by Calculated Risk on 7/10/2009 08:53:00 AM

Friday, July 10, 2009

GM Emerges from Bankruptcy, Press Conferenace at 9 AM ET

Here is the press conference at 9 AM ET:

From the NY Times: With Sale of Its Good Assets, G.M. Tries for a Fresh Start

General Motors completed a major step in its turnaround on Friday and closed the sale of its good assets to a new, government-backed carmaker....That was fast!

G.M.’s sale of its desirable assets, including brands like Chevrolet, Cadillac and GMC, to the new company — now named Vehicle Acquisition Company but soon to be renamed the General Motors Company — is meant to shed decades of buckling liabilities. The federal government will hold nearly 61 percent of the new company ...

The new company will be much smaller, with brands like Saturn, Hummer, Opel and Pontiac in the process of being sold or closed.

Monday, July 06, 2009

GM Bankruptcy Plan Approved

by Calculated Risk on 7/06/2009 09:03:00 AM

From the NY Times: Court Ruling Clears Path for G.M. to Restructure

A federal judge approved a plan by General Motors late on Sunday to sell its best assets to a new, government-backed company ...The ruling is being appealed.

In his 95-page opinion, Judge Gerber wrote that he agreed with G.M.’s main contention: that the asset sale was needed to preserve its business in the face of steep losses and government financing that is scheduled to run out by the end of the week.

“Bankruptcy courts have the power to authorize sales of assets at a time when there still is value to preserve — to prevent the death of the patient on the operating table,” Judge Gerber wrote.

...

Other groups, including those representing product liability claims and asbestos litigants, ... fought against G.M.’s plan. Under the terms of the sale, most of those claims would remain with the remnants of G.M. in bankruptcy, meaning they were likely to recover little, if anything.

This was quick - GM filed for bankruptcy on June 1st.

Wednesday, July 01, 2009

Graphs: Auto Sales in June

by Calculated Risk on 7/01/2009 04:43:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for June (red, light vehicle sales of 9.69 million SAAR from AutoData Corp).

June was about average for the year so far on seasonally adjusted basis, and sales are still on pace to be the worst since 1967. The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The small increase in June hardly shows up on the graph.

In 1967 there were 103 million drivers and 9.54 million light vehicles sold; now there are about twice that many (205.7 million licensed drivers in 2007). Compared to the number of drivers, the current sales rate is the lowest since the BEA started tracking auto sales.

General Motors June sales fell 33.6% YoY

by Calculated Risk on 7/01/2009 02:01:00 PM

From MarketWatch: General Motors U.S. June sales decline 33.6%

This is worse the the 29% drop in May.

Also: Toyota June U.S. sales down 32% to 131,654 units

And Chrysler June U.S. sales down 42% to 68,297 units

I'll have a summary for the month soon.

Ford June U.S. light vehicle sales down 11% YOY

by Calculated Risk on 7/01/2009 12:27:00 PM

From MarketWatch:

Ford June U.S. sales down 11% to 148,153 units

Ford to increase Q3 production to 485,000 vehicles

Volvo June U.S. sales down 0.6% to 7,042 units

Daimler June U.S. sales fell 26.5% to 16,271 vehicles.

MORE TO COME ...

Previous months:

Ford U.S. May sales fall 24.2%

Ford April U.S. vehicle sales off 31.3%

Ford U.S. March sales dropped 40.9%

February Ford sales were off 46.3% YoY

January off 42.1%

December off 32.4%

November off 31%

Monday, June 29, 2009

Auto Sales Expected to be near 10 Million SAAR in June

by Calculated Risk on 6/29/2009 09:24:00 PM

There will be a flood of data released over the next three days, including the June employment numbers on Thursday. Other highlights include Case-Shiller house prices tomorrow and auto sales on Wednesday.

