by Calculated Risk on 10/29/2009 08:48:00 AM

Thursday, October 29, 2009

Weekly Initial Unemployment Claims: 530 Thousand

The DOL reports weekly unemployment insurance claims decreased slightly to 530,000:

In the week ending Oct. 24, the advance figure for seasonally adjusted initial claims was 530,000, a decrease of 1,000 from the previous week's unrevised figure of 531,000. The 4-week moving average was 526,250, a decrease of 6,000 from the previous week's unrevised average of 532,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending Oct. 17 was 5,797,000, a decrease of 148,000 from the preceding week's revised level of 5,945,000.

Click on graph for larger image in new window.

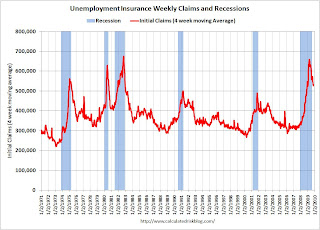

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 6,000 to 526,250, and is now 132,500 below the peak in April. The significant decline from the peak strongly suggests that initial weekly claims have peaked for this cycle.

However, the key question is: Will claims continue to decline sharply, like following the recessions in the '70s and '80s, or will claims plateau for some time at an elevated level, as happened during the jobless recoveries in the early '90s and '00s?

The level is still very high suggesting continuing job losses ...

BEA: GDP Increases at 3.5% Annual Rate in Q3

by Calculated Risk on 10/29/2009 08:30:00 AM

From the BEA:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 3.5 percent in the third quarter of 2009, (that is, from the second quarter to the third quarter), according to the "advance" estimate released by the Bureau of Economic Analysis.This is close to expectations, and GDP in Q4 will probably be in the same range with more inventory restocking and stimulus spending. But the question is: what happens in 2010?

...

The upturn in real GDP in the third quarter primarily reflected upturns in PCE, in private inventory investment, in exports, and in residential fixed investment and a smaller decrease in nonresidential fixed investment that were partly offset by an upturn in imports, a downturn in state and local government spending, and a deceleration in federal government spending.

...

Real personal consumption expenditures increased 3.4 percent in the third quarter, in contrast to a decrease of 0.9 percent in the second.

...

Real nonresidential fixed investment decreased 2.5 percent in the third quarter, compared with a decrease of 9.6 percent in the second. Nonresidential structures decreased 9.0 percent, compared with a decrease of 17.3 percent. Equipment and software increased 1.1 percent, in contrast to a decrease of 4.9 percent. Real residential fixed investment increased 23.4 percent, in contrast to a decrease of 23.3 percent.

I'll have some more on investment later ...

Wednesday, October 28, 2009

In re Olga: of Bankruptcy and Foreclosure

by Calculated Risk on 10/28/2009 09:23:00 PM

CR Note: This is a guest post from albrt.

In re Olga: of Bankruptcy and Foreclosure.

An article by a person named Morgenson appeared in the New York Times last weekend, calling to our collective attention a New York bankruptcy case that adds to our collective knowledge of our collective foreclosure problem. Driven by a suspicion that the article would have helped us understand more if it had been written by someone other than the aforesaid Morgenson, your intrepid foreclosure correspondent dug into the record and filed the following report.

Picking on Poor Gretchen

First, for recent arrivals, there is a long and honored history at this site of Picking on Poor Gretchen. In this case I want to congratulate Morgenson, as it appears she did break this story herself rather than picking it up, unattributed, from bloggers. Let me also say I am not necessarily the best person to carry on the tradition of Picking on Poor Gretchen. I experimented with journalism in my youth, and I know how difficult it can be to get enough actual facts in a short time to fill up the number of column inches your editor is expecting from you.

But the more I thought about the Times article, the harder it was to escape the conclusion that Brad Delong is right – the print dinosaurs are doomed, and they have done it to themselves. The first few paragraphs of Morgenson’s purported article are appallingly fact-free and hyperbolic, or as Tanta put it, “Morgenson’s valid points are drowning in a sea of sensational swill.”

The article begins:

FOR decades, when troubled homeowners and banks battled over delinquent mortgages, it wasn’t a contest. Homes went into foreclosure, and lenders took control of the property.Morgenson deserves credit for finding this story, but it is hardly the first foreclosure-gone-wrong story of the decade, or even of the “recent foreclosure wave.” Morgenson has apparently forgotten the redoubtable Judge Boyko, who dismissed some Ohio foreclosure complaints in 2007 based on somewhat similar facts. We know Morgenson covered that story, so it is not clear to me whether the “decades” of judicial neglect and rubber stamping occurred before 2007 or after. But, well, whatever.

