by Calculated Risk on 12/31/2017 08:57:00 PM

Sunday, December 31, 2017

Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

Earlier I posted some questions for next year: Ten Economic Questions for 2018. I'm adding some thoughts, and maybe some predictions for each question.

4) Inflation: The inflation rate has increased a little recently, and some key measures are now close to the the Fed's 2% target. Will core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

First, Tim Duy discusses the Fed's view of inflation: 5 Questions for the Fed in 2018

Inflation is always just a year away in the Fed’s forecast, and this year is no exception to that rule. In general, central bankers maintain that temporary factors such as declining mobile-phone service costs accounted for this year’s inflation shortfall. Hence, policy makers expect core inflation to accelerate to 1.9 percent in 2018 as those factors dissipate. Another inflation disappointment in 2018, however, would increase chatter at the central bank that maybe inflation expectations are declining and need to be bolstered with a more gradual path of tightening.This is a key question: Was inflation soft in 2017 due to transitory factors? Or was soft inflation more structural? I'm not going to discuss the possible structural reasons for low inflation, but there are several possible reasons including demographics, globalization, online buying, wealth inequality and more.

Although there are different measure for inflation (including some private measures) they mostly show inflation a little below the Fed's 2% inflation target, especially Core PCE.

Note: I follow several measures of inflation, median CPI and trimmed-mean CPI from the Cleveland Fed. Core PCE prices (monthly from the BEA) and core CPI (from the BLS).

Click on graph for larger image.

Click on graph for larger image.On a year-over-year basis in November, the median CPI rose 2.3%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy rose 1.7%. Core PCE is for October and increased 1.4% year-over-year.

On a monthly basis, median CPI was at 2.7% annualized, trimmed-mean CPI was at 2.4% annualized, and core CPI was at 1.4% annualized.

The Fed is projecting core PCE inflation will increase to 1.7% to 1.9% by Q4 2018. However there are risks for higher inflation with the labor market near full employment, and new tax law providing some fiscal stimulus.

I do think there are structural reasons for low inflation, but currently I think PCE core inflation (year-over-year) will increase in 2018 and be closer to 2% by Q4 2018 (up from 1.4%), but too much inflation will still not be a serious concern in 2018.

Here are the Ten Economic Questions for 2018 and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

by Calculated Risk on 12/31/2017 01:41:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2018. I'm adding some thoughts, and maybe some predictions for each question.

5) Monetary Policy: The Fed raised rates three times in 2017 and started to reduce their balance sheet. The Fed is forecasting three more rate hikes in 2018. Some analysts think there will be more, from Goldman Sachs:

"We expect the next rate hike to come in March with subjective odds of 75%, and we continue to expect a total of four hikes in 2018."Will the Fed raise rates in 2018, and if so, by how much?

For years, following the great recession, I made fun of those predicting an imminent Fed Funds rate increase. Based on high unemployment and low inflation, I argued it would be a "long time" before the first rate hike. A long time passed ... and in 2015 I finally argued a rate hike was likely.

The Fed raised rates once in 2015, and then once again in December 2016, and then three times in 2017. Currently the target range for the federal funds rate is 1-1/4 to 1‑1/2 percent.

There is a wide range of views on the FOMC. As of December, the FOMC members see the following number of rate hikes in 2018:

| 25bp Rate Hikes in 2018 | FOMC Members |

|---|---|

| One Rate Cut | 1 |

| No Hikes | 1 |

| One | 1 |

| Two | 3 |

| Three | 6 |

| Four | 3 |

| More than Four | 1 |

The main view of the FOMC is three rate hikes in 2018.

As the economy approaches full employment, and with the new tax law adding a little stimulus, it is possible that inflation will pick up a little in 2018 - and, if so, the Fed could hike more than expected.

Tim Duy wrote Thursday: 5 Questions for the Fed in 2018

Is this the year inflation begins to pick up?My current guess is the Fed will hike three times in 2018.

...

Will job growth slow as expected?

...

Are policy makers underestimating the impact of the tax cuts?

...

Should the Fed care about inverting the yield curve?

...

Will financial stability concerns affect rate policy?

...

... as we think about these issues, note that the Fed will be navigating these waters with a new captain as Chair Janet Yellen is succeeded by Governor Jerome Powell. Plus, there will be a new crew in the form of Randy Quarles and, if confirmed, Marvin Goodfriend. Moreover, the more dovish voting members of the Federal Open Market Committee such as December dissenters Kashkari and Charles Evans rotate off in favor of the more hawkish voices such as John Williams and Loretta Mester. On net, the Fed will find more reasons to hike rates than hold steady in 2018, leaving the current three hike projection as the best bet.

As an aside, many new Fed Chairs have faced a crisis early in their term. A few examples, Paul Volcker took office in August 1979, and inflation hit almost 12% (up from 7.9% the year before), and the economy went into recession as Volcker raised rates. Alan Greenspan took office in August 1987, and the stock market crashed almost 34% within a couple months of Greenspan taking office (including over 20% in one day!). And Ben Bernanke took office in February 2006, just as house prices peaked - and he was challenged by the housing bust, great recession and financial crisis.

Hopefully Jerome Powell will see smoother sailing.