Several analysts expect an increase in auto sales in June, compared to May, on a seasonally adjusted annual rate (SAAR) basis. From the WSJ: Car-Sales Rebound Seen for June

[A]nnualized U.S. sales could hit 10 million this month for the first time in 2009, Ford Motor Co. analyst George Pipas said on Monday. The deep discounts that General Motors Corp. and Chrysler Group LLC have offered to boost sales are also likely to bolster June sales.But before everyone gets all Green Shootie ...

...

A GM spokesman also said an annualized 10 million sales rate is possible for June.

J.D. Power and Associates predicts annualized June sales of 10.3 million new cars and trucks, up from 9.9 million in May, while Edmunds.com expects the sales rate to top 10 million, though overall sales will still be 25% lower than a year ago.

This graph shows light vehicle sales since the BEA started keeping data in 1967.

This graph shows light vehicle sales since the BEA started keeping data in 1967.Breaking 10 million (SAAR) in June might put sales 10% off the bottom in February, but is is still more than 25% off from June 2008 (13.7 million light vehicle SAAR) and still near the bottom of the cliff.

Saturday, June 27, 2009

New GM Agrees to Assume Future Product Liability Claims

by Calculated Risk on 6/27/2009 07:58:00 PM

From the WSJ: GM to Take on Future Product-Liability Claims (ht sportsfan, Basel Too)

General Motors Corp ... has agreed to assume legal responsibility for injuries drivers suffer from vehicle defects after the auto maker emerges from bankruptcy protection.This agreement doesn't cover current product liability plaintiffs - this just appears to cover future car-accident victims.

...

Under GM's original bankruptcy plan, the auto maker planned to leave such liabilities behind after selling its "good" assets to a "New GM" owned by the government. That meant future GM car-accident victims who believed faulty manufacturing caused their injuries would be unable to sue the New GM. Instead, they would have been treated as unsecured creditors, fighting over the remains of GM's old bankruptcy estate.

GM's move to take responsibility for future product-liability claims, outlined in a court filing late Friday evening, represents a partial victory for more than a dozen state attorneys general and several consumer advocacy groups.

...

Car-accident victims with pending lawsuits and those who had won damages against GM before it filed for bankruptcy would still be unable to bring claims against the new GM. They would remain with other unsecured creditors making claims against the "old GM." As GM's old estate winds down, those victims are likely to recover little or nothing.

Saturday, June 20, 2009

More GM Bankruptcy

by Calculated Risk on 6/20/2009 12:11:00 AM

During the Chrysler bankruptcy, I excerpted and linked to lawyer Steve Jakubowski's Bankruptcy Litigation Blog. Steve has taken it a step further and stepped into the GM fray ...

From Steve: Objecting to the GM 363 Sale's Treatment of Product Liability Claims: Stepping Into The Fray

[A] lot of panicked plaintiffs' lawyers involved in cases against GM are screaming these days as they watch years of toil on behalf of people seriously injured by defective GM products (like crushed roofs, exploding "side saddle" gas tanks, and collapsing seat backs) potentially go for naught as GM makes its grandest attempt ever to crush an entire class of former customers and existing and future products liability claimants in a sale that many plaintiffs lawyers of record only received written notice of in the past couple of days.From the NY Times: New Objections May Delay G.M. Exit From Bankruptcy

Those following this blog know my rising concern (even anger) over how products liability claimants were completely stiffed in Chrysler ...

So, I decided to do something about it, and officially stepped into the fray by filing this Objection to the GM Sale and this Memorandum in Support jointly with counsel for the Center for Auto Safety, Consumer Action, Consumers for Auto Reliability and Safety, National Association of Consumer Advocates, and Public Citizen.

A group of General Motors bondholders and some of the automaker’s labor unions filed objections on Friday to G.M.’s plan to sell its assets to a new company that could emerge from bankruptcy protection.The GM bankruptcy might take a little longer than Chrysler.

