by Calculated Risk on 2/24/2011 06:37:00 PM

Thursday, February 24, 2011

Fannie, Freddie, FHA combined REO Inventory at Record Level

The combined REO (Real Estate Owned) inventory for Fannie, Freddie and the FHA increased to a record 295,307 units at the end of Q4, although REO inventory decreased slightly for both Fannie Mae and Freddie Mac in Q4 (compared to Q3). The REO inventory increased 71% compared to Q4 2009 (year-over-year comparison).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the REO inventory for Fannie, Freddie and FHA through Q4 2010.

The REO inventory for the "Fs" has increased sharply over the last year, from 172,368 at the end of 2009 to a record 295,307 at the end of 2010.

From Fannie Mae: Fannie Mae Reports Fourth-Quarter and Full-Year 2010 Results

Given the large number of seriously delinquent loans in our single-family guaranty book of business and the large current and anticipated supply of single-family homes in the market, we expect it will take years before our REO inventory approaches pre-2008 levels.Also, this is just a portion of the total REO inventory. Private label securities and banks and thrifts also hold a substantial number of REOs.

Monday, December 27, 2010

Freddie Mac: 90+ Day Delinquency Rate increases in November

by Calculated Risk on 12/27/2010 06:11:00 PM

Freddie Mac reported that the serious delinquency rate increased to 3.85% in November from 3.82% in October. The following graph shows the Freddie Mac serious delinquency rate (loans that are "three monthly payments or more past due or in foreclosure"):

Some of the rapid increase last year was probably because of foreclosure moratoriums, and from modification programs because loans in trial mods were considered delinquent until the modifications were made permanent. As modifications have become permanent, they are no longer counted as delinquent.

The increases in October and November are probably related to the new foreclosure moratoriums. The rate will probably start to decrease again in 2011.

Note: Fannie Mae reported the serious delinquency rate declined slightly in October (they are a month behind Freddie Mac).

Monday, August 09, 2010

Fannie, Freddie, FHA REO Inventory Increases 13% in Q2 from Q1 2010

by Calculated Risk on 8/09/2010 11:25:00 AM

The combined REO (Real Estate Owned) inventory for Fannie, Freddie and the FHA increased by 13% in Q2 2010 from Q1 2010. The REO inventory (lender Real Estate Owned) increased 74% compared to Q2 2009 (year-over-year comparison). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the REO inventory for Fannie, Freddie and FHA through Q2 2010.

The REO inventory for the "Fs" has increased sharply over the last year, from 135,868 at the end of Q2 2009 to 236,338 at the end of Q2 2010.

This is a new record for Fannie and Freddie; the FHA's REO inventory decreased slightly in Q2 2010.

Remember this is just a portion of the total REO inventory. Private label securities and banks and thrifts also hold a substantial number of REOs.

Thursday, August 05, 2010

Fannie Mae: REO Inventory doubles, expected to increase "significantly"

by Calculated Risk on 8/05/2010 07:55:00 PM

Fannie Mae reported: "a net loss of $1.2 billion in the second quarter of 2010, compared to a net loss of $11.5 billion in the first quarter of the year." and the FHFA requested another $1.5 billion from Treasury.

On house prices, Fannie Mae "expects home prices to decline slightly for the balance of 2010 and into 2011 before stabilizing, and that home sales will be basically flat for all of 2010." Click on graph for larger image in new window.

Click on graph for larger image in new window.

Fannie Mae reported that their REO inventory more than doubled since Q2 2009, from 62,615 to 129,310 in Q2 2010.

REO: Real Estate Owned.

See page 11 of the 2010 Second Quarter Credit Supplement (ht jb)

This graph shows the rapid increase in REO.

From Fannie Mae 10-Q (page 9):

During the second quarter of 2010, we acquired approximately 69,000 foreclosed single-family properties, up from approximately 62,000 during the first quarter of 2010, and we disposed of approximately 50,000 single-family properties. The carrying value of the single-family REO we held as of June 30, 2010 was $13.0 billion, and we expect our REO inventory to continue to increase significantly throughout 2010.Freddie Mac and the FHA together have about the same number of REOs as Fannie Mae. When that data is released, I'll put up a chart of all three.

Also this does not include REO held by other lenders and private-label RMBS.

Monday, July 12, 2010

FHFA attempting to recoup some losses of Fannie and Freddie

by Calculated Risk on 7/12/2010 02:15:00 PM

From the Federal Housing Finance Agency: FHFA Issues Subpoenas for PLS Documents

FHFA, as Conservator of Fannie Mae and Freddie Mac (the Enterprises), has issued 64 subpoenas to various entities, seeking documents related to private-label mortgage-backed securities (PLS) in which the two Enterprises invested. The documents will enable the FHFA to determine whether PLS issuers and others are liable to the Enterprises for certain losses they have suffered on PLS. If so, the Conservator expects to recoup funds, which would be used to offset payments made to the Enterprises by the U.S. Treasury.Many of the originators of the PLS mortgages are no longer in business (New Century, etc.), however most of the PLS issuers still exist.

...

Before and during conservatorship, the Enterprises sought to assess and enforce their rights as investors in PLS, in an effort to recoup losses suffered in connection with their portfolios. Specifically, the Enterprises have attempted to determine whether misrepresentations, breaches of warranties or other acts or omissions by PLS counterparties would require repurchase of loans underlying the PLS by the counterparties and whether other remedies might be appropriate. However, difficulty in obtaining the loan documents has presented a challenge to the Enterprises’ efforts. FHFA has therefore issued these subpoenas for various loan files and transaction documents pertaining to loans securing the PLS to trustees and servicers controlling or holding that documentation.

Wednesday, June 30, 2010

Fannie Mae: Serious Delinquency rate declines in April

by Calculated Risk on 6/30/2010 09:55:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

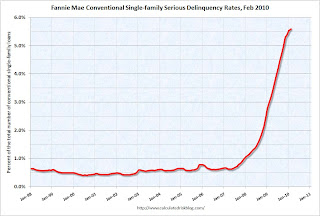

Fannie Mae reported today that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business decreased to 5.30% in April, down from 5.47% in March - and up from 3.42% in April 2009.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans."

This is similar to the report from Freddie Mac (although Fannie Mae releases data one month later). Just as for Freddie Mac, some of the earlier rapid increase was probably because of foreclosure moratoriums, and distortions from modification programs because loans in trial mods were considered delinquent until the modifications were made permanent.

More modifications have become permanent (and no longer counted as delinquent) and Fannie Mae is foreclosing again (they have a record number of REOs) - so there has been a slight decline in the delinquency rate.

Wednesday, June 23, 2010

Fannie Mae cracks down on "Walk Aways"

by Calculated Risk on 6/23/2010 04:00:00 PM

Note: Earlier post on New Home sales: New Home Sales collapse to Record Low in May

From Fannie Mae: Fannie Mae Increases Penalties for Borrowers Who Walk Away

Fannie Mae (FNM/NYSE) announced today policy changes designed to encourage borrowers to work with their servicers and pursue alternatives to foreclosure. Defaulting borrowers who walk-away and had the capacity to pay or did not complete a workout alternative in good faith will be ineligible for a new Fannie Mae-backed mortgage loan for a period of seven years from the date of foreclosure.I'm not sure how they can tell if someone "walks away" (a borrower who could afford to make their mortgage payments, but instead strategically defaults), or if the borrower had no real choice.

...

Fannie Mae will also take legal action to recoup the outstanding mortgage debt from borrowers who strategically default on their loans in jurisdictions that allow for deficiency judgments. In an announcement next month, the company will be instructing its servicers to monitor delinquent loans facing foreclosure and put forth recommendations for cases that warrant the pursuit of deficiency judgments.

But this suggests that the number of strategic defaults is increasing.

And this reminds us of one of the tragedies of the bubble: many people bought before they were ready, or bought too much home. Whether they are "walking away" or losing their home because they can't afford it, they will be out of the market for some time.

Tuesday, June 01, 2010

Fannie Mae: Serious Delinquencies decline in March

by Calculated Risk on 6/01/2010 08:17:00 PM

Breaking a trend ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Fannie Mae reported today that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business decreased to 5.47% in March, down from 5.59% in February - and up from 3.13% in March 2009.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans."

This is the first decline since early 2006 and could be because Fannie (and Freddie and the FHA) are moving ahead with foreclosures.

As noted last month, the combined REO (Real Estate Owned) inventory for Fannie, Freddie and the FHA increased by 22% in Q1 2010 from Q4 2009. The REO inventory (foreclosed homes) increased 59% compared to Q1 2009 (year-over-year comparison). This graph shows the REO inventory for Fannie, Freddie and FHA through Q1 2010.

