by Calculated Risk on 4/20/2011 11:30:00 AM

Wednesday, April 20, 2011

Existing Home Inventory decreases 2.1% Year over Year

Earlier the NAR released the existing home sales data for March; here are a couple more graphs ...

The first graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Although inventory increased from February to March (as usual), inventory decreased 2.1% year-over-year in March (from March 2010). This is the second consecutive month with a small YoY decrease in inventory.

Inventory should increase over the next few months (the normal seasonal pattern), and the YoY change is something to watch closely this year. Inventory is already very high, and any YoY increase in inventory would put more downward pressure on house prices.

The second graph shows existing home sales Not Seasonally Adjusted (NSA).

The second graph shows existing home sales Not Seasonally Adjusted (NSA).

The red columns in January, February and March are for 2011.

Sales NSA are below the tax credit boosted level of sales in March 2010, but above the level of March sales in 2008 and 2009.

The bottom line: March is the beginning of the selling season, and sales activity (so far) is above the 2008 and 2009 levels. Much of this activity is from all cash-sales (both investors and homebuyers). The NAR reported "All-cash sales were at a record market share of 35 percent in March, up from 33 percent in February; they were 27 percent in March 2010."

The NAR also mentioned: "Distressed homes – typically sold at discounts in the vicinity of 20 percent – accounted for a 40 percent market share in March, up from 39 percent in February and 35 percent in March 2010." A higher percentage of distressed sales probably means lower prices - and we should expect the repeat sales indexes to show further price declines in March.

The year-over-year decline in inventory will put less downward pressure on house prices, although the level is still very high (and this is just the visible inventory).

Note: The Case-Shiller price index will be released next Tuesday (April 26th), and is released with a significant lag. The Case-Shiller report will be for February (average of three months) - and the NAR report, with the high level of distressed sales and cash buyers, suggests further price declines in March.

March Existing Home Sales: 5.10 million SAAR, 8.4 months of supply

by Calculated Risk on 4/20/2011 10:00:00 AM

The NAR reports: Existing-Home Sales Rise in March

Existing-home sales1, which are completed transactions that include single-family, townhomes, condominiums and co-ops, increased 3.7 percent to a seasonally adjusted annual rate of 5.10 million in March from an upwardly revised 4.92 million in February, but are 6.3 percent below the 5.44 million pace in March 2010.

...

All-cash sales were at a record market share of 35 percent in March, up from 33 percent in February; they were 27 percent in March 2010. Investors accounted for 22 percent of sales activity in March, up from 19 percent in February; they were 19 percent in March 2010.

...

Total housing inventory at the end of March rose 1.5 percent to 3.55 million existing homes available for sale, which represents an 8.4-month supply4 at the current sales pace, compared with a 8.5-month supply in February.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March 2011 (5.10 million SAAR) were 3.7% higher than last month, and were 6.3% lower than March 2010.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory increased to 3.549 million in March from 3.498 million in February.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall and winter. Inventory will probably increase significantly over the next several months.

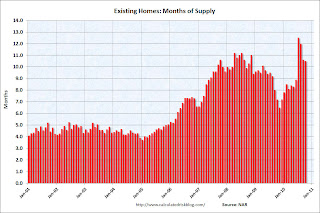

The last graph shows the 'months of supply' metric.

The last graph shows the 'months of supply' metric.Months of supply decreased to 8.4 months in March, down from 8.5 months in February. The months of supply will probably increase over the next few months as inventory increases. This is higher than normal.

Special Note: Back in January, I noted that it appeared the NAR had overestimated sales by 5% or so in 2007, and that the errors had increased since then (perhaps 10% or 15% or more in 2009 and 2010). I reported in January that the NAR was working on benchmarking existing home sales for earlier years with other industry data, and I expected "this effort will lead to significant downward revisions to previously reported sales". The numbers reported today were estimated using the old method and will probably be revised down significantly, but they are still useful on a month-to-month basis.

