by Calculated Risk on 10/31/2012 09:10:00 PM

Wednesday, October 31, 2012

Thursday: ADP Employment, Weekly Unemployment Claims, Auto Sales, ISM Mfg

Here are the winners for the October economic question contest:

1st: Don Durito

2nd tie: Pat MacAuley, Vijay Kumar, Christopher Brandow, Daniel Brawdy and 2 OpenID Users.

Congratulations all!

Thursday:

• At 8:15 AM: ADP will release their Employment Report for October. This report is for private payrolls only (no government). The consensus is for 155,000 payroll jobs added in October. However this is the first report using a new methodology, and the consensus probably doesn't reflect that change. I expect something significantly lower than the "consensus". This doesn't mean the labor market is weaker than originally thought - just that the ADP methodology has been changed.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 365 thousand from 369 thousand. Note: There will probably some increase in weekly unemployment claims over the next few weeks related to Hurricane Sandy.

• Also at 8:30 AM, Productivity and Costs for Q3. The consensus is for a 1.3% increase in unit labor costs.

• At 10:00 AM, the ISM Manufacturing Index for October will be released. The consensus is for a decrease to 51.0, down from 51.5 in September. (above 50 is expansion).

• Also at 10:00 AM, the Census Bureau will released the Construction Spending report for September. The consensus is for a 0.7% increase in construction spending.

• All day: Light vehicle sales for October. The consensus is for light vehicle sales to increase to 15.0 million SAAR in October (Seasonally Adjusted Annual Rate).

Here are the first four questions for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Restaurant Performance Index declined in September

by Calculated Risk on 10/31/2012 06:27:00 PM

From the National Restaurant Association: Restaurant Performance Index Declined in September Due to Softer Sales, Traffic

The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.4 in September, down 0.3 percent from August. Despite the decline, September represented the 11th consecutive month that the RPI stood above 100, which signifies continued expansion in the index of key industry indicators.

“Although restaurant operators reported softer same-store sales and customer traffic levels in September, they are somewhat more bullish about sales growth in the months ahead,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Forty-five percent of restaurant operators expect their sales to improve in the next six months, while only 11 percent expect weaker sales.”

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 99.9 in September – down 0.7 percent from a level of 100.6 in August. Although same-store sales remained positive in September, the softness in the labor and customer traffic indicators outweighed the performance, which led to a Current Situation Index reading below 100 for the second time in the last three months.

Click on graph for larger image.

Click on graph for larger image.The index declined to 100.4 in September, down 0.3% from August (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

NMHC Apartment Survey: Market Conditions Tighten, Growth Rate Moderates

by Calculated Risk on 10/31/2012 04:00:00 PM

From the National Multi Housing Council (NMHC): Apartment Market Expansion Continues as Growth Rate Moderates

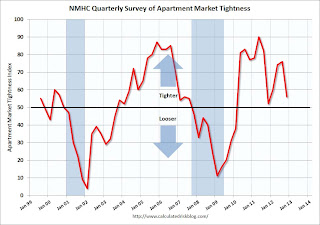

Apartment markets improved across all areas for the seventh quarter in a row, but the pace of improvement moderated according to the National Multi Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions. The survey’s indexes measuring Market Tightness (56), Sales Volume (51), Equity Financing (56) and Debt Financing (65) all measured at 50 or higher, indicating growth from the previous quarter.

“Even after nearly three years of recovery, apartment markets around the country remain strong as more report tightening conditions than not,” said NMHC Chief Economist Mark Obrinsky. “The dynamic that began in 2010 remains in place: the increase in prospective apartment residents continues to outpace the pickup in new apartments completed. While development activity has picked up considerably since the trough, finance for both acquisition and construction remains constrained, flowing mainly to the best properties in the top markets.”

...

Market Tightness Index declined to 56 from 76. Marking the 11th straight quarter of the index topping 50, the majority (62 percent) reported stable market conditions. One quarter reported tighter markets and 14 percent indicated markets as looser.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. The index has indicated tighter market conditions for the last eleven quarters and suggests falling vacancy rates and or rising rents.

This fits with the recent Reis data showing apartment vacancy rates fell in Q3 2012 to 4.6%, down from 4.7% in Q2 2012, and down from 8.0% at the end of 2009. This was the lowest vacancy rate in the Reis survey in over 10 years.

Even though multifamily starts have been increasing, completions lag starts by about a year - so the builders are still trying to catch up. There will be many more completions in 2012 than in 2011, increasing the supply.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010 - and will probably be useful in indicating when the vacancy rate will stop falling.

Fed: Some domestic banks "reported easing standards", Many banks seeing "strengthening of demand"

by Calculated Risk on 10/31/2012 02:30:00 PM

From the Federal Reserve: The October 2012 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the October survey, small fractions of domestic banks, on net, reported easing standards for business lending and some categories of consumer lending over the past three months. Respondents reported little change in residential real estate lending standards on balance. Significant fractions of banks reported a strengthening of demand for commercial real estate loans, residential mortgages, and auto loans, on balance, while demand for most other types of loans was about unchanged.

...

Within consumer lending, modest fractions of respondents continued to report an easing of standards on credit card and auto loans; respondents indicated that their standards on other types of consumer loans were about unchanged.

...

Special questions on lending to and competition from European banks. The October survey also included questions about European banking institutions and their affiliates that have been asked on several recent surveys. Respondents to the domestic and foreign survey again reported that their lending standards to European banks and their affiliates had tightened over the past three months, but the fractions of respondents indicating that they had tightened standards declined significantly between the July and October surveys, on net. As in the July survey, domestic banks reported that they had experienced little change in demand for loans from European banks and their affiliates and subsidiaries.

Of the respondents that indicated that their banks compete with European banks for their business, a slight majority reported that they had experienced a decrease in competition from European banks over the past three months, but the decrease did not appreciably boost business at their banks. A smaller but significant fraction of respondents indicated that a decrease in competition from European banks had increased business at their banks to some extent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

This graph shows the change in demand for CRE (commercial real estate) loans.

Increasing demand and some easing in standards suggests some increase in CRE activity.

The second graph shows the change in demand for residential mortgages. Note the break in the graph - in recent years, the Fed has asked about demand for different types of mortgages.

The second graph shows the change in demand for residential mortgages. Note the break in the graph - in recent years, the Fed has asked about demand for different types of mortgages.The survey also has some discussion on Europe. Whereas domestic banks are easing standards slightly and seeing an increase in demand, they are tightening standards for lending to European banks.