This graph shows the REO inventory for Fannie, Freddie and FHA through Q1 2010.

Even with all the delays in foreclosure, the REO inventory has increased sharply over the last three quarters, from 135,868 at the end of Q2 2009, to 153,007 in Q3 2009, 172,357 at the end of Q4 2009 and now 209,500 at the end of Q4 2010.

These are new records for all three agencies.

Monday, May 10, 2010

Fannie Mae: $11.5 billion loss, sees no profits for "indefinite future"

by Calculated Risk on 5/10/2010 08:58:00 AM

For a EU / ECB summary, please see previous post: Euro Summary

From Fannie Mae:

Fannie Mae (FNM/NYSE) reported a net loss of $11.5 billion in the first quarter of 2010, compared with a net loss of $15.2 billion in the fourth quarter of 2009. Including $1.5 billion of dividends on our senior preferred stock held by the U.S. Department of Treasury, the net loss attributable to common stockholders was $13.1 billion ...Foreclosure activity is increasing:

We acquired 61,929 single-family real estate-owned properties through foreclosure in the first quarter of 2010, compared with 47,189 in the fourth quarter of 2009. As of March 31, 2010, our inventory of single-family real estate owned properties was 109,989, compared with 86,155 as of December 31, 2009.Greg Morcroft at MarketWatch reports:

Fannie sees no profits for the "indefinite future" ... financial sustainability uncertain.Here is the monthly Fannie Mae seriously delinquent graph through February ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.Fannie Mae reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.59% in February, up from 5.52% in January - and up from 2.96% in February 2009.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans."

It does appear the increases in the delinquency rate have slowed.

Saturday, May 01, 2010

96.5% of Mortgages Backed by Government entities in Q1

by Calculated Risk on 5/01/2010 08:42:00 AM

From Nick Timiraos at the WSJ: U.S. Role in Mortgage Market Grows Even Larger

Government-related entities backed 96.5% of all home loans during the first quarter, up from 90% in 2009, according to Inside Mortgage Finance.The following graph from San Francisco Fed Senior Economist John Krainer puts this in perspective (from Oct 2009): Recent Developments in Mortgage Finance

As the U.S. housing market has moved from boom in the middle of the decade to bust over the past two years, the sources of mortgage funding have changed dramatically. The government-sponsored enterprises—Fannie Mae, Freddie Mac, and Ginnie Mae—now own or guarantee an overwhelming share of originations. At the same time, non-agency mortgage securitization and loans retained in lender portfolios have largely dried up.

Click on graph for slightly larger in new window.

Click on graph for slightly larger in new window.This is figure 3 from the Economic Letter.

[T]he sources of mortgage finance have shifted as the housing market has gone from boom to bust. Figure 3 plots the evolution of these funding sources over the past decade. Fannie Mae and Freddie Mac combined have consistently been the largest players in the market, owning or guaranteeing about half or more of the mortgages in the sample at any given time. Non-agency securitization peaked in the first quarter of 2006, when it accounted for nearly 40% of new originations. Finally, the share of mortgages retained in the originating institution's portfolio averaged about 15% throughout the boom, but has fallen considerably since.Without the government backed entities there would be almost no mortgage market. We are a long way from normal ...

...

With the vast majority of current mortgage lending now intermediated in some form by the GSEs, it will be difficult for the housing market to return to normal.

Wednesday, March 31, 2010

Fannie Mae: Delinquencies Increase in January

by Calculated Risk on 3/31/2010 02:54:00 PM

Here is the monthly Fannie Mae hockey stick graph for January ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Fannie Mae reported today that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.52% in January, up from 5.38% in December - and up from 2.77% in January 2009.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans."

Monday, March 22, 2010

Obama Adminstration to outline changes for Fannie and Freddie

by Calculated Risk on 3/22/2010 08:45:00 PM

There will be hearing tomorrow about Fannie and Freddie, but the Obama administration will only "outline broad principles".

