by Calculated Risk on 10/01/2009 08:53:00 AM

Thursday, October 01, 2009

August PCE and Saving Rate

Note: A large portion of the increase in durable goods consumption in August was due to cash-for-clunkers, however there was also a significant increase in non-durable goods.

From the BEA: Personal Income and Outlays, August 2009

Personal income increased $19.3 billion, or 0.2 percent, and disposable personal income (DPI) increased $15.5 billion, or 0.1 percent, in August, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $129.6 billion, or 1.3 percent.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.9 percent in August, compared with an increase of 0.2 percent in July. Purchases of durable goods increased 5.8 percent, compared with an increase of 1.8 percent. Reflecting the impact of the federal CARS program (popularly called "cash for clunkers"), purchases of motor vehicles and parts accounted for most of the August increase in purchases of durable goods and more than accounted for the July increase.

...

Personal saving -- DPI less personal outlays -- was $324.1 billion in August, compared with $436.0 billion in July. Personal saving as a percentage of disposable personal income was 3.0 percent in August, compared with 4.0 percent in July.

Click on graph for large image.

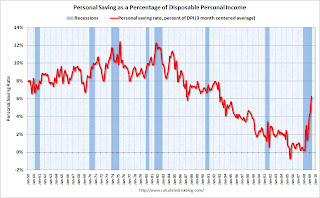

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the August Personal Income report. The saving rate was 3.0% in August.

This decline in the saving rate was probably temporary, and I expect the saving rate to continue to rise.

The following graph shows real Personal Consumption Expenditures (PCE) through August (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.The colored rectangles show the quarters, and the blue bars are the real monthly PCE.

The July and August numbers suggest PCE will grow at over 3% (annualized rate) in Q3, however I expect September to be much lower. So I expect a 2% increase in Q3 PCE.

Note that PCE declined sharply in Q3 and Q4 2008 - the cliff diving - and was been relatively flat in Q1 and Q2 2009. Auto sales gave a boost to PCE in Q3, but in general PCE will probably remain weak into 2010 as households continue to repair their balance sheets.

Friday, August 28, 2009

July PCE and Saving Rate

by Calculated Risk on 8/28/2009 08:30:00 AM

From the BEA: Personal Income and Outlays, July 2009

Personal income increased $3.8 billion, or less than 0.1 percent, and disposable personal income (DPI) decreased $4.6 billion, or less than 0.1 percent, in July, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $25.0 billion, or 0.2 percent.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in July, compared with an increase of 0.1 percent in June.

...

Personal saving -- DPI less personal outlays – was $458.5 billion in July, compared with $486.8 billion in June. Personal saving as a percentage of disposable personal income was 4.2 percent in July, compared with 4.5 percent in June.

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the July Personal Income report. The saving rate was 4.2% in July.

Households are saving substantially more than during the last few years (when the saving rate was around 1.0%). The saving rate will probably continue to rise.

The following graph shows real Personal Consumption Expenditures (PCE) through July (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.The colored rectangles show the quarters, and the blue bars are the real monthly PCE.

The July numbers suggest PCE will grow at a 1.3% (annualized rate) in Q3.

Note that PCE declined sharply in Q3 and Q4 2008 - the cliff diving - and was been relatively flat in Q1 and Q2 2009. Auto sales should gave a boost to PCE in Q3, but in general PCE will probably remain weak over the 2nd half of 2009 and into 2010 as households continue to repair their balance sheets.

Saturday, August 15, 2009

Retailers Expect Slow Back-to-School Sales

by Calculated Risk on 8/15/2009 12:29:00 AM

From the NY Times: Retailers See Slowing Sales in Back-to-School Season

Halfway through the back-to-school shopping season, retail professionals are predicting the worst performance for stores in more than a decade ...From the National Retail Federation: NRF's 2009 Back-to-School and Back-to-College Surveys

The National Retail Federation, an industry group, expects the average family with school-age children to spend nearly 8 percent less this year than last. And ShopperTrak, a research company, predicted customer traffic would be down 10 percent from a year ago.

“This is going to be the worst back-to-school season in many, many years,” said Craig F. Johnson, president of Customer Growth Partners, a retailing consultant firm.

