by Calculated Risk on 10/26/2012 09:55:00 AM

Friday, October 26, 2012

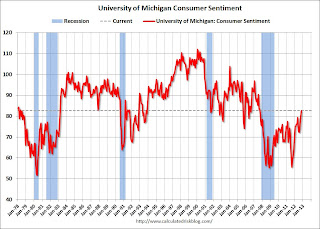

Final October Consumer Sentiment at 82.6

Note: I'll have much more on GDP soon.

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for October declined to 82.6 from the preliminary reading of 83.1, and was up from the September reading of 78.3.

This was slightly below the consensus forecast of 83.1. Overall sentiment is still weak - probably due to a combination of the high unemployment rate and the sluggish economy - but consumer sentiment has been improving.

Real GDP increased 2.0% annual rate in Q3

by Calculated Risk on 10/26/2012 08:38:00 AM

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.0 percent in the third quarter of 2012 (that is, from the second quarter to the third quarter), according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 1.3 percent.

The increase in real GDP in the third quarter primarily reflected positive contributions from personal consumption expenditures (PCE), federal government spending, and residential fixed investment that were partly offset by negative contributions from exports, nonresidential fixed investment, and private inventory investment. Imports, which are a subtraction in the calculation of GDP, decreased.

The acceleration in real GDP in the third quarter primarily reflected an upturn in federal government spending, a downturn in imports, an acceleration in PCE, a smaller decrease in private inventory investment, an acceleration in residential fixed investment, and a smaller decrease in state and local government spending that were partly offset by downturns in exports and in nonresidential fixed investment.

Click on graph for larger image.

Click on graph for larger image.This graph shows the quarterly real GDP growth (at an annual rate) for the last 30 years.

The Red column (and dashed line) is the advance estimate for Q3 GDP.

A few comments:

• Consumer spending picked up a little. Real personal consumption expenditures increased 2.0 percent in the third quarter, compared with an increase of 1.5 percent in the second.

• Residential investment increased. Real residential fixed investment increased 14.4 percent, compared with an increase of 8.5 percent.

• State and local government made a negative contribution to GDP for the twelfth straight quarter, but the negative contribution was very minor.

This was slightly above expectations. I'll have more on GDP later ...

Thursday, October 25, 2012

Friday: Q3 GDP

by Calculated Risk on 10/25/2012 09:06:00 PM

Expectations for Q3 GDP are pretty low ... and moving lower. From the WSJ: GDP Estimates Move Lower Following Durables Report

The consensus estimate of economists surveyed by Dow Jones Newswires is that Friday’s report will show the economy grew at a seasonally adjusted annual rate of 1.8% in the July-to-September quarter. But after Thursday’s figures on business investment, some economists said they are bracing for a weaker GDP report than the consensus figure.Friday:

Wells Fargo — pointing out that shipments of core capital goods fell at an annual pace of 4.9% over three months — lowered its estimate of third-quarter GDP growth to an annual rate of 1.4% from 1.6%. J.P. Morgan Chase lowered its forecast to 1.6% from 1.8%.

“The downside risks are mounting to our already below-consensus estimate that GDP increased by only 1.3% in the third quarter,” Paul Ashworth, chief U.S. economist at London-based Capital Economics, said in a note to clients. “At 1.8%, the consensus forecast looks way to high.”

• At 8:30 AM ET, the advance release for Q3 GDP will be released by the BEA. The consensus is that real GDP increased 1.9% annualized in Q3.

• At 9:55 AM, the Reuters/University of Michigan's Consumer sentiment index (final for October). The consensus is for no change from the preliminary reading of 83.1.

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Lawler: Home Builders: On Balance, Strong Results

by Calculated Risk on 10/25/2012 04:17:00 PM

From economist Tom Lawler:

Several publicly-traded home builders posted results for the quarter ended September 30th this week, and the general theme was strong net orders, slightly lower cancellation rates, higher margins/lower concessions, and higher home sales prices. Below are some summary stats.

Average sales prices, of course, don’t necessarily reflect gains in “constant-quality” homes, but are affected by changes in the type of homes sold and the regional mix of homes sold. Nevertheless, most home builders appear to be selling homes at “effective” prices well above a year ago.