Here are the Ten Economic Questions for 2018 and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

Question #6 for 2018: How much will wages increase in 2018?

by Calculated Risk on 12/31/2017 08:11:00 AM

Earlier I posted some questions for next year: Ten Economic Questions for 2018. I'm adding some thoughts, and maybe some predictions for each question.

6) Real Wage Growth: Wage growth picked up in 2016 (up 2.9%), but slowed in 2017 (up 2.5% year-over-year in November). How much will wages increase in 2018?

The most followed wage indicator is the “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report.

The blue line shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth had been running close to 2% since 2010, and picked up a little in 2015, and more in 2016.

However nominal wage growth was a little soft in 2017.

The red line is real wage growth (adjusted using headline CPI). Real wages increased during the crisis because CPI declined sharply. CPI was very low in 2015 - due to the decline in oil prices - so real wage growth picked up in 2015.

Real wage growth trended down in 2017.

There are two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation. All three data series are different, and most of the focus recently has been the CES series (used in the graph above).

![]() The second graph is from the Atlanta Fed Wage Tracker. This measure is the year-over-year change in nominal wages for individuals.

The second graph is from the Atlanta Fed Wage Tracker. This measure is the year-over-year change in nominal wages for individuals.

By following wage changes for individuals, this removes the demographic composition effects (older workers who are retiring tend to be higher paid, and younger workers just entering the workforce tend to be lower paid).

The Atlanta Fed Wage tracker showed nominal wage growth close to 4% at the end of 2016, but only 3.2% in November 2017.

As the labor market continues to tighten, we should see more wage pressure as companies have to compete for employees. I expect to see some further increases in both the Average hourly earning from the CES, and in the Atlanta Fed Wage Tracker. Perhaps nominal wages will increase close to 3% in 2018 according to the CES.

Here are the Ten Economic Questions for 2018 and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

Saturday, December 30, 2017

Question #7 for 2018: How much will Residential Investment increase?

by Calculated Risk on 12/30/2017 05:20:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2018. I'm adding some thoughts, and maybe some predictions for each question.

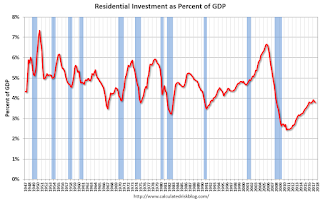

7) Residential Investment: Residential investment (RI) was sluggish in 2017, although new home sales were up solidly. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2018? How about housing starts and new home sales in 2018?

First a graph of RI as a percent of Gross Domestic Product (GDP) through Q3 2017:

Usually residential investment is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and that weakness was a key reason why the start of the recovery was sluggish.

Residential investment finally turned positive during 2011 and made a solid positive contribution to GDP every year since then.

RI as a percent of GDP is still low - close to the lows of previous recessions - and was sluggish in 2017.

Housing starts are on pace to increase close to 3% in 2017. The slower growth in 2017 was due to the weakness in the multi-family sector.

Even after the significant increase over the last several years, the approximately 1.21 million housing starts in 2017 will still be the 17th lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the seven lowest years were 2008 through 2014). The other lower years were the bottoms of previous recessions.

New home sales in 2017 were up about 9% compared to 2016 at close to 612 thousand.

Here is a table showing housing starts and new home sales since 2005. No one should expect an increase to 2005 levels, however demographics and household formation suggest starts will return to close to the 1.5 million per year average from 1959 through 2000. That would suggest starts would increase close to 25% over the next few years from the 2017 level.

| Housing Starts and New Home Sales (000s) | ||||

|---|---|---|---|---|

| Housing Starts | Change | New Home Sales | Change | |

| 2005 | 2068 | --- | 1,283 | --- |

| 2006 | 1801 | -12.9% | 1,051 | -18.1% |

| 2007 | 1355 | -24.8% | 776 | -26.2% |

| 2008 | 906 | -33.2% | 485 | -37.5% |

| 2009 | 554 | -38.8% | 375 | -22.7% |

| 2010 | 587 | 5.9% | 323 | -13.9% |

| 2011 | 609 | 3.7% | 306 | -5.3% |

| 2012 | 781 | 28.2% | 368 | 20.3% |

| 2013 | 925 | 18.5% | 429 | 16.6% |

| 2014 | 1003 | 8.5% | 437 | 1.9% |

| 2015 | 1112 | 10.9% | 501 | 14.7% |

| 2016 | 1174 | 5.6% | 561 | 12.0% |

| 20171 | 1210 | 3.1% | 612 | 9.1% |

| 12017 estimated | ||||

Most analysts are looking for starts to increase to around 1.25 to 1.3 million in 2018, and for new home sales of around 650 thousand.

I also think there will be further growth in 2018. My guess is starts will increase to just over 1.25 million in 2018 and new home sales will be just over 650 thousand.

Here are the Ten Economic Questions for 2018 and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

December 2017: Unofficial Problem Bank list declines to 103 Institutions, Q4 2017 Transition Matrix

by Calculated Risk on 12/30/2017 01:59:00 PM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for December 2017.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for December 2017. During the month, the list fell by five institutions to 103 after seven removals and two additions. Assets declined to $20.9 billion from $25.5 billion a month earlier. A year ago, the list held 169 institutions with assets of $45 billion.