These sales numbers were above the consensus of 5.0 million SAAR, and are about what I expected (Lawler's forecast was 5.08 million). I'll have more soon.

Monday, March 21, 2011

February Existing Home Sales: 4.88 million SAAR, 8.6 months of supply

by Calculated Risk on 3/21/2011 10:00:00 AM

The NAR reports: February Existing-Home Sales Decline

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, dropped 9.6 percent to a seasonally adjusted annual rate of 4.88 million in February from an upwardly revised 5.40 million in January, and are 2.8 percent below the 5.02 million pace in February 2010.

...

Total housing inventory at the end of February rose 3.5 percent to 3.49 million existing homes available for sale, which represents an 8.6-month supply at the current sales pace, up from a 7.5-month supply in January.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February 2011 (4.88 million SAAR) were 9.6% lower than last month, and were 2.8% lower than February 2010.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory increased to 3.49 million in February from 3.37 million in January.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall and winter. Inventory will probably increase significantly over the next several months.

The last graph shows the 'months of supply' metric.

The last graph shows the 'months of supply' metric.Months of supply increased to 8.6 months in February up from 7.5 months in January. The months of supply will probably increase over the next few months as inventory increases. This is higher than normal.

Special Note: Back in January, I noted that it appeared the NAR had overestimated sales by 5% or so in 2007, and that the errors had increased since then (perhaps 10% or 15% or more in 2009 and 2010). I reported in January that the NAR was working on benchmarking existing home sales for earlier years with other industry data, and I expected "this effort will lead to significant downward revisions to previously reported sales". The numbers reported today were estimated using the old method and will probably be revised down significantly, but they are still useful on a month-to-month basis.

These sales numbers were below the consensus of 5.15 million SAAR, and are slightly below what I expected (Lawler's forecast was 5 million). I'll have more soon.

Wednesday, February 23, 2011

January Existing Home Sales: 5.36 million SAAR, 7.6 months of supply

by Calculated Risk on 2/23/2011 10:00:00 AM

The NAR reports: January Existing-Home Sales

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, increased 2.7 percent to a seasonally adjusted annual rate of 5.36 million in January from a downwardly revised 5.22 million in December, and are 5.3 percent above the 5.09 million level in January 2010.

...

Total housing inventory at the end of January fell 5.1 percent to 3.38 million existing homes available for sale, which represents a 7.6-month supply at the current sales pace, down from an 8.2-month supply in December. The inventory supply is at the lowest level since December 2009 when there was a 7.3-month supply.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in January 2010 (5.36 million SAAR) were 2.7% higher than last month, and were 5.3% higher than January 2010.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 3.38 million in January from 3.56 million in December.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall - and then really declining during the holidays. So this decline was expected. Inventory should start to increase again in February.

The last graph shows the 'months of supply' metric.

The last graph shows the 'months of supply' metric.Months of supply decreased to 7.6 months in January from 8.2 months in December. The months of supply will probably increase over the next few months as sales slow a little, and inventory increases. This is still higher than normal.

These sales numbers were above the consensus of 5.2 million SAAR, and are above what I expected (Lawler's forecast was 5.17 million). I'll have more later.

Special Note: Back in January, I noted that it appeared the NAR had overestimated sales by 5% or so in 2007, and that the errors had increased since then (perhaps 10% or 15% or more in 2009 and 2010). I reported in January that the NAR was working on benchmarking existing home sales for earlier years with other industry data, and I expected "this effort will lead to significant downward revisions to previously reported sales". The numbers reported today were estimated using the old method and will probably be revised down significantly, but they are still useful on a month-to-month basis.

Thursday, January 20, 2011

December Existing Home Sales: 5.28 million SAAR, 8.1 months of supply

by Calculated Risk on 1/20/2011 10:00:00 AM

The NAR reports: December Existing-Home Sales

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, rose 12.3 percent to a seasonally adjusted annual rate of 5.28 million in December from an upwardly revised 4.70 million in November, but remain 2.9 percent below the 5.44 million pace in December 2009.

