by Calculated Risk on 1/27/2010 11:25:00 AM

Wednesday, January 27, 2010

More on New Home Sales and the FOMC Statement

As I mentioned in the New Home sales post this morning, the FOMC statement today will probably be changed to reflect the renewed weakness in the housing market. This includes the decline in new home sales, housing starts, and other indicators including mortgage applications and builder confidence.

The first two sentences in the last FOMC statement are no longer operative.

From the FOMC December 16, 2009 statement:

Information received since the Federal Open Market Committee met in November suggests that economic activity has continued to pick up and that the deterioration in the labor market is abating. The housing sector has shown some signs of improvement over recent months.Most indicators suggest economic activity has picked up, but the labor market and the housing sector have shown renewed signs of deterioration.

I expect the main statement points will remain the same: the target range for the federal funds rate will remain at 0 to 1/4 percent, expectations are for the MBS purchase plan to be completed by the end of the first quarter of 2010, and the "exceptionally low levels of the federal funds rate for an extended period" phrase will be included.

Here is more on the "distressing gap" between existing and new home sales.

The following graph shows the ratio of existing home sales divided by new home sales through November.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This ratio is just off from the all time high last month when existing home sales were artificially boosted by the first time home buyer tax credit.

The ratio of existing to new home sales increased at first because of the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The recent increase in the ratio was partially due to the timing of the first time home buyer tax credit (before the extension) - and partially because the tax credit spurred existing home sales more than new home sales.

On timing issues: New home sales are counted when the contract is signed, and usually before construction begins. So to close before the original Dec 1st deadline, the contract had to be signed early this Summer. Existing home sales are counted when escrow closes. And the recent surge in existing home sales was primarily due to buyers rushing to beat the tax credit.

The second graph shows the same information with existing home sales (left axis), and new home sales (right axis). This is updated through the December data released this morning.

The second graph shows the same information with existing home sales (left axis), and new home sales (right axis). This is updated through the December data released this morning.Although distressed sales will stay elevated for some time, I expect this gap to eventually close - probably from an eventual increase in new home sales and a decrease in existing home sales. This just shows the housing market is far from healthy.

New Home Sales Decline Sharply in December

by Calculated Risk on 1/27/2010 10:00:00 AM

The Census Bureau reports New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 342 thousand. This is a sharp decrease from the revised rate of 370 thousand in November (revised from 355 thousand). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. In December 2009, a record low 23 thousand new homes were sold (NSA); this ties the previous record low set in December 1966.

Sales in December 2008 were at 26 thousand.  The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now only 4% above the low in January.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now only 4% above the low in January.

Sales of new one-family houses in December 2009 were at a seasonally adjusted annual rate of 342,000 ... This is 7.6 percent (±14.6%)* below the revised November rate of 370,000 and is 8.6 percent (±15.2%)* below the December 2008 estimate of 374,000.And another long term graph - this one for New Home Months of Supply.

There were 8.1 months of supply in December. Rising, but still significantly below the all time record of 12.4 months of supply set in January.

There were 8.1 months of supply in December. Rising, but still significantly below the all time record of 12.4 months of supply set in January.The seasonally adjusted estimate of new houses for sale at the end of December was 231,000. This represents a supply of 8.1 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

Months-of-supply and inventory have both peaked for this cycle, and sales might have bottomed too. New home sales are far more important for the economy than existing home sales, and new home sales will remain under pressure until the overhang of excess housing inventory declines much further.

Obviously this is another very weak report. I expect the Fed will change their statement on housing today. I'll have more later ...

MBA: Mortgage Applications Decline

by Calculated Risk on 1/27/2010 07:39:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 10.9 percent on a seasonally adjusted basis from one week earlier. ...

“Refinance activity fell substantially last week,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “Although rates remain low, there appears to be a smaller pool of borrowers who are willing and able to refinance at today’s rates.”

The Refinance Index decreased 15.1 percent from the previous week and the seasonally adjusted Purchase Index decreased 3.3 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.02 percent from 5.00 percent, with points decreasing to 1 from 1.05 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four week moving average has declined sharply since October, and is at about the same level as September 1997. There are many cash buyers (mostly investors at the low end), but this decline in mortgage applications is significant. Also, it appears the refinance boom is ending.

Tuesday, January 26, 2010

Existing Home Inventory: A long way from Normal

by Calculated Risk on 1/26/2010 09:56:00 PM

James Hagerty at the WSJ writes about existing home inventory: Housing Momentum Builds but Perils Persist

Inventories of homes listed for sale are down sharply across the U.S. and have reached very low levels in some areas ... The decrease in supplies has sparked a return of bidding wars on lower-end properties in some neighborhoods, but the national picture is mixed.We've been discussing the bidding wars on low end properties since last spring - and that frenzy was driven by a combination of a high number of foreclosures at the low end pushing down prices (what housing economist Tom Lawler called "destickification"), and the first time home buyer tax credit. In some areas - like San Diego - the frenzy has moved up to more expensive areas.

But the national picture is still ugly.

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.29 million in December from 3.52 million in November. This is not seasonally adjusted and December is usually the lowest month of the year - and this decline was mostly seasonal.

Inventory levels are still well above normal even though the number of units For Sale has been falling for some time.

The second graph shows the year-over-year percentage change in inventory and the months of supply.

The second graph shows the year-over-year percentage change in inventory and the months of supply.Note the sharp increase in mid-2005 - that was one of the signals that helped me call the end of the boom phase of the housing bubble.

The YoY change has been negative since mid-2008, indicating that inventory is declining. However the months of supply is still above normal (usually 4 to 6 months), even with sales (the denominator) being pushed artificially high.

In a normal market, sales would be about 6% of owner occupied units per year, or close to 5 million units per year. Six months of inventory would be something under 2.5 million units - so at 3.3 million, the level of inventory is still a long way from normal. And this doesn't include all the various shadow inventory that will come on the market.

In a normal year, inventory starts to increase in January (many homeowners remove their homes from the market during the holidays). I wouldn't be surprised if the YoY change was no longer negative some time early in 2010. And I'd expect inventory levels to be above normal levels for an extended period.

BofA signs up for HAMP Second Lien Program

by Calculated Risk on 1/26/2010 06:32:00 PM

From BofA: Bank of America Becomes First Mortgage Servicer to Sign Contract for Home Affordable Second-Lien Modification Program

Bank of America announced that it is the first mortgage servicer to sign an agreement formally committing to participation in the pending second-lien component of the federal government's Home Affordable Modification Program (HAMP)And more from HousingWire: BofA Signs up as First Servicer for HAMP Second Lien Program

...

Bank of America has systems in place to begin implementing the Second Lien Modification Program (2MP) with the release of final program policies and guidelines by federal regulatory agencies, which is expected soon. 2MP will require modifications that reduce the monthly payments on qualifying home equity loans and lines of credit under certain conditions, including completion of a HAMP modification on the first mortgage on the property.

This program was announced in April 2009, and is still in process. Here are the guidelines for the HAMP 2nd lien program. I don't have high hopes for this program.

NY Times: AIG Hearing Preview

by Calculated Risk on 1/26/2010 03:49:00 PM

From the NY Times Dealbook: A Preview of the House’s A.I.G. Hearing

DealBook has obtained the prepared testimony of three of the witnesses called by the House Oversight and Government Reform Committee: Thomas C. Baxter, general counsel of the Federal Reserve Bank of New York; Stephen Friedman, the former chairman of the New York Fed, and Elias Habayeb, the former chief financial officer of A.I.G.Dealbook provides the statements of all three.

In his prepared remarks, Mr. Baxter defended the A.I.G. bailout, saying a bankruptcy by the insurer “would have had catastrophic consequences for our financial system and our economy.” He called the decision to rescue A.I.G. “a difficult one,” but one that the Fed’s policymakers felt compelled to make.The TARP Inspector General Neil Barofsky will also testify although Dealbook doesn't provide his statement. Barofsky's comments on the AIG bailout, the benefits to counterparties, and his investigations into possible misconduct will be closely scrutinized.

Mr. Baxter explained that the New York Fed felt compelled to pay out A.I.G.’s counterparties in full to unwind derivative contracts because “there was little time, and substantial execution risk and attendant harm of not getting the deal done by the deadline of Nov. 10,” when A.I.G. was scheduled to report its earning and could face downgrades from credit ratings agencies. That would have led to more collateral calls and even greater liquidity problems for A.I.G., Mr. Baxter said.

He added, “Even in a best-case scenario, we did not expect that the counterparties would offer anything more than a modest discount to par.” Under the circumstance, he said, “the Federal Reserve had little or no bargaining power.”

Oil Prices and China

by Calculated Risk on 1/26/2010 01:50:00 PM

Two weeks ago I suggested it might be time to start looking for signs of demand destruction for oil (like we did in the first half of 2008). So far domestic demand (as far as vehicle miles) is still increasing slightly, however demand growth in China might be slowing ...

From MarketWatch: Oil slumps on expected rise in supplies, China worries

Oil futures fell on Tuesday, pressured by concerns that China's attempt to slow its growth will curb demand and expectations that U.S. crude-oil supplies are rising.I think that needs a graph!

...

"China is really the driving force in this market," said Dan Flynn, energy trader at PFGBest.

...

Broad concerns about weak growth and demand globally were also heightened ahead of supply data due Tuesday and Wednesday, Flynn said.

"We still have an oil glut in the market place. All in all, [oil trading] should remain sideways to lower," he said.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Shanghai SSE Composite Index and the Cushing, OK WTI Spot Price oil prices on a weekly basis (in blue).

The SSE Composite Index closed down 2.42% to 3,019.39 and oil prices are off from the recent high.

There appears to be a relationship between the two although the Shanghai Composite turned down in last 2007 and early 2008 - well before oil prices collapsed.

Case Shiller House Price Seasonal Adjustment

by Calculated Risk on 1/26/2010 11:11:00 AM

Case-Shiller released the November house price index this morning and most news reports focused on the small decrease, not seasonally adjusted (NSA), from October to November. As I noted earlier, the seasonally adjusted (SA) data showed a small price increase from October to November.

House price data has a clear seasonal pattern, and I think the headlines for this data should be the Seasonally Adjusted number.

The following graph shows the month-to-month change of the Case-Shiller Composite 10 index for both the NSA and SA data (annualized). Note that Case-Shiller uses a three-month moving average to smooth the data. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Blue line is the NSA data. There is a clear seasonal pattern for house prices.

The red line is the SA data as provided by Case-Shiller.

The seasonal adjustment appears pretty good in the '90s, however it appears insufficient now. Still the SA data is probably a better indicator than the NSA data - and to be consistent I've kept reporting the SA data.

The second graph compares the Case-Shiller Composite 10 SA index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts).

NOTE: This is using the Seasonally Adjusted (SA) composite 10 series. The Stress Test scenarios use the Composite 10 index and starts in December. Here are the numbers:

The Stress Test scenarios use the Composite 10 index and starts in December. Here are the numbers:

Case-Shiller Composite 10 Index, November: 157.66

Stress Test Baseline Scenario, November: 140.86

Stress Test More Adverse Scenario, November: 128.54

This puts house prices 12% above the baseline scenario and 22% above the more adverse scenario.

Case Shiller House Prices Increase Slightly in November

by Calculated Risk on 1/26/2010 09:00:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for November this morning.

This monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). This is the Seasonally Adjusted data - some sites report the NSA data.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.4% from the peak, and up about 0.2% in November.

The Composite 20 index is off 29.5% from the peak, and up 0.2% in November.

NOTE: S&P reported this as "down", but they were using the NSA data. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 4.5% from November 2008.

The Composite 20 is off 5.3% from November 2008.

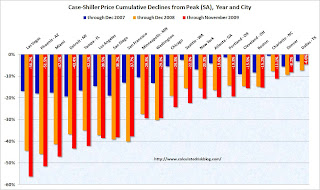

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices decreased (SA) in 6 of the 20 Case-Shiller cities in October.

Prices decreased (SA) in 6 of the 20 Case-Shiller cities in October.

In Las Vegas, house prices have declined 56.2% from the peak. At the other end of the spectrum, prices in Dallas are only off about 4.6% from the peak. Several cities are showing price increases in 2009 including San Diego, San Francisco, Denver and Dallar. Prices have declined by double digits from the peak in 18 of the 20 Case-Shiller cities.

The impact of the massive government effort to support house prices led to small increases in prices over the Summer, and the question is what happens to prices as these programs end over the next 6 months. I expect further price declines in many cities.

Monday, January 25, 2010

ATA Truck Tonnage Index Increases in December

by Calculated Risk on 1/25/2010 11:11:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Jumped 2.1 Percent in December Click on graph for slightly larger image in new window.

Click on graph for slightly larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index climbed 2.1 percent in December, following a 2.6 percent increase in November. The latest gain boosted the SA index from 106.2 (2000=100) in November to 108.4 in December, its highest level since November 2008.As ATA Chief Economist Bob Costello noted, trucking benefited from the inventory correction, however he believes that is nearing completion.

...

ATA Chief Economist Bob Costello said that while tonnage jumped again on a month-to-month basis, the rate of increase may slow in the coming months. “The robust tonnage numbers in November and December were aided by better economic growth as well as a positive inventory effect,” Costello noted. “However, economic activity is expected to moderate in the current quarter, which will keep a lid on tonnage growth.”

...

Trucking serves as a barometer of the U.S. economy, representing nearly 69 percent of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods.