by Calculated Risk on 3/13/2010 08:26:00 AM

Saturday, March 13, 2010

LA Area Port Traffic in February

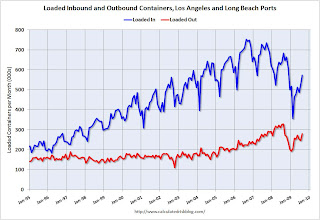

Note: this data is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports. LA area ports handle about 40% of the nation's container port traffic.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Loaded inbound traffic was up 33.8% compared to February 2009. (up 9.5% compared to last year using three month average).

Of course trade collapsed in February 2009, so this is a very easy comparison. Inbound traffic was still down 18.3% vs. two years ago (Feb 2008).

Loaded outbound traffic was up 32.7% from February 2009. (+33.5% using three months average) This was also an easy YoY comparison for exports, because U.S. exports fell off a cliff in near the end of 2008.

Just as with imports, exports are still off from 2 years ago (off 10.0%).

And more from Ronald White at the LA Times: Trade numbers climb sharply at Southland ports

Trade numbers at the ports of Los Angeles and Long Beach, the nation's busiest seaport complex, rose sharply in February compared with the same month last year, lending strength to the arguments of some experts who believe that a stronger-than-anticipated recovery may be underway.The LA Times article is using the YoY numbers. However looking at the graph (red line), exports recovered in the first half of 2009, but export traffic has been mostly flat since last summer. The YoY increase for March will be much less than for February!

...

"Our feeling is that consumers are coming back. They are spending a bit more of their money. They are less concerned about losing their jobs than they have been in the last three months," said Ben Hackett, founder of Hackett Associates, which tracks international trade at the nation's busiest seaports for the National Retail Federation.

Hackett said his firm had scaled back its expectations for trade growth in 2010, "but we think we'll be seeing a relatively strong year at a 10% to 14% increase. We should see steady improvement, minus the usual seasonal adjustments."

It is harder to tell about imports (blue line) because of the large seasonal swings.

Thursday, March 11, 2010

Trade Deficit decreases slightly in January

by Calculated Risk on 3/11/2010 09:07:00 AM

The Census Bureau reports:

[T]otal January exports of $142.7 billion and imports of $180.0 billion resulted in a goods and services deficit of $37.3 billion, down from $39.9 billion in December, revised.

Click on graph for larger image.

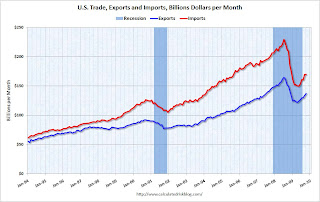

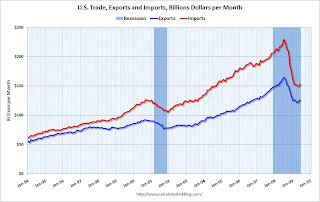

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through January 2010.

Both imports and exports decreased in January. On a year-over-year basis, exports are up 15% and imports are up 12%. This is an easy comparison because of the collapse in trade at the end of 2008 and into early 2009.

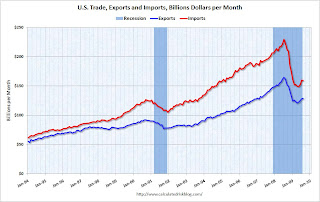

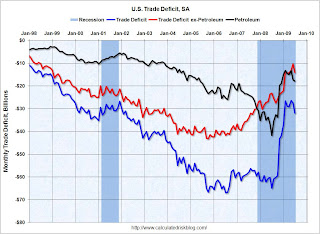

The second graph shows the U.S. trade deficit, with and without petroleum, through January.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices increased to $73.89 in December - up 88% from the low in February 2009 (at $39.22). Oil import volumes declined in January.

In general trade has been increasing, although both imports and exports are still below the pre-financial crisis levels. China and oil account for most of the trade deficit.

Tuesday, February 16, 2010

LA Area Port Traffic in January

by Calculated Risk on 2/16/2010 09:50:00 PM

Note: this data is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports. LA area ports handle about 40% of the nation's container port traffic.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Loaded inbound traffic was down 0.7% compared to January 2009. (down 4.2% compared to last year using three month average)

Loaded outbound traffic was up 31.8% from January 2009. (+25.5% using three months average) This was an easy YoY comparison for exports, because U.S. exports fell off a cliff in near the end of 2008.

Note: Imports usually peak in the August through October period (as retailers import goods for the holidays) and then decline at the end of the year. Import traffic will decline sharply in February, but that is just the seasonal pattern.

