by Calculated Risk on 9/15/2012 08:07:00 AM

Saturday, September 15, 2012

Summary for Week Ending Sept 14th

The key event of the week was the FOMC announcement. Here were my posts:

• FOMC Statement: QE3 $40 Billion per Month, Extend Guidance to mid-2015

• FOMC Projections and Bernanke Press Conference

• Analysis: Bernanke Delivered

In other news, retail sales were strong due to higher gasoline prices. From Merrill Lynch:

Gasoline prices surged in the month, forcing consumers to spend more at the pump. Gasoline station sales climbed 5.5%, contributing to the majority of the gain in total sales. Netting out gasoline station sales, spending was only up 0.3%. ...Some of the other data was impacted by hurricane Isaac: Industrial production declined although this was partially due to the impact of Hurricane Isaac and weekly unemployment claims increased - also partially blamed on the hurricane.

Outside of gasoline, autos and building materials, core control sales fell 0.1%. This was a decidedly weak report, showing a pullback in consumer spending. ...

The combination of weak August core retail sales and a downward revision to July and June (0.1pp in each month), slices 0.4pp from our Q3 GDP tracking model. We are now looking for GDP growth of only 1.1% in Q3.

In a little good news, consumer sentiment increased some in September.

Overall this suggests more sluggish growth.

Here is a summary of last week in graphs:

• Retail Sales increased 0.9% in August

Click on graph for larger image.

Click on graph for larger image.On a monthly basis, retail sales were up 0.9% from July to August (seasonally adjusted), and sales were up 4.7% from August 2011. This increase was largely due to higher gasoline prices.

Sales for July were revised down to a 0.6% increase (from 0.8% increase).

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 22.7% from the bottom, and now 7.3% above the pre-recession peak (not inflation adjusted)

This was above the consensus forecast for retail sales of a 0.8% increase in August, and above (edit) the consensus for a 0.7% increase ex-auto.

• Trade Deficit at $42.0 Billion in July

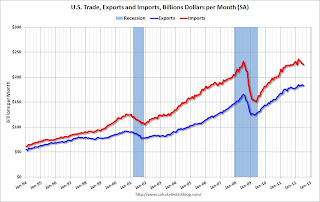

The Department of Commerce reported: "[T]otal July exports of $183.3 billion and imports of $225.3 billion resulted in a goods and services deficit of $42.0 billion, up from $41.9 billion in June, revised. July exports were $1.9 billion less than June exports of $185.2 billion. July imports were $1.8 billion less than June imports of $227.1 billion."

The Department of Commerce reported: "[T]otal July exports of $183.3 billion and imports of $225.3 billion resulted in a goods and services deficit of $42.0 billion, up from $41.9 billion in June, revised. July exports were $1.9 billion less than June exports of $185.2 billion. July imports were $1.8 billion less than June imports of $227.1 billion."The trade deficit was below the consensus forecast of $44.3 billion.

This graph shows the monthly U.S. exports and imports in dollars through July 2012.

Exports are 10% above the pre-recession peak and up 3% compared to July 2011; imports are just below the pre-recession peak, and up about 1% compared to July 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through July.

• Industrial Production declined 1.2% in August, Capacity Utilization decreased

This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).Capacity utilization at 78.2% is still 2.1 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.Industrial production decreased in August to 96.8. This is 16% above the recession low, but still 3.9% below the pre-recession peak.

The consensus was for Industrial Production to decrease 0.1% in August, and for Capacity Utilization to decline to 79.2%. Both IP and Capacity Utilization were below expectations.

• Consumer Sentiment increases in September to 79.2

The preliminary Reuters / University of Michigan consumer sentiment index for September increased to 79.2, up from the August reading of 74.3.

The preliminary Reuters / University of Michigan consumer sentiment index for September increased to 79.2, up from the August reading of 74.3.This was above the consensus forecast of 73.5 but still fairly low. Sentiment remains weak due to the high unemployment rate, sluggish economy and higher gasoline prices.

• Weekly Initial Unemployment Claims increase to 382,000

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 375,000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 375,000.This was above the consensus forecast of 370,000.

Via MarketWatch: "The government said about 9,000 claims stemmed from the storm that passed through the Gulf Coast in late August."

The 4-week average of unemployment claims has mostly moved sideways this year.

• BLS: Job Openings "little changed" in July

The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS. Jobs openings decreased in July to 3.664 million, down from 3.722 million in June. The number of job openings (yellow) has generally been trending up, and openings are up about 9% year-over-year compared to July 2011.

Quits increased slightly in July, and quits are up about 8% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

• Other Economic Stories ...

• Key Measures show slowing inflation in August

• Lawler: Where has the increase in the number of renters of Single Family homes come from?

• CoreLogic: Negative Equity Decreases in Q2 2012

• Lawler: Preliminary Table of Short Sales and Foreclosures for Selected Cities in August