by Calculated Risk on 10/31/2012 04:00:00 PM

Wednesday, October 31, 2012

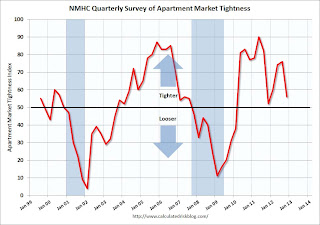

NMHC Apartment Survey: Market Conditions Tighten, Growth Rate Moderates

From the National Multi Housing Council (NMHC): Apartment Market Expansion Continues as Growth Rate Moderates

Apartment markets improved across all areas for the seventh quarter in a row, but the pace of improvement moderated according to the National Multi Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions. The survey’s indexes measuring Market Tightness (56), Sales Volume (51), Equity Financing (56) and Debt Financing (65) all measured at 50 or higher, indicating growth from the previous quarter.

“Even after nearly three years of recovery, apartment markets around the country remain strong as more report tightening conditions than not,” said NMHC Chief Economist Mark Obrinsky. “The dynamic that began in 2010 remains in place: the increase in prospective apartment residents continues to outpace the pickup in new apartments completed. While development activity has picked up considerably since the trough, finance for both acquisition and construction remains constrained, flowing mainly to the best properties in the top markets.”

...

Market Tightness Index declined to 56 from 76. Marking the 11th straight quarter of the index topping 50, the majority (62 percent) reported stable market conditions. One quarter reported tighter markets and 14 percent indicated markets as looser.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. The index has indicated tighter market conditions for the last eleven quarters and suggests falling vacancy rates and or rising rents.

This fits with the recent Reis data showing apartment vacancy rates fell in Q3 2012 to 4.6%, down from 4.7% in Q2 2012, and down from 8.0% at the end of 2009. This was the lowest vacancy rate in the Reis survey in over 10 years.

Even though multifamily starts have been increasing, completions lag starts by about a year - so the builders are still trying to catch up. There will be many more completions in 2012 than in 2011, increasing the supply.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010 - and will probably be useful in indicating when the vacancy rate will stop falling.