by Calculated Risk on 10/30/2010 12:30:00 PM

Saturday, October 30, 2010

Investment Contribution to GDP: Leading and Lagging Sectors

By request, the following graph is an update to: The Investment Slump in Q2 2009

The following graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, blue.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

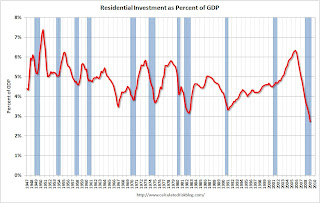

Residential Investment (RI) made a negative contribution to GDP in Q3 2010, and the four quarter rolling average is negative again.

RI was negatively impacted by the slowdown in new home construction, and also because the number of existing home sold fell sharply (real estate commissions are included in RI).

Equipment and software investment has made a significant positive contribution to GDP for five straight quarters (it is coincident).

The contribution from nonresidential investment in structures was slightly positive in Q3. The details will be released next week, but I expect that oil and gas investment made a positive contribution, and hotels, malls and office investment were negative again. As usual nonresidential investment in structures is the last sector to recover.

The key leading sector - residential investment - has lagged this recovery because of the huge overhang of existing inventory. Usually RI is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and this is a key reason why the recovery has been sluggish so far.

Saturday, May 01, 2010

Investment Contributions to GDP: Leading and Lagging Sectors

by Calculated Risk on 5/01/2010 03:57:00 PM

By request, the following graph is an update to: The Investment Slump in Q2 2009

The following graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, blue. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Residential Investment (RI) made a small positive contribution to GDP in the second half of 2009, but was a drag in Q1 2010. The rolling four quarter change is moving up, but as expected there has been no strong boost to GDP from RI.

Equipment and software investment has made a positive contribution to GDP for three straight quarters (it is coincident).

Nonresidential investment in structures continues to be a drag on the economy, and as usual the economy is recovering long before nonresidential investment in structures recovers.

The key leading sector - residential investment - is lagging the recovery because of the huge overhang of existing inventory. Usually RI is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and this is a key reason why the recovery has been sluggish so far.

Monday, February 01, 2010

Q4: Office, Mall and Lodging Investment

by Calculated Risk on 2/01/2010 12:43:00 PM

Here are graphs of office, mall and lodging investment through Q4 2009 based on the underlying detail data released by the BEA ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

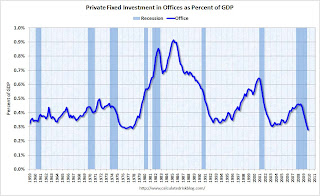

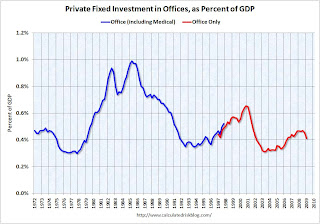

This graph shows investment in offices as a percent of GDP. Office investment as a percent of GDP peaked at 0.46% in Q3 2008 and has declined sharply to a new all time low (as percent of GDP).

Reis reported that the office vacancy rate rose to a 15 year high in Q4 to 17.0%, from 16.5% in Q3 and from 15.9% in Q2. The peak vacancy rate following the 2001 recession was 16.9%. With the office vacancy rate rising, office investment will probably decline through 2010.

Office investment is usually the most overbuilt in a boom, but this time the office market struggled for a few years after the stock market bubble burst and there was comparatively more investment in malls and hotels. The second graph is for investment in malls.

The second graph is for investment in malls.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and has fallen by 50% (note that investment includes remodels, so this will not fall to zero). Mall investment will probably continue to decline through 2010.

Reis reported that the mall vacancy rate in Q4 was the highest on record at 8.8% for regional malls, and 10.6% for strip malls. From Reis economist Ryan Severino:

"Our outlook for retail properties as a whole is bleak ... we do not foresee a recovery in the retail sector until late 2012 at the earliest."

The third graph is for lodging (hotels).

The third graph is for lodging (hotels).The recent boom in lodging investment was stunning. Lodging investment peaked at 0.32% of GDP in Q2 2008 and has declined rapidly to 0.16% in Q4 2009.

I expect lodging investment to continue to decline through at least 2010, to perhaps one-third of the peak or even lower (investment as percent of GDP).

