by Calculated Risk on 1/31/2010 10:43:00 PM

Sunday, January 31, 2010

Next Stimulus: $100 Billion

Note: earlier posts:

From the Financial Times: Obama plans $100bn jobs push

Robert Gibbs, ... called for a bill “somewhere in the $100bn range” ... Mr Obama championed the idea of a jobs bill in his State of the Union address last week – calling for $30bn for community bank lending to small businesses, a new small business tax credit and a tax incentive for all businesses to invest ...And from the LA Times: Obama pairs a push for jobs with proposed spending cuts

excerpted with permission

The details aren't clear, but this is smaller than the bill approved by the House of Representatives in December.

Is this really "Walking Away"?

by Calculated Risk on 1/31/2010 06:51:00 PM

The NY Post has an article: I'm walking from my underwater mortgage

I stopped paying my $1,450-a-month mortgage ... in September 2008 -- after making the hard decision to walk away from my mortgage because it is hopelessly underwater.First, "walking away" usually means the homeowner can afford to pay their mortgage, but are choosing to strategically default (or in the language of servicers "ruthlessly default") simply because they owe more than their home is worth.

... in this case I had no practical solutions to my financial dilemma -- I lost my job, was turned down for a mortgage modification and owed a lot more than the house is worth.

I am a single parent with three children, one with medical issues. So, with only unemployment benefits and child-support money, I decided to pull the plug on my mortgage payments.

...

This house originally cost $100,000. In 2005, as the housing market heated up and I needed cash, I refinanced it. An appraiser said it was worth $154,000 ... I cashed out the house at that value.

Today, with the housing market in bad shape, the house is worth about $120,000. On top of that, it is starting to fall apart.

This homeowner lost her job and has other financial issues. Yes, she owes more than her house is worth, but this sounds like a normal foreclosure caused by financial distress.

Second, why is her mortgage payment $1,450 per month on a $154,000 mortgage? Is that a 10%+ interest rate? Is this PITI? Is there a 2nd with Tony Soprano? Perhaps the reporter could have explained this a little better.

Third, if she stopped paying her mortgage in September 2008, what has the bank been doing?

There are no foreclosure signs up -- because there is no bank forcing it.Why isn't the bank foreclosing? What are the foreclosure laws in Pennsylvania? Are these recourse loans? Why isn't the reporter asking questions?

The only good thing about this article is it gives me an excuse to link to Tanta's advice to reporters from two years ago: Let's Talk about Walking Away

I actually believe that reporters should never abandon their skepticism anywhere, including here. ... the danger arises that an "echo chamber" starts to create conventional wisdom about default behavior, which may be hard to challenge if it turns out to be a bit of an exaggeration.

Weekly Summary and a Look Ahead

by Calculated Risk on 1/31/2010 02:38:00 PM

The most anticipated economic release this week is the BLS employment report on Friday. The consensus is for a small net gain in payroll jobs in January, on a seasonally adjusted (SA) basis, and the unemployment rate flat at 10.0%. My guess is the report will still show net job losses, and the unemployment rate will increase slightly. We will have a better idea after the ADP and ISM reports are released earlier in the week.

Two points on the employment report: 1) the annual benchmark revision for March 2009 will be released as part of the report. This will probably show over 800,000 more jobs lost than the original reports (my graphs will include the revisions), and 2) January is heavily adjusted for seasonal factors - even in good years there are around 2.5 million payroll jobs lost in January. The SA number is the one to follow.

On Monday the BEA will release the Personal Income and Spending report for December. The quarterly data was released on Friday, along with the GDP report, so we already have a good idea for December. Along with this release, the BEA will release supplemental data for hotel, office and mall investment.

Also on Monday the ISM Manufacturing report for January will be released (expectations are for a small decline from 55.9), construction spending for December (another decline is expected), and possibly the Fed's Senior Loan Officers’ Survey.

On Tuesday, auto sales for January will be reported (expect a small decline to under 11 million SAAR), Personal Bankruptcy Filings for January, Pending Home sales, and the Q4 Housing Vacancies and Homeownership report from the Census Bureau (expect a record vacancy rate). Also on vacancies, the NMHC Quarterly Survey of Apartment Market Conditions will probably be released this week.

On Wednesday, the ADP employment report (estimates are for around 40,000 jobs lost) will be released and the ISM non-manufacturing report (small increase expected).

On Thursday, Jobless Claims and Factory Orders.

And then on Friday, the BLS employment report, consumer credit and more bank failures.

And a summary of last week ...

From the BEA:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 5.7 percent in the fourth quarter of 2009, (that is, from the third quarter to the fourth quarter), according to the "advance" estimate released by the Bureau of Economic Analysis.And from my comments on the Q4 GDP report:

Any analysis of the Q4 GDP report has to start with the change in private inventories. This change contributed a majority of the increase in GDP, and annualized Q4 GDP growth would have been 2.3% without the transitory increase from inventory changes.

Unfortunately - although expected - the two leading sectors, residential investment (RI) and personal consumption expenditures (PCE), both slowed in Q4.PCE slowed from 2.8% annualized growth in Q3 to 2.0% in Q4. RI slowed from 18.9% in Q3 to just 5.7% in Q4.

...

The transitory boost from inventory changes is frequently a great kick start to the economy at the beginning of a recovery - as long as the leading sectors (PCE and RI) are also picking up. This report has to be viewed as concerning ... and is reminiscent of Q1 1981 and Q1 2002 ... both examples of inventory changes making large contributions to GDP, but underlying growth remained weak.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in Dec 2009 (5.45 million SAAR) were 16.7% lower than last month, and were 15% higher than Dec 2008 (4.74 million SAAR).

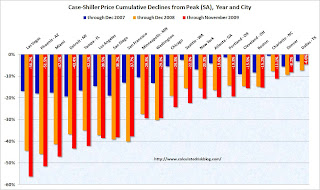

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).The Composite 10 index is off 30.4% from the peak, and up about 0.2% in November.

The Composite 20 index is off 29.5% from the peak, and up 0.2% in November.

Prices decreased (SA) in 6 of the 20 Case-Shiller cities in October.

Prices decreased (SA) in 6 of the 20 Case-Shiller cities in October. In Las Vegas, house prices have declined 56.2% from the peak. At the other end of the spectrum, prices in Dallas are only off about 4.6% from the peak. Several cities are showing price increases in 2009 including San Diego, San Francisco, Denver and Dallar. Prices have declined by double digits from the peak in 18 of the 20 Case-Shiller cities.

This graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

This graph shows monthly new home sales (NSA - Not Seasonally Adjusted).Note the Red columns for 2009. In December 2009, a record low 23 thousand new homes were sold (NSA); this ties the previous record low set in December 1966.

Sales in December 2008 were at 26 thousand.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now only 4% above the low in January.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now only 4% above the low in January. Sales of new one-family houses in December 2009 were at a seasonally adjusted annual rate of 342,000 ... This is 7.6 percent (±14.6%)* below the revised November rate of 370,000 and is 8.6 percent (±15.2%)* below the December 2008 estimate of 374,000.

Fannie Mae reported this week that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.29% in November, up from 4.98% in October - and up from 2.13% in November 2008.

Fannie Mae reported this week that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.29% in November, up from 4.98% in October - and up from 2.13% in November 2008.Some of these loans are in modification programs, but this is quite a hockey stick!

The owners of Stuyvesant Town and Peter Cooper Village ... have decided to turn over the properties to creditors, officials said Monday morning.

Best wishes to all.

TARP Inspector General: Government Programs "risk re-inflating bubble"

by Calculated Risk on 1/31/2010 11:01:00 AM

To the extent that the crisis was fueled by a “bubble” in the housing market, the Federal Government’s concerted efforts to support home prices risk re-inflating that bubble in light of the Government’s effective takeover of the housing market through purchases and guarantees, either direct or implicit, of nearly all of the residential mortgage market.From Office of the Special Inspector General for the Troubled Asset Relief Program: Quarterly Report to Congress, January 30, 2010 (ht Ronald Orol, MarketWatch)

The following SIGTARP table shows the government support of the residential market (note: a few smaller program are not included for simplicity). This is from Section 3 of the report that discusses these programs:

Section 3 concludes:

Mechanisms for Supporting Home Prices

Supporting home prices is an explicit policy goal of the Government. As the White House stated in the announcement of HAMP for example, “President Obama’s programs to prevent foreclosures will help bolster home prices.”384

In general, housing obeys the laws of supply and demand: higher demand leads to higher prices. Because increasing access to credit increases the pool of potential home buyers, increasing access to credit boosts home prices. The Federal Reserve can thus boost home prices by either lowering general interest rates or purchasing mortgages and MBS. Both actions, which the Federal Reserve is pursuing, have the effect of lowering interest rates, which increases demand by permitting borrowers to afford a higher home price on a given income. Similarly, the Administration is boosting home prices by encouraging bank lending (such as through TARP) and by instituting purchase incentives such as the First-Time Homebuyer Tax Credit. All of these actions increase the demand for homes, which increases home prices. In addition to direct Government activity, home prices can be lifted by general expectations among homebuyers of future price increases. Figure 3.7 provides a graphic representation of the relationship between possible Government actions and their impact on home prices.

This flow chart from the report shows the possible mechanisms for supporting house prices.

This flow chart from the report shows the possible mechanisms for supporting house prices.We've been discussing this for some time, and there is a good chance that house prices will fall further as the government support is withdrawn since house prices appear too high based on price-to-income and price-to-rent ratios.

Other key points:

• To the extent that huge, interconnected, “too big to fail” institutions contributed to the crisis, those institutions are now even larger, in part because of the substantial subsidies provided by TARP and other bailout programs.

• To the extent that institutions were previously incentivized to take reckless risks through a “heads, I win; tails, the Government will bail me out” mentality, the market is more convinced than ever that the Government will step in as necessary to save systemically significant institutions. This perception was reinforced when TARP was extended until October 3, 2010, thus permitting Treasury to maintain a war chest of potential rescue funding at the same time that banks that have shown questionable ability to return to profitability (and in some cases are posting multi-billion-dollar losses) are exiting TARP programs.

• To the extent that large institutions’ risky behavior resulted from the desire to justify ever-greater bonuses — and indeed, the race appears to be on for TARP recipients to exit the program in order to avoid its pay restrictions — the current bonus season demonstrates that although there have been some improvements in the form that bonus compensation takes for some executives, there has been little fundamental change in the excessive compensation culture on Wall Street.

Volcker: "How to Reform Our Financial System"

by Calculated Risk on 1/31/2010 08:46:00 AM

Here is an OpEd in the NY Times from Paul Volcker: How to Reform Our Financial System

A few excerpts:

The further proposal set out by the president recently to limit the proprietary activities of banks approaches the problem from a complementary direction. The point of departure is that adding further layers of risk to the inherent risks of essential commercial bank functions doesn’t make sense, not when those risks arise from more speculative activities far better suited for other areas of the financial markets.And Volcker concludes:

The specific points at issue are ownership or sponsorship of hedge funds and private equity funds, and proprietary trading — that is, placing bank capital at risk in the search of speculative profit rather than in response to customer needs. Those activities are actively engaged in by only a handful of American mega-commercial banks, perhaps four or five. Only 25 or 30 may be significant internationally.

