by Calculated Risk on 12/01/2008 10:00:00 AM

Monday, December 01, 2008

Construction Spending Declines in October

The Census Bureau reported this morning that private non-residential construction decreased in October with declines in both residential and non-residential spending. I expect that non-residential investment will decline sharply over the next year or two.

From the Census Bureau: September 2008 Construction at $1,060.1 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $756.5 billion, 2.0 percent (±1.1%) below the revised September estimate of $771.9 billion. Residential construction was at a seasonally adjusted annual rate of $338.8 billion in October, 3.5 percent (±1.3%) below the revised September estimate of $351.2 billion. Nonresidential construction was at a seasonally adjusted annual rate of $417.7 billion in October, 0.7 percent (±1.1%)* below the revised September estimate of $420.6 billion.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The graph shows private residential and nonresidential construction spending since 1993.

Nonresidential spending had been strong as builders completed projects, but there is substantial evidence of a slowdown - less lending for new projects, less work for architects - and it appears the expected slowdown in non-residential spending has arrived. On the graph nonresidential spending has been relatively flat for the last few months, but I expect some serious cliff diving over the next 18 months.

The second graph shows the year-over-year change for private residential and non-residential construction spending.

The YoY change in non-residential spending is starting to slow down and will probably turn negative later this year or early in 2009.

It now looks like investment in non-residential structures will negatively impact GDP in Q4. This had been one of the few bright spots for the economy.

Tuesday, November 18, 2008

CRE: Environmental site assessments down sharply

by Calculated Risk on 11/18/2008 11:53:00 AM

Another indicator that the CRE slump is here from HousingWire: Study: Real Estate Woes Move into CRE

Residential real estate woes are spreading into commercial real estate markets across the nation, with a report released Tuesday morning showing a 17 percent annual decline in the number of environmental site assessments conducted across the U.S. in the third quarter.The non-residential investment slump will be a signficant drag on Q4 GDP. Goldman Sachs is estimating business investment will subtract 0.8% from GDP in Q4 (worst case 2.7%!).

The data, released as part of a report from Environmental Data Resources Inc., is a key leading indicator of overall CRE market health; phase I environmental site assessments (called ESAs, in industry speak) are a standard pre-closing activity for many commercial real estate transactions.

Monday, November 17, 2008

Forecast: 2009 Hotel Occupancy Rate to be Lowest Since 1971

by Calculated Risk on 11/17/2008 03:38:00 PM

From PricewaterhouseCoopers: PricewaterhouseCoopers Forecasts a Substantial Reduction in Hotel RevPAR in 2009

According to the PwC forecast, 2008 RevPAR will decrease by 0.8 percent, primarily due to a 3.7 percent decrease in occupancy, the highest annual decrease in occupancy since 2001. In 2009, demand is forecast to decrease by 2.0 percent, which, when coupled with a 1.6 percent increase in supply, is expected to further reduce occupancy to 58.6 percent, the lowest since 1971.Note: RevPAR is revenue per available room. The article also mentions ADR: average daily room rate.

...

"The deteriorating outlook for the economy is impacting travel habits and spending, and hotels are expected to experience reduced occupancy levels, and to a lesser degree, some room rate erosion through 2009," said Scott Berman, principal and U.S. Leader of PricewaterhouseCoopers' Hospitality and Leisure practice.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the annual occupancy rate for the last 50 years. The data is from PricewaterhouseCoopers LLP (1958 to 1986), and Smith Travel Research (1987 to 2007).

The PricewaterhouseCoopers forecast for 2008 and 2009 are in red. Note: The y-axis starts at 50% to better show the change.

Just more evidence of the coming slowdown in non-residential investment.

Thursday, November 13, 2008

Office Vacancy Rate Doubles in Bend, Oregon

by Calculated Risk on 11/13/2008 07:09:00 PM

This is a story that is playing out everywhere ...

Click on graph for larger image in new window.

Credit: Greg Cross, The Bulletin.

This graph from The Bulletin shows the office and industrial vacancy rates in Bend, Oregon. The office vacancy rate has doubled from last year and has almost tripled from the low in Q1 2007.