As projects are completed there will be little new investment in these categories probably at least through 2010. This will be a steady drag on GDP (nothing like the decline in residential investment though), and a steady drag on construction employment.

Notice that investment in all three categories typically falls for a year or two after the end of a recession, and then usually recovers very slowly. Something similar will probably happen again, and there will not be a recovery in these categories until the vacancy rates fall significantly.

Friday, July 31, 2009

The Investment Slump in Q2

by Calculated Risk on 7/31/2009 08:53:00 AM

The investment slump continued in Q2 ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Residential investment (RI) has been declining for 14 consecutive quarters, and the decline in Q2 was still very large - a 29.3% annual rate in Q2.

This puts RI as a percent of GDP at 2.4%, by far the lowest level since WWII. The second graph shows non-residential investment as a percent of GDP. All areas of investment are declining.

The second graph shows non-residential investment as a percent of GDP. All areas of investment are declining.

Business investment in equipment and software was off 9.0% (annualized) and has declined for 6 consecutive quarters. Investment in non-residential structures was only off 8.9% (annualized) and will probably fall sharply over the next year or so.

The third graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures. The graph shows the rolling 4 quarters for each investment category.

This is important to follow because residential tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy. Residential investment (red) has been a huge drag on the economy for the last three and a half years. The good news is the drag on GDP will probably end soon. The bad news is any rebound in residential investment will probably be small because of the huge overhang of existing inventory.

Residential investment (red) has been a huge drag on the economy for the last three and a half years. The good news is the drag on GDP will probably end soon. The bad news is any rebound in residential investment will probably be small because of the huge overhang of existing inventory.

As expected, nonresidential investment - both structures (blue), and equipment and software (green) - declined in Q2. If there is a surprise it is how well nonresidential investment in structures held up in Q2 (although we could see this in the construction spending data). This investment will decline sharply soon as many major projects are completed, and few new projects are started.

In previous downturns the economy recovered long before nonresidential investment in structures recovered - and that will probably be true again this time.

As always, residential investment is the most important investment area to follow - and I expect it to turn slightly positive in the second half of 2009.

Thursday, April 30, 2009

Q1: Office, Mall and Lodging Investment

by Calculated Risk on 4/30/2009 09:27:00 AM

Here are some graphs of office, mall and lodging investment through Q1 2009 based on the underlying detail data released this morning by the BEA ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows investment in lodging (based on data from the BEA) as a percent of GDP. The recent boom in lodging investment has been stunning. Lodging investment peaked at 0.33% of GDP in Q3 2008 and is now declining sharply (0.28% in Q1 2009).

I expect lodging investment to continue to decline through at least 2010, to perhaps one-third of the peak.

Note: prior to 1997, the BEA included Lodging in a category with a few other buildings. This earlier data was normalized using 1997 data, and is an approximation. Investment in multimerchandise shopping structures (malls) peaked in Q4 2007 and is continuing to decline. As projects are completed, mall investment should fall much further.

Investment in multimerchandise shopping structures (malls) peaked in Q4 2007 and is continuing to decline. As projects are completed, mall investment should fall much further.

As David Simon, Chief Executive Officer or Simon Property Group, the largest U.S. shopping mall owner said earlier this year:

"The new development business is dead for a decade. Maybe it’s eight years. Maybe it’s not completely dead. Maybe I’m over-dramatizing it for effect."

The third graph shows office investment as a percent of GDP since 1972. Office investment peaked in Q3 2008, and with the office vacancy rate rising sharply, office investment will probably decline at least through 2010.

The third graph shows office investment as a percent of GDP since 1972. Office investment peaked in Q3 2008, and with the office vacancy rate rising sharply, office investment will probably decline at least through 2010.Note: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

The non-residential structures investment bust is here and will continue for some time.

Wednesday, April 29, 2009

The Investment Slump

by Calculated Risk on 4/29/2009 09:13:00 AM

The huge investment slump was the key story in Q1. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Residential investment (RI) has been declining for 13 consecutive quarters, and Q1 2009 was the worst quarter (in percentage terms) of the entire bust. Residential investment declined at a 38% annual rate in Q1.

