by Calculated Risk on 2/24/2010 08:12:00 AM

Wednesday, February 24, 2010

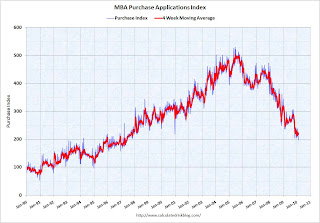

MBA: Mortgage Purchase Applications at Lowest Level Since May 1997

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index ... decreased 8.5 percent on a seasonally adjusted basis from one week earlier. ...

“As many East Coast markets were digging out from the blizzard last week, purchase applications fell, another indication that housing demand remains relatively weak,” said Michael Fratantoni, MBA's Vice President of Research and Economics. “With home prices continuing to drift amid an abundant inventory of homes on the market, potential homebuyers do not see any urgency to lock in purchases.”

The Refinance Index decreased 8.9 percent from the previous week. The seasonally adjusted Purchase Index decreased 7.3 percent from one week earlier, putting the index at its lowest level since May 1997. ...

The refinance share of mortgage activity decreased to 68.1 percent of total applications from 69.3 percent the previous week. ...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.03 percent from 4.94 percent, with points increasing to 1.34 from 1.09 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Once again, the decline in purchase applications since October appears significant.

Also, with mortgage rates back above 5% again, refinance activity declined too.