...

Total housing inventory at the end of December fell 4.2 percent to 3.56 million existing homes available for sale, which represents an 8.1-month supply at the current sales pace, down from a 9.5-month supply in November.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in December 2010 (5.28 million SAAR) were 12.3% higher than last month, and were 2.9% lower than December 2009.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 3.56 million in December from 3.72 million in November. The all time record high was 4.58 million homes for sale in July 2008.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall - and then really declining during the holidays. So this decline was expected.

The last graph shows the 'months of supply' metric.

The last graph shows the 'months of supply' metric.Months of supply decreased to 8.1 months in December from 9.5 months in November. The months of supply will probably increase over the next few months as sales slow a little, and inventory increases. This is still higher than normal.

These sales numbers were above the consensus of 4.9 million SAAR, and are slightly above what I expected (Lawler's forecast was 5.13 million). I'll have more later.

Wednesday, December 22, 2010

November Existing Home Sales: 4.68 million SAAR, 9.5 months of supply

by Calculated Risk on 12/22/2010 10:00:00 AM

The NAR reports: Existing-Home Sales Resume Uptrend with Stable Prices

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, rose 5.6 percent to a seasonally adjusted annual rate of 4.68 million in November from 4.43 million in October, but are 27.9 percent below the cyclical peak of 6.49 million in November 2009, which was the initial deadline for the first-time buyer tax credit.

...

Total housing inventory at the end of November fell 4.0 percent to 3.71 million existing homes available for sale, which represents a 9.5-month supply at the current sales pace, down from a 10.5-month supply in October.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in November 2010 (4.68 million SAAR) were 5.6% higher than last month, and were 27.9% lower than November 2009.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 3.71 million in November from 3.86 million in October. The all time record high was 4.58 million homes for sale in July 2008.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall. I'll have more on inventory later ...

The last graph shows the 'months of supply' metric.

The last graph shows the 'months of supply' metric.Months of supply decreased to 9.5 months in November from 10.5 months in October. This is very high and suggests prices, as measured by the repeat sales indexes like Case-Shiller and CoreLogic, will continue to decline.

These weak numbers are below the consensus of 4.85 million SAAR, are are close to what I expected (Lawler's forecast was 4.61 million). I'll have more later.

Tuesday, November 23, 2010

Existing Home Inventory increases 8.4% Year-over-Year

by Calculated Risk on 11/23/2010 11:13:00 AM

Earlier the NAR released the existing home sales data for October; here are a couple more graphs ...

The first graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Although inventory decreased from September 2010 to October 2010, inventory increased 8.4% YoY in October. This is the largest YoY increase in inventory since early 2008.

The year-over-year increase in inventory is especially bad news because the reported inventory very high (3.864 million), and the 10.5 months of supply in October is far above normal.

By request - the second graph shows existing home sales Not Seasonally Adjusted (NSA).

By request - the second graph shows existing home sales Not Seasonally Adjusted (NSA).

The red columns are for 2010. Sales for the last four months are significantly below the previous years, and sales will probably be well weak for the remainder of 2010.

The bottom line: Sales were weak in October - almost exactly at the levels I expected - and will continue to be weak for some time. Inventory is very high - and the significant year-over-year increase in inventory is very concerning. The high level of inventory and months-of-supply will put downward pressure on house prices.

October Existing Home Sales: 4.43 million SAAR, 10.5 months of supply

by Calculated Risk on 11/23/2010 10:00:00 AM

The NAR reports: Existing-Home Sales Decline in October Following Two Monthly Gains

Existing-home sales1, which are completed transactions that include single-family, townhomes, condominiums and co-ops, declined 2.2 percent to a seasonally adjusted annual rate of 4.43 million in October from 4.53 million in September, and are 25.9 percent below the 5.98 million-unit level in October 2009 when sales were surging prior to the initial deadline for the first-time buyer tax credit.