The combined order backlog of the five builders on September 30th, 2012 was 17,907, up 42.2% from last September.

| New Orders | Settlements | |||||

|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/30/2012 | 9/30/2011 | % Chg | 9/30/2012 | 9/30/2011 | % Chg |

| PulteGroup | 4,544 | 3,564 | 27.5% | 4,418 | 4,198 | 5.2% |

| NVR | 2,558 | 2,218 | 15.3% | 2,656 | 2,255 | 17.8% |

| The Ryland Group | 1,507 | 1,008 | 49.5% | 1,322 | 1,015 | 30.2% |

| Meritage Homes | 1,204 | 906 | 32.9% | 1,197 | 840 | 42.5% |

| M/I Homes | 757 | 587 | 29.0% | 746 | 582 | 28.2% |

| Total | 10,570 | 8,283 | 27.6% | 10,339 | 8,890 | 16.3% |

| Average Closing Price | |||

|---|---|---|---|

| Qtr. Ended: | 9/30/2012 | 9/30/2011 | % Chg |

| PulteGroup | $279,000 | $262,000 | 6.5% |

| NVR | $321,700 | $308,900 | 4.1% |

| The Ryland Group | $264,000 | $249,000 | 6.0% |

| Meritage Homes | $280,000 | $259,000 | 8.1% |

| M/I Homes | $266,000 | $238,000 | 11.8% |

| Total | $287,229 | $270,558 | 6.2% |

Housing: What Numbers Matter (Part 2)

by Calculated Risk on 10/25/2012 02:28:00 PM

Apparently some people think if existing home sales go flat, or even decline, the housing recovery is in trouble ... or something ...

From Diana Olick at CNBC: Why Today's Housing Report Spooked Investors So Much

[T]he National Association of Realtors reported no change in signed contracts to buy existing homes in September. ...The number of existing home sales is just part of the story.

It wasn't so much the slight disappointment in the monthly index, it was more the comment from the Realtors' chief economist Lawrence Yun:

"This means only minor movement is likely in near-term existing-home sales, but with positive underlying market fundamentals they should continue on an uptrend in 2013.”

Not exactly a rave.

We know we're coming off the bottom of the housing crash, but over the summer it felt to some like we were rocketing off the bottom. Now, not so much.

...

Existing home sales are coming off lows from last year, but last year was the hangover from the 2010 home buyer tax credit ...

"The year-over-year gain was the smallest of the year and comps against last year when the housing market was in a full blown double-dip mode," notes analyst Mark Hanson.

Let me repeat what I wrote earlier this year: Home Sales Reports: What Matters: "When we look at sales for existing homes, the focus should be on the composition between conventional and distressed. Total sales are probably close to the normal level of turnover, but the composition of sales is far from normal - sales are still heavily distressed sales. Over time, existing home sales will probably settle around 5 million per year, but the percentage of distressed sales will eventually decline. Those looking at the number of existing home sales for a recovery in housing are looking at the wrong number. Look at inventory and the percent of conventional sales."

Unfortunately I have little confidence in the NAR's estimate of conventional sales, but most local data shows a fairly strong increase in conventional sales (as opposed to short sales and foreclosures). As an example, the percent of conventional sales in Phoenix increased from 35.9% in September 2011 to 60.1% in September 2012. Now overall sales were down sharply - the Arizona Regional MLS reported sales in September were down 17.9% from September 2011, but conventional sales were up 37%. I think this is a positive.

Of course the key housing numbers for the economy and jobs are housing starts and new home sales. Also house prices matter too. But the housing report this morning (pending home sales) was mostly irrelevant.

Misc: Pending Home Sales index increases slightly, KC Mfg Index contracts, Remodeling increases

by Calculated Risk on 10/25/2012 11:00:00 AM

A few miscellaneous releases:

• From the NAR: September Pending Home Sales Show Slight Improvement

The Pending Home Sales Index, a forward-looking indicator based on contract signings, edged up 0.3 percent to 99.5 in September from 99.2 in August and is 14.5 percent above September 2011 when it was 86.9. The data reflect contracts but not closings.Contract signings usually lead sales by about 45 to 60 days, so this is for sales in October and November.

• From the Kansas City Fed: Tenth District Manufacturing Activity Declined Slightly

Tenth District manufacturing activity declined slightly in October, and producers’ expectations for future activity fell considerably but remained slightly positive. Several producers commented on growing uncertainty related to the upcoming election and fiscal situation, which has put a hold on many customers’ orders and spending. Price indexes were mixed, with minimal changes overall.Another weak regional manufacturing survey.

The month-over-month composite index was -4 in October, down from 2 in September and 8 in August, and the lowest in over three years ... The employment index moved into negative territory for the first time this year, while the shipments index inched higher but still remained negative.

“We saw factories pull back this month for the first time in quite a while, which many firms attributed to the impact of the uncertain political and fiscal situation on customers’ willingness to order” said [Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City]. “Expectations also weakened considerably for production and employment but, encouragingly, factories’ capital spending plans for early next year remained largely intact.”

• From the NAHB: Remodeling Market Index Climbs Five Points, Returns to 2005 Levels

The Remodeling Market Index (RMI) climbed to 50 in the third quarter of 2012, up from 45 in the previous quarter, according to the National Association of Home Builders (NAHB). Released today, the RMI is at its highest point since the third quarter of 2005, tracking the positive trends recently seen in the rest of the housing sector.

...

“The improvement in the RMI provides more evidence that the remodeling industry is making the orderly recovery from its low point in 2009 as we’ve been expecting,” said NAHB Chief Economist David Crowe. “Although remodeling projects over $25,000 are now showing some signs of strength, they are still lagging behind smaller property alterations and maintenance and repair jobs."