CoreLogic: 57,000 Completed Foreclosures in September

by Calculated Risk on 10/31/2012 12:42:00 PM

From CoreLogic: CoreLogic® Reports 57,000 Completed Foreclosures in September

CoreLogic ... today released its National Foreclosure Report for September that provides monthly data on completed U.S. foreclosures and the overall foreclosure inventory. According to the report, there were 57,000 completed foreclosures in the U.S. in September 2012, down from 83,000 in September 2011 and 59,000 in August 2012. Prior to the decline in the housing market in 2007, completed foreclosures averaged 21,000 per month between 2000 and 2006. Completed foreclosures are an indication of the total number of homes actually lost to foreclosure. Since the financial crisis began in September 2008, there have been approximately 3.9 million completed foreclosures across the country.Note: The foreclosure inventory reported by CoreLogic is lower than the number reported by LPS of 3.87% of mortgages or 1.9 million in foreclosure.

Approximately 1.4 million homes, or 3.3 percent of all homes with a mortgage, were in the national foreclosure inventory as of September 2012 compared to 1.5 million, or 3.5 percent, in September 2011. Month-over-month, the national foreclosure inventory was down 1.1 percent from August 2012 to September 2012. The foreclosure inventory is the share of all mortgaged homes in any stage of the foreclosure process.

“The continuing downward trend in foreclosures along with a gradual clearing of the shadow inventory are signs of stabilization and improvement in the housing market,” said Anand Nallathambi, president and CEO of CoreLogic. “Increasingly improving market conditions and industry and government policy are allowing distressed homeowners to pursue refinancing, loan modifications or short sales rather than foreclosures.”

...

“Homes lost to foreclosure in September 2012 are down 50 percent since the peak month in September 2010 and 22 percent less than the beginning of the year,” said Mark Fleming, chief economist for CoreLogic. “While there is significant progress to be made before returning to pre-crisis levels, the trend is in the right direction as short sales, up 27 percent year over year in August, continue to gain popularity.”

Many observers expected a "surge" in foreclosures this year, but that hasn't happened. However there are still a large number of properties in the foreclosure inventory in some states:

The five states with the highest foreclosure inventory as a percentage of all mortgaged homes were: Florida (11.5 percent), New Jersey (7.3 percent), New York (5.3 percent), Illinois (5.2 percent) and Nevada (4.9 percent).

Chicago PMI: Activity "Idled"

by Calculated Risk on 10/31/2012 09:53:00 AM

From the Chicago ISM:

October 2012: The Chicago Purchasing Managers reported October's Chicago Business Barometer idled, up just 0.2 to a still contractionary 49.9.New orders improved slightly from 47.4 to 50.6 in October. Employment was at 50.3, down from 52.0 in September.

Business Activity measures reflected weakness in five of seven indexes, most notably as the rate of expansion in Production and Employment slowed while New Orders stalled near neutral and Order Backlogs remained in contraction.

EMPLOYMENT: 33 month low;

INVENTORIES: slipped into contraction;

PRICES PAID: inflation slowed a bit;

This was below expectations of a reading of 51.0.

MBA:Refinance Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 10/31/2012 07:03:00 AM

From the MBA: Refinance Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 6 percent from the previous week to the lowest level since the end of August. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.The refinance index has declined for four straight weeks, but is still at a high level.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.65 percent from 3.63 percent, with points decreasing to 0.39 from 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index. The purchase index has been mostly moving sideways over the last two years.

This index is not indicating a pickup in purchase activity.

Tuesday, October 30, 2012

Wednesday: Markets Open, Chicago PMI, Delayed Surveys

by Calculated Risk on 10/30/2012 08:20:00 PM

US Markets will be open on Wednesday. Currently S&P 500 futures are up slightly.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 9:45 AM, the Chicago Purchasing Managers Index for October will be released. The consensus is for an increase to 51.0, up from 49.7 in September.

• Weather delayed: The October National Multi Housing Council (NMHC) Quarterly Apartment Survey will be released either Wednesday or Thursday. This is a key survey for apartment vacancy rates and rents.

• Weather delayed: The October 2012 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

The last question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Earlier on House Prices:

• Case-Shiller: House Prices increased 2.0% year-over-year in August

• House Price Comments, Real House Prices, Price-to-Rent Ratio

• All Current House Price Graphs

HVS: Q3 Homeownership and Vacancy Rates

by Calculated Risk on 10/30/2012 05:23:00 PM

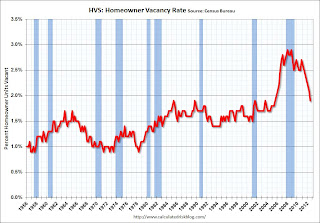

The Census Bureau released the Housing Vacancies and Homeownership report for Q3 2012 this morning.

This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, based on the initial evaluation, it appears the vacancy rates are too high.

It might show the trend, but I wouldn't rely on the absolute numbers. My understanding is the Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply, or rely on the homeownership rate, except as a guide to the trend.

Click on graph for larger image.

Click on graph for larger image.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate was unchanged from Q2 at 65.5%, and down from 66.3% in Q3 2011.

I'd put more weight on the decennial Census numbers and that suggests the actual homeownership rate is probably in the 64% to 65% range.

The HVS homeowner vacancy rate declined to 1.9% from 2.1% in Q2. This is the lowest level since 2005 for this report.

The HVS homeowner vacancy rate declined to 1.9% from 2.1% in Q2. This is the lowest level since 2005 for this report.

The homeowner vacancy rate has peaked and is now declining, although it isn't really clear what this means. Are these homes becoming rentals? Anyway - once again - this probably shows that the trend is down, but I wouldn't rely on the absolute numbers.

The rental vacancy rate was unchanged from Q2 at 8.6%, and down from 9.8% in Q3 2011.

The rental vacancy rate was unchanged from Q2 at 8.6%, and down from 9.8% in Q3 2011.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the overall trend in the rental vacancy rate - and Reis reported that the rental vacancy rate has fallen to the lowest level since 2001.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey. Unfortunately many analysts still use this survey to estimate the excess vacant supply. However this does suggest that the housing vacancy rates have declined sharply.