Apart from the risks inherent in these activities, they also present virtually insolvable conflicts of interest with customer relationships, conflicts that simply cannot be escaped by an elaboration of so-called Chinese walls between different divisions of an institution. The further point is that the three activities at issue — which in themselves are legitimate and useful parts of our capital markets — are in no way dependent on commercial banks’ ownership. These days there are literally thousands of independent hedge funds and equity funds of widely varying size perfectly capable of maintaining innovative competitive markets. Individually, such independent capital market institutions, typically financed privately, are heavily dependent like other businesses upon commercial bank services, including in their case prime brokerage. Commercial bank ownership only tilts a “level playing field” without clear value added.

emphasis added

I am well aware that there are interested parties that long to return to “business as usual,” even while retaining the comfort of remaining within the confines of the official safety net. They will argue that they themselves and intelligent regulators and supervisors, armed with recent experience, can maintain the needed surveillance, foresee the dangers and manage the risks.There is much more in the piece, but Volcker makes it clear:

In contrast, I tell you that is no substitute for structural change, the point the president himself has set out so strongly.

I’ve been there — as regulator, as central banker, as commercial bank official and director — for almost 60 years. I have observed how memories dim. Individuals change. Institutional and political pressures to “lay off” tough regulation will remain — most notably in the fair weather that inevitably precedes the storm.

The implication is clear. We need to face up to needed structural changes, and place them into law. To do less will simply mean ultimate failure — failure to accept responsibility for learning from the lessons of the past and anticipating the needs of the future.

1) There are huge competitive advantages of being "too big to fail", so naturally these banks want to continue with "business as usual".

2) Although improved regulation and capital requirements are important, structural changes are critical.

Saturday, January 30, 2010

Daily Show: CNBC Financial Advice

by Calculated Risk on 1/30/2010 10:31:00 PM

A little flashback from Jon Stewart: CNBC Financial Advice

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| CNBC Financial Advice | ||||

| www.thedailyshow.com | ||||

| ||||

FDIC Bank Failure Update

by Calculated Risk on 1/30/2010 05:44:00 PM

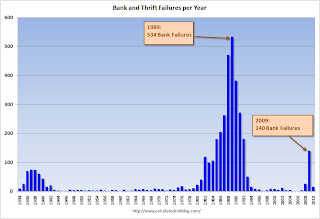

There have been 183 bank failures in this cycle (starting in 2007):

| FDIC Bank Failures by Year | 2007 | 3 |

|---|---|

| 2008 | 25 |

| 2009 | 140 |

| 2010 | 15 |

| Total | 183 |

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows bank failures by week in 2008, 2009 and 2010.

The FDIC is off to a fast start in 2010.

My prediction is the FDIC will close more banks in 2010 than in 2009 (more than 140), but fewer banks than in 1989 - peak of the S&L crisis (534 banks).

The second graph shows bank failures by year since the FDIC was started.

The second graph shows bank failures by year since the FDIC was started.The 140 bank failures last year was the highest total since 1992 (181 bank failures).

And since people always ask, the third graph is of bank failures by number of institutions and assets, from the December Congressional Oversight Panel’s Troubled Asset Relief Program report.

Note: This is through Nov 30th for 2009.

Note: This is through Nov 30th for 2009.From the report (page 45):

Figure 11 shows numbers of failed banks, and total assets of failed banks since 1970. It shows that, although the number of failed banks was significantly higher in the late 1980s than it is now, the aggregate assets of failed banks during the current crisis far outweighs those from the 1980s. At the high point in 1988 and 1989, 763 banks failed, with total assets of $309 billion.167 Compare this to 149 banks failing in 2008 and 2009, with total assets of $473 billion.168Note: This is in 2005 dollars and this includes the failure of WaMu in 2008 with $307 billion in assets that didn't impact the DIF.

I'll update the losses for the Deposit Insurance Fund (DIF) over the next few weeks.

Summers: "Statistical recovery and a human recession"

by Calculated Risk on 1/30/2010 02:16:00 PM

Quote of the day ...

""What we see in the United States and some other economies is a statistical recovery and a human recession."

Larry Summers, Davos, Jan 30, 2010 (via CNBC) Click on graph for larger image in new winder.

Click on graph for larger image in new winder.

This graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The current employment recession is the worst since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

And the graph is before the annual benchmark revision that will be announced next Friday, and is expected to show the loss of an additional 824,000 jobs.

Investment Contributions to GDP: Leading and Lagging

by Calculated Risk on 1/30/2010 11:15:00 AM

By request, the following graph is an update to: The Investment Slump in Q2

The following graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Residential Investment (RI) has made a positive contribution to GDP the last two quarters, and the rolling four quarter change is moving up.

Equipment and software investment made a small positive contribution to GDP in Q3, and a larger contribution in Q4. The four quarter average is also moving up.

As expected, nonresidential investment in structures is now declining sharply as major projects are completed. The economy will recover long before nonresidential investment in structures recovers.

And as always, residential investment is the best leading indicator for the economy.

NPR: To Stay Or Walk Away

by Calculated Risk on 1/30/2010 08:53:00 AM

Here is an interesting podcast from NPR's Planet Money: To Stay Or Walk Away

NPR's Alex Blumberg and Chana Joffe-Walt interview Arizona attorney Mary Kinsley. She describes how a couple years ago homeowners would call her, in tears, trying desperately to save their homes from foreclosure.

Now homeowners call, their voices calm, and ask her the best way to strategically default - and in some cases how to get the banks to take back the houses they've been delinquent on for over a year. Pretty amazing. She thinks this is just the beginning of "walking away".

P.S. I appreciate the mention!

Friday, January 29, 2010

Unofficial Problem Bank List increases to 599

by Calculated Risk on 1/29/2010 10:29:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Changes and comments from surferdude808:

The Unofficial Problem Bank List underwent significant changes since last as a net 15 institutions were added. Twenty-six institutions were added while 11 institutions were removed because of failure. Please note that the six failures were removed along with the five last Friday. Usually, failures are removed with a one-week lag.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

After these changes, the list stands at 599 institutions with aggregate assets of $322.5 billion, up from 584 institutions with assets of $305.3 billion last week.

Among the eleven failures are First Regional Bank ($2.2 billion); Charter Bank ($1.25 billion); Community Bank & Trust ($1.2 billion); Columbia River Bank ($1.1 billion); Florida Community Bank ($875 million); and First National Bank of Georgia ($833 million).

The 26 institutions added this week have aggregate assets of $25.9 billion. Notable among the additions are Flagstar Bank, FSB, Troy, MI ($14.8 billion); The Stillwater National Bank and Trust Company, Stillwater, OK ($2.7 billion); Guaranty Bank and Trust Company, Denver, CO ($2.1 billion); Fireside Bank, Pleasanton, CA ($1.0 billion); Darby Bank & Trust Co., Vidalia, GA ($909 million); and LibertyBank, Eugene, OR ($856 million).

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #15: American Marine Bank, Bainbridge Island, Washington

by Calculated Risk on 1/29/2010 09:04:00 PM

The first month of twenty ten

Not a record....yet.

by Soylent Green is People

From the FDIC: Columbia State Bank, Tacoma, Washington, Assumes All of the Deposits of American Marine Bank, Bainbridge Island, Washington

American Marine Bank, Bainbridge Island, Washington, was closed today by the Washington Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...That makes six.

As of September 30, 2009, American Marine Bank had approximately $373.2 million in total assets and $308.5 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $58.9 million. ... American Marine Bank is the 15th FDIC-insured institution to fail in the nation this year, and the third in Washington. The last FDIC-insured institution closed in the state was Evergreen Bank, Seattle, on January 22, 2010.

Bank Failure #14: First Regional Bank, Los Angeles, California

by Calculated Risk on 1/29/2010 07:51:00 PM

Gobbled up by East coast bank.

Zero near partners?

by Soylent Green is People

From the FDIC: First-Citizens Bank & Trust Company, Raleigh, North Carolina, Assumes All of the Deposits of First Regional Bank, Los Angeles, California

First Regional Bank, Los Angeles, California, was closed today by the California Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Five down, at almost a $2 billion cost to DIF.

As of September 30, 2009, First Regional Bank had approximately $2.18 billion in total assets and $1.87 billion in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $825.5 million. ... First Regional Bank is the 14th FDIC-insured institution to fail in the nation this year, and the first in California. The last FDIC-insured institution closed in the state was Imperial Capital Bank, La Jolla, on December 18, 2009.

Bank Failure #13 in 2010: Community Bank and Trust, Cornelia, Georgia

by Calculated Risk on 1/29/2010 07:03:00 PM

"Community" is spot on.

Loss, absorbed by all.

by Soylent Green is People

From the FDIC: SCBT, N.A., Orangeburg, South Carolina, Assumes All of the Deposits of Community Bank and Trust, Cornelia, Georgia

Community Bank and Trust, Cornelia, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Four down and about $1 billion in losses today ...

As of September 30, 2009, Community Bank and Trust had approximately $1.21 billion in total assets and $1.11 billion in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $354.5 million. .... Community Bank and Trust is the 13th FDIC-insured institution to fail in the nation this year, and the second in Georgia. The last FDIC-insured institution closed in the state was First National Bank of Georgia, Carrollton, earlier today.

Bank Failures #10 to #12: Georgia, Florida, and Minnesota

by Calculated Risk on 1/29/2010 06:23:00 PM

Frail green shoots die each weeks end

Three more banks are hushed

by Soylent Green is People

From the FDIC: Community & Southern Bank, Carrollton, Georgia, Assumes All of the Deposits of First National Bank of Georgia, Carrollton, Georgia

First National Bank of Georgia, Carrollton, Georgia, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: Premier American Bank, National Association, Miami Florida, Assumes All of the Deposits of Florida Community Bank, Immokalee, Florida

As of September 30, 2009, First National Bank of Georgia had approximately $832.6 million in total assets and $757.9 million in total deposits....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $260.4 million. ... First National Bank of Georgia is the tenth FDIC-insured institution to fail in the nation this year, and the first in Georgia. The last FDIC-insured institution closed in the state was Rockbridge Commercial Bank, Atlanta, on December 18, 2009.

Florida Community Bank, Immokalee, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: United Valley Bank, Cavalier, North Dakota, Assumes All of the Deposits of Marshall Bank, National Association, Hallock, Minnesota

As of September 30, 2009, Florida Community Bank had approximately $875.5 million in total assets and $795.5 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $352.6 million. .... Florida Community Bank is the 11th FDIC-insured institution to fail in the nation this year, and the second in Florida. The last FDIC-insured institution closed in the state was Premier American Bank, Miami, on January 22, 2010.

Marshall Bank, National Association, Hallock, Minnesota, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of September 30, 2009, Marshall Bank, N.A. had approximately $59.9 million in total assets and $54.7 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $4.1 million. ... Marshall Bank, National Association is the 12th FDIC-insured institution to fail in the nation this year, and the second in Minnesota. The last FDIC-insured institution closed in the state was St. Stephen State Bank, St. Stephen, on January 15, 2010.

Market Update

by Calculated Risk on 1/29/2010 04:15:00 PM

Since it is the end of January ... here is a market update: Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today. The S&P 500 was first at this level in March 1998; almost 12 years ago.

The market is off 6.6% from the recent peak - not even a correction yet, but keep your Dow 10K hats at the ready (the Dow is down to 10,067)!

The S&P 500 is up 59% from the bottom in 2009 (397 points), and still off 31% from the peak (491 points below the max).

The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Real GDP: Declines from Prior Peak

by Calculated Risk on 1/29/2010 03:21:00 PM

This is an update to a graph I posted in early 2009 ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the real GDP declines from the prior peak for post WWII recessions.

The recent recession was the worst since WWII (the peak decline was 3.83% in Q2 2009).

Even after the strong GDP growth in Q4 (due to inventory changes), current GDP is still 1.9% below the prior peak in real terms. If the recovery is sluggish - as I expect - it will take several more quarters to return to the pre-recession peak in real GDP.

Restaurant Index Improves in December

by Calculated Risk on 1/29/2010 01:24:00 PM

Note: This index is based on year-over-year performance, and the headline index might be slow to recognize a pickup in business.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Unfortunately the data for this index only goes back to 2002.

Note: Any reading below 100 shows contraction for this index.

This is the highest level in almost two years, but the current situation index still suggests contraction in the restaurant industry.

From the National Restaurant Association (NRA): December Restaurant Performance Index Rose to Highest Level in Nearly Two Years

[T]he Association’s Restaurant Performance Index (RPI) ... stood at 98.7 in December, up 0.9 percent from November and its strongest level in nearly two years.

“The RPI’s strong gain in December was the result of broad-based improvements among several index components,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the National Restaurant Association. “Although restaurant operators continued to report a net decline in same-store sales and customer traffic, both registered their strongest performances since the summer of 2008.”

“Along with a solid improvement among the current situation indicators, restaurant operators are increasingly optimistic about industry growth in the months ahead,” Riehle added. “More than a third of restaurant operators expect to their sales to improve in six months, the highest level in more than two years.”

... The full report is available online. ...

... Index values above 100 indicate that key industry indicators are in a period of expansion, and index values below 100 represent a period of contraction for key industry indicators. Despite the solid improvement in December, the RPI remained below 100 for the 26th consecutive month.

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 97.3 in December – up a strong 1.4 percent from November and its highest level since August 2008. However, December still represented the 28th consecutive month below 100, which signifies contraction in the current situation indicators.

...

Restaurant operators also reported an improving customer traffic performance in December. Thirty percent of restaurant operators reported an increase in customer traffic between December 2008 and December 2009, up from just 21 percent who reported higher customer traffic in November. Forty-seven percent of operators reported a traffic decline in December, down from 62 percent who reported lower traffic in November.

Although restaurant operators reported stronger sales and traffic results in December, capital spending activity continued to drop off. ...

emphasis added

A Few Comments on Q4 GDP Report

by Calculated Risk on 1/29/2010 10:57:00 AM

Any analysis of the Q4 GDP report has to start with the change in private inventories. This change contributed a majority of the increase in GDP, and annualized Q4 GDP growth would have been 2.3% without the transitory increase from inventory changes.

Unfortunately - although expected - the two leading sectors, residential investment (RI) and personal consumption expenditures (PCE), both slowed in Q4.

Note: for more on leading and lagging sectors, see Business Cycle: Temporal Order and Q1 GDP Report: The Good News.

It is not a surprise that both key leading sectors are struggling. The personal saving rate increased slightly to 4.6% in Q4, and I expect the saving rate to increase over the next year or two to around 8% - as households repair their balance sheets - and that will be a constant drag on PCE.

And there is no reason to expect a sustained increase in RI until the excess housing inventory is absorbed. In fact, based on recent reports of housing starts and new home sales, there is a good chance that residential investment will be a slight drag on GDP in Q1 2010.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graphs shows Residential investment (RI) as a percent of GDP since 1947.

RI had declined for 14 consecutive quarters before the increase in Q3 2009. The Q4 report puts RI as a percent of GDP at just over 2.5%, barely above the record low - since WWII - set in Q2 2009.

Notice that RI usually recovers very quickly coming out of a recession. This time RI is moving sideways - not a good sign for a robust recovery in 2010.

The second graph shows non-residential investment as a percent of GDP.

The second graph shows non-residential investment as a percent of GDP.Business investment in equipment and software increased 13.3% (annualized). This is a good sign, but continued investment probably depends on increases in underlying demand.

Investment in non-residential structures was only off 15.4% (annualized) and will probably be revised down (this has happened for the last few quarters). I expect non-residential investment in structures to continue to decline sharply over the next several quarters. In previous downturns the economy recovered long before nonresidential investment in structures recovered - and that will probably be true again this time.

When the supplemental data is released, I'll post graphs of investment in retail, offices, and hotels, and a breakdown of residential investment.

The transitory boost from inventory changes is frequently a great kick start to the economy at the beginning of a recovery - as long as the leading sectors (PCE and RI) are also picking up. This report has to be viewed as concerning ... and is reminiscent of Q1 1981 and Q1 2002 ... both examples of inventory changes making large contributions to GDP, but underlying growth remained weak.

BEA: GDP Increases at 5.7% Annual Rate in Q4

by Calculated Risk on 1/29/2010 08:30:00 AM

As expected, GDP growth in Q4 was driven by changes in private inventories, adding 3.39% to GDP.

From the BEA:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 5.7 percent in the fourth quarter of 2009, (that is, from the third quarter to the fourth quarter), according to the "advance" estimate released by the Bureau of Economic Analysis.This is very close to my expectations and shows a fairly weak economy (real PCE increase 2.0%). The question is: what happens in 2010?

...

The increase in real GDP in the fourth quarter primarily reflected positive contributions from private inventory investment, exports, and personal consumption expenditures (PCE). Imports, which are a subtraction in the calculation of GDP, increased.

The acceleration in real GDP in the fourth quarter primarily reflected an acceleration in private inventory investment, a deceleration in imports, and an upturn in nonresidential fixed investment that were partly offset by decelerations in federal government spending and in PCE.

...

Real personal consumption expenditures increased 2.0 percent in the fourth quarter, compared with an increase of 2.8 percent in the third.

...

Real nonresidential fixed investment increased 2.9 percent in the fourth quarter, in contrast to a decrease of 5.9 percent in the third. Nonresidential structures decreased 15.4 percent, compared with a decrease of 18.4 percent. Equipment and software increased 13.3 percent, compared with an increase of 1.5 percent. Real residential fixed investment increased 5.7 percent, compared with an increase of 18.9 percent.

I'll have some more on GDP and investment later ...

Thursday, January 28, 2010

Fed MBS Purchases by Week

by Calculated Risk on 1/28/2010 10:41:00 PM

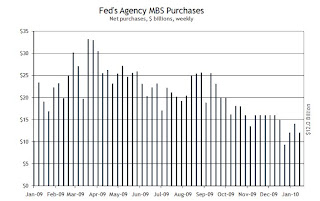

This graph from the Atlanta Fed weekly Financial Highlights shows the Fed MBS purchases by week:  Click on graph for larger image.

Click on graph for larger image.

From the Atlanta Fed:

The Fed purchased an additional $12 billion net in MBS over the last week, bringing the total to $1.164 trillion or just over 93% complete.The Fed purchased a net total of $12 billion of agency-backed MBS through the week of January 20. This purchase brings its total purchases up to $1.152 trillion, and by the end of the first quarter 2010 the Fed will have purchased $1.25 trillion (thus, it is 92% complete).

This shows that the Fed has slowed down purchases significantly from earlier this year, but so has the issuance of Fannie and Freddie MBS - so I don't think the slowdown has impacted mortgage rates yet.

The second graph shows the weekly MBA refinance index. Refinance activity was very strong in the first half of 2009 (when the Fed was purchasing more agency MBS), but has since fallen off along with agency issuance.

The second graph shows the weekly MBA refinance index. Refinance activity was very strong in the first half of 2009 (when the Fed was purchasing more agency MBS), but has since fallen off along with agency issuance.It sounds like the refinance boom is ending, from the MBA this week:

“Refinance activity fell substantially last week,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “Although rates remain low, there appears to be a smaller pool of borrowers who are willing and able to refinance at today’s rates.”With 9 weeks to go, the Fed needs to average just under $10 billion in net purchases per week.

Recourse: One of the Dangers of "Walking Away"

by Calculated Risk on 1/28/2010 07:31:00 PM

From Bloomberg: Lenders Pursue Mortgage Payoffs Long After Homeowners Default

[L]enders are exercising their rights to pursue unpaid mortgage balances. To get their money, they can seize wages, tap bank accounts and put liens on other assets held by debtors.As we've discussed before, the recourse laws vary by state. As an example Florida is a recourse state, however in California purchase money is non-recourse. If the borrower walks away in California, the lender is stuck with the collateral. However, if the borrower in California refinanced their home, then the lender usually has recourse, and can pursue a judicial foreclosure (as opposed to a trustee's sale), and seek a deficiency judgment. Usually 2nd liens have recourse too.

...

While there are no statistics on the number of deficiency judgments approved by courts, the Federal Deposit Insurance Corp. tracks the amount banks collect after defaulted loans were written off.

These mortgage recoveries rose 48 percent to a record $1.01 billion in the first nine months of last year compared with the year-earlier period, according to the Washington-based regulator. Recoveries on defaulted home-equity loans almost doubled to $392 million, the FDIC data shows.

Historically lenders rarely pursued a deficiency judgment in California because the trustee's sale was much cheaper and quicker than a judicial foreclosure - and the borrowers rarely had any resources anyway. However in Florida, all foreclosures are judicial, so the lender might as well obtain a deficiency judgment too.

This is important for short sales too. All sellers should obtain the advice of a lawyer and make sure the lender waives their rights for a deficiency judgment if possible.

Update: For a few examples in California, see Greg Weston's blog on jingle mail.

Fannie Mae: Delinquencies Increase Sharply in November

by Calculated Risk on 1/28/2010 04:41:00 PM

Earlier I posted the Freddie Mac delinquency graph.

And here is the monthly Fannie Mae hockey stick graph ... (note that Fannie releases delinquency data with a one month lag to Freddie). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Fannie Mae reported today that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.29% in November, up from 4.98% in October - and up from 2.13% in November 2008.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans."

Once again it is important to note these stats do include Home Affordable Modification Program (HAMP) loans in trial modifications.

Treasury Releases new Guidance for HAMP

by Calculated Risk on 1/28/2010 02:11:00 PM

There are two key components:

1) New Requirements that Documentation be Provided Before Trial Modification Begins.

2) and guidance on Converting Borrowers in the Temporary Review Period to Permanent Modifications

From Treasury: Administration Updates Documentation Collection Process and Releases Guidance to Expedite Permanent Modifications. And the Special Directive.

1) On beginning trial modifications: The original plan allowed servicer discretion on when to place borrowers in HAMP trial modification programs. Some servicers required documentation and a first payment before putting the borrower in a trial program, others just accepted a verbal agreement over the phone. The new rules include:

Effective for all trial period plans with effective dates on or after June 1, 2010, a servicer may evaluate a borrower for HAMP only after the servicer receives the following documents, subsequently referred to as the “Initial Package”. The Initial Package includes:The trial period will start after the initial documents are received, a trial plan is sent to the borrower, and the borrower makes the initial payment.Request for Modification and Affidavit (RMA) Form, IRS Form 4506-T or 4506T-EZ, and Evidence of Income

The Treasury was initially trumpeting the number of trial modifications, but that was a poor metric of success since some servicers were just putting anyone who answered the phone in a trial modification.

2) The second key component of the directive is how to handle all the current trial modifications. For the borrowers who have not made all of their payments, the directive requires the HAMP trial program to be canceled. For borrowers who have made payments, but are missing documentation, Treasury provides some additional guidelines.

This suggests a surge of trial cancellations in February.

Hotel RevPAR off 10.3%

by Calculated Risk on 1/28/2010 01:16:00 PM

The good news for hotels is it appears the occupancy rate might be near the bottom. This week Smith Travel Research reported the occupancy rate was "virtually flat with an 0.9-percent decrease" compared to the same week in 2009.

The bad news for hotels is the average daily rate (ADR) is still falling because the occupancy rate is so low. Therefore RevPAR (revenue per available room) is still falling.

From HotelNewsNow.com: Boston leads occ., RevPAR increases in STR weekly numbers

Overall, in year-over-year measurements, the industry’s occupancy ended the week virtually flat with an 0.9-percent decrease to 46.8 percent, average daily rate dropped 9.4 percent to US$93.87, and RevPAR for the week fell 10.3 percent to finish at US$43.89.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week since 2000, and the rolling 52 week average occupancy rate.

Notes: the scale doesn't start at zero to better show the change.

The graph shows the distinct seasonal pattern for the occupancy rate; higher in the summer because of leisure/vacation travel, and lower on certain holidays. Business travel is the key over the next few months.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Freddie Mac: Delinquencies Increase Sharply in December

by Calculated Risk on 1/28/2010 11:04:00 AM

Here is the monthly Freddie Mac hockey stick graph ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Freddie Mac reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 3.87% in December 2009, up from 3.72% in November - and up from 1.72% in December 2008.

"Single-family delinquencies are based on the number of mortgages 90 days or more delinquent or in foreclosure as of period end ..."

Just more evidence of the growing delinquency problem, although some of these loans may be in the trial modification programs and are still included as delinquent until they become permanent.

Fannie Mae should report soon ...

Chicago Fed: Economic Activity Moved Lower in December

by Calculated Risk on 1/28/2010 08:55:00 AM

From the Chicago Fed: Index shows economic activity moved lower in December

Led by declines in employment-related indicators, the Chicago Fed National Activity Index decreased to –0.61 in December, down from –0.39 in November. Three of the four broad categories of indicators that make up the index moved lower, although both the production and income category and the sales, orders, and inventories category made positive contributions.

...

In contrast to the monthly index, the index’s three-month moving average, CFNAI-MA3, increased slightly to –0.61 in December from –0.68 in November. December’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend; but the level of activity remained in a range historically consistent with the early stages of a recovery following a recession.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

"When the economy is coming out of a recession, the CFNAI-MA3 moves significantly into positive territory a few months after the official NBER date of the trough. Specifically, after the onset of a recession, when the index first crosses +0.20, the recession has ended according to the NBER business cycle measures. ... The critical question is: how early does the CFNAI-MA3 reveal this turning point? For four of the last five recessions, this happened within five months of the business cycle trough."Although the CFNAI-MA3 improved slightly in December, the index is still negative. According to Chicago Fed, it is still early to call the official recession over.

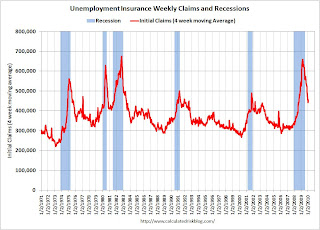

Weekly Initial Unemployment Claims: 470,000

by Calculated Risk on 1/28/2010 08:31:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Jan. 23, the advance figure for seasonally adjusted initial claims was 470,000, a decrease of 8,000 from the previous week's revised figure of 478,000. The 4-week moving average was 456,250, an increase of 9,500 from the previous week's revised average of 446,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending Jan. 16 was 4,602,000, a decrease of 57,000 from the preceding week's revised level of 4,659,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 9,500 to 456,250.

The level of the 4-week average is still relatively high and suggests continued job losses in January.

Wednesday, January 27, 2010

Jon Stewart: Obama takes on Bankers

by Calculated Risk on 1/27/2010 10:45:00 PM

NOTE: here is the New Home sales post from early this morning.

Now for a little fun ... this was last night (link here)

ALSO another great segment with Elizabeth Warren.

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Obama Takes On Bankers | ||||

| www.thedailyshow.com | ||||

| ||||

President Obama: SOTU Address at 9 PM ET

by Calculated Risk on 1/27/2010 08:36:00 PM

NOTE: here is the New Home sales post from early this morning.

Here is the WhiteHouse.gov live feed.

Here is the CNBC feed.

And a live feed from C-SPAN.

From the NY Times: Text: Obama’s State of the Union Address

Unemployment Rate and Presidential Disapproval

by Calculated Risk on 1/27/2010 06:31:00 PM

From Pew Research: It's All About Jobs, Except When It's Not

Recent history shows that the public response to all presidents has been shaped to some degree by rising or falling unemployment. However, only Ronald Reagan's ratings in his first term have borne as close a connection as have Obama's to changes in the unemployment rate.

In fact, the relationship between unemployment and presidential approval varies from crystal clear to murky. Indeed since 1981 there have been a number of times when the ties between changes in joblessness rates and public judgments of the president have been weak or even indiscernible. But the link is strongest when unemployment rises precipitously. And it weakens, or even disappears entirely, when other concerns -- such as national security -- become dominant public issues.

Click on graph for larger image in new window.

This graph shows the relationship between the unemployment rate and approval rating. The report also breaks it down by each President starting with Reagan.

Although other factors matter - like 9/11 or the Iran-Contra scandal - it mostly is "the unemployment rate, stupid!", especially when the unemployment rate is high.

DataQuick on California: Record Notices of Default filed in 2009

by Calculated Risk on 1/27/2010 03:54:00 PM

Click on graph for larger image in new window.

This graph shows the Notices of Default (NOD) by year through 2009 in California from DataQuick.

There were a record number of NODs filed in California last year, however the pace slowed in the 2nd half.