From Jeff McDonald at The Bulletin: More offices empty as demand goes soft

The vacancy rate in Bend’s office market more than doubled from third quarter 2007 to third quarter 2008, to 17.1 percent ... The vacancy rate is the highest in at least 15 years, said Darren Powderly, a Bend-based broker for Compass Commercial Real Estate Services ...This happened in many places across the country - demand for offices increased with the housing bubble, developers responded by building new office buildings (and industrial buildings, malls and hotels) and now demand is waning just as the new buildings are coming on line.

[T]he spike in demand for office space that occurred during the boom years between 2004 and 2006 resulted in a glut of new office buildings that appeared on the market this year — just as demand levels waned with the economic downturn ...

The good news is very little building is planned for 2009, so vacancy rates are expected to flatten in Redmond and Bend, Powderly said.

The "good news" in the article is that "little building is planned for 2009". That is also happening everywhere, and while less building might be good news for building owners, it also means a significant decline in non-residential investment in 2009.

Wednesday, November 12, 2008

Macy's Sharply Reduces 2009 Planned Capital Expenditures

by Calculated Risk on 11/12/2008 12:10:00 PM

From an 8-K SEC filing this morning:

"In recognition of the weak economy, we reduced our budget for 2009 capital expenditures from approximately $1 billion to a range of $550 million to $600 million, compared with approximately $950 million in 2008."This significant reduction in 2009 capital expenditures appears widespread (many companies are announcing reduced CapEx for 2009) - and this will hit non-residential investment in both structures and equipment. This is another blow for commercial real estate.

Terry J. Lundgren, Macy's, Nov 12, 2008

Monday, November 03, 2008

Construction Spending in September

by Calculated Risk on 11/03/2008 10:00:00 AM

The Census Bureau reported this morning that private non-residential construction increased slightly in September from August, but spending is still below the peak in June 2008. I expect that non-residential investment will decline sharply over the next year or two.

From the Census Bureau: September 2008 Construction at $1,060.1 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $751.7 billion, 0.1 percent above the revised August estimate of $751.1 billion. Residential construction was at a seasonally adjusted annual rate of $336.5 billion in September, 1.3 percent below the revised August estimate of $340.8 billion.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The graph shows private residential and nonresidential construction spending since 1993.

Nonresidential spending had been strong as builders completed projects, but there is substantial evidence of a looming slowdown - less lending for new projects, less work for architects - and it appears the expected slowdown in non-residential spending has arrived.

The second graph shows the year-over-year change for private residential and non-residential construction spending.

The YoY change in non-residential spending is starting to slow down and will probably turn negative later this year or early in 2009.

It now looks like investment in non-residential structures will negatively impact GDP in Q4. This had been one of the few bright spots for the economy.

Friday, October 31, 2008

Q3: Office, Malls and Lodging Investment

by Calculated Risk on 10/31/2008 09:04:00 AM

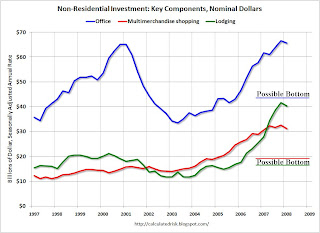

Here are a couple of graphs for non-residential structure investment based on the underlying details for the Q3 GDP report.

Based on tighter lending standards, rising vacancy rates (lower occupancy rate for hotels), and the Architectural Billing index, and declining non-residential construction spending, it appears there will be a sharp slowdown in investment in offices, malls and hotels at the end of 2008 and through 2009.

So far this slowdown is not showing up in the BEA numbers. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Investment in multimerchandise shopping structures (malls) increased slightly in Q3 2008, after peaking in Q4 2007.

Investment in lodging soared in Q3 to $48.3 billion (SAAR) from $36.5 billion (SAAR) in Q3 2007. This is probably due to builders rushing to finish projects.

This investment in lodging will probably decline sharply in the 2nd half of '08 and in '09 as builders cancel or postpone projects. As an example, from the WSJ: MGM Mirage Suspends Casino Projects as Profit Falls

Predevelopment work has been done on the MGM Grand Atlantic City, but the company will halt development until the economy and capital markets "are sufficiently improved," said Chairman and Chief Executive Terry Lanni.

He added that design and preconstruction work on its Las Vegas joint venture with Kerzner International and Istithmar is also being deferred.