...

Total housing inventory at the end of October fell 3.4 percent to 3.86 million existing homes available for sale, which represents a 10.5-month supply4 at the current sales pace, down from a 10.6-month supply in September.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October 2010 (4.43 million SAAR) were 2.2% lower than last month, and were 25.9% lower than October 2009.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 3.86 million in October from 4.00 million in September. The all time record high was 4.58 million homes for sale in July 2008.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall. I'll have more on inventory later ...

The last graph shows the 'months of supply' metric.

The last graph shows the 'months of supply' metric.Months of supply decreased to 10.5 months in October from 10.6 months in September. This is extremely high and suggests prices, as measured by the repeat sales indexes like Case-Shiller and CoreLogic, will continue to decline.

These weak numbers are exactly what I expected. The ongoing high level of supply - and double digit months-of-supply are the key stories. I'll have more ...

Wednesday, November 10, 2010

Lawler: Early Read on October Existing Home Sales

by Calculated Risk on 11/10/2010 06:18:00 PM

CR Note: This is from housing economist Tom Lawler:

Based on data available so far, it would appear as if national existing home sales in October ran at a seasonally adjusted annual rate that was little changed from September [4.53 million SAAR]. Of course, October’s YOY sales decline on an unadjusted basis is significantly larger than September’s. But October sales were significantly goosed (SAAR of 5.98 million) last October by the expiring (or so folks thought!) first time home buyer tax credit. In addition, there was one fewer business day this October than last October.

The incoming listings data have on average been consistent with the realtor.com data showing a 3.2% decline in existing home sales inventory in October.

CR Note: A 3.2% decline in inventory, and sales of 4.53 million SAAR would put the months-of-supply at about 10.4 months in October. That would be the fourth straight month of double digit supply.

Based on this early forecast, YoY sales would be off 24%, and inventory would be up close to 10% YoY.

Existing home sales for October will be released on Tuesday November 23rd at 10 AM ET.

Friday, November 05, 2010

Pending Home Sales Index declines 1.8% in September

by Calculated Risk on 11/05/2010 12:30:00 PM

Earlier employment posts:

From the NAR:

Pending Home Sales Slip but Modest Recovery Expected in 2011

The Pending Home Sales Index,* a forward-looking indicator, slipped 1.8 percent to 80.9 based on contracts signed in September from an upwardly revised 82.4 in August. ... The data reflects contracts and not closings, which normally occur with a lag time of one or two months.August was revised up slightly from 82.3.

This suggests existing home sales in October and November might be slightly lower than in September and months-of-supply will probably still be in double digits putting downward pressure on house prices. As usual, I'll take the under on the NAR forecast for 2011 ("more than 5.1 million existing home sales" in 2011).

Monday, October 25, 2010

September Existing Home Sales: 4.53 million SAAR, 10.7 months of supply

by Calculated Risk on 10/25/2010 10:00:00 AM

The NAR reports: September Existing-Home Sales Show Another Strong Gain

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, jumped 10.0 percent to a seasonally adjusted annual rate of 4.53 million in September from a downwardly revised 4.12 million in August, but remain 19.1 percent below the 5.60 million-unit pace in September 2009 when first-time buyers were ramping up in advance of the initial deadline for the tax credit last November.

...

Total housing inventory at the end of September fell 1.9 percent to 4.04 million existing homes available for sale, which represents a 10.7-month supply at the current sales pace, down from a 12.0-month supply in August.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in September 2010 (4.53 million SAAR) were 10% higher than last month, and were 19.1% lower than September 2009 (5.6 million SAAR).

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased slightly to 4.04 million in September from August from 4.12 million in August. The all time record high was 4.58 million homes for sale in July 2008.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory increasing in the spring and into the summer. I'll have more on inventory later ...

The last graph shows the 'months of supply' metric.