From Jim Puzzanghera at the LA Times: Pressure rises to overhaul Fannie Mae, Freddie Mac

[I]n a hearing Tuesday, lawmakers will start pressing the Obama administration for an exit strategy [for Fannie Mae and Freddie Mac] ...And from Nick Timiraos and Michale Crittenden at the WSJ: New Plan to Reshape Mortgage Market

"It's clear that Fannie and Freddie, as they currently exist, should be put out of existence, which means the important question is what combination of entities public and private will replace them," said Rep. Barney Frank (D-Mass.), chairman of the House Financial Services Committee.

He has called Treasury Secretary Timothy F. Geithner to testify at the hearing before his committee about how to do that.

The administration will outline broad principles for the future of the mortgage market at the hearing, including stronger consumer protections and explicit guarantees for any government backstop of mortgages.Clearly we can't go back to a structure that privatizes profits and socializes losses.

"The housing-finance system cannot continue to operate as it has in the past," Mr. Geithner says in prepared testimony. The administration won't issue a detailed overhaul proposal until later this year.

Monday, March 01, 2010

Fannie, Freddie and FHA REO Inventory

by Calculated Risk on 3/01/2010 04:02:00 PM

REO: Real Estate Owned. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph (ht Tom Lawler) shows the REO inventory for Fannie, Freddie and FHA through Q4 2009.

Even with all the delays in foreclosure, the REO inventory has increased sharply over the last two quarters, from 135,868 at the end of Q2 2009, to 153,007 in Q3 2009, and 172,357 at the end of Q4 2009.

Friday, February 26, 2010

Fannie Mae Reports $15.2 Billion Loss

by Calculated Risk on 2/26/2010 07:36:00 PM

Press Release: Fannie Mae Reports Fourth-Quarter and Full-Year 2009 Results

Fannie Mae reported a net loss of $15.2 billion in the fourth quarter of 2009 ... For the full year of 2009, Fannie Mae reported a net loss of $72.0 billion...I'm old enough to remember when $15 billion was a large number.

The fourth-quarter loss resulted in a net worth deficit of $15.3 billion as of December 31, 2009, taking into account unrealized gains on available-for-sale securities during the fourth quarter. As a result, on February 25, 2010, the Acting Director of the Federal Housing Finance Agency submitted a request for $15.3 billion from Treasury on the company’s behalf. FHFA has requested that Treasury provide the funds on or prior to March 31, 2010.

...

Although there have been signs of stabilization in the housing market and economy, we expect that our credit-related expenses will remain high in the near term due in large part to the stress of high unemployment and underemployment on borrowers and the fact that many borrowers who owe more on their mortgagees than their houses are worth are defaulting.

...

We expect to have a net worth deficit in future periods, and therefore will be required to obtain additional funding from Treasury ...

Thursday, January 28, 2010

Fannie Mae: Delinquencies Increase Sharply in November

by Calculated Risk on 1/28/2010 04:41:00 PM

Earlier I posted the Freddie Mac delinquency graph.

And here is the monthly Fannie Mae hockey stick graph ... (note that Fannie releases delinquency data with a one month lag to Freddie). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Fannie Mae reported today that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.29% in November, up from 4.98% in October - and up from 2.13% in November 2008.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans."

Once again it is important to note these stats do include Home Affordable Modification Program (HAMP) loans in trial modifications.

Monday, December 28, 2009

Fannie Mae: Delinquencies Increase Sharply in October

by Calculated Risk on 12/28/2009 08:01:00 PM

Here is the monthly Fannie Mae hockey stick graph ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Fannie Mae reported today that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 4.98% in October, up from 4.72% in September - and up from 1.89% in October 2008.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans. These rates are based on conventional single-family mortgage loans and exclude reverse mortgages and non-Fannie Mae mortgage securities held in our portfolio.

...

A measure of credit performance and indicator of future defaults for the single-family ... credit books. We include single-family loans that are three months or more past due or in the foreclosure process ... We include conventional single-family loans that we own and that back Fannie Mae MBS in our single-family delinquency rate, including those with substantial credit enhancement."

Just more evidence of the growing delinquency problem, although it is important to note these stats do include Home Affordable Modification Program (HAMP) loans in trial modifications (and the trial modification periods have been extended again).

Thursday, December 24, 2009

Treasury: More Support for Fannie and Freddie

by Calculated Risk on 12/24/2009 03:14:00 PM

From the WSJ: U.S. Uncaps Support for Fannie, Freddie

The Treasury said it would provide capital as needed to Fannie Mae and Freddie Mac over the next three years, in a move aimed at soothing investors' concerns about the government's continued support of the mortgage giants.A press release before the holiday ... I was wondering what would come out today.

