by Calculated Risk on 3/02/2009 11:36:00 AM

Monday, March 02, 2009

January PCE and Personal Saving Rate

Amid all the gloom this morning - the AIG bailout and massive losses, the weak manufacturing ISM index, the cliff diving construction spending numbers - there was this Personal Income and Outlays report for January from the BEA.

This report showed that personal income increased in January, however the increase was mostly because of special factors related to government and military wage increases. But this report also showed that PCE was up slightly from October to January (the period that matters for GDP); about 0.7% in real terms annualized. Not much - and this is just one data point and could be revised, and this might be impacted by gift cards (this data uses the January retail numbers) - but perhaps PCE won't fall completely off a cliff in Q1. I still expect PCE to decline sharply in Q1, but maybe not as rapidly as in Q3 2008 (-3.8% SAAR) and Q4 2008 (-4.3% SAAR)

(SAAR: seasonally adjusted annual rate)

Also interesting:

Personal saving -- DPI less personal outlays -- was $545.5 billion in January, compared with $416.8 billion in December. Personal saving as a percentage of disposable personal income was 5.0 percent in January, compared with 3.9 percent in December.This increase in the percent saved is an important part of the rebalancing process and helps repair household balance sheets.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing).

Although this data may be revised significantly, this does suggest households are saving substantially more than during the last few years (when they saving rate was close to zero). This is a necessary but painful step ... and a rising saving rate will repair balance sheets, but also keep downward pressure on personal consumption.

Friday, February 27, 2009

Restaurant Performance Index Rebounds Slightly

by Calculated Risk on 2/27/2009 10:57:00 AM

From the National Restaurant Association (NRA): Restaurant Industry Outlook Improved Somewhat in January as Restaurant Performance Index Rebounded From December’s Record Low

The outlook for the restaurant industry improved somewhat in January, as the National Restaurant Association’s comprehensive index of restaurant activity bounced back from December’s record low. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 97.4 in January, up 1.0 percent from December’s record low level of 96.4.

“Despite the encouraging January gain, the RPI remained below 100 for the 15th consecutive month, which signifies contraction in the key industry indicators,” said Hudson Riehle, senior vice president of Research and Information Services for the Association. “Same-store sales and customer traffic remained negative in January, and only one out of four operators expect to have stronger sales in six months.”

...

Restaurant operators reported negative customer traffic levels for the 17th consecutive month in January.

...

Along with soft sales and traffic levels, capital spending activity remained dampened in recent months. Thirty-four percent of operators said they made a capital expenditure for equipment, expansion or remodeling during the last three months, matching the proportion who reported similarly last month and tied for the lowest level on record.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Unfortunately the data for this index only goes back to 2002.

The index values above 100 indicate a period of expansion; index values below 100 indicate a period of contraction.

Based on this indicator, the restaurant industry has been contracting since November 2007. Also note the record low business investment by restaurant operators - this is happening in most industries, and is showing up as a significant decline in equipment and software investment in the GDP report (-28.8% annualized in the Q4 report!)

Thursday, February 12, 2009

Retail Sales Increase Slightly in January

by Calculated Risk on 2/12/2009 08:30:00 AM

On a monthly basis, retail sales increased slightly from December to January (seasonally adjusted), but sales are off 10.6% from January 2008 (retail and food services decreased 9.7%).

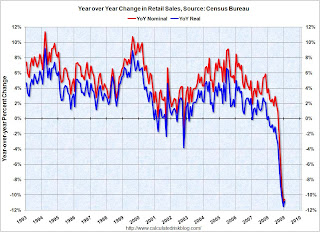

The following graph shows the year-over-year change in nominal and real retail sales since 1993. Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the monthly PCE price index from the BEA was used (January PCE prices were estimated as the same as December).

Although the Census Bureau reported that nominal retail sales decreased 10.6% year-over-year (retail and food services decreased 9.7%), real retail sales declined by 10.9% (on a YoY basis). The YoY change decreased slightly from last month.

There is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for January, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $344.6 billion, an increase of 1.0 percent (±0.5%) from the previous month, but 9.7 percent (±0.7%) below January 2008. Total sales for the November 2008 through January 2009 period were down 9.5 percent (±0.5%) from the same period a year ago. The November to December 2008 percent change was revised from –2.7 percent (±0.5%) to –3.0 percent (±0.2%).One month does not make a trend change, and January retail sales are still over 2% below sales in Q4 - suggesting a further decline in Q1 PCE.

