by Calculated Risk on 3/10/2010 07:25:00 AM

Wednesday, March 10, 2010

MBA: Mortgage Applications Increase Slightly

The MBA reports: Purchase Applications Increase in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased 0.5 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 1.5 percent the previous week and the seasonally adjusted Purchase Index increased 5.7 percent from one week earlier. ...

The refinance share of mortgage activity decreased to 67.2 percent of total applications from 69.1 percent the previous week. The refinance share is at its lowest level since it was 66.1 percent in October 2009. ...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.01 percent from 4.95 percent, with points decreasing to 0.82 from 0.99 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

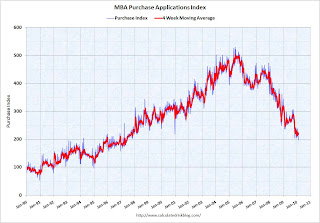

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Even with the increase in purchase applications this week, the 4 week average is still at the levels of 1997.

Also, with mortgage rates slightly above 5% again, refinance activity decreased last week.

Wednesday, March 03, 2010

MBA: Mortgage Purchase Applications increase slightly

by Calculated Risk on 3/03/2010 07:21:00 AM

The MBA reports: Mortgage Refinance Applications Increase in Latest MBA Weekly Survey

The Market Composite Index ... increased 14.6 percent on a seasonally adjusted basis from one week earlier. ...

“Mortgage applications rebounded last week, particularly refis, as rates dropped back below 5 percent,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “Purchase activity remains subdued, with application volumes remaining within the narrow range seen in the last few months.”

The Refinance Index increased 17.2 percent from the previous week and the seasonally adjusted Purchase Index increased 9.0 percent from one week earlier. ...

The refinance share of mortgage activity increased to 69.1 percent of total applications from 68.1 percent the previous week. ...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.95 percent from 5.03 percent, with points decreasing to 0.99 from 1.34 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

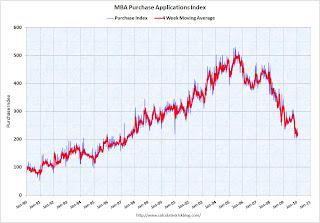

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Even with the increase in purchase applications this week, the level is back to the levels of 1997.

Also, with mortgage rates back below 5% again, refinance activity increased last week.

Wednesday, February 24, 2010

MBA: Mortgage Purchase Applications at Lowest Level Since May 1997

by Calculated Risk on 2/24/2010 08:12:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index ... decreased 8.5 percent on a seasonally adjusted basis from one week earlier. ...

“As many East Coast markets were digging out from the blizzard last week, purchase applications fell, another indication that housing demand remains relatively weak,” said Michael Fratantoni, MBA's Vice President of Research and Economics. “With home prices continuing to drift amid an abundant inventory of homes on the market, potential homebuyers do not see any urgency to lock in purchases.”

The Refinance Index decreased 8.9 percent from the previous week. The seasonally adjusted Purchase Index decreased 7.3 percent from one week earlier, putting the index at its lowest level since May 1997. ...

The refinance share of mortgage activity decreased to 68.1 percent of total applications from 69.3 percent the previous week. ...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.03 percent from 4.94 percent, with points increasing to 1.34 from 1.09 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Once again, the decline in purchase applications since October appears significant.

Also, with mortgage rates back above 5% again, refinance activity declined too.

Friday, February 19, 2010

Mortgage Delinquencies by Period

by Calculated Risk on 2/19/2010 12:11:00 PM

Much was made this morning about the decline in the 30 day delinquency "bucket" (percent of loans between 30 and 60 days delinquent). Hopefully this graph will put the problem in perspective ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Loans 30 days delinquent are still elevated, and still above the levels in 2007 - and at about the level of early 2008 - when prices were falling sharply.

The 60 day bucket also declined in Q4, but it is still above the levels of 2008.

As MBA Chief Economist Jay Brinkmann noted, the 90 day and 'in foreclosure' rates are at record levels. Obviously the lenders have been slow to start foreclosure proceedings - and the 90+ day delinquent bucket is now very full. And lenders have been slow to actually foreclose - and the 'in foreclosure' bucket is at record levels.

What impacts prices are distress sales; homes coming out of the 'in foreclosure' bucket without being cured. Since the lenders slowed foreclosures to a trickle, prices have stabilized or even increased slightly in some areas.