MGM has been struggling to find financing to complete construction of its $11 billion CityCenter project on the Las Vegas Strip.

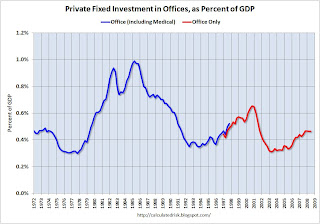

The second graph shows office investment as a percent of GDP since 1972. Office investment increased slightly in Q3 2008 in nominal dollars, but decreased slightly as a percent of GDP.

The second graph shows office investment as a percent of GDP since 1972. Office investment increased slightly in Q3 2008 in nominal dollars, but decreased slightly as a percent of GDP.With the office vacancy rate rising sharply, office investment will probably decline through 2009.

NOTE: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

I expect investment in all three categories - malls, lodging and offices - to decline through 2009.

Thursday, October 30, 2008

Office Vacancy Rate vs. Unemployment

by Calculated Risk on 10/30/2008 12:27:00 PM

One of the key components of non-residential structure investment is construction of new offices. When the supplemental data is released for Q3 GDP, I expect it will show that office investment started to decline in the most recent quarter - and I expect office investment will decline significantly over the next year.

The following graphs show office vacancy rate vs. unemployment (hat tip Will). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the office vacancy rate vs. the quarterly unemployment rate and recessions.

Changes in the unemployment rate and the office vacancy rate are highly correlated. As the unemployment rate continues to rise over the next year or more, we'd expect the office vacancy rate to rise too. And this will discourage investment in new office structures - and put significant pressure on office rents and prices. The second graph shows the relationship between the office vacancy rate and the unemployment rate using data starting in Q1 1991. The unemployment rate is from the BLS and the office vacancy rate is from REIS.

The second graph shows the relationship between the office vacancy rate and the unemployment rate using data starting in Q1 1991. The unemployment rate is from the BLS and the office vacancy rate is from REIS.

I've added the polynomial trend line (with R^2 of 0.88). The two most recent quarters are marked in red.

This suggests that office vacancy rates are currently below the expected level, and vacancy rates will probably increase sharply over the next year.

Investment in Structures: Residential vs. Non-Residential

by Calculated Risk on 10/30/2008 09:09:00 AM

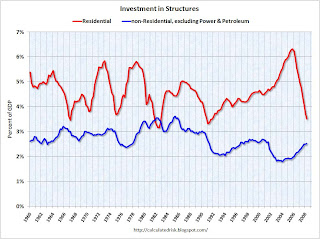

The following graph shows residential investment compared to investment in non-residential structures as a percent of GDP since 1960. All data from the BEA.

Note: Residential investment is primarily single family structures, multi-family structures, commissions, and home improvement. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The recent housing boom and bust is very clear (in red).

Residential investment was 3.3% of GDP in Q3 2008, the lowest level since 1982 (just under 3.2%).

Non-residential investment in structures increased to almost 4% of GDP in Q3. This investment is slowing down right now (the Census Bureau has reported declines in non-residential investment for the last two months), and investment in non-residential structures will almost certainly be negative in Q4.

The positive contributions to GDP were exports, government spending, and investment in non-residential structures. Non-residential structures will be negative in Q4, and exports are slowing - so Q4 GDP will probably be much worse than Q3.

Note: I'll have much more on non-residential investment in offices, malls and hotels when the underlying details are released in a few days.

Monday, October 27, 2008

Non-Residential Investment: WalMart Spending to Decline

by Calculated Risk on 10/27/2008 03:44:00 PM

From MarketWatch: Wal-Mart U.S. to add remodels, trim new store growth

Capital spending for Wal-Mart U.S. is expected to decline to $5.8 billion to $6.4 billion for fiscal 2009 from $9.1 billion last year. For fiscal 2010, capital spending is pegged at $6.3 billion to $6.8 billion ...Just more evidence of the imminent non-residential construction downturn.

Wednesday, October 01, 2008

Non-Residential Construction Spending Declines

by Calculated Risk on 10/01/2008 10:00:00 AM

It now appears that private non-residential construction has peaked, and I expect non-residential investment will decline sharply over the next year.