Friday, January 30, 2009

Restaurant Performance Index at New Low

by Calculated Risk on 1/30/2009 02:55:00 PM

Note: This is a new "record low", but the index has only been compiled since 2002, so this is the first recession for the index.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Softens as the Restaurant Performance Index Fell to a Record Low in December

The outlook for the restaurant industry continued to weaken in December, as the National Restaurant Association's comprehensive index of restaurant activity fell to another record low. The Association's Restaurant Performance Index (RPI) - a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry - stood at 96.4 in December, down 0.2 percent from November and its 14th consecutive month below 100.

The December decline in the Restaurant Performance Index was the result of a drop in the current situation component. Same-store sales results were the softest in the history of the Restaurant Performance Index, with nearly two-thirds of restaurant operators reporting lower sales in December.

...

Capital spending activity in the restaurant industry deteriorated along with sales and traffic in recent months. Thirty-four percent of operators said they made a capital expenditure for equipment, expansion or remodeling during the last three months, the lowest level on record.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Unfortunately the data for this index only goes back to 2002.

The index values above 100 indicate a period of expansion; index values below 100 indicate a period of contraction.

Based on this indicator, the restaurant industry has been contracting since November 2007.

Wednesday, January 07, 2009

Restaurant Performance Index at Record Low

by Calculated Risk on 1/07/2009 02:17:00 PM

From the National Restaurant Association (NRA): Restaurant Performance Index Fell to a Record Low in November as Economy Continued to Worsen

The outlook for the restaurant industry worsened in November, as the National Restaurant Association’s comprehensive index of restaurant activity fell to a record-low level. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 96.7 in November, down 0.4 percent from October and its 13th consecutive month below 100.

“The November decline in the Restaurant Performance Index was the result of broad-based declines across the index components, with the Current Situation index falling to a new record low,” said Hudson Riehle, senior vice president of Research and Information Services for the Association. “A solid majority of restaurant operators reported negative same-store sales and traffic levels in November, while nearly one-half expect their sales in six months to be lower than the same period in the previous year.”

“The continued deterioration in economic conditions is reflected in operator sentiment, with a record 47 percent of restaurant operators saying the economy is currently the number-one challenge facing their business,” Riehle added. “Looking forward, restaurant operators aren’t particularly optimistic about an improvement either, with 49 percent expecting economic conditions to worsen in six months.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.Unfortunately the data for this index only goes back to 2002.

The index values above 100 indicate a period of expansion; index values below 100 indicate a period of contraction.

Based on this indicator, the restaurant industry has been contracting since November 2007.

Wednesday, December 24, 2008

Estimating PCE Growth for Q4 2008

by Calculated Risk on 12/24/2008 09:26:00 AM

Last quarter I was the first to note that PCE would probably be negative in the quarter based on the "two month estimate". That was the first decline in PCE since Q4 1991.

This quarter the two month estimate suggests PCE will be negative again. However most analysts might be a little too pessimistic for Q4 2008.

The BEA reports on Personal Income and Outlays:

Personal consumption expenditures (PCE) decreased $56.1 billion, or 0.6 percent.That may sound bad, but it is somewhat better than expected.

Maybe December will be especially weak, or maybe October and November will be revised downwards, but the two month estimate suggests real PCE will decline in Q4 by about 2.9% (annual rate).

Other components of GDP - especially invesment - will be very weak in Q4, but most estimates of negative 5% GDP change (annualized) included a decline of PCE in the negative 4% to 4.5% range.

As an example, here is the Northern Trust forecast (last page) of -5.0% GDP, and -4.0% PCE in Q4 2008. Since PCE accounts for about 71% of GDP, maybe these forecasts will be revised up slightly.