On top of that, courts rubber-stamped the array of foreclosure charges that lenders heaped onto borrowers and took banks at their word when the lenders said they owned the mortgage notes underlying troubled properties.

* * *

But some judges are starting to scrutinize the rules-don’t-matter methods used by lenders and their lawyers in the recent foreclosure wave.

So What Happened In This Case?

Most of the sensational swill is in the first few paragraphs of this Times story. Once you get past the first third, Morgenson’s facts are basically correct. Unfortunately, much of the context is missing. For example, one of the things you would never guess from reading the Times article is that it matters whether you’re talking about a bankruptcy case or a foreclosure case. That is Takeaway Lesson Number One from this case: Bankruptcy is different from foreclosure.

The purpose of a foreclosure case is usually to allow a lender to take back collateral after the borrower stops paying on a loan. It should not be a surprise that lenders often win such cases, frequently by default. By contrast, the purpose of a bankruptcy case is to allow the debtor to restructure debt, distribute the available assets fairly among creditors, and extinguish debt that can’t realistically be paid. It should not be surprising that debtors “win” bankruptcy cases more often than foreclosure cases, especially if the debtor can show the lender has not followed the rules.

I will call the debtor in this case “Olga.” Her last name is redacted because she doesn’t seem to be seeking publicity. Olga filed bankruptcy under Chapter 13, which is a section of the bankruptcy code allowing individuals with regular income to develop a three or five year plan to pay their debts under supervision of a trustee. The debtor is protected from bill collectors, and most debts that can’t reasonably be paid are discharged. Chapter 13 theoretically allows the debtor to keep a mortgaged home if the debtor can catch up on payments within the plan period. The bankruptcy judge does not have the power to change the loan contract much, though, so many people can’t keep their homes using Chapter 13 unless the lender can somehow be “persuaded” to modify the loan.

But Olga was willing to try. She gave notice to creditors and filed a plan, among other things, and her mortgage servicer (PHH Mortgage Corp.) filed a proof of claim with a schedule stating how much was allegedly owed on Olga’s house. Olga’s lawyer noticed that PHH’s paperwork was not very complete, so he sent some information requests. He was not satisfied with the response, so he filed a motion to have PHH’s proof of claim expunged.

Olga’s Motion to Expunge

Mortgage servicers have important rights under the various contracts associated with the loan, but the servicer frequently is not, and PHH in this case was not, the actual owner of the note or the mortgage. In addition, the paperwork provided by PHH was woefully incomplete. Woefully incomplete paperwork can mean something different in bankruptcy than it does in foreclosure.

When your paperwork is woefully incomplete in a foreclosure case, you can ask for a delay or you can drop the case or have it dismissed, and you usually get another chance. Bankruptcy, by contrast, is kind of a one-shot deal by nature. The judge will add up all the debts, add up all the money available, approve a plan, and that’s it. Very limited do-overs.

Olga’s motion listed a number of problems:

These items are explained a little bit more in Olga’s Response to the lender’s objection to her motion to expunge the proof of claim, which is a pretty good summary of things borrowers might want to think about when they are considering whether to contest foreclosures. MERS was a nominee at some point, but was not directly involved in the case.

My impression is that Olga’s lawyer did not expect the proof of claim to be expunged, and was primarily interested in getting more information and forcing the lender to negotiate. Bankruptcy Judge Robert Drain had other ideas – he expunged the claim.

The Aftermath

This is probably not the end of the story because, as Olga’s lawyer explained, a title company probably will not insure the title if Olga tries to sell the house without taking any further action. Judge Drain did not explain much in his order, but what seems to have gotten his attention is the likelihood that the note and mortgage really never were properly assigned to the securitization trust.

Takeaway Lesson Number Two from this case is that, if Judge Drain is right, this is not a nothingburger. This could apply to a large number of securitized mortgages based on the language of the securitization documents themselves, not on the quirks of local law. The decision has been appealed to the district court, so we will likely find out more unless the case settles.

Morgenson also noted that this decision was by a “federal judge.” It is probably worth noting that bankruptcy judges are not quite the same as U.S. District Court judges. Bankruptcy judges are not appointed for life, they only have jurisdiction over matters that are related to bankruptcy, and their decisions are appealable to a District Court judge, as happened in this case. But bankruptcy judges have a lot of power over core bankruptcy matters. This particular judge was the one who slashed executive compensation in the Delphi case.

