by Calculated Risk on 10/31/2008 09:04:00 AM

Friday, October 31, 2008

Q3: Office, Malls and Lodging Investment

Here are a couple of graphs for non-residential structure investment based on the underlying details for the Q3 GDP report.

Based on tighter lending standards, rising vacancy rates (lower occupancy rate for hotels), and the Architectural Billing index, and declining non-residential construction spending, it appears there will be a sharp slowdown in investment in offices, malls and hotels at the end of 2008 and through 2009.

So far this slowdown is not showing up in the BEA numbers. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Investment in multimerchandise shopping structures (malls) increased slightly in Q3 2008, after peaking in Q4 2007.

Investment in lodging soared in Q3 to $48.3 billion (SAAR) from $36.5 billion (SAAR) in Q3 2007. This is probably due to builders rushing to finish projects.

This investment in lodging will probably decline sharply in the 2nd half of '08 and in '09 as builders cancel or postpone projects. As an example, from the WSJ: MGM Mirage Suspends Casino Projects as Profit Falls

Predevelopment work has been done on the MGM Grand Atlantic City, but the company will halt development until the economy and capital markets "are sufficiently improved," said Chairman and Chief Executive Terry Lanni.

He added that design and preconstruction work on its Las Vegas joint venture with Kerzner International and Istithmar is also being deferred.

MGM has been struggling to find financing to complete construction of its $11 billion CityCenter project on the Las Vegas Strip.

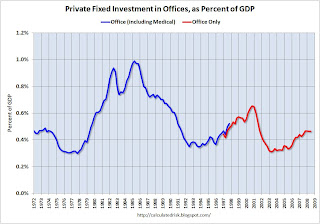

The second graph shows office investment as a percent of GDP since 1972. Office investment increased slightly in Q3 2008 in nominal dollars, but decreased slightly as a percent of GDP.

The second graph shows office investment as a percent of GDP since 1972. Office investment increased slightly in Q3 2008 in nominal dollars, but decreased slightly as a percent of GDP.With the office vacancy rate rising sharply, office investment will probably decline through 2009.

NOTE: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

I expect investment in all three categories - malls, lodging and offices - to decline through 2009.