Friday, December 19, 2008

Q3 2008: Mortgage Equity Extraction Strongly Negative

by Calculated Risk on 12/19/2008 10:55:00 AM

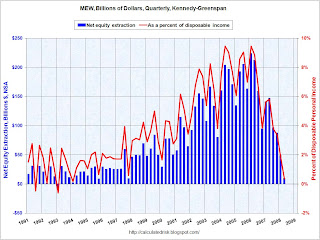

Here are the Kennedy-Greenspan estimates (NSA - not seasonally adjusted) of home equity extraction for Q3 2008, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q3 2008, Dr. Kennedy has calculated Net Equity Extraction as minus $64.1 billion, or negative 2.4% of Disposable Personal Income (DPI).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.  Dr. Kennedy provides several other measures of equity extraction. The second graph shows what Dr. Kennedy calls "active MEW" (Mortgage Equity Withdrawal). This is defined as "Gross cash out" plus the change in the balance of "Home equity loans".

Dr. Kennedy provides several other measures of equity extraction. The second graph shows what Dr. Kennedy calls "active MEW" (Mortgage Equity Withdrawal). This is defined as "Gross cash out" plus the change in the balance of "Home equity loans".

This measure is also slightly negative.

The Fed's Flow of Funds report shows the amount of mortgages outstanding is declining, and this is partially because of debt cancellation per foreclosure sales, and partially due to homeowners paying down their mortgages (as opposed to borrowing more). Note: most homeowners pay down their principal a little each month (unless they have an IO or Neg AM loan), so with no new borrowing, equity extraction would always be negative.

But this suggests that the Home ATM is closed, and MEW is no longer supporting consumption.

Wednesday, November 26, 2008

On Faltering Consumption

by Calculated Risk on 11/26/2008 06:24:00 PM

First, look at these three comments on consumer spending:

From the WSJ: Data Indicate Faltering Demand

Spending is declining in the consumer and capital sectors, as demand for expensive goods took its biggest spill in two years in October and consumption dropped at the sharpest rate in seven years.From Professor Roubini wrote:

Another batch of worse than awful news greeted today Americans getting ready for the Thanksgiving holiday: free falling consumption spending, collapsing new homes sales, falling consumer confidence, very high initial claims for unemployment benefits, collapsing orders for durable goods.And from Bloomberg: Consumer Spending in U.S. Falls 1%, Most in 7 Years

Spending by U.S. consumers dropped in October by the most since the 2001 contraction, signaling the economy is sinking into a deeper recession.emphasis added

...

The biggest consumer spending slump in three decades is likely to persist as home prices fall and job losses mount, threatening the holiday sales outlook ...

Sounds pretty bad, and the numbers from the BEA were definitely ugly - but the numbers were slightly better than I expected. The monthly data is pretty noisy and may be revised significantly, but the reported numbers showed a 3.9% annualized real decline in personal consumption expenditures (PCE) from July to October (the period that matters for GDP), and that was somewhat better than 4.5% to 5.0% decline I was expecting. This is just one month of 4th quarter data - and PCE could get revised or decline more in November and December - but this suggests the more dire predictions (worse than 5% annualized real GDP decline) for Q4 GDP might be excessive.

Hey, a 5% annualized decline in real GDP is bad enough!

Tuesday, November 25, 2008

House Prices vs. PCE

by Calculated Risk on 11/25/2008 03:23:00 PM

Earlier I posted the Case-Shiller monthly house prices, the house price-to-rent ratio, and the house price-to-income ratio.

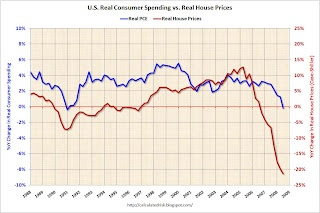

Here is a look at the real year-over-year (YoY) change in house prices vs. personal consumption expenditures (PCE):  Click on image for larger graph in new window.

Click on image for larger graph in new window.

This graph compares the YoY change in real house prices with the YoY change in real PCE.

For this limited data set (house price data is only available since 1987) the YoY changes move somewhat together, although house prices started declining before PCE during the current economic downturn. This difference in timing could be because of homeowners withdrawing equity from their homes (the Home ATM) even after prices first started falling. However recent data shows that the Home ATM is now pretty much closed - and as expected consumption has started to decline sharply.

Based on this general relationship, I wouldn't be surprised to see the YoY change in real PCE fall to -4% or so at some point next year.

Friday, October 31, 2008

Real Personal Spending Declined Sharply in September

by Calculated Risk on 10/31/2008 08:37:00 AM

As expected - based on the advance GDP report - the BEA reports that real Personal Consumption Expenditures (PCE) declined sharply in September.