Earlier on House Prices:

• Case-Shiller: House Prices increased 2.0% year-over-year in August

• House Price Comments, Real House Prices, Price-to-Rent Ratio

• All Current House Price Graphs

Update: House Price Seasonality

by Calculated Risk on 10/30/2012 02:58:00 PM

The Not Seasonally Adjusted (NSA) house price indexes will show month-to-month declines soon. I expect the CoreLogic index to show month-to-month declines in the September report, and the Case-Shiller Composite 20 (NSA) to decline month-to-month in October. This will not be a sign of impending doom - or another collapse in house prices - it is just the normal seasonal pattern.

Even in normal times house prices tend to be stronger in the spring and early summer, then in the fall and winter. Currently there is a stronger than normal seasonal pattern because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have a larger negative impact on prices in the fall and winter.

In the coming months, the key will be to watch the year-over-year change in house prices and to compare to the NSA lows in early 2012. I think house prices have already bottomed, and will be up slightly year-over-year when prices reach the usual seasonal bottom in early 2013.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index over the last several years (both through August). Right now it looks like CoreLogic will turn negative in the September report (CoreLogic is 3 month weighted average, with the most recent month weighted the most). Case-Shiller NSA will probably turn negative month-to-month in the October report (also a three month average, but not weighted).

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust. (I was one of several people to question this change in the seasonal factor - and this lead to Case-Shiller reporting the NSA numbers).

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust. (I was one of several people to question this change in the seasonal factor - and this lead to Case-Shiller reporting the NSA numbers).

It appears the seasonal factor has stopped increasing, and I expect that over the next several years, the seasonal factors will slowly move back towards the previous levels.

House Price Comments, Real House Prices, Price-to-Rent Ratio

by Calculated Risk on 10/30/2012 11:41:00 AM

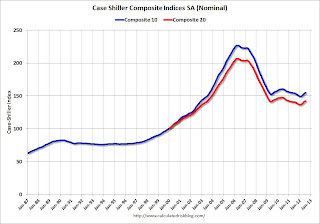

Case-Shiller reported the third consecutive year-over-year (YoY) gain in their house price indexes since 2010 - and the increase back in 2010 was related to the housing tax credit. Excluding the tax credit, the previous YoY increase was back in 2006. The YoY increase in August suggests that house prices probably bottomed earlier this year (the YoY change lags the turning point for prices).

The following table shows the year-over-year increase since the beginning of the year.

| Case-Shiller Composite 20 Index | |

|---|---|

| Month | YoY Change |

| Jan-12 | -3.9% |

| Feb-12 | -3.5% |

| Mar-12 | -2.5% |

| Apr-12 | -1.7% |

| May-12 | -0.5% |

| Jun-12 | 0.6% |

| Jul-12 | 1.1% |

| Aug-12 | 2.0% |

| Sep-12 | |

| Oct-12 | |

| Nov-12 | |

| Dec-12 | |

| Jan-13 | |

On a not seasonally adjusted basis (NSA), house prices will probably start to decline month-to-month in October. But I think prices will remain above the post-bubble lows set earlier this year.

Here is another update to a few graphs: Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio. Real prices, and the price-to-rent ratio, are back to late 1999 to 2000 levels depending on the index.

Nominal House Prices

Click on graph for larger image.

Click on graph for larger image.The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through August) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q1 2003 levels (and also back up to Q4 2010), and the Case-Shiller Composite 20 Index (SA) is back to August 2003 levels, and the CoreLogic index (NSA) is back to December 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to mid-1999 levels, the Composite 20 index is back to June 2000, and the CoreLogic index back to February 2001.

In real terms, most of the appreciation early in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q3 1999 levels, the Composite 20 index is back to June 2000 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to 1999 or early 2000 levels.

Case-Shiller: House Prices increased 2.0% year-over-year in August

by Calculated Risk on 10/30/2012 09:00:00 AM

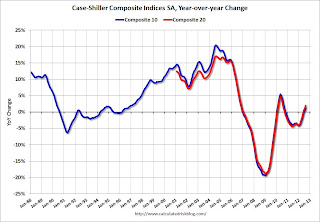

S&P/Case-Shiller released the monthly Home Price Indices for July (a 3 month average of June, July and August).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Home Prices Continued to Rise in August 2012 According to the S&P/Case-Shiller Home Price Indices

Data through August 2012, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices, the leading measure of U.S. home prices, showed average home prices increased by 0.9% for both the 10- and 20-City Composites in August versus July 2012. Nineteen of the 20 cities and both Composites posted positive monthly gains in August; Seattle was the only exception where prices declined 0.1% over the month.

The 10- and 20-City Composites recorded annual returns of +1.3% and +2.0% in August 2012 – an improvement over the +0.6% and +1.2% respective annual rates posted for July 2012. Eighteen of the 20 cities and both Composites posted better annual returns in August compared to July 2012. Annual returns for Dallas remained unchanged at +3.6% and Chicago saw its annual return worsen from -1.0% in July to 1.6% in August 2012.

...

“Home prices continued climbing across the country in August,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Nineteen of the 20 cities and both Composites showed monthly gains in August. Seventeen cities and both Composites posted positive annual returns in August 2012. In 18 cities and both Composites annual rates improved in August versus July. Dallas’ rate remained unchanged at +3.6% and Chicago worsened slightly from a -1.0% annual rate in July to a -1.6% annual rate in August.

“Phoenix continues to lead the home price recovery. It recorded its fourth consecutive month of double-digit positive annual returns with a +18.8% rate for August. Atlanta posted a -6.1% annual rate, however this is significantly better than the nine consecutive months of double-digit declines it posted from October 2011 through June 2012. Las Vegas’ annual rate finally moved to positive territory with a +0.9% annual rate of change in August 2012, its first since January 2007.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.5% from the peak, and up 0.4% in August (SA). The Composite 10 is up 4.0% from the post bubble low set in March (SA).

The Composite 20 index is off 30.92% from the peak, and up 0.5% (SA) in August. The Composite 20 is up 4.4% from the post-bubble low set in March (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 1.3% compared to August 2011.

The Composite 20 SA is up 2.0% compared to August 2011. This was the third consecutive month with a year-over-year gain since 2010 (when the tax credit boosted prices temporarily).

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 19 of the 20 Case-Shiller cities in August seasonally adjusted (also 19 of 20 cities increased NSA). Prices in Las Vegas are off 59.5% from the peak, and prices in Dallas only off 5.8% from the peak. Note that the red column (cumulative decline through August 2012) is above previous declines for all cities.