This puts RI as a percent of GDP at 2.7%, by far the lowest level since WWII. The second graph shows non-residential investment as a percent of GDP. All areas of investment are now cliff diving.

The second graph shows non-residential investment as a percent of GDP. All areas of investment are now cliff diving.

Business investment in equipment and software was off 33.8% (annualized), and investment in non-residential structures was off 44.2% (annualized).

The third graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures. The graph shows the rolling 4 quarters for each investment category.

This is important to follow because residential tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy. Residential investment (red) has been a huge drag on the economy for the last couple of years. The good news is the drag on GDP will probably be getting smaller going forward.

Residential investment (red) has been a huge drag on the economy for the last couple of years. The good news is the drag on GDP will probably be getting smaller going forward.

Even if there is no rebound in residential investment later this year, the drag will be less because there isn't much residential investment left! The bad news is any rebound in residential investment will probably be small because of the huge overhang of existing inventory.

As expected, nonresidential investment - both structures (blue), and equipment and software (green) - fell off a cliff. In previous downturns the economy recovered long before nonresidential investment in structures recovered - and that will probably be true again this time.

As always, residential investment is the most important investment area to follow - it is the best predictor of future economic activity.

Friday, March 27, 2009

Q4: Non-Residential Investment Revised

by Calculated Risk on 3/27/2009 11:04:00 AM

In addition to the Personal Income report this morning, the BEA released the final Q4 private fixed investment supplemental tables.

One of the key areas for downward revisions in the final Q4 GDP report was non-residential investment. These revisions were significant.

I'll use lodging as an example ... this first graph was based on the advanced GDP report: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows investment in lodging as a percent of GDP.

In the advance report, lodging investment was reported at 0.34% of GDP - an all time high.

Note: prior to 1997, the BEA included Lodging in a category with a few other buildings. This earlier data was normalized using 1997 data, and is an approximation. The second graph is based on the final Q4 GDP report.

The second graph is based on the final Q4 GDP report.

Instead of increasing slightly in Q4 - as suggested by the advance report - lodging investment declined at a 15.7% annual rate in Q4.

Office investment declined at a 10.1% annual rate in Q4, and mall investment declined at a 11.3% annual rate.

The turning point for non-residential investment was in Q4. Let the cliff diving begin!

Sunday, March 15, 2009

Domestic Oil Investment to Decline Sharply in 2009

by Calculated Risk on 3/15/2009 12:18:00 PM

Here is another area of domestic non-residential investment that will slump in 2009.

From the NY Times: As Oil and Gas Prices Plunge, Drilling Frenzy Ends

The great American drilling boom is over.The following graph compares real domestic investment in petroleum and natural gas with real gasoline prices.

The number of oil and gas rigs deployed to tap new energy supplies across the country has plunged to less than 1,200 from 2,400 last summer, and energy executives say the drop is accelerating further.

Click on graph for larger image in new window.

Click on graph for larger image in new window.After the oil shock of 1973, oil exploration investment (real dollars) has tracked real gasoline prices pretty closely.

This graph shows oil investment in 2000 dollars. Investment in 2008 was $138 billion in nominal dollars.

The recent rapid decline in gasoline prices suggests investment in petroleum and natural gas exploration and wells could decline by 1/3 or more in 2009 from the $138 billion invested in 2008. This is another area of non-residential structure investment that will decline sharply in 2009 - along with investment in offices, malls and hotels.

Note: Real gasoline prices are annual prior to 1980. The gasoline data is from the EIA.

Friday, February 27, 2009

Investment Contributions to GDP

by Calculated Risk on 2/27/2009 02:00:00 PM

The following graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures. The graph shows the rolling 4 quarters for each investment category.

This is important to follow because residential tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Residential investment (red) has been a huge drag on the economy for the last couple of years. The good news is the drag is getting smaller, and the drag on GDP will be significantly less in 2009, than in 2007 and 2008.

Even if there is no rebound in residential investment later this year, the drag will be less because there isn't much residential investment left! The bad news is any rebound in residential investment will probably be small because of the huge overhang of existing inventory.

