by Calculated Risk on 11/30/2016 07:20:00 PM

Wednesday, November 30, 2016

Thursday: ISM Mfg, Auto sales, Unemployment claims, Construction Spending

A few comments from Steven Kopits of Princeton Energy Advisors LLC:

"OPEC today struck what increasingly appears to be a historic deal, with both cuts and participation well in excess of earlier expectations. Total OPEC cuts, compared to OPEC production as recorded by secondary sources for October 2016, are forecast at 1.2 mbpd. To this is added 0.3 mbpd from Russia, and another, yet-to-be-confirmed 275 kpbd from Mexico, Oman and Kazakhstan.Thursday:

In total, this would represent a cut of over 1.7 mbpd. Compliance should be expected at 70% based on historical precedent, representing an effective cut of 1.2 mbpd compared to October 2016 levels. This is a big deal, and may be enough to balance markets (which some think are already drawing in any event). With these cuts, global excess crude and product inventories should be run off as soon as the end of Q2 2017, and not later than Q4 2017.

This implies that a robust recovery for the global oil sector is in store, with a strong H2 2017 in the outing."

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 253 thousand initial claims, up from 251 thousand the previous week.

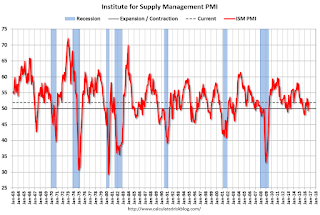

• At 10:00 AM, ISM Manufacturing Index for November. The consensus is for the ISM to be at 52.3, up from 51.9 in October. The ISM manufacturing index indicated expansion at 51.9% in October. The employment index was at 52.9%, and the new orders index was at 52.1%.

• Also at 10:00 AM, Construction Spending for October. The consensus is for a 0.6% increase in construction spending.

• All day, Light vehicle sales for November. The consensus is for light vehicle sales to decrease to 17.8 million SAAR in November, from 17.9 million in October (Seasonally Adjusted Annual Rate).

Fannie Mae: Mortgage Serious Delinquency rate declined in October

by Calculated Risk on 11/30/2016 04:21:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined to 1.21% in October, down from 1.24% in September. The serious delinquency rate is down from 1.58% in October 2015.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The Fannie Mae serious delinquency rate has fallen 0.37 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% for about 7 more months.

Note: Freddie Mac reported yesterday.

Fed's Beige Book: Modest to moderate expansion, Tightening labor market

by Calculated Risk on 11/30/2016 02:33:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Cleveland based on information collected on or before November 18, 2016."

Reports from the twelve Federal Reserve Districts indicate that the economy continued to expand across most regions from early October through mid-November. Activity in the Boston, Minneapolis, and San Francisco Districts grew at a moderate pace, while Atlanta, Chicago, St. Louis, and Dallas cited modest growth. Philadelphia, Cleveland, and Kansas City cited a slight pace of growth. Richmond characterized economic activity as mixed, and New York said activity has remained flat since the last report. Outlooks were mainly positive, with six Districts expecting moderate growth.And on real estate:

...

A tightening in labor market conditions was reported by seven Districts, with modest employment growth on balance. Districts noted slight upward pressure on overall prices..

emphasis added

Residential real estate activity improved across Districts. Reports about existing- and new-home sales were mixed, but most Districts noted a slight to modest increase during the period. Residential construction was up in the Cleveland, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, and Dallas Districts. Home prices grew in many Districts, including Boston, Philadelphia, Cleveland, Atlanta, St. Louis, Kansas City, and San Francisco. Philadelphia reported that the strength of the single-family market is in high-end housing. In contrast, Kansas City reported that sales of low- and medium-priced homes continued to outpace sales of higher-priced homes. Dallas reported that the sales of lower-priced homes remained solid. Home inventories were generally reported to be low or declining and restraining sales growth. Boston, Philadelphia, Cleveland, Richmond, and Minneapolis reported low or decreasing inventories. Reports on inventory levels varied in Atlanta, while inventories held steady in Kansas City.Real estate is decent.

Commercial construction activity moved higher in the New York, Cleveland, Richmond, Atlanta, St. Louis, Kansas City, and San Francisco Districts. In contrast, Minneapolis noted a slowing in commercial construction. The Boston, Richmond, Minneapolis, and San Francisco Districts reported increases in leasing activity, while Philadelphia noted a lull in nonresidential leasing growth compared with the prior period. Dallas reported leasing activity as mostly unchanged. Commercial sales activity continued to be robust in Minneapolis and grew modestly in Kansas City. Ongoing multifamily construction has been steady at a fairly high level in New York. Multifamily construction varied in the Atlanta District and slowed somewhat in Richmond, Minneapolis, and San Francisco.

NY Fed: Household Debt Increased Slightly in Q3 2016, Mortgage Delinquency Rates Declined

by Calculated Risk on 11/30/2016 11:16:00 AM

The Q3 report was released today: Household Debt and Credit Report.

From the NY Fed: Total Household Debt Remains Sluggish Yet Non-Housing Debt Continues Expanding

The Federal Reserve Bank of New York today issued its Quarterly Report on Household Debt and Credit, which reported that total household debt increased modestly by $63 billion (a 0.5% increase) to $12.35 trillion during the third quarter of 2016. There were increases across every type of non-housing debt, with a 2.9% increase in auto loan balances, a 2.5% increase in credit card balances, and a 1.6% percent increase in student loan balances this quarter. This report is based on data from the New York Fed's Consumer Credit Panel, a nationally representative sample of individual- and household-level debt and credit records drawn from anonymized Equifax credit data.

...

Mortgage delinquencies continued to decline as seen since the financial crisis, while new foreclosure notations reached another new low for the 18-year history of this series.

...