According to the National Retail Federation’s 2009 Back to School Consumer Intentions and Actions Survey, conducted by BIGresearch, the average family with students in grades Kindergarten through 12 is expected to spend $548.72 on school merchandise, a decline of 7.7 percent from $594.24 in 2008. ...There are some positive signs for the economy - like new home sales, auto sales increasing, and industrial production/capacity utilization possibly bottoming out - but without the consumer, any recovery will be sluggish at best.

According to the survey, the economy is having a major impact on back-to-school spending as four out of five Americans (85%) have made some changes to back-to-school plans this year as a result. Some of those changes impact spending, with 56.2 percent of back-to-school shoppers hunting for sales more often, 49.6 percent planning to spend less overall, 41.7 percent purchasing more store brand/generic products and 40.0 percent are planning to increase their use of coupons. Others say the economy has impacted lifestyle decisions, with 11.4 percent saying children will cut back on extracurricular activities or sports and 5.7 percent saying that the economy is impacting whether their children will attend a private or public school.

“The economy has clearly changed the spending habits of American families, which will likely create a difficult back-to-school season for retailers,” said Tracy Mullin, President and CEO of NRF.

Thursday, August 13, 2009

Retail Sales Decline Slightly in July

by Calculated Risk on 8/13/2009 08:31:00 AM

On a monthly basis, retail sales decreased 0.1% from June to July (seasonally adjusted), and sales are off 8.3% from July 2008 (retail ex food services decreased 9.3%).

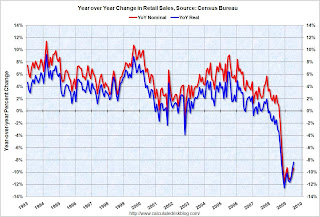

The following graph shows the year-over-year change in nominal and real retail sales since 1993. Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the monthly PCE price index from the BEA was used (July PCE prices were estimated as the average increase over the previous 3 months).

Real retail sales declined by 8.4% on a YoY basis. The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

NOTE: The graph doesn't start at zero to better show the change.

This shows that retail sales fell off a cliff in late 2008, and may have bottomed - but at a much lower level.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for July, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $342.3 billion, a decrease of 0.1 percent (±0.5%)* from the previous month and 8.3 percent (±0.7%) below July 2008. Total sales for the May through July 2009 period were down 9.0 percent (±0.5%) from the same period a year ago. The May to June 2009 percent change was revised from +0.6 percent (±0.5%) to +0.8 percent (±0.2%).Maybe the cliff diving is over, but retail sales are still at the bottom of the cliff ...

Tuesday, August 04, 2009

Consumer Products: "No trend of increasing orders"

by Calculated Risk on 8/04/2009 04:11:00 PM

Brian sent me these comments from Multi-Color Corp. (this company makes labels mostly for consumer product companies: P&G was 19% of Q1 sales and Miller Beer was 13%.)

Multi-Color: “While there is increasing evidence that the worst of the recession may be over, we remain cautious about sales volume for the remainder of the year. While you would expect inventories to be replenished as the economy stabilizes, we have not seen a trend of increasing orders to date.”The end of cliff diving is not the same as green shoots!

Analyst: Just a few questions. The first would be can you talk about the phasing of order flow by month over the course of the quarter? And can you provide any color on how July trended?

Frank Gerace, Multi-Color CEO: Yes, order flow actually was pretty decent during the month of June, better than May, and then as July came in, July began looking more like May, so there was an improvement during June and then it kind of went back to the way it was looking in May. And what we're seeing now is just steady, stable, steady orders, no increases that we can speak of to date.

emphasis added

Friday, July 31, 2009

Restaurants: 22nd Consecutive Month of Traffic Declines in June

by Calculated Risk on 7/31/2009 10:10:00 AM

Note: Any reading below 100 shows contraction for this index.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Remained Uncertain In June as Restaurant Performance Index Declined for Second Consecutive Month

The restaurant industry’s economic challenges continued to persist in June, as the National Restaurant Association’s comprehensive index of restaurant activity declined for the second consecutive month. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 97.8 in June, down 0.5 percent from May and its 20th consecutive month below 100.