But these record levels of long term delinquencies are why Brinkmann cautioned about house prices. This morning he pointed out on the conference call that there are a record 4.5 million homes seriously delinquent or in foreclosure. The loans on some of these homes will be cured - perhaps by HAMP modifications of by other lender modification programs - but many of these homes will go to foreclosure or be sold as short sales putting pressure on house prices.

MBA: 14.05 Percent of Mortgage Loans in Foreclosure or Delinquent in Q4

by Calculated Risk on 2/19/2010 10:00:00 AM

The MBA reports 14.05 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q4 2009. This is a slight decrease from 14.11% (edit) in Q3 2009, and an increase from 13.5% in Q2 2009 (note: older data was revised).

From the MBA: Delinquencies, Foreclosure Starts Fall in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four unit residential properties fell to a seasonally adjusted rate of 9.47 percent of all loans outstanding as of the end of the fourth quarter of 2009, down 17 basis points from the third quarter of 2009, and up 159 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The non-seasonally adjusted delinquency rate increased 50 basis points from 9.94 percent in the third quarter of 2009 to 10.44 percent this quarter.I'll have notes from the conference call and graphs soon.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 4.58 percent, an increase of 11 basis points from the third quarter of 2009 and 128 basis points from one year ago. The combined percentage of loans in foreclosure or at least one payment past due was 15.02 percent on a non-seasonally adjusted basis, the highest ever recorded in the MBA delinquency survey.

The percentage of loans on which foreclosure actions were started during the third quarter was 1.20 percent, down 22 basis points from last quarter and up 12 basis points from one year ago. The percentages of loans 90 days or more past due and loans in foreclosure set new record highs. The percentage of loans 30 days past due is still below the record set in the second quarter of 1985.

“We are likely seeing the beginning of the end of the unprecedented wave of mortgage delinquencies and foreclosures that started with the subprime defaults in early 2007, continued with the meltdown of the California and Florida housing markets due to overbuilding and the weak loan underwriting that supported that overbuilding, and culminated with a recession that saw 8.5 million people lose their jobs,” said Jay Brinkmann, MBA’s chief economist.

Wednesday, February 17, 2010

MBA: Mortgage Purchase Applications Decline

by Calculated Risk on 2/17/2010 07:00:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 2.1 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 1.2 percent from the previous week and the seasonally adjusted Purchase Index decreased 4.0 percent from one week earlier. ...

The average contract interest rate for 30-year fixed-rate mortgages remained unchanged at 4.94 percent, with points increasing to 1.09 from 1.06 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The 4 week average of the seasonally adjusted purchase index declined to 221.7, just above the 12 year low set in early January.

Refinance activity also declined even with rates below 5%, since most borrowers who are able to refinance already have - and the other half of homeowners with mortgages are unable to refinance for several reasons. (see: Dina ElBoghdady and Renae Merle at the WaPo: Refinancing unavailable for many borrowers ).

Wednesday, February 10, 2010

MBA: Mortgage Purchase Applications Decline, Rates Fall below 5.0%

by Calculated Risk on 2/10/2010 07:28:00 AM

The MBA reports: Purchase Applications Decline in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.2 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index increased 1.4 percent from the previous week and the seasonally adjusted Purchase Index decreased 7.0 percent from one week earlier. ... The four week moving average is up 0.8 percent for the seasonally adjusted Purchase Index, while this average is up 4.8 percent for the Refinance Index.

The refinance share of mortgage activity increased to 69.7 percent of total applications from 69.2 percent the previous week. ...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.94 percent from 5.01 percent, with points increasing to 1.06 from 1.04 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The decline in mortgage applications since October appears significant.

Refinance activity picked up slightly with the decline in mortgage rates.

Wednesday, February 03, 2010

MBA: Mortgage Applications Increase to mid-December Levels

by Calculated Risk on 2/03/2010 12:15:00 PM

From earlier this morning ... the MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased of 21.0 percent on a seasonally adjusted basis from one week earlier. ...

"Mortgage application volume rebounded last week, returning the purchase and refinance indexes to levels from mid-December," said Michael Fratantoni, MBA's Vice President of Research and Economics. "Rates continue to hover around 5 percent, quite low by historical standards, but are well above the record lows seen in 2009, and hence are not generating substantial refi volume. We expect that rates will rise over the next few months as the Federal Reserve winds down its MBS purchase program, and this will likely lead to a decline in refinance volume."

