current strength of the U.S. housing markets. As we reported in this month’s RPX Monthly Housing Market Report, the RPX 25-MSA Composite Price declined 0.2% through the end of June on a year-over-year basis. ...

The conflict between the strength expressed in the S&P/Case-Shiller indices and the weakness apparent in other housing market indicators likely arises from the fact that the S&P/Case-Shiller indices are calculated using data from transactions that occur over a three-month period. As a result, the indices smooth over recent price movements and can take a number of months to reflect price fluctuations.

... Our concern is that, as we saw in spring 2009, the only effective stimulus of new housing demand will prove to be a precipitous decline in home prices. Our current analysis shows early signs that such a dynamic is approaching.

FDIC Q2 Banking Profile: 829 Problem Banks

by Calculated Risk on 8/31/2010 11:12:00 AM

The FDIC released the Q2 Quarterly Banking Profile today.

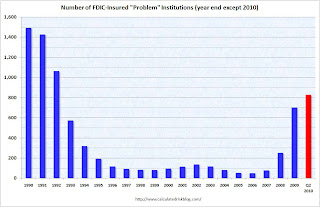

The FDIC listed 829 banks with $403 billion in assets as “problem” banks in Q2, up from 775 banks in Q1 2010, but the total assets declined from $431 billion in assets in Q1 2010.

There were 702 banks with $403 billion in assets on the list at the end of 2009.

Note: Not all problem banks will fail - and not all failures will be from the problem bank list - but this shows the problem is significant and still growing.

The Unofficial Problem Bank List shows 840 problem banks with $410 billion in assets - the difference is timing of releases of formal actions (or hints of pending actions).  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of FDIC insured "problem" banks since 1990.

All data is year end except Q1 2010.

The 829 problem banks reported at the end of Q2 is the highest since 1992.

The FDIC is just behind the pace for 1,000 problem banks by the end of the year, although it also depends on how many banks are removed from the list.

On the Deposit Insurance Fund: The fund had an ending balance of -$15.2 billion at the end of Q2, an improvement from -$20.7 billion at the end of Q1. However the fund has plenty of cash because of the prepaid assessments last year - but those assessments will not be accounted for until they were originally due.