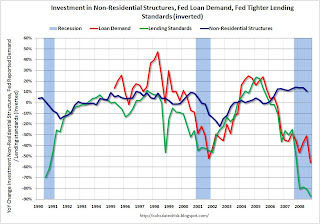

The REALLY bad news is nonresidential investment (blue) is about to fall off a cliff. Nonresidential investment subtracted -0.24% (SAAR) from GDP in Q4, and will decline sharply in 2009 based on the Fed's Senior Loan Officer Survey, the Architecture Billings Index, and many many other reports and stories. In previous downturns the economy recovered long before nonresidential investment - and that will probably be true again this time.

As always, residential investment is the investment area to follow - it is the best predictor of future economic activity.

Monday, February 16, 2009

Report: Hotel Recession Reaches 15 months

by Calculated Risk on 2/16/2009 04:40:00 PM

From Smith Travel Research (STR): Hotel industry recession reaches 15 months

The Hotel Industry’s Pulse index declined 1.9-percent in January to bring the index to a reading of 90.8, according to a report from economic research firm e-forecasting.com in conjunction with Smith Travel Research.

The index measures the likelihood of a recession for the U.S. hotel industry. It was set to equal 100 in 2000. January’s 1.9-percent decline followed a drop of 1.2 percent in December.

HIP’s six-month growth rate, which historically has signaled turning points in U.S. hotel business activity, decreased by an annual rate of 16.1 percent in January, building on December’s 14.5 percent decline.

...

“According to HIP, the hotel industry entered its 15th month in the current recession in January,” said Chad Church from Smith Travel Research.

The previous two industry recessions, in 1991 and 2001, lasted 17 months each. “If HIP continues to decline for a few more months, the current recession in the hotel industry may outpace the longest hotel recession on record that occurred in 1981 and lasted 20 months,” Simos added.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph from e-forecasting.com and Smith Travel Research shows the hotel recessions based on the Hotel Industry’s Pulse index and the NBER's business cycle dating methodology.

In general, hotel recessions correspond to general economic recessions, although they last longer. There was a double dip recession for hotels following the 2001 recession.

The second graph shows investment in lodging (based on data from the BEA) as a percent of GDP. In general investment in lodging starts to decline during a hotel recession, however the recent boom in lodging investment has been stunning. Lodging investment is now at 0.34% of GDP - an all time high. However, with the hotel industry in recession, it appears likely that investment in lodging will decline sharply in 2009.

The second graph shows investment in lodging (based on data from the BEA) as a percent of GDP. In general investment in lodging starts to decline during a hotel recession, however the recent boom in lodging investment has been stunning. Lodging investment is now at 0.34% of GDP - an all time high. However, with the hotel industry in recession, it appears likely that investment in lodging will decline sharply in 2009.Note: prior to 1997, the BEA included Lodging in a category with a few other buildings. This earlier data was normalized using 1997 data, and is an approximation.

Friday, February 06, 2009

Fed's Yellen: Economic Outlook and Community Banks

by Calculated Risk on 2/06/2009 10:31:00 PM

From San Francisco Fed President Janet Yellen: The Economic Outlook for 2009 and Community Banks. A few excerpt on a common topic: CRE and non-residential investment:

Nonresidential construction declined modestly at the end of last year but, surprisingly enough, has not yet shown the steep declines that have been expected for some time. However, such declines are almost surely imminent. With business activity slowing and new buildings coming on line, vacancy rates on office, industrial, and retail space are all on the rise. For developers, financing is indeed extremely hard to get. The market for commercial mortgage-backed securities has all but dried up. Banks and other traditional lenders have also become less willing to extend funding. It’s no wonder that my contacts are talking about substantial cutbacks on new projects and planned capital improvements on existing buildings.

...

Many community banks have significant commercial real estate concentrations, and these loans are a particular concern in the current environment. At present, the performance of such loans has deteriorated only mildly. But, as I suggested earlier, we can’t count on that situation to continue, since the downturn in commercial real estate construction is just getting started and is likely to be quite challenging.

Friday, January 30, 2009

Investment as a Percent of GDP

by Calculated Risk on 1/30/2009 09:09:00 AM

Here are a couple of graphs on the investment slump. Residential real residential fixed investment decreased at an a 23.6% annualized rate in Q4. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows residential investment (RI) as a percent of GDP since 1947. Residential investment has fallen to 3.07% of GDP. This is the lowest residential investment, as a percent of GDP, since WW II.