Exports recovered somewhat in the first half of 2009, however export traffic has essentially been flat since last summer. Export growth was one of the key drivers of the economy in 2009, but it now appears - based on traffic - that export growth has stalled.

Wednesday, February 10, 2010

Trade Deficit increases to $40.2 Billion in December

by Calculated Risk on 2/10/2010 08:49:00 AM

The Census Bureau reports:

[T]otal December exports of $142.7 billion and imports of $182.9 billion resulted in a goods and services deficit of $40.2 billion, up from $36.4 billion in November, revised. December exports were $4.6 billion more than November exports of $138.1 billion. December imports were $8.4 billion more than November imports of $174.5 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through December 2009.

Both imports and exports increased in December. On a year-over-year basis, exports are up 7.4% and imports are up 4.6%. This is an easy comparison because of the collapse in trade at the end of 2008.

The second graph shows the U.S. trade deficit, with and without petroleum, through December.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices increased to $73.20 in December - up 87% from the low in February (at $39.22). Oil import volumes were up sharply in December.

Overall trade continues to increase, although both imports and exports are still below the pre-financial crisis levels.

Thursday, January 14, 2010

LA Area Port Traffic in December

by Calculated Risk on 1/14/2010 06:15:00 PM

Note: this is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports. LA area ports handle about 40% of the nation's container port traffic.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Loaded inbound traffic was 2.9% above December 2008. (-9.2% over last three months)

Loaded outbound traffic was 35.9% above December 2008. (+14.5% three months average) This was an easy YoY comparison for exports, because U.S. exports fell off a cliff in November 2008.

It took a little longer for imports to decline sharply because the ships were already underway.

Exports recovered somewhat earlier this year, however export growth has been sluggish since May. Last year (2009) was the 3rd best year for export traffic at LA area ports, behind 2007 and 2008.

For imports, traffic is at about the December 2003 level, and 2009 was the weakest year for import traffic since 2002.

Note: Imports usually peak in the August through October period (as retailers import goods for the holidays) and then decline at the end of the year.

Tuesday, January 12, 2010

Trade Deficit Increases in November

by Calculated Risk on 1/12/2010 08:31:00 AM

The Census Bureau reports:

The ... total November exports of $138.2 billion and imports of $174.6 billion resulted in a goods and services deficit of $36.4 billion, up from $33.2 billion in October, revised. November exports were $1.2 billion more than October exports of $137.0 billion. November imports were $4.4 billion more than October imports of $170.2 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through November 2009.

Both imports and exports increased in November. On a year-over-year basis, exports are off 2.3% and imports are off 5.5%.

The second graph shows the U.S. trade deficit, with and without petroleum, through November.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices increased to $72.54 in November - up 85% from the low in February (at $39.22).

Oil import volumes are off 8% from last November.

Overall trade continues to increase, although both imports and exports are still off significantly from the pre-financial crisis levels. Net export growth had been one of the positives for the U.S. economy - but now imports are growing faster than exports.

Friday, December 18, 2009

LA Area Port Traffic in November

by Calculated Risk on 12/18/2009 09:18:00 AM

Note: this is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports. LA area ports handle about 40% of nation's container port traffic.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Loaded inbound traffic was 13.1% below November 2008. (-15.1% over last three months)

Loaded outbound traffic was 11.4% above November 2008. (+0.8% three months average)

U.S. exports fell off a cliff in November 2008, but it took a little longer for imports to decline sharply (because the ships were already underway).

There was a clear recovery in U.S. exports earlier this year; however exports have been mostly flat since May. Still this year will be the 3rd best year for export traffic at LA area ports, behind 2007 and 2008.

For imports, traffic is below the November 2003 level, and 2009 will be the weakest year for import traffic since 2002.

Note: Imports usually peak in the August through October period (as retailers import goods for the holidays) and then decline in November.

The lack of further export growth to Asia is definitely discouraging.

Thursday, December 10, 2009

Trade Deficit Declines in October

by Calculated Risk on 12/10/2009 08:59:00 AM

The Census Bureau reports:

The ... total October exports of $136.8 billion and imports of $169.8 billion resulted in a goods and services deficit of $32.9 billion, down from $35.7 billion in September, revised. October exports were $3.5 billion more than September exports of $133.4 billion. October imports were $0.7 billion more than September imports of $169.0billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through October 2009.

Imports and exports increased in October. On a year-over-year basis, exports are off 9% and imports are off 19%.

The second graph shows the U.S. trade deficit, with and without petroleum, through October.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices decreased slightly to $67.39 in October - still up more than 50% from the prices in February (at $39.22) - and the decline followed seven consecutive monthly increases in the price of oil.