Prices increased (SA) in 19 of the 20 Case-Shiller cities in August seasonally adjusted (also 19 of 20 cities increased NSA). Prices in Las Vegas are off 59.5% from the peak, and prices in Dallas only off 5.8% from the peak. Note that the red column (cumulative decline through August 2012) is above previous declines for all cities.This was about at the consensus forecast and the recent change to a year-over-year increase is a significant story. I'll have more on prices later.

Monday, October 29, 2012

Tuesday: Case-Shiller House Prices

by Calculated Risk on 10/29/2012 07:10:00 PM

NOTE: US Markets will remain closed on Tuesday due to severe weather in the New York area. Stay safe!

Here is the preliminary tide level data for The Battery, NY (raw data not checked yet) . Apparently the record level is 11.2 feet. This gauge is currently showing 11.07 feet, and high tide is in about 2 hours. Ouch.

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for August is expected to be released. Although this is the August report, it is really a 3 month average of June, July and August. The consensus is for a 1.9% year-over-year increase in the Composite 20 prices (NSA) for August.

• At 10:00 AM, the Conference Board's consumer confidence index for October is expected to be released. The consensus is for an increase to 74.0 from 70.3 last month.

• Also at 10:00, Q3 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, based on the initial evaluation, it appears the vacancy rates are too high. The Census Bureau is looking into the differences between the HVS, the ACS, and the decennial Census, and until the issues are resolved, this survey probably shouldn't be used to estimate the excess vacant housing supply.

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Wells Fargo raises Housing Forecasts for 2013 and 2014

by Calculated Risk on 10/29/2012 04:26:00 PM

Near the end of the year, I collect housing forecasts from a number of analysts. From Mark Vitner and Anika Khan at Wells Fargo:

We have raised our forecast for new home sales and housing starts in 2013 and 2014 due to recent reports from homebuilders, strong gains in building permits and starts, record low new home inventories, and the Fed’s stated intentions to purchase large quantities of mortgage-backed securities on an ongoing basis. ...Wells Fargo is now forecasting total starts of 990 thousand in 2013, and 1.17 million in 2014 (from around 770 thousand in 2012).

[G]iven the strong gain in permits, which are running slightly ahead of starts, the gain in the Wells Fargo/NAHB Homebuilders’ Index and robust orders data from several large homebuilders, we raised our expectations for 2013 and 2014 to 990,000 and 1.17 million homes, respectively.

They are forecasting single family starts of 680 thousand in 2013, and 820 thousand in 2014 (around 530 thousand this year).

Their forecast for new home sales is 465 thousand in 2013, and 530 thousand in 2014 (from 370 thousand this year).

That is an increase of around 25%+ next year, and an additional 15% to 20% in 2014.

For 2012, Wells Fargo forecast 350 thousand new home sales, 457 single family starts, and 690 total starts. All too low.

Update: Employment Report expected on Friday

by Calculated Risk on 10/29/2012 02:51:00 PM

From the WSJ: UPDATE: Labor Department ‘Working Hard’ to Ensure Jobs Report Released on Time

The U.S. Labor Department on Monday said it is “working hard to ensure the timely release” of the October jobs report, saying it intends to released the report on schedule Friday despite Hurricane Sandy.From the NY Times: Still at Sea, Storm Drenches East Coast

“It is our intention that Friday will be business as usual,” said Carl Fillichio, a senior press advisor at Labor. Mr. Fillichio’s statement provided clarity to an earlier Labor statement that said the agency would assess how to handle data releases this week after the “weather emergency” is over.

Hurricane Sandy churned relentlessly through the Atlantic Ocean on Monday on the way to carving what forecasters agreed would be a devastating path on land that is expected to paralyze life for millions of people in more than a half-dozen states, with extensive evacuations, once-in-a-generation flooding, widespread power failures and mass transit disruptions.Oh my. Please stay safe.

The huge storm, which picked up speed over the water on Monday morning, was producing sustained winds of 90 miles per hour by 11 a.m., up from 75 m.p.h. on Sunday night. The center of Hurricane Sandy made its expected turn toward the New Jersey coast early on Monday. ...

According to forecasters, the storm is on a scale that weather historians say has little precedent along the East Coast. Landfall is predicted on Monday night somewhere between central New Jersey and southern Delaware. But most of the eastern United States will feel Hurricane Sandy’s effects, making the exact landfall spot less important than the overall trajectory.

emphasis added

No Decision yet on delaying October Jobs Report

by Calculated Risk on 10/29/2012 12:20:00 PM

From the WSJ: Labor Department May Delay Jobs Report

The U.S. Labor Department on Monday said it hasn’t made a decision yet on whether to delay Friday’s October jobs report ... The U.S. Census Bureau also said it hasn’t made a decision on whether to delay economic reports it plans to release this week, including construction spending on Thursday and factory orders on Friday.This is minor compared to other storm related issues, but I'll check up on this. They will probably know any schedule changes by Wednesday. Stay safe.

Update: For anyone interested, the WSJ online is free today.

Dallas Fed: Regional Manufacturing Activity expands slowly in October

by Calculated Risk on 10/29/2012 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Activity Expands but at a Slower Pace

Texas factory activity increased in October, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, dipped from 10 to 7.9, indicating slightly slower growth.This was at expectations of a reading of 2 for the general business activity index. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Most other measures of current manufacturing activity also suggested growth in October, although new orders declined. The capacity utilization index edged up from 9.3 to 11.4, with more than one-quarter of manufacturers noting an increase. The shipments index held steady at 4.7, suggesting shipments rose at about the same pace as in September. The new orders index fell from 5.3 to –4.5, reaching its lowest level this year and indicating a decrease in demand.

Perceptions of general business conditions improved slightly in October. The general business activity index rose to 1.8, registering its first positive reading since June. The company outlook index was positive for the sixth month in a row and remained unchanged at 2.4.

Labor market indicators reflected slow but steady labor demand growth and shrinking workweeks. The employment index was 5.2 in October, largely unchanged from last month but well below the higher levels seen earlier in the year. About 15 percent of firms reported hiring new workers, while 10 percent reported layoffs. The hours worked index fell back into negative territory with a reading of –5.9, down from 2.8 in September.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through October), and five Fed surveys are averaged (blue, through October) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through September (right axis).

The ISM index for October will be released Thursday, Nov 1st, and these surveys suggest another weak reading close to 50.