Their opposition, with objections filed by consumer groups, a handful of states and cities, and individual retirees, shareholders and bondholders, threatens to put the brakes on what the company and the government had hoped would be a rapid trip through the Chapter 11 process.

Thursday, June 18, 2009

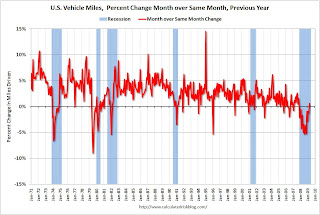

DOT: U.S. Vehicles Miles increase YoY in April

by Calculated Risk on 6/18/2009 03:41:00 PM

This is the first same month year-over-year increase in miles driven (April 2009 compared to the April 2008) since November 2007.

Of course gasoline prices have increased sharply since April. The EIA reports that gasoline prices have increased from about $2.10 per gallon in April, to $2.70 per gallon in June - and that will probably impact miles driven.

The Dept of Transportation reports on U.S. Traffic Volume Trends:

Travel on all roads and streets changed by +0.6% (1.4 billion vehicle miles) for April 2009 as compared with April 2008. Travel for the month is estimated to be 249.5 billion vehicle miles.

Cumulative Travel for 2009 changed by -1.1% (-10.0 billion vehicle miles).

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off 3.1% Year-over-year (YoY); the decline in miles driven was worse than during the early '70s and 1979-1980 oil crisis.

Note that rolling miles driven has a built in lag, and miles driven was larger in April 2009 than April 2008.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT. As the DOT noted, miles driven in April 2009 were 0.6% greater than in April 2008.

This is the first same month year-over-year increase since November 2007.

Year-over-year miles driven started to decline in December 2007, and really fell off a cliff in March 2008. This makes for an easier comparison for April 2009.

Tuesday, June 09, 2009

Supreme Court Lifts Stay on Chrysler Deal

by Calculated Risk on 6/09/2009 07:36:00 PM

From SCOTUS Blog: Court clears Chrysler sale

Ending four days of intense, round-the-clock and high-stakes legal maneuvering in the Supreme Court, the Justices on Tuesday evening removed a legal obstacle to sale of the troubled auto industry giant, Chrysler.More at link ...

Insisting that it was denying a postponement “in this case alone,” the two-page order said the challengers had not met their burden of showing that a delay was justified. The order allows a closing of the deal as of next Monday, because it lifts a temporary stay that Justice Ruth Bader Ginsburg had issued on Monday, apparently to give the Court time to ponder the issue.

The Court said nothing about the biggest issue lurking in the case: the legality of using federal “bailout” money to pay for the rescue of an auto manufacturer. In fact, the order stressed that “a denial of a stay is not a ddecision on the merits of the underlying legal issues.”

Chrysler Updates

by Calculated Risk on 6/09/2009 05:15:00 PM

From the AP: Judge OKs Chrysler plan to terminate franchises. The AP is reporting that U.S. Judge Arthur Gonzalez said Chrysler can terminate 789 dealers effective immediately.

From the SCOTUS Blog: Chrysler and the meaning of June 15

[I]t seemed clear that Ginsburg — and perhaps the full Court — were awaiting the new round of briefing on what a widely disputed June 15 “deadline” means.And from Steve Jakubowski at the Bankruptcy Litigation Blog: What's Bothering Ruthie? Chrysler Bankruptcy Sale Opinion Analysis - Part II

It is not clear how central this dispute is to the Justices’ ultimate view of the legal and financial situation, but there was no doubt of the vigor with which all sides were debating that question.

The Indiana funds, in a somewhat triumphant though brief filing, contended Tuesday that they had undermined the claims that Fiat would back out and the deal would collapse if it is not closed by next Monday. Its evidence was a brief wire story on Bloomberg News quoting a Fiat executive as saying it “would never walk away” from the pact.

