by Calculated Risk on 12/01/2009 12:02:00 PM

Tuesday, December 01, 2009

Ford: U.S. November Sales Flat

From MarketWatch: Ford U.S. Nov. sales flat at 123,167 units

Update: CNBC is reporting Ford Motor November US Sales Rise 8.6% on an Adjusted Basis

UPDATE2:

This is a comparison to Nov 2008.

Click on graph for larger image in new window.

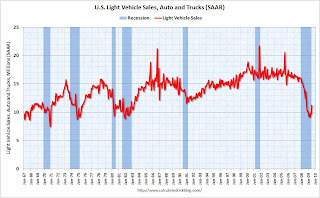

Click on graph for larger image in new window.This graph shows total U.S. light vehicle sales (seasonally adjusted annual rate) from the BEA since Jan 2006.

Sales declined sharply in Oct 2008, and fell further in November. On a year-over-year basis light vehicle sales declined slightly in October (Blue labels and arrow), but the comparison is easier for November (red data label for November 2008).

So the Ford numbers seem disappointing.

Once all the reports are released, I'll post a graph of the estimated total November sales (SAAR: seasonally adjusted annual rate) - usually around 4 PM ET.

Tuesday, November 03, 2009

A Look Back at a the GM Sales Forecast

by Calculated Risk on 11/03/2009 07:04:00 PM

Just one more post on auto sales ...

The following table is from the GM restructuring plan, presented to Treasury in mid-February (no longer available online).

This data is for all vehicles (the charts in the previous post excluded heavy trucks). All information in Red is added. Click on graph for larger image in new window.

Click on graph for larger image in new window.

GM overestimated sales in Q2. Of course they weren't planning on going bankrupt! And GM underestimated sales in Q3 because of cash-for-clunkers.

Overall their forecast has been pretty close for 2009.

And I wouldn't be surprised to see sales increase to 12 million plus in 2010, even with a sluggish recovery. That is about the replacement level for auto sales.

The real question mark is what happens in the later years. Although total sales in the U.S. were above 17 million for several years, some of those sales were probably the result of incentives and loose lending (buying cars using home equity, and many subprime auto loans). I doubt we will see a return to those practices any time soon.

I'd like to emphasize that the 10.5 million (SAAR) for light vehicles in October is a very low number, and is close to the average sales rate during the early '80s recession.

If sales increase to 12 million in 2010 that would still be worse than the depths of the '91 recession.

Light Vehicle Sales 10.5 Million (SAAR) in October

by Calculated Risk on 11/03/2009 04:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for October (red, light vehicle sales of 10.46 million SAAR from AutoData Corp). The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Obviously sales were boosted significantly by the "Cash-for-clunkers" program in August and some in July.

This was the first month over a 10 million sales rate (SAAR) - excluding July and August - since December 2008. Still very low ...

Ford: U.S. Oct. sales rise 2.6%

by Calculated Risk on 11/03/2009 12:02:00 PM

From MarketWatch: U.S. Oct. sales rise 2.6% to 132,483 vehicles

This is a comparison to Oct 2008.

Update: From MarketWatch: Chrysler U.S. Oct sales drop 30.4%

Toyota U.S. Oct. sales near flat

GM U.S. Oct. sales rises 4.1%

Once all the reports are released, I'll post a graph of the estimated total October sales (SAAR: seasonally adjusted annual rate) - usually around 4 PM ET.

Thursday, October 01, 2009

Light Vehicle Sales 9.2 Million (SAAR) in September

by Calculated Risk on 10/01/2009 03:38:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for September (red, light vehicle sales of 9.22 million SAAR from AutoData Corp).

This is the third lowest vehicle sales this year. The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Obviously sales were boosted significantly by the "Cash-for-clunkers" program in August and some in July. Although this wasn't as bad as some of the lower forecasts, it was still below most estimates.

Note: the answer to the earlier poll was 746 thousand (not seasonally adjusted sales).

Wednesday, September 23, 2009

DOT: Vehicle Miles increase in July

by Calculated Risk on 9/23/2009 10:49:00 AM

Although vehicle miles increased in July 2009 compared to July 2008, miles driven are still 1.3% below the peak for the month of July in 2007.

The Dept of Transportation reports on U.S. Traffic Volume Trends:

Travel on all roads and streets changed by +2.3% (5.8 billion vehicle miles) for July 2009 as compared with July 2008. Travel for the month is estimated to be 263.4 billion vehicle miles.

Cumulative Travel for 2009 changed by 0.0% (-0.6 billion vehicle miles).

Click on graph for larger image in new window.