This month, actions were terminated against The Brand Banking Company, Lawrenceville, GA ($2.3 billion); Los Alamos National Bank, Los Alamos, NM ($1.3 billion); PBI Bank, Louisville, KY ($961 million Ticker: PBIB); Brickyard Bank, Lincolnwood, IL ($106 million); American Metro Bank, Chicago, IL ($63 million); State Bank of Burnettsville, Burnettsville, IN ($39 million); and Eagle Community Bank, Maple Grove, MN ($23 million).

The two additions this month were South LaFourche Bank & Trust Company, Larose, LA ($157 million) and Bank of Hazlehurst, Hazlehurst, GA ($124 million). Concentrations of lending to commodities sectors are contributing factors in these banks problem status – oil & gas lending for South LaFourche Bank & Trust Company and agriculture lending for the Bank of Hazlehurst.

Two weeks ago, Washington Federal Bank for Savings, Chicago, IL ($166 million) became the eight failure of 2017; however, its failure did not cause a removal from the Unofficial Problem Bank List as the thrift had not been identified as a problem bank by the Office of the Comptroller of the Currency (OCC), its primary federal regulator. The FDIC estimated the thrift’s resolution cost at an extremely high 36.4 percent of the thrift’s assets. It seems likely that a long running fraud happened at the thrift. The lack of fraud identification by the OCC and the high resolution cost would lead some observers to say there was negligent oversight by the primary regulator. The untimely failure left $11.6 million of uninsured deposits at risk of loss. Moreover, the thrift’s CEO & president committed suicide about two weeks before the failure. Perhaps better and timelier oversight would have limited the losses. See this media account for further details: Failed Bridegport bank sold, millions in uninsured deposits at risk

With it being the end of the third quarter, we bring an updated transition matrix to detail how banks are moving off the Unofficial Problem Bank List. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, a total of 1,725 institutions have appeared on a weekly or monthly list at some point. Only 6.0 percent of the banks that have appeared on a list remain today. In all, there have been 1,622 institutions that have transitioned through the list. Departure methods include 946 action terminations, 406 failures, 253 mergers, and 17 voluntary liquidations. Of the 389 institutions on the first published list, only 9 or 2.3 percent still remain in a designated troubled status more than eight years later. The 406 failures represent 23.5 percent of the 1,725 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 178 | (65,500,762) | |

| Unassisted Merger | 40 | (9,818,439) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 158 | (186,397,337) | |

| Asset Change | (256,902) | ||

| Still on List at 12/31/2017 | 9 | 3,755,875 | |

| Additions after 8/7/2009 | 94 | 17,175,536 | |

| End (12/31/2017) | 103 | 20,931,411 | |

| Intraperiod Removals1 | |||

| Action Terminated | 768 | 318,084,198 | |

| Unassisted Merger | 213 | 81,629,084 | |

| Voluntary Liquidation | 13 | 2,515,855 | |

| Failures | 248 | 125,152,210 | |

| Total | 1,242 | 527,381,347 | |

| 1Institution not on 8/7/2009 or 12/31/2017 list but appeared on a weekly list. | |||

Schedule for Week of December 31st

by Calculated Risk on 12/30/2017 08:09:00 AM

Happy New Year!

The key report this week is the December employment report on Friday.

Other key indicators include the December ISM manufacturing and non-manufacturing indexes, the November trade deficit, and December auto sales.

Also the Q4 quarterly Reis surveys for office and malls will be released this week.

All US markets will be closed in observance of the New Year's Day Holiday.

10:00 AM: Corelogic House Price index for November.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

Early: Reis Q4 2017 Office Survey of rents and vacancy rates.

10:00 AM: ISM Manufacturing Index for December. The consensus is for the ISM to be at 58.0, down from 58.2 in November.

10:00 AM: ISM Manufacturing Index for December. The consensus is for the ISM to be at 58.0, down from 58.2 in November.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in October. The PMI was at 58.2% in November, the employment index was at 59.7%, and the new orders index was at 64.0%.

10:00 AM: Construction Spending for November. The consensus is for a 0.6% increase in construction spending.

All day: Light vehicle sales for December. The consensus is for light vehicle sales to be 17.5 million SAAR in December, up from 17.4 million in November (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for December. The consensus is for light vehicle sales to be 17.5 million SAAR in December, up from 17.4 million in November (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the November sales rate.

2:00 PM: FOMC Minutes, Meeting of December 12 - 13, 2017

8:15 AM: The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 185,000 payroll jobs added in December, down from 190,000 added in November.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, down from 245 thousand the previous week.

Early: Reis Q4 2017 Mall Survey of rents and vacancy rates.

8:30 AM: Employment Report for December. The consensus is for an increase of 190,000 non-farm payroll jobs added in December, down from the 228,000 non-farm payroll jobs added in November.

The consensus is for the unemployment rate to be unchanged at 4.1%.

The consensus is for the unemployment rate to be unchanged at 4.1%.This graph shows the year-over-year change in total non-farm employment since 1968.

In November the year-over-year change was 2.07 million jobs.

A key will be the change in wages.

8:30 AM: Trade Balance report for November from the Census Bureau.

8:30 AM: Trade Balance report for November from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through October. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $48.3 billion in November from $48.7 billion in October.

10:00 AM: the ISM non-Manufacturing Index for December. The consensus is for index to increase to 57.6 from 57.4 in November.