“While there are signs that suggest an improvement may be on the horizon, the latest figures indicate that the restaurant industry’s recovery has yet to gain a firm foothold,” said Hudson Riehle, senior vice president of Research and Information Services for the Association. “Restaurant operators continued to report declines in same-store sales and customer traffic in June, and their outlook for sales growth in the months ahead remains mixed.”

...

Restaurant operators also reported negative customer traffic levels in June, marking the 22nd consecutive month of traffic declines.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Unfortunately the data for this index only goes back to 2002.

The restaurant business is still contracting, and although not contracting as fast as late last year, the pace of contraction has picked up over the last two months.

Someone must have eaten the green shoots.

Tuesday, June 30, 2009

Restaurants: 21st Consecutive Month of Traffic Declines

by Calculated Risk on 6/30/2009 11:00:00 AM

Note: Any reading below 100 shows contraction.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Softened in May as Restaurant Performance Index Posted First Decline in Five Months

The outlook for the restaurant industry was dampened somewhat in May, as the National Restaurant Association’s comprehensive index of restaurant activity registered its first decline in five months. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 98.3 in May, down 0.3 percent from April and its 19th consecutive month below 100.

“With the performance of the current situation indicators holding relatively steady in May, the RPI’s decline was the result of restaurant operators’ dampened outlook for each of the four forward-looking indicators,” said Hudson Riehle, senior vice president of Research and Information Services for the Association. “Although restaurant operators remain relatively optimistic that economic conditions will improve in six months, their outlook for sales growth and capital spending activity softened somewhat.”

...

Restaurant operators also reported negative customer traffic levels in May, marking the 21st consecutive month of traffic declines.

...

Capital spending activity remained relatively steady, despite the continued soft sales and traffic levels. Forty-one percent of operators said they made a capital expenditure for equipment, expansion or remodeling during the last three months, down from 43 percent who reported similarly last month.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Unfortunately the data for this index only goes back to 2002.

This is another example of still contracting, but contracting at a slower pace than earlier this year.

Friday, June 26, 2009

Personal Income and Outlays Boosted by Stimulus

by Calculated Risk on 6/26/2009 08:30:00 AM

From the BEA: Personal Income and Outlays, April 2009

Personal income increased $167.1 billion, or 1.4 percent, and disposable personal income (DPI) increased $178.1 billion, or 1.6 percent, in May, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $25.1 billion, or 0.3 percent. In April, personal income increased $78.3 billion, or 0.7 percent, DPI increased $140.0 billion, or 1.3 percent, and PCE increased $1.0 billion, or less than 0.1 percent, based on revised estimates. The pattern of changes in personal income and in DPI reflect, in part, the pattern of increased government social benefit payments associated with the American Recovery and Reinvestment Act of 2009.The May numbers were impacted by the American Recovery and Reinvestment Act of 2009. As an example, payments to seniors increased sharply and “Personal Current Transfers,” increased by $165 billion (annual rate). This boosted personal income.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in May, in contrast to a decrease of 0.1 percent in April.

...

Personal saving -- DPI less personal outlays -- was $768.8 billion in May, compared with $608.5 billion in April. Personal saving as a percentage of disposable personal income was 6.9 percent in May, compared with 5.6 percent in April.

This also pushed up the saving rate sharply to the highest rate since Dec 1993 (but this is a temporary boost).

A couple points:

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the April Personal Income report. The saving rate was 6.9% in April. (6.3% with average)

The saving rate was boosted by the stimulus package, but this suggests households are saving substantially more than during the last few years (when the saving rate was close to zero). The saving rate will probably dip - the stimulus boost is unsustainable - but then continue to rise (an aging population usually pushes the saving rate higher) and a rising saving rate will repair household balance sheets, but this will also keep pressure on personal consumption.

The following graph shows real Personal Consumption Expenditures (PCE) through May (2000 dollars). Note that the y-axis doesn't start at zero to better show the change.

PCE declined sharply in Q3 and Q4 2008, and rebounded slightly in Q1 2009.