By early afternoon, the three main defenders of the rescue plan joined the new battle, with Fiat saying that the benefit funds’ new thrust was “unwarranted.” The deal, by its own express terms, “will terminate automatically” if not closed “on or before June 15.” (emphasis in the original).

I'm guessing, though, that what bothers her most -- and frankly what's really been bothering me most (hence Part II) -- is the sale's treatment of tort claimants, both present and future, and Judge Gonzalez's cursory justification for such treatment.And other auto news from CNBC: US House Passes 'Cash for Clunkers' Plan

[T]he House approved a plan Tuesday to provide vouchers of up to $4,500 for consumers who turn in their gas-guzzling cars and trucks for more fuel-efficient vehicles.

Monday, June 08, 2009

Supreme Court temporarily blocks Chrysler deal

by Calculated Risk on 6/08/2009 06:14:00 PM

From the SCOTUS Blog: Ginsburg temporarily blocks Chrysler deal

Supreme Court Justice Ruth Bader Ginsburg put a temporary hold Monday on the deal to sell Chrysler to save it from collapse. Her order, however, simply gives her or the full Court more time to ponder whether to postpone the sale further, or allow it to go forward. The order can be found here.There is more ...

...

The deal remains in legal limbo until Ginsburg, as the Circuit Justice, or the full Court takes some definitive action. There is now no timetable for further action at the Supreme Court, although the terms of the deal allow Chrysler’s new business spouse — Fiat, the Italian automaker — to back out as of next Monday if the deal has not closed. Moreover, the papers filed in the Supreme Court have suggested that Chrysler is losing money at the rate of $100 million a day, pending the sale. That gives the Justices some incentive not to let much time pass before acting.

Friday, June 05, 2009

Courts Affirms Chrysler Sale

by Calculated Risk on 6/05/2009 06:58:00 PM

From the WSJ: Court Affirms Chrysler Sale but Puts Deal on Hold Until Monday

From attorney Steve Jakubowski at the Bankrutpcy Litigation Blog: Chrysler's Bankruptcy Sale Opinion - Part I: Proving "What Goes Around, Comes Around" Well it's official, and really no surprise:

Judge Gonzalez in this opinion (WL) approved the sale of Chrysler's assets in the Fiat Transaction "free and clear of liens, claims, interests and encumbrances."

...Was it a sub rosa plan? The Court said no. And I actually agree. ... Was the absolute priority rule violated? The Court danced around this issue pretty well, taking the position, well stated in this Credit Slips blog post, that "the allocation of ownership interests in the new enterprise is irrelevant to the estates' economic interests" and that "in addition, the UAW, VEBA, and the Treasury are not receiving distributions on account of their prepetition claims ... [but] under separately-negotiated agreements with New Chrysler ... [that are] not value which would otherwise inure to the benefit of the Debtors' estates."

...Has the "Rule of Law" Been Withered (as questioned here)? Maybe, as I'll discuss later in Part II, but not for the reasons the Indiana Pension Funds are arguing on appeal. In fact, if anything, the following well-worn rules have been affirmed in this case: 1. You can't circumvent chapter 11's plan process when you can't even fund next week's payroll.

2. You can't violate the absolute priority rule if junior creditors necessary to the new enterprise get something out of the deal.

3. Lenders of last resort owe no duty to anyone but themselves and can dictate the terms of a plan or sale so long as the terms aren't unconscionable, which they aren't here.

Wednesday, June 03, 2009

Daily Show: The BiG Mess

by Calculated Risk on 6/03/2009 10:08:00 PM

Tuesday, June 02, 2009

Graphs: Auto Sales in May

by Calculated Risk on 6/02/2009 04:01:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for May (red, light vehicle sales of 9.91 million SAAR from AutoData Corp).

May was the best month of 2009 (on seasonally adjusted basis), but sales are still on pace to be the worst since 1967. The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The small increase in May hardly shows up on the graph.

