by Calculated Risk on 8/31/2010 11:12:00 AM

Tuesday, August 31, 2010

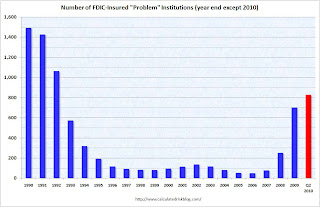

FDIC Q2 Banking Profile: 829 Problem Banks

The FDIC released the Q2 Quarterly Banking Profile today.

The FDIC listed 829 banks with $403 billion in assets as “problem” banks in Q2, up from 775 banks in Q1 2010, but the total assets declined from $431 billion in assets in Q1 2010.

There were 702 banks with $403 billion in assets on the list at the end of 2009.

Note: Not all problem banks will fail - and not all failures will be from the problem bank list - but this shows the problem is significant and still growing.

The Unofficial Problem Bank List shows 840 problem banks with $410 billion in assets - the difference is timing of releases of formal actions (or hints of pending actions).  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of FDIC insured "problem" banks since 1990.

All data is year end except Q1 2010.

The 829 problem banks reported at the end of Q2 is the highest since 1992.

The FDIC is just behind the pace for 1,000 problem banks by the end of the year, although it also depends on how many banks are removed from the list.

On the Deposit Insurance Fund: The fund had an ending balance of -$15.2 billion at the end of Q2, an improvement from -$20.7 billion at the end of Q1. However the fund has plenty of cash because of the prepaid assessments last year - but those assessments will not be accounted for until they were originally due.