Overall delinquency rates worsened slightly this quarter, while the rate of bankruptcy notations continued its overall trend of improving since the financial crisis.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q3. Household debt peaked in 2008, and bottomed in Q2 2013.

Mortgage debt decreased in Q3, from the NY Fed:

Mortgage balances, the largest component of household debt saw a 0.1% decline during the quarter. Mortgage balances shown on consumer credit reports on September 30 stood at $8.35 trillion, a $12 billion drop from the second quarter of 2016. Balances on home equity lines of credit (HELOC) declined by $6 billion, to $472 billion. By contrast, balances on every type of non-housing debt grew in the second quarter, boosting up the total.

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is generally declining, although there was a slight increase in short term delinquencies in Q3. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is generally declining, although there was a slight increase in short term delinquencies in Q3. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).The overall delinquency rate increased slightly in Q3 to 4.9%. From the NY Fed:

Overall delinquency rates worsened slightly in 2016Q3, reflecting an uptick in early delinquencies. As of September 30, 4.9% of outstanding debt was in some stage of delinquency. Of the $609 billion of debt that is delinquent, $400 billion is seriously delinquent (at least 90 days late or “severely derogatory”).

NAR: Pending Home Sales Index increased 0.1% in October, up 1.8% year-over-year

by Calculated Risk on 11/30/2016 10:02:00 AM

From the NAR: Pending Home Sales Crawl Forward in October

Pending home sales were mostly unchanged in October, but did squeak out a meager gain for the second consecutive month, according to the National Association of Realtors®.This was below expectations of a 0.8% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in November and December.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, inched up 0.1 percent to 110.0 in October from a slight downward revision of 109.9 in September. With last month's small increase, the index is now 1.8 percent higher than last October (108.1).

...

The PHSI in the Northeast nudged forward 0.4 percent to 96.9 in October, and is now 3.9 percent above a year ago. In the Midwest the index rose 1.6 percent to 106.3 in October, and is now 1.2 percent higher than October 2015.

Pending home sales in the South declined 1.3 percent to an index of 120.1 in October but are still 0.8 percent higher than last October. The index in the West climbed 0.7 percent in October to 108.3, and is now 2.5 percent above a year ago.

emphasis added

Personal Income increased 0.6% in October, Spending increased 0.3%

by Calculated Risk on 11/30/2016 08:37:00 AM

The BEA released the Personal Income and Outlays report for October:

Personal income increased $98.6 billion (0.6 percent) in October according to estimates released today by the Bureau of Economic Analysis. ... personal consumption expenditures (PCE) increased $38.1 billion (0.3 percent).The October PCE price index increased 1.4 percent year-over-year (compared to 1.2 percent YoY in September) and the October PCE price index, excluding food and energy, increased 1.7 percent year-over-year (same as in September).

...

Real PCE increased 0.1 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

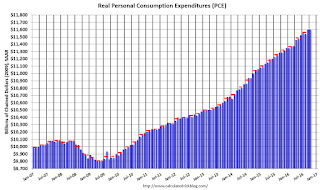

The following graph shows real Personal Consumption Expenditures (PCE) through October 2016 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was above consensus, and the increase in PCE was at consensus expectations.

A solid increase in personal income.

ADP: Private Employment increased 216,000 in November

by Calculated Risk on 11/30/2016 08:19:00 AM

Private sector employment increased by 216,000 jobs from October to November according to the November ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was well abvoe the consensus forecast for 160,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “Businesses hired aggressively in November and there is little evidence that the uncertainty surrounding the presidential election dampened hiring. In addition, because of the tightening labor market, retailers may be accelerating seasonal hiring to secure an adequate workforce to meet holiday demand, although total expected seasonal hiring may be no higher than last year’s.”

The BLS report for November will be released Friday, and the consensus is for 170,000 non-farm payroll jobs added in November.

MBA: Mortgage Refinance Activity Declines 16 Percent in Latest Weekly Survey

by Calculated Risk on 11/30/2016 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

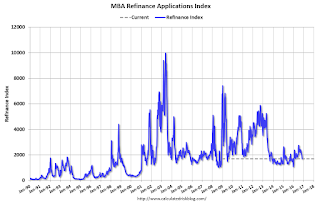

Mortgage applications decreased 9.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 25, 2016. This week’s results included an adjustment for the Thanksgiving holiday.

... The Refinance Index decreased 16 percent from the previous week. The seasonally adjusted Purchase Index decreased 0.2 percent from one week earlier. The unadjusted Purchase Index decreased 34 percent compared with the previous week and was 3 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to its highest level since July 2015, 4.23 percent, from 4.16 percent, with points increasing to 0.41 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With the current level of mortgage rates, refinance activity will probably decline further.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index was "3 percent higher than the same week one year ago".

Tuesday, November 29, 2016

Wednesday: ADP Employment, Personal Income and Outlays, Pending Home Sales, Beige Book, and More

by Calculated Risk on 11/29/2016 08:32:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 160,000 payroll jobs added in November, up from 147,000 added in October.

• At 8:30 AM, Personal Income and Outlays for October. The consensus is for a 0.4% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:45 AM, Chicago Purchasing Managers Index for November. The consensus is for a reading of 52.0, up from 50.6 in October.

• At 10:00 AM, Pending Home Sales Index for October. The consensus is for a 0.8% increase in the index.

• At 11:00 AM, The New York Fed will release their Q3 2016 Household Debt and Credit Report

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Freddie Mac: Mortgage Serious Delinquency rate increased slightly in October

by Calculated Risk on 11/29/2016 05:29:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate increased in October to 1.03%, up from 1.02% in September. Freddie's rate is down from 1.38% in October 2015.

This was the first month-to-month increase since January of this year, but the trend is still down.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The Freddie Mac serious delinquency rate has fallen 0.35 percentage points over the last year, and at that rate of improvement, the serious delinquency rate could be below 1% in November or December.