The last graph shows the 'months of supply' metric.Months of supply decreased to 10.7 months in September from 12.0 months in August. This is extremely high and suggests prices, as measured by the repeat sales indexes like Case-Shiller and CoreLogic, will continue to decline.

Ignore the NAR spin and the median price! These fairly weak numbers are exactly what I expected.

The ongoing high level of supply - and double digit months-of-supply are the key stories. I'll have more ...

Tuesday, October 12, 2010

Lawler: "Early read" on September Existing Home Sales

by Calculated Risk on 10/12/2010 03:55:00 PM

CR Note: This is from housing economist Tom Lawler:

While as always results vary by area, on balance most local realtors/MLS are reporting significant YOY home sales declines for September sales. However, it’s important to remember that last September home sales were “goosed” a bit by the federal home buyer tax credit, which was set to expire at the end of November. Existing home sales ran at an estimated seasonally adjusted annual rate of 5.6 million last September, compared to 5.1 million in August 2009.

While I only have data on a relatively small part of the country, right now I estimate that existing home sales ran at a seasonally adjusted annual rate of about 4.50 million, up almost 9% from the August [2010] pace [of 4.13 million SAAR].

CR Note: This would put the months of supply around 10.3 months in September based on an estimate of 3.85 million for inventory.

Note: It is too soon for any impact on sales from "Foreclosure-Gate".

Existing home sales for September will be released on Monday October 25th at 10 AM ET.

Thursday, September 23, 2010

Existing Home Sales at 4.1 million SAAR, 11.6 months of supply

by Calculated Risk on 9/23/2010 10:00:00 AM

The NAR reports: Existing-Home Sales Move Up in August

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, increased 7.6 percent to a seasonally adjusted annual rate of 4.13 million in August from an upwardly revised 3.84 million in July, but remain 19.0 percent below the 5.10 million-unit pace in August 2009.

...

Total housing inventory at the end of August slipped 0.6 percent to 3.98 million existing homes available for sale, which represents an 11.6-month supply at the current sales pace, down from a 12.5-month supply in July.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August 2010 (4.13 million SAAR) were 7.6% higher than last month, and were 19.0% lower than August 2009 (5.1 million SAAR).

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased slightly to 3.98 million in August from 4.01 million in July. The all time record high was 4.58 million homes for sale in July 2008.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory increasing in the spring and into the summer. I'll have more on inventory later ...

The last graph shows the 'months of supply' metric.

The last graph shows the 'months of supply' metric.Months of supply decreased to 11.6 months in August from 12.5 months in July. This is extremely high and suggests prices, as measured by the repeat sales indexes like Case-Shiller and CoreLogic, will continue to decline.

These weak numbers are exactly what I expected. Ignore the median price! Double digit supply and the low sales rate are the key stories. I'll have more ...

Thursday, September 02, 2010

Pending Home Sales increase in July

by Calculated Risk on 9/02/2010 10:00:00 AM

From the NAR: Pending Home Sales Rise

The Pending Home Sales Index ... rose 5.2 percent to 79.4 based on contracts signed in July from a downwardly revised 75.5 in June, but remains 19.1 percent below July 2009 when it was 98.1. The data reflects contracts and not closings, which normally occur with a lag time of one or two months.This suggests a small increase in existing home sales in September (reported when transactions close), but this also suggests double digit months of supply for some time.

Lawrence Yun, NAR chief economist, cautioned that there would be a long recovery process. “Home sales will remain soft in the months ahead ..."

Tuesday, August 24, 2010

Existing Home Inventory decreases 1.9% Year-over-Year

by Calculated Risk on 8/24/2010 11:30:00 AM

Earlier the NAR released the existing home sales data for July; here are a couple more graphs ...

The first graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Although inventory increased from June 2010 to July 2010, inventory decreased 1.9% YoY in July. The slight year-over-year decline is probably because some sellers put their homes on the market in the Spring hoping to take advantage of the home buyer tax credit.