Personal Income increased 0.4% in September, Spending increased 0.8%

by Calculated Risk on 10/29/2012 08:30:00 AM

The BEA released the Personal Income and Outlays report for September:

Personal income increased $48.1 billion, or 0.4 percent ... in September, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $87.9 billion, or 0.8 percent.The following graph shows real Personal Consumption Expenditures (PCE) through September (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.4 percent in September, compared with an increase of 0.1 percent in August. ... The price index for PCE increased 0.4 percent in September, the same increase as in August. The PCE price index, excluding food and energy, increased 0.1 percent in September, the same increase as in August.

...

Personal saving -- DPI less personal outlays -- was $395.0 billion in September, compared with $445.1 billion in August. The personal saving rate -- personal saving as a percentage of disposable personal income -- was 3.3 percent in September, compared with 3.7 percent in August.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE. The September pickup in PCE is clear.

A key point is the PCE price index has only increased 1.7% over the last year, and core PCE is up only 1.7%. In August, core PCE increased at a 1.4% annualized rate.

Sunday, October 28, 2012

Monday: Personal Income and Spending, Senior Loan Officer Survey

by Calculated Risk on 10/28/2012 09:50:00 PM

UPDATE: US Markets closed on Monday. From NBC abd Reuters: NYSE and Nasdaq to close on Monday due to Hurricane Sandy

U.S. stock trading will be closed on Monday and possibly Tuesday in response to Hurricane Sandy, NYSE Euronext said late on Sunday.To all in the path of Sandy: Stay safe and dry!

NYSE Euronext, which runs the New York Stock Exchange, had previously said that electronic trading would remain open and that only the exchange's trading floor would close.

In a statement, the company said that "the dangerous conditions developing as a result of Hurricane Sandy will make it extremely difficult to ensure the safety of our people and communities, and safety must be our first priority."

Nasdaq said it would also close all U.S. equity and derivatives exchanges, as well as the Nasdaq/FINRA TRF on Monday, CNBC reported late Sunday night. It is likley the markets will also be closed on Tuesday, according to the statement from the exchange.

Monday:

• At 8:30 AM ET, the Personal Income and Outlays report for September is expected to be released. The consensus is for a 0.4% increase in personal income in September, and for 0.6% increase in personal spending. And for the Core PCE price index to increase 1.7% year-over-year.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for October. The consensus is for a reading of 2, up from -0.9 last month. This is the last of the regional survey for October.

• At 2:00 PM, The Federal Reserve is expect to release the October 2012 Senior Loan Officer Opinion Survey on Bank Lending Practices.

• Expected: the National Multi Housing Council (NMHC) Quarterly Apartment Survey. This is a key survey for apartment vacancy rates and rents.

The Asian markets are mixed tonight, with the Nikkei up 0.3%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 2 and DOW futures are down 10.

Oil prices are down recently with WTI futures at $86.28 per barrel and Brent down to $110.12 per barrel.

Weekend:

• Summary for Week Ending Oct 26th

• Schedule for Week of Oct 28th

Three more questions this week for the October economic prediction contest and four question for the November contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Sandy: D.C. Government Offices closed to Public, NYSE Trading Floor Closed

by Calculated Risk on 10/28/2012 06:15:00 PM

Stay safe! Here is the National Hurricane Center website.

From the U.S. Office of Personnel Management: Monday, October 29, 2012, FEDERAL OFFICES in the Washington, DC, area are CLOSED TO THE PUBLIC.

From the NY Times: N.Y.S.E. Plans to Close Its Trading Floor

The New York Stock Exchange plans to close its trading floor on Monday as Hurricane Sandy approaches, in its first weather-related closure in 27 years. Trading operations will be conducted through its electronic market instead.I think the economic releases scheduled for Monday will still be released (Personal Income and Spending, Senior Loan Officer Survey), but there could be delays.

...

Clients should not notice any differences in the way their orders are executed, Duncan L. Niederauer, the chief executive of NYSE Euronext, said by telephone on Sunday.

Yesterday:

• Summary for Week Ending Oct 26th

• Schedule for Week of Oct 28th

The S&P 500 change following Presidential Elections

by Calculated Risk on 10/28/2012 01:45:00 PM

For fun on a Sunday: I've been asked frequently how investors will react to the election. First, every election is different. Sometimes it is obvious who is going to win, and the election results are completely expected (like Reagan in 2004 or Clinton in 1996). Other times the election is close (this election is close although I expect President Obama to be reelected).

Sometimes the economy is clearly headed into recession like in 2008. The 2000 election was during the ongoing decline following the stock bubble, and the election was especially unsettling because the Supreme Court made the final decision.

There are always some partisan analysts who predict doom if their candidate doesn't win (see Bruce Bartlett's Partisan Bias and Economic Forecasts). But any "doom" related to the election will be in the intermediate or long term, not in 2013.

The following graph shows the change in the S&P 500 from election day through the end of the year for all elections since 1952. Note: The number of trading days varied mostly because of the timing of the election.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The two worst performing years - no surprise - were 2000 and 2008. The 2000 election followed the stock market bubble, and the economy was collapsing in 2008.

The other elections with a slight negative change were 1956, 1964, and 1984. These were all presidents being reelected and the results were obvious in advance: Eisenhower won reelection with 57.4% of the vote, Johnson won with 61.1%, and Reagan with 58.8%.

But most of the time the market has increased following the election, and the median increase from election day to the end of the year was 3.6%. Every election is different and this is NOT investment advice!

Some "Principal Relief" on Fannie Mae and Freddie Mac Loans

by Calculated Risk on 10/28/2012 09:44:00 AM

From Kathleen Pender at the San Francisco Chronicle: Principal relief for stressed homeowners

A limited number of underwater homeowners in California will soon be able to get principal reductions of up to $100,000 apiece on Fannie Mae and Freddie Mac loans through the federally funded Keep Your Home California program.This is a fairly small program, but this will provide some principal relief for a few borrowers.

...

... in mid-September, Fannie and Freddie told servicers they could immediately begin accepting money for principal reductions from programs financed by the U.S. Treasury's Hardest Hit Fund, including Keep Your Home California.

Fannie's and Freddie's willingness to accept money from Hardest Hit Funds does not signal a change of heart on the part of their regulator, the Federal Housing Finance Agency. ... Fannie Mae spokesman Andrew Wilson says, "This in fact for us is not a principal reduction. It's a principal payment. It's as if your grandmother wanted to give you $50,000 to apply to your mortgage. In this case, the grandmother, as it were, was the Hardest Hit Fund."

...

The fund was set up in 2010 to provide $17 billion in homeowner assistance to 18 states hardest hit by the housing crisis. ... The California Housing Finance Agency set up four programs under the Keep Your Home name to distribute California's share - $1.9 billion. It allocated $772 million to principal reduction ...