The year-over-year change in real PCE is now negative for the first time since 1991.

The change from June (third month of Q2) to September declined at a 3.9% annual rate, the fastest 3 month decline since 1991. Note: I look at the change in the same month in each quarter (June to September here) to compare to the quarterly GDP report.

Here is the story from the WSJ: Consumer Spending Declines

Thursday, October 30, 2008

PCE: Worse in September

by Calculated Risk on 10/30/2008 03:12:00 PM

Just a quick note: Real Personal Consumption Expenditures (PCE) declined 3.1% (annualized) in Q3 according to the BEA Q3 Advance GDP report. This was the first decline since 1992, and real PCE was less in Q3 2008 than in Q3 2007!

This also suggests that spending declined sharply in September (or that earlier months were revised down).

My "two month" estimate for PCE in Q3 was -2.4%, and two Fed researchers proposed another method that forecast PCE of -2.3%.

Either way, the quarterly decline of -3.1% suggests that the decline in consumer spending was even worse in September than for July and August, and assuming no downward revision for the previous months, this indicates a decline of -4.4% (annual rate) for September compared to June.

Note: when comparing months, the headline number will be to the previous month (August in this case), but the better comparison - for comparing to the quarterly data - is to compare to the monthly data of the same month of the previous quarter (third month in Q2 or June).

The BEA will release the numbers for September tomorrow morning, and they will probably be ugly.

Saturday, October 25, 2008

The Oil Cushion

by Calculated Risk on 10/25/2008 11:03:00 PM

How much will the decline in oil prices cushion the U.S. recession? That seems like a key question.

Here is an excerpt from Time: What's Behind (and Ahead for) the Plunging Price of Oil

If gasoline drops $1.50 the $900 [the average driver] saves would amount to a big stimulus package. According to Ed Leamer, director of the UCLA's Anderson Forecast, the current price slide could drop another $200-to-$250 billion into consumers' pockets, given that as of the second quarter personal spending for gas fuel oil and other energy was about $442 billion on an annualized basis.The following graph shows the monthly personal consumption expenditures (PCE) at a seasonally adjusted annual rate (SAAR) for gasoline, oil and other energy goods compared to the U.S. spot price for oil (monthly).

Click on graph for larger image in new window.

Click on graph for larger image in new window. At current oil prices, it appears oil related PCE will fall to $300-$350 billion SAAR, from close to $500 billion SAAR in July. This is a savings of $12 to $15 billion per month compared to July. And that would be helpful and definitely provide some cushion for consumers. This might show up as more savings, as opposed to other consumption, but rebuilding savings is probably a necessary step towards rebuilding household balance sheets.

Data sources:

PCE from BEA underlying detail tables: Table 2.4.5U. Personal Consumption Expenditures by Type of Product line 117.

Oil prices from EIA U.S. Spot Prices.

Friday, October 24, 2008

Fed Researchers on Predicting PCE

by Calculated Risk on 10/24/2008 06:29:00 PM

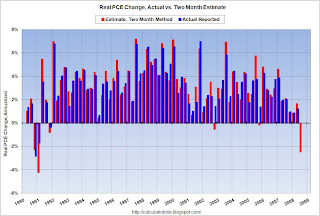

I've been using a two month method to predict PCE. This estimate suggests real PCE will decline by 2.4% in Q3.

Fed economists Riccardo DiCecio and Charles S. Gascon have used real time data to estimate PCE and check the reliability of this approach: Predicting Consumption: A Lesson in Real-Time Data (November 2008)

Whereas I used revised data for historical comparisons, the Fed economists only used data that was available for analysts at the time of the estimate (a much better test of the approach). The economists found that using the change in the second-month of each quarter (over the second-month of the previous quarter) was very reliable. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The chart plots the approximated (second-month) and actual growth rates of PCE since 1991 using real-time data: That is, the growth rates at each point on the chart are computed using only the data that would have been available to a researcher at the time of the estimate. The approximated measure for 2008:Q3 is –2.3 percent, suggesting the first decline in PCE since the fourth quarter of 1991.Since PCE accounts for almost 71% of GDP, this also suggests the change in real GDP in Q3 might be negative. This depends on exports, changes in inventories and government spending (investment will certainly be negative in Q3).

