by Calculated Risk on 10/31/2015 01:01:00 PM

Saturday, October 31, 2015

Schedule for Week of November 1st

The key report this week is the October employment report on Friday.

Other key indicators include October vehicle sales, the October ISM manufacturing and non-manufacturing indexes, and the September trade deficit.

There will be several Federal Reserve speakers this week.

10:00 AM: ISM Manufacturing Index for October. The consensus is for the ISM to be at 50.0, down from 50.2 in September.

10:00 AM: ISM Manufacturing Index for October. The consensus is for the ISM to be at 50.0, down from 50.2 in September.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 50.2% in September. The employment index was at 50.5%, and the new orders index was at 50.1%.

10:00 AM: Construction Spending for September. The consensus is for a 0.4% increase in construction spending.

2:00 PM ET: the October 2015 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

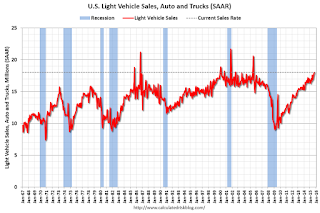

All day: Light vehicle sales for October. The consensus is for light vehicle sales to decrease to 17.7 million SAAR in October from 18.1 million in September (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for October. The consensus is for light vehicle sales to decrease to 17.7 million SAAR in October from 18.1 million in September (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the September sales rate.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for September. The consensus is a 0.9% decrease in orders.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 185,000 payroll jobs added in October, down from 200,000 in September.

8:30 AM: Trade Balance report for September from the Census Bureau.

8:30 AM: Trade Balance report for September from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through August. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $41.1 billion in September from $48.3 billion in August.

10:00 AM: the ISM non-Manufacturing Index for October. The consensus is for index to decrease to 56.7 from 56.9 in September.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 262 thousand initial claims, up from 260 thousand the previous week.

8:30 AM: Employment Report for October. The consensus is for an increase of 190,000 non-farm payroll jobs added in October, up from the 142,000 non-farm payroll jobs added in September.

The consensus is for the unemployment rate to decrease to 5.0%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In September, the year-over-year change was 2.75 million jobs.

A key will be the change in real wages - and as the unemployment rate falls, wage growth should pickup.

3:00 PM: Consumer Credit for September from the Federal Reserve. The consensus is consumer credit increased by $18.0 billion in September.

October 2015: Unofficial Problem Bank list declines to 264 Institutions

by Calculated Risk on 10/31/2015 08:11:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for October 2015.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for October 2015. During the month, the list fell from 276 institutions to 264 after 12 removals. Assets dropped by $2.8 billion to an aggregate $79.2 billion. A year ago, the list held 422 institutions with assets of $133.5 billion.

Actions have been terminated against Severn Savings Bank, FSB, Annapolis, MD ($779 million Ticker: SVBI); Artisans' Bank, Wilmington, DE ($472 million); Valley Bank & Trust, Brighton, CO ($295 million); The Citizens Bank of Logan, Logan, OH ($191 million); United International Bank, Flushing, NY ($184 million); First National Bank, Goodland, KS ($181 million); Goldwater Bank, N.A., Scottsdale, AZ ($103 million); Tri-Valley Bank, San Ramon, CA ($103 million Ticker: TRVB); PNA Bank, Chicago, IL ($96 million); and Park State Bank & Trust, Woodland Park, CO ($91 million).

Two banks failed during the month -- The Bank of Georgia, Peachtree City, GA ($294 million) and Hometown National Bank, Longview, WA ($5 million). Astonishingly, there was a bank failure in Georgia as we thought there were not any banks left to fail in the state. Since the on-set of the Great Recession, 90 banks headquartered in Georgia have failed. Nearly 26 percent of the 352 banks headquartered in Georgia at year-end 2007 have failed. These failures have cost the FDIC insurance fund about $11.7 billion, with the average cost approximating an exorbitant 34 percent of failed bank assets. It does not take rocket science to understand this is what happens when unfettered construction & development lending collides with a housing downturn.

Friday, October 30, 2015

Q3 2015 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 10/30/2015 05:33:00 PM

The BEA released the underlying details for the Q3 advance GDP report today.

Yesterday, the BEA reported that investment in non-residential structures decreased slightly in Q3.

The decline was due to less investment in petroleum exploration. Investment in petroleum and natural gas exploration declined from a $88.6 billion annual rate in Q2 to a $75.0 billion annual rate in Q3. "Mining exploration, shafts, and wells" investment is down 49% year-over-year.

Excluding petroleum, non-residential investment in structures increased solidly in Q3.

The first graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased a little recently, but from a very low level.

Investment in offices increased in Q3, and is up 24% year-over-year -increasing from a very low level - and is still near the lows for previous recessions (as percent of GDP). .

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is up slightly year-over-year. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment increased further in Q3, and with the hotel occupancy rate near record levels, it is likely that hotel investment will increase further in the near future. Lodging investment is up 39% year-over-year.

Home improvement was the top category for twenty consecutive quarters following the housing bust ... but now investment in single family structures has been back on top for the last 7 quarters and will probably stay there for a long time.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect further increases over the next few years.

Investment in single family structures was $211 billion (SAAR) (about 1.2% of GDP).

Investment in home improvement was at a $178 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (just under 1.0% of GDP).

These graphs show investment is generally increasing, but is still very low.

Restaurant Performance Index indicates slower expansion in September

by Calculated Risk on 10/30/2015 03:41:00 PM

Here is a minor indicator I follow from the National Restaurant Association: Restaurant Performance Index: Operators’ Sales Outlook at Two-Year Low

Although same-store sales and customer traffic remained positive in September, the National Restaurant Association’s Restaurant Performance Index (RPI) registered a modest decline. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.4 in September, down slightly from a level of 101.5 in August. Despite the decline, September represented the 31st consecutive month in which the RPI stood above 100, which signifies expansion in the index of key industry indicators.