From DataQuick: Another Drop in California Mortgage Defaults

The number of California homes entering the foreclosure process declined again during fourth quarter 2009 amid signs that the worst may be over in hard-hit entry-level markets, while slowly spreading to more expensive neighborhoods. There are mixed signals for 2010: It's unclear how much of the drop in mortgage defaults is due to shifting market conditions, and how much is the result of changing foreclosure policies among lenders and loan servicers, a real estate information service reported.In terms of units, the peak of the foreclosure crisis may be over, but the mid-to-high end foreclosures are increasing - and the values of these properties is much higher than the low end starter properties. This suggests that prices may have bottomed in some low end areas, but we will see further price declines in many mid-to-high end areas.

A total of 84,568 Notices of Default ("NODs") were recorded at county recorder offices during the October-to-December period. That was down 24.3 percent from 111,689 for the prior quarter, and up 12.4 percent from 75,230 in fourth-quarter 2008, according to San Diego-based MDA DataQuick.

NODs reached an all-time high in first-quarter 2009 of 135,431, a number that was inflated by activity put off from the prior four months. In the second quarter of last year, NODs totaled 124,562. The low of recent years was in the third quarter of 2004 at 12,417, when housing market annual appreciation rates were around 20 percent.

"Clearly, many lenders and servicers have concluded that the traditional foreclosure process isn't necessarily the best way to process market distress, and that losses may be mitigated with so-called short sales or when loan terms are renegotiated with homeowners," said John Walsh, DataQuick president.

While many of the loans that went into default during fourth quarter 2009 were originated in early 2007, the median origination month for last quarter's defaulted loans was July 2006, the same month as during the prior three quarters. The median origination month during the last quarter of 2008 was June 2006. This means the foreclosure process has moved forward through one month of bad loans during the past 12 months.

"Mid 2006 was clearly the worst of the 'loans gone wild' period and it's taking a long time to work through them. We're also watching foreclosure activity start to move into more established mid-level and high-end neighborhoods. Homeowners there were able to make their payments longer than homeowners in entry-level neighborhoods, but because of the recession and job losses, that's changing. Foreclosure activity is a lagging indicator of distress," Walsh said.

The state's most affordable sub-markets, which represent 25 percent of the state's housing stock, accounted for 52.0 percent of all default activity a year ago. In fourth-quarter 2009 that fell to 34.9 percent. ...

emphasis added

FOMC Statement: No Change

by Calculated Risk on 1/27/2010 02:15:00 PM

Information received since the Federal Open Market Committee met in December suggests that economic activity has continued to strengthen and that the deterioration in the labor market is abating. Household spending is expanding at a moderate rate but remains constrained by a weak labor market, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software appears to be picking up, but investment in structures is still contracting and employers remain reluctant to add to payrolls. Firms have brought inventory stocks into better alignment with sales. While bank lending continues to contract, financial market conditions remain supportive of economic growth. Although the pace of economic recovery is likely to be moderate for a time, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability.I think the most important point in the FOMC statement was that they reiterated the ending dates for the Fed facilities and MBS purchases. The Fed is giving advance warning that these facilities will expire as previously announced. It would take a major credit or economic event to change these dates at this point.

With substantial resource slack continuing to restrain cost pressures and with longer-term inflation expectations stable, inflation is likely to be subdued for some time.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period. To provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve is in the process of purchasing $1.25 trillion of agency mortgage-backed securities and about $175 billion of agency debt. In order to promote a smooth transition in markets, the Committee is gradually slowing the pace of these purchases, and it anticipates that these transactions will be executed by the end of the first quarter. The Committee will continue to evaluate its purchases of securities in light of the evolving economic outlook and conditions in financial markets.

In light of improved functioning of financial markets, the Federal Reserve will be closing the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility, the Commercial Paper Funding Facility, the Primary Dealer Credit Facility, and the Term Securities Lending Facility on February 1, as previously announced. In addition, the temporary liquidity swap arrangements between the Federal Reserve and other central banks will expire on February 1. The Federal Reserve is in the process of winding down its Term Auction Facility: $50 billion in 28-day credit will be offered on February 8 and $25 billion in 28-day credit wil be offered at the final auction on March 8. The anticipated expiration dates for the Term Asset-Backed Securities Loan Facility remain set at June 30 for loans backed by new-issue commercial mortgage-backed securities and March 31 for loans backed by all other types of collateral. The Federal Reserve is prepared to modify these plans if necessary to support financial stability and economic growth.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Donald L. Kohn; Sandra Pianalto; Eric S. Rosengren; Daniel K. Tarullo; and Kevin M. Warsh. Voting against the policy action was Thomas M. Hoenig, who believed that economic and financial conditions had changed sufficiently that the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted.

There is some concern about what will happen when the Fed stops buying agency MBS. The important thing to remember is that there will be buyers; it is just a matter of price. My guess is that mortgage rates will rise about 35 bps relative to the Ten Year treasury when the Fed stops buying MBS. It could be more or less ...

Another important point in the Fed statement was the recognition that the housing sector is not as strong as it appeared in November or December. They just removed the language on housing:

Jan, 2010: No comment.

Dec, 2009: "The housing sector has shown some signs of improvement over recent months."

Nov, 2009: "Activity in the housing sector has increased over recent months"

One-month Treasury Bill Rates turn Negative

by Calculated Risk on 1/27/2010 12:58:00 PM

While we wait for the FOMC, there are signs of more economic weakness ... (update: this isn't a sign of a "flight to quality" or a panic - just too much money looking for a parking place).

From Bloomberg: U.S. One-Month Bill Rate Negative for First Time Since March (ht jb)

Treasury one-month bill rates turned negative for the first time in 10 months, as issuance declines while investors seek the most easily-traded securities amid a renewal of risk aversion.The Ten Year yield is back down to 3.61%.

The rate on the four-week security dropped to negative 0.0101 percent, the lowest since it reached negative 0.015 percent on March 26. The Treasury sold $10 billion of four-week bills on Jan. 26 at a rate of zero percent ...

And from the Chicago Fed: Midwest Manufacturing Output Decreased in December