...

To qualify for principal reduction in California, homeowners must live in the home, owe more than it is worth, be of low-to-moderate income, and be delinquent or have some hardship that puts them in imminent risk of default.

...

To date, 2,511 homeowners have received principal reductions totaling $185.6 million - or roughly $74,000 apiece.

Earlier:

• Summary for Week Ending Oct 26th

• Schedule for Week of Oct 28th

Saturday, October 27, 2012

Schedule for Week of Oct 28th

by Calculated Risk on 10/27/2012 03:55:00 PM

Earlier:

• Summary for Week Ending Oct 26th

The key report this week is the October employment report to be released on Friday. Other key reports include the August Case-Shiller house price index on Tuesday, October auto sales on Thursday, and the October ISM manufacturing index, also on Thursday.

There are two interesting surveys that will be released on Monday; the Fed's Senior Loan Officer Survey that might show some slight increase in loan demand or loosening of lending standards, and the NMHC apartment survey that tends to lead other indicators of changes in the apartment market.

10:30 AM: Dallas Fed Manufacturing Survey for October. This is the last of the regional survey for October.

2:00 PM: The October 2012 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

Expected: National Multi Housing Council (NMHC) Quarterly Apartment Survey. This is a key survey for apartment vacancy rates and rents.

9:00 AM: S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August.

9:00 AM: S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through May 2012 (the Composite 20 was started in January 2000).

The consensus is for a 2.1% year-over-year increase in the Composite 20 prices (NSA) for August. The Zillow forecast is for the Composite 20 to increase 1.7% year-over-year, and for prices to increase 0.2% month-to-month seasonally adjusted. The CoreLogic index increased 0.2% in August (NSA).

10:00 AM: Conference Board's consumer confidence index for October. The consensus is for an increase to 72.0 from 70.3 last month.

10:00 AM: Q3 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, based on the initial evaluation, it appears the vacancy rates are too high. The Census Bureau is looking into the differences between the HVS, the ACS, and the decennial Census, and until the issues are resolved, this survey probably shouldn't be used to estimate the excess vacant housing supply.

9:45 AM: Chicago Purchasing Managers Index for October. The consensus is for an increase to 51.7, up from 49.7 in September.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 365 thousand from 369 thousand.

8:30 AM: Productivity and Costs for Q3. The consensus is for a 1.3% increase in unit labor costs.

10:00 AM ET: ISM Manufacturing Index for October.

10:00 AM ET: ISM Manufacturing Index for October. Here is a long term graph of the ISM manufacturing index. The ISM index indicated expansion in September, after three consecutive months of contraction. The consensus is for a decrease to 51.0, up from 51.5 in September. (above 50 is expansion).

10:00 AM: Construction Spending for September. The consensus is for a 0.7% increase in construction spending.

All day: Light vehicle sales for October. The consensus is for light vehicle sales to increase to 15.0 million SAAR in October (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the September sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the September sales rate. TrueCar is forecasting:

The October 2012 forecast translates into a Seasonally Adjusted Annualized Rate (“SAAR”) of 14.9 million new car sales, up from 13.3 million in October 2011 and down from 14.94 million in September 2012Edmunds.com is forecasting:

Edmunds.com ... forecasts that 1,132,878 new cars will be sold in October for an estimated Seasonally Adjusted Annual Rate (SAAR) this month of 14.8 million light vehicles.

8:30 AM: Employment Report for October. The consensus is for an increase of 120,000 non-farm payroll jobs in October; there were 114,000 jobs added in September.

8:30 AM: Employment Report for October. The consensus is for an increase of 120,000 non-farm payroll jobs in October; there were 114,000 jobs added in September.The consensus is for the unemployment rate to increase to 7.9% in October, up from 7.8% in September.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through September.

The economy has added 5.2 million private sector jobs since employment bottomed in February 2010 including preliminary benchmark revision (4.6 million total jobs added including all the public sector layoffs).

The economy has added 5.2 million private sector jobs since employment bottomed in February 2010 including preliminary benchmark revision (4.6 million total jobs added including all the public sector layoffs).There are still 3.7 million fewer private sector jobs now than when the recession started in 2007 (including benchmark revision).

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for September. The consensus is for a 4.0% decrease in orders.

Unofficial Problem Bank list declines to 864 Institutions

by Calculated Risk on 10/27/2012 01:11:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 26, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

The FDIC released its actions through September 2012 and closed a bank this week. There were five removals and four additions leaving the Unofficial Problem Bank List with 864 institutions with assets of $330.4 billion. A year ago, the list had 985 institutions with assets of $406.6 billion. For the month, changes included 11 action terminations, four failures, one unassisted merger, and six additions. Overall, it was a quiet month as it was the fewest action terminations since February 2012 and the fewest additions since the publication of the list.CR Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

Actions were terminated against Metro Bank, Lemoyne, PA ($2.4 billion Ticker: METR); Heritage Bank of Central Illinois, Trivoli, IL ($308 million); Minnwest Bank South, Tracy, MN ($213 million); and Freedom Bank, Sterling, IL ($76 million). The failure was Nova Bank, Berwyn, PA ($483 million), which the FDIC could not find a buyer for.

The additions were First State Financial, Inc., Pineville, KY ($395 million); Golden Eagle Community Bank, Woodstock, IL ($152 million); Signature Bank of Georgia, Sandy Springs, GA ($136 million); and Talbot State Bank, Woodland, GA ($72 million). Who would have guessed there are still some unidentified problem banks in Georgia.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now, with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Earlier:

• Summary for Week Ending Oct 26th

Summary for Week Ending Oct 26th

by Calculated Risk on 10/27/2012 08:09:00 AM

There was some disappointing data last week - mostly from some regional manufacturing surveys, but also mortgage delinquencies increased - but overall this was the fourth week in a row with somewhat better than expected data, and this suggests a little pickup in economic activity.

Once again housing beat expectations. New home sales increased to 389,000, a pace well above the 306,000 sales in 2011, and the highest level since the tax credit related spike in April 2010. Q3 GDP was weak, but slightly above expectations - and residential investment was a fairly strong contributor to growth.

