by Calculated Risk on 9/23/2019 04:40:00 PM

Monday, September 23, 2019

NAHB: "55+ Housing Market Remains Solid in Second Quarter"

This was released last month. This index is similar to the overall NAHB housing market index (HMI), but only released quarterly. The NAHB started this index in Q4 2008 (during the housing bust), so the readings were initially very low.

From the NAHB: 55+ Housing Market Remains Solid in Second Quarter

Builder confidence in the single-family 55+ housing market remained solid in the second quarter with a reading of 71, edging down one point from the previous quarter due to softness in traffic of prospective buyers, according to the National Association of Home Builders' (NAHB) 55+ Housing Market Index (HMI) released today.

...

“Although the single-family HMI fell slightly, builder sentiment still remains strong for this segment of the market,” said Karen Schroeder, chair of NAHB's 55+ Housing Industry Council and vice president of Mayberry Homes in East Lansing, Mich. “In fact, the reading of 71 is just one point off from the all-time high of 72 from the previous quarter. We expect the 55+ housing market to continue on a positive path moving forward.”

For the three index components of the 55+ single-family HMI, present sales remained even at 76, expected sales for the next six months increased one point to 78 and traffic of prospective buyers fell five points to 56.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ Single Family HMI through Q2 2019. Any reading above 50 indicates that more builders view conditions as good than as poor. The index decreased to 71 in Q2 down from a record high 72 in Q1.

There are two key drivers in addition to the improved economy: 1) there is a large cohort that recently moved into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics are favorable for the 55+ market.

Black Knight's First Look: National Mortgage Delinquency Rate Decreased in August, Foreclosure Inventory Lowest Since 2005

by Calculated Risk on 9/23/2019 10:16:00 AM

From Black Knight: Black Knight’s First Look: Foreclosure Starts Hit 18-year Low in August; Mortgage Prepayments Continue to Rise in Lower Interest Rate Environment

• August’s 36,200 foreclosure starts made for the lowest single-month total since December 2000According to Black Knight's First Look report for August, the percent of loans delinquent decreased slightly in August compared to July, and decreased 1.5% year-over-year.

• The number of loans in active foreclosure inventory also fell; at 253,000, it’s the fewest since 2005

• Prepayment activity – typically a good indicator of refinance activity – continues to press upward, increasing 5% from July to reach a three-year high

• August’s prepayment rate was up 62% from the same time last year and 2.5 times the 18-year low hit in January

• Given a 30-45 day closing window, the month’s prepayment activity reflects June/July interest rates; as rates fell further in August and September, the peak in refinance-driven prepayments is likely still to come

The percent of loans in the foreclosure process decreased 2.4% in August and were down 11.5% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.45% in August down from 3.46% in July.

The percent of loans in the foreclosure process decreased in August to 0.48% from 0.49% in July.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Aug 2019 | Jul 2019 | Aug 2018 | Aug 2017 | |

| Delinquent | 3.45% | 3.46% | 3.52% | 3.93% |

| In Foreclosure | 0.48% | 0.49% | 0.54% | 0.76% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,813,000 | 1,807,000 | 1,818,000 | 2,003,000 |

| Number of properties in foreclosure pre-sale inventory: | 253,000 | 258,000 | 280,000 | 385,000 |

| Total Properties Delinquent or in foreclosure | 2,066,000 | 2,065,000 | 2,099,000 | 2,388,000 |

Chicago Fed "Index Points to a Pickup in Economic Growth in August"

by Calculated Risk on 9/23/2019 08:35:00 AM

From the Chicago Fed: Index Points to a Pickup in Economic Growth in August

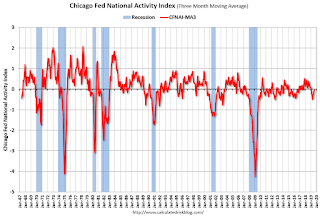

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.10 in August from –0.41 in July. All four broad categories of indicators that make up the index increased from July, but three of the four categories made negative contributions to the index in August. The index’s three-month moving average, CFNAI-MA3, edged up to –0.06 in August from –0.14 in July.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was slightly below the historical trend in August (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, September 22, 2019

Sunday Night Futures

by Calculated Risk on 9/22/2019 08:51:00 PM

Weekend:

• Schedule for Week of September 22, 2019

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for August. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 10 and DOW futures are up 91 (fair value).

Oil prices were down over the last week with WTI futures at $58.71 per barrel and Brent at $64.97 barrel. A year ago, WTI was at $71, and Brent was at $79 - so oil prices are down about 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.67 per gallon. A year ago prices were at $2.85 per gallon, so gasoline prices are down 18 cents year-over-year.

Hotels: Occupancy Rate Unchanged Year-over-year

by Calculated Risk on 9/22/2019 09:36:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 14 September

The U.S. hotel industry reported mostly positive year-over-year results in the three key performance metrics during the week of 8-14 September 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 9-15 September 2018, the industry recorded the following:

• Occupancy: flat at 69.6%

• Average daily rate (ADR): +0.8% to US$132.59

• Revenue per available room (RevPAR): +0.8% at US$92.26

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, and close to-date compared to the previous 4 years.

However occupancy will be lower this year than in 2018 (the record year).

Seasonally, the 4-week average of the occupancy rate will now increase during the Fall business travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, September 21, 2019

Schedule for Week of September 22, 2019

by Calculated Risk on 9/21/2019 08:11:00 AM

The key reports this week are August New Home sales, and the third estimate of Q2 GDP.

Other key indicators include Personal Income and Outlays for August and Case-Shiller house prices for July.

For manufacturing, the Richmond and Kansas City Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for August. This is a composite index of other data.

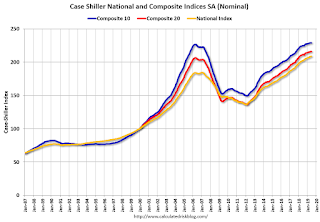

9:00 AM ET: S&P/Case-Shiller House Price Index for July.

9:00 AM ET: S&P/Case-Shiller House Price Index for July.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 2.1% year-over-year increase in the Comp 20 index for July.

9:00 AM: FHFA House Price Index for July 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM ET: Richmond Fed Survey of Manufacturing Activity for September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for August from the Census Bureau.

10:00 AM: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 665 thousand SAAR, up from 635 thousand in July.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 211 thousand initial claims, up from 208 thousand the previous week.

8:30 AM: Gross Domestic Product, 2nd quarter 2018 (Third estimate). The consensus is that real GDP increased 2.0% annualized in Q2, unchanged from the second estimate of 2.0%.

10:00 AM: Pending Home Sales Index for August. The consensus is 0.6% increase in the index.

11:00 AM: the Kansas City Fed manufacturing survey for September. This is the last of the regional surveys for September.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 1.2% decrease in durable goods orders.

8:30 AM: Personal Income and Outlays for August. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: University of Michigan's Consumer sentiment index (Final for September). The consensus is for a reading of 92.0.

Friday, September 20, 2019

Mortgage Equity Withdrawal Positive in Q2

by Calculated Risk on 9/20/2019 03:07:00 PM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released last week) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q2 2019, the Net Equity Extraction was $23 billion, or a 0.6% of Disposable Personal Income (DPI) .

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

MEW has been mostly positive for the last four years. With a slower rate of debt cancellation, MEW will likely be mostly positive going forward - but nothing like during the housing bubble.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $76 billion in Q2.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Fed's Flow of Funds: Household Net Worth Increased in Q2

by Calculated Risk on 9/20/2019 01:27:00 PM

The Federal Reserve released the Q2 2019 Flow of Funds report today: Flow of Funds.

The net worth of households and nonprofits rose to $113.5 trillion during the second quarter of 2019. The value of directly and indirectly held corporate equities increased $0.9 trillion and the value of real estate increased $0.3 trillion.

Household debt increased 4.3 percent at an annual rate in the second quarter of 2019. Consumer credit grew at an annual rate of 4.6 percent, while mortgage debt (excluding charge-offs) grew at an annual rate of 3.2 percent.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q2 2019, household percent equity (of household real estate) was at 64.2% - down slightly from Q1.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 64.2% equity - and about 2 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $76 billion in Q2.

Mortgage debt is still down from the peak during the housing bubble, and, as a percent of GDP is at 48.8% (the lowest since 2001), down from a peak of 73.5% of GDP during the housing bubble.

The value of real estate, as a percent of GDP, decreased slightly in Q2, and is above the average of the last 30 years (excluding bubble). However, mortgage debt as a percent of GDP, continues to decline.

Q3 GDP Forecasts: Around 2.0%

by Calculated Risk on 9/20/2019 11:19:00 AM

From Merrill Lynch:

We expect 2Q GDP to be revised slightly higher to 2.1% qoq saar in the final release. 3Q GDP tracking remains at 2.0% qoq saar. [Sept 20 estimate]From Goldman Sachs:

emphasis added

[W]e left our Q3 GDP tracking estimate unchanged on a rounded basis at +2.2% (qoq ar). [Sept 19 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.2% for 2019:Q3 and 2.0% for 2019:Q4. [Sept 20 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2019 is 1.9 percent September 18, up from 1.8 percent on September 13. [Sept 18 estimate]CR Note: The GDP estimates increased this week mostly due to better than expected housing starts and industrial production numbers. These estimates suggest real GDP growth will be around 2.0% annualized in Q3.

BLS: August Unemployment rates at New Series Lows in Alabama, Alaska, Illinois, Maine and New Jersey

by Calculated Risk on 9/20/2019 10:12:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in August in 5 states, higher in 3 states, and stable in 42 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Five states had jobless rate decreases from a year earlier, 2 states had increases, and 43 states and the District had little or no change.

...

Vermont had the lowest unemployment rate in August, 2.1 percent. The rates in Alabama (3.1 percent), Alaska (6.2 percent), Illinois (4.0 percent), Maine (2.9 percent), and New Jersey (3.2 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 6.2 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

At the worst of the great recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 6% (dark blue). Note that Alaska set a new series low (since 1976). Three states and the D.C. have unemployment rates above 5%; Alaska, Arizona and Mississippi.

A total of eleven states are at a series low: Alabama, Alaska, Arkansas, California, Illinois, Maine, New Jersey, Oregon, South Carolina, Texas and Vermont.