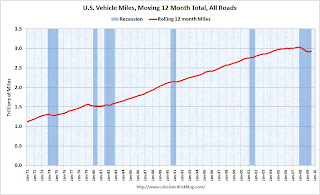

Click on graph for larger image in new window.The first graph shows the rolling 12 month of U.S. vehicles miles driven.

By this measure (used to remove seasonality) vehicle miles declined sharply, and are set to slowly increase.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT. As the DOT noted, miles driven in July 2009 were 2.3% greater than in July 2008.

Year-over-year miles driven started to decline in December 2007, and really fell off a cliff in March 2008. This makes for an easier comparison for July 2009.

Tuesday, September 01, 2009

Light Vehicle Sales 14.1 Million (SAAR) in August

by Calculated Risk on 9/01/2009 04:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for August (red, light vehicle sales of 14.09 million SAAR from AutoData Corp).

This is the highest vehicle sales since May 2008 (14.23 million SAAR). The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Obviously sales were boosted significantly by the "Cash-for-clunkers" program. Although this wasn't as bad as some of the lower forecasts, it still a disappointing number.

The real question is: What happens in September?

Autos: Ford U.S. August sales rise 17%

by Calculated Risk on 9/01/2009 12:08:00 PM

From MarketWatch: Ford U.S. August sales rise 17%

Ford Motor Co. said Tuesday that total U.S. sales in August rose 17% to 182,149 vehicles from 155,690 last year.From MarketWatch: Volkswagen U.S. August sales rise 11.4%

From MarketWatch: Daimler U.S. August sales fall 10.5%

Update: MarketWatch: Chrysler U.S. August sales decline 15%

Toyota, GM and more to come.

Once all the reports are released, I'll post a graph of the estimated total August sales (SAAR: seasonally adjusted annual rate). The range of estimates for August have been very wide because of the Clunker program - from a low of 13 million SAAR to a high of about 16 million SAAR.

Monday, August 31, 2009

Clunkers and August Auto Sales

by Calculated Risk on 8/31/2009 08:23:00 PM

There is no question auto sales will decline sharply in September, but there is a pretty amazing range of estimates for August ... a couple of excerpts:

From the WSJ: Next for Auto Sector, Post-Clunker Hangover

Auto sales for August, due out by Tuesday afternoon, are expected to come in between 13 million SAAR, or the seasonally adjusted annual rate of car sales, and 16 million.And from Bloomberg: U.S. Auto-Sales Rate May Be Highest Since April 2008

U.S. auto sales in August probably will run at the highest rate since April 2008 after the federal government’s “cash for clunkers” rebates fueled demand.There probably were 550 thousand clunker related sales in August, but the question is the number of non-clunker sales. If there was little cannibalization of regular sales, non-clunker sales would probably be close to 800 thousand. August is usually a strong sales month, and adjusting for seasonal factors, this would suggest a sales rate close to 16 million SAAR.

The so-called seasonally adjusted annual rate for this month will be 14.3 million, the average estimate of 10 analysts surveyed by Bloomberg.

...

August sales results, released tomorrow, will reflect more than three weeks of transactions under the clunkers program, which ran from July 27 through Aug. 24.

From Dow Jones: Edmunds.com Sees Aug US Auto Sales Up 18%; Wary On Sept

Edmunds.com is projecting August U.S. new-vehicle sales of about 1.17 million and a seasonally adjusted annualized rate of slightly more than 13 million.A sales rate of 13 million SAAR - although the highest rate since last August - would have to be considered very disappointing.

Thursday, August 27, 2009

Report: Car Sales Slump 11% Below June Levels

by Calculated Risk on 8/27/2009 11:57:00 AM

From the Financial Times: ‘Cash-for-clunkers’ sales disappoint Detroit (ht James)

[S]igns are already emerging that overall sales will fall back sharply now that the incentives have expired.It now appears that sales in August were at about a 16 million SAAR (auto sales for August will be released next week).

...

[Edmunds.com] estimates that, based on visits to its websites, “purchase intent” is down 11 per cent from the average in June ...

excerpted with permission

This follows an 11.22 million SAAR in July. The Cash-for-clunkers program started on July 24th.

If sales in September are 11% below June - that would put sales at under 9 million SAAR - the lowest sales for this cycle, and perhaps at the lowest rate since the early '70s. Of course the program just ended, but it will be interesting to see how much Cash-for-Clunkers cannibalized future sales.