In my opinion, Takeaway Lesson Number Three is this: lenders would probably have been better off with a reasonable cramdown provision in the bankruptcy laws. As Tanta explained in her cramdown post, home mortgages were often modified in bankruptcy proceedings before 1993. Morgenson’s claim that all types of court proceedings have uniformly favored lenders “for decades” is wrong, but the bankruptcy laws got a lot worse for consumers in 1993 and again in 2005. In the absence of reasonable solutions imposed by a bankruptcy judge, lawyers for debtors and home mortgage lenders sometimes act like Reagan and Brezhnev, threatening each other with nuclear options and hoping none of the tactical warheads go off prematurely. Which is what seems to have happened in this case.

CR Note: This is a guest post from albrt.

Home Buyer Tax Credit Revision

by Calculated Risk on 10/28/2009 05:54:00 PM

From Bloomberg: Senate Said to Revise Plan to Extend, Expand Homebuyer Credit (ht Anthony)

The article states the plan might still change .

The details:

The key change from yesterday is the increase in income limits for first-time home buyers (and somewhat minor changes to the size of the tax credit).

Report: The WaMu "Bank Run" Rumors were True

by Calculated Risk on 10/28/2009 03:17:00 PM

In July 2008 there were persistent rumors of a bank run at WaMu. According to a fascinating piece by Kirsten Grind at the Puget Sound Business Journal, the bank run was more than a rumor ...

From Ms. Grind: The downfall of Washington Mutual

To recreate WaMu’s final days, the Puget Sound Business Journal examined hundreds of pages of documents obtained through the Freedom of Information Act and interviewed dozens of former WaMu executives and employees, as well as government regulators and outside observers.There is much more in the article.

...

These interviews show that WaMu suffered through not one but two bank runs in its final months. ...

In early July 2008, hundreds of people lined up outside the headquarters of IndyMac Bank in Pasadena, Calif. ... Fearing the bank was on the verge of failure, customers were pulling out their money. The line stretched down the block. ...

Two blocks away, managers at a large, white-columned WaMu branch watched the commotion. Soon, their own customers began asking, “Is my money safe?”

...

Through a flurry of sometimes heated emails, managers ... worked out a rough plan. WaMu’s deposit team would forecast the potential size of a run, based on daily data about cash outflows. Branch managers would try to reassure anxious customers. ...

Despite these efforts, WaMu suffered a $9.4 billion run — seven times bigger than IndyMac’s. Southern California became the epicenter, although customers all around the country pulled out cash. Unlike IndyMac, however, WaMu executives kept the five-alarm fire under wraps. No lines formed down the block. No TV cameras splashed the news. Shareholders never knew, either.

emphasis added

Ms. Grind also notes that the Inspector General is expected to release a report on the WaMu failure soon.

Another Home Buyer Tax Credit Update

by Calculated Risk on 10/28/2009 12:53:00 PM

Yesterday I heard a compromise had been reached on extending and expanding eligibility for the home buyer tax credit, and that the housing tax credit would be attached to the extension of unemployment benefits, and that the Senate would vote today - and a House vote would follow shortly.

Hold on ...

Albert Buzzo at CNBC reports: Senate Vote On Home-Buyer Tax Credit Unlikely Today. Buzzo says there is "no chance" the Senate will vote today on the home buyer's tax credit.

There was hope last night that a vote on one of several versions might be voted on Wednesday but a battle over legislation extending unemployment benefits is taking priority and right now there's "no agreement" on that issue ...CNBC's Diana Olick provides the same details that I heard on the tax credit: A Compromise on Home Buyer Tax Credit? and adds:

[T]here may have been a bit of a revolt among Democrats who didn't want the controversial measure attached to the Unemployment Insurance bill.And from Andy Sullivan and Corbett Daly at Reuters:

Reid had wanted to attach a bill to extend the homebuyer credit as an amendment to a bill to lengthen insurance benefits for unemployed workers. The Senate voted 87-13 on Tuesday to take up the insurance benefit bill, but did not attach the homebuyer tax credit to the measure as Reid had wanted.As Ms. Olick concluded: "Stay tuned. It could all change dramatically."

Despite that apparent roadblock, Senate Finance Committee Chairman Max Baucus, who has been involved in negotiations over the tax credit, told Reuters late on Tuesday that he expected the Senate would vote on the bill sometime this week.

New and Existing Home Sales: The Distressing Gap

by Calculated Risk on 10/28/2009 11:30:00 AM

Note: For graphs based on the new home sales report this morning, please see: New Home Sales Decrease in September

This is obvious but worth stating: new home sales are far more important for employment and the economy than existing home sales. When an existing home is sold, the housing stock doesn't change, and the only direct contribution to the economy are the transaction costs. When a new home is sold, the housing stock of the nation increases, and there is a significant amount of spending on material and labor.

During the housing bust, new home sales fell much further than existing home sales (as a percent of sales). I've jokingly referred to the difference in percentage declines as the "Distressing" gap, because of all the distressed sales of existing homes.