Monday, October 06, 2008

The Impact of Less Equity Withdrawal on Consumption

by Calculated Risk on 10/06/2008 08:13:00 PM

Earlier today I posted the Q2 2008 home equity extraction data provided by the Fed's Dr. James Kennedy. This shows that equity withdrawal has fallen almost to zero as of Q2. Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q2 2008, Dr. Kennedy has calculated Net Equity Extraction as $9.5 billion, or 0.3% of Disposable Personal Income (DPI).

Note: This data is based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41.

Equity extraction was close to $700 billion per year in 2004, 2005 and 2006, before declining to $471 billion last year and will probably be less than $100 billion in 2008.

The questions are: how much will this impact consumption? And over what period?

Unfortunately there is no clear answer. Fed Chairman Bernanke has argued that falling house prices, not equity extraction, impacts consumption (from the WSJ in 2007):

"Our sense ... is that consumers respond to changes in the value of their home essentially because there’s a change in their wealth, not because there’s a change in their access to liquid assets."Others place more weight on MEW. Since equity withdrawal is a somewhat recent development, and there are many factors that impact consumption, it is hard to develop a predictive model on the impact of MEW on consumption. Equity withdrawal probably started in earnest with the Tax Reform Act of 1986 that eliminated the interest deduction for credit cards and consumer loans.

...

Mr. Bernanke went on to reiterate it’s the price of homes, not MEW or financial contagion that represents the biggest risk of spillover from the housing slump. ... [H]e said a hit to consumer spending could be expected on the order of “4 cents and 9 cents on the dollar” of lost home wealth.

In an Economic Letter in 2006, Fed economist John V. Duca wrote:

We can think of the overall impact of home prices on consumption as the combination of two parts—the traditional wealth effect and the relatively new and growing phenomenon of mortgage equity withdrawal (MEW). In recent years, U.S. households have been extracting housing wealth through home-equity loans, cash-out mortgage refinancings or by not fully rolling over capital gains from sales into down payments on subsequent home purchases. Because home-equity loans and mortgages are collateralized, they usually carry lower interest rates than unsecured loans; thus, homeowners can borrow more cheaply. Also, by making housing wealth more accessible, financial innovations have opened new avenues for families to act more quickly on their consumption preferences.Duca didn't mention the impact of falling house prices.

Consistent with a growing liquidity, or MEW effect, some new studies have found wealth effects are now greater than earlier research suggested. One estimates that a $100 rise in housing wealth leads to a $9 increase in spending. Another finds that increases in housing wealth generate three times the spending from stock-price gains. Neither study, however, directly examines whether housing wealth has a greater impact on consumption today because of the greater ease of accessing home equity.

...

The limited U.S. econometric evidence indicates that the strong pace of MEW may have boosted annual consumption growth by 1 to 3 percentage points in the first half of the present decade. This implies that a slowing of home-price appreciation into the low single digits might shave 1 to 2 percentage points off consumption growth and 0.75 to 1.5 percentage points from GDP growth for a few years.

While these estimates provide an idea of housing’s potential economic impact, considerable uncertainty exists about how much a slowdown in MEW might restrain consumption growth.

As far as when the impact occurs, on the wealth effrect, Carroll, Otsuka, and Slacalek, How Large Is the Housing Wealth Effect? A New Approach October 18, 2006 suggested that the impact would be over several quarters:

[W]e estimate that the immediate (next-quarter) marginal propensity to consume from a $1 change in housing wealth is about 2 cents, with a final long run effect around 9 cents.For MEW, it is also uncertain. Kennedy and Greenspan tried to quantify the data in Sources and Uses of Equity Extracted from Homes, however:

Our results do not provide an estimate of the [marginal propensity to consume (MPC)] out of housing wealth; nor do they address the question as to whether extraction of housing wealth has an effect on PCE in addition to the standard wealth effect.My guess is that the MEW effect lasts over several quarters (only a guess). Greenspan estimated that approximately 50% of MEW is consumed, and in interviews he suggested it is probably consumed over several quarters. Since MEW was $471 billion in 2007, and will probably be under $100 billion in 2008, we can estimate that half of the $400 billion or so decline in MEW (or $200 billion) is the drag on PCE in 2008 from less MEW.