Friday, December 29, 2017

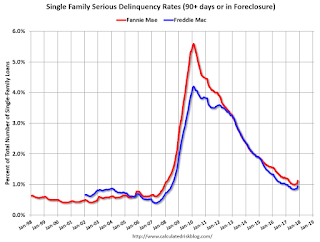

Fannie Mae: Mortgage Serious Delinquency rate increased in November due to Hurricanes

by Calculated Risk on 12/29/2017 04:30:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate increased to 1.12% in November, up from 1.01% in October. The serious delinquency rate is down from 1.23% in November 2016.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (4% of portfolio), 3.05% are seriously delinquent. For loans made in 2005 through 2008 (7% of portfolio), 6.26% are seriously delinquent, For recent loans, originated in 2009 through 2017 (89% of portfolio), only 0.42% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

This increase in the delinquency rate was due to the hurricanes - and we might see a further increase over the next month (These are serious delinquencies, so it takes three months late to be counted).

After the hurricane bump, maybe the rate will decline another 0.5 percentage points or so to a cycle bottom, but this is pretty close to normal.

Note: Freddie Mac reported earlier.

Question #8 for 2018: What will happen with house prices in 2018?

by Calculated Risk on 12/29/2017 03:58:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2018. I'm adding some thoughts, and maybe some predictions for each question.

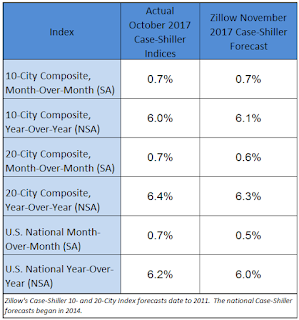

8) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up over 6% in 2017. What will happen with house prices in 2018?

The following graph shows the year-over-year change through October 2017, in the seasonally adjusted Case-Shiller Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 SA was up 6.0% compared to October 2016, the Composite 20 SA was up 6.4% and the National index SA was up 6.2% year-over-year. Other house price indexes have indicated similar gains (see table below).

Although I mostly use Case-Shiller, I also follow several other price indexes. The following table shows the year-over-year change for several house prices indexes.

| Year-over-year Change for Various House Price Indexes | ||

|---|---|---|

| Index | Through | Increase |

| Case-Shiller Comp 20 | Oct-17 | 6.4% |

| Case-Shiller National | Oct-17 | 6.2% |

| CoreLogic | Oct-17 | 7.0% |

| Black Knight | Oct-17 | 6.5% |

| FHFA Purchase Only | Oct-17 | 6.2% |

Most analysts are forecasting prices will increase in the 3% to 5% range in 2017.

Inventories will probably remain low in 2018, although I expect inventories to increase on a year-over-year basis by December of 2018. Low inventories, and a decent economy suggests further price increases in 2018.

Perhaps higher mortgage rates will slow price appreciation. If we look back at the "taper tantrum" in 2013, price appreciation slowed somewhat over the next year - but that was from a high level. In June 2013, the Case-Shiller National index was up 9.3% year-over-year. By June 2014, the index was up 6.3% year-over-year.

If inventory increases year-over-year as I expect by December 2018, it seems likely that price appreciation will slow to the low-to-mid single digits.

Here are the Ten Economic Questions for 2018 and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

Question #9 for 2018: Will housing inventory increase or decrease in 2018?

by Calculated Risk on 12/29/2017 10:01:00 AM

Earlier I posted some questions for next year: Ten Economic Questions for 2018. I'm adding some thoughts, and maybe some predictions for each question.

9) Housing Inventory: Housing inventory declined in 2015, 2016 and 2017. Will inventory increase or decrease in 2018?

Tracking housing inventory is very helpful in understanding the housing market. The plunge in inventory in 2011 helped me call the bottom for house prices in early 2012 (The Housing Bottom is Here). And the increase in inventory in late 2005 (see first graph below) helped me call the top for house prices in 2006.

This graph shows nationwide inventory for existing homes through November 2017.

According to the NAR, inventory decreased to 1.67 million in November from 1.80 million in October.

Inventory has steadily been decreasing over the last few years.

This was the lowest level for the month of November since 2000.

Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January as sellers take their homes off the market for the holidays.

Inventory decreased 9.7% year-over-year in November compared to November 2016. Months of supply was at 3.4 months in November.

Note that the blue line (year-over-year change) turned slightly positive in 2013, but has been negative since mid-2015.

Two of the key reasons inventory is low: 1) A large number of single family home and condos were converted to rental units. In 2015, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, and the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we have seen a surge in home improvement spending, and this is also limiting supply.

The recent change in the tax law might lead to more inventory in certain areas, and I'll be tracking that over the course of the year.

I was wrong on inventory last year (and the previous year), but right now my guess is active inventory will increase in 2018 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in December 2018). My reasons for expecting more inventory are 1) inventory is historically low (lowest for November since 2000), 2) and the recent changes to the tax law.

If correct, this will keep house price increases down in 2018 (probably lower than the 6% or so gains in 2017).