The Refinance Index increased 26.3 percent from the previous week and the seasonally adjusted Purchase Index increased 10.3 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.01 percent from 5.02 percent, with points increasing to 1.04 from 1.00 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four week moving average has declined sharply since October, and is at about the same level as November 1997. The increase this week was just a rebound from the decline last week.

The decline in mortgage applications since October appears significant, and even with the increase in refinance applications last week, it also appears the refinance boom is ending.

The second graph shows the weekly MBA refinance activity, and the Ten Year Treasury yield.

The second graph shows the weekly MBA refinance activity, and the Ten Year Treasury yield.Every time the 10 year yield drops sharply, refinance activity picks up. But notice what happened at the end of 1995. The Ten Year yield dropped, but the increase in refinance activity was muted. This was because mortgage rates didn't fall below the rates of a couple years earlier - and many people had already refinanced at those lower rates. The same thing will happen this year and next - there will only be a surge in refinance activity if rates fall below the rates of 2009.

Wednesday, January 27, 2010

MBA: Mortgage Applications Decline

by Calculated Risk on 1/27/2010 07:39:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 10.9 percent on a seasonally adjusted basis from one week earlier. ...

“Refinance activity fell substantially last week,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “Although rates remain low, there appears to be a smaller pool of borrowers who are willing and able to refinance at today’s rates.”

The Refinance Index decreased 15.1 percent from the previous week and the seasonally adjusted Purchase Index decreased 3.3 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.02 percent from 5.00 percent, with points decreasing to 1 from 1.05 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four week moving average has declined sharply since October, and is at about the same level as September 1997. There are many cash buyers (mostly investors at the low end), but this decline in mortgage applications is significant. Also, it appears the refinance boom is ending.

Wednesday, January 20, 2010

MBA: Mortgage Applications Increase Slightly, Rates Fall

by Calculated Risk on 1/20/2010 10:12:00 AM

The MBA reports: Refinance Applications Increase as Mortgage Rates Fall in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased 9.1 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index increased 10.7 percent from the previous week and the seasonally adjusted Purchase Index increased 4.4 percent from one week earlier. ...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.00 percent from 5.13 percent, with points decreasing to 1.05 from 1.17 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four week moving average has declined sharply since October, and is slightly above the 12 year low set last week.

Wednesday, January 13, 2010

MBA: Mortgage Purchase Applications Flat

by Calculated Risk on 1/13/2010 08:39:00 AM

The MBA reports: Mortgage Refinance Applications Increase While Purchase Applications Remain Flat

The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the week ending January 8, 2010. The Market Composite Index, a measure of mortgage loan application volume, increased 14.3 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index increased 21.8 percent from last week’s holiday adjusted index ... The seasonally adjusted Purchase Index increased 0.8 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.13 percent from 5.18 percent, with points decreasing to 1.17 from 1.28 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four week moving average is now at the lowest level since July 1997.

Wednesday, December 23, 2009

MBA: Mortgage Applications Decrease Sharply

by Calculated Risk on 12/23/2009 07:24:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume decreased 10.7 percent on a seasonally adjusted basis from one week earlier. ...Rates are probably back above 5% now.

The Refinance Index decreased 10.1 percent from the previous week and the seasonally adjusted Purchase Index decreased 11.6 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages remained flat at 4.92 percent, with points increasing to 1.23 from 1.08 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Note: In the past the MBA index was somewhat predictive of future sales - and was a favorite indicator of Alan Greenspan, but it has been questionable for some time. The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007 even though activity was actually declining. Recently there has been a substantial number of cash buyers, so the MBA index missed the strength of the recent existing home sales increase.

However it is hard to ignore the sharp decline in purchase applications over the last couple of months.

Wednesday, December 16, 2009

MBA: Mortgage Purchase Applications Flat, Rates Rise

by Calculated Risk on 12/16/2009 09:49:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume increased 0.3 percent on a seasonally adjusted basis from one week earlier. ...Also - most lenders are quoting mortgage rates back above 5% this week.

The Refinance Index increased 0.9 percent from the previous week and the seasonally adjusted Purchase Index decreased 0.1 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.92 percent from 4.88 percent, with points decreasing to 1.08 from 1.17 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Note: In the past the MBA index was somewhat predictive of future sales - and was a favorite indicator of Alan Greenspan, but it has been questionable for some time. The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007 even though activity was actually declining. Recently there has been a substantial number of cash buyers, so the MBA index missed the strength of the recent existing home sales increase.

