by Calculated Risk on 7/25/2009 03:46:00 PM

Saturday, July 25, 2009

New Home Sales, Single Family Starts and Housing Market Index

New Home sales for June are scheduled to be released on Monday morning by the Census Bureau. The consensus forecast is for 350 thousand sales on a Seasonally Adjusted Annual Rate (SAAR) basis, up slightly from the 342 thousand SAAR in May.

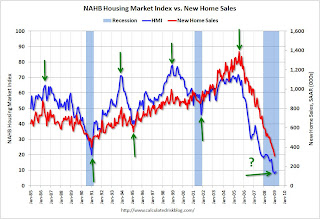

Since we already have the NAHB Housing Market Index (HMI) through July and single family housing starts through June - and since both series have increased recently - I thought it might be interesting to compare all three series. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the NAHB HMI (left scale) with new home sales and single family housing starts (right scale).

Both the new home sales and single family starts series are very noisy (month-to-month variability is high), so it is hard to use starts to predict sales on a monthly basis. However this does suggest a possible increase in sales over the next few months.

When comparing the HMI to single family starts, r-squared is 0.60.

For HMI to new home sales, r-squared is 0.42.

For single family starts to new home sales, r-squared is 0.85 (pretty high).

It looks like builder optimism (as measured by the HMI) is a little more related to building than selling. (Just a joke).

NOTE: For purposes of determining if starts are above or below sales, you have to use the quarterly data by intent. You can't compare the monthly total single family starts directly to new home sales, because single family starts include several categories not included in sales (like owner built units and high rise condos).

Saturday, June 27, 2009

Norris on New and Existing Home Sales

by Calculated Risk on 6/27/2009 08:36:00 AM

From Floyd Norris at the NY Times: How Bad Is the Recession? Check New Home Sales

... For more than three decades, the sales volume of existing single-family homes and newly built houses tended to rise and fall by about the same percentage, as can be seen in the accompanying charts. To be sure, sales of new homes did tend to do a little worse during recessions, but the difference was small and short-lived.

...

At the peak of the housing boom in 2005, sales of both existing and new homes were running at twice the 1976 rate. This year, the sales rate for existing homes seems to have stabilized at about one-third higher than the 1976 rate. New-home sales also seem to have stabilized, but at about half the 1976 rate.

Excerpt from the New York Times.

Excerpt from the New York Times.Click on graph for NY Times Graphic.

Norris doesn't mention that the gap between the two series is a result of the extraordinary number of distressed existing home sales. This has pushed down new home sales (the builders can't compete with REO prices), and is keeping existing home sales elevated.

For more, see: Distressing Gap: Ratio of Existing to New Home Sales

I also linked to this post by Professor Brian Peterson earlier this week (including some thoughts prices): House Prices and New versus Existing Homes Sales

Wednesday, June 24, 2009

More on the New and Existing Homes Sales Gap

by Calculated Risk on 6/24/2009 08:51:00 PM

Earlier today I posted some analysis of the gap between existing and new home sales: Distressing Gap: Ratio of Existing to New Home Sales (see the post for several graphs - including the ratio between new and existing home sales)

Professor Brian Peterson has more (including some thoughts prices): House Prices and New versus Existing Homes Sales

To get a feel for how the two series [New and existing home sales] move together, figure 2 plots the percentage deviation for each series from its mean from 1975-2008. We see clearly that from 1975 to 2006 (the solid lines) that new home sales and existing homes sales move around together, with a correlation of 0.944 over the the time period up to 2006. However, as shown by the dashed lines, a gap has developed post 2006, resulting in the correlation for the sample from 1975-2008 falling to 0.876. There seems to be some type of a shock that is driving existing homes sale up relative to new homes sales.

I find it strange that most analysts are looking at existing home sales for stability in the housing market. I think the new home market is the place to look.

Distressing Gap: Ratio of Existing to New Home Sales

by Calculated Risk on 6/24/2009 11:47:00 AM

For graphs based on the new home sales report this morning, please see: New Home Sales: Record Low for May

Yesterday, the National Association of Realtors (NAR) reported that distressed properties accounted for one-third of all sales in May. Distressed sales include REO sales (foreclosure resales) and short sales, and based on the 4.77 million existing home sales (SAAR) that puts distressed sales at about a 1.6 million annual rate in April.

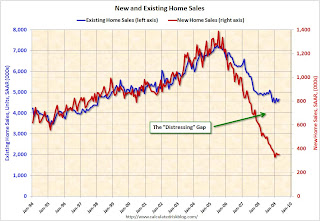

All this distressed sales activity has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap.

This is an update including May new and existing home sales data. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows existing home sales (left axis) and new home sales (right axis) through March.

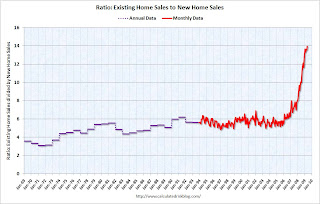

As I've noted before, I believe this gap was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.  The second graph shows the same information, but as a ratio for existing home sales divided by new home sales.

The second graph shows the same information, but as a ratio for existing home sales divided by new home sales.

Although distressed sales will stay elevated for some time, eventually I expect this ratio to decline - probably with a combination of falling existing home sales and eventually rising new home sales.  The third graph shows the ratio back to 1969 (annual data before 1994).

The third graph shows the ratio back to 1969 (annual data before 1994).

Note: the NAR has changed their data collection over time and the older data does not include condos: Single-family data collection began monthly in 1968, while condo data collection began quarterly in 1981; the series were combined in 1999 when monthly collection of condo data began.

New Home Sales: Record Low for May

by Calculated Risk on 6/24/2009 10:00:00 AM

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 342 thousand. This is essentially the same as the revised rate of 344 thousand in April. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. This is the lowest sales for May since the Census Bureau started tracking sales in 1963. (NSA, 32 thousand new homes were sold in May 2009; the record low was 36 thousand in May 1982).

As the graph indicates, sales in May 2009 were substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in May 2009 were at a seasonally adjusted annual rate of 342,000 ...And another long term graph - this one for New Home Months of Supply.

This is 0.6 percent (±17.8%)* below the revised April rate of 344,000 and is 32.8 percent (±10.9%) below the May 2008 estimate of 509,000..

There were 10.2 months of supply in May - significantly below the all time record of 12.4 months of supply set in January.

There were 10.2 months of supply in May - significantly below the all time record of 12.4 months of supply set in January.The seasonally adjusted estimate of new houses for sale at the end of May was 292,000. This represents a supply of 10.2 months at the current sales rate.

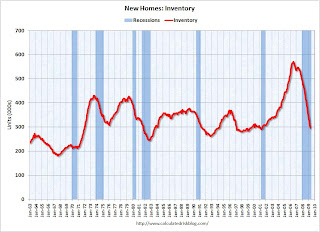

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

It appears the months-of-supply for inventory has peaked, and there is some chance that sales of new homes has bottomed for this cycle - but we won't know for many months. However any recovery in sales will likely be modest because of the huge overhang of existing homes for sale.

This is another weak report. I'll have more later ...

Friday, May 29, 2009

Home Sales Ratio: Existing to New

by Calculated Risk on 5/29/2009 10:02:00 AM

Yesterday I posted a graph labeled the distressing gap showing that existing home sales have held up much better during the housing bust than new home sales - probably because of distressed sales (foreclosure resales and short sales). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the same information, but as a ratio for existing home sales divided by new home sales (ht Michael)

The recent change in the ratio is probably related to distressed sales - home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

Although distressed sales will stay elevated from some time, eventually I expect this ratio to decline - with a combination of falling existing home sales and eventually rising new home sales.  The second graph shows the ratio back to 1969 (annual data before 1994).

The second graph shows the ratio back to 1969 (annual data before 1994).

Note: the NAR has changed their data collection over time and the older data does not include condos: Single-family data collection began monthly in 1968, while condo data collection began quarterly in 1981; the series were combined in 1999 when monthly collection of condo data began.

Thursday, May 28, 2009

New Home Sales: The Distressing Gap

by Calculated Risk on 5/28/2009 12:11:00 PM

For graphs based on the new home sales report this morning, please see: New Home Sales Flat in April

Yesterday, the National Association of Realtors (NAR) reported that "Distressed properties ... accounted for 45 percent of all sales in April". Distressed sales include REO sales (foreclosure resales) and short sales, and based on the 4.68 million existing home sales (SAAR) that puts distressed sales at a 2.1 million annual rate in April.

That fits with the MBA foreclosure and delinquency data released this morning that shows that "3.85% of all mortgages somewhere in the foreclosure process at the end of the first quarter".

All this distessed sales activity has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap.

This is an update including April new and existing home sales data. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows existing home sales (left axis) and new home sales (right axis) through March.

As I've noted before, I believe this gap was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

Over time, as we slowly work through the distressed inventory of existing homes, I expect existing home sales to fall further - See Existing Home Sales: Turnover Rate - and eventually for the distressing gap to close.

New Home Sales Flat in April

by Calculated Risk on 5/28/2009 10:00:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 352 thousand. This is essentially the same as the revised rate of 351 thousand in March. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. This is the second lowest sales for April since the Census Bureau started tracking sales in 1963. (NSA, 33 thousand new homes were sold in March 2009; the record low was 32 thousand in April 1982).

As the graph indicates, sales in April 2009 were substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in April 2009 were at a seasonally adjusted annual rate of 352,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.And another long term graph - this one for New Home Months of Supply.

This is 0.3 percent (±14.5%)* above the revised March rate of 351,000, but is 34.0 percent (±11.0%) below the April 2008 estimate of 533,000.

There were 10.1 months of supply in April - significantly below the all time record of 12.4 months of supply set in January.

There were 10.1 months of supply in April - significantly below the all time record of 12.4 months of supply set in January.The seasonally adjusted estimate of new houses for sale at the end of April was 297,000. This represents a supply of 10.1months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

It appears the months-of-supply for inventory has peaked, and there is some chance that sales of new homes has bottomed for this cycle - but we won't know for many months. However any recovery in sales will likely be modest because of the huge overhang of existing homes for sale. I'll have more ...

Tuesday, May 19, 2009

Quarterly Housing Starts and New Home Sales

by Calculated Risk on 5/19/2009 10:58:00 AM

The Census Bureau has released the "Quarterly Starts and Completions by Purpose and Design" report for Q1 2009 today.

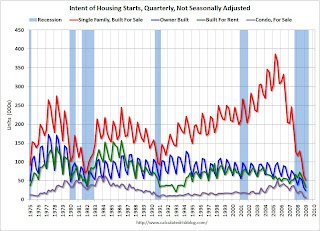

Monthly housing starts (even single family starts) cannot be compared directly to new home sales, because the monthly housing starts report from the Census Bureau includes apartments, owner built units and condos that are not included in the new home sales report.

However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis. The quarterly report shows that there were 52,000 single family starts, built for sale, in Q1 2009 and that is less than the 87,000 new homes sold for the same period. This data is Not Seasonally Adjusted (NSA). This suggests homebuilders are selling more homes than they are starting.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions), although this is not perfect because homebuilders have recently been stuck with “unintentional spec homes” because of the high cancellation rates. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph provides a quarterly comparison of housing starts and new home sales. In 2005, and most of 2006, starts were higher than sales, and inventories of new homes rose sharply. For the last six quarters, starts have been below sales – and new home inventories have been falling. The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Condo starts have collapsed to almost zero (5,000 started in Q1 2009) and owner built units have fallen by about 75% from the peak. Units built for rent have held up the best, and they are still off about 60% from the highs of recent years.

Condo starts in Q1 were the all time record low for Condos built for sale (5,000), breaking the previous record of 8,000 set in Q1 1991 (data started in 1975). Owner built units set a new record low (24,000 units compared to 35,000 units in Q1 1982), and of course single family units built for sale set a record low (52,000 compared to 64,000 in Q4 2008 and 71,000 in Q4 1981).

Friday, April 24, 2009

New Home Sales: 356 Thousand SAAR in March

by Calculated Risk on 4/24/2009 10:00:00 AM

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 356 thousand. This is slightly below the upwardly revised rate of 358 thousand in February. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. This is the lowest sales for March since the Census Bureau started tracking sales in 1963. (NSA, 34 thousand new homes were sold in March 2009; the previous low was 36 thousand in March 1982).

As the graph indicates, sales in March 2009 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in March 2009 were at a seasonally adjusted annual rate of 356,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.And one more long term graph - this one for New Home Months of Supply.

This is 0.6 percent (±19.0%)* below the revised February rate of 358,000 and is 30.6 percent (±10.7%) below the March 2008 estimate of 513,000.

There were 10.7 months of supply in March - significantly below the all time record of 12.5 months of supply set in January.

There were 10.7 months of supply in March - significantly below the all time record of 12.5 months of supply set in January.The seasonally adjusted estimate of new houses for sale at the end of March was 311,000. This represents a supply of 10.7 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

Although sales were at a March record low, there are positives in this report - especially considering the upward revisions for previous months. It appears the months-of-supply has peak, and there is a reasonable chance that new home sales has bottomed for this cycle - however any recovery in sales will be modest because of the huge overhang of existing homes for sale. I'll have more soon.

Wednesday, April 15, 2009

NAHB: Builder Confidence Increases in April

by Calculated Risk on 4/15/2009 01:00:00 PM

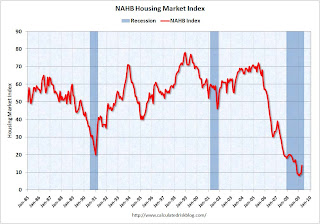

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased to 14 in April from 9 in March. The record low was 8 set in January.

The increase in April follows five consecutive months at either 8 or 9.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Press release from the NAHB (added): April Data Suggests Market At or Near Bottom

Builder confidence in the market for newly built, single-family homes rose five points in April to the highest level since October 2008, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. This gain was the largest one-month increase recorded since May of 2003, and brings the HMI out of single-digit territory for the first time in six months – to 14. Every component of the HMI reflected the boost, with the biggest gain recorded for sales expectations in the next six months.

...

“This is a very encouraging sign that we are at or near the bottom of the current housing depression,” said NAHB Chief Economist David Crowe. “With the prime home buying season now underway, builders report that more buyers are responding to the pull of much-improved affordability measures, including low home prices, extremely favorable mortgage rates and the introduction of the $8,000 first-time home buyer tax credit.”

...

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations in the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

Each of the HMI’s component indexes recorded substantial gains in April. The largest of these gains was a 10-point surge in the component gauging builder sales expectations for the next six months, which brought that index to 25. The component gauging current sales conditions and the component gauging traffic of prospective buyers each rose five points, to 13 and 14, respectively.

The HMI also rose in every region in April, with an eight-point gain to 16 in the Northeast, a six-point gain to 14 in the Midwest, a five-point gain to 17 in the South and a 4-point gain to 9 in the West.

Wednesday, April 08, 2009

Pulte and Centex Merge

by Calculated Risk on 4/08/2009 12:26:00 PM

From Bloomberg: Pulte to Buy Centex for $1.3 Billion in Survival Bid

Pulte Homes Inc. agreed to buy Centex Corp. for $1.3 billion in an all-stock deal that creates the largest U.S. homebuilder by revenue ...This is a stock swap (no cash).

“This is really good because not only are there too many homes, there are too many homebuilders,” said Vicki Bryan, a senior high-yield bond analyst for New York-based Gimme Credit LLC.

...

Because of complementary geographic presence and market segments, the new company will save $350 million annually, [Pulte Chief Executive Officer Richard Dugas] said.

Dugas talks about signs of a housing bottom, but the last sentence makes it clear that this merger is about layoffs and cost savings.

Wednesday, March 25, 2009

New Home Sales: Is this the bottom?

by Calculated Risk on 3/25/2009 02:31:00 PM

Earlier today I posted some graphs of new home sales, inventory and months of supply.

A few key points:

This is 4.7 percent (±18.3%) above the revised January rate of 322,000, but is 41.1 percent (±7.9%) below the February 2008 estimate of 572,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the February "rebound".

You have to look closely - this is an eyesight test - and you will see the increase in sales (if you expand the graph).

Not only was this the worst February in the Census Bureau records, but this was the 2nd worst month ever on a seasonally adjusted annual rate basis (only January was worse).

This graph shows existing home sales and new home sales through February.

This graph shows existing home sales and new home sales through February. For a number of years the ratio between new and existing home sales was pretty steady. After activity in the housing market peaked in 2005, the ratio changed. This change was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

To close the gap, existing home sales need to fall or new home sales increase - or a combination of both. This will probably take several years ...

The following table, from Business Cycle: Temporal Order, shows a simplified typical temporal order for emerging from a recession.

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment(1) | ||

There are a number of reasons why housing and personal consumption won't rebound quickly, but they will probably bottom soon. And that means the recession is moving to the lagging areas of the economy. But we know the first signs to watch: Residential Investment (RI) and PCE.

(1) In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

New Home Sales: Just above Record Low

by Calculated Risk on 3/25/2009 10:00:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate of 337 thousand. This is slightly above the record low of 322 thousand in January. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red column for 2009. This is the lowest sales for February since the Census Bureau started tracking sales in 1963. (NSA, 27 thousand new homes were sold in February 2009; the previous low was 29 thousand in February 1982).

As the graph indicates, sales in February 2009 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in February 2009 were at a seasonally adjusted annual rate of 337,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.And one more long term graph - this one for New Home Months of Supply.

This is 4.7 percent (±18.3%) above the revised January rate of 322,000, but is 41.1 percent (±7.9%) below the February 2008 estimate of 572,000.

There were 12.2 months of supply in February - just below the al time record of 12.9 months of supply set in January.

There were 12.2 months of supply in February - just below the al time record of 12.9 months of supply set in January.The seasonally adjusted estimate of new houses for sale at the end of February was 330,000. This represents a supply of 12.2 months at the current sales rate.

Update: Corrected Y-Axis label.

Update: Corrected Y-Axis label. The final graph shows new home inventory. For new homes, both sales and inventory are falling quickly - since starts have fallen off a cliff.

Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

This is a another extremely weak report. Even with the small increase in sales, sales are near record lows. And months of supply is also just off the record high. I'll have more on new home sales later today ...

Monday, March 16, 2009

Comparing the NAHB Housing Market Index and New Home Sales

by Calculated Risk on 3/16/2009 06:06:00 PM

Here is a comparison of the National Association of Home Builders (NAHB) Housing Market Index and new home sales from the Census Bureau. Since new home sales are released with a lag, the NAHB index provides a possible leading indicator for sales.

Note: the NAHB index released this morning was for a March survey. New Home sales for February will be released on March 25th - so the NAHB is released almost 6 weeks ahead of the corresponding sales numbers. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This shows that major tops and bottoms (green arrows) for the two series line up pretty well (usually within 1 month). However both series are noisy month to month, and there are plenty of head fakes in between the significant peaks and troughs. Also the new home sales data is revised significantly (this graph uses revised data).

Just something to watch going forward ...

Thursday, February 26, 2009

Record Low New Home Sales in January

by Calculated Risk on 2/26/2009 10:00:00 AM

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate of 309 thousand. This is the lowest sales rate the Census Bureau has ever recorded (starting in 1963).  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red column for January 2009. This is the lowest sales for January since the Census Bureau started tracking sales in 1963. (NSA, 23 thousand new homes were sold in January 2009).

As the graph indicates, sales in January 2009 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in January 2009 were at a seasonally adjusted annual rate of 309,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.And one more long term graph - this one for New Home Months of Supply.

This is 10.2 percent (±15.4%)* below the revised December rate of 344,000 and is 48.2 percent (±6.8%) below the January 2008 estimate of 597,000.

The months of supply is at an ALL TIME RECORD 13.3 months in January (this is seasonally adjusted)!

The months of supply is at an ALL TIME RECORD 13.3 months in January (this is seasonally adjusted)!The seasonally adjusted estimate of new houses for sale at the end of January was 342,000. This represents a supply of 13.3 months at the current sales rate.

The final graph shows new home inventory. For new homes, both sales and inventory are falling quickly - since starts have fallen off a cliff.

The final graph shows new home inventory. For new homes, both sales and inventory are falling quickly - since starts have fallen off a cliff.Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

This is a another extremely weak report. Record low sales. Record high months of supply. More Cliff Diving. I'll have more on new home sales later today ...

Wednesday, February 25, 2009

New and Existing Home Sales: The "Distressing" Gap

by Calculated Risk on 2/25/2009 01:10:00 PM

Real Time Economics at the WSJ excerpts some analyst comments about the existing home sales report: Economists React: ‘So Much for Signs of Stability’ in Housing. A few comments from analysts:

"So much for signs of stability."I wouldn't look at existing home sales for signs of stability.

"The drop back in the number of existing U.S. home sales in January dashes hopes that housing activity had found a floor."

"Overall, the longer housing activity remains in the doldrums, the less likely it is that the economy will see a decent recovery in 2010 as Fed Chairman Ben Bernanke hopes."

"The rate of decline in existing home sales over the last three months suggests that the market has not yet entered a bottoming phase and housing remains under considerable pressure."

A large percentage of existing home sales (45% according to the NAR) are distressed sales: REO sales (foreclosure resales) or short sales. This has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales (left axis through January) and new home sales (right axis through December).

Update (Feb 26, 2009): The graph is updated through January now (and right axis label corrected).

For a number of years the ratio between new and existing home sales was pretty steady. After activity in the housing market peaked in 2005, the ratio changed. This change was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

If we are looking for the first "signs of stability" in the housing market, I think we should look for declining inventory, a bottom in new home sales, and the gap between new and existing home sales closing.

Note: Existing home inventory might be declining, see the 5th graph here. However this might be misleading (see caveats in post).

Monday, February 23, 2009

Home Builder: "We can't compete"

by Calculated Risk on 2/23/2009 11:32:00 AM

Last weekend I spoke with a few builders and land developers. Talk about a depressing group. In many areas of California the builders can't compete with lender REOs, since the lenders are selling REOs below replacement costs (including construction and all entitlements).

As one developer said: "We can't compete even if the land is free!"

And on the stock market, it was just last Thursday that I wrote:

The DOW closed at 7,465.95; a six year low. The low in 2002 was 7286.27, if the market breaks that level, the DOW will be back to 1997 levels. That would mean more than a lost decade for DOW investors (not counting dividends).Also note that the closing low last November for the S&P 500 was 752.44. That could be broken today. Best to all.

As an aside, Greenspan made the "irrational exuberance" comment in a speech on December 5, 1996 with the DOW at 6,437. Not a prediction, but we are getting close to that level over 12 years later!

Wednesday, February 18, 2009

Quarterly Housing Starts and New Home Sales

by Calculated Risk on 2/18/2009 02:59:00 PM

The Census Bureau has released the "Quarterly Starts and Completions by Purpose and Design" report for Q4 today.

It is incorrect to directly compare monthly housing starts to new home sales. The monthly housing starts report from the Census Bureau includes apartments, owner built units and condos that are not included in the new home sales report.

However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis. The quarterly report shows there were 65,000 single family starts, built for sale, in Q4 2008 and that is less than the 82,000 new homes sold for the same period. This data is Not Seasonally Adjusted (NSA). This suggests homebuilders are selling more homes than they are starting – but not by much.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions), although this isn’t perfect because homebuilders have recently been stuck with “unintentional spec homes” because of the high cancellation rates. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph provides a quarterly comparison of housing starts and new home sales. In 2005, and most of 2006, starts were higher than sales, and inventories of new homes rose sharply. For the last several quarters, starts have been below sales – and new home inventories have been falling - but it continues to be a race to the bottom between starts and sales. The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Condo starts have collapsed to almost zero (8 thousand started in Q4 2008) and owner built units have fallen by about half. Units built for rent have held up the best, and they are still well off the highs of recent years.

Condos built for sale tied the record low set in Q1 1991 (data started in 1975). Owner built units set a new record low (33,000 units compared to 35,000 units in Q1 1982), and of course single family units built for sale set a record low (65,000 compared to 71,000 in Q4 1981).

Thursday, January 29, 2009

Record Low New Homes Sales in December

by Calculated Risk on 1/29/2009 10:00:00 AM

The Census Bureau reports, New Home Sales in December were at a seasonally adjusted annual rate of 331 thousand. This is the lowest sales rate the Census Bureau has ever recorded (starting in 1963).  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for December since 1966. (NSA, 23 thousand new homes were sold in December 2008, 23 thousand were sold in December 1966).

As the graph indicates, sales in 2008 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in December 2008 were at a seasonally adjusted annual rate of 331,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.And one more long term graph - this one for New Home Months of Supply.

This is 14.7 percent (±13.9%)* below the revised November of 388,000 and is 44.8 percent (±10.8%) below the December 2007 estimate of 600,000.

The months of supply is at an ALL TIME RECORD 12.9 months in December (this is seasonally adjusted)!

The months of supply is at an ALL TIME RECORD 12.9 months in December (this is seasonally adjusted)!The seasonally adjusted estimate of new houses for sale at the end of December was 357,000. This represents a supply of 12.9 months at the current sales rate.

The final graph shows new home inventory. For new homes, both sales and inventory are falling quickly since starts have fallen off a cliff.

The final graph shows new home inventory. For new homes, both sales and inventory are falling quickly since starts have fallen off a cliff.Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

This is a another very weak report. Record low sales. Record high months of supply. Ouch. I'll have more on new home sales later today ...