Here are the Ten Economic Questions for 2018 and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

Chicago PMI "Rises" in December "to Six-and-a-Half Year High"

by Calculated Risk on 12/29/2017 09:33:00 AM

From the Chicago PMI: December Chicago Business Barometer Rises to 67.6

The MNI Chicago Business Barometer rose to 67.6 in December, up from 63.9 in November, closing the year at the highest level since March 2011.This was well above the consensus forecast of 61.8, and a strong reading.

On a calendar quarter basis, the Barometer rose to 65.9 in Q4 from 61.0 in Q3, the best quarterly performance since Q1 2011, only the second time in the last decade there have been three consecutive above-60 readings in the Oct-Dec period.

...

“Sentiment among businesses started 2017 in good shape and only impressed more as the year progressed. December’s result secured the MNI Chicago Business Barometer’s first full year of expansion since 2014 and with New Orders ending the quarter in fine shape there is every chance this form could be carried over into 2018,” said Jamie Satchi, Economist at MNI Indicators.

emphasis added

Thursday, December 28, 2017

Zillow Case-Shiller Forecast: More Solid House Price Gains in November

by Calculated Risk on 12/28/2017 06:43:00 PM

Friday:

• At 9:45 AM ET, Chicago Purchasing Managers Index for December. The consensus is for a reading of 61.8, down from 63.9 in November.

The Case-Shiller house price indexes for October were released on Tuesday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Aaron Terrazas at Zillow: Case-Shiller October Results and November Forecast: Still Defying Gravity

The last few months of 2017 have clearly demonstrated the extent to which the housing market refuses to be knocked off its stride. Sales of existing homes have risen strongly and unexpectedly, despite a severe and worsening shortage of homes actually available to buy. To cope, buyers simply linger longer on the market, even into the slower winter months if needed.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be smaller in November than in October. Zillow is forecasting a larger year-over-year increase for the 10-city index, and a smaller increase for the 20-city index in November.

The Case-Shiller National Index of home prices for October climbed 6.2 percent year-over-year, while its gain from September was 0.7 percent.

The 10-City Composite Index increased 6.0 percent year-over-year and 0.7 percent from September, while the 20-City Composite Index grew 6.4 percent year-over-year and 0.7 percent from September. Seattle, Las Vegas and San Diego continued to post the strongest annual gains among the 20 cities, with increases of 12.7 percent, 10.2 percent and 8.1 percent, respectively.

Home builders have managed to start construction on more homes than at any point since prior to the recession, despite high and rising land, labor and materials costs. An economy that keeps adding jobs and wages that continue to grow both have consumers feeling confident. And they’re boosted by mortgage interest rates that remain near all-time lows, defying expectations and conventional wisdom alike that both say – and have been saying for years – that rates have to begin rising at some point.

Freddie Mac: Mortgage Serious Delinquency rate up sharply in November

by Calculated Risk on 12/28/2017 04:07:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in November was at 0.95%, up sharply from 0.86% in October. Freddie's rate is down from 1.03% in November 2016.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

This increase in the delinquency rate was due to the hurricanes - and we might see a further increase over the next month (These are serious delinquencies, so it takes three months late to be counted).

After the hurricane bump, maybe the rate will decline another 0.2 to 0.4 percentage points or so to a cycle bottom, but this is pretty close to normal.

Note: Fannie Mae will report for November soon.

Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

by Calculated Risk on 12/28/2017 02:07:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2018. I'm adding some thoughts, and maybe some predictions for each question.

10) Housing and Taxes A key change in the new tax law is limiting the deductibility of State and Local Taxes (SALT) and property taxes to $10,000. Many analysts think this will hit certain segments of the housing market in states like New York, New Jersey and California. The NAR noted their forecast today:

"Heading into 2018, existing-home sales and price growth are forecast to slow, primarily because of the altered tax benefits of homeownership affecting some high-cost areas."Relative to the overall market, will sales slow, inventory increase, and price growth slow in these states?

First, to track the impact over the course of the year, I'll follow certain markets and compare to the overall market (possibly in California, New York and New Jersey).

My sense is the low end of the housing market will be fine. The Mortgage Interest Deduction (MID) will be capped at interest on a mortgage up to $750,000 instead of $1,000,000, so the lower priced markets will not be hit by the reduction in the MID. There might be some additional taxes for these buyers due to the limits on SALT and property taxes, but this should be minor.

I also expect the high end of the market to be fine. The high end is already doing well even with the MID capped at $1 million. For these buyers, the bigger impact will be the SALT and property tax limitations, but there will be offsets for these buyers due to the lower rates - and these buyers will likely benefit from the corporate tax cuts. Many of these buyers will also benefit from the changes to the Alternative Minimum Tax (AMT).

It is the upper-mid-range in the certain markets that will probably slow. This might be in the $750,000 to $1.5 million price range. These potential buyers probably don't benefit from the AMT or corporate changes, but they will likely be hit by the SALT and property tax limits.

There could be a ripple effect. If the upper-mid-range slows, that could impact some of the purchases in the next higher range. This is my current guess on the impact.