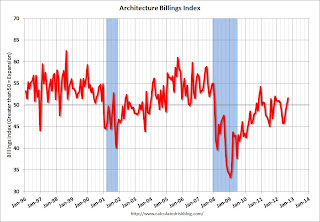

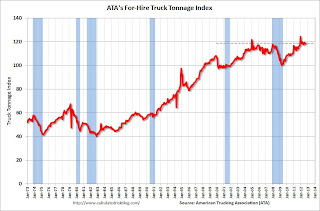

The Architecture Billings Index is now showing expansion (an indicator for commercial real estate including apartments). And the trucking index increased in September (although this index has been moving sideways this year).

On the downside, the Richmond and Kansas City Fed manufacturing surveys were weak and indicated contraction in October. The recent trend is continuing: housing is improving, but manufacturing is struggling.

Here is a summary of last week in graphs:

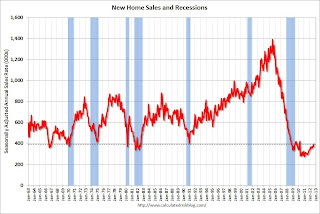

• New Home Sales at 389,000 SAAR in September

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The Census Bureau reported New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 389 thousand. This was up from a revised 368 thousand SAAR in August (revised down from 373 thousand). This is the highest level since April 2010 (tax credit related bounce).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Starting in 1973 the Census Bureau broke inventory down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale was at a record low 38,000 units in September. The combined total of completed and under construction is just above the record low since "under construction" is starting to increase.

Even though sales are still very low, new home sales have clearly bottomed. New home sales have averaged 364 thousand SAAR over the first 9 months of 2012, after averaging under 300 thousand for the previous 18 months. Sales are finally above the lows for previous recessions too.

This was slightly above expectations of 385,000, and was another fairly solid report. This indicates an ongoing recovery in residential investment.

• Real GDP increased 2.0% annual rate in Q3

This graph shows the quarterly real GDP growth (at an annual rate) for the last 30 years.

This graph shows the quarterly real GDP growth (at an annual rate) for the last 30 years.The Red column (and dashed line) is the advance estimate for Q3 GDP.

The Q3 GDP report was weak, with 2.0% annualized real GDP growth, but slightly better than expected. Final demand increased in Q3 as personal consumption expenditures increased at a 2.0% annual rate (up from 1.5% in Q2), and residential investment increased at a 14.4% annual rate (up from 8.5% in Q2).

Investment in equipment and software was flat in Q3, and investment in non-residential structures was negative. However, it appears the drag from state and local governments will end soon (after declining for 3 years).

The next graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 6 quarters (through Q3 2012).

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 6 quarters (through Q3 2012).However the drag from state and local governments is ongoing, although the drag in Q3 was very small. State and local governments have been a drag on GDP for twelve consecutive quarters. Although not as large a negative as the worst of the housing bust (and much smaller spillover effects), this decline has been relentless and unprecedented. The good news is the drag appears to be ending.

In real terms, state and local government spending is now back to 2001 levels, even with a larger population.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units. Last year the increase in RI was mostly from multifamily and home improvement investment. Now the increase is from most categories including single family. I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The key story is that residential investment is continuing to increase, and I expect this to continue (although the recovery in RI will be sluggish compared to previous recoveries). Since RI is the best leading indicator for the economy, this suggests no recession this year or in 2013 (with the usual caveats about Europe and policy errors in the US).

• AIA: Architecture Billings Index increased in September

This graph shows the Architecture Billings Index since 1996. The index was at 51.6 in September, up from 50.2 in August. Anything above 50 indicates expansion in demand for architects' services.

This graph shows the Architecture Billings Index since 1996. The index was at 51.6 in September, up from 50.2 in August. Anything above 50 indicates expansion in demand for architects' services.This increase is mostly being driven by demand for design of multi-family residential buildings - and this suggests there are more apartments coming (there are already quite a few apartments under construction). Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests increase in CRE investment next year (it will be some time before investment in offices and malls increases).

• ATA Trucking Index increased in September

From ATA: ATA Truck Tonnage Index Rose 0.4% in September

From ATA: ATA Truck Tonnage Index Rose 0.4% in SeptemberNote: ATA Chief Economist Bob Costello says, for trucking, the pickup in housing is offsetting the "flattening in manufacturing output".

Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. The index is above the pre-recession level and up 2.4% year-over-year - but has been mostly moving sideways in 2012.

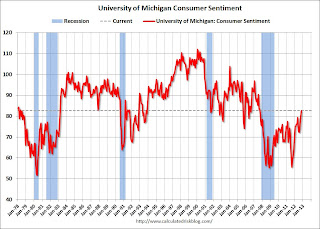

• Final October Consumer Sentiment at 82.6

The final Reuters / University of Michigan consumer sentiment index for October declined to 82.6 from the preliminary reading of 83.1, and was up from the September reading of 78.3.

The final Reuters / University of Michigan consumer sentiment index for October declined to 82.6 from the preliminary reading of 83.1, and was up from the September reading of 78.3.This was slightly below the consensus forecast of 83.1. Overall sentiment is still weak - probably due to a combination of the high unemployment rate and the sluggish economy - but consumer sentiment has been improving.

Friday, October 26, 2012

Report: Bailout Costs for Fannie and Freddie expected to decline

by Calculated Risk on 10/26/2012 10:50:00 PM

From Nick Timiraos at the WSJ: Cost of Bailing Out Fannie and Freddie Expected to Fall Sharply

Fannie Mae and Freddie Mac are expected to begin repaying taxpayers for their bailout faster than initially projected, in part because of an improving housing market.Here is the report from the FHFA: FHFA Updates Projections of Potential Draws for Fannie Mae and Freddie Mac.

The Federal Housing Finance Agency, the companies' federal regulator, released a report on Friday that estimated they will pay between $32 billion and $78 billion to the U.S. Treasury through 2015. The baseline forecast assumes that the companies would end up costing taxpayers $76 billion by the end of 2015, down from the current tab of $142 billion.

...

The regulator's latest forecasts show that Freddie Mac won't require additional government support, even under a "worst case" scenario that envisions further home-price declines. Fannie might need government aid this year to pay the 10% dividend but would only need additional aid in subsequent years if home prices were to fall sharply.

Bank Failure #47: NOVA Bank, Berwyn, Pennsylvania

by Calculated Risk on 10/26/2012 06:08:00 PM

Ahora supernova

Abandonado

by Soylent Green is People

From the FDIC: FDIC Approves the Payout of the Insured Deposits of NOVA Bank, Berwyn, Pennsylvania

The FDIC was unable to find another financial institution to take over the banking operations of NOVA Bank. The FDIC will mail checks directly to depositors of NOVA Bank for the amount of their insured money.No one wanted this one.