From the Census Bureau: August 2008 Construction at 1,072.1 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $759.6 billion, 0.3 percent below the revised July estimate of $761.8 billion.

Residential construction was at a seasonally adjusted annual rate of $343.6 billion in August, 0.3 percent above the revised July estimate of $342.5 billion.

Nonresidential construction was at a seasonally adjusted annual rate of $416.0 billion in August, 0.8 percent below the revised July estimate of $419.3 billion.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The graph shows private residential and nonresidential construction spending since 1993.

Nonresidential spending has been strong as builders complete projects, but there is substantial evidence of a looming slowdown - less lending for new projects, less work for architects - and it appears the expected slowdown in non-residential spending has arrived.

The second graph shows the year-over-year change for private residential and non-residential construction spending.

The YoY change in non-residential spending is starting to slow down and will probably turn negative later this year or early in 2009.

Not only has Personal Consumption Expenditures (PCE) turned negative in Q3, but it now looks like non-residential investment in structures is starting to decline. This was one of few bright spots in the economy (along with exports), and a decline in non-residential investment is more evidence of a recession.

Wednesday, September 10, 2008

Investment: Residential vs. Non-Residential

by Calculated Risk on 9/10/2008 09:55:00 PM

Since investment in non-residential structures is about to slow (especially malls, hotels, and offices), a key question is how did the commercial real estate (CRE) investment boom compare to the residential housing bubble?

The following graph shows residential investment compared to investment in non-residential structures (excluding Power and Petroleum exploration) as a percent of GDP since 1960. All data from the BEA.

Note: Residential investment is primarily single family structures, multi-family structures, commissions, and home improvement. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The recent housing boom and bust is very clear (in red). But this shows that the recent boom in non-residential investment (ex power and petro) was not as excessive as the housing bubble.

Also, the recent boom for CRE was much less than the S&L related boom in the '80s, and even less than the late '90s office boom.

Some areas of non-residential investment have been overbuilt (especially hotels and malls, and offices somewhat). But those looking for a collapse in CRE investment of the same size as the current residential investment bust are wrong.

Tuesday, August 05, 2008

Q2 Office, Hotel and Mall Investment

by Calculated Risk on 8/05/2008 03:18:00 PM

A couple more graphs based on the underlying details for the Q2 GDP report.

Based on tighter lending standards, rising vacancy rates (lower occupancy rate for hotels), and the Architectural Billing index, it appears there will be a sharp slowdown in investment in offices, malls and hotels in the 2nd half of 2008.

However, as of Q2 2008, only mall investment is declining - in fact, investment in lodging soared in Q2! Click on graph for larger image in new window.

Click on graph for larger image in new window.

Investment in multimerchandise shopping structures (malls) declined slightly in Q2 2008, after peaking in Q4 2007.

Investment in lodging soared in Q2 to $46.1 billion (SAAR) from $40.4 billion (SAAR) in Q1. This is probably due to builders rushing to finish projects.

This investment in lodging will probably decline sharply in the 2nd half of '08 as builders cancel or postpone projects. As an example, from CNNMoney: Boyd Gaming suspends Vegas casino-resort project (hat tip Erik)

[C]asino operator Boyd Gaming Corp. announced Friday that it will stop work for nine months to a year on a $4.8 billion mega development.

The Echelon [includes] nearly 5,000 guest rooms in five hotels ...

The second graph shows office investment as a percent of GDP since 1972.

The second graph shows office investment as a percent of GDP since 1972.NOTE: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

This shows the huge over investment in offices in the '80s due to the S&L lending. This graph also shows the office building boom associated with the stock market bubble. The office bubble is smaller this time, but I expect investment to decline for all three categories - offices, lodging and malls - in the 2nd half of 2008.

Thursday, July 31, 2008

The Coming Hotel Bust

by Calculated Risk on 7/31/2008 12:17:00 PM

From Abha Bhattari and Fred Bernstein at the NY Times: Terrible Timing for a Hotel Boom

A record number of hotels are opening this year, and the timing could not be worse.Back in May I relayed a conversation I had with well known hospitality attorney Jim Butler. At that time it was clear that financing for hotels was becoming significantly tighter (see earlier post for his comments). For anyone interested, Jim writes a blog on hotel legal issues: Hotel Law Blog

...