Here are the Ten Economic Questions for 2018 and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

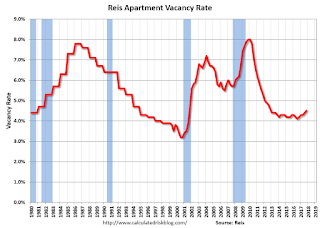

Reis: Apartment Vacancy Rate increased in Q4 to 4.5%

by Calculated Risk on 12/28/2017 11:03:00 AM

Reis reported that the apartment vacancy rate was at 4.5% in Q4 2017, up from 4.4% in Q3, and up from 4.2% in Q4 2016. This is the highest vacancy rate since Q4 2012 (although the increase has been small). The vacancy rate peaked at 8.0% at the end of 2009, and bottomed at 4.1% in 2016.

From Reis:

The apartment market continued to face pressure from added supply in the fourth quarter as the national vacancy rate increased 10 basis points to 4.5% in the quarter. Asking rents increased 0.4% in the fourth quarter, while effective rents grew 0.3%. Effective rents net out landlord concessions. Over the year, asking rents increased 3.9% while effective rents grew by 3.3%. These growth rates reflect a deceleration in apartment market fundamentals compared to recent years, due in part to the large amount of new supply coming online. New construction totaled 43,769 units in the fourth quarter, raising the year-end total to 213,802 units. The national apartment market has not seen new completions in excess of 200,000 since 1986.

At 4.5%, the national vacancy rate increased 10 basis points from 4.4% in the third quarter. This represents a 30 basis point increase in year-over-year vacancy (the year-end vacancy rate in 2016 was 4.2%); vacancies have more or less been on an upward march since the middle of 2016. The net change in occupied stock, or net absorption, was 31,554 units, lower than new supply. With supply growth outstripping demand, vacancies were pushed upwards this quarter.

At $1,364, the average asking rent grew 0.4% in the quarter. This is well below the 0.9% average quarterly growth rate for the prior six quarters. Effective rent growth was 0.3% in the quarter, also below the 0.8% average quarterly effective rent growth for the prior six quarters. Overall, these statistics reflect a distinct pullback in the national apartment market, especially when compared to 2015. However, the gap between asking rent growth and effective rent growth remained within a 10 basis point range. This suggests that landlords’ offers of free rent were less aggressive – implying that demand remains relatively robust.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate had been mostly moving sideways for the last few years. However it appears the vacancy rate has bottomed and is starting to increase. With more supply coming on line next year - and less favorable demographics - the vacancy rate will probably continue to increase in 2018.

Apartment vacancy data courtesy of Reis.

Weekly Initial Unemployment Claims unchanged at 245,000

by Calculated Risk on 12/28/2017 08:34:00 AM

The DOL reported:

In the week ending December 23, the advance figure for seasonally adjusted initial claims was 245,000, unchanged from the previous week's unrevised level of 245,000. The 4-week moving average was 237,750, an increase of 1,750 from the previous week's unrevised average of 236,000.The previous week was unrevised.

Claims taking procedures continue to be disrupted in the Virgin Islands. The claims taking process in Puerto Rico has still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 237,750.

This was higher than the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, December 27, 2017

Thursday: Unemployment Claims, Apartment Survey

by Calculated Risk on 12/27/2017 09:00:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, down from 245 thousand the previous week.

• Early: Reis Q4 2017 Apartment Survey of rents and vacancy rates.

Ten Economic Questions for 2018

by Calculated Risk on 12/27/2017 05:21:00 PM

Here is a review of the Ten Economic Questions for 2017.

Here are my ten questions for 2018. I'll follow up with some thoughts on each of these questions.

The purpose of these questions is to provide a framework to think about how the U.S. economy will perform in 2018, and - when there are surprises - to adjust my thinking.

1) Economic growth: Heading into 2018, most analysts are pretty sanguine and expecting some pickup in growth due to the recent tax cuts. From Goldman Sachs:

"We are adjusting our forecasts to reflect the final details of the tax bill, as well as the incremental easing in financial conditions and continued strong economic momentum to end the year. We are increasing our GDP forecasts for 2018 and 2019 by 0.3pp and 0.2pp, respectively, on a Q4/Q4 basis (to 2.6% and 1.7%)."How much will the economy grow in 2018?

2) Employment: Through November, the economy has added just over 1,900,000 jobs this year, or 174,000 per month. As expected, this was down from the 187 thousand per month in 2016. Will job creation in 2018 be as strong as in 2017? Or will job creation be even stronger, like in 2014 or 2015? Or will job creation slow further in 2018?

3) Unemployment Rate: The unemployment rate was at 4.1% in November, down 0.5 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will be in the 3.7% to 4.0% range in Q4 2018. What will the unemployment rate be in December 2018?

4) Inflation: The inflation rate has increased a little recently, and some key measures are now close to the the Fed's 2% target. Will core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

5) Monetary Policy: The Fed raised rates three times in 2017 and started to reduce their balance sheet. The Fed is forecasting three more rate hikes in 2018. Some analysts think there will be more, from Goldman Sachs:

"We expect the next rate hike to come in March with subjective odds of 75%, and we continue to expect a total of four hikes in 2018."Will the Fed raise rates in 2018, and if so, by how much?

6) Real Wage Growth: Wage growth picked up in 2016 (up 2.9%), but slowed in 2017 (up 2.5% year-over-year in November). How much will wages increase in 2018?

7) Residential Investment: Residential investment (RI) was sluggish in 2017, although new home sales were up solidly. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2018? How about housing starts and new home sales in 2018?

8) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up over 6% in 2017. What will happen with house prices in 2018?