Although existing home sales will be very strong in November (as buyers rushed to beat the initial tax credit deadline), the indicators for residential investment have been mostly flat to weak in Q4. This includes the NAHB housing market index, housing starts, new home sales and the MBA purchase index.

Although the FOMC statement today will probably be more upbeat on the economy than in November, the statement on housing will probably have a more negative tone. Last month the FOMC said: "Activity in the housing sector has increased over recent months." That is not true now except for existing home sales that are largely irrelevant1 for residential investment and the economy.

1 Existing home sales generate some fees and commissions, but home turnover does not add to the value of the housing stock. Some people spend money on improvements and furnishings after buying a home, but this has probably been limited recently because of the types of buyers (mostly first time home buyers with minimum downpayments) and cash-flow investors. Neither group will be adding a pool or other major improvement any time soon!

Wednesday, December 09, 2009

MBA: Mortgage Refinance Applications Increase

by Calculated Risk on 12/09/2009 08:46:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased 8.5 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index increased 11.1 percent from the previous week and the seasonally adjusted Purchase Index increased 4.0 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.88 percent from 4.79 percent, with points increasing to 1.17 from 1.00 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This ends a six week run of declining 30-year fixed rates which may have triggered the increase in refinance applications.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

In the past, the MBA index was somewhat predictive of future sales, but it has been questionable for some time. The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007 even though activity was actually declining.

Recently there has been a substantial number of cash buyers, so the MBA index missed the strength of the recent existing home sales increase. However - even with the increase in the purchase index this week - the recent plunge in the purchase index is probably worth watching.

Wednesday, November 25, 2009

MBA: Mortgage Applications Decrease, Rates Fall Slightly

by Calculated Risk on 11/25/2009 12:38:00 PM

I skipped the MBA market index earlier ...

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 4.5 percent on a seasonally adjusted basis from one week earlier. ...Note: This is the lowest contract interest rate since mid-May.

The Refinance Index decreased 9.5 percent from the previous week and the seasonally adjusted Purchase Index increased 9.6 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.82 percent from 4.83 percent, with points increasing to 1.19 from 1.18 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

In the past, the MBA index was predictive of future sales, but it has been questionable for some time. The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007 even though activity was actually declining.

Recently there has been a substantial number of cash buyers, so the MBA index missed the strength of the recent existing home sales increase. Still the recent plunge in the 4 week moving average of the purchase index is probably worth watching.

Thursday, November 19, 2009

States: Seriously Delinquent Mortgages vs. Unemployment Rate

by Calculated Risk on 11/19/2009 06:45:00 PM

Here is a scatter graph comparing the seriously delinquency rate for mortgage loans vs. unemployment rate for all states. The seriously delinquent rate include 90+ days delinquent loans, and loans in the foreclosure process for Q3 2009 (Source: MBA). Click on graph for larger image in new window.

Click on graph for larger image in new window.

There is a relationship between delinquency rates and the unemployment rate.

Florida really stands out because of state specific foreclosure laws. Arizona and Nevada also have higher than expected foreclosure rates - possibly because of high investor activity during the housing bubble.

As the unemployment rate continues to rise, the mortgage delinquency rate will increase too.

For more on the MBA National Delinquency Survey, see:

Mortgage Delinquencies and Foreclosures by Period Past Due

by Calculated Risk on 11/19/2009 03:49:00 PM

Click on graph for larger image in new window.

First, on the market ...

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Reader Yuri asked me if the number of 30 day delinquencies is decreasing. He was curious if the overall number of delinquencies is increasing because of the loan modifications and other actions that are limiting the outflow - but that that overall increase might be masking some improvement for the inflow of new delinquencies. This graph shows the delinquencies by time period (30, 60, 90 day, and in foreclosure) for all loans.\

This graph shows the delinquencies by time period (30, 60, 90 day, and in foreclosure) for all loans.\

The percentage of 30 and 60 day delinquencies have decreased slightly. However the rates are still near record levels.

For the 30 day bucket, there were 3.57% percent delinquent - not much lower than the high in Q1 of 3.77%. For 60 days, the rate was 1.67% - also below the high in Q1.

Clearly most of the increase was in the 90 day and in foreclosure buckets. And that is why the modification programs are so important. The second graph provides the same data for prime fixed rate mortgages. Both the 30 and 60 day buckets are still at record levels, although the rate of increase has slowed.