I'll post more on the components of RI in a few days when the supplemental data is released. The second graph shows non-residential investment as a percent of GDP.

The second graph shows non-residential investment as a percent of GDP.

Investment in software and equipment declined at a 27.8% annualized rate in Q4. Cliff diving! This investment is at the lowest rate since the '70s.

However investment in non-residential structures only declined at a 1.8% annualized rate. As a percent of GDP, non-residential structure investment actually increased slightly in Q4. This story will change in 2009, and non-residential structure investment will be a significant drag on GDP.

I'll have much more on non-residential structures in a few days ...

This investment slump is a huge part of the recession story. Residential led the economy into recession (as is typical) and now non-residential investment is falling off a cliff - or, as in the case of non-residential structures, will fall off a cliff in 2009.

Saturday, January 03, 2009

Non-Residential Structure Investment vs.Residential Investment

by Calculated Risk on 1/03/2009 07:33:00 PM

From the AP: Commercial real estate in for tough 2009

[T]he welfare of commercial real estate trails the rest of the economy, so landlords might not get any relief for another two years.There is much more in the AP article on CRE, but I'd like to focus on the excerpt.

"If the economy recovers late this year," said Robert Bach, chief economist at Grubb and Ellis Co. "Our industry will still have a ways to go before it will recover."

Typically non-residential investment in structures trails residential investment by about 5 quarters.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the year-over-year (YoY) change in residential investment (shifted 5 quarters into the future) and the YoY change for non-residential structures.

Although a 5 quarter lag is the best fit, non-residential investment typically trails residential investment by 3 to 8 quarters.

The second graph shows the correlation coefficient for different lags (zero quarters to an 8 quarter lag).

The second graph shows the correlation coefficient for different lags (zero quarters to an 8 quarter lag).Because of this historical relationship, I expected a non-residential investment bust starting at the end of 2007 or in early 2008. Instead non-residential investment in structures is only now turning negative - a lag of over 10 quarters following residential investment.

This suggests that the recovery might be more sluggish than Robert Bach, the chief economist at Grubb and Ellis Co. expects. Instead of two years, I think the CRE slump will probably be longer.

Saturday, December 27, 2008

CRE Boom Ends in New York

by Calculated Risk on 12/27/2008 10:10:00 AM

From the NY Times: Downturn Ends Building Boom in New York

Nearly $5 billion in development projects in New York City have been delayed or canceled because of the economic crisis, an extraordinary body blow to an industry that last year provided 130,000 unionized jobs, according to numbers tracked by a local trade group.More bad CRE news ...

...

The long-term impact is potentially immense, experts said. Construction generated more than $30 billion in economic activity in New York last year, said Louis J. Coletti, the chief executive of the Building Trades Employers’ Association. The $5 billion in canceled or delayed projects tracked by Mr. Coletti’s association include all types of construction: luxury high-rise buildings, office renovations for major banks and new hospital wings. Mr. Coletti’s association, which represents 27 contractor groups, is talking to the trade unions about accepting wage cuts or freezes. So far there is no deal.

Not surprisingly, unemployment in the construction industry is soaring: in October, it was up by more than 50 percent from the same period last year, labor statistics show.

Tuesday, December 16, 2008

Best Buy Cites "Historic Slowdown", cuts Capital Spending Plans in Half

by Calculated Risk on 12/16/2008 09:00:00 AM

Press Release:

“The historic slowdown in the economy and its effect on our business over the past 90 days have been the most challenging consumer environment our company has ever faced,” said Brad Anderson, vice chairman and CEO of Best Buy. “We believe that there has been a dramatic and potentially long-lasting change in consumer behavior as people adjust to the new realities of the marketplace."Company after company is announcing reduced capital spending plans, and this means non-residential investment will decline sharply next year.

...