Note: Usually July is the peak month for inventory.

This level of inventory is especially bad news because the reported inventory is already historically very high, and the 12.5 months of supply in July is far above normal.

The months-of-supply will probably decline in August as sales rebound slightly and some sellers take their homes off the market, but I expect double digit months-of-supply for some time - and that will be a really bad sign for house prices ...

A normal housing market usually has under 6 months of supply. The following graph shows the relationship between supply and house prices (using Case-Shiller). This graph show months of supply (through July 2010) and the annualized change in the Case-Shiller Composite 20 house price index (through May 2010).

This graph show months of supply (through July 2010) and the annualized change in the Case-Shiller Composite 20 house price index (through May 2010).

Below 6 months of supply (blue line) house prices are typically rising (black line).

Above 6 or 7 months of supply, house prices are usually falling. This isn't perfect - it is just a guideline. Over the last year, there have been many programs aimed at supporting house prices, and house prices increased slightly even with higher than normal supply. However those programs have mostly ended.

This is a key reason why I expect house prices to fall further later this year as measured by the Case-Shiller and CoreLogic repeat sales house price indexes, although I don't expect huge declines like in 2008. My expectation is further price declines of 5% to 10% on the repeat sales indexes.

Notes: The Case-Shiller house price index for June will be reported next week (really a 3 month average of April, May and June). We really want to see prices for July - and those will not be reported until the end of September. And once again the July numbers will be a 3 month average. So it might take until the end of October to see the price declines that are already happening in the housing market.

Existing Home Sales lowest since 1996, 12.5 months of supply

by Calculated Risk on 8/24/2010 10:00:00 AM

The NAR reports: July Existing-Home Sales Fall as Expected but Prices Rise

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, dropped 27.2 percent to a seasonally adjusted annual rate of 3.83 million units in July from a downwardly revised 5.26 million in June, and are 25.5 percent below the 5.14 million-unit level in July 2009.

Sales are at the lowest level since the total existing-home sales series launched in 1999, and single family sales – accounting for the bulk of transactions – are at the lowest level since May of 1995.

...

Total housing inventory at the end of July increased 2.5 percent to 3.98 million existing homes available for sale, which represents a 12.5-month supply at the current sales pace, up from an 8.9-month supply in June.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July 2010 (3.83 million SAAR) were 27.2% lower than last month, and were 25.5% lower than July 2009 (5.14 million SAAR).

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory increased to 3.98 million in July from 3.89 million in June. The all time record high was 4.58 million homes for sale in July 2008.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory increasing in the spring and into the summer. I'll have more on inventory later ...

The last graph shows the 'months of supply' metric.

The last graph shows the 'months of supply' metric.Months of supply increased to 12.5 months in July from 8.9 months in June. A normal market has under 6 months of supply, so this is extremely high and suggests prices, as measured by the repeat sales indexes like Case-Shiller and CoreLogic, will start declining.

Ignore the median price! Double digit supply and lowest sales rate since 1996 are the key stories.

I'll have more soon.

Friday, July 23, 2010

Existing Home Sales: Still above historical median

by Calculated Risk on 7/23/2010 05:11:00 PM

It might be a little surprising, but existing home sales are still above the historical median level of the last 40 years as a percent of owner occupied units ...

Click on graph for larger image in new window.

The first graph shows existing home sales on an annual basis, and end of year inventory. For 2010, sales are estimated at 5.0 million units and year end inventory at 3.4 million units (currently 4.0 million in June, but inventory will decline seasonally).

The second graph shows the same information normalized by the number of owner occupied units. Because of the high number of low end foreclosures (investor buying), and various government programs (tax credit, etc.) the number of existing home sales have stayed fairly high.

Because of the high number of low end foreclosures (investor buying), and various government programs (tax credit, etc.) the number of existing home sales have stayed fairly high.