Wednesday, August 26, 2009

New Hampshire: The Clunker State

by Calculated Risk on 8/26/2009 07:56:00 PM

From the DOT: Cash for Clunkers Stats

Number Submitted: 690,114This should push light vehicle sales to about 16 million (SAAR) in August. Of course the real question is what happens in September.

Dollar Value: $2,877.9M

Darn - Floyd Norris beat me to it, but my table is sortable.

Using the Census Bureau population estimates, here is a table of dollars per person.

New Hampshire is the "Clunker State" by 'Dollars per person'. What happened in D.C.? No one wanted a new car? (UPDATE: several people told me almost everyone in D.C. buys cars in Virginia or Maryland)

NOTE: Columns are sortable - click on column headers: State (includes territories), Clunker dollars, Population, Dollars per person.

Tuesday, August 18, 2009

Market, Autos and Misc

by Calculated Risk on 8/18/2009 04:00:00 PM

Note: Google / Blogger is under a DDoS-style attack again - sorry for any inconvenience. Click on graph for larger image in new window.

Instead of comparing the markets from the peak (See: the Four Bad Bears), Doug Short matched up the market bottoms for four crashes (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

From Edmunds.com: “Cash for Clunkers” Sales on the Rapid Decline (ht Bob_in_MA)

The rush of automotive sales activity brought on by the "Cash for Clunkers" program is fading fast, according to Edmunds.com, whose latest study of car buyer behavior indicates that automotive purchase intent is down 31 percent from its peak in late July.And from a Guaranty Bank (Texas) NT 10-Q SEC filing:

“Now that there is plenty of money in the program and the most eager shoppers have already participated, the sense of urgency is gone, and the pace of intent decline is accelerating,” observed Edmunds.com CEO Jeremy Anwyl. "Inventories are getting lean and prices are climbing, giving consumers reasons to sit back."

Last week, activity was down 15 percent from the late July peak, and Edmunds.com analysts predict that in the coming days, purchase intent will return to levels seen before the launch of Cash for Clunkers. Purchase intent has proven to be a reliable leading indicator of sales to come in the following 90 days.

“Our research indicates that Cash for Clunkers buyers have come in three waves: the first was the informed, pent-up buyers who anxiously waited for the program to launch, while the second was the mass market who responded to advertising and other promotional coverage of the program,” recalls Edmunds.com Senior Analyst Jessica Caldwell. “Now the industry is largely servicing the third wave, which is generally made up of people who had to chase down copies of lost titles and other paperwork and are now able to finally participate. It is unclear where the customers will come from after this wave crests and breaks.”

As described in the July 23 8-K, the Company does not believe it is possible to raise sufficient capital to comply with the Orders to Cease and Desist described in the Company’s Current Report on Form 8-K filed on April 8, 2009. Accordingly, the Company no longer believes that it will be able to continue as a going concern.Bids for Guaranty's assets were due today, and it is very likely that Guaranty will be seized this week by the FDIC. Guaranty keeps repeating the warning - and still the stock is trading above zero ...

The Company continues to cooperate with the Office of Thrift Supervision (the “OTS”) and the Federal Deposit Insurance Corporation (“FDIC”) as they pursue alternatives for the business of the Bank. Any such transaction would not be expected to result in the receipt of any proceeds by the stockholders of the Company.

Monday, August 10, 2009

Auto Sales and the Unemployment Rate

by Calculated Risk on 8/10/2009 06:11:00 PM

On Saturday I posted a graph and some analysis of Housing Starts and the Unemployment Rate

Today I received a request for a similar graph of auto sales and the unemployment rate.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows light vehicles sales including SUVs and small trucks, and the unemployment rate (inverted - see right scale).

Light vehicle sales usually bottom sometime before the unemployment rate peaks - just like for housing starts. This makes sense since the usual two engines of recovery are housing and personal consumption. See Business Cycle: Temporal Order

Wednesday, August 05, 2009

More Cash for Clunkers

by Calculated Risk on 8/05/2009 11:26:00 PM

From CNBC: Senate Reaches Deal on $2 Billion 'Clunkers' Refill

The Senate reached a deal on saving the dwindling "cash for clunkers" program ... that would add $2 billion to the popular rebate program ...The deal is to allow some amendments to be offered that will be voted down, and then the bill will be passed exactly as it is.

... The Toyota Corolla is the top-selling vehicle on the list, followed by the Ford Focus, Honda Civic, Toyota Prius and the Toyota Camry. There is one SUV on the list, the Ford Escape, which also comes in a hybrid model. Six of the top-10 selling vehicles are built by foreign manufacturers, but most are built in North America.