...

“The RPI's current situation indicators continued to illustrate growth in September, as both same-store sales and customer traffic remained positive,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “However, restaurant operators are more cautious about business conditions in the months ahead, as the proportion expecting a sales increase fell to a two-year low.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index decreased to 101.4 in September, down from 101.5 in August. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month. Even with this decline, the index is indicating expansion, and it appears restaurants are benefiting from lower gasoline prices.

Freddie Mac: Mortgage Serious Delinquency rate declined in September, Lowest since October 2008

by Calculated Risk on 10/30/2015 12:54:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in September to 1.41%, down from 1.45% in August. Freddie's rate is down from 1.96% in September 2014, and the rate in September was the lowest level since October 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for September soon.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.55 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until the second half of 2016.

So even though delinquencies and distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales through 2016 (mostly in judicial foreclosure states).

Chicago PMI increases Sharply, Final October Consumer Sentiment at 90.0

by Calculated Risk on 10/30/2015 10:00:00 AM

Chicago PMI: Oct Chicago Business Barometer Up 7.5 Points To 56.2

The Chicago Business Barometer increased 7.5 points to 56.2 in October from 48.7 in September, led by strong gains in both Production and New Orders.This was well above the consensus forecast of 49.2.

The sharp increase in the Barometer pushed it to the highest since January and marks a promising start to the fourth quarter, building on the small gain made in Q3.

...

Chief Economist of MNI Indicators Philip Uglow said, “The dissapointing September data look more like an aberration than the start of a trend, and the October results mark a good start to the final quarter of the year. Respondents were optimistic that orders will continue to pick-up, consistent with an acceleration in economic activity in Q4.“

emphasis added

Click on graph for larger image.

The final University of Michigan consumer sentiment index for October was at 90.0, down from the preliminary reading of 92.1, and up from 87.2 in September.

BEA: Personal Income increased 0.1% in September, Core PCE prices up 1.3% year-over-year

by Calculated Risk on 10/30/2015 08:32:00 AM

From the BEA, the Personal Income and Outlays report for September:

Personal income increased $18.6 billion, or 0.1 percent ... in September, according to the Bureau of Economic Analysis.On inflation: the PCE price index was up 0.2% year-over-year (the decline in oil prices pushed down the headline price index). However core PCE is only up 1.3% year-over-year - still way below the Fed's target.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in September, compared with an increase of 0.4 percent in August. ... The price index for PCE decreased 0.1 percent in September, compared with a decrease of less than 0.1 percent in August. The PCE price index, excluding food and energy, increased 0.1 percent in September, the same increase as in August.

The September price index for PCE increased 0.2 percent from September a year ago. The September PCE price index, excluding food and energy, increased 1.3 percent from September a year ago.

Thursday, October 29, 2015

Friday: Personal Income and Outlays, Employment Cost Index, Chicago PMI, Consumer Sentiment

by Calculated Risk on 10/29/2015 09:10:00 PM

Earlier today, the UCLA Ziman Center for Real Estate released some predictions for 2016:

[W]e are forecasting housing starts of 1.14 million units this year and 1.42 million units and 1.44 million units in 2016 and 2017, respectively. ...This housing start forecast for 2016 seems way too optimistic and I doubt the builders could ramp up that quickly. Also I doubt we will see 200 thousand jobs added per month through 2017; it takes less that 100 thousand jobs per month to hold the unemployment rate steady - and I've been expecting job growth to slow.

Our forecast is underpinned by continued growth in real GDP that will likely run at 3% in 2016, continued jobs gains in excess of 200,000 a month for most of the forecast period, relatively low mortgage rates at least through 2016 and household formations in excess of one million a year in 2016 and 2017.

Friday:

• At 8:30 AM ET, Personal Income and Outlays for September. The consensus is for a 0.2% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• Also at 8:30 AM, the Employment Cost Index for Q3. The consensus is for a 0.6% increase in Q3.

• At 9:45 AM, Chicago Purchasing Managers Index for October. The consensus is for a reading of 49.2, up from 48.7 in September.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 92.5, up from the preliminary reading of 92.1.

Zillow Forecast: Expect September Year-over-year Change for Case-Shiller Index Similar to August

by Calculated Risk on 10/29/2015 06:10:00 PM

The Case-Shiller house price indexes for August were released Tuesday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: September Case-Shiller Forecast: Look for Continued Modest Growth in Pace of Appreciation

he August S&P Case-Shiller (SPCS) data published [Tuesday] showed home prices rising on a seasonally-adjusted monthly basis, with slight rises in the 10- and 20- city indices and almost half a percentage point rise in the national index.This suggests the year-over-year change for the September Case-Shiller National index will be about the same as in the August report.

We expect the September SPCS to show similar slight increases of 0.1 percent for the 10-City Index and 0.2 percent for the 20-City Index from August to September. The national index is expected to gain half of a percentage point over the same period (seasonally adjusted). We expect the 10- City and national indices to both grow 4.7 percent for the year ending in September, and the 20-City Index to grow 5.1 percent, the same rates of annual appreciation reported for August.

