by Calculated Risk on 1/31/2010 02:38:00 PM

Sunday, January 31, 2010

Weekly Summary and a Look Ahead

The most anticipated economic release this week is the BLS employment report on Friday. The consensus is for a small net gain in payroll jobs in January, on a seasonally adjusted (SA) basis, and the unemployment rate flat at 10.0%. My guess is the report will still show net job losses, and the unemployment rate will increase slightly. We will have a better idea after the ADP and ISM reports are released earlier in the week.

Two points on the employment report: 1) the annual benchmark revision for March 2009 will be released as part of the report. This will probably show over 800,000 more jobs lost than the original reports (my graphs will include the revisions), and 2) January is heavily adjusted for seasonal factors - even in good years there are around 2.5 million payroll jobs lost in January. The SA number is the one to follow.

On Monday the BEA will release the Personal Income and Spending report for December. The quarterly data was released on Friday, along with the GDP report, so we already have a good idea for December. Along with this release, the BEA will release supplemental data for hotel, office and mall investment.

Also on Monday the ISM Manufacturing report for January will be released (expectations are for a small decline from 55.9), construction spending for December (another decline is expected), and possibly the Fed's Senior Loan Officers’ Survey.

On Tuesday, auto sales for January will be reported (expect a small decline to under 11 million SAAR), Personal Bankruptcy Filings for January, Pending Home sales, and the Q4 Housing Vacancies and Homeownership report from the Census Bureau (expect a record vacancy rate). Also on vacancies, the NMHC Quarterly Survey of Apartment Market Conditions will probably be released this week.

On Wednesday, the ADP employment report (estimates are for around 40,000 jobs lost) will be released and the ISM non-manufacturing report (small increase expected).

On Thursday, Jobless Claims and Factory Orders.

And then on Friday, the BLS employment report, consumer credit and more bank failures.

And a summary of last week ...

From the BEA:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 5.7 percent in the fourth quarter of 2009, (that is, from the third quarter to the fourth quarter), according to the "advance" estimate released by the Bureau of Economic Analysis.And from my comments on the Q4 GDP report:

Any analysis of the Q4 GDP report has to start with the change in private inventories. This change contributed a majority of the increase in GDP, and annualized Q4 GDP growth would have been 2.3% without the transitory increase from inventory changes.

Unfortunately - although expected - the two leading sectors, residential investment (RI) and personal consumption expenditures (PCE), both slowed in Q4.PCE slowed from 2.8% annualized growth in Q3 to 2.0% in Q4. RI slowed from 18.9% in Q3 to just 5.7% in Q4.

...

The transitory boost from inventory changes is frequently a great kick start to the economy at the beginning of a recovery - as long as the leading sectors (PCE and RI) are also picking up. This report has to be viewed as concerning ... and is reminiscent of Q1 1981 and Q1 2002 ... both examples of inventory changes making large contributions to GDP, but underlying growth remained weak.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in Dec 2009 (5.45 million SAAR) were 16.7% lower than last month, and were 15% higher than Dec 2008 (4.74 million SAAR).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).The Composite 10 index is off 30.4% from the peak, and up about 0.2% in November.

The Composite 20 index is off 29.5% from the peak, and up 0.2% in November.

Prices decreased (SA) in 6 of the 20 Case-Shiller cities in October.

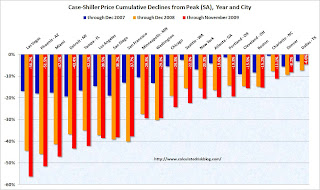

Prices decreased (SA) in 6 of the 20 Case-Shiller cities in October. In Las Vegas, house prices have declined 56.2% from the peak. At the other end of the spectrum, prices in Dallas are only off about 4.6% from the peak. Several cities are showing price increases in 2009 including San Diego, San Francisco, Denver and Dallar. Prices have declined by double digits from the peak in 18 of the 20 Case-Shiller cities.

This graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

This graph shows monthly new home sales (NSA - Not Seasonally Adjusted).Note the Red columns for 2009. In December 2009, a record low 23 thousand new homes were sold (NSA); this ties the previous record low set in December 1966.

Sales in December 2008 were at 26 thousand.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now only 4% above the low in January.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now only 4% above the low in January. Sales of new one-family houses in December 2009 were at a seasonally adjusted annual rate of 342,000 ... This is 7.6 percent (±14.6%)* below the revised November rate of 370,000 and is 8.6 percent (±15.2%)* below the December 2008 estimate of 374,000.

Fannie Mae reported this week that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.29% in November, up from 4.98% in October - and up from 2.13% in November 2008.

Fannie Mae reported this week that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.29% in November, up from 4.98% in October - and up from 2.13% in November 2008.Some of these loans are in modification programs, but this is quite a hockey stick!

The owners of Stuyvesant Town and Peter Cooper Village ... have decided to turn over the properties to creditors, officials said Monday morning.

Best wishes to all.