Oil import volumes dropped sharply in October, and the decline in oil imports was the major contributor to decrease in the trade deficit.

Friday, November 13, 2009

Trade Deficit Increases in September

by Calculated Risk on 11/13/2009 08:37:00 AM

The Census Bureau reports:

The ... total September exports of $132.0 billion and imports of $168.4 billion resulted in a goods and services deficit of $36.5 billion, up from $30.8 billion in August, revised. September exports were $3.7 billion more than August exports of $128.3 billion. September imports were $9.3 billion more than August imports of $159.1 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through September 2009.

Imports and exports increased in September. On a year-over-year basis, exports are off 13% and imports are off 21%.

The second graph shows the U.S. trade deficit, with and without petroleum, through September.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices increased to $68.17 in September - up more than 50% from the prices in February (at $39.22) - and the seventh monthly increase in a row. Import oil prices will probably rise further in October.

The major contributors to the increase in the trade deficit were the increase in oil prices, and more imports from China. Also - the deficit is higher than expected, suggesting a downward revision to Q3 GDP.

Saturday, October 17, 2009

LA Area Port Traffic in September

by Calculated Risk on 10/17/2009 09:30:00 AM

Note: this is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inbound traffic was 17.4% below September 2008.

Outbound traffic was 8.6% below September 2008.

Even with the decline in September, there has been a clear recovery in U.S. exports. And export traffic at the LA area ports is at the September 2006 level.

However, for imports, traffic is about at the September 2003 level, and 2009 will probably be the weakest year for import traffic since 2002.

Note: Imports usually peak in the August through October period (as retailers import goods for the holidays) and then decline in November.

And some color from the LA Times: Imports dive at ports of Los Angeles and Long Beach

As dismal as those figures are for the two ports, which rank first and second in the U.S. in container volume and together rank fifth in the world, a greater worry goes beyond the immediate and substantial loss of local trade-related jobs: Some of the ports' most important tenants were so poorly positioned for the downturn that they might sink completely in a sea of billions of dollars of red ink, experts say.

"Without a doubt, the Southern California ports should be worried," said Neil Dekker, an analyst at Drewry Shipping Consultants in London who produces container industry forecasts. "Companies will go bust; freight rates may take years to recover."

Friday, October 09, 2009

Trade Deficit Decreases Slightly in August

by Calculated Risk on 10/09/2009 08:37:00 AM

The Census Bureau reports:

The ... total August exports of $128.2 billion and imports of $158.9 billion resulted in a goods and services deficit of $30.7 billion, down from $31.9 billion in July, revised. August exports were $0.2 billion more than July exports of $128.0 billion. August imports were $0.9 billion less than July imports of $159.8 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through August 2009.

Imports were down in August, and exports increased slightly. On a year-over-year basis, exports are off 21% and imports are off 29%.

The second graph shows the U.S. trade deficit, with and without petroleum, through August.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices increased to $64.75 in August - up more than 50% from the prices in February (at $39.22) - and the sixth monthly increase in a row. Import oil prices will probably rise further in September.

It appears the cliff diving for U.S. trade is over. The weaker dollar is probably helping exports - and hurting imports.

Tuesday, September 15, 2009

LA Area Port Traffic in August

by Calculated Risk on 9/15/2009 05:15:00 PM

Note: this is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inbound traffic was 14.5% below August 2008.

Outbound traffic was 16.2% below August 2008.

There has been a clear recovery in U.S. exports (the year-over-year comparison was off 30% from December through February). And export traffic, at the LA area ports, is at the August 2007 level.

However, for imports, traffic is at the August 2003 level, and 2009 will probably be the weakest year for import traffic since 2002.

Note: Imports usually peak in the August through October period (as retailers import goods for the holidays) and then decline in November.

Thursday, September 10, 2009

Trade Deficit Increases in July

by Calculated Risk on 9/10/2009 08:46:00 AM

The Census Bureau reports:

The ... total July exports of $127.6 billion and imports of $159.6 billion resulted in a goods and services deficit of $32.0 billion, up from $27.5 billion in June, revised.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through July 2009.

Imports were up again in July, and exports also increased. On a year-over-year basis, exports are off 22% and imports are off 30%.

The second graph shows the U.S. trade deficit, with and without petroleum, through July.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices increased to $62.48 in July - up about 50% from the prices in February (at $39.22) - and the fifth monthly increase in a row. Import oil prices will probably rise further in August.

It appears the cliff diving for U.S. trade might be over, although recent port data shows some weakness in traffic.

Saturday, August 15, 2009

LA Area Ports: Export Traffic Declines in July

by Calculated Risk on 8/15/2009 01:48:00 PM

Note: this is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inbound traffic was 22.0% below July 2008.