More recently the gap has been supported by misdirected government policy.

Here is a graph of the "gap":  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows existing home sales (left axis) and new home sales (right axis) through September.

I believe this gap was initially caused by distressed sales, but more recently the gap has also been widened as a result of the first-time home buyer tax credit.

The second graph shows the same information, but as a ratio for existing home sales divided by new home sales. The ratio is now at an all time record high.

The ratio is now at an all time record high.

Although distressed sales will stay elevated for some time, eventually I expect this ratio to decline back to the previous ratio.

The ratio could decline because of an increase in new home sales, or a decrease in existing home sales - I expect a combination of both.

Although I think we've seen the bottom for new home sales, I think we will see further declines in existing home sales as the impact of the home-buyer tax credit wanes, and as we see fewer distressed sales in low priced areas.

New Home Sales Decrease in September

by Calculated Risk on 10/28/2009 10:00:00 AM

The Census Bureau reports New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 402 thousand. This is a decrease from the revised rate of 417 thousand in August (revised from 429 thousand). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. Sales in September 2009 (31 thousand) were below September 2008 (35 thousand). This is the 3rd lowest sales for September since the Census Bureau started tracking sales in 1963.

In September 2009, 31 thousand new homes were sold (NSA); the record low was 28 thousand in September 1981; the record high for September was 99 thousand in 2005. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but are now 22% above the low in January.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but are now 22% above the low in January.

Sales of new one-family houses in September 2009 were at a seasonally adjusted annual rate of 402,000 ...And another long term graph - this one for New Home Months of Supply.

This is 3.6 percent (±10.2%)* below the revised August rate of 417,000 and is 7.8 percent (±12.0%)* below the September 2008 estimate of 436,000.

There were 7.5 months of supply in September - significantly below the all time record of 12.4 months of supply set in January.

There were 7.5 months of supply in September - significantly below the all time record of 12.4 months of supply set in January.The seasonally adjusted estimate of new houses for sale at the end of September was 251,000. This represents a supply of 7.5 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

Months-of-supply and inventory have both peaked for this cycle, and new homes sales has probably also bottomed for this cycle. Sales were probably impacted by the end of the first-time home buyer tax credit (because of timing, new home sales are impacted before existing home sales).

New home sales are far more important for the economy than existing home sales, and new home sales will remain under pressure until the overhang of existing homes declines much further.

I'll have more later ...

MBA: Mortgage Applications Decrease

by Calculated Risk on 10/28/2009 08:32:00 AM

The MBA reports: Mortgage Applications Decrease

The Market Composite Index, a measure of mortgage loan application volume, decreased 12.3 percent on a seasonally adjusted basis from one week earlier. ...The purchase index is off almost 17% over the last 3 weeks, and the refinance index is off about 30%.

The Refinance Index decreased 16.2 percent from the previous week and the seasonally adjusted Purchase Index decreased 5.2 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.04 percent from 5.07 percent, with points increasing to 1.25 from 1.13 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

It appears the post home buyer tax credit slump has started, although apparently the tax credit will be extended and the eligibility expanded - so the slump might be delayed ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

The Purchase index declined to 254.9, and the 4-week moving average declined to 280.

Note: The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007, even though activity was actually declining.

Tuesday, October 27, 2009

Report: GMAC in Talks for Bailout, and Summary

by Calculated Risk on 10/27/2009 08:23:00 PM

A busy day ... here is a summary:

Income eligibility for first-time home buyers stays at $75,000 for individuals, and $150,000 for couples. For move-up buyers, income eligibility is $125,000 for individuals and $250,000 for couples. There is a minimum 5 year residency requirement - in their current home - for move-up home buyers. The tax credit is the lesser of $7,290 or 10% of the purchase price. The credit runs from Dec. 1, 2009 to April 30, 2010, with an additional 60 day period to close escrow. (So end of April to sign contract, end of June to close escrow) Expect bill to be signed by Friday, packaged with the unemployment benefit extension.

Boston Properties Inc. ... reported Tuesday ... that gross rents declined 17% when comparing what new tenants are paying with the rent that had been paid by old tenants occupying that space. ... The results follow similar releases Monday by SL Green Realty Corp. (SLG), one of New York's largest office landlords, and Liberty Property Trust (LRY), of Malvern, Pa., which owns 700 properties including offices and light manufacturing.Earlier I posted some interesting comments from the Liberty Property Trust conference call.

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.5% from the peak, and up about 1.0% in August.

The Composite 20 index is off 31.3% from the peak, and up 1.0% in August.

Prices increased in 16 of the 20 Case-Shiller cities.