In 1967 there were 103 million drivers; now there are about twice that many (205.7 million licensed drivers in 2007). Compared to the number of drivers, the current sales rate is the lowest since the BEA started tracking auto sales.

GM May U.S. vehicle sales off 29%, Toyota off 40.7%

by Calculated Risk on 6/02/2009 02:04:00 PM

From MarketWatch: GM May U.S. vehicle sales drop 29%

GM ... reported a 29% drop in May U.S. light vehicle sales ... GM posted sales of 190,881 vehicles, down from 268,892 a year ago.Also from MarketWatch: Toyota U.S. May sales fall 40.7%

Toyota said ... May U.S. sales declined 40.7% to 152,583 vehicles from 257,406 a year agoMore on auto sales soon (with a graph of course)

Ford Sales Off 24.2% in May

by Calculated Risk on 6/02/2009 11:54:00 AM

From MarketWatch: Ford U.S. May sales fall 24.2%

Ford Motor Co. said Tuesday that total U.S. May sales fell 24.2% to 161,531 vehicles from 213,238 a year ago. ... Ford said it will increase North American production by 10,000 vehicles to 445,000 in the second quarter, and by 42,000 vehicles to 460,000 vehicles in the third quarterNote: This is year-over-year (May 2009 vs. May 2008)

Previous months:

Ford April U.S. vehicle sales off 31.3%

Ford U.S. March sales dropped 40.9%

February Ford sales were off 46.3% YoY

January off 42.1%

December off 32.4%

November off 31%

Monday, June 01, 2009

GM News

by Calculated Risk on 6/01/2009 09:30:00 PM

Just some excerpts ...

From the WSJ: Filings Reveal Depth of Problems

General Motors Corp.'s $82.2 billion in assets and $172 billion in liabilities spell out the extent of its problems and sheer breadth of the 101-year-old giant's bankruptcy.More details from Bloomberg: GM Files Bankruptcy to Spin Off More Competitive Firm

In a torrent of filings at the U.S. Bankruptcy Court in Manhattan, GM's mind-numbing scale is evident: It has 463 subsidiaries and has built 450 million cars and trucks over the years. It employs 235,000 people worldwide. This includes 91,000 in the United States, which it pays $476 million each month, and 493,000 retirees with various benefits. It spends $50 billion a year buying parts and services from 11,500 vendors in North America.

From the WSJ: GM to Announce Tentative Hummer Sale

General Motors Corp., fresh off filing for bankruptcy protection Monday, will start its second day of court proceedings by announcing the tentative sale of the Hummer brand ...Auto sales for May will be announced tomorrow. The bankruptcy of Chrysler - and now GM - will probably depress auto sales further for a few months, although probably not by much.

Sunday, May 31, 2009

GM to file Bankruptcy Monday Morning

by Calculated Risk on 5/31/2009 06:47:00 PM

From the Detroit News: GM bankruptcy filing expected 6 a.m. Monday (ht jb)

The Obama administration will name a veteran turnaround expert as chief restructuring officer for General Motors Corp., which plans to file for bankruptcy protection about 6 a.m. Monday in New York ... Al Koch, a managing director at AlixPartners LLP, will be named chief restructuring officer Monday, a government official familiar with the matter said, and will help to wind down GM's "bad" assets that it plans to leave behind in bankruptcy.The WSJ says 8 AM.

GM Bondholders Agree to Debt-for-Equity, Hummer Sale Near

by Calculated Risk on 5/31/2009 10:12:00 AM

From the NY Times: G.M. Bankruptcy Plan Clears Bondholder Hurdle

General Motors’ bondholders finished voting Saturday on the company’s plan to exchange their debt for an ownership stake ... Bondholders with slightly more than 50 percent of G.M.’s $27.2 billion in bond debt agreed to support the plan by the deadline of 5 p.m ... Bondholders would initially get a 10 percent stake, along with warrants for 15 percent.And the WSJ is reporting that the sale of GM's Hummer brand is near - without details.