PCE declined sharply in Q3 and Q4 2008, and rebounded slightly in Q1 2009.Although PCE increased in May (compared to April), Q2 2009 is off to a somewhat weak start, with PCE in both April and May slightly below the levels of Q1. Although it is possible that PCE will pick up in June, it seems likely that PCE will be flat to slightly negative in Q2 (although not the cliff diving of the 2nd half of 2008). The two-month estimate suggests a real PCE decline of 0.7% in Q2 2009.

Usually PCE and Residential Investment (RI) lead the economy out of recession, and right now both remain weak. As households increase their savings rate to repair their balance sheets, it seems unlikely that PCE will increase significantly any time soon.

Monday, June 01, 2009

More on Consumption in April

by Calculated Risk on 6/01/2009 01:18:00 PM

The following graph shows real Personal Consumption Expenditures (PCE) through April (2000 dollars). Note that the y-axis doesn't start at zero to better show the change. Click on graph for larger image in new window.

Click on graph for larger image in new window.

PCE declined sharply in Q3 and Q4 2008, and rebounded slightly in Q1 2009.

Q2 2009 is off to a weak start, with PCE in April below the levels of Q1. Although it is possible that PCE will pick up in May and June, it seems likely that PCE will be negative in Q2 (although not the cliff diving of the 2nd half of 2008).

Usually PCE and Residential Investment (RI) lead the economy out of recession, and right now both remain weak. As households increase their savings rate to repair their balance sheets, it seems unlikely that PCE will increase significantly any time soon.

Just a reminder - the end to cliff diving is not the same thing as "green shoots".

Consumption Down, Saving Rate Increases in April

by Calculated Risk on 6/01/2009 08:44:00 AM

From the BEA: Personal Income and Outlays, April 2009

Personal income increased $58.2 billion, or 0.5 percent, and disposable personal income (DPI) increased $121.8 billion, or 1.1 percent, in April, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $5.4 billion, or 0.1 percent. ... The pattern of changes in income reflect, in part, the pattern of reduced personal current taxes and increased government social benefit payments associated with the American Recovery and Reinvestment Act of 2009.A few points:

...

Real PCE -- PCE adjusted to remove price changes -- decreased 0.1 percent in April, compared with a decrease of 0.3 percent in March.

...

Personal saving as a percentage of disposable personal income was 5.7 percent in April, compared with 4.5 percent in March.

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the April Personal Income report. The saving rate was 5.7% in April. (5.1% with average)

The saving rate was boosted by the stimulus package, but this suggests households are saving substantially more than during the last few years (when the saving rate was close to zero). The saving rate will probably continue to rise (an aging population usually pushes the saving rate higher) and a rising saving rate will repair household balance sheets, but this will also keep pressure on personal consumption.

Friday, May 22, 2009

The Oil Cushion: Getting Smaller

by Calculated Risk on 5/22/2009 03:09:00 PM

Last year I wrote a post about how falling oil prices would provide some cushion for the U.S. economy: The Oil Cushion. Here is another update ...

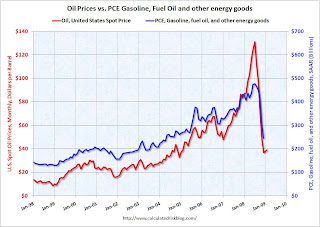

The following graph shows the monthly personal consumption expenditures (PCE) at a seasonally adjusted annual rate (SAAR) for gasoline, oil and other energy goods compared to the U.S. spot price for oil (monthly). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Last quarter I noted:

"The good news is at current oil prices (U.S. spot prices averaged about $39 per barrel in February), oil related PCE will be in the $250 billion seasonally adjusted annual rate (SAAR) range in Q1 - well below the $440 billion SAAR of the first 8 months of 2008.

This is a savings of about $16 billion per month compared to the first 8 months of 2008. That savings will definitely provide a cushion for consumers."

As expected, the BEA reported "PCE, Gasoline, fuel oil, and other energy goods" at $265 billion (SAAR) in Q1.

Now, with spot prices pushing $60 per barrel, oil related PCE will probably come in close to $300 billion (SAAR) in Q2.

That is still provides a sizable cushion compared to the first eight months of 2008 (about $11 billion per month), but this is a drag compared to Q1.

Data sources:

PCE from BEA underlying detail tables: Table 2.4.5U. Personal Consumption Expenditures by Type of Product line 117.