"[B]ased on the recent changes we’ve seen in consumer behavior and the potential for worsening consumer spending, we need to prepare our organization to operate in a wide range of potential macro economic scenarios in the coming year. Additional prudent actions will be taken to prepare the business, such as reducing our capital spending by approximately 50 percent next year, including a substantial reduction in new store openings in the United States, Canada and China."

emphasis added

Monday, December 15, 2008

The Impact of Falling Oil Prices on Energy Investment

by Calculated Risk on 12/15/2008 11:02:00 PM

Jad Mouawad at the NY Times writes about the impact of falling oil prices on investment: Big Oil Projects Put in Jeopardy by Fall in Prices

The NY Times article discusses the impact of falling oil prices on energy investment worldwide, but also interesting is the impact on domestic investment. The following graph compares real oil prices (data from the St. Louis Fed, adjusted with CPI) and real investment in petroleum exploration and wells in the U.S. (data from the BEA).

This doesn't include investment in alternative energy sources. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Not surprisingly there is a strong correlation between oil prices and investment. With oil prices now in the $45 per barrel range, this suggests that domestic investment could fall to $25 billion per year or so. This is another area of non-residential investment that will probably see a significant decline in 2009.

Wednesday, December 10, 2008

Office Depot to Close 112 Stores, Reduce New Openings

by Calculated Risk on 12/10/2008 09:16:00 AM

Press Release: Office Depot Announces Update of Strategic Review (hat tip Joshua)

The Company plans to close 112 underperforming retail stores in North America over the next three months, reducing the North American store base to 1,163. ... Additionally, 14 stores will be closed through 2009 as their leases expire or other lease arrangements are finalized.More bad news for retail space, and another company reducing capital spending plans ...

New store openings for 2009 now have been reduced to approximately 20, down from the previous estimate of 40 stores. This will facilitate a reduction in total Company capital spending in 2009 to less than $200 million ...

Office Depot also plans to close six of its 33 distribution facilities in North America.

Tuesday, December 09, 2008

Lodging Investment and the Hotel Bust

by Calculated Risk on 12/09/2008 07:10:00 PM

Start with a stunning graph ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows investment in lodging (based on data from the BEA) as a percent of GDP. The recent boom in lodging investment has been stunning.

Note: prior to 1997, the BEA included Lodging in a category with a few other buildings. This earlier data was normalized using 1997 data, and is an approximation.

And a press release today from PKF Hospitality Research: PKF Forecasts 7.8 Percent RevPAR Decline in 2009

U.S. hotels have entered the initial stages of one of the deepest and longest recessions in the history of the domestic lodging industry according to a new report issued today by PKF Hospitality Research (PKF-HR). The 7.8 percent drop in RevPAR that the hospitality research firm is now forecasting for 2009 will be the fifth largest annual decline in this important measure since 1930.Compare this to the recent forecast from PricewaterhouseCoopers: PricewaterhouseCoopers Forecasts a Substantial Reduction in Hotel RevPAR in 2009

According to the PwC forecast, 2008 RevPAR will decrease by 0.8 percent, primarily due to a 3.7 percent decrease in occupancy, the highest annual decrease in occupancy since 2001. In 2009, demand is forecast to decrease by 2.0 percent, which, when coupled with a 1.6 percent increase in supply, is expected to further reduce occupancy to 58.6 percent, the lowest since 1971.Mix in tight lending standards, and I expect a significant decline in lodging investment as current projects are completed.

...

"The deteriorating outlook for the economy is impacting travel habits and spending, and hotels are expected to experience reduced occupancy levels, and to a lesser degree, some room rate erosion through 2009," said Scott Berman, principal and U.S. Leader of PricewaterhouseCoopers' Hospitality and Leisure practice.

Note: notice the scale. Whereas residential peaked at over 6.3% of GDP in 2005, investment in lodging is peaking now at just a fraction of residential investment - around 0.34% of GDP. Size matters when evaluating the economic impact of a bust on the economy.

The CRE Bust: Quick Overview

by Calculated Risk on 12/09/2008 01:49:00 PM

This post is a summary of recent commercial real estate (CRE) data suggesting that investment in non-residential real estate will decline sharply over the next several quarters.

Note: There is another problem with CRE too (not discussed here) - many existing properties were recently purchased at prices that were based on overly optimistic pro forma income projections. These loans typically included reserves to pay interest until rents increased (like a negatively amortizing option ARM), and it is likely that many of these deals will blow up when the interest reserve is depleted - probably in the 2009-2010 period.