The second graph provides the same data for prime fixed rate mortgages. Both the 30 and 60 day buckets are still at record levels, although the rate of increase has slowed.

Since prime fixed rate mortgages account for about 2/3s of the mortgage market, a large portion of future foreclosures will probably be from these loans.

MBA: Record 14.4 Percent of Mortgage Loans in Foreclosure or Delinquent in Q3

by Calculated Risk on 11/19/2009 10:00:00 AM

The MBA reports a record 14.4 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2009. This is an increase from 13.2% in Q2 2009.

From the MBA: Delinquencies Continue to Climb in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties rose to a seasonally adjusted rate of 9.64 percent of all loans outstanding as of the end of the third quarter of 2009, up 40 basis points from the second quarter of 2009, and up 265 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The non-seasonally adjusted delinquency rate increased 108 basis points from 8.86 percent in the second quarter of 2009 to 9.94 percent this quarter.

Top Line Results

The delinquency rate breaks the record set last quarter. The records are based on MBA data dating back to 1972.

The delinquency rate includes loans that are at least one payment past due but does not include loans somewhere in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 4.47 percent, an increase of 17 basis points from the second quarter of 2009 and 150 basis points from one year ago. The combined percentage of loans in foreclosure or at least one payment past due was 14.41 percent on a non-seasonally adjusted basis, the highest ever recorded in the MBA delinquency survey.

The percentage of loans on which foreclosure actions were started during the third quarter was 1.42 percent, up six basis points from last quarter and up 35 basis points from one year ago.

The percentages of loans 90 days or more past due, loans in foreclosure, and foreclosures started all set new record highs. The percentage of loans 30 days past due is still below the record set in the second quarter of 1985.

Increases Driven by Prime and FHA Loans

“Despite the recession ending in mid-summer, the decline in mortgage performance continues. Job losses continue to increase and drive up delinquencies and foreclosures because mortgages are paid with paychecks, not percentage point increases in GDP. Over the last year, we have seen the ranks of the unemployed increase by about 5.5 million people, increasing the number of seriously delinquent loans by almost 2 million loans and increasing the rate of new foreclosures from 1.07 percent to 1.42 percent,” said Jay Brinkmann, MBA’s Chief Economist.

“Prime fixed-rate loans continue to represent the largest share of foreclosures started and the biggest driver of the increase in foreclosures. 33 percent of foreclosures started in the third quarter were on prime fixed-rate and loans and those loans were 44 percent of the quarterly increase in foreclosures. The foreclosure numbers for prime fixed-rate loans will get worse because those loans represented 54 percent of the quarterly increase in loans 90 days or more past due but not yet in foreclosure.

“The performance of prime adjustable rate loans, which include pay-option ARMs in the MBA survey, continue to deteriorate with the foreclosure rate on those loans for the first time exceeding the rate for subprime fixed-rate loans. In contrast, both subprime fixed-rate and subprime adjustable rate loans saw decreases in foreclosures.

“The foreclosure rate on FHA loans also increased, despite having a large increase in the number of FHA-insured loans outstanding. The number of FHA loans outstanding has increased by about 1.1 million over the last year. This increase in the denominator depresses the delinquency and foreclosure percentages. If we assume these newly-originated loans are not the ones defaulting and remove the big denominator increase from the calculation results, the foreclosure rate would be1.76 percent rather than 1.31 percent reported.

....

“The outlook is that delinquency rates and foreclosure rates will continue to worsen before they improve. First, it is unlikely the employment picture will get better until sometime next year and even then jobs will increase at a very slow pace. Perhaps more importantly, there is no reason to expect that when the economy begins to add more jobs, those jobs will be in areas with the biggest excess housing inventory and the highest delinquency rates. Second, the number of loans 90 days or more past due or in foreclosure is now a little over 4 million as compared with 3.9 million new and previously occupied homes currently for sale, although there is likely some overlap between the two numbers. The ultimate resolution of these seriously delinquent loans will put added pressure on the hardest hit sections of the country.”

Tuesday, October 20, 2009

MBA's Chief Economist Brinkmann on State of Housing

by Calculated Risk on 10/20/2009 12:08:00 PM

Emile Brinkmann, MBA Chief Economist, testified today before the Senate Committee on Banking, Housing and Urban Affairs at a hearing titled, "The State of the Nation's Housing Market." Here are some excerpts:

"... Whenever I am asked when the housing market will recover, I explain that the economy and the housing market are inextricably linked. The number of people receiving paychecks will drive the demand for houses and apartments and the recovery will begin when unemployment stops rising. ...Edit: this is correct in terms of housing units, but it is important to note that housing investment leads the economy both into and out of a recession, and, in recent recessions, employment lags. I'd argue the recovery in housing investment has already started, but it will be a very sluggish recovery.