9) Housing Inventory: Housing inventory declined in 2015, 2016 and 2017. Will inventory increase or decrease in 2018?

10) Housing and Taxes A key change in the new tax law is limiting the deductibility of State and Local Taxes (SALT) and property taxes to $10,000. Many analysts think this will hit certain segments of the housing market in states like New York, New Jersey and California. The NAR noted their forecast today:

"Heading into 2018, existing-home sales and price growth are forecast to slow, primarily because of the altered tax benefits of homeownership affecting some high-cost areas."Relative to the overall market, will sales slow, inventory increase, and price growth slow in these states?

There are other important questions, but these are the ones I'm focused on right now. I'll write on each of these questions over the next couple of weeks.

Here is some discussion and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

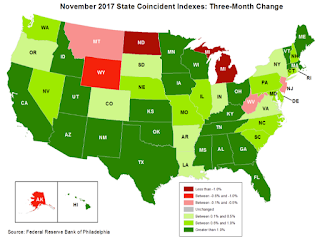

Philly Fed: State Coincident Indexes increased in 35 states in November

by Calculated Risk on 12/27/2017 03:00:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for November 2017. Over the past three months, the indexes increased in 43 states and decreased in seven, for a three-month diffusion index of 72. In the past month, the indexes increased in 35 states, decreased in 11, and remained stable in four, for a one-month diffusion index of 48.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

Recently several states have turned red.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In November, 37 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices.

The reason for the mid-to-late 2017 sharp decrease in the number of states with increasing activity is unclear.

Q4 Review: Ten Economic Questions for 2017

by Calculated Risk on 12/27/2017 11:59:00 AM

At the end of last year, I posted Ten Economic Questions for 2017. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2017 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

Here is a Q4 review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2017: Will housing inventory increase or decrease in 2017?

right now my guess is active inventory will increase in 2017 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in December 2017). My reasons for expecting more inventory are 1) inventory is historically low (lowest for November since 2000), 2) and the recent increase in interest rates.According to the November NAR report on existing home sales, inventory was down 9.7% year-over-year in November, and the months-of-supply was at 3.4 months. I was definitely wrong. Inventory will be a key metric to watch in 2018.

9) Question #9 for 2017: What will happen with house prices in 2017?

Inventories will probably remain low in 2017, although I expect inventories to increase on a year-over-year basis by December of 2017. Low inventories, and a decent economy suggests further price increases in 2017.The Case-Shiller data released yesterday showed prices up 6.2% year-over-year in November. With falling inventory, house prices increased faster in 2017 than in 2016.

Perhaps higher mortgage rates will slow price appreciation. If we look back at the "taper tantrum" in 2013, price appreciation slowed somewhat over the next year - but that was from a high level. In June 2013, the Case-Shiller National index was up 9.3% year-over-year. By June 2014, the index was up 6.3% year-over-year.

If inventory increases year-over-year as I expect by December 2017, it seems likely that price appreciation will slow to the low-to-mid single digits.

8) Question #8 for 2017: How much will Residential Investment increase?

Most analysts are looking for starts to increase to around 1.25 million in 2017, and for new home sales of around 600 to 650 thousand. This would be an increase of around 7% for starts and maybe 10% for new home sales.Through November, starts were up 3.1% year-over-year compared to the same period in 2016. And new home sales were up 9.1% year-over-year. About as expected.

I think there will be further growth in 2017, but I think a combination of higher mortgage rates, less multi-family starts, and not enough lots for low-to-mid range new homes will mean sluggish growth in 2017.

My guess is starts will increase to just over 1.2 million in 2017 and new home sales will be in the low 600 thousand range.

7) Question #7 for 2017: How much will wages increase in 2017?

As the labor market continues to tighten, we should see more wage pressure as companies have to compete for employees. I expect to see some further increases in both the Average hourly earning from the CES, and in the Atlanta Fed Wage Tracker. Perhaps nominal wages will increase more than 3% in 2017 according to the CES.Through November 2017, nominal hourly wages were up 2.5% year-over-year. This is a decrease from last year, and it appears wages will increase at a slower rate in 2017. Wages were disappointing in 2017.

6) Question #6 for 2017: Will the Fed raise rates in 2017, and if so, by how much?

Analysts are being cautious on forecasting rate hikes, probably because they forecasted too many hikes over the last few years. However, as the economy approaches full employment, and with the possibility of fiscal stimulus in 2017, it is possible that inflation will pick up a little - and, if so, the Fed could hike more than expected.The Fed hiked three times in 2017, and started to reduce their balance sheet.

My current guess is the Fed will hike twice in 2017.

5) Question #5 for 2017: Will the core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

The Fed is projecting core PCE inflation will increase to 1.8% to 1.9% by Q4 2017. However there are risks for higher inflation. The labor market is approaching full employment, and the new administration is proposing some fiscal stimulus (tax cuts, possible infrastructure spending), so it is possible - as a result - that inflation will increase more than expected in 2017 and 2018.Inflation has eased, and is below the Fed's target by most measures.

Currently I think PCE core inflation (year-over-year) will increase further and be close to 2% in 2017, but too much inflation will still not be a serious concern in 2017.