Historically investment in non-residential structures lags investment in residential by 5 to 8 quarters. The reasons are pretty clear - the commercial builders (for malls, offices, lodging, etc.) usually build after they "see the rooftops", i.e. the residential is in place.

It appears the Commercial Real Estate (CRE) bust has started. Here is a summary of recent data:

Click on graph for larger image in new window.

Click on graph for larger image in new window. On the heels of a six-point drop in September, the Architecture Billings Index (ABI) plummeted to its lowest level since the survey began in 1995. As a leading economic indicator of construction activity, the ABI shows an approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the October ABI rating was 36.2, down significantly from the 41.4 mark in September (any score above 50 indicates an increase in billings). The inquiries for new projects score was 39.9, also a historic low point.The key here is that the index fell off a cliff in early 2008, and that there is "an approximate nine to twelve month lag time between architecture billings and construction spending". We should expect weaker non-residential structure investment for the foreseeable future (at least through 2009).

emphasis added

Of particular interest is the increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.

Of particular interest is the increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.Note that any reading below zero for loan demand means less demand than the previous quarter. This is strong evidence of a significant slump in CRE investment.

The graph shows private residential and nonresidential construction spending since 1993.

The graph shows private residential and nonresidential construction spending since 1993. Nonresidential construction was at a seasonally adjusted annual rate of $417.7 billion in October, 0.7 percent below the revised September estimate of $420.6 billion.It appears spending on private non-residential construction (blue line) peaked in June and is just starting to decline.

This graph based on data from the Federal Reserve shows the delinquency rates at the commercial banks for residential and commercial real estate.

This graph based on data from the Federal Reserve shows the delinquency rates at the commercial banks for residential and commercial real estate.Commercial real estate delinquencies are rising rapidly, and are at the highest rate since Q3 '94 (as delinquency rates declined following the S&L crisis).

From the WSJ: Mall Vacancies Grow as Retailers Pack Up Shop

From the WSJ: Mall Vacancies Grow as Retailers Pack Up Shop For strip centers and other open-air shopping venues, the vacancy rate climbed to 8.4% in the third quarter from 8.1% in the second quarter. That marks the highest rate since 1994, according to Reis.This graph shows the strip mall vacancy rate since Q2 2007. Note that the graph doesn't start at zero to better show the change.

From Reuters: Office vacancy rate reaches 2-year high: report

U.S. office vacancy rose to 13.6 percent, up 0.5 percentage points from the second quarter, its largest one-quarter jump since the second quarter of 2002. The third-quarter vacancy rate was the highest since the second quarter of 2006 and was 110 percentage points higher than its recent low of 12.5 percent set in the third quarter of 2007.

About 23.7 million square feet of office space was available in the third quarter than was leased. About 18.2 million square feet of that was added in just the third quarter, Reis said. That is more than five times the 3.59 million square feet added in the second quarter.

|

This graph shows the annual occupancy rate for the last 50 years. The data is from PricewaterhouseCoopers LLP (1958 to 1986), and Smith Travel Research (1987 to 2007).

The PricewaterhouseCoopers forecast for 2008 and 2009 are in red. Note: The y-axis starts at 50% to better show the change.

Monday, December 08, 2008

FedEx: "Significantly weaker macroeconomic conditions"

by Calculated Risk on 12/08/2008 04:52:00 PM

[S]ignificantly weaker macroeconomic conditions are expected to offset the benefits from lower fuel prices and the announced departure of DHL from the U.S. domestic package market.There are a couple of key points: 1) the weaker economy is more than offsetting any fuel savings for FedEx, and 2) capital spending plans have been reduced significantly (we are seeing company after company announce lower capital spending plans for 2009).

...

Second quarter results benefited from rapidly declining fuel prices and continued cost management,” said Alan B. Graf, Jr., executive vice president and chief financial officer. “However, demand for our services weakened sequentially throughout the quarter and global economic trends continue to worsen, substantially reducing our second half outlook. We are adjusting our expense plans to more closely align with the weaker business conditions, and are now targeting capital spending of $2.5 billion for fiscal 2009, down from $3.0 billion at the start of the year.”