... Prior to the onset of this recession, the housing market was already weakened due in part to the heavy use of loans like pay option ARMs and stated income loans by borrowers for whom these loans were not designed. Together with rampant fraud by some borrowers buying multiple properties and speculating on continued price increases, this led to very high levels of construction to meet that increased demand, demand that turned out to be unsustainable. When that demand disappeared, a large number of houses were stranded without potential buyers. The resulting imbalance in supply and demand drove prices down, particularly in the most overbuilt markets like California, Florida, Arizona, and Nevada - markets that had previously seen some of the nation's largest price increases.Unfortunately the MBA didn't take the lead in trying to halt the spread of these products (Option ARMs and Stated Income loans).

emphasis added

Thus the nature of the problem has shifted. A year ago, subprime ARM loans accounted for 36 percent of foreclosures started, the largest share of any loan type despite being only 6 percent of the loans outstanding. Now prime fixed-rate loans represent the largest share of foreclosures initiated.We're all subprime now!

Unfortunately, the consensus is that unemployment will continue to get worse through the middle of next year before it slowly begins to improve. While we have seen certain good signs like a stabilization of home prices and millions of borrowers refinancing into lower rates, we still face major challenges.My estimate is an increase of 35 bps for mortgage rates (relative to the Ten Year Treasury yield).

The most immediate challenge is what will happen to interest rates when the Federal Reserve terminates its program for purchasing Fannie Mae and Freddie Mac mortgage-backed securities in March. The Federal Reserve has purchased the vast majority of MBS issued by these two companies this year and in September purchased more than 100% of the Fannie and Freddie MBS issued that month. The benefit has been that mortgage rates have been held lower than what they otherwise would have been without the purchase program, but there is growing concern over where rates may go once the Federal Reserve stops buying and what this will mean for borrowers. While the most benign estimates are for increases in the range of 20 to 30 basis points, some estimates of the potential increase in rates are several times those amounts.

The extension of the Fed's MBS purchase program to March gives the Obama administration time to announce its interim and, perhaps, long-term recommendations for Fannie and Freddie in February's budget release.One of the concerns is privatizing profits and socializing losses - exactly what happened with Fannie and Freddie. This proposal has some positive features - especially restricting insurance to "the safest types of mortgages". That would be prime fixed and ARM loans only, with no risk layering. Subprime would be excluded. Alt-A should disappear.

All of this, however, points to the need to begin replacing Fannie Mae and Freddie Mac with a long-term solution. MBA has been working on this problem for over a year now and recently released its plan for rebuilding the secondary market for mortgages.

MBA's plan envisions a system composed of private, non-government credit guarantor entities that would insure mortgage loans against default and securitize those mortgages for sale to investors. These entities would be well-capitalized and regulated, and would be restricted to insuring only a core set of the safest types of mortgages, and would only be allowed to hold de minimus portfolios. The resulting securities would, in turn, have a federal guarantee that would allow them to trade similar to the way Ginnie Mae securities trade today. The guarantee would not be free. The entities would pay a risk-based fee for the guarantee, with the fees building up an insurance fund that would operate similar to the bank deposit insurance fund. Any credit losses would be borne first by private equity in the entities and any risk-sharing arrangements put in place with lenders and private mortgage insurance companies. In the event one of these entities failed, the insurance fund would cover the losses. Only if the insurance fund were exhausted, would the government need to intervene.

It appears - although it isn't explicitly stated - that no other entities could securtize mortgages. That would be a key.

Wednesday, September 30, 2009

MBA: 30 Year Mortgage Rate Falls to 4.94 Percent

by Calculated Risk on 9/30/2009 08:42:00 AM

The MBA reports: Mortgage Applications Decrease

The Market Composite Index, a measure of mortgage loan application volume, decreased 2.8 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 0.8 percent from the previous week and the seasonally adjusted Purchase Index decreased 6.2 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.94 percent from 4.97 percent ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

The Purchase index declined to 270.4, and the 4-week moving average declined to 283.9.

Note: The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007, even though activity was actually declining.