Until recently, the industry was in the midst of a major boom, and it was during those good times that the hotel companies made plans to build many of the new rooms. ... Nationwide, hotel occupancy levels have been hovering around 65 percent, down about 5 percentage points from last year, according to Smith Travel Research.

...

The industry now has about 6,000 new hotels, with nearly 800,000 rooms, under development, a 27 percent increase from last year, according to Lodging Econometrics ...

I also posted this graph comparing investments in lodging vs investments in other non-residential structures:

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the strong growth in lodging in recent years (from the BEA supplemental tables). I'll have an update soon for Q2.

Clearly lodging investment has been in a quite a boom (as the NY Times story noted). But occupancy

Lodging is one of the three key components of non-residential investment that I expect to decline sharply. The other two are office buildings and multimerchandise shopping (malls!).

GDP and Investment

by Calculated Risk on 7/31/2008 10:09:00 AM

The BEA reported that GDP increased 1.9% in Q2 2008 at a seasonally adjusted annual rate (SAAR). But the underlying details - especially for investment - are weak.

Residential investment (RI) declined at a 15.6% (SAAR).

Investment in equipment and software declined 3.4% (SAAR).

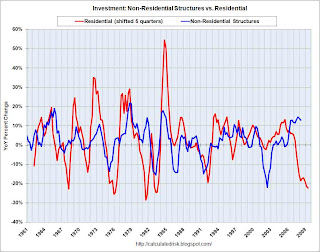

The lone bright spot for investment was non-residential investment in structures. Non-RI structure investment increased at a 14.4% SAAR. But all evidence suggests this investment is about to slow sharply. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This first graph shows the typical relationship between residential investment and non-residential investment in structures. Note that residential investment is shifted 5 quarters into the future on the graph (non-residential investment usually follows residential by about 4 to 7 quarters).

The current non-residential boom has gone on a little longer than normal, probably for two reasons: 1) there was a slump in investment following the bursting of the tech bubble, and 2) loose lending standards kept non-residential investment lending strong until mid-year 2007, and it takes time to build non-residential structures.

All signs suggest that the bust is now here, and non-residential investment will probably be a drag on GDP for the next year or more. The second graph shows non-residential investment as a percent of GDP. This shows the current boom is even greater than the boom in the late '90s.

The second graph shows non-residential investment as a percent of GDP. This shows the current boom is even greater than the boom in the late '90s.

Some of the current investment boom is energy related, and I'll break out the three key areas that will soon go bust - office buildings, multimerchandise shopping, and lodging - as soon as the underlying detail tables are available. The third graph shows residential investment (RI) as a percent of GDP.

The third graph shows residential investment (RI) as a percent of GDP.

RI as a percent of GDP is at 3.5%, just above the cycle lows in 1982 and 1991. It is possible that RI, as a percent of GDP, will bottom later this year (or possibly in early 2009) since inventory is finally declining (housing starts are now below housing sales).

When RI finally bottoms, the good news is RI will no longer be a drag on GDP, but the bad news is RI will probably not recovery quickly because of the huge overhang of inventory. Unfortunately, by the time RI bottoms, non-residential investment will probably have taken over as a significant drag on GDP - suggesting the recession will linger.

Investment is usually the key to the economy, and investment remains weak.

Monday, July 21, 2008

Office Investment

by Calculated Risk on 7/21/2008 02:20:00 PM

Recently I've posted articles on office vacancies in Orange County and San Diego. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is a photo from lunatic fringe in Orange County, CA:

[I drove] down the street and [to see] how leasing was going at the new office park at Jeffrey and the 5. It doesn't look too good, I think maybe 6-7 of the buildings were partially or fully leased and the remaining 15 or so were empty as can be. ... What's sad is this complex has been open for leasing since late 2007.The other photos showed mostly see through buildings too. And these are some of the smaller building for lease - along the 405 there are several much larger see throughs.

Office investment is one of the three key components of non-residential investment in structures that will probably decline in the 2nd half of 2008 (and into 2009). The three key areas are: office buildings, multimerchandise shopping, and lodging.

This graph shows the investment in each of the categories in nominal dollars. See here for investment as percent of GDP. My estimate for a possible investment bottom are marked in red, green and blue and labeled "possible bottom".