...

As of June 30, 2012, NOVA Bank had approximately $483.0 million in total assets and $432.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $91.2 million. NOVA Bank is the 47th FDIC-insured institution to fail in the nation this year, and the second in Pennsylvania.

Zillow forecasts Case-Shiller House Price index to show 1.7% Year-over-year increase for August

by Calculated Risk on 10/26/2012 03:32:00 PM

Note: The Case-Shiller report to be released next Tuesday is for August (really an average of prices in June, July and August).

Zillow Forecast: August Case-Shiller Composite-20 Expected to Show 1.7% Increase from One Year Ago

On Tuesday Oct. 30, the Case-Shiller Composite Home Price Indices for August will be released. Zillow predicts that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) will be up by 1.7 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) will be up 1.2 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from July to August will be 0.2 percent for the 20-City Composite and 0.3 percent for the 10-City Composite Home Price Index (SA). All forecasts are shown in the table below and are based on a model incorporating the previous data points of the Case-Shiller series, the August Zillow Home Value Index data and national foreclosure re-sales.Zillow's forecasts for Case-Shiller have been pretty close.

As the housing market recovery continues, home prices are expected to modestly appreciate, with growth rates being below “normal” pre-housing recession levels. Zillow’s Home Value Index for September was released on Monday night and shows the largest quarterly appreciation since March 2006, showing that the market is regaining some of its strength. National home values are up 3.2 percent from year-ago levels and have now seen four consecutive quarters of appreciation. While the national housing market is showing consistent signs of improvement, the recovery is uneven across the country. Some markets, such as Phoenix, Riverside and Miami are doing exceptionally well, while St. Louis and Atlanta are still faltering. Part of the strong home value appreciation we are seeing is driven by acute inventory shortages in many markets with foreclosures and foreclosure re-sales down and many people still locked up in negative equity, limiting overall supply. In these last months of 2012, Case-Shiller indices are expected to moderate and likely report monthly declines toward the end of the year tracking the Zillow Home Value Index. Monthly depreciation toward the end of the year is largely a function of declining overall monthly sales volume, which will increase the percentage of foreclosure re-sales in the transactional mix being tracked by Case-Shiller.

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

|---|---|---|---|---|---|

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | August 2011 | 156.51 | 153.49 | 142.97 | 140.11 |

| Case-Shiller (last month) | July 2012 | 157.3 | 154.85 | 144.61 | 142.1 |

| Zillow June Forecast | YoY | 1.2% | 1.2% | 1.7% | 1.7% |

| MoM | 0.7% | 0.3% | 0.5% | 0.2% | |

| Zillow Forecasts1 | 158.4 | 155.3 | 145.4 | 142.4 | |

| Current Post Bubble Low | 146.52 | 149.19 | 134.10 | 136.45 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 8.1% | 4.1% | 8.4% | 4.4% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

LPS: House Price Index increased 0.2% in August

by Calculated Risk on 10/26/2012 02:20:00 PM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, LPS, Zillow, FNC and more). The timing of different house prices indexes can be a little confusing. LPS uses August closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From LPS: U.S. Home Prices Up 0.2 Percent for the Month; Up 2.6 Percent Year-Over-Year

Lender Processing Services ... today released its latest LPS Home Price Index (HPI) report, based on August 2012 residential real estate transactions. The LPS HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 15,500 U.S. ZIP codes. The LPS HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The LPS HPI is off 23.0% from the peak in June 2006.

In May, the LPS HPI was up 0.4% year-over-year, in June, the index was up 0.9% year-over-year, and 1.8% in July, and now 2.6% in August. This is steady improvement on a year-over-year basis. Note: Case-Shiller for August will be released this coming Tuesday.

Comments on Q3 GDP and Investment

by Calculated Risk on 10/26/2012 12:15:00 PM

The Q3 GDP report was weak, with 2.0% annualized real GDP growth, but slightly better than expected. Final demand increased in Q3 as personal consumption expenditures increased at a 2.0% annual rate (up from 1.5% in Q2), and residential investment increased at a 14.4% annual rate (up from 8.5% in Q2).

Investment in equipment and software was flat in Q3, and investment in non-residential structures was negative. However, it appears the drag from state and local governments will end soon (after declining for 3 years).

Overall this was another weak report indicating sluggish growth.

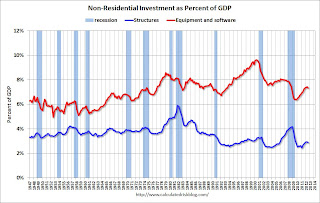

The following graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter centered average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.

Residential Investment (RI) made a positive contribution to GDP in Q3 for the sixth consecutive quarter. Usually residential investment leads the economy, but that didn't happen this time because of the huge overhang of existing inventory, but now RI is contributing. The good news: Residential investment has clearly bottomed.

The contribution from RI will probably continue to be sluggish compared to previous recoveries, but the ongoing positive contribution to GDP is a significant story.

Equipment and software investment was unchanged in Q3 (compared to Q2). This followed twelve consecutive quarters with a positive contribution.

The contribution from nonresidential investment in structures was negative in Q3. Nonresidential investment in structures typically lags the recovery, however investment in energy and power has masked the ongoing weakness in office, mall and hotel investment (the underlying details will be released next week).

The second graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 6 quarters (through Q3 2012).

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 6 quarters (through Q3 2012).

However the drag from state and local governments is ongoing, although the drag in Q3 was very small. State and local governments have been a drag on GDP for twelve consecutive quarters. Although not as large a negative as the worst of the housing bust (and much smaller spillover effects), this decline has been relentless and unprecedented. The good news is the drag appears to be ending.

In real terms, state and local government spending is now back to 2001 levels, even with a larger population.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units.

Last year the increase in RI was mostly from multifamily and home improvement investment. Now the increase is from most categories including single family. I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The last graph shows non-residential investment in structures and equipment and software.

The last graph shows non-residential investment in structures and equipment and software.

I'll add details for investment in offices, malls and hotels next week.

The key story is that residential investment is continuing to increase, and I expect this to continue (although the recovery in RI will be sluggish compared to previous recoveries). Since RI is the best leading indicator for the economy, this suggests no recession this year or in 2013 (with the usual caveats about Europe and policy errors in the US).

Earlier with revision graphs:

• Real GDP increased 2.0% annual rate in Q3