Oil prices from EIA U.S. Spot Prices.

Wednesday, May 13, 2009

MEW, Consumption and Personal Saving Rate

by Calculated Risk on 5/13/2009 09:29:00 PM

Here is a new paper on Mortgage Equity Withdrawal (MEW): House Prices, Home Equity-Based Borrowing, and the U.S. Household Leverage Crisis by Atif Mian and Amir Sufi (both University of Chicago Booth School of Business and NBER) (ht Jan Hatzius)

From the authors abstract (the entire paper is available at the link):

Using individual-level data on homeowner debt and defaults from 1997 to 2008, we show that borrowing against the increase in home equity by existing homeowners is responsible for a significant fraction of both the sharp rise in U.S. household leverage from 2002 to 2006 and the increase in defaults from 2006 to 2008. Employing land topology-based housing supply elasticity as an instrument for house price growth, we estimate that the average homeowner extracts 25 to 30 cents for every dollar increase in home equity. Money extracted from increased home equity is not used to purchase new real estate or pay down high credit card debt, which suggests that consumption is a likely use of borrowed funds. Home equity-based borrowing is stronger for younger households, households with low credit scores, and households with high initial credit card utilization rates. Homeowners in high house price appreciation areas experience a relative decline in default rates from 2002 to 2006 as they borrow heavily against their home equity, but experience very high default rates from 2006 to 2008. Our estimates suggest that home equity based borrowing is equal to 2.3% of GDP every year from 2002 to 2006, and accounts for over 20% of new defaults in the last two years.A couple of key points:

emphasis added

And this brings us to the personal saving rate.

In an earlier post I argued that the saving rate declined into the early '90s because of demographic changes, however I expected the saving rate to start to rise as the boomers reached their mid-40s (in the late 1990s). Obviously this didn't happen.

I posited that the wealth effect from the twin bubbles - stock market and housing - had led the boomers into believing they had saved more than they actually had.

This research suggests that MEW played a significant role in suppressing the saving rate too. And since the Home ATM is now closed, this is more evidence that the saving rate will increase (probably back to 8% or so) - and keep pressure on the growth of personal consumption expenditures (PCE).

For background, here are couple of graphs:

Click on graph for large image.

Click on graph for large image.The first graph shows the annual saving rate back to 1929.

Notice that the saving rate went negative during the Depression as household used savings to supplement income. And the saving rate rose to over 25% during WWII.

There is a long period of a rising saving rate (from after WWII to about 1974) and a long period of a declining saving rate (from the early '80s to 2008). (corrected text)

Some of the change in saving rate was related to demographics. As the large baby boom cohort entered the work force in the mid '70s, the saving rate declined (younger families usually save less). But, as I noted above, I expected the saving rate to start to increase in the last '90s.

And here are the Kennedy-Greenspan estimates (NSA - not seasonally adjusted) of home equity extraction through Q4 2008, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41.

NOTE: Anyone who wants the Equity Extraction data, please see this post for a spreadsheet and how to credit Dr. Kennedy's work.

This graph shows what Dr. Kennedy calls "active MEW" (Mortgage Equity Withdrawal). This is defined as "Gross cash out" plus the change in the balance of "Home equity loans".

This graph shows what Dr. Kennedy calls "active MEW" (Mortgage Equity Withdrawal). This is defined as "Gross cash out" plus the change in the balance of "Home equity loans".This measure is near zero ($7.2 billion for the quarter) and is an estimate of the impact of MEW on consumption. When people refinance with cash out or draw down HELOCs, they usually spend the money.

Monday, May 11, 2009

The Impact of Changes in the Saving Rate on PCE

by Calculated Risk on 5/11/2009 01:44:00 PM

On Saturday I excerpted from a NY Times article Shift to Saving May Be Downturn’s Lasting Impact. I argued:

The saving rate will probably continue to rise (an aging population usually pushes the saving rate higher) and a rising saving rate will repair household balance sheets, but ... this will also keep pressure on personal consumption.First, here is a graph of the annual saving rate back to 1929.

Click on graph for large image.

Click on graph for large image.Notice that the saving rate went negative during the Depression as household used savings to supplement income. And the saving rate rose to over 25% during WWII.