Outbound traffic was 22.7% below July 2008.

There had been some recovery in U.S. exports earlier this year (the year-over-year comparison was off 30% from December through February). And this showed up in the in the Q1 and Q2 GDP reports as net exports of goods and services added 2.64% and 1.38% to GDP in Q1 and Q2, respectively.

This data suggests exports in Q3 are off to a slow start.

Wednesday, August 12, 2009

Trade Deficit Increases in June

by Calculated Risk on 8/12/2009 08:30:00 AM

The Census Bureau reports:

The ... total June exports of $125.8 billion and imports of $152.8 billion resulted in a goods and services deficit of $27.0 billion, up from $26.0 billion in May, revised. June exports were $2.4 billon more than May exports of $123.4 billion. June imports were $3.5 billion more than May imports of $149.3 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through June 2009.

Imports were up in June, mostly because of a spike in oil prices. Exports also increased in June. On a year-over-year basis, exports are off 22% and imports are off 31%.

The second graph shows the U.S. trade deficit, with and without petroleum, through June.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. Import oil prices increased to $59.17 in June - up about 50% from the prices in February - and the fourth monthly increase in a row. Import oil prices will rise further for July and August.

It appears the cliff diving for U.S. trade might be over - especially for U.S. exports.

Thursday, July 16, 2009

LA Area Port Traffic in June

by Calculated Risk on 7/16/2009 06:31:00 PM

Note: this is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inbound traffic was 22.2% below June 2008.

Outbound traffic was 19.2% below May 2008.

There had been some recovery in U.S. exports over the last few months (the year-over-year comparison was off 30% from December through February). And this showed up in the in the May trade report, but the port data suggests exports were a little weaker in June.

Friday, July 10, 2009

Trade Deficit Declined in May

by Calculated Risk on 7/10/2009 08:30:00 AM

The Census Bureau reports:

The ... total May exports of $123.3 billion and imports of $149.3 billion resulted in a goods and services deficit of $26.0 billion, down from $28.8 billion in April, revised. May exports were $1.9 billion more than April exports of $121.4 billion. May imports were $0.9 billion less than April imports of $150.2 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through May 2009.

Imports declined again in May, but U.S. exports were up slightly. On a year-over-year basis, exports are off 21% and imports are off 31%.

The second graph shows the U.S. trade deficit, with and without petroleum, through May.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. Import oil prices increased slightly to $51.21 in May - the third monthly increase in a row. Spot prices have increased since May, so oil prices will rise further for June and July.

It appears the cliff diving for U.S. trade might be over - especially for U.S. exports.

Monday, June 15, 2009

LA Area Port Traffic in May

by Calculated Risk on 6/15/2009 05:16:00 PM

Note: this is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inbound traffic was 19.7% below May 2008.

Outbound traffic was 15.3% below May 2008.

There has been some recovery in exports over the last few months (the year-over-year comparison was off 30% from December through February). But this is the 3nd worst YoY comparison for imports - only February and April were worse. So imports from Asia appear especially weak.

This suggests a little more improvement in the trade balance with Asia in the May trade report. Of course the overall trade deficit will probably be worse because of rising oil prices.

Wednesday, June 10, 2009

Trade Deficit Increases Slightly in April

by Calculated Risk on 6/10/2009 08:43:00 AM

The Census Bureau reports:

The ... total April exports of $121.1 billion and imports of $150.3 billion resulted in a goods and services deficit of $29.2 billion, up from $28.5 billion in March, revised. April exports were $2.8 billon less than March exports of $123.9 billion. April imports were $2.2 billion less than March imports of $152.5 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through April 2009.

Both imports and exports declined again in April. On a year-over-year basis, exports are off 21% and imports are off 31%!

The second graph shows the U.S. trade deficit, with and without petroleum, through April.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. Import oil prices increased slightly to $46.60 in April - the second monthly increase in a row - and following eight consecutive monthly declines. Spot prices have increased sharply since April, so the decline in the trade deficit due to lower oil prices is over for now.

Friday, May 15, 2009

LA Area Port Traffic

by Calculated Risk on 5/15/2009 02:00:00 PM

Note: this is not seasonally adjusted.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inbound traffic was 21.5% below April 2008.

Outbound traffic was 18.3% below April 2008.

There has been some slight recovery in exports the last two months (the year-over-year comparison was off 30% from December through February). But this is the 2nd worst YoY comparison for imports - only February was worse, and that might have been related to the Chinese New Year. So imports from Asia appear especially weak.

This suggests a little more improvement in the trade balance with Asia in the April trade report. Of course the overall trade deficit will probably be worse because of rising oil prices.