Chicago Fed: Economic Activity Improved in September

by Calculated Risk on 10/25/2012 09:58:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Activity improved in September

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to 0.00 in September from –1.17 in August. All four broad categories of indicators that make up the index increased from August, and each one except the consumption and housing category made a positive contribution to the index in September.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased from –0.53 in August to –0.37 in September—its seventh consecutive reading below zero. September’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity improved, but growth was still below trend in September.

According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Weekly Initial Unemployment Claims decline to 369,000

by Calculated Risk on 10/25/2012 08:30:00 AM

The DOL reports:

In the week ending October 20, the advance figure for seasonally adjusted initial claims was 369,000, a decrease of 23,000 from the previous week's revised figure of 392,000. The 4-week moving average was 368,000, an increase of 1,500 from the previous week's revised average of 366,500.The previous week was revised up from 388,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 368,000. This is 5,000 above the cycle low for the 4-week average of 363,000 in March.

Weekly claims were lower than the consensus forecast of 372,000.

And here is a long term graph of weekly claims:

Mostly moving sideways this year, but near the cycle bottom. The large swings over the previous two weeks were related to timing and technical factors.

Wednesday, October 24, 2012

Thursday: Unemployment Claims, Durable Goods Orders, Pending Home Sales

by Calculated Risk on 10/24/2012 09:01:00 PM

From the NY Times Dealbook: Federal Prosecutors Sue Bank of America Over Mortgage Program

In a civil complaint that seeks to collect $1 billion from the bank, the Justice Department took aim at a home loan program known as the “hustle,” a venture that has become emblematic of the risk-fueled mortgage bubble.Thursday:

...

Bank of America inherited the “hustle” home loan program with its purchase of Countrywide Financial in 2008. Prosecutors say the effort, kept alive by Bank of America through 2009, was intended to churn out mortgages at a rapid pace without proper checks on wrongdoing. The bank then sold the “defective” loans without warning to Fannie Mae and Freddie Mac, the government-controlled housing giants, which were stuck with heavy losses and a glut of foreclosed properties.

“The fraudulent conduct alleged in today’s complaint was spectacularly brazen in scope,” Preet Bharara, the United States attorney in Manhattan, said in a statement.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 372 thousand from 388 thousand..

• Also at 8:30 AM, the Durable Goods Orders for September will be released by the Census Bureau. The consensus is for a 7.0% decrease in durable goods orders.

• Also at 8:30 AM, the Chicago Fed National Activity Index for September will be released. This is a composite index of other data.

• At 10:00 AM, the NAR will release the Pending Home Sales Index for September. The consensus is for a 2.5% increase in the index.

• At 11:00 AM, the Kansas City Fed regional Manufacturing Survey for October will be released. The consensus is for an a reading of 4, up from 2 in September (above zero is expansion).

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Earlier:

• New Home Sales at 389,000 SAAR in September

• New Home Sales and Distressing Gap

• New Home Sales graphs

Updates to the ADP Employment Report

by Calculated Risk on 10/24/2012 06:50:00 PM

ADP announced some changes to their monthly employment report today (ht Rob). Here is the press release, and here is the website with FAQs, methodology and more:

The newly expanded ADP National Employment Report will be issued each month by the ADP Research InstituteSM, a specialized group within ADP that provides insights around employment trends and workforce strategy. The first enhanced monthly report issued in collaboration with Moody’s Analytics will be released on November 1, and will report private payroll changes for the month of October 2012.Basically ADP/Moody's uses the ADP payroll data and attempts to predict the BLS report of private sector payroll jobs added or lost each month. They use matched pairs (companies that report for both the current month and the previous month), and adjust the data by category to align with the BLS data (final data after revisions). It is a fairly complicated process.

...

This new collaboration allows the ADP National Employment Report to increase the number of industry categories reported and expands the number of business sizes reported each month. Other key enhancements of the report include the development of a new methodology to further align with the final, revised U.S. Bureau of Labor Statistics (BLS) numbers. A look back at historical data from 2001 to present using the new methodology shows a very strong correlation (96%) with the revised BLS numbers. In addition, the overall sample size used to create the report has been increased from 344,000 U.S. companies to 406,000, and from 21 million employees to 23 million; which accounts for more than 20% of all U.S. private sector employees. Originally launched in 2006, the ADP National Employment Report is a derived from actual payroll data from an anonymous subset of ADP’s clients in the U.S.

However the ADP employment report is still a black box and we will not be able to judge the "improvements" for a few years. I think it would be much better for analysts if ADP just reported actual payroll gains or losses by industry (perhaps in percentage terms). That would be a useful and independent measure of the labor market.

The first "enhanced" report will be released next week on Nov 1st.

Earlier:

• New Home Sales at 389,000 SAAR in September

• New Home Sales and Distressing Gap

• New Home Sales graphs