There is a long period of a rising saving rate (from after WWII to 1974) and a long period of a declining saving rate (from 1975 to 2008).

Some of the change in saving rate was related to demographics. As the large baby boom cohort entered the work force in the mid '70s, the saving rate declined (younger families usually save less), however I expected the saving rate to start to rise as the boomers reached their mid-40s (in the late '90s). This didn't happen.

Perhaps the twin bubbles - stock market and housing - deluded the boomers into thinking they had saved more than they actually had. Perhaps the boomers were deluded by bad economic analysis (see David Malpass: Running on Empty?)

Whatever the reason, I expect the saving rate to continue to rise over the next year or two. And that raises a question: what will be the impact on PCE of a rising saving rate?

I created the following scatter graph for the period from 1955 through Q1 2009. This compares the annual change in PCE with the annual change in the saving rate.

Note that R-squared is only .125, so there are other factors impacting PCE (like changes in income!).

Note that R-squared is only .125, so there are other factors impacting PCE (like changes in income!).But a rising saving rate does seem to suppress PCE (as expected). If the saving rate rises to 8% by the end of 2010, this suggests that real PCE growth will be about 1% below trend per year.

So with wages barely rising, and a rising saving rate suppressing PCE, I'd expect PCE growth to be sluggish for some time. And since PCE is usually one of the engines of recovery (along with residential investment), I expect the recovery to be very sluggish too (no Immaculate recovery).

Friday, May 01, 2009

Comparing Quarterly and Monthly PCE

by Calculated Risk on 5/01/2009 03:00:00 PM

Here is a common question:

Q: I was looking at the Q1 Advance GDP report, and it showed that PCE was up 2.2%. However the March Personal Income and Outlay report showed that real March PCE was off -0.2%, after increasing 0.1% in February, and 0.9% in January. How did they get 2.2% for Q1 PCE growth? How does that compare to the monthly numbers?

A: First, the reported change in the Personal Income report is from the previous month (not annualized). The quarterly GDP report is the annualized change from Q4 to Q1.

Second, the quarterly change is from the average PCE in Q4 to the average PCE in Q1. Look at the following chart ...

Click on graph for larger image in new window.

Note: graph doesn't start at zero to show the change. All numbers are in billions.

This shows both the quarterly (red) and monthly (blue) PCE data (2000 dollars).

If you average October, November and December PCE, you get the Q4 PCE. And Q1 PCE is the average of January, February and March.

The math is simple: $8,214.2 (Q1 2009) divided by $8170.5 (Q4 2008) equals 1.00535. Take that to the 4th power (to annualize), subtract 1, and that gives the annualized rate of change in real PCE from Q4 to Q1: 2.2%.

Notice that the month-to-month change isn't useful in comparing to the quarterly change. Also notice that I didn't even report the March PCE numbers - that was mostly captured in the Q1 GDP report - and the monthly series is noisy.

The first two Personal Income reports each quarter are much more useful than the final month. When the April Personal Income report is released, the media will focus on the month-to-month change. However I will compare April PCE to January PCE - and then May PCE to February. This is the "two month" estimate for Q2 PCE (notice the calculation compares to the same month of the previous quarter, not the previous month).

For some time I had been forecasting a slump in consumer spending, and then using the two month method, I was able to declare the slump had arrived, see: Personal Income for August Indicates Consumer Recession and Estimating PCE Growth for Q3 2008

[T]his will be the first decline in PCE since Q4 1991. This is strong evidence that the indefatigable U.S. consumer is finally throwing in the towel.I was also among the first to point out PCE would probably be positive in Q1: February PCE and Personal Saving Rate

This suggests that PCE will make a positive contribution to GDP in Q1.The monthly data is extremely useful for forecasting - especially the first two months of each quarter.

Tuesday, March 31, 2009

Restaurant Peformance Index: 16th Consecutive Month of Contraction

by Calculated Risk on 3/31/2009 11:55:00 AM

From the National Restaurant Association (NRA): Restaurant Industry Outlook Remains Uncertain as Restaurant Performance Index Stood Below 100 for 16th Consecutive Month

Restaurant industry performance remained soft in February, as the National Restaurant Association’s comprehensive index of restaurant activity stood below 100 for the 16th consecutive month. The Association’s Restaurant Performance Index (RPI) ... stood at 97.5 in February, up 0.1 percent from its January level.