Note: Fannie Mae will probably report tomorrow.

FDIC: Fewer Problem banks, Residential REO Declined in Q3

by Calculated Risk on 11/29/2016 02:13:00 PM

The FDIC released the Quarterly Banking Profile for Q3 today:

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $45.6 billion in the third quarter of 2016, up $5.2 billion (12.9 percent) from a year earlier. The increase in earnings was mainly attributable to a $10 billion (9.2 percent) increase in net interest income and a $1.2 billion (1.9 percent) rise in noninterest income. One-time accounting and expense items at three institutions had an impact on the growth in income. Banks increased their loan-loss provisions by $2.9 billion (34 percent) from a year earlier. Financial results for the third quarter of 2016 are included in the FDIC’s latest Quarterly Banking Profile released today.

...

“Revenue and net income rose from a year ago, loan balances increased, asset quality improved, and the number of unprofitable banks and ‘problem banks’ continued to fall,” Gruenberg said. “Community banks also reported solid results for the quarter with strong income, revenue, and loan growth.

“Nevertheless, the banking industry continues to operate in a challenging environment,” he said. “Low interest rates for an extended period have led some institutions to reach for yield, which has increased their exposure to interest-rate risk, liquidity risk, and credit risk. Current oil and gas prices continue to affect borrowers that depend on the energy sector and have had an adverse effect on asset quality. These challenges will only intensify as interest rates normalize.”

...

Deposit Insurance Fund’s Reserve Ratio Rises to 1.18 Percent: The DIF increased $2.8 billion during the third quarter, from $77.9 billion at the end of June to $80.7 billion at the end of September, largely driven by $2.6 billion in assessment income. The DIF reserve ratio rose from 1.17 percent to 1.18 percent during the quarter. Because the reserve ratio surpassed 1.15 percent on June 30, lower regular FDIC assessment rates on all insured institutions went into effect in the third quarter. On average, regular quarterly assessments were about one-third lower than in the previous quarter, although temporary assessment surcharges on banks with assets greater than $10 billion led to an increase in total assessments at most large banks.

emphasis added

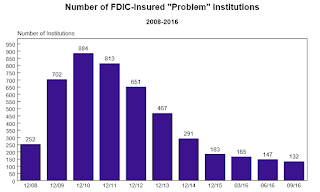

Click on graph for larger image.

Click on graph for larger image.The FDIC reported the number of problem banks declined (Note: graph shows problem banks for Q1, Q2 and Q3 2016, and year end prior to 2016):

“Problem List” Shows Further Improvement: The number of banks on the FDIC’s Problem List fell from 147 to 132 during the third quarter. This is the smallest number of problem banks in more than seven years and is down significantly from the peak of 888 in the first quarter of 2011. Total assets of problem banks fell from $29.0 billion to $24.9 billion during the third quarter.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $4.12 billion in Q2 2016 to $3.98 billion in Q3. This is the lowest level of REOs since Q1 2007.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $4.12 billion in Q2 2016 to $3.98 billion in Q3. This is the lowest level of REOs since Q1 2007.This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

Since REOs are reported in dollars, and house prices have increased, it is unlikely FDIC institution REOs will get back to the $2.0 to $2.5 billion range back that happened in 2003 to 2005. FDIC REOs will probably bottom closer to $3 billion.

Real Prices and Price-to-Rent Ratio in September

by Calculated Risk on 11/29/2016 11:59:00 AM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.5% year-over-year in September

It has been ten years since the bubble peak. In the Case-Shiller release this morning, the National Index, not seasonally adjusted (NSA) was reported as being at a new nominal high. The seasonally adjusted (SA) index was reported as being only 0.8% below the bubble peak. However, in real terms, the National index (SA) is still about 15.7% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now around 5%. In September, the index was up 5.5% YoY.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation (38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to February 2006 levels, and the Case-Shiller Composite 20 Index (SA) is back to June 2005 levels, and the CoreLogic index (NSA) is back to August 2005.

Real House Prices

CPI less Shelter is unchanged over the last two, so real prices increased the same as nominal prices.

In real terms, the National index is back to March 2004 levels, the Composite 20 index is back to November 2003, and the CoreLogic index back to February 2004.

In real terms, house prices are back to late 2003 / early 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to August 2003 levels, the Composite 20 index is back to April 2003 levels, and the CoreLogic index is back to July 2003.

In real terms, and as a price-to-rent ratio, prices are back to late 2003 - and the price-to-rent ratio maybe moving a little more sideways now.

Case-Shiller: National House Price Index increased 5.5% year-over-year in September

by Calculated Risk on 11/29/2016 09:16:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for September ("September" is a 3 month average of July, August and September prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: The S&P CoreLogic Case-Shiller National Index Reaches New High as Home Price Gains Continue

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, surpassed the peak set in July 2006 as the housing boom topped out. The National index reported a 5.5% annual gain in September, up from 5.1% last month. The 10-City Composite posted a 4.3% annual increase, up from 4.2% the previous month. The 20-City Composite reported a yearover-year gain of 5.1%, unchanged from August.

Seattle, Portland, and Denver reported the highest year-over-year gains among the 20 cities over each of the last eight months. In September, Seattle led the way with an 11.0% year-over-year price increase, followed by Portland with 10.9%, and Denver with an 8.7% increase. 12 cities reported greater price increases in the year ending September 2016 versus the year ending August 2016.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.4% in September. Both the 10-City Composite and the 20-City Composite posted a 0.1% increase in September. After seasonal adjustment, the National Index recorded a 0.8% month-over-month increase, the 10-City Composite posted a 0.2% month-over-month increase, and the 20-City Composite reported a 0.4% month-over-month increase. 15 of 20 cities reported increases in September before seasonal adjustment; after seasonal adjustment, all 20 cities saw prices rise.

emphasis added

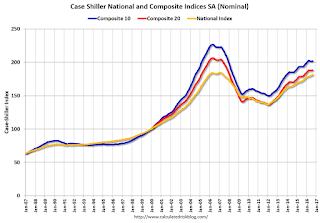

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 10.7% from the peak, and up 0.2% in September (SA).