All SPCS forecasts are shown in the table below. These forecasts are based on today’s August SPCS data release and the September 2015 Zillow Home Value Index (ZHVI), released October 26. The SPCS Composite Home Price Indices for September will not be officially released until Tuesday, November 24.

| Zillow Case-Shiller Forecast | ||||||

|---|---|---|---|---|---|---|

| Case-Shiller Composite 10 | Case-Shiller Composite 20 | Case-Shiller National | ||||

| NSA | SA | NSA | SA | NSA | SA | |

| August Actual YoY | 4.7% | 4.7% | 5.1% | 5.1% | 4.7% | 4.7% |

| September Forecast YoY | 4.7% | 4.7% | 5.1% | 5.1% | 4.7% | 4.7% |

| September Forecast MoM | -0.1% | 0.1% | -0.1% | 0.2% | 0.0% | 0.5% |

Lawler: Builders say Labor Shortages Delaying Closings, Pushing Up Costs; and Some Other Observations

by Calculated Risk on 10/29/2015 03:04:00 PM

From housing economist Tom Lawler:

Several builders have released earnings and had earnings conference calls for the quarter ended September 30, 2015, and one of the key “themes” from builders was that resource “constraints,” specifically with respect to labor, slowed home closings last quarter, and in some cases contributed to weaker than expected net orders. PulteGroup, M/I Homes, Meritage Homes, and MDC Holdings all said, in one form or another, that labor “shortages” – laborers, land development, and various trades – had resulted both in accelerating labor costs and delays in land development and home construction. Most builders said that the main impact in terms of their operating results were lower-than-expected home closings last quarter, though one said that in some markets longer construction timelines appear to have led some buyers to forgo a home purchase.

Most builders noted that both land and labor costs had increased “significantly” of late, though costs of most materials were down. Several of the builders said that they were “able” to increase prices to match increases in overall construction costs in most markets, though at least one builder implied that price hikes in a few markets where costs had increased significantly may have led to fewer home orders.

While only one builder – Meritage -- gave specific numbers on the intra-quarterly patterrn of net home orders last quarter, the numbers were startling. According to a Meritage official, the YOY % change in the company’s net orders was +22% in July and +8% in August, but -15% in September. The official wasn’t sure what prompted the sharp slowdown in home orders in September, but he said he was pretty sure other builders say the same drop-off in sales in September. (Earlier this week Census reported that its preliminary estimate of new home sales fell sharply on a seasonally adjusted basis from August to September.) He also said that based on preliminary numbers it appeared as if net home orders would be up 10 to 15% YOY in October.

Commentary on first-time buyers has been mixed. PultgGroup showed a chart suggesting that 33% of its home deliveries last quarter were to “first-time buyers,” but in response to a question (about prices) an official said that PulteGroup was not so much focused on “entry-level” fist-time buyers but more on “affluent” first-time buyers purchasing homes in the $300,000-$400,000 range. M/I Homes said that it was “watching” for signs that the entry-level home buyer market was improving, and that it would be “ready to respond,” but that at present it had no new product plants designed for that market. Officials did note, however, that in the early part of last decade it sold a “substantial” number of sub-2,000 square-foot homes.

Meritage Homes, in contrast, said that it had seen an improvement in the demand from first-time buyers, and that it planned to increase its offerings of smaller, lower price homes over the next year.

On of the more striking aspects of the most recent “recovery” in single-family housing production has been the incredible low production levels of new single-family homes that are “affordable” to what used to be considered the “typical” first-time buyer.

While builders with a presence in Houston for the most part have downplayed the severity of the weakness in the Houston housing markets, Meritage officials gave some intra-quarterly color that suggested the market had deteriorated significantly over the past few months. Specifically, officials said that company’s sales cancellation rate have “spiked up,” and that sales has fallen “significantly,” over the past 60 days.

Flipping back to the “substantial” increase in labor costs at home builders, the BLS data on average hourly earnings for construction workers (including those involved in building single-family homes) does not show the sort of increases builders are reporting. One would assume, however, that they will soon.

Here is a summary of some selected stats from builders who have reported results for the quarter ended September 30, 2015.

| Net Orders | Settlements | Average Closing Price ($000s) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/15 | 9/14 | % Chg | 9/15 | 9/14 | % Chg | 9/15 | 9/14 | % Chg |

| PulteGroup | 4,092 | 3,779 | 8.3% | 4,356 | 4,646 | -6.2% | 336.0 | 334.0 | 0.6% |

| NVR | 3,258 | 2,936 | 11.0% | 3,607 | 3,236 | 11.5% | 380.4 | 366.2 | 3.9% |

| Meritage Homes | 1,567 | 1,500 | 4.5% | 1,712 | 1,522 | 12.5% | 387.0 | 358.0 | 8.1% |

| MDC Holdings | 1,109 | 1,081 | 2.6% | 1,080 | 1,093 | -1.2% | 421.1 | 370.6 | 13.6% |

| M/I Homes | 988 | 892 | 10.8% | 994 | 985 | 0.9% | 349.0 | 320.0 | 9.1% |

| Total | 11,014 | 10,188 | 8.1% | 11,749 | 11,482 | 2.3% | 366.0 | 348.5 | 5.0% |

Q3 GDP: Investment

by Calculated Risk on 10/29/2015 01:01:00 PM

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Note: This can't be used blindly. Residential investment is so low as a percent of the economy that the small decline early last year was not a concern.

Residential investment (RI) increased at a 6.1% annual rate in Q3. Equipment investment increased at a 5.3% annual rate, and investment in non-residential structures decreased at a 4.0% annual rate. On a 3 quarter trailing average basis, RI (red) and equipment (green) are both positive, and nonresidential structures (blue) is slightly negative.

Note: Nonresidential investment in structures typically lags the recovery, however investment in energy and power provided a boost early in this recovery - and is now causing a slight decline. Other areas of nonresidential are now increasing significantly. I'll post more on the components of non-residential investment once the supplemental data is released.

I expect investment to be solid going forward (except for energy and power), and for the economy to continue to grow at a steady pace.

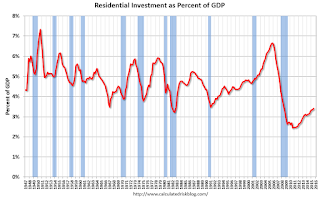

The second graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP has been increasing, but is only just above the bottom of the previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

NAR: Pending Home Sales Index decreased 2.3% in September, up 3% year-over-year

by Calculated Risk on 10/29/2015 10:05:00 AM

From the NAR: Pending Home Sales Lose Further Steam in September

The Pending Home Sales Index, a forward–looking indicator based on contract signings, declined 2.3 percent to 106.8 in September from a slightly downwardly revised 109.3 in August but is still 3.0 percent above September 2014 (103.7). With last month's decline, the index is now at its second lowest level of the year (103.7 in January), but has still increased year–over–year for 13 straight months.This is well below expectations of a 1% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in October and November.

...

The PHSI in the Northeast fell 4.0 percent to 89.6 in September, but is still 3.9 percent above a year ago. In the Midwest the index declined 2.5 percent to 104.7 in September, but remains 4.3 percent above September 2014.

Pending home sales in the South decreased 2.6 percent to an index of 118.3 in September and are now 0.1 percent below last September. The index in the West inched back 0.2 percent in September to 104.4, but is still 6.6 percent above a year ago.

emphasis added

Weekly Initial Unemployment Claims increased to 260,000, 4-Week Average Lowest since 1973

by Calculated Risk on 10/29/2015 08:56:00 AM

The DOL reported:

In the week ending October 24, the advance figure for seasonally adjusted initial claims was 260,000, an increase of 1,000 from the previous week's unrevised level of 259,000. The 4-week moving average was 259,250, a decrease of 4,000 from the previous week's unrevised average of 263,250. This is the lowest level for this average since December 15, 1973 when it was 256,750.The previous week was unrevised at 259,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 259,250. This is the lowest level since 1973.

This was below the consensus forecast of 265,000, and the low level of the 4-week average suggests few layoffs.

BEA: Real GDP increased at 1.5% Annualized Rate in Q3

by Calculated Risk on 10/29/2015 08:37:00 AM

From the BEA: Gross Domestic Product: Third Quarter 2015 (Advance Estimate)

Real gross domestic product -- the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes -- increased at an annual rate of 1.5 percent in the third quarter of 2015, according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 3.9 percent.The advance Q3 GDP report, with 1.5% annualized growth, was below expectations of a 1.7% increase.

...

The increase in real GDP in the third quarter primarily reflected positive contributions from personal consumption expenditures (PCE), state and local government spending, nonresidential fixed investment, exports, and residential fixed investment that were partly offset by negative contributions from private inventory investment. Imports, which are a subtraction in the calculation of GDP, increased.

emphasis added

Personal consumption expenditures (PCE) increased at a 3.2% annualized rate - a solid pace. Residential investment (RI) increased at a 6.1% pace, and equipment investment at a 5.3% pace - both solid. Domestic demand was solid.

The key negatives were investment in inventories (subtracted 1.44 percentage point) and investment in nonresidential structures (subtracted 0.11 percentage points).

I'll have more later ...

Wednesday, October 28, 2015

Thursday: GDP, Unemployment Claims, Pending Home Sales

by Calculated Risk on 10/28/2015 06:39:00 PM

From the WSJ: House Passes Two-Year Budget Deal

The House on Wednesday passed a two-year budget deal that would extend the government’s borrowing limit less than a week before the Treasury risks being unable to pay its bills.Thursday:

The legislation passed the House by a vote of 266-167 and now heads to the Senate, which is expected to pass it later this week or weekend ...

• At 8:30 AM ET, Gross Domestic Product, 3rd quarter 2015 (Advance estimate). The consensus is that real GDP increased 1.7% annualized in Q3.

• Also at 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, up from 259 thousand the previous week.

• At 10:00 AM, Pending Home Sales Index for September. The consensus is for a 1.0% increase in the index.

FOMC Statement: No Rate Hike

by Calculated Risk on 10/28/2015 02:00:00 PM

Less global concern. Slightly more positive. December still on table.

FOMC Statement:

Information received since the Federal Open Market Committee met in September suggests that economic activity has been expanding at a moderate pace. Household spending and business fixed investment have been increasing at solid rates in recent months, and the housing sector has improved further; however, net exports have been soft. The pace of job gains slowed and the unemployment rate held steady. Nonetheless, labor market indicators, on balance, show that underutilization of labor resources has diminished since early this year. Inflation has continued to run below the Committee's longer-run objective, partly reflecting declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation moved slightly lower; survey-based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate. The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced but is monitoring global economic and financial developments. Inflation is anticipated to remain near its recent low level in the near term but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of declines in energy and import prices dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining whether it will be appropriate to raise the target range at its next meeting, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Dennis P. Lockhart; Jerome H. Powell; Daniel K. Tarullo; and John C. Williams. Voting against the action was Jeffrey M. Lacker, who preferred to raise the target range for the federal funds rate by 25 basis points at this meeting.

emphasis added

Bankruptcy Filings declined 11% in Fiscal 2015, Lowest Filings since 2007

by Calculated Risk on 10/28/2015 11:20:00 AM

From the US Court: Fiscal Year Bankruptcy Filings Continue Fall

Bankruptcy cases filed in federal courts for the fiscal year 2015—the 12-month period ending September 30, 2015—totaled 860,182, down 11 percent from the 963,739 bankruptcy filings in FY 2014, according to statistics released today by the Administrative Office of the U.S. Courts. This is the lowest number of bankruptcy filings for any 12-month period since 2007, and the fifth consecutive fiscal year filings have fallen.The number of filings for the fiscal year ending Sept 2015 were the lowest since 2007, and business filings were the lowest in decades.

Click on graph for larger image.

Click on graph for larger image.This graph shows the business and non-business bankruptcy filings by year since 1987.

The sharp decline in 2006 and 2007 was due to the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005". (a good example of Orwellian named legislation since this was more a "Lender Protection Act").

Other than 2007, this was the lowest level for filings since 1994. This is another indicator of an economy mostly recovered from the housing bust and financial crisis.

Merrill on FOMC: Expect No "major changes in policy or language"

by Calculated Risk on 10/28/2015 10:07:00 AM

From Merrill Lynch:

The October FOMC meeting is unlikely to deliver any major changes in policy or language ... At this stage, we continue to see a relatively flat distribution for the timing of liftoff. December is our modal forecast for the first rate hike, but there is a significant chance that it could be later — depending on the upcoming data flow.

Markets are expecting a more dovish assessment of the outlook from the Fed, and the FOMC statement is likely to acknowledge that the recent US data have been more mixed since the September meeting. The FOMC may mark down their assessment of growth from moderate to modest, and may note that the pace of improvement in the labor market has slowed. They also may note the significant drag from inventory reduction and a widening trade deficit. However, watch for the possibility that the FOMC suggests that much of the current weakness should be short-lived — that would be a hawkish signal relative to market expectations for the first rate hike no earlier than March 2016.

...

The FOMC has tried to dissuade markets from expecting any explicit signals about upcoming policy changes, emphasizing data dependence. As such, we anticipate no meaningful changes to the policy guidance language. That should not be read as a sign the Fed will not hike in December; rather that they are keeping all options open. We still see a significant chance that the FOMC will hike this year ...

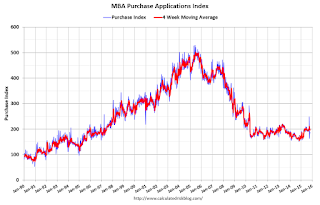

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Purchase Applications up 23% YoY

by Calculated Risk on 10/28/2015 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 23, 2015. The previous week’s results included an adjustment for the Columbus Day holiday.

...

The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index increased 7 percent compared with the previous week and was 23 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.98 percent from 3.95 percent, with points increasing to 0.44 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 23% higher than a year ago.

Tuesday, October 27, 2015

Regional Fed Manufacturing Surveys Weak Again in October

by Calculated Risk on 10/27/2015 04:50:00 PM

Earlier from the Richmond Fed: Manufacturing Sector Activity Remained Soft; Volume of New Orders Leveled Off

Overall, manufacturing conditions remained soft in October. The composite index for manufacturing flattened to a reading of −1, following last month's reading of −5. Additionally, the index for new orders leveled off this month, gaining 12 points to end at 0. The index for shipments remained negative, losing one point to end at −4. Manufacturing employment continued to increase mildly this month. The indicator remained at a reading of 3 for a second month.This was the last of the regional Fed surveys for October. All of the regional surveys indicated contraction in October - although mostly slower than in September - and mostly due to weakness from oil and exports.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through October), and five Fed surveys are averaged (blue, through October) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through September (right axis).

It seems likely the ISM index will be weak again in October, and could possibly show contraction - a reading below 50. (although these regional surveys overemphasize oil producing areas). The early consensus is for an increase to 51.0 for the ISM index, from 50.2 in September.

Real Prices and Price-to-Rent Ratio in August

by Calculated Risk on 10/27/2015 01:22:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 4.7% year-over-year in August

The year-over-year increase in prices is mostly moving sideways now at between 4% and 5%.. In October 2013, the National index was up 10.9% year-over-year (YoY). In August 2015, the index was up 4.7% YoY.

Here is the YoY change since January 2014 for the National Index:

| Month | YoY Change |

|---|---|

| Jan-14 | 10.5% |

| Feb-14 | 10.1% |

| Mar-14 | 8.9% |

| Apr-14 | 7.9% |

| May-14 | 7.0% |

| Jun-14 | 6.3% |

| Jul-14 | 5.6% |

| Aug-14 | 5.1% |

| Sep-14 | 4.8% |

| Oct-14 | 4.6% |

| Nov-14 | 4.6% |

| Dec-14 | 4.5% |

| Jan-15 | 4.3% |

| Feb-15 | 4.2% |

| Mar-15 | 4.3% |

| Apr-15 | 4.3% |

| May-15 | 4.4% |

| Jun-15 | 4.5% |

| Jul-15 | 4.6% |

| Aug-15 | 4.7% |

Most of the slowdown on a YoY basis is now behind us. This slowdown in price increases this year was expected by several key analysts, and I think it is good news for housing and the economy.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation (38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 6.7% below the bubble peak. However, in real terms, the National index is still about 20.6% below the bubble peak.

Nominal House Prices

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through August) in nominal terms as reported.

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through August) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to July 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to January 2005 levels, and the CoreLogic index (NSA) is back to July 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to July 2003 levels, the Composite 20 index is back to April 2003, and the CoreLogic index back to January 2004.

In real terms, house prices are back to 2003 levels.

Note: CPI less Shelter is down 1.1% year-over-year, so this is pushing up real prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to May 2003 levels, the Composite 20 index is back to December 2002 levels, and the CoreLogic index is back to November 2003.

In real terms, and as a price-to-rent ratio, prices are back to 2003 levels - and the price-to-rent ratio maybe moving a little sideways now.

HVS: Q3 2015 Homeownership and Vacancy Rates

by Calculated Risk on 10/27/2015 11:00:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q3 2015.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate increased to 63.7% in Q3, from 63.4% in Q2.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

This has been mostly moving sideways for the last 2+ years.

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate, but this does suggest the rental vacancy rate might have bottomed.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Case-Shiller: National House Price Index increased 4.7% year-over-year in August

by Calculated Risk on 10/27/2015 09:20:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for August ("August" is a 3 month average of June, July and August prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Widespread Gains in Home Prices for August According to the S&P/Case-Shiller Home Price Indices

The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, recorded a slightly higher year-over-year gain with a 4.7% annual increase in August 2015 versus a 4.6% increase in July 2015. The 10-City Composite increased 4.7% in the year to August compared to 4.5% in the prior month. The 20-City Composite’s year-over-year gain was 5.1% versus 4.9% in the year to July.

...

Before seasonal adjustment, the National Index posted a gain of 0.3% month-over-month in August. The 10-City Composite and 20-City Composite both reported gains of 0.3% and 0.4% month-over-month respectively. After seasonal adjustment, the National Index posted a gain of 0.4%, while the 10-City and 20-City Composites both increased 0.1% month-over-month. Eighteen of 20 cities reported increases in August before seasonal adjustment; after seasonal adjustment, five were down, 11 were up, and four were unchanged.

...

“Home prices continue to climb at a 4% to 5% annual rate across the country,” says David M. Blitzer, Managing Director and Chairman of the Index Committee for S&P Dow Jones Indices.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 14.8% from the peak, and up 0.1% in August (SA).

The Composite 20 index is off 13.6% from the peak, and up 0.1% (SA) in August.

The National index is off 6.7% from the peak, and up 0.4% (SA) in August. The National index is up 26.1% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.7% compared to August 2014.

The Composite 20 SA is up 5.1% year-over-year..

The National index SA is up 4.7% year-over-year.

Prices increased (SA) in 13 of the 20 Case-Shiller cities in August seasonally adjusted. (Prices increased in 18 of the 20 cities NSA) Prices in Las Vegas are off 39.2% from the peak, and prices in Denver and Dallas are at new highs (SA).

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 53% above January 2000 (53% nominal gain in almost 16 years).

These are nominal prices, and real prices (adjusted for inflation) are up about 40% since January 2000 - so the increase in Phoenix from January 2000 until now is about 12% above the change in overall prices due to inflation.

Two cities - Denver (up 68% since Jan 2000) and Dallas (up 51% since Jan 2000) - are above the bubble highs (a few other Case-Shiller Comp 20 city are close - Boston, Charlotte, San Francisco, Portland). Detroit prices are barely above the January 2000 level.

I'll have more on house prices later.

Monday, October 26, 2015

Tuesday: Case-Shiller House Prices, Durable Goods

by Calculated Risk on 10/26/2015 08:00:00 PM

From Nick Timiraos And Siobhan Hughes at the WSJ: White House and Boehner Close In on Budget Deal

The White House and Speaker John Boehner (R., Ohio) Monday were nearing a deal on a two-year budget plan that would also increase the federal debt limit, according to people familiar with the discussions.Tuesday:

...

A main object of the talks is to remove the risk that the government might default next month or face a partial government shutdown in December. A deal would suspend the debt limit into early 2017 and establish new spending levels through September 2017, according to people familiar with the discussions.

• At 8:30 AM ET, Durable Goods Orders for September from the Census Bureau. The consensus is for a 1.0% decrease in durable goods orders.

• At 9:00 AM, S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August prices. The consensus is for a 5.1% year-over-year increase in the Comp 20 index for August. The Zillow forecast is for the National Index to increase 4.7% year-over-year in August.

• At 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for October.

• Also at 10:00 AM, the Q3 Housing Vacancies and Homeownership from the Census Bureau.

Vehicle Sales Forecast for October: Over 17 Million Annual Rate Again

by Calculated Risk on 10/26/2015 04:37:00 PM

The automakers will report October vehicle sales on Tuesday, November 3rd. Sales in September were at 18.1 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in October will be over 17 million SAAR again. Sales in September were boosted by the timing of Labor Day.

Note: There were 28 selling days in October, up from 27 in October 2014. Here are two forecasts:

From WardsAuto: Forecast: SAAR Expected to Remain Above 17 Million in October

WardsAuto forecast calls for October U.S. light-vehicle sales to reach a 17.5 million-unit seasonally adjusted annual rate, making it the sixth consecutive month above 17 million.From J.D. Power: October New-Vehicle Retail Sales Strongest in 15 years

The 17.5 million-unit SAAR would be higher than the 17.2 million recorded year-to-date through September and an 11-year peak for the month.

New-vehicle retail and total sales in October 2015 are expected to be the strongest for the month since 2001, according to a monthly sales forecast developed jointly by J.D. Power and LMC Automotive. ...Another solid month for auto sales, although I expect Volkswagen sales to be down year-over-year.

“September was a strong month—bolstered by the Labor Day weekend—so the expectation is that we would see some weakness is subsequent months, but that hasn’t been the case,” said John Humphrey, senior vice president of the global automotive practice at J.D. Power. “Through the first 18 days in October, retail sales are up 7 percent compared with the same period a year ago.” [17.4 million SAAR]

emphasis added

Comments on September New Home Sales

by Calculated Risk on 10/26/2015 01:18:00 PM

The new home sales report for September was well below expectations and sales for July and August were revised down. Sales were up only 2.0% year-over-year in September (SA). Overall this was a disappointing report.

Earlier: New Home Sales decreased to 468,000 Annual Rate in September.

Even though the September report was disappointing, sales are still up solidly year-to-date. The Census Bureau reported that new home sales this year, through September, were 392,000, not seasonally adjusted (NSA). That is up 17.6% from 333,000 sales during the same period of 2014 (NSA). That is a strong year-over-year gain for the first nine months of 2015!

In other words, no worries.

This graph shows new home sales for 2014 and 2015 by month (Seasonally Adjusted Annual Rate).

The year-over-year gain was weak in September, and I expect the year-over-year increases to be lower over the remaining months compared to earlier this year - but the overall year-over-year gain should be solid in 2015.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move sideways (distressed sales will continue to decline and be partially offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

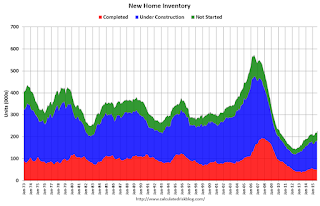

New Home Sales decreased to 468,000 Annual Rate in September

by Calculated Risk on 10/26/2015 10:14:00 AM

The Census Bureau reports New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 468 thousand.

The previous three months were revised down by a total of 39 thousand (SAAR).

"Sales of new single-family houses in September 2015 were at a seasonally adjusted annual rate of 468,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 11.5 percent below the revised August rate of 529,000, but is 2.0 percent above the September 2014 estimate of 459,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in September to 5.8 months.

The months of supply increased in September to 5.8 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of September was 225,000. This represents a supply of 5.8 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In September 2015 (red column), 36 thousand new homes were sold (NSA). Last year 37 thousand homes were sold in September.

The all time high for August was 99 thousand in 2005, and the all time low for September was 24 thousand in 2011.

This was well below expectations of 549,000 sales SAAR in August, and prior months were revised down - a disappointing report. I'll have more later today.

Black Knight: House Price Index up 0.3% in August, Up 5.5% year-over-year

by Calculated Risk on 10/26/2015 09:08:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: U.S. Home Prices Up 0.3 Percent for the Month; Up 5.5 Percent Year-Over-Year

Today, the Data and Analytics division of Black Knight Financial Services, Inc. released its latest Home Price Index (HPI) report, based on August 2015 residential real estate transactions in the United States. The Black Knight HPI combines the company's extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 18,500 U.S. ZIP codes. The Black Knight HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The Black Knight HPI increased 0.3% percent in August, and is off 5.3% from the peak in June 2006 (not adjusted for inflation).

For a more in-depth review of this month's home price trends, including detailed views of results from the 20 largest states and 40 largest metros, please download the full Black Knight HPI Report.

The year-over-year increase in the index has been about the same for the last year.

The report has data for the 20 largest states, and 40 MSAs.

Black Knight shows prices off 37.4% from the peak in Las Vegas, off 31.1% in Orlando, and 27.4% off from the peak in Riverside-San Bernardino, CA (Inland Empire).

Note: Case-Shiller for August will be released tomorrow.

Sunday, October 25, 2015

Monday: New Home Sales

by Calculated Risk on 10/25/2015 07:50:00 PM

Most economist think there is a better than 50% chance of a Fed rate hike in December. Analysts and traders don't think so. From Min Zeng at the WSJ: Betting Against a Fed Rate Rise

[Global] developments, together with mixed U.S. economic data in recent months, increase the likelihood the Fed will keep interest rates near zero for the rest of 2015, according to analysts and traders ...Weekend:

The odds Friday were measured at 37% for an increase at the Dec. 15-16 policy meeting, compared with 44% last month.

• Schedule for Week of October 25, 2015

Monday:

• At 10:00 AM ET, New Home Sales for September from the Census Bureau. The consensus is for a decrease in sales to 549 thousand Seasonally Adjusted Annual Rate (SAAR) in September from 552 thousand in August.

• At 10:30 AM, Dallas Fed Manufacturing Survey for October.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 2 and DOW futures are dwon 25 (fair value).

Oil prices were down over the last week with WTI futures at $44.61 per barrel and Brent at $47.99 per barrel. A year ago, WTI was at $81, and Brent was at $86 - so prices are down about 40% year-over-year (It was a year ago that prices were falling sharply).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.20 per gallon (down about $0.85 per gallon from a year ago).

Goldman: FOMC Preview

by Calculated Risk on 10/25/2015 10:50:00 AM

A few excerpts from a research piece by Goldman Sachs economist David Mericle

We do not expect significant changes in the October FOMC statement. The statement is likely to acknowledge slower payroll gains while still describing growth as “moderate.” We would view such an outcome as indicating that, despite the weaker-than-expected recent data, the leadership’s baseline for liftoff remains December.The FOMC is meeting on Tuesday and Wednesday of this week, and the FOMC statement will be released at 2 PM ET on Wednesday.

The October meeting is unlikely to resolve questions about recent dovish comments from Governors Brainard and Tarullo. Although their comments have been widely interpreted as implying that a hike this year is unlikely, we instead see their remarks as reflecting reasonable and predictable disagreement, and we continue to expect liftoff in December, though only with 60% confidence.

Saturday, October 24, 2015

Schedule for Week of October 25th

by Calculated Risk on 10/24/2015 08:11:00 AM

The key reports this week are September New Home sales on Monday, the advance estimate of Q3 GDP on Thursday, and August Case-Shiller house prices on Tuesday.

The FOMC meets on Tuesday and Wednesday, but no change in policy is expected.

10:00 AM: New Home Sales for September from the Census Bureau.

10:00 AM: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the August sales rate.

The consensus is for a decrease in sales to 549 thousand Seasonally Adjusted Annual Rate (SAAR) in September from 552 thousand in August.

10:30 AM: Dallas Fed Manufacturing Survey for October.

8:30 AM: Durable Goods Orders for September from the Census Bureau. The consensus is for a 1.0% decrease in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August prices.

9:00 AM: S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the July 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 5.1% year-over-year increase in the Comp 20 index for August. The Zillow forecast is for the National Index to increase 4.7% year-over-year in August.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October.

10:00 AM: the Q3 Housing Vacancies and Homeownership from the Census Bureau.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: FOMC Meeting Announcement. No change in policy is expected at this meeting.

8:30 AM ET: Gross Domestic Product, 3rd quarter 2015 (Advance estimate). The consensus is that real GDP increased 1.7% annualized in Q3.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, up from 259 thousand the previous week.

10:00 AM: Pending Home Sales Index for September. The consensus is for a 1.0% increase in the index.

8:30 AM ET: Personal Income and Outlays for September. The consensus is for a 0.2% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

8:30 AM ET: Employment Cost Index for Q3. The consensus is for a 0.6% increase in Q3.

9:45 AM: Chicago Purchasing Managers Index for October. The consensus is for a reading of 49.2, up from 48.7 in September.

10:00 AM: University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 92.5, up from the preliminary reading of 92.1.

Friday, October 23, 2015

Merrill on Q3 GDP and Headwinds

by Calculated Risk on 10/23/2015 08:00:00 PM

The advance estimate for Q3 GDP will be released Thursday October 29th. Here is Merrill Lynch's forecast:

The economy has faced some strong headwinds this year, including a sharp rise in the dollar, weaker-than-expected global growth and sharp cuts in oil sector investment. Further, the economy is in the middle of an inventory correction. Weaker data, particularly for inventories, has contributed to lower GDP tracking, and we are now incorporating that weakness into our official forecast, cutting 3Q real GDP growth by 0.8pp to 1.2%. This lowers 2014 annual GDP growth to 2.4% from 2.5%. Looking past trade and inventories, domestic demand is expected to remain strong, rising by 3.5% in 3Q 2015, and by 3.0% in 2015 as a whole.And on headwinds for the U.S. economy:

First, while the economy faces new global headwinds, the fundamental backdrop for the domestic economy has improved significantly. Post-crisis deleveraging has largely run its course. The housing and banking sectors are back on their feet. And Washington is no longer a major source of austerity and confidence shocks: Federal and state and local fiscal policy has shifted from a 1% or higher GDP headwind to a small tailwind and Americans have learned to largely ignore the budget battles in Washington. In our view, the new global headwinds—a strong dollar, weak growth in emerging markets and weak commodity prices—have less impact on US growth than the fading domestic headwinds –deleveraging, crippled banking and housing sectors and fiscal shocks.The future is bright!

Second, it is important to get the timing of the various shocks right. In our view, most of the hit to growth from global developments has already happened. The strong dollar is an ongoing drag on growth, but model simulations suggest a hump-shape pattern, with small effects last year, a peak drag on growth this summer and diminishing drag in the quarters ahead. On a similar vein, the biggest hit from the collapse in oil prices is behind us, with the collapse in mining investment in the first half of the year. Going forward, we expect a small net effect from low prices as a slow decline in mining related activity is offset or more than offset by consumers spending more of their savings from lower gas prices. The same applies to the inventory adjustment: almost all of the correction came in 3Q. The only shock that builds, rather than diminishes, going forward is the trade and confidence shocks from weakness in China and the rest of emerging markets. Our hope and expectation is that these effects will be small.

Off topic: Hurricane Patricia

by Calculated Risk on 10/23/2015 04:51:00 PM

Hurricane Patricia is about to make landfall in Mexico as a category 5 storm. According to the National Hurricane Center:

There has been little change in the satellite appearance of Patricia since the earlier Hurricane Hunter aircraft left the hurricane. Based on this, the initial intensity remains 175 kt. Some fluctuations in strength are possible before landfall, but it is expected that Patricia will make landfall as a Category 5 hurricane in southwestern Mexico in less than 12 hours. After landfall, a combination of the mountainous terrain of Mexico and increasing shear should cause the cyclone to rapidly weaken, with the system likely to dissipate completely after 36 hours.Below is a satellite image of Patricia. The storm east of Hawaii is Olaf (that is expected to dissipate). For a larger image, click here.

...

The global models continue to depict the development of a cyclone near the Texas coast over the weekend. This system should be non-tropical in nature. However, this cyclone is expected to draw significant amounts of moisture from Patricia's remnants, and could result in locally heavy rainfall over portions of the northwestern Gulf of Mexico coastal area within the next few days.

A Few Random Comments on September Existing Home Sales

by Calculated Risk on 10/23/2015 02:43:00 PM

Once again, housing economist Tom Lawler's projection of the NAR reported sales rate was much closer than the consensus. For September, the NAR reported sales of 5.55 million on a seasonally adjusted annual rate (SAAR) basis, the consensus was 5.35 million, and Lawler's projection was 5.56 million (almost exact). Thanks to Tom for sharing his research with all of us!

Yesterday: Existing Home Sales in September: 5.55 million SAAR

Even though sales were up in September, I expect that the seasonally adjusted pace for existing home sales will slow in coming months due to limited inventory and higher prices.

However, if sales do slow, it is important to remember that new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc - but overall the economic impact is small compared to a new home sale. So some slowing for existing home sales (if it happens) will not be a big deal for the economy.

Also, I've been expecting some increase in inventory this year, but it hasn't happened yet. Inventory is still very low (down 3.1% year-over-year in September). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases.

Also, the NAR reported distressed sales declined a little further year-over-year:

Distressed sales — foreclosures and short sales — remained at 7 percent in September for the third consecutive month; they were 10 percent a year ago. Six percent of September sales were foreclosures and 1 percent (lowest since NAR began tracking in October 2008) were short sales.The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in September (red column) were the highest for September since 2006 (NSA).