“Although the index registered its second consecutive monthly gain, each of the RPI’s eight indicators stood below 100 in February, which signifies continued contraction,” said Hudson Riehle, senior vice president of Research and Information Services for the Association. “A majority of restaurant operators reported negative same-store sales and customer traffic levels in February, and their outlook for sales growth in the months ahead remains uncertain.”

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Unfortunately the data for this index only goes back to 2002.

The index values above 100 indicate a period of expansion; index values below 100 indicate a period of contraction.

Based on this indicator, the restaurant industry has been contracting since November 2007.

Sunday, March 29, 2009

Personal Saving and Mortgage Equity Withdrawal

by Calculated Risk on 3/29/2009 03:42:00 PM

Much has been made about the personal saving rate falling to zero during the housing bubble, and rising sharply in recent months. This decline in the saving rate was probably related to homeowner's borrowing against their homes.

During the housing bubble there was a huge surge in home equity borrowing or cash-out refinancing - commonly called mortgage equity withdrawal (MEW) - that led many people to spend more than their usually defined disposable personal income (DPI). (ht Professor Martha Olney)

However this didn't capture MEW. The following two graphs show the impact of MEW. Note: I used 50% of MEW, because that appears to be the amount consumed. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows disposal personal income (blue), disposal personal income plus MEW (green) and personal outlays (red). Note: Graph doesn't start at zero to better show the change.

The BEA defines personal saving as the difference between the blue and red lines:

Personal Savings = Disposable Personal Income - Personal Outlays

However many people acted as if MEW was income, and that would mean personal saving was the difference between the green and red lines. The second graph shows the same data except as a saving rate.

The second graph shows the same data except as a saving rate.

As Professor Olney mentioned to me, the aggregate saving rate captures the behavior of both savers (who probably didn't change their behavior) and "dissavers" (who borrowed heavily). The saving rate declined to zero, probably because the dissavers were using MEW as income.

Now that the Home ATM is closed, the saving rate is rising because of less borrowing - as dissavers are forced to live within their incomes.

Friday, March 27, 2009

February PCE and Personal Saving Rate

by Calculated Risk on 3/27/2009 08:26:00 AM

The BEA released the Personal Income and Outlays report for February this morning. The report shows that PCE will probably make a positive contribution to GDP in Q1 2009.

Each quarter I've been estimating PCE growth based on the Two Month method. This method is based on the first two months of each quarter and has provided a very close estimate for the actual quarterly PCE growth.

Some background: The BEA releases Personal Consumption Expenditures monthly and quarterly, as part of the GDP report (also released separately quarterly).

You can use the monthly series to exactly calculate the quarterly change in real PCE. The quarterly change is not calculated as the change from the last month of one quarter to the last month of the next. Instead, you have to average all three months of a quarter, and then take the change from the average of the three months of the preceding quarter.

So, for Q1 2009, you would average real PCE for January, February, and March, then divide by the average for October, November and December. Of course you need to take this to the fourth power (for the annual rate) and subtract one.

The March data isn't released until after the advance Q1 GDP report. But we can use the change from October to January, and the change from November to February (the Two Month Estimate) to approximate PCE growth for Q1.

The two month method suggests real PCE growth in Q1 of 0.8% (annualized). Not much, but a significant improvement from the previous two quarters (declines of -3.8% and -4.3% in PCE).

The following graph shows this calculation: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows real PCE for the last 12 months. The Y-axis doesn't start at zero to better show the change.

The dashed red line shows the comparison between January and October. The dashed green line shows the comparison between February and November.

Since PCE was weak in December, the March to December comparison will probably be positive too.

This graph also show the declines in PCE in Q3 and Q4.

For Q3, compare July through September with April through June. Notice the sharp decline in PCE. The same was true in Q4.

This suggests that PCE will make a positive contribution to GDP in Q1.

Also interesting:

Personal saving -- DPI less personal outlays -- was $450.7 billion in February, compared with $478.1 billion in January. Personal saving as a percentage of disposable personal income was 4.2 percent in February, compared with 4.4 percent in January.This is substantially above the near zero percent saved of recent years.