That is a big number, but to put that in perspective, PCE increased over $500 billion from 2007 to 2008. So nominal PCE will increase in 2008, although consumption will probably slow sharply.

PCE will also be impacted by lost jobs and changes in consumer psychology (all the scary news will probably lead to less consumer spending).

Nearly six out of ten Americans believe another economic depression is likely, according to a poll released Monday.So once again it will be difficult to separate out the various factors impacting consumption. This will probably be an area of significant econometric research over the next few years.

The CNN/Opinion Research Corp. poll, which surveyed more than 1,000 Americans over the weekend, cited common measures of the economic pain of the 1930s:25% unemployment rate; widespread bank failures; and millions of Americans homeless and unable to feed their families.

It does appear that real personal consumption expenditures declined in Q3 2008 for the first time since 1991. And some of that decline is probably related to the decline in MEW.

Friday, October 03, 2008

Goldman Sachs Forecasts "Deeper" Recession

by Calculated Risk on 10/03/2008 07:40:00 PM

From Rex Nutting at MarketWatch: More severe recession now forecast by Goldman Sachs

The U.S. recession will be "significantly deeper" than they previously thought, Goldman Sachs economists predicted Friday in a research note. ... The unemployment rate will likely rise to 8% by the end of next year from 6.1% currently.Goldman is now forecasting Q3 2008 real GDP growth at 0.0%, with PCE at minus 2.5% (annualized as reported by BEA). This is similar to my two month estimate for PCE, see Estimating PCE Growth for Q3 2008. Both PCE and investment will be negative in Q3, but net exports, private inventories and government spending will probably all show positive growth in Q3. So GDP may be close to zero.

A major change in the Goldman outlook is the increase in the unemployment rate to 8% in 2009 (their previous forecast was for unemployment reaching 7% in 2009).

One of the features of recent recessions is that the unemployment rate kept rising for 18 months to two years after the recession officially ended. This suggests that the peak unemployment rate (for this cycle) might not happen until 2011, even if the recession ends in late 2009 - scary. I'll have some more thoughts on unemployment soon.

Note that this is the headline unemployment number. Other measures of unemployment are much higher: See Krugman: The track record

Tuesday, September 30, 2008

Estimating PCE Growth for Q3 2008

by Calculated Risk on 9/30/2008 04:19:00 PM

With the focus on the bailout bill yesterday, the August release from the Bureau of Economic Analysis (BEA) of personal income and outlays almost went unnoticed.

Asha Bangalore at Northern Trust noticed:

The July-August data point to a possible drop in consumer spending during the third quarter. If the forecast is accurate, it would be the first quarterly decline since fourth quarter of 1991. Given the importance of consumer spending in GDP, a drop in consumer spending in the third quarter raises the probability of a contraction in real GDP in the third quarter.I wrote:

This report is strong evidence that the U.S. economy is in recession and that the change in Personal Consumption Expenditures (PCE) will be negative for Q3.Let me explain why:

The BEA releases Personal Consumption Expenditures monthly as part of the Personal Income and Outlays report, and quarterly as part of the GDP report (also released separately quarterly).

You can use the monthly series to exactly calculate the quarterly change in PCE as reported in the GDP report. However, the quarterly change is not calculated as the change from the last month of one quarter to the last month of the next quarter. Instead, you have to average all three months of a quarter, and then take the change from the average of the three months of the preceding quarter.

So, for Q3, you would average real PCE for July, August and September, and then divide by the average for April, May and June. Of course you need to take this to the fourth power (for the annual rate) and subtract one (for a percentage increase). This gives the real annualized rate of change for the quarter as reported in the GDP report.

Of course the report for September hasn't been released yet, and will not be released until after the advance Q3 GDP report is released on October 30th. As an estimate, we can use the change from April to July, and the change from May to August (the Two Month Estimate) to approximate PCE growth for Q3.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the two month estimate versus the actual change in real PCE. The correlation is high (0.924).

Sometimes the growth rate for the third month of a quarter is substantially stronger or weaker than the first two months. As an example, in Q3 2005, PCE growth was strong for the first two months, but slumped in September because of hurricane Katrina. So the two month estimate was too high.

And the following quarter (Q4 2005), the two month estimate was too low. The first two months of Q4 were negatively impacted by the hurricanes, but real PCE growth in December was strong.