The Composite 20 index is off 8.5% from the peak, and up 0.4% (SA) in September.

The National index is off 0.8% from the peak (SA), and up 0.8% (SA) in September. The National index is up 34.0% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.3% compared to September 2015.

The Composite 20 SA is up 5.1% year-over-year.

The National index SA is up 5.5% year-over-year.

Note: According to the data, prices increased in all 20 cities month-over-month seasonally adjusted.

I'll have more later.

Q3 GDP Revised Up to 3.2% Annual Rate

by Calculated Risk on 11/29/2016 08:46:00 AM

From the BEA: Gross Domestic Product: Third Quarter 2016 (Second Estimate)

Real gross domestic product increased at an annual rate of 3.2 percent in the third quarter of 2016, according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 1.4 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised up from 2.1% to 2.8%. (decent PCE). Non-Residential investment in structures was revised up from 5.4% to +10.1%. This was above the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.9 percent. With the second estimate for the third quarter, the general picture of economic growth remains the same; the increase in personal consumption expenditures was larger than previously estimated ...

emphasis added

Black Knight: Mortgage "Foreclosure Starts Hit Lowest Level Since January 2005" in October

by Calculated Risk on 11/29/2016 07:01:00 AM

Note: There was a report of a "foreclosure spike" in October. This data shows the opposite happened.

From Black Knight: Black Knight’s First Look at October 2016 Mortgage Data: Foreclosure Starts Hit Lowest Level Since January 2005; Foreclosure Rate Falls Below One Percent for First Time Since July 2007

• October’s 56,500 foreclosure starts is the lowest one-month total in nearly 12 yearsAccording to Black Knight's First Look report for October, the percent of loans delinquent increased 2% in October compared to September, and declined 8.9% year-over-year.

• Delinquencies see modest seasonal increase in October; still down nine percent from last year

• Active foreclosure inventory continues to improve, just over 500,000 active foreclosure cases remain

• Prepayment activity down slightly from September but remains 37 percent above last year’s level

The percent of loans in the foreclosure process declined 1% in October and were down 30% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.35% in October, up from 4.27% in September.

The percent of loans in the foreclosure process declined in October to 0.99%. This is the lowest level since July 2007.

The number of delinquent properties, but not in foreclosure, is down 214,000 properties year-over-year, and the number of properties in the foreclosure process is down 217,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for October on December 5th.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Oct 2016 | Sept 2016 | Oct 2015 | Oct 2014 | |

| Delinquent | 4.35% | 4.27% | 4.77% | 5.42% |

| In Foreclosure | 0.99% | 1.00% | 1.43% | 1.81% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,202,000 | 2,165,000 | 2,415,000 | 2,731,000 |

| Number of properties in foreclosure pre-sale inventory: | 504,000 | 509,000 | 721,000 | 912,000 |

| Total Properties | 2,706,000 | 2,674,000 | 3,136,000 | 3,643,000 |

Monday, November 28, 2016

Tuesday: GDP, Case-Shiller House Prices

by Calculated Risk on 11/28/2016 07:32:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Fall at Fastest Pace Since Brexit

WARNING: this article's headline makes the overall mortgage rate situation sound much better than it actually is. While it is indeed a fact that today's rates are lower than the previous business day's rates by the widest margin since Brexit, caveats abound. First off, the Brexit move was more than twice as big. Today's move is only slightly better than a handful of other decent days over the past 5 months.Tuesday:

The post-Brexit move also occurred when rates were already fairly low. In fact, rates were near all-time lows already, and had been moving almost exclusively lower all year. In stark contrast, today's improvement comes on the heels of one of the sharpest moves higher in history. It's fairly normal to see a decent-sized correction after a huge spike higher.

...

Bottom line: it was a great individual day for rates, but we're still very much in the "new normal" range of conventional 30yr fixed rates between 4% and 4.25%.

emphasis added

• At 8:30 AM ET, Gross Domestic Product, 3rd quarter 2016 (Second estimate). The consensus is that real GDP increased 3.1% annualized in Q3, revised from 2.9% in the advance report.

• At 9:00 AM, S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September prices. The consensus is for a 5.2% year-over-year increase in the Comp 20 index for September. The Zillow forecast is for the National Index to increase 5.4% year-over-year in September.

Possible Policy Impacts on Housing

by Calculated Risk on 11/28/2016 03:44:00 PM

On Friday I posted a few 2017 housing forecasts. I'll add more forecasts soon. Some of these forecasts may be revised due to the Presidential results and also due to the possibility of higher mortgage rates.

Here are some preliminary thoughts on several potential issues for housing over the next couple of years:

1) Higher interest rates due to policy changes (tax cuts and more spending). Higher mortgage rates could slow housing activity. However, if the tax cuts and more spending lead to more jobs, then that might offset any increase in mortgage rates.

2) Immigration. If the next administration focuses on deportation, this could lead to less demand in certain areas. This could lead to lower rents, fewer sales, more inventory, fewer housing starts, and possibly lower prices in those areas.

3) Financing. Although most policy discussions have focused on deregulation, it is also possible that Fannie and Freddie will be privatized, and that some mortgage lending will dry up. FHA loans might also become more expensive.