4) Question #4 for 2017: What will the unemployment rate be in December 2017?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will declining slightly by December 2017 from the current 4.7%.The unemployment rate was at 4.1% in November, below the level I expected for the end of 2017.

3) Question #3 for 2017: Will job creation slow further in 2017?

So my forecast is for gains of 125,000 to 150,000 payroll jobs per month in 2017. Lower than in 2016, but another solid year for employment gains given current demographics.Through November 2017, the economy has added 1,916,000 jobs, or 174,000 per month, down from 187,000 per month in 2016. This was slightly above my expectations.

2) Question #2 for 2017: How much will the economy grow in 2017?

There will probably be some economic boost from oil sector investment in 2017 since oil prices have increased (this was a drag last year).GDP was a 1.2% in Q1, 3.2% in Q2, and 3.1% in Q3. It appears GDP will be around 3% (annualized) in Q4, putting GDP growth around 2.6% for the year. About as expected.

The housing recovery is ongoing, however auto sales might have peaked.

And demographics are improving (the prime working age population is growing about 0.5% per year, compared to declining a few years ago).

All these factors combined will probably push GDP growth into the mid-to-high 2% range in 2017, but this will depend somewhat on which policies are enacted.

1) Question #1 for 2017: What about fiscal and regulatory policy in 2017?

We are still waiting for the details. As far as the impact on 2017, my expectation is there will be both individual and corporate tax cuts - and some sort of infrastructure program. I expect that something will happen with the ACA (those that have insurance for 2017 will keep their insurance, but they might not have insurance in 2018 - and that impact would be in 2018). I think the negative proposals (immigration, trade) will impact the economy in 2018 or later - overall there will be a small boost to GDP in 2017.The key policy change was the recently passed tax cuts. Policy had little impact on 2017, but will have an impact going forward.

A final comment: The words of a President matter. Mr Trump has been impulsive, reckless and irresponsible with his comments, and that has continued since the election. One absurd comment could send the markets into a tailspin and negatively impact the economy (and that could happen at any time).

Currently it looks like 2017 unfolded mostly as expected. GDP was at expectations, employment gains were slightly better, but down from 2016 (as expected), housing starts and new home sales were also at expectations. The key surprises were wage growth disappointed and housing inventory declined further.

NAR: Pending Home Sales Index Increased Slightly in November, Up 0.8% Year-over-year

by Calculated Risk on 12/27/2017 10:10:00 AM

From the NAR: Pending Home Sales Inch Up 0.2 Percent in November

ending home sales were mostly unmoved in November, but did squeak out a minor gain both on a monthly and annualized basis, according to the National Association of Realtors®. Heading into 2018, existing-home sales and price growth are forecast to slow, primarily because of the altered tax benefits of homeownership affecting some high-cost areas.This was above expectations of a 0.8% decrease for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in December and January.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 0.2 percent to 109.5 in November from 109.3 in October. With last month’s modest increase, the index remains at its highest reading since June (110.0), and is now 0.8 percent above a year ago.

...

The PHSI in the Northeast jumped 4.1 percent to 98.9 in November, and is now 1.1 percent above a year ago. In the Midwest the index rose 0.4 percent to 105.8 in November, and is now 0.8 percent higher than November 2016.

Pending home sales in the South decreased 0.4 percent to an index of 123.1 in November but are still 2.5 percent higher than last November. The index in the West declined 1.8 percent in November to 100.4, and is now 2.3 percent below a year ago.

emphasis added

Tuesday, December 26, 2017

Wednesday: Pending Home Sales

by Calculated Risk on 12/26/2017 08:23:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Seasonally Sideways

Mortgage rates were lifeless today as financial markets drifted sideways. [30YR FIXED - 4.125%] Although rates CAN move during the last week of December when there's an imbalance between buyers and sellers in bond markets, that's the exception to the rule. We tend to see days exactly like today with effectively zero change in lender rates sheets compared to the previous business day (in this case, last Friday).Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. (might not be released this week due to holidays)

• At 10:00 AM, Pending Home Sales Index for November. The consensus is for a 0.8% decrease in the index.

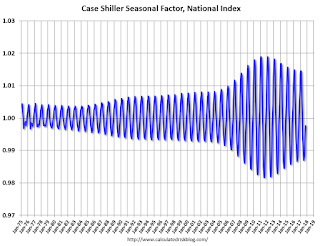

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 12/26/2017 04:20:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through October 2017). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Real House Prices and Price-to-Rent Ratio in October

by Calculated Risk on 12/26/2017 01:18:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 6.2% year-over-year in October

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 5.7% above the previous bubble peak. However, in real terms, the National index (SA) is still about 12.2% below the bubble peak (and historically there has been an upward slope to real house prices).

The year-over-year increase in prices is mostly moving sideways now around 6%. In October, the index was up 6.2% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $280,400 today adjusted for inflation (40%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at a new peak, and the Case-Shiller Composite 20 Index (SA) is back to January 2006 levels.

Real House Prices

In real terms, the National index is back to September 2004 levels, and the Composite 20 index is back to April 2004.

In real terms, house prices are back to 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to December 2003 levels, and the Composite 20 index is back to September 2003 levels.

In real terms, prices are back to mid 2004 levels, and the price-to-rent ratio is back to 2003 - and the price-to-rent ratio has been increasing slowly.