Monday, August 03, 2009

Light Vehicle Sales Over 11 Million (SAAR) in July

by Calculated Risk on 8/03/2009 04:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for July (red, light vehicle sales of 11.24 million SAAR from AutoData Corp).

This is the highest vehicle sales since September 2008 (12.5 million SAAR). The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Although sales were boosted by the "Cash-for-clunkers" program, I think sales would have rebounded some anyway. If "Cash-for-clunkers" is extended, then August will probably be over 11 million SAAR too, but I'd expect sales to falter a little later in the year.

Ford: July sales increase 2.3 Percent Compared to July 2008

by Calculated Risk on 8/03/2009 11:19:00 AM

From CBS MarketWatch: Ford U.S. July sales rise 2.3%

Ford Motor said Monday that U.S. July sales rose 2.3% to 165,279 vehicles, reversing nearly two years of monthly year-over-year losses.Ford said the "Cash for Clunkers" program helped July sales (no kidding).

This is the first year-over-year increase reported by Ford since November 2007.

Notes: The auto companies compare sales to the same month of the previous year (so this is compared to July 2008). Auto sales will be released all morning, and I'll post a saesonally adjusted graph when a summary is available.

Friday, July 31, 2009

More Cash for More Clunkers

by Calculated Risk on 7/31/2009 02:57:00 PM

From NY Times: House Votes for $2 Billion Fund to Extend ‘Clunker’ Plan (ht Paul)

The House of Representatives voted to provide an emergency $2 billion for the “cash for clunkers” program on Friday, and the White House declared the program very much alive, even though car buyers appear to have already snapped up the $1 billion that Congress originally appropriated.

...

The Senate, which will be in session next week, will take up the program then.

...

“If you were planning on going to buy a car this weekend using this program, the program continues to run,” [Robert Gibbs, the chief White House spokesman] said. “If you meet the requirements of the program, the certificates will be honored.”

Thursday, July 30, 2009

Auto: Cash-for-Clunkers to be Suspended

by Calculated Risk on 7/30/2009 07:52:00 PM

From the Detroit Free Press: Cash-for-clunkers program to be suspended (ht Basel Too)

The U.S. government will suspend the popular cash-for-clunkers program after less than four days in business, telling Congress that the plan would burn through its $950-million budget by midnight, several sources told the Free Press. ... auto dealers may have already arranged the sale of more than the 250,000 vehicles that federal officials expected the plan to generate.Sources tell me (no link) that showroom traffic jumped by about 33% at auto dealers over the last week to about the levels of last September. See the following graph:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for June (red, light vehicle sales of 9.69 million SAAR from AutoData Corp).

Light vehicle sales last September (before the collapse in October) were at a 12.46 million SAAR. Of course this is just one week of July at that sales rate ... and the program is now suspended. But that means July sales will probably be over 10 million SAAR for the first time this year.

Saturday, July 25, 2009

'Cash for Clunkers' Rules Released

by Calculated Risk on 7/25/2009 12:45:00 AM

From the LA Times: 'Cash for clunkers' rules are released, sparking a rush

The law creating the $1-billion program went into effect July 1, but many dealers were reluctant to participate until they got a look at the rules. The arrival of the 100-plus-page document Friday morning sparked a registration rush that overwhelmed the government's computers, resulting in waits of two hours or more, the National Automobile Dealers Assn. reported.The article mentions several rules to avoid fraud, and a requirement that the "clunker" be crushed. This should give a some boost to auto sales over the next few months.

The program is also exciting a fair amount of interest among consumers. Online auto information provider Edmunds.com said its traffic has been at record levels in recent weeks. Part of that comes from what may be the beginnings of a rebound in car sales, but the clunkers program is helping.

Monday, July 20, 2009

DOT: Vehicle Miles Flat YoY

by Calculated Risk on 7/20/2009 03:09:00 PM

This is the second consecutive month were vehicles miles driven were flat, or slightly above, the comparable month in 2008 (May 2009 compared to the May 2008).

The Dept of Transportation reports on U.S. Traffic Volume Trends:

Travel on all roads and streets changed by +0.1% (0.2 billion vehicle miles) for May 2009 as compared with May 2008. Travel for the month is estimated to be 257.3 billion vehicle miles.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the rolling 12 month of U.S. vehicles miles driven. (label corrected: trillions)

By this measure (used to remove seasonality) vehicle miles declined sharply and are now moving sideways.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT. As the DOT noted, miles driven in May 2009 were 0.1% greater than in May 2008.

Year-over-year miles driven started to decline in December 2007, and really fell off a cliff in March 2008. This makes for an easier comparison for May 2009.