Treasury also will suspend its purchases of the companies' mortgage-backed securities ...

Under the new terms announced Thursday, the cap on Treasury's support would increase according to how much each firm loses in a quarter, beginning the first quarter of next year and through 2012. The cap in place at the end of 2012 would apply thereafter.

Update: Here is the press release: TREASURY ISSUES UPDATE ON STATUS OF SUPPORT FOR HOUSING PROGRAMS (ht Steelhead)

Wednesday, November 11, 2009

Fannie, Freddie, Counterparty Risk and More

by Calculated Risk on 11/11/2009 10:08:00 PM

Yesterday I posted some excerpt from Freddie Mac's 10-Q:

We believe that several of our mortgage insurance counterparties are at risk of falling out of compliance with regulatory capital requirements, which may result in regulatory actions that could threaten our ability to receive future claims payments, and negatively impact our access to mortgage insurance for high LTV loans.The WSJ has more tonight, including the risks to Fannie Mae: Fannie, Freddie Warn on More Losses

Fannie Mae has about $109.5 billion of mortgage-insurance coverage in force ... Freddie Mac had $63.4 billion in mortgage insurance and $12.2 billion in bond insurance.And this a key sentence:

The reduction in private insurance coverage has contributed to the rise in the volume of loans backed by the Federal Housing Administration ...Instead of using private mortgage insurance for loans greater than 80% LTV, low down payment borrowers are now using FHA insurance.

That will probably end well ...

Also - the WSJ has more on the new FDIC "Prudent Commercial Real Estate Loan Workouts" guidance issued Oct 30th: Banks Hasten to Adopt New Loan Rules. Here is the new FDIC guidance that states performing loans "made to creditworthy borrowers" will not require write downs "solely because the value of the underlying collateral declined".

Thursday, November 05, 2009

Fannie Mae: $18.9 Billion Loss, Requests Another $15 Billion

by Calculated Risk on 11/05/2009 05:20:00 PM

Press Release: Fannie Mae Reports Third-Quarter 2009 Results

Fannie Mae (FNM/NYSE) reported a net loss of $18.9 billion in the third quarter of 2009, compared with a loss of $14.8 billion in the second quarter of 2009. ... Third-quarter results were largely due to $22.0 billion of credit related expenses, reflecting the continued build of the company’s combined loss reserves and fair value losses associated with the increasing number of loans that were acquired from mortgage backed securities trusts in order to pursue loan modifications.

...

As a result, on November 4, 2009, the Acting Director of the Federal Housing Finance Agency (FHFA) submitted a request for $15.0 billion from Treasury on the company’s behalf.

...

The seriously delinquent loans in our single-family book of business, which we define as those loans 90 or more days delinquent or in the process of foreclosure, increased and aged during the third quarter. This was caused by a greater number of loans that transitioned to seriously delinquent status, while the proportion of already seriously delinquent loans that cured or transitioned to completed foreclosures declined. Factors contributing to the increase in serious delinquencies included: high unemployment that hampered the ability of many delinquent borrowers to cure their delinquencies; Home Affordable Modifications in trial periods, which remain classified as delinquent; our directive that servicers delay foreclosure sales until other alternatives, including Home Affordable Modification, have been exhausted; and, the slowdown in the legal process for foreclosures in a number of states.

...

Total nonperforming loans in our guaranty book of business were $198.3 billion, compared with $171.0 billion on June 30, 2009, and $119.2 billion on December 31, 2008. The carrying value of our foreclosed properties was $7.3 billion, compared with $6.2 billion on June 30, 2009, and $6.6 billion on December 31, 2008.

emphasis added

Friday, October 30, 2009

Fannie Mae: Delinquencies Increase Sharply in August

by Calculated Risk on 10/30/2009 05:40:00 PM

Here is the monthly Fannie Mae hockey stick graph ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Fannie Mae reported today that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 4.45% in August, up from 4.17% in July - and up from 1.57% in August 2008.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans. These rates are based on conventional single-family mortgage loans and exclude reverse mortgages and non-Fannie Mae mortgage securities held in our portfolio."

Just more evidence of the growing delinquency problem, although these stats do include Home Affordable Modification Program (HAMP) loans in trial modifications.