This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing).

This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing).Although this data may be revised significantly, this does suggest households are saving substantially more than during the last few years (when they saving rate was close to zero). This is a necessary but painful step ... and a rising saving rate will repair balance sheets, but also keep downward pressure on personal consumption.

It is not much, but this is definitely a positive report.

Thursday, March 26, 2009

House Prices vs. PCE

by Calculated Risk on 3/26/2009 06:24:00 PM

We do requests (sometimes). This is an update to a graph I posted last November.

This is a look at the real year-over-year (YoY) change in house prices vs. personal consumption expenditures (PCE) through Q4 2008:  Click on image for larger graph in new window.

Click on image for larger graph in new window.

This graph shows real Case-Shiller quarterly national prices adjusted using CPI less Shelter vs. real PCE. Note that YoY real Case-Shiller prices fell at a slightly slower pace in Q4 - only 17% - compared to 21% YoY in Q3, mostly because CPI less shelter declined in Q4.

For this limited data set (house price data is only available since 1987) the YoY changes move somewhat together, although house prices started declining before PCE during the current economic downturn. This difference in timing could be because of homeowners withdrawing equity from their homes (the Home ATM) even after prices first started falling. However the recent MEW data shows that the Home ATM is closed and consumption has declined sharply.

This doesn't tell us how much further real PCE will decline on a YoY basis - my initial guess was 4%, but it might be less.

Sunday, March 15, 2009

Hamilton: "What will recovery look like?"

by Calculated Risk on 3/15/2009 06:10:00 PM

Professor Hamilton provides a number of graphs on the temporal order of a recovery: What will recovery look like?

This adds to my post: Business Cycle: Temporal Order

Here is the table I provided of a simplified temporal order for emerging from a recession. The table shows when each area typically starts to recovery relative to the end of the recession.

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment(1) | ||

And this graph from Professor Hamilton shows the average pattern for all the recessions since 1947.

And here is what the current recession looks like. The record slump in RI has changed the scale of the graph, but the order appears the same.

For recovery, we know what to watch: Residential Investment (RI) and PCE. The increasingly severe slump in CRE / non-residential investment in structures will be interesting, but that is a lagging indicator for the economy.

Unfortunately there are reasons that RI (excess supply) and PCE (too much debt) won't rebound quickly, but they are still the areas to watch.

And here is an excerpt from a research note by Jan Hatzius, Chief Economist at Goldman Sachs, sent out this afternoon:

"Although we still think real GDP will fall by about 7% annualized in Q1 and the labor market numbers remain awful, the good news is that the weakness is shifting from more leading to more lagging sectors."(1) In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

Saturday, March 07, 2009

The Oil Cushion

by Calculated Risk on 3/07/2009 12:43:00 PM

Last year I wrote a post about how falling oil prices would provide some cushion for the U.S. economy: The Oil Cushion. Here is an update ...

The following graph shows the monthly personal consumption expenditures (PCE) at a seasonally adjusted annual rate (SAAR) for gasoline, oil and other energy goods compared to the U.S. spot price for oil (monthly). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The good news is at current oil prices (U.S. spot prices averaged about $39 per barrel in February), oil related PCE will be in the $250 billion seasonally adjusted annual rate (SAAR) range in Q1 - well below the $440 billion SAAR of the first 8 months of 2008.

This is a savings of about $16 billion per month compared to the first 8 months of 2008. That savings will definitely provide a cushion for consumers.

The previous two quarters (Q3 and Q4) saw two of the four largest percentage declines in PCE in the last 40 years (-4.3% and -3.8% respectively). But there was little or no oil cushion in Q3, and about $7 billion per month in Q4 ... and as expected, the Q4 oil cushion showed up more as savings, as opposed to other consumption. But savings is a help too, because rebuilding savings is a necessary step towards rebuilding household balance sheets.

In Q1 the oil savings is much larger and will probably provide more of a cushion for consumers.

Data sources:

PCE from BEA underlying detail tables: Table 2.4.5U. Personal Consumption Expenditures by Type of Product line 117.

Oil prices from EIA U.S. Spot Prices.