Hotels: Finishing Year Strong, Could be Best Year on Record

by Calculated Risk on 11/28/2016 01:34:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 19 November

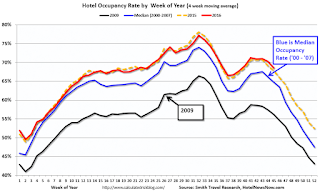

The U.S. hotel industry reported positive results in the three key performance metrics during the week of 13-19 November 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In year-over-year comparisons, the industry’s occupancy rose 4.5% to 65.8%. Average daily rate (ADR) increased 4.6% to US$122.02. Revenue per available room (RevPAR) grew 9.2% to US$80.25.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking just behind 2015, and well ahead of the median rate. With a solid finish, 2016 could be the best year on record.

Year-to-date, the three best years are:

1) 2015: 67.4% average occupancy.

2) 2016: 67.4% average.

3) 2000: 66.5% average.

For hotels, the Fall business travel season is slowing down, and the occupancy rate will decline into the holiday season.

Data Source: STR, Courtesy of HotelNewsNow.com

Dallas Fed: Regional Manufacturing Activity "Continues to Expand" in November

by Calculated Risk on 11/28/2016 10:36:00 AM

Note: All regional Fed surveys indicated expansion in November. This is the first time all regional surveys were positive in two years (the decline in oil prices hit some regions hard - like Dallas).

From the Dallas Fed: Texas Manufacturing Activity Continues to Expand

Texas factory activity increased again in November, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, posted a fifth consecutive positive reading and edged up to 8.8. ...This was the last of the regional Fed surveys for November.

...

The general business activity index shot up to 10.2 after nearly two years of negative readings.

...

Labor market measures indicated increased employment levels and longer workweeks. The employment index came in at 4.5 after a near-zero reading last month. Seventeen percent of firms noted net hiring, compared with 13 percent noting net layoffs. The hours worked index returned to positive territory in November, coming in at 2.5. ...

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through November), and five Fed surveys are averaged (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

It seems likely the ISM manufacturing index will show expansion again in November, and the consensus is for a reading of 52.3.

Black Knight: House Price Index up 0.1% in September, Up 5.4% year-over-year

by Calculated Risk on 11/28/2016 08:53:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index Report: September 2016 Transactions, U.S. Home Prices Up 0.1 Percent for the Month; Up 5.4 Percent Year-Over-Year

• September’s home price movement was relatively flat at the national level, with home prices ticking up just 0.1 percent from AugustThe year-over-year increase in this index has been about the same for the last year.

• U.S. home prices are up 5.4 percent from last year and are now within just 0.6 percent of hitting a new national peak

• Home prices in seven of the nation’s 20 largest states and seven of the 40 largest metros hit new peaks

Note that house prices are close to the bubble peak in nominal terms, but not in real terms (adjusted for inflation). Case-Shiller for September will be released tomorrow.

Sunday, November 27, 2016

Sunday Night Futures

by Calculated Risk on 11/27/2016 08:18:00 PM

The words of a President matter. Same with the words of a President-elect. Just like during the campaign, Donald Trump just keeps making stuff up ...

"In addition to winning the Electoral College in a landslide, I won the popular vote if you deduct the millions of people who voted illegally" Donald Trump, Nov 27, 2016There is no evidence of significant voter fraud. Sad. And dangerous. Trump is known to make up economic data too ... and that could have negative consequences for the economy and stock market.

Weekend:

• Schedule for Week of Nov 27, 2016

• November NFP Forecasts

Monday:

• At 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for November. This is the last of the regional Fed surveys for October.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are down 5, and DOW futures are down 30 (fair value).

Oil prices were up over the last week with WTI futures at $45.39 per barrel and Brent at $46.52 per barrel. A year ago, WTI was at $41, and Brent was at $43 - so oil prices are up year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.12 per gallon - a year ago prices were at $2.04 per gallon - so gasoline prices are up slightly year-over-year.

November NFP Forecasts

by Calculated Risk on 11/27/2016 11:01:00 AM

I hope everyone is having a great Thanksgiving weekend!

A couple of NFP forecasts ...

From Nomura:

[W]e forecast private payrolls grew by 155k in November with an additional 5k increase in government payrolls, implying that nonfarm payrolls grew by 160k. ... given another month of solid job gains, we think that the unemployment rate will tick down for a consecutive month and settle on a rounded basis at 4.8% in November. Lastly, on wage growth, we think some negative payback is in order as wage gains in October were amplified by inclement weather cutting short the workweek during the BLS survey reference period. Therefore, we forecast only a 0.1% m-o-m increase in average hourly earnings.From Merrill Lynch:

emphasis added

Recent labor market data has continued to show solid improvement. We expect the trend to continue in November with 170,000 in nonfarm payroll growth, a slight deceleration from the 176,000 average over the prior three months. We expect 165,000 in private payroll growth, with a modest 5,000 expansion in government payrolls.

We expect the labor force participation rate to remain at 62.8% and the unemployment rate to also remain unchanged at 4.9%. We expect a softer 0.2% mom gain in average hourly earnings after the strong 0.4% mom pop last month, leaving the year-over-year rate at 2.8%.

Saturday, November 26, 2016

November 2016: Unofficial Problem Bank list unchanged at 173 Institutions

by Calculated Risk on 11/26/2016 04:31:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for November 2016.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for November 2016. During the month, the list remained unchanged at 173 institutions after one removal and one addition.

However, assets increased by $5.0 billion to $59.9 billion. Updating to third quarter 2016 asset figures added $477 million to the asset total.

A year ago, the list held 255 institutions with assets of $77.0 billion. This is the first monthly increase in the asset total since $405 million during January 2015 and the largest increase since a $17.2 billion increase during April 2011. The FDIC terminated its enforcement actions against Noah Bank, Elkins Park, PA ($320 million) and issued a new action against First NBC Bank, New Orleans, LA ($4.9 billion).

Schedule for Week of Nov 27, 2016

by Calculated Risk on 11/26/2016 08:11:00 AM

The key report this week is the November employment report on Friday.

Other key indicators include October Personal Income and Outlays, November ISM manufacturing index, Case-Shiller house prices and November auto sales.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for November. This is the last of the regional Fed surveys for October.