You can see a similar pattern in Q3 2001 because of 9/11.

But in general, the two month estimate is pretty accurate. Maybe September was exceptionally strong (very unlikely from anecdotal evidence), or maybe July and August will be revised upwards, but the two month estimate suggests real PCE will decline in Q3 by about 2.4% (annual rate).

Since PCE accounts for about 71% of GDP, this also suggests the change in real GDP in Q3 might be negative. This depends on exports and changes in inventories (investment will be weak).

If accurate, this will be the first decline in PCE since Q4 1991. This is strong evidence that the indefatigable U.S. consumer is finally throwing in the towel.

Monday, September 29, 2008

Personal Income for August Indicates Consumer Recession

by Calculated Risk on 9/29/2008 08:36:00 AM

From the BEA: Personal Income and Outlays

Real DPI -- DPI adjusted to remove price changes -- decreased 0.9 percent in August, compared with a decrease of 1.5 percent in July.This report is strong evidence that the U.S. economy is in recession and that the change in Personal Consumption Expenditures (PCE) will be negative for Q3.

Real PCE -- PCE adjusted to remove price changes -- increased less than 0.1 percent in August, in contrast to a decrease of 0.5 percent in July.

Although these numbers may be revised, or perhaps September was surprisingly strong (unlikely), based on the two month method, the change in real PCE in Q3 will be about minus 2.4%.

With PCE accounting for almost 71% of GDP, and real PCE declining in Q3, along with declining investment, the change in GDP for Q3 should be negative.

Friday, August 29, 2008

Personal Income and Outlays Report Suggests Slowdown

by Calculated Risk on 8/29/2008 09:16:00 AM

From the BEA: July Personal Income and Outlays

Real DPI decreased 1.7 percent in July, compared with a decrease of 2.6 percent in June. Real PCE decreased 0.4 percent, compared with a decrease of 0.1 percent.So real Disposable Personal Income (DPI) declined in both June and July, as did real Personal Consumption Expenditures (PCE). This suggests that the impact from the stimulus checks is mostly behind us, and there is a good chance PCE growth will be negative in the 2nd half of 2008.

For more, see the WSJ: Consumer Spending Slowed in July As Inflation Continued to Take Toll

Tuesday, August 26, 2008

Olive Garden Warns

by Calculated Risk on 8/26/2008 08:27:00 PM

Another casual dining chain feels the pinch ...

From the WSJ: Olive Garden's Parent Warns on Profit

A surprise warning on earnings by Darden Restaurants Inc. suggests that sit-down restaurants will continue struggling through the fall after a dismal summer.Just more evidence that the 2nd half recovery has been cancelled.

...

"The environment was weaker this quarter than it's been for a while," Darden Chief Executive Clarence Otis said in an interview. Asked how the overall industry will perform during the next few months, he said "We're not counting on it getting a whole lot better."

In coming months, restaurants are expected to close more locations, build fewer new ones, offer more low-priced promotions and tighten worker scheduling to contain labor costs ...

emphasis added

Case Shiller: Real National Prices Decline to Q4 2002 Levels

by Calculated Risk on 8/26/2008 11:40:00 AM

The first graph compares real and nominal Case-Shiller Home Prices through Q2 2008 (real is current index adjusted using CPI less Shelter). Click on graph for larger image in new window.

Click on graph for larger image in new window.

In real terms, the Case-Shiller National Home price index is off 25% from the peak. Real prices are now back to the Q4 2002 level (nominal prices are back to mid-2004).

With existing home inventory at record levels, and tighter lending standards, prices will probably continue to decline over the next few years - perhaps another 15% to 25% in real terms on a national basis. The second graph compares the year-over-year (YoY) change in real Case-Shiller house prices with the YoY change in Personal Consumption Expenditure (PCE) from the BEA GDP report.

The second graph compares the year-over-year (YoY) change in real Case-Shiller house prices with the YoY change in Personal Consumption Expenditure (PCE) from the BEA GDP report.

There is some correlation, but there are other factors that impact PCE such as changes in income, consumer borrowing and other assets prices (like the stock market). I still think YoY PCE growth will turn negative in the coming quarters, but so far PCE has held up pretty well given the sharp decline in real house prices.