This graph shows the investment in each of the categories in nominal dollars. See here for investment as percent of GDP. My estimate for a possible investment bottom are marked in red, green and blue and labeled "possible bottom". Note: data from the BEA. The BEA started breaking out office and multimerchandise shopping in 1997.

This is why I keep posting on offices, malls, and hotels. Of these three categories, office investment is the largest, but was also the least overbuilt during the recent boom. Offices were overbuilt during the late '90s because of the stock bubble, so it took some time to get the current office boom started.

The second graph shows office investment as a percent of GDP since 1972.

The second graph shows office investment as a percent of GDP since 1972.NOTE: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

This shows the huge over investment in offices in the '80s due to the S&L lending (and eventual crisis). This graph also shows the office building boom associated with the stock market bubble.

The most recent office boom was smaller as a percent of GDP than the late '90s boom. However the booms for malls and lodging were larger this time - and the busts, on a percentage basis, will probably be larger for malls and lodging too. All three categories will see declines in investment later this year.

Thursday, July 10, 2008

WaPo: "Hotel boom is kaput"

by Calculated Risk on 7/10/2008 09:38:00 PM

From Michael Rosenwald at the WaPo: Slide by Marriott Signals Distress for Hotel Industry (hat tip John)

Let there be no mistaking it now: The hotel boom is kaput.This fits with my post yesterday: Hotel Vacancies Rising

Marriott International, one of the world's largest hotel operators, released a stream of unsettling news for the industry yesterday: Its second quarter profit fell 24 percent, to $157 million; it lowered yearly profit estimates again; and most importantly, it said revenue per available room, a key measure of hotel strength, could decrease this year in the United States by 1 percent.

"There's no doubt we are in a very turbulent period," said Thomas Baltimore, the president of Bethesda's RLJ Development, one of the largest owners of Marriott hotels. "Clearly we are seeing softening demand -- there's no doubt about that."

...

Chief executive Bill Marriott said in a statement that "while our hotels outside the U.S. continue to benefit from solid global demand, business conditions have deteriorated in the U.S. . . . We expect weak economic growth and soft U.S. lodging demand to persist into 2009."

Friday, June 06, 2008

Wal-Mart: Capital Spending Will be at Low End

by Calculated Risk on 6/06/2008 02:07:00 PM

From MarketWatch: Wal-Mart sees growth both in U.S., overseas

Chief Financial Financial Officer Tom Schoewe also said it's "highly likely" that Wal-Mart's capital spending this fiscal year will be at the low end of its previous estimate of $13.5 billion to $15.2 billion ...A billion less capital spending here, a billion there ... and the non-residential investment slump is here.

Monday, June 02, 2008

Construction Spending Declines in April

by Calculated Risk on 6/02/2008 10:11:00 AM

Construction spending declined in April for residential, but increased to for non-residential private construction.

From the Census Bureau: March 2008 Construction Spending at $1,123.5 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $823.8 billion, 0.5 percent below the revised March estimate of $827.7 billion.

Residential construction was at a seasonally adjusted annual rate of $435.8 billion in April, 2.3 percent below the revised March estimate of $445.8 billion.

Nonresidential construction was at a seasonally adjusted annual rate of $388.0 billion in April, 1.6 percent above the revised March estimate of $381.8 billion.

Click on graph for larger image.

Click on graph for larger image. The graph shows private residential and nonresidential construction spending since 1993.

Over the last couple of years, as residential spending has declined, nonresidential has been very strong. It appeared earlier this year that the expected slowdown in non-residential spending had arrived.

However, non-residential spending in April set a new nominal record (seasonally adjusted annual rate). This is a little surprising given tighter lending standards and reduced capital spending plans.

Wednesday, May 28, 2008

CRE: Orange County Non-Residential Permits Value off 40%

by Calculated Risk on 5/28/2008 04:35:00 PM

From Jon Lansner at the O.C. Register: O.C.’s commercial construction down in ‘08

The Construction Industry Research Board reports ... that the estimated value of permits for non-residential construction fell nearly 40% this year so far from the same period in 2007. Permit values fell to just under $527 million so far this year. Last year, developers received permits for projects valued at $873 million from January through April.Just more evidence of the CRE bust.