The median for sales is about 6.1% of owner occupied units or currently about 4.6 million sales per year.

The median for inventory is about 3.1% of owner occupied units or just over 2.3 million units (about 6 months of inventory).

As distressed sales move into the mid-to-high priced areas and investor activity declines, I expect turnover will slow, and overall sales will probably decline to the median level over the next year or two. This is below most forecasts ...

The NAR forecast for 2011 is 5.6 million existing home sales. So I'll take the under.

Thursday, July 22, 2010

Existing Home Sales decline in June

by Calculated Risk on 7/22/2010 10:00:00 AM

The NAR reports: Existing-Home Sales Slow in June but Remain Above Year-Ago Levels

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, fell 5.1 percent to a seasonally adjusted annual rate of 5.37 million units in June from 5.66 million in May, but are 9.8 percent higher than the 4.89 million-unit pace in June 2009.

...

Total housing inventory at the end of June rose 2.5 percent to 3.99 million existing homes available for sale, which represents an 8.9-month supply at the current sales pace, up from an 8.3-month supply in May.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June 2010 (5.37 million SAAR) were 5.1% lower than last month, and were 9.8% higher than June 2009 (4.89 million SAAR).

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory increased to 3.99 million in June from 3.89 million in May. The all time record high was 4.58 million homes for sale in July 2008.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory increasing in the spring and into the summer. I'll have more on inventory later ...

The last graph shows the 'months of supply' metric.

The last graph shows the 'months of supply' metric.Months of supply increased to 8.9 months in June from 8.3 months in May. A normal market has under 6 months of supply, so this is already high - and probably excludes some substantial shadow inventory. And the months of supply will increase sharply next month when sales collapse.

I'll have more ...

Wednesday, July 21, 2010

WSJ: Housing Market Stumbles

by Calculated Risk on 7/21/2010 08:55:00 AM

Nick Timiraos and Robbie Whelan write at the WSJ Housing Market Stumbles. A few excerpts:

The Wall Street Journal's quarterly survey of housing-market conditions in 28 major metropolitan areas shows that inventory levels have grown in many markets.A few comments:

... newly signed contracts in May and June have plunged. ...

More broadly, the housing market faces two big problems: too many homes and falling demand.

Monday, July 19, 2010

Lawler: Preview on Existing Home Sales

by Calculated Risk on 7/19/2010 03:10:00 PM

CR Note: Last month, housing economist Tom Lawler's forecast was well below the consensus of 6.2 million (SAAR) for May and close to the actual reported existing home sales (he does a bottom up calculation every month, and he has been very close). Here is his preview for this month:

The pace of existing home sales in June varied dramatically across the country in June, with some of the difference reflecting the pace of closings of contracts signed to beat the federal home buyer tax credit. Long Island was a “standout” to the upside, with home closings in June coming in at 73.8% higher than last June, reflecting the longer-than-national norm time to close signed contracts. Most other markets saw materially slower YOY sales growth in June compared to May, with a number of areas seeing YOY declines. And many markets where a year ago sales were dominated by foreclosure sales saw YOY sales declines, with the drops mainly reflecting significantly lower foreclosure sales.

Based on all the data I have so far, I estimate that existing home sales ran at a seasonally adjusted annual rate of about 5.3 million in June, down about 6.4% from May’s pace. July sales, of course, will see a MUCH bigger drop.

On the inventory front, the local realtor/MLS were on balance consistent with my national tracking, which showed active residential listings up about 1.6% from May. I don’t know if the NAR data will show the same thing however; the NAR apparently doesn’t use available national listings but instead uses reports from the sample of realtor/MLS groups it gets each month, and uses that to “gross up” total inventory in a fashion that clearly produces some “spurious” volatility.

CR Note: this was from housing economist Tom Lawler. The National Association for Realtors (NAR) will release the June existing home sales report on Thursday. The consensus is for a decline to 5.3 million sales in June (SAAR, seasonally adjusted annual rate).