8:30 AM ET: Gross Domestic Product, 3rd quarter 2016 (Second estimate). The consensus is that real GDP increased 3.1% annualized in Q3, revised from 2.9% in the advance report.

9:00 AM ET: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September prices.

9:00 AM ET: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the August 2016 report (the Composite 20 was started in January 2000).

The consensus is for a 5.2% year-over-year increase in the Comp 20 index for September. The Zillow forecast is for the National Index to increase 5.4% year-over-year in September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 160,000 payroll jobs added in November, up from 147,000 added in October.

8:30 AM ET: Personal Income and Outlays for October. The consensus is for a 0.4% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for November. The consensus is for a reading of 52.0, up from 50.6 in October.

10:00 AM: Pending Home Sales Index for October. The consensus is for a 0.8% increase in the index.

11:00 AM: The New York Fed will release their Q3 2016 Household Debt and Credit Report

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 253 thousand initial claims, up from 251 thousand the previous week.

10:00 AM: ISM Manufacturing Index for November. The consensus is for the ISM to be at 52.3, up from 51.9 in October.

10:00 AM: ISM Manufacturing Index for November. The consensus is for the ISM to be at 52.3, up from 51.9 in October.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 51.9% in October. The employment index was at 52.9%, and the new orders index was at 52.1%.

10:00 AM: Construction Spending for October. The consensus is for a 0.6% increase in construction spending.

All day: Light vehicle sales for November. The consensus is for light vehicle sales to decrease to 17.8 million SAAR in November, from 17.9 million in October (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for November. The consensus is for light vehicle sales to decrease to 17.8 million SAAR in November, from 17.9 million in October (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the October sales rate.

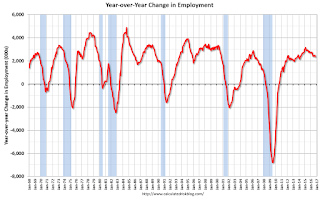

8:30 AM: Employment Report for November. The consensus is for an increase of 170,000 non-farm payroll jobs added in November, up from the 161,000 non-farm payroll jobs added in October.

The consensus is for the unemployment rate to be unchanged at 4.9%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In October, the year-over-year change was 2.36 million jobs.

A key will be the change in wages.

Friday, November 25, 2016

FHFA increases Conforming Loan Limits

by Calculated Risk on 11/25/2016 03:39:00 PM

This was announced Wednesday. From Jann Swanson at MortgageNewsDialy.com: FHFA Ups Conforming Loan Limit to $424,100

After leaving them in a holding pattern for 10 long years the Federal Housing Finance Agency (FHFA) has raised conforming loan limits for mortgages acquired by Fannie Mae and Freddie Mac. Separate loan limit announcements are expected shortly from FHA and the Veterans Administration.

The current loan limit, $417,000, has been in place since 2006. ... the agency has raised conforming loan limits by 1.7 percent to $424,100. The new loan limits are effective as of January 1, 2017.

FHFA designates as so-called high-cost areas, markets where 115 percent of the local median home value exceeds the baseline loan limit. HERA sets the maximum loan limit as a function of the area median home value with a ceiling on the limit of 150 percent of the baseline limit. Under this formula, the new limit for the highest cost areas will have a ceiling of $636,150 in 2017.

...

A list of the maximum conforming loan limits for all counties and county-equivalent areas can be found at 2017 Conforming Loan Limits

First Look: 2017 Housing Forecasts

by Calculated Risk on 11/25/2016 08:11:00 AM

Towards the end of each year I collect some housing forecasts for the following year. It looks like analysts are optimistic on New Home sales for 2017, although that might change with higher mortgage rates and policy changes. I'll post updates as the forecasts change (and add more forecasts soon).

First a review of the previous four years ...

Here is a summary of forecasts for 2016. In 2016, new home sales will probably be around 565 thousand, and total housing starts will be around 1.175 million. Fannie Mae and Merrill Lynch were very close on New Home sales, and MetroStudy was close on starts.

Here is a summary of forecasts for 2015. In 2015, new home sales were 501 thousand, and total housing starts were 1.112 million. Zillow, CoreLogic, and the MBA were right on with New Home sales, and CoreLogic, MetroStudy, MBA and Zillow were all correct on starts.

Here is a summary of forecasts for 2014. In 2014, new home sales were 437 thousand, and total housing starts were 1.003 million. No one was close on New Home sales (all way too optimistic), and Michelle Meyer (Merrill Lynch) and Fannie Mae were the closest on housing starts (about 10% too high). In 2014, many analysts underestimated the impact of higher mortgage rates and higher new home prices on new home sales and starts.

Here is a summary of forecasts for 2013. In 2013, new home sales were 429 thousand, and total housing starts were 925 thousand. Barclays was the closest on New Home sales followed by David Crowe (NAHB). Fannie Mae and the NAHB were the closest on housing starts.

The table below shows a few forecasts for 2017:

From Fannie Mae: Housing Forecast: November 2016

From NAHB: NAHB’s housing and economic forecast

From Wells Fargo: Monthly Economic Outlook

From NAR: U.S. Economic Outlook: November 2016

Note: For comparison, new home sales in 2016 will probably be around 565 thousand, and total housing starts around 1.175 million.

| Housing Forecasts for 2017 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | House Prices1 | |

| Fannie Mae | 671 | 883 | 1,308 | 4.8%2 |

| Merrill Lynch | 1,225 | |||

| NAHB | 647 | 873 | 1,258 | |

| NAR | 623 | 838 | 1,221 | 4.2%3 |

| Wells Fargo | 1,180 | |||

| 1Case-Shiller unless indicated otherwise 2FHFA Purchase-Only Index 3NAR Median Prices | ||||

Thursday, November 24, 2016

Five Economic Reasons to be Thankful

by Calculated Risk on 11/24/2016 10:26:00 AM

With a Hat Tip to Neil Irwin (he started doing this a few years ago) ... here are five economic reasons to be thankful this Thanksgiving ...

1) Low unemployment claims.

The number of new claims for unemployment insurance benefits is at the lowest level in 40 years (with a much smaller population back then). The four week average of new unemployment has fallen to 251,000, down from 297,000 a year ago, and down from the peak of 660,000 during the great recession.

Here is a graph of initial weekly unemployment claims.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 251,000.

The low level of claims suggests relatively few layoffs.

2) Job Openings Near Record Levels.

There were 5.5 million job openings in September. This is close to the record high of 5.8 million in April 2016.

Job openings (yellow) have been above 5 million for 20 consecutive months.

Note that Quits are up 12% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

More job openings, and rising quits, are positive signs for the labor market.

3) Household Debt burdens are near record lows.

Household debt burdens have declined sharply over the last several years.

The Household debt service ratio was at 13.2% in 2007, and has fallen to under 10% now.

The overall Debt Service Ratio increased slightly in Q2 2016, and has been moving sideways and is near a record low. Note: The financial obligation ratio (FOR) was unchanged in Q2 and is also near a record low (not shown).

The DSR for mortgages (blue) are near the low for the last 35 years. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

This data suggests aggregate household cash flow has improved.

4) Gasoline prices are near the lows since the Great Recession.

Here is a 10 year graph from Gasbuddy.com for nationwide gasoline prices.

Gasoline prices are around $2.12 per gallon, slightly higher than last year at Thanksgiving, and near the lowest since the Great Recession.

5) Wages growth is picking up.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.8% YoY in October. This series is noisy, however overall wage growth is trending up - especially over the last year and a half.

There is much more positive economic news - solid auto sales, housing starts increasing, U-3 unemployment rate below 5%, and U-6 rate falling, the recent pickup in GDP - and much more.

There are still problems - not everyone has participated in the current expansion, wealth and income inequality are record extremes, there is too much student debt, and climate change is posing a real threat to the economy in the future - but there are many economic reasons to be thankful this Thanksgiving.

Happy Thanksgiving to All!

Wednesday, November 23, 2016

Lawler: Table of Distressed Sales and All Cash Sales for Selected Cities in October

by Calculated Risk on 11/23/2016 05:12:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and all cash sales for selected cities in October.

On distressed: The total "distressed" share is down year-over-year in most of these markets.

Short sales and foreclosures are down in these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors continue to pull back, the share of all cash buyers continues to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Oct- 2016 | Oct- 2015 | Oct- 2016 | Oct- 2015 | Oct- 2016 | Oct- 2015 | Oct- 2016 | Oct- 2015 | |

| Las Vegas | 5.1% | 6.3% | 5.6% | 7.3% | 10.7% | 13.6% | 27.4% | 30.9% |

| Reno** | 1.0% | 4.0% | 2.0% | 3.0% | 3.0% | 7.0% | ||

| Phoenix | 1.8% | 2.7% | 2.0% | 3.6% | 3.8% | 6.3% | 21.0% | 24.6% |

| Sacramento | 2.3% | 4.0% | 2.0% | 3.5% | 4.3% | 7.5% | 14.4% | 17.8% |

| Minneapolis | 1.2% | 2.3% | 3.9% | 7.8% | 5.1% | 10.1% | 12.7% | 15.5% |

| Mid-Atlantic | 2.8% | 3.7% | 8.9% | 11.9% | 11.8% | 15.6% | 16.6% | 19.3% |

| Florida SF | 2.3% | 3.6% | 8.0% | 15.6% | 10.4% | 19.3% | 28.6% | 34.2% |

| Florida C/TH | 1.5% | 2.1% | 6.7% | 13.5% | 8.2% | 15.7% | 55.5% | 61.6% |

| Miami MSA SF | 3.5% | 5.7% | 8.3% | 17.1% | 11.8% | 22.8% | 29.6% | 33.8% |

| Miami MSA CTH | 1.6% | 2.5% | 9.1% | 16.5% | 10.6% | 19.0% | 58.8% | 63.9% |

| Chicago (city) | 13.0% | 18.3% | ||||||

| Spokane | 7.2% | 12.3% | ||||||

| Northeast Florida | 13.9% | 25.6% | ||||||

| Orlando | 29.0% | 36.5% | ||||||

| Toledo | 25.6% | 30.4% | ||||||

| Tucson | 23.4% | 28.1% | ||||||

| Knoxville | 22.6% | 25.4% | ||||||

| Peoria | 23.3% | 20.8% | ||||||

| Georgia*** | 20.1% | 23.1% | ||||||

| Omaha | 16.1% | 15.5% | ||||||

| Pensacola | ||||||||

| Rhode Island | 9.9% | 9.6% | ||||||

| Richmond VA | 8.0% | 9.3% | 16.3% | 17.1% | ||||

| Memphis | 9.3% | 15.5% | ||||||

| Springfield IL** | 7.6% | 7.8% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

FOMC Minutes: "Appropriate to raise the target range for the federal funds rate relatively soon"

by Calculated Risk on 11/23/2016 02:30:00 PM

There are still different views, but most participants think it will be appropriate to raise the Fed Funds rate "relatively soon". (probably means December)

From the Fed: Minutes of the Federal Open Market Committee, November 1-2, 2016 . Excerpts:

Most participants expressed a view that it could well become appropriate to raise the target range for the federal funds rate relatively soon, so long as incoming data provided some further evidence of continued progress toward the Committee's objectives. Some participants noted that recent Committee communications were consistent with an increase in the target range for the federal funds rate in the near term or argued that to preserve credibility, such an increase should occur at the next meeting. A few participants advocated an increase at this meeting; they viewed recent economic developments as indicating that labor market conditions were at or close to those consistent with maximum employment and expected that recent progress toward the Committee's inflation objective would continue, even with further gradual steps to remove monetary policy accommodation. In addition, many judged that risks to economic and financial stability could increase over time if the labor market overheated appreciably, or expressed concern that an extended period of low interest rates risked intensifying incentives for investors to reach for yield, potentially leading to a mispricing of risk and misallocation of capital. In contrast, some others judged that allowing the unemployment rate to fall below its longer-run normal level for a time could result in favorable supply-side effects or help hasten the return of inflation to the Committee's 2 percent objective; noted that proximity of the federal funds rate to the effective lower bound places potential constraints on monetary policy; or stressed that global developments could pose risks to U.S. economic activity. More generally, it was emphasized that decisions regarding near-term adjustments of the stance of monetary policy would appropriately remain dependent on the outlook as informed by incoming data, and participants expected that economic conditions would evolve in a manner that would warrant only gradual increases in the federal funds rate.

emphasis added

A few Comments on October New Home Sales

by Calculated Risk on 11/23/2016 12:31:00 PM

New home sales for October were reported below the consensus forecast at 563,000 on a seasonally adjusted annual rate basis (SAAR). And the previous months were revised down.

However, sales were up 17.8% year-over-year in October, and this is the best month for October (NSA) since 2007. And sales are up 12.7% year-to-date compared to the same period in 2015.

The glass is more than half full. This is very solid year-over-year growth and just suggests that expectations were ahead of reality. This is why we look at the trend and not just one month.

Note that these sales (for October) were before the recent increase in mortgage rates.

Earlier: New Home Sales at 563,000 Annual Rate in October.

This graph shows new home sales for 2015 and 2016 by month (Seasonally Adjusted Annual Rate). Sales to date are up 12.7% year-over-year, because of very strong year-over-year growth over the last seven months.

Overall I expected lower growth this year, in the 4% to 8% range. Slower growth seemed likely this year because Houston (and other oil producing areas) will have a problem this year. It looks like I was too pessimistic on new home sales this year.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 563,000 Annual Rate in October

by Calculated Risk on 11/23/2016 10:11:00 AM

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 563 thousand.

The previous three months were revised down by a total of 34 thousand (SAAR).

"Sales of new single-family houses in October 2016 were at a seasonally adjusted annual rate of 563,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.9 percent below the revised September rate of 574,000, but is 17.8 percent above the October 2015 estimate of 478,000"

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in October to 5.2 months.

The months of supply increased in October to 5.2 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of October was 246,000. This represents a supply of 5.2 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In October 2016 (red column), 45 thousand new homes were sold (NSA). Last year, 39 thousand homes were sold in October. This was the highest sales for October since 2007.

The all time high for October was 105 thousand in 2005, and the all time low for October was 23 thousand in 2010.

This was below expectations of 590,000 sales SAAR in October. I'll have more later today.

Weekly Initial Unemployment Claims increase to 251,000

by Calculated Risk on 11/23/2016 08:39:00 AM

The DOL reported:

In the week ending November 19, the advance figure for seasonally adjusted initial claims was 251,000, an increase of 18,000 from the previous week's revised level. The previous week's level was revised down by 2,000 from 235,000 to 233,000. The 4- week moving average was 251,000, a decrease of 2,000 from the previous week's revised average. The previous week's average was revised down by 500 from 253,500 to 253,000.The previous week was revised down.

There were no special factors impacting this week's initial claims. This marks 90 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 251,000.

This was at the consensus forecast. The low level of claims suggests relatively few layoffs.

MBA: Mortgage "Purchase Applications Drive Increase in Latest Weekly Survey "

by Calculated Risk on 11/23/2016 07:00:00 AM

From the MBA: Purchase Applications Drive Increase in Latest MBA Weekly Survey

Mortgage applications increased 5.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 18, 2016.

... The Refinance Index decreased 3 percent from the previous week to its lowest level since January 2016. The seasonally adjusted Purchase Index increased 19 percent from one week earlier. The unadjusted Purchase Index increased 13 percent compared with the previous week and was 11 percent higher than the same week one year ago.

“Mortgage rates have continued to move higher in the post-election period, as investors worldwide are looking for increases in growth and inflation, with the 30-year mortgage rate reaching its highest weekly average since the beginning of 2016,” said Michael Fratantoni, Chief Economist and Senior Vice President of Research & Technology at the Mortgage Bankers Association. “Refinance volume dropped further over the week, particularly for refinances of FHA and VA loans. Purchase volume increased sharply for the week compared to both last week, which included the Veteran’s Day holiday, and last year, with purchase volume up more than 11 percent on a year over year basis. The increase in purchase activity was driven by borrowers seeking larger loans and that drove up the average loan amount on home purchase applications to $310 thousand, the highest in the survey, which dates back to 1990.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to its highest level since January 2016, 4.16 percent, from 3.95 percent, with points unchanged at 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With the current level of mortgage rates, refinance activity will probably decline further.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index was "11 percent higher than the same week one year ago".

Tuesday, November 22, 2016

Wednesday: New Home Sales, Unemployment Claims, FOMC Minutes, and More

by Calculated Risk on 11/22/2016 06:55:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 250 thousand initial claims, up from 235 thousand the previous week.

• Also at 8:30 AM, Durable Goods Orders for October from the Census Bureau. The consensus is for a 1.5% increase in durable goods orders.

• At 9:00 AM, FHFA House Price Index for September 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.7% month-to-month increase for this index.

• At 10:00 AM, New Home Sales for September from the Census Bureau. The consensus is for an decrease in sales to 590 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 593 thousand in September.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (final for November). The consensus is for a reading of 91.6, unchanged from the preliminary reading 91.6.

• At 2:00